Additional Proxy Soliciting Materials (definitive) (defa14a)

May 15 2023 - 4:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant

☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

RAPT Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

| ☐ |

Fee paid previously with preliminary materials. |

RAPT THERAPEUTICS, INC.

561 Eccles Avenue

South

San Francisco, California 94080

2023 ANNUAL MEETING OF STOCKHOLDERS

To be held online on May 24, 2023 at www.virtualshareholdermeeting.com/RAPT2023

EXPLANATORY NOTE

On

April 7, 2023, RAPT Therapeutics, Inc., or the Company, filed its Definitive Proxy Statement on Schedule 14A, or the Proxy Statement, and filed the related Proxy Card on April 7, 2023 for the Company’s 2023 Annual Meeting of

Stockholders, or the Annual Meeting, with the Securities and Exchange Commission, or the SEC, to be held virtually at www.virtualshareholdermeeting.com/RAPT2023 on Wednesday May 24, 2023, at 10:00 a.m. Pacific Daylight Time.

The Company is filing this Supplement to the Proxy Statement solely to revise its initial disclosure regarding its Non-Employee Director Compensation Policy to reflect events occurring after the date of the Proxy Statement and to update disclosures in the Proxy Statement that may have been affected by such subsequent events.

Other than the revised language in this Supplement, no other changes have been made to the Proxy Statement or the Proxy Card and they continue

to be in full force and effect as originally filed and the Board of Directors continues to seek the vote of Company stockholders to be voted on at the Annual Meeting as recommended in the original filing.

EXCEPT AS DESCRIBED IN THIS SUPPLEMENT, THE INFORMATION PROVIDED IN THE PROXY STATEMENT CONTINUES TO APPLY. TO THE EXTENT THAT INFORMATION

IN THIS SUPPLEMENT DIFFERS FROM OR UPDATES INFORMATION CONTAINED IN THE PROXY STATEMENT, THE INFORMATION IN THIS SUPPLEMENT IS MORE CURRENT. THE PROXY STATEMENT CONTAINS ADDITIONAL INFORMATION. THIS SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE

PROXY STATEMENT.

The Section titled “Director Compensation – Non-Employee

Director Compensation Policy” beginning on page 33 of the Proxy Statement is amended in its entirety as follows:

Non-Employee Director Compensation Policy

We have adopted a non-employee director compensation policy, pursuant to which our

non-employee directors are eligible to receive compensation for service on our Board of Directors and committees of our Board of Directors.

In 2022, each non-employee director received an annual cash retainer of $40,000 for serving on the Board of Directors.

The chair of the Board of Directors received a cash retainer of $30,000 in addition to the annual retainer received by other non-employee directors for serving in that role. In May 2023, we amended our non-employee director compensation policy to provide for an increased retainer for the chair and members of the Compensation Committee as noted below, as well as a change in the methodology for determining equity

compensation for non-employee directors (the “Amended Non-Employee Director Compensation Policy”).

Under the Amended Non-Employee Director Compensation Policy, the chair and members of the three committees of our

Board of Directors are entitled to the following additional annual cash retainers:

|

|

|

|

|

|

|

|

|

| Board Committee |

|

Chair Fee |

|

|

Member Fee |

|

| Audit Committee |

|

$ |

25,000 |

|

|

$ |

12,500 |

|

| Compensation Committee |

|

|

12,000 |

(1) |

|

|

6,000 |

(2) |

| Nominating and Corporate Governance Committee |

|

|

8,000 |

|

|

|

4,000 |

|

| (1) |

Increased from $10,000 per year. |

| (2) |

Increased from $5,000 per year. |

All annual cash compensation amounts are payable in equal quarterly installments no later than 30 days following the end of each fiscal quarter in which the

service occurred, pro-rated based on the days remaining in the calendar quarter. In addition, each non-employee director may elect to receive all of the annual cash

compensation that such non-employee director is eligible to earn, as set forth above, in the form of stock options granted pursuant to the Company’s 2019 Plan. Such stock options will automatically be

granted on the last business day in March of such fiscal year. Any such award will vest as follows: (i) 25% will vest on the last day of the first fiscal quarter during such fiscal year and (ii) 25% will vest on the last day of each subsequent

fiscal quarter during such fiscal year, provided that the non-employee director is in service on the first day of the fiscal quarter of the applicable scheduled vesting date.

Prior to the adoption of the Amended Non-Employee Director Compensation Policy, newly appointed directors received a one-time initial award of a stock option to purchase 17,000 shares and an annual award of a stock option to purchase 8,500 shares. In order to be consistent with the methodology used to size awards made to

management and other Company employees, we adopted the Amended Non-Employee Director Compensation Policy in part to provide for the denomination of equity grants in terms of a dollar value instead of a number

of options. Accordingly, under the Amended Non-Employee Director Compensation Policy, newly appointed non-employee directors will receive a one-time initial award of a stock option under our 2019 Plan with a grant date fair value of $400,000, determined based on the average stock price over the 30 consecutive days immediately preceding the

grant date. Each initial grant will vest in a series of three successive equal annual installments over the three-year period measured from the date of grant, subject to the non-employee director’s

continuous service through each applicable vesting date. Thereafter, each non-employee director will receive an annual award of a stock option to purchase shares on the date of each annual meeting of

stockholders with a grant date fair value of $200,000, determined based on the average stock price over the 30 consecutive days immediately preceding the grant date. Each annual grant will vest on the earlier of the one-year anniversary of the grant date or the day prior to the Company’s next annual meeting occurring after the grant date, subject to the non-employee director’s

continuous service through the vesting date. In addition, in the event of a change in control (as defined in the 2019 Plan) of the Company, the shares underlying such grants will vest and become exercisable immediately prior to the effectiveness of

such change in control.

The exercise price per share of each stock option granted under the

non-employee director compensation policy will be equal to 100% of the fair market value of a share of the underlying common stock on the date of grant. Each stock option will have a term of ten years from the

date of grant, subject to earlier termination in connection with a termination of the non-employee director’s continuous service with us or a corporate transaction, each as provided under the 2019

Plan.

RAPT THERAPEUTICS, INC.

561 Eccles Avenue

South

San Francisco, California 94080

VOTING MATTERS

This Supplement to the Proxy Statement does not change the proposals to be acted upon at the Annual Meeting, which are described in the Proxy

Statement.

You are urged to read the Proxy Statement and this Supplement carefully in deciding how to vote. As a stockholder, your

vote is very important, and the Board of Directors encourages you to exercise your right to vote whether or not you plan to attend the Annual Meeting. If you have already voted by Internet, telephone or by mail, you do not need to take any action

unless you wish to change your vote. Proxy voting instructions already returned by stockholders (via Internet, telephone or mail) will remain valid and will be voted at the Annual Meeting unless revoked.

|

| By Order of the Board of Directors, |

|

| /s/ Brian Wong, M.D., Ph.D. |

| Brian Wong, M.D., Ph.D. |

| President and Chief Executive Officer |

South San Francisco, California

May 15, 2023

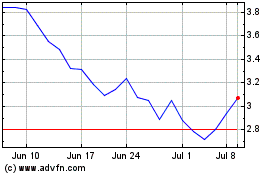

RAPT Therapeutics (NASDAQ:RAPT)

Historical Stock Chart

From Oct 2024 to Nov 2024

RAPT Therapeutics (NASDAQ:RAPT)

Historical Stock Chart

From Nov 2023 to Nov 2024