false

0000868278

0000868278

2024-08-15

2024-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 15, 2024

PROPHASE

LABS, INC.

(Exact

name of Company as specified in its charter)

| Delaware |

|

000-21617 |

|

23-2577138

|

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

711

Stewart Avenue, Suite 200

Garden

City, New York |

|

11530 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (215) 345-0919

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any

of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered Pursuant to Section 12(b) of the Exchange Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.0005 |

|

PRPH |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

August 15, 2024, ProPhase Labs, Inc. (the “Company”) issued an Amended and Restated Unsecured Promissory Note and Guaranty

(the “Note”) for an aggregate principal amount of $10.0 million to JXVII Trust (“JXVII”), that supersedes, terminates,

restates, replaces, and amends the Unsecured Promissory Note And Guaranty, dated as of January 26, 2023, for an aggregate principal

amount of $7.6 million issued to JXVII that was previously disclosed pursuant to a Form 8-K filed by the Company on January 30,

2023. The Note is due and payable on August 15, 2027, the third anniversary of August 15, 2024, the date on which the Note was

funded (the “Closing Date”), and accrues interest at a rate of 15% per year from the Closing Date, payable on a quarterly

basis, until the Note is repaid in full. The Company has the right to prepay the Note at any time after the Closing Date and prior to

the maturity date without premium or penalty upon providing seven days’ written notice to JXVII.

The

Note contains customary events of default. If a default occurs and is not cured within the applicable cure period or is not waived, any

outstanding obligations under the Note may be accelerated. The Note requires the Company to use proceeds from any divestment of assets

(other than in the ordinary course) for general working capital purposes and prohibits the Company from distributing or reinvesting such

proceeds without the prior approval of JXVII, subject to certain exceptions.

The

Company intends to use the proceeds from the Note for working capital and general corporate purposes, which may include capital expenditures,

product development and commercialization expenditures, and acquisitions of companies, businesses, technologies and products within and

outside the consumer products industry.

The

foregoing description of the Note does not purport to be complete and is subject to, and is qualified in its entirety by reference to,

the full text of the Note, which is attached as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein

by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

disclosure provided in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

Item

8.01 Other Events.

The

Company is supplementing the Company’s risk factors in its Annual Report on Form 10-K filed with the U.S. Securities and Exchange

Commission (the “SEC”) on March 29, 2024, and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June

30, 2024, filed with the SEC on May 10, 2024 and August 14, 2024, respectively, with the risk factor set forth below.

Servicing

our debt will require a significant amount of cash, and we may not have sufficient cash flow from our business to pay our debt.

Our

ability to make scheduled payments of the principal of, to pay interest on or to refinance our indebtedness depends on our future performance,

which is subject to economic, financial, competitive and other factors beyond our control. We had, as of June 30, 2024, approximately

$13.6 million of outstanding indebtedness, net of discounts and approximately $2.4 million in cash and cash equivalents. In addition,

on August 15, 2024, we amended and restated the unsecured promissory note and guaranty previously issued to JXVII Trust that increased

the principal amount from $7.6 million to $10.0 million. Our business may not generate cash flow from operations in the future sufficient

to service our debt obligations and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required

to adopt one or more alternatives, such as selling assets, restructuring debt or obtaining additional equity capital on terms that may

be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition

at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result

in a default on our debt obligations.

Item

9.01. Financial Statements and Exhibits.

| * |

Certain

portions of this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(6) promulgated under the Exchange Act of 1934,

as amended. The Company agrees to furnish supplementally a copy of any omitted schedule to the SEC

upon request. |

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

ProPhase

Labs, Inc. |

| |

|

|

| |

By: |

/s/

Ted Karkus |

| |

|

Ted

Karkus |

| |

|

Chief

Executive Officer |

| |

|

|

| Date:

August 21, 2024 |

|

|

Exhibit

10.1

CERTAIN

INFORMATION HAS BEEN OMITTED FROM THIS EXHIBIT PURSUANT TO ITEM 601(B)(10) OF REGULATION S-K, BECAUSE IT IS BOTH NOT MATERIAL AND THE

TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. IN ADDITION, CERTAIN PERSONALLY IDENTIFIABLE INFORMATION HAS BEEN OMITTED

FROM THIS EXHIBIT PURSUANT TO ITEM 601(A)(6) OF REGULATION S-K. [***] INDICATES THAT INFORMATION HAS BEEN REDACTED.

