ProShares, a premier provider of ETFs, announced today forward

and reverse share splits on twelve of its ETFs. The splits will not

change the total value of a shareholder’s investment.

Forward Splits

Two ETFs will forward split shares at the following split

ratios:

Ticker

ProShares ETF

Split Ratio

RXL

ProShares Ultra Health Care

2:1

TQQQ

ProShares UltraPro QQQ

2:1

All forward splits will apply to shareholders of record as of

market close on January 19, 2021, payable after market close on

January 20, 2021. All forward splits will be effective prior to

market open on January 21, 2021, when the funds will begin trading

at their post-split price. The ticker symbols and CUSIP numbers for

the funds will not change.

The forward splits will decrease the price per share of each

fund with a proportionate increase in the number of shares

outstanding. For example, for a two-for-one split, every pre-split

share will result in the receipt of two post-split shares, which

will be priced at one-half the net asset value (“NAV”) of a

pre-split share.

Illustration of a Forward Split

The following table shows the effect of a hypothetical

two-for-one forward split:

Period

# of Shares Owned

Hypothetical NAV

Value of Shares

Pre-Split

100

$120.00

$12,000.00

Post-Split

200

$60.00

$12,000.00

Reverse Splits

Ten ETFs will reverse split shares at the following split

ratios:

Ticker

ProShares ETF

Split Ratio

Old CUSIP

New CUSIP

MZZ

ProShares UltraShort MidCap400

1:2

74348A343

74348A129

SDD

ProShares UltraShort SmallCap600

1:2

74348A327

74348A137

SDP

ProShares UltraShort Utilities

1:2

74347B722

74347G721

SIJ

ProShares UltraShort Industrials

1:2

74348A368

74348A111

SKF

ProShares UltraShort Financials

1:2

74347B748

74347G713

SMDD

ProShares UltraPro Short MidCap400

1:2

74347G879

74347G697

QID

ProShares UltraShort QQQ

1:4

74347B243

74347G739

TWM

ProShares UltraShort Russell2000

1:4

74348A319

74347G689

SPXU

ProShares UltraPro Short S&P500

1:5

74347B268

74347B110

SRTY

ProShares UltraPro Short Russell2000

1:5

74348A152

74347G747

All reverse splits will be effective prior to market open on

January 21, 2021, when the funds will begin trading at their

post-split price. The ticker symbols for the funds will not change.

All funds undergoing a reverse split will be issued new CUSIP

numbers, listed above.

The reverse splits will increase the price per share of each

fund with a proportionate decrease in the number of shares

outstanding. For example, for a one-for-four reverse split, every

four pre-split shares will result in the receipt of one post-split

share, which will be priced four times higher than the NAV of a

pre-split share.

Illustration of a Reverse Split

The following table shows the effect of a hypothetical

one-for-four reverse split:

Period

# of Shares Owned

Hypothetical NAV

Value of Shares

Pre-Split

1,000

$10.00

$10,000.00

Post-Split

250

$40.00

$10,000.00

Fractional Shares from Reverse Splits

For shareholders who hold quantities of shares that are not an

exact multiple of the reverse split ratio (for example, not a

multiple of four for a one-for-four reverse split), the reverse

split will result in the creation of a fractional share.

Post-reverse split fractional shares will be redeemed for cash and

sent to your broker of record. This redemption may cause some

shareholders to realize gains or losses, which could be a taxable

event for those shareholders.

About ProShares

ProShares has been at the forefront of the ETF revolution since

2006. ProShares now offers one of the largest lineups of ETFs, with

more than $45 billion in assets. The company is the leader in

strategies such as dividend growth, interest rate hedged bond and

geared (leveraged and inverse) ETF investing. ProShares continues

to innovate with products that provide strategic and tactical

opportunities for investors to manage risk and enhance returns.

January 6, 2021

ProShares is the leader in strategies such as dividend growth,

interest rate hedged bond and geared (leveraged and inverse) ETF

investing. Source: ProShares, 2021.

Geared (leveraged or short) ProShares ETFs seek returns that are

a multiple of (e.g., 2x or -2x) the return of an index or other

benchmark (target) for a single day, as measured from one

NAV calculation to the next. Due to the compounding of daily

returns, ProShares' returns over periods other than one day will

likely differ in amount and possibly direction from the target

return for the same period. These effects may be more pronounced in

funds with larger or inverse multiples and in funds with volatile

benchmarks. Investors should monitor their ProShares holdings

consistent with their strategies, as frequently as daily. For more

on correlation, leverage and other risks, please read the

prospectus.

Investing involves risk, including the possible loss of

principal. ProShares ETFs are generally non-diversified, and

each entails certain risks, which may include risk associated with

the use of derivatives (swap agreements, futures contracts and

similar instruments), imperfect benchmark correlation, leverage and

market price variance, all of which can increase volatility and

decrease performance. Short positions lose value as security prices

increase. Narrowly focused investments typically exhibit higher

volatility. Investments in smaller companies typically exhibit

higher volatility. Smaller company stocks also may trade at greater

spreads or lower trading volumes and may be less liquid than stocks

of larger companies. Please see summary and full prospectuses for a

more complete description of risks. There is no guarantee any

ProShares ETF will achieve its investment objective.

Carefully consider the investment objectives, risks, charges

and expenses of ProShares before investing. This and other

information can be found in their summary and full prospectuses.

Read them carefully before investing.

ProShares are distributed by SEI Investments Distribution Co.,

which is not affiliated with the funds' advisor or sponsor.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210106005789/en/

Media Contact: Tucker Hewes, Hewes Communications, Inc.,

212.207.9451, tucker@hewescomm.com

Investor and Financial Professional Contact: ProShares,

866.776.5125, info@proshares.com, ProShares.com

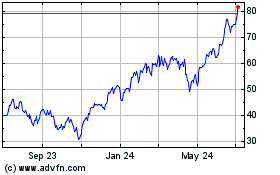

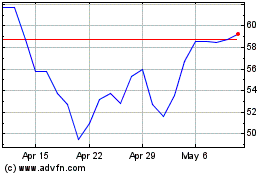

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Mar 2024 to Mar 2025