Rani Therapeutics Reports Third Quarter 2024 Financial Results; Provides Corporate Update

November 14 2024 - 8:00AM

Rani Therapeutics Holdings, Inc. (“Rani Therapeutics” or “Rani”)

(Nasdaq: RANI), a clinical-stage biotherapeutics company focused on

the oral delivery of biologics and drugs, today reported financial

results for the quarter ended September 30, 2024 and provided a

corporate update.

“We are pleased with the progress we have made this quarter

headlined by new preclinical pharmacokinetic data supporting the

transenteric delivery of a GLP-1 incretin triagonist. This data,

combined with the previously announced pharmacodynamic data from

the study, underscores the potential of the RaniPill® to contribute

to the GLP-1 receptor agonist space and the broader obesity

therapeutics market,” said Talat Imran, Chief Executive Officer of

Rani. “Additionally, we raised $20 million in aggregate gross

proceeds from financings in July and October, enabling us to extend

our cash runway into the third quarter of 2025. Looking ahead, we

are excited to start our Phase 1 trial of RT-114 containing a

GLP-1/GLP-2 dual agonist for the treatment of obesity next

year.”

Third Quarter 2024 and Subsequent

Highlights:

- Announced new preclinical pharmacokinetic data

supporting transenteric delivery of GLP-1 incretin

triagonist. In October 2024, Rani announced new

pharmacokinetic data from a preclinical study evaluating a GLP-1,

GIP and glucagon receptors incretin triagonist with a delivery

method mimicking the RaniPill® route of administration. The

pharmacokinetic data provides further evidence of the RaniPill®

platform’s potential to enable oral delivery of multiple obesity

treatments.

- Completed two equity offerings for total gross proceeds

of approximately $20.0 million. In equity offerings in

July and October 2024, Rani completed the sale and issuance of

Class A common stock, pre-funded warrants to purchase Class A

common stock, and warrants to purchase Class A common stock, to an

institutional investor for total gross proceeds of approximately

$20.0 million, excluding any potential proceeds from the exercise

of warrants, if any.

Near-Term Milestone Expectations:

- Initiation of Phase 1 clinical trial of RT-114 containing a

GLP-1/GLP-2 dual agonist for the treatment of obesity expected in

2025.

Third Quarter 2024 Financial Results:

- Cash, cash equivalents and marketable

securities as of September 30, 2024 totaled $30.4 million,

compared to $48.5 million for the year ended December 31, 2023.

Rani expects its cash, cash equivalents and marketable securities

to be sufficient to fund its operations into the third quarter of

2025.

- Research and development expenses for the

three months ended September 30, 2024 were $6.2 million, compared

to $11.2 million for the same period in 2023. The decrease of $5.0

million in research and development expenses in the three months

ended September 30, 2024, as compared to the same period in

2023, was primarily attributed to lower compensation costs of $1.9

million due to reduction in workforce, $2.7 million reduction in

third-party services and $0.4 million reduction in materials and

supplies due to the timing of certain preclinical and clinical

studies.

- General and administrative expenses for the

three months ended September 30, 2024 were $5.6 million, compared

to $6.6 million for the same period in 2023. The decrease of $1.0

million in general and administrative expenses in the three months

ended September 30, 2024, as compared to the same period in

2023, was primarily attributed to lower compensation costs of $0.5

million due to reduction in workforce, $0.4 million reduction in

third-party services due to lower directors and officers insurance

premiums and $0.3 million reduction in other costs, offset by an

increase in facility costs of $0.2 million due to the lease in

Fremont, California.

- Net loss for the three months ended September

30, 2024 was $12.7 million, compared to $18.3 million for the same

period in 2023, including stock-based compensation expense of $4.1

million for the three months ended September 30, 2024, compared to

$5.0 million for the same period in 2023.

About Rani TherapeuticsRani Therapeutics is a

clinical-stage biotherapeutics company focused on advancing

technologies to enable the development of orally administered

biologics and drugs. Rani has developed the RaniPill® capsule,

which is a novel, proprietary and patented platform technology,

intended to replace subcutaneous injection or intravenous infusion

of biologics and drugs with oral dosing. Rani has successfully

conducted several preclinical and clinical studies to evaluate

safety, tolerability and bioavailability using RaniPill® capsule

technology. For more information, visit ranitherapeutics.com.

Forward-Looking StatementsStatements contained

in this press release regarding matters that are not historical

facts are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include statements regarding, among

other things, the expected initiation of a Phase 1 trial of RT-114

in 2025, the potential of the RaniPill® platform to contribute to

the GLP-1 receptor agonist space and broader obesity therapeutics

market, the potential of the RaniPill® platform to enable oral

delivery of multiple obesity treatments. the sufficiency of Rani’s

cash reserves, the timing and extent of its expenses, and future

financial performance. Because such statements are subject to risks

and uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements. Words such

as “intend,” “looking ahead,” “potential,” “expect” and similar

expressions are intended to identify forward-looking statements.

These forward-looking statements are based upon Rani’s current

expectations and involve assumptions that may never materialize or

may prove to be incorrect. Actual results could differ materially

from those anticipated in such forward-looking statements as a

result of various risks and uncertainties, which include, without

limitation, risks and uncertainties associated with Rani’s business

in general and the other risks described in Rani’s filings with the

Securities and Exchange Commission, including Rani’s annual report

on Form 10-K for the year ended December 31, 2023, and subsequent

filings and reports by Rani. All forward-looking statements

contained in this press release speak only as of the date on which

they were made and are based on management’s assumptions and

estimates as of such date. Rani undertakes no obligation to update

such statements to reflect events that occur or circumstances that

exist after the date on which they were made, except as required by

law.