THE

ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS NOTE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED

OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED,

OR (B) AN OPINION OF COUNSEL TO THE HOLDER (IF REQUESTED BY THE COMPANY), IN A FORM REASONABLY ACCEPTABLE TO THE COMPANY, THAT REGISTRATION

IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD OR ELIGIBLE TO BE SOLD PURSUANT TO RULE 144 UNDER SAID ACT.

AMENDED

AND RESTATED UNSECURED PROMISSORY NOTE AND GUARANTY

| $10,000,000 |

Dated

as of: August 15, 2024 |

ARTICLE

I

GENERAL

1.1.

General.

PROPHASE

LABS, INC. (the “Company”) and JXVII TRUST are parties to that certain Unsecured Promissory Note and Guaranty

dated as of January 26, 2023 (the “Original Note”). The parties hereby amend and restate the Original Note. Accordingly,

or value received, hereby promises to pay to the order of or such holder’s successors and assigns (the “Holder”),

the parties agree that

(a)

the principal amount of the Original Note is increased from Seven Million Six Hundred Thousand Dollars ($7,600,000.00) to Ten Million

Dollars $10,000,000, which amount includes all amounts due and owing under the Original Note; and

(b)

Holder shall remit an additional Two Million Four Hundred Thousand Dollars ($2,400,000) to the Company, less the amount set forth in

Section 1.1(c) below, on or before the close of business on the Closing Date (the “Additional Funding”); and

(c)

Accrued and unpaid interest due on the Original Note through the Closing Date totals $93,698.63, which amount Holder shall deduct

from the remittance of the Additional Funding in full satisfaction of the Company’s obligation to pay such interest; and

(d)

This Amended and Restated Unsecured Promissory Note (the “New Note”) supercedes, terminates, restates, replaces and amends

the Original Note and Guaranty in all respects, and the Original Note is hereby deemed satisfied and paid in full, and all obligations

arising thereunder are hereby released; and

(e)

The Company agrees to repay principal borrowed under the New Note, together with interest thereon calculated from the Closing Date, in

accordance with the provisions of New Note (as the same may be amended, amended and restated, supplemented or otherwise modified from

time to time).

1.2.

Defined Terms.

As

used in this Note:

(a)

“Affiliate” shall mean any Person that, directly or indirectly, through one or more intermediaries, is in control

of, is controlled by, or under common control with the Person specified. “Affiliate” of any Person also includes any of his

or her immediate family, including spouse, and their respective lineal descendants.

(b)

“Business Day” shall mean any day other than Saturday, Sunday or days on which commercial banks in New York, New York

are authorized or required by law to close.

(c)

“Closing Date” shall mean August 15, 2024, or such other date on which the Company first receives the proceeds of

the Additional Funding.

(d)

“Company” shall have the meaning ascribed to such term in Section 1.1.

(e)

“Event of Default” shall have the meaning ascribed to such term in Section 3.1 hereof.

(f)

“GAAP” means generally accepted accounting principles in the United States of America as in effect from

time to time.

(g)

“Guarantor” means ProPhase Labs, Inc.

(h)

“Holder” shall have the meaning ascribed to such term in Section 1.1 hereof.

(i)

“Interest Rate” shall mean fifteen percent (15%) per annum.

(j)

“Lien” means any lien, encumbrance, mortgage, pledge, charge or security interest of any kind upon any property or

assets of the Company or any of its Subsidiaries, whether any such property or assets are now owned or hereafter acquired.

(k)

“Maturity Date” shall mean the third anniversary of the Closing Date set forth in this New Note.

(l)

“Note Register” means the register or other ledger maintained by the Company that records the record owners of the

Notes.

(m)

“Obligations” means all obligations (monetary or otherwise, whether absolute or contingent, matured or unmatured)

of the Company arising under or in connection with this Note and the principal of and premium, if any, and interest (including interest

accruing during the pendency of any proceeding of the type described in Section 3.1(b), whether or not allowed in such proceeding)

on the Loan.

