Prospect Capital Corporation Extends and Increases Revolving Credit Facility to Over $2.1 Billion of Aggregate Commitments

October 07 2024 - 10:28AM

Prospect Capital Corporation (NASDAQ: PSEC) (“Prospect”) extended

and increased total commitments for its revolving credit facility

(the “Facility”) for Prospect Capital Funding LLC, a GAAP

consolidated subsidiary of Prospect, with the most recent upsize in

the quarter ended September 30, 2024.

Facility commitments currently aggregate $2.1215 billion from a

group of 48 banks (with a combined asset base of over $7.5

trillion), which Prospect considers the largest number of lenders

to any business development company’s credit facility. The Facility

includes an accordion feature allowing aggregate commitments to be

increased up to $2.25 billion.

The Facility term comprises five years from the initial closing,

with a maturity of June 28, 2029. The Facility has a revolving

period of four years from the initial closing, extending through

June 28, 2028 and followed by an additional one-year amortization

period.

"Prospect Capital is pleased to have the longstanding support of

so many strong relationship banks, some of which date all the way

back to 2009 with our credit relationship," said Grier Eliasek,

President and Chief Operating Officer of Prospect. "We look forward

to continuing such relationships for many years to come, with our

industry leading facility providing Prospect with efficient capital

to help meet the investment and financing needs of our business and

portfolio companies."

About Prospect Capital Corporation

Prospect is a business development company that focuses on

lending to and investing in private businesses. Prospect’s

investment objective is to generate both current income and

long-term capital appreciation through debt and equity

investments.

Prospect has elected to be treated as a business development

company under the Investment Company Act of 1940 (“1940 Act”).

Prospect is required to comply with a series of regulatory

requirements under the 1940 Act as well as applicable NASDAQ,

federal and state rules and regulations. We have elected to be

treated as a regulated investment company under the Internal

Revenue Code of 1986.

Caution Concerning Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, whose safe harbor for forward-looking statements does not

apply to business development companies. Any such statements, other

than statements of historical fact, are highly likely to be

affected by other unknowable future events and conditions,

including elements of the future that are or are not under our

control, and that we may or may not have considered; accordingly,

such statements cannot be guarantees or assurances of any aspect of

future performance. Actual developments and results are highly

likely to vary materially from any forward-looking statements. Such

statements speak only as of the time when made, and we undertake no

obligation to update any such statement now or in the future.

For further information, contact:

Grier Eliasek, President and Chief Operating Officer

grier@prospectcap.com

Telephone (212) 448-0702

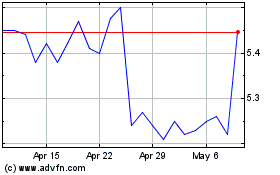

Prospect Capital (NASDAQ:PSEC)

Historical Stock Chart

From Jan 2025 to Feb 2025

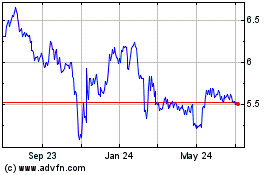

Prospect Capital (NASDAQ:PSEC)

Historical Stock Chart

From Feb 2024 to Feb 2025