ProPhase Labs, Inc. (NASDAQ: PRPH) (“ProPhase” or the “Company”), a

next-generation biotech, genomics, and diagnostics company, today

reported its financial and operational results for the three months

ended March 31, 2024.

The three months ended March 31, 2024, marked a

continuation of the transformation of ProPhase Labs. As the

expansion plans at its wholly owned subsidiary, Pharmaloz

Manufacturing, gain momentum, the Company is evaluating strategic

alternatives including the potential sale or securing long-term

agreements to optimize the capacity of its forthcoming second

production line.

The shortage of lozenge manufacturing capacity

that the Company has previously highlighted shows no sign of

abating. In Q1 the Company attended Expo West, the largest health

and wellness expo of the year. Pharmaloz was the only attending

company, to our knowledge, that was offering future lozenge

manufacturing capacity. Nearly a dozen companies expressed

significant interest, and we are in negotiations with several such

companies. Some of the newer potential customers are seeking out

functional year-round lozenges that deliver vitamins, immunity

boosters or overall health and wellness. Over the next several

quarters, Pharmaloz intends to enter into agreements with multiple

customers that will require year-round production that should

smooth out the manufacturing seasonality. The new automation

equipment incorporated into line one is running smoothly and the

capacity has been increased to over $15 million per year.

Furthermore, the Company intends to increase the efficiency of line

one by incorporating cutting-edge water recycling that will

decrease water usage by over 96%. Line two is being delivered in

several stages, with completion expected during the third quarter.

It is anticipated that the addition of line two could lead to a

significant increase in revenues at Pharmaloz starting in the

fourth quarter.

Subject to market conditions, our ability to

generate enhanced revenues, and other factors, the Company

anticipates that there will be a significant sequential improvement

in revenues and EBITDA in the second half of 2024, driven by

strategic advancements across its subsidiaries.

Participants can register for the virtual

conference call by navigating to:

https://www.renmarkfinancial.com/events/first-quarter-2024-results-virtual-conference-call-nasdaq-prph-2024-05-09-110000

Additional corporate highlights for the three

months ended March 31, 2024, and recent positive developments,

include the following:

1) Pharmaloz Manufacturing

| |

● |

The Company is currently engaged in late-stage negotiations to

potentially either sell the plant or pre-book some or all of the

future capacity of its second manufacturing line. |

| |

● |

Anticipate $40 - $45 million of potential revenue capacity once

line two is fully operational in Q3. $80 - $100 million of

potential revenue capacity if an additional two lines are installed

in 2025. |

| |

● |

There is a significant shortage of lozenge manufacturing capacity

in both the U.S. and globally. |

| |

● |

The Company estimates that to build a new manufacturing facility

from scratch with the capacity that Pharmaloz could have next year

might cost approximately $100 million and take 5 years to complete

with FDA approvals. And of course, any such new facility would not

include the customers that the Company already has. |

| |

● |

Pharmaloz recently signed two significant deals representing over

$5 million in additional revenues per year. Manufacturing has

already begun for the first of these deals. Both deals could expand

significantly in the future. Importantly, the second customer is

not seasonal. |

| |

● |

The Company is working on several more non-seasonal customers that

were sourced at the largest annual health and wellness expo. |

| |

● |

Engineering completed the design of phase 1 and phase 2 plans. This

could potentially take the plant from 1 lozenge line to a potential

of up to 7 operational lines within the next four years and a

potential of over $250 million in annual revenue capacity. |

| |

● |

New liquid fill equipment is ahead of schedule and already enroute

to the factory with manufacturing anticipated to begin by the end

of May. |

| |

● |

Existing customers accepted an average price increase of 15.2% for

production in 2024. |

| |

● |

Passed the 3-year FDA audit with no citations. |

| |

● |

Recently passed the 4-Day UL Audit. |

2) Nebula Genomics

| |

● |

Expanded its business development team to increase global outreach

and access to advanced genetic testing. |

| |

● |

Automated workflows and added key technicians in the New York lab

have significantly improved throughput and reduced turnaround

times. |

| |

● |

Nebula has built a massive database over the last six years, from

whole genome sequencing tests across more than 130 countries,

equivalent to roughly 150 million ancestry SNP-based tests. |

| |

● |

Data is safeguarded by world-class cyber security measures to

protect sensitive genetic information. |

| |

● |

Nebula’s whole genome sequencing technology analyzes greater than

99% of human DNA, providing a deeper insight compared to typical

ancestry tests that analyze less than 1%. |

| |

● |

Nebula’s proprietary bioinformatics platform delivers in-depth

genetic health information, identifies rare genetic mutations, and

traces ancestry at highly competitive prices. |

| |

● |

Signed key international business-to-business agreement with

MenaDNA, Inc., a well-established global distribution company,

enabling significant global growth opportunities. |

| |

● |

Additional significant agreements are currently under

negotiation. |

| |

|

|

3) BE-Smart Esophageal Cancer Test

| |

● |

Completed additional samples which are currently being analyzed by

Stat King, a division of Genesis Drug Discovery and Development, to

further validate the 90%+ sensitivity and specificity of the

BE-Smart Esophageal Cancer test. |

| |

● |

Company on track to commercialize BE-Smart in the second half of

2024. Working with multiple consultants to secure CPT codes by the

second half of 2024. |

| |

● |

Discussions for commercialization continue with a potential global

partner. |

| |

● |

Working in conjunction with multiple groups to fully develop the

‘advanced traffic light’ approach of green, yellow, orange, and red

to assess distinct levels of cancer risk, leading to optimized

treatment approaches. This approach could lead to insurance

companies mandating the use of the BE-Smart test for endoscopies

performed on Barrett’s Esophagus patients. |

| |

● |

Working with Mayo Clinic to assess additional potential areas of

interest within a panel of 55 additional markers. These patterns

could help in conjunction with ZenQ-AI to develop potential

targeted oncology therapies. |

| |

|

|

4) Project ZenQ-AI

|

|

● |

The launch of Project ZenQ-AI marks a significant leap forward in

cancer treatment research, utilizing the Company’s massive global

genomics database and analyzing patented discoveries from its

BE-Smart Esophageal Cancer diagnostic test. |

|

|

● |

This initiative deploys state-of-the-art AI algorithms to discover

potential new cancer therapies, specifically focusing on antibody

drug conjugates. |

|

|

|

|

5) Equivir

|

|

● |

Anticipate that by the end of May, the 300th patient will have

reached the 180-day mark thereby completing the original target of

enrolling 300 or more patients and monitoring such patients over a

180-day period. |

|

|

● |

Currently have over 329 active patients in the study. |

|

|

● |

Released impressive interim preliminary results from 152 patients

at the 90-day mark. |

|

|

● |

Remain on target for full data unlocking by the end of the second

quarter. |

|

|

● |

The Company is planning to increase production of the Equivir

capsules with a second half 2024 launch timeframe. |

|

|

● |

Currently working with the Company’s distribution partner to

potentially leverage distribution longer term in over 40,000 food,

drug and mass retail stores. |

|

|

|

|

6) Some additional financial

highlights

|

|

● |

Ended April with over $4.6 million in cash on the balance

sheet. |

|

|

● |

Realized over $3.6 million on the partial sale of an

investment. |

|

|

● |

Raised over $2.5 million by securitizing a small portion of

outstanding receivables. |

|

|

● |

Increased monthly accounts receivable collections with current

collection partner. |

|

|

● |

Started to receive payment from a key insurance company

representing a receivable of close to $4.2 million. |

|

|

|

|

Ted Karkus, ProPhase Lab’s Chief Executive

Officer, commented, “Q1 continues to be transformative for ProPhase

Labs. The expansion of Pharmaloz and new strategic interest, the

potential commercialization of our BE-Smart Esophageal Cancer test,

the continued development of Nebula Genomics and the most recent AI

initiative are collectively paving the way for a very exciting

future.

Pharmaloz is no longer an undiscovered gem as it

was one of the stars of the expo in April. We discussed potential

deals with a dozen companies that, if consummated, would fill our

near term planned capacity expansion. Several key industry players

have turned to Pharmaloz to help develop bench samples of products

that they have not been able to develop on their own. Furthermore,

the interest from a couple of the largest brands has been quite

staggering as they are seeking to potentially lock up our newest

line with long-term contracts. We are also excited to roll out our

liquid-filled capacity, starting late in Q2, as many customers are

noting growing demand in the liquid-filled segment.

ProPhase Biopharma remains a primary focus as

our BE-Smart Esophageal Cancer test moves ever closer to

commercialization. The Company is in discussions with multiple

experts in the field to secure the CPT codes and plan for a

successful commercial launch. The initial target market for

BE-Smart is $7 - $14 billion dollars. We believe that there is an

incredible need and lack of competition for our breakthrough cancer

test.

We also eagerly await the results of the Equivir

trial expected to be released sometime by the end of the second

quarter. Once we confirm the results, the Company is poised with a

commercial launch designed to coincide with the start of the upper

respiratory disease season.

As we move forward, our focus remains on driving

value across all subsidiaries, with a clear vision of realizing and

maximizing shareholder value. As of April 30, 2024, the Company had

over $4.6 million in cash. The Company has no current plans to

raise additional equity capital as there are three potential

liquidity events that we are focused on. There is a potential

strategic acquisition at Pharmaloz that could require a significant

downpayment. Additionally, there could be a substantial downpayment

to secure capacity on line two. Separately, there is the potential

for a significant inflow of capital related to our enhanced

accounts receivable collection initiatives. Any one of these three

key liquidity events may happen within the next quarter or two. The

future of ProPhase has never been brighter, and the best is yet to

come”, concluded Mr. Karkus.