(n)

“Party” means each of the Company, the Guarantor and the Holder.

(o)

“Payment Date” shall mean (x) each March 31st, June 30th, September 30th and December

31st beginning with September 30, 2024 during the term of the New Loan and (y) the Maturity Date.

(p)

OMITTED

(q)

“Person” means natural persons, corporations, limited liability companies, limited partnerships, general partnerships,

limited liability partnerships, joint ventures, trusts, land trusts, business trusts, or other organizations, irrespective of whether

they are legal entities, and governments and agencies and political subdivisions thereof.

(r)

“Subsidiary” means any Person that is controlled, directly or indirectly, by the Company.

ARTICLE

II

NOTE PROVISIONS

2.1.

Maturity Date

The

outstanding principal balance of the Loan, together will all accrued and unpaid interest thereon, shall be due and payable on the Maturity

Date.

2.2.

Interest

Except

as otherwise provided herein, on and after the Closing Date, interest on the outstanding principal balance of the Loan shall accrue at

the rate per annum equal to the Interest Rate from the date the Loan was made until payment in full of the Loan, whether at maturity,

upon acceleration, by prepayment or otherwise. Interest on the Loan shall be computed on the basis of the actual number of days the principal

is outstanding on the basis of a 365-day or 366-day year, as is applicable. Interest shall accrue on the Loan on the day on which such

Loan is made, and shall not accrue on the day on which, the Loan or any portion of the Loan, is paid. Interest on the Loan shall be due

and payable in arrears on each Payment Date and at such other times as may be specified herein.

2.3.

Payments

(a)

All payments of interest and principal shall be in lawful money of the United States of America to Holder, at the address specified in

this Note, or at such other address as may be specified from time to time by Holder in a written notice delivered to the Company. If

any payment under this Note shall come due on a day other than a Business Day, such payment shall be made on the next succeeding Business

Day, and such extension of time shall in such case be included in the computation of interest.

(b)

Amounts prepaid or repaid may not be reborrowed.

2.4.

Prepayments. At any time after the Closing Date and prior to the Maturity Date, the Company may prepay the Loan in whole or

in part without premium or penalty upon seven (7) Business Days’ prior notice to the Holder. Any such payments shall be applied

first to any accrued unpaid interest and then to the outstanding principal balance hereunder.

2.5.

Guarantee. Guarantor hereby unconditionally and irrevocably guarantees to the Holder, as a guaranty of payment and not a mere

guaranty of collection, the payment of all sums required to be paid by the Company under this New Note. Guarantor represents and warrants

to the Holder that (a) Guarantor has received good and valuable consideration for the guaranty herein and (b) Guarantor is not currently

insolvent and shall not be rendered insolvent by reason of the guaranty provided herein. For purposes hereof, the term “insolvent”

shall mean, with respect to Guarantor, that (a) the present fair saleable value of Guarantor’s assets is less than the amount required

to pay Guarantor’s total indebtedness, (b) Guarantor is unable to pay its debts and liabilities, subordinated, contingent or otherwise,

as such debts and liabilities become absolute and matured, (c) Guarantor intends to incur or believes that it will incur debts that would

be beyond its ability to pay as such debts mature, or (d) Guarantor has unreasonably small capital with which to conduct the business

in which it is engaged as such business is now conducted and is proposed to be conducted.

2.6

Common Stock Purchase Warrant. In partial consideration for the Original Note, the Company, previously issued to the Holder

a Common Stock Purchase Warrant (the “Warrant Agreement”) granting to the Holder a right to purchase 76,000 shares of Common

Stock of the Company at the exercise price of $9.00 per share, subject to adjustment as provided therein. The terms, provisions, obligations,

rights and benefits of the Warrant Agreement shall survive for the full term provided for therein notwithstanding any prior payment of

discharge of the Original Note or this New Note.

ARTICLE

III EVENTS

OF DEFAULT

3.1.

Events of Default.

