Pyxis Tankers Announces Joint Venture Agreement to Acquire Modern Dry-Bulk Vessel, Expansion of Common Share Repurchase Program & Partial Redemption of Series A Cumulative Convertible Preferred Stock

May 21 2024 - 8:05AM

Maroussi, Greece – May 21, 2024 – Pyxis Tankers

Inc. (NASDAQ Cap Mkts: PXS), (“we”, “our”, “us”, the “Company” or

“Pyxis Tankers”), an international shipping company, announced

today key strategic and financial actions to further enhance its

shareholder value.

- The Company has entered into an agreement with a group of

sellers, including the Company’s Chairman and Chief Executive

Officer, Mr. Eddie Valentis, to acquire, through a joint venture,

an eco-efficient Kamsarmax (82,000 dwt), dry-bulk vessel built

in 2015 at Jiangsu New Yangzi Shipbuilding fitted with a ballast

water treatment system (“the Vessel”). The purchase price of the

Vessel, the “Konkar Venture”, is $30.0 million, which, in

conjunction with Vessel working capital and transaction fees and

expenses, is expected to be funded by $16.5 million of bank

debt, $13.2 million of total cash and the new issuance of $1.5

million of restricted common shares of the Company. The Company,

through the Vessel owning subsidiary, expects to enter into a new 5

year amortizing term loan with one of its existing lenders that

will be secured by the Vessel and bears interest at SOFR plus

2.15%. As a further sign of commitment to the Company, entities

controlled by Mr. Valentis have agreed to re-invest $5.9 million in

cash for a 40% minority interest in the Vessel owning subsidiary,

with the Company owning the 60% majority interest through an

investment of $7.3 million in cash and $1.5 million of restricted

common shares of the Company (the “Shares”). The number of Shares

to be issued will be calculated based on the greater of (a) $5.60

or (b) the average of (i) the average of the closing daily volume

weighted average prices (“VWAPs”) for the five-day period

immediately before the public announcement of the Vessel

acquisition and (ii) the average of the closing daily VWAPs for the

five-day period immediately after the public announcement of the

Vessel acquisition. The Shares shall be restricted from sale for a

period of one year from issuance. The acquisition of the “Konkar

Venture”, which was unanimously approved by the Company’s

independent and disinterested directors, is subject to customary

closing conditions and is expected to be completed in June

2024.

- After a comprehensive review of the results of the Company’s

common share re-purchase program over the past year, the Company’s

board of directors (the “Board”) approved an increase of

$1.0 million in incremental common share repurchase authority

for a period of 12 months expiring on May 16, 2025, bringing the

Company’s total share repurchase authority to $1.4 million. The

common share repurchase program does not require the Company to

purchase a specific number or amount of common shares, and may be

suspended or re-instated at any time at the Company’s discretion

and without notice. The initial $2.0 million program was put in

place in May, 2023, and as of May 16, 2024, the Company had spent a

total of $1.6 million, including commissions, to acquire a total of

415,371 common shares of the Company. At that date, there were

10,458,767 common shares of the Company outstanding.

- The Board also approved the Company’s redemption of 100,000

shares of our Series A Cumulative Convertible Preferred Stock (the

“Preferred Shares”) (NASDAQ Cap Mkts: PXSAP). A redemption date of

June 20, 2024 (the “Redemption Date”) has been established and the

Preferred shareholders who have been selected for the redemption

will be notified. Pursuant to the Certificate of Designation, the

redemption price is 100% of the Liquidation Preference of the

Preferred Shares of $25.00, plus accrued dividends up to, but not

including the Redemption Date. Upon redemption, the 100,000 PXSAP

shares will be cancelled by the Company and cash dividends in

respect of these shares will no longer be payable. After this

partial redemption, there will be 303,631 PXSAP shares

outstanding, which are convertible into 1,354,204 common shares, if

fully converted, a reduction of 446,429 in fully-diluted common

shares.

Mr. Eddie Valentis, Chairman and Chief

Executive Officer of the Company, commented: “Secondhand

values for modern eco-efficient product tankers continue to

appreciate unabated. In our opinion, current asset prices are

prohibitively high for fleet expansion of our MR’s. In our

commitment to enhancing shareholder value, we have continued to

improve our balance sheet, repurchased common shares and

selectively expanded our footprint in the dry-bulk sector. After

due consideration, the independent and disinterested members of the

Board unanimously approved the acquisition of the “Konkar Venture”,

which is the sister ship of our 2015 built “Konkar Asteri”. We will

own 60% of this joint venture and the remaining 40% will be owned

by a company related to our Chairman and Chief Executive Officer,

Mr. Valentis, who will reinvest $5.9 million in cash and receive

$1.5 million in restricted shares of the Company as part of his

portion of the Vessel purchase consideration. The Vessel will

continue to be managed by Konkar Shipping Services, S.A., a company

that is also related to Mr. Valentis, thereby minimizing

acquisition risk and assuring smooth operational integration to our

expanding fleet. Similar to the joint venture of the “Konkar Ormi”,

we believe this counter-cyclical investment opportunity should

provide attractive returns to us through a well-managed

structure.