Financial Results

Three Months Ended March 31, 2024 as

compared to the Three Months Ended March 31, 2023

For the three months ended March 31, 2024, net

revenue was $3.6 million as compared to $19.3 million for the three

months ended March 31, 2023. The decrease in net revenue was the

result of a $14.5 million decrease in net revenue from diagnostic

services, and a $1.1 million decrease in consumer products. The

decrease in net revenue for diagnostic services was due to

decreased COVID-19 testing volumes compared to the 2023 period as a

result of the highly contagious Omicron variant, which emerged in

early 2022. Overall diagnostic testing volume decreased from

120,000 tests in the three months ended March 31, 2023 to zero

tests in the three months ended March 31, 2024. None of the tests

during the three months ended March 31, 2023 were reimbursed by the

HRSA uninsured program.

Cost of revenues for the three months ended

March 31, 2024 were $4.1 million, comprised of $0.7 million for

diagnostic services and $3.4 million for consumer products. Cost of

revenues for the three months ended March 31, 2023 were $8.8

million, comprised of $5.2 million for diagnostic services and $3.6

million for consumer products.

We realized a gross margin loss of $0.4 million

for the three months ended March 31, 2024 as compared to a gross

margin profit of $10.5 million for the three months ended March 31,

2023. The decrease of $10.9 million was comprised of a decrease of

$10.0 million in diagnostic services, and a decrease of $0.9

million in consumer products. For the three months ended March 31,

2024 and 2023 we realized an overall gross margin of (11.9)% and

54.5%, respectively. Gross margin for diagnostic services was zero

or not applicable due to no revenue and 64.0% in the 2024 and 2023

comparable periods, respectively. Gross margin for consumer

products was 7.8% and 25.5% in the 2024 and 2023 comparable

periods, respectively. Gross margin for consumer products has

historically been influenced by fluctuations in quarter-to-quarter

production volume, fixed production costs and related overhead

absorption, raw ingredient costs, inventory mark to market

write-downs and timing of shipments to customers.

Diagnostic services costs for the three months

ended March 31, 2024 were zero compared to $1.2 million for the

three months ended March 31, 2023. The decrease in diagnostic

service costs of $1.2 million for the three months ended March 31,

2024 as compared to the three months ended March 31, 2023 was due

to decreased COVID-19 testing volumes in 2024 compared to the 2023

period.

General and administration expenses for the

three months ended March 31, 2024 were $7.6 million as compared to

$8.3 million for the three months ended March 31, 2023. The

decrease in general and administration expenses of $0.7 million for

the three months ended March 31, 2024 as compared to the three

months ended March 31, 2023 was principally related to a decrease

in personnel expenses and professional fees associated with our

diagnostic services business.

Research and development costs for the three

months ended March 31, 2024 were $272,000 as compared to $144,000

for the three months ended March 31, 2023. The increase in research

and development costs of $128,000 for the three months ended March

31, 2024 as compared to the three months ended March 31, 2023 was

principally due to increased activities at PBIO. These activities

include product research and field testing.

As a result of the effects described above, net

loss for the three months ended March 31, 2024 was $6.3 million, or

$(0.07) per share, as compared to net income of $0.6 million, or

$0.03 per share, for the three months ended March 31, 2023. Diluted

loss and earnings per share for the three months ended March 31,

2024 and 2023 were $(0.07) and $0.03, respectively.

Our aggregate cash and cash equivalents as of

March 31, 2024 were $1.7 million as compared to $2.1 million at

December 31, 2023. Our working capital was $21.1 million and $26.7

million as of March 31, 2024 and December 31, 2023, respectively.

The decrease of $0.4 million in our cash and cash equivalents for

the three months ended March 31, 2024 was principally due to the

proceeds from the sale of marketable debt securities of $3.4

million, and proceeds from issuance of notes payable and mortgage

loan of $2.5 million, offset by (i) $5.1 million cash used in

operating activities, (ii) capital expenditures of $0.9 million,

and (iii) repayment of notes payable for $189,000. As of April 30,

2024 the Company had $4.6 million of cash.

Webcast Details

Investors interested in participating in this

live event will need to register using the link below. After the

event, a replay will be available on The Company’s Investor

website.

REGISTER HERE:

https://www.renmarkfinancial.com/events/first-quarter-2024-results-virtual-conference-call-nasdaq-prph-2024-05-09-110000

About ProPhase Labs

ProPhase Labs Inc. (Nasdaq: PRPH) (“ProPhase”)

is a next-generation biotech, genomics and diagnostics company. Our

goal is to create a healthier world with bold action and the power

of insight. We’re revolutionizing healthcare with industry-leading

Whole Genome Sequencing solutions, while developing potential game

changer diagnostics and therapeutics in the fight against cancer.

This includes a potentially life-saving cancer test focused on

early detection of esophageal cancer and potential breakthrough

cancer therapeutics with novel mechanisms of action. Our

world-class CLIA labs and cutting-edge diagnostic technology

provide wellness solutions for healthcare providers and consumers.

We develop, manufacture, and commercialize health and wellness

solutions to enable people to live their best lives. We are

committed to executional excellence, smart diversification, and a

synergistic, omni-channel approach. ProPhase Labs’ valuable

subsidiaries, their synergies, and significant growth underscore

our multi-billion-dollar potential