The

occurrence of each of the following events or circumstances after the Closing Date shall constitute an “Event of Default”:

(a)

the Company or the Guarantor shall fail to pay any amount under this Note when due and such failure continues for a period of at least

ten (10) Business Days;

(b)

any representation or warranty made by the Company or Guarantor in this New Note, proves to have been incorrect in any material respect

as of the date thereof;

(c)

default is made in the due observance or performance of any of the covenants or agreements of the Company or Guarantor contained in this

New Note and such default shall continue for 15 days following notice from Lender of such default or of any event, fact or circumstance

constituting such default; or

(d)

the Company shall generally not pay its debts as such debts become due, or shall admit in writing its inability to pay its debts generally,

or shall make a general assignment for the benefit of creditors, or any proceeding shall be instituted by or against the Company seeking

to adjudicate it a bankrupt or insolvent, or seeking liquidation, winding up, reorganization, arrangement, adjustment, protection, relief,

or composition of it or its debts under any law relating to bankruptcy, insolvency or reorganization or relief of debtors, or seeking

the entry of an order for relief or the appointment of a receiver, trustee, or other similar official for it or for any substantial part

of its property and in the case of any such proceeding instituted against the Company such proceeding shall not be stayed or dismissed

within ninety (90) days from the date of institution thereof.

3.2.

Action upon any Event of Default.

If

any Event of Default shall occur and while such Event of Default is continuing, the Holder, may at its option and without any prior notice

to the Company or the Guarantor declare the entire outstanding principal amount of the Loan, together with any accrued but unpaid interest

owing thereunder immediately due and payable. Following the occurrence of any Event of Default, interest shall accrue on all unpaid principal

hereunder at the lesser of (i) eighteen percent (18%) per annum and (ii) the maximum non-usurious rate of interest permitted by applicable

law The Company hereby agrees to pay all expenses, including reasonable attorneys’ fees, all of which shall become a part of the

principal hereof, incurred by Holder if this Note is placed in the hands of an attorney for collection, or if collected by suit or through

any probate, bankruptcy or any other legal proceedings.

ARTICLE

IV

COVENANTS

AND OTHER PROVISIONS

4.1.

Covenants.

(a)

Divestment covenant. If after the Closing Date any assets of the Company or any of its Subsidiaries are divested (other

than the sale of assets in the ordinary course of the Company’s business consistent with past practices), the proceeds of such

sale shall be utilized for general working capital purposes and may not be distributed or reinvested by the Company or any Subsidiary

other than as short term cash and cash equivalents without the prior approval of the Holder.

4.2.

Waivers, Amendments, etc.

The

provisions of this Note may from time to time be amended, modified or waived if such amendment, modification or waiver is in writing

and executed by the Parties.

4.3.

Notices.

All

notices, requests or communications required or permitted to be given, sent or delivered to any of the parties to this Agreement shall

be in writing and shall be deemed to have been given, sent or delivered, subject to the further provisions of this 3, (a) the same day,

when presented personally to such party or emailed, (b) the next Business Day, when sent by nationally recognized overnight delivery

service or (c) the third Business Day following mailing, when sent by first class U.S. mail, to such party at its address set forth below,

in each case, it being understood that a receipt of any notice on any day other than a Business Day or after 5:00 p.m. (in the recipient’s

time zone) on any day shall be deemed to have been received, or as context may require, given, on the next Business Day.

If

to the Company or the Guarantor, addressed to the Company: ProPhase Labs, Inc.

711

Stewart Avenue, Suite 200

Garden

City, New York 11530 Attention: Ted Karkus

Telephone:

[***]

Email:

[***]

If

to the Holder, addressed to it:

JXVII

Trust

[***]

Attention:

[***]

Telephone:

[***]

Email:

[***]

or

to such other persons or entities or addresses as any one Party may request or notify the other Party from time to time.

4.4.

Severability.

Any

provision of this Note which is prohibited or unenforceable in any jurisdiction shall, as to such provision and such jurisdiction, be

ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions of this New Note or affecting

the validity or enforceability of such provision in any other jurisdiction.

4.5.

Headings.

The

headings of this New Note are inserted for convenience only and shall not affect the meaning or interpretation of this Note or any provisions

hereof.

4.6.

Replacement of Note.