Investor

Contact:investors@ranitherapeutics.com

Media

Contact:media@ranitherapeutics.com

|

RANI THERAPEUTICS HOLDINGS, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands, except

par value) |

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,277 |

|

|

$ |

5,864 |

|

|

Marketable securities |

|

|

26,127 |

|

|

|

42,675 |

|

|

Prepaid expenses and other current assets |

|

|

1,967 |

|

|

|

2,308 |

|

|

Total current assets |

|

|

32,371 |

|

|

|

50,847 |

|

|

Property and equipment, net |

|

|

5,496 |

|

|

|

6,105 |

|

|

Operating lease right-of-use asset |

|

|

5,427 |

|

|

|

718 |

|

|

Other assets |

|

|

246 |

|

|

|

246 |

|

|

Total assets |

|

$ |

43,540 |

|

|

$ |

57,916 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,566 |

|

|

$ |

648 |

|

|

Accrued expenses and other current liabilities |

|

|

1,867 |

|

|

|

1,726 |

|

|

Deferred revenue |

|

|

600 |

|

|

|

— |

|

|

Current portion of long-term debt |

|

|

14,768 |

|

|

|

4,897 |

|

|

Current portion of operating lease liability |

|

|

1,410 |

|

|

|

718 |

|

|

Total current liabilities |

|

|

20,211 |

|

|

|

7,989 |

|

|

Long-term debt, less current portion |

|

|

13,537 |

|

|

|

24,484 |

|

|

Operating lease liability, less current portion |

|

|

4,017 |

|

|

|

— |

|

|

Total liabilities |

|

|

37,765 |

|

|

|

32,473 |

|

| Stockholders' equity: |

|

|

|

|

|

|

| Preferred stock, $0.0001 par

value - 20,000 shares authorized; none issued and outstanding as of

September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

| Class A common stock, $0.0001

par value - 800,000 shares authorized; 29,807 and 26,036 issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively |

|

|

3 |

|

|

|

3 |

|

| Class B common stock, $0.0001

par value - 40,000 shares authorized; 24,116 issued and outstanding

as of September 30, 2024 and December 31, 2023 |

|

|

2 |

|

|

|

2 |

|

| Class C common stock, $0.0001

par value - 20,000 shares authorized; none issued and outstanding

as of September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

97,067 |

|

|

|

85,762 |

|

|

Accumulated other comprehensive gain (loss) |

|

|

8 |

|

|

|

(12 |

) |

|

Accumulated deficit |

|

|

(93,960 |

) |

|

|

(72,889 |

) |

|

Total stockholders' equity attributable to Rani Therapeutics

Holdings, Inc. |

|

|

3,120 |

|

|

|

12,866 |

|

|

Non-controlling interest |

|

|

2,655 |

|

|

|

12,577 |

|

|

Total stockholders' equity |

|

|

5,775 |

|

|

|

25,443 |

|

|

Total liabilities and stockholders' equity |

|

$ |

43,540 |

|

|

$ |

57,916 |

|

|

RANI THERAPEUTICS HOLDINGS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In

thousands, except per share

amounts) (Unaudited) |

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

6,172 |

|

|

$ |

11,220 |

|

|

$ |

19,872 |

|

|

$ |

32,018 |

|

|

General and administrative |

|

|

5,627 |

|

|

|

6,635 |

|

|

|

18,484 |

|

|

|

20,647 |

|

|

Total operating expenses |

|

$ |

11,799 |

|

|

$ |

17,855 |

|

|

$ |

38,356 |

|

|

$ |

52,665 |

|

|

Loss from operations |

|

|

(11,799 |

) |

|

|

(17,855 |

) |

|

|

(38,356 |

) |

|

|

(52,665 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income and other, net |

|

|

414 |

|

|

|

839 |

|

|

|

1,403 |

|

|

|

2,626 |

|

|

Interest expense and other, net |

|

|

(1,337 |

) |

|

|

(1,316 |

) |

|

|

(3,909 |

) |

|

|

(3,789 |

) |

| Net loss |

|

$ |

(12,722 |

) |

|

$ |

(18,332 |

) |

|

$ |

(40,862 |

) |

|

$ |

(53,828 |

) |

| Net loss attributable to

non-controlling interest |

|

|

(5,939 |

) |

|

|

(9,135 |

) |

|

|

(19,791 |

) |

|

|

(26,956 |

) |

| Net loss attributable to Rani

Therapeutics Holdings, Inc. |

|

$ |

(6,783 |

) |

|

$ |

(9,197 |

) |

|

$ |

(21,071 |

) |

|

$ |

(26,872 |

) |

|

Net loss per Class A common share attributable to Rani Therapeutics

Holdings, Inc., basic and diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.78 |

) |

|

$ |

(1.06 |

) |

| Weighted-average Class A

common shares outstanding—basic and diluted |

|

|

28,836 |

|

|

|

25,552 |

|

|

|

27,071 |

|

|

|

25,380 |

|

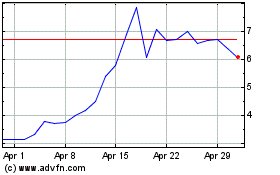

Rani Therapeutics (NASDAQ:RANI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rani Therapeutics (NASDAQ:RANI)

Historical Stock Chart

From Dec 2023 to Dec 2024