As described elsewhere in this release, since

the start of our common share repurchase program one year ago, we

have acquired 415,371 common shares, which represented

approximately 9% of our public common shares that not owned by

Company insiders. In addition, our redemption of approximately 25%

of the outstanding Preferred Shares will lower our monthly cash

dividend payments, but more importantly further reduce dilution on

the basis of earnings and net asset value per share and improve

share liquidity.”

About Pyxis Tankers Inc.

The Company currently owns a modern fleet of

mid-sized eco-vessels consisting of three MR product tankers, one

Kamsarmax, bulk carrier and a controlling interest in a single ship

Ultramax, dry-bulk venture engaged in seaborne transportation of a

broad range of refined petroleum products and dry-bulk commodities.

The Company is positioned to opportunistically expand and maximize

its fleet of eco-efficient vessels due to significant capital

resources, competitive cost structure, strong customer

relationships and an experienced management team whose interests

are aligned with those of its shareholders. For more information,

visit: http://www.pyxistankers.com. The information on the

Company’s website is not incorporated into and does not form a part

of this release.

Forward Looking Statements

This press release includes forward-looking

statements intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995

in order to encourage companies to provide prospective information

about their business. These statements include statements about our

plans, strategies, goals financial performance, prospects or future

events or performance and involve known and unknown risks that are

difficult to predict. As a result, our actual results, performance

or achievements may differ materially from those expressed or

implied by these forward-looking statements. In some cases, you can

identify forward-looking statements by the use of words such as

“may,” “could,” “expects,” “seeks,” “predict,” “schedule,”

“projects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “targets,” “continue,” “contemplate,” “possible,”

“likely,” “might,” “will, “should,” “would,” “potential,” and

variations of these terms and similar expressions, or the negative

of these terms or similar expressions. All statements that are not

statements of either historical or current facts, including among

other things, our expected financial performance, expectations or

objectives regarding future and market charter rate expectations

and, in particular, the effects of the war in the Ukraine and the

Red Sea conflict, on our financial condition and operations as well

as the nature of the product tanker and dry-bulk industries, in

general, are forward-looking statements. Such forward-looking

statements are necessarily based upon estimates and assumptions.

Although the Company believes that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond the Company’s

control, the Company cannot assure you that it will achieve or

accomplish these expectations, beliefs or projections. The

Company’s actual results may differ, possibly materially, from

those anticipated in these forward-looking statements as a result

of certain factors, including changes in the Company’s financial

resources and operational capabilities and as a result of certain

other factors listed from time to time in the Company’s filings

with the U.S. Securities and Exchange Commission. The Company is

reliant on certain independent and affiliated managers for its

operations, including most recently an affiliated private company,

Konkar Shipping Agencies, S.A., for the management of its dry-bulk

vessels. For more information about risks and uncertainties

associated with our business, please refer to our filings with the

U.S. Securities and Exchange Commission, including without

limitation, under the caption “Risk Factors” in our Annual Report

on Form 20-F for the fiscal year ended December 31, 2023. We

caution you not to place undue reliance on any forward-looking

statements, which are made as of the date of this press release. We

undertake no obligation to update publicly any information in this

press release, including forward-looking statements, to reflect

actual results, new information or future events, changes in

assumptions or changes in other factors affecting forward-looking

statements, except to the extent required by applicable laws.

CompanyPyxis Tankers Inc. 59 K. Karamanli

Street Maroussi, 15125 Greece info@pyxistankers.com

Visit our website at www.pyxistankers.com

Company ContactHenry Williams Chief Financial

Officer Tel: +30 (210) 638 0200 / +1 (516) 455-0106

Email: hwilliams@pyxistankers.com

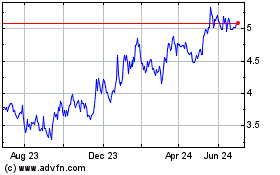

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Jan 2025 to Feb 2025

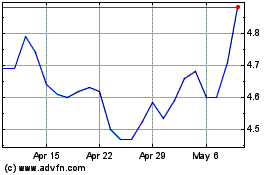

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Feb 2024 to Feb 2025