Upon

the Company’s receipt of evidence satisfactory to it of the loss, theft, destruction or mutilation of this New Note and, in case

of loss, theft or destruction, of an indemnity reasonably satisfactory to it, or, in the case of mutilation, upon surrender and cancellation

of this New Note, and in all cases upon reimbursement to the Company of all reasonable expenses incidental thereto, the Company will

make and deliver a replacement Note of like tenor in lieu of this New Note.

4.7.

Governing Law; Submission to Jurisdiction; Waiver of Jury Trial.

THIS

NEW NOTE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS OF THE STATE OF NEW YORK (INCLUDING FOR SUCH PURPOSE

SECTIONS 5-1401 AND 5-1402 OF THE GENERAL OBLIGATIONS LAW OF THE STATE OF NEW YORK) AND WITHOUT GIVING EFFECT TO ANY CHOICE OR CONFLICT

OF LAW PROVISION OR RULE THAT WOULD CAUSE THE APPLICATION OF THE LAWS OF ANY OTHER JURISDICTION OTHER THAN THE STATE OF NEW YORK. ALL

DISPUTES AND CONTROVERSIES BETWEEN THE PARTIES HERETO ARISING OUT OF OR IN CONNECTION WITH OR RELATING TO THIS NEW NOTE OR ANY MATTERS

DESCRIBED OR CONTEMPLATED HEREIN SHALL BE HANDLED AT A PROCEEDING IN COURTS IN THE BOROUGH OF MANHATTAN IN THE CITY OF NEW YORK IN THE

STATE OF NEW YORK OR IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK. EACH OF THE PARTIES EXPRESSLY CONSENTS

TO THE FOREGOING JURISDICTION AND AGREES TO WAIVE TO THE FULL EXTENT PERMITTED BY LAW ANY OBJECTION THAT THEY MAY NOW OR HEREAFTER HAVE

TO THE VENUE OF ANY SUCH LITIGATION, PROCEEDING OR ACTION IN ANY SUCH COURT OR THAT ANY SUCH LITIGATION, PROCEEDING OR ACTION WAS BROUGHT

IN AN INCONVENIENT FORUM. EACH PARTY HERETO IRREVOCABLY AND UNCONDITIONALLY WAIVES THE RIGHT TO A TRIAL BY JURY IN ANY LEGAL ACTION OR

PROCEEDING IN CONNECTION WITH OR RELATING TO THIS AGREEMENT, THE SECURITY AGREEMENT OR ANY OTHER DOCUMENT RELATING THERETO AND FOR ANY

COUNTERCLAIM THEREIN.

4.8.

Entire Understanding.

This

New Note constitutes the entire understanding and agreement between the parties hereto concerning the subject matter hereof. All negotiations

and writings between the parties with respect to the subject matter hereof are merged into this New Note, and there are no representations,

warranties, covenants, understandings, or agreements, oral or otherwise, in relation thereto between the parties other than those incorporated

herein or to be delivered hereunder.

4.9.

Usury Laws.

It

is the intention of the Company, the Guarantor and the Holder of this New Note to conform strictly to all applicable usury laws now or

hereafter in force, and if at any time and for any reason the interest rate payable on the Loan shall exceed the maximum legal amount

permitted to be charged under applicable usury laws such interest rate shall be reduced automatically to the maximum rate of interest

permitted to be charged under applicable law and that portion of each sum paid attributable to that portion of such interest rate that

exceeds the maximum rate of interest permitted by applicable law shall be deemed a voluntary prepayment of principal.

4.10.

Successors; Restrictions on Transfer; Transfer Mechanics.

(a)

This New Note shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted

assigns; provided, however, that neither the Company nor Holder may assign, sell, pledge or otherwise transfer its rights

or obligations under this Note without the prior written consent of the other party, which consent may be withheld in the other party’s

sole discretion and any transfer shall be subject to the restrictions on transfer described below.

(b)

This New Note has not been registered under the Securities Act, or the securities laws of any state or other jurisdiction. Neither this

New Note nor any interest or participation herein may be reoffered, sold, assigned, transferred, pledged, encumbered or otherwise disposed

of (a “Transfer”) in the absence of such registration or unless (i) such transaction is exempt from, or not subject

to, registration under the Securities Act or the securities laws of any state or other jurisdiction and (ii) is made in compliance with

applicable federal and state statutory resale restrictions, if any. The Holder by its acceptance of this New Note agrees that it shall

not offer, sell, assign, transfer, pledge, encumber or otherwise dispose of this Note or any portion thereof or interest therein and

then (other than with respect to a Transfer pursuant to a registration statement that is effective at the time of such Transfer) only

(A) to the Company, (B) to an Affiliate of the Holder, (C) to a Person it reasonably believes to be an “accredited investor”

within the meaning of Rule 501(a) under the Securities Act, or (D) pursuant to a transaction in compliance with Rule 144 or Rule 144A

under the Securities Act, and in the case of (B), (C) and (D) above in which the transferor furnishes the Company with such certifications,

legal opinions or other information as the Company may reasonably request to confirm that such transfer is being made pursuant to an

exemption from, or in a transaction not subject to, the registration requirements of the Securities Act as applicable.

(c)

The Holder represents that it is an “accredited investor” within the meaning of Rule 501 of the Securities Act. The Holder

has been advised that this New Note has not been registered under the Securities Act, or any state securities laws and, therefore, cannot

be resold unless it is registered under the Securities Act and applicable state securities laws or unless an exemption from such registration

requirements is available. The Holder is aware that the Company is under no obligation to effect any such registration or to file for

or comply with any exemption from registration. The Holder has not been formed solely for the purpose of making this investment and is

acquiring the New Note for its own account for investment, and not with a view to, or for resale in connection with, the distribution

thereof.

(d)

The Company shall cooperate with the Holder and take all actions reasonably necessary to effectuate any Transfer of this New Note by

the Holder that is permitted under Section 4.10 (b) above.

(e)

The transfer of this New Note is registrable on the Note Register upon surrender of this Note for registration of transfer at the address

of the Company identified in Section 4.3 of this New Note (the “Designated Office”), duly endorsed by, or accompanied

by a written instrument of transfer in form satisfactory to the Company duly executed by, the Holder hereof or such Holder’s attorney

duly authorized in writing, and thereupon one or more new notes, of authorized denominations and for the same aggregate principal amount,

will be issued to the designated transferee or transferees. Such notes are issuable only in registered form without coupons in denominations

of $50,000. No service charge shall be made for any such registration of transfer, but the Company may require payment of a sum sufficient

to recover any tax or other governmental charge payable in connection therewith. Prior to due presentation of this New Note for registration

of transfer, the Company and any agent of the Company may treat the Person in whose name this New Note is registered as the owner thereof

for all purposes, whether or not this New Note be overdue, and neither the Company nor any such agent shall be affected by notice to

the contrary.

(f)

Upon presentation of this New Note for registration of transfer at the Designated Office accompanied by (i) certification by the transferor

that such transfer is in compliance with the terms hereof and (ii) by a written instrument of transfer in a form approved by the Company

executed by the Holder, in person or by the Holder’s attorney thereunto duly authorized in writing, and including the name, address

and telephone and fax numbers of the transferee and name of the contact person of the transferee, such note shall be transferred on the

Note Register, and a new note of like tenor and bearing the same legends shall be issued in the name of the transferee and sent to the

transferee at the address and c/o the contact person so indicated. Transfers and exchanges of notes shall be subject to such additional

restrictions as are set forth in the legends on the notes and to such additional reasonable regulations as may be prescribed by the Company

as specified in this Section 4.10. Successive registrations of transfers as aforesaid may be made from time to time as desired, and each

such registration shall be noted on the note register.

4.11.

Waiver.

Except

as otherwise provided for in this New Note, and to the fullest extent permitted by applicable law, Company waives presentment, notice,

demand and protest, and notice of non-payment, presentment, dishonor, acceleration of maturity and diligence in connection with the enforcement

of this New Note or the taking of any actions to collect sums owing hereunder. No failure or delay on the part of the Holder in the exercise

of any power, right or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power,

right or privilege preclude other or further exercise thereof or of any other right, power or privilege at any other time. All rights

and remedies existing hereunder are cumulative.

4.12.

Counterparts.

This

New Note may be executed by the parties hereto in several counterparts, each of which shall be an original and all of which shall constitute

together but one and the same agreement. This New Note shall become effective when counterparts hereof executed on behalf of all of the

signatories hereto, shall have been received by the Holder. Delivery of an executed counterpart of a signature page to this New Note

by email (e.g. “pdf” or “tiff”) or telecopy or via Docusign shall be effective as delivery of a manually executed

counterpart of this New Note.

4.13.

No Recourse Against Others.

No

director, officer, employee or stockholder, as such, of neither the Company not the Guarantor shall have any liability for any obligations

of the Company or the Guarantor under this New Note or for any claim based on, in respect or by reason of, such obligations or their

creation. The Holder by accepting this New Note waives and releases all such liability. This waiver and release are part of the consideration

for the issue of this New Note.

4.14.

Attorney’s Fees and Costs.

Each

Party is obligated to pay its own costs and expenses in connection with this Note (including fees and expenses of counsel and costs incurred

by the Holder in connection with enforcement).

4.15

Representations and Warranties of the Company. The Company and the Guarantor (collectively, the “Loan Parties”)

represent and warrant to the Holder as follows:

(a)

Each Loan Party (i) is duly organized, legally existing and in good standing under the laws of the jurisdiction in which it is organized,

(ii) has all requisite corporate power and authority, as applicable, to own or lease and operate its properties and to carry on its business

as now conducted and as proposed to be conducted, and (iii) is duly qualified to do business and is in good standing in each jurisdiction

where necessary in light of its business as now conducted.

(b)

Each Loan Party has full corporate power and authority, as applicable, to enter into, deliver and perform this New Note and to perform

its obligations contemplated herein and has taken all necessary corporate action to authorize the execution, delivery and performance

by it of this New Note. This New Note has been duly executed and delivered by each Loan Party and is in full force and effect.

(c)

This New Note constitutes the valid and binding obligation of each Loan Party, enforceable in accordance with its terms except as enforcement

may be limited (i) by bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws affecting creditors’

rights generally and (ii) by general principles of equity (regardless of whether such enforceability is considered in a proceeding in

equity or at law).

(d)

The execution, delivery and performance by each Loan Party of this New Note do not and will not (i) violate the organizational documents

of such Loan Party, (ii) violate or result in a breach of, or constitute a default under, any material indenture, loan agreement, mortgage,

deed of trust or other instrument or agreement to which it is a party or by which it is bound, (iii) conflict with or result in a breach

of, or constitute a default under, any applicable law, or (iv) or result in the creation or imposition of any Lien upon any properties

of such Loan Party, other Permitted Liens.

(e)

The execution, delivery and performance of this New Note does not require the consent or approval of any other Person, including, without

limitation, any governmental authority, except consents or approvals that have been obtained.

[Signature

Page Follows]

IN

WITNESS WHEREOF, each of the undersigned Parties have duly executed and delivered this Note as of the date first written above.

| |

COMPANY:

PROPHASE LABS, INC. |

| |

|

| |

By: |

/s/

Ted Karkus |

| |

Name: |

Ted

Karkus |

| |

Title: |

Chief

Executive Officer |

| |

HOLDER: |

| |

|

|

| |

JXVII TRUST |

| |

|

|

| |

By: |

/s/

George R Harrison |

| |

|

George

R Harrison, Trustee |

v3.24.2.u1

Cover

|

Aug. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 15, 2024

|

| Entity File Number |

000-21617

|

| Entity Registrant Name |

PROPHASE

LABS, INC.

|

| Entity Central Index Key |

0000868278

|

| Entity Tax Identification Number |

23-2577138

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

711

Stewart Avenue

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Garden

City

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11530

|

| City Area Code |

(215)

|

| Local Phone Number |

345-0919

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0005

|

| Trading Symbol |

PRPH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

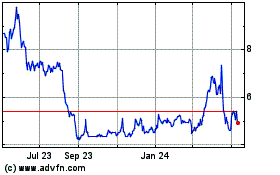

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

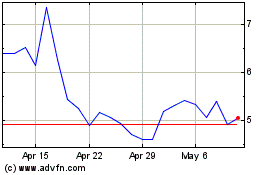

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Nov 2023 to Nov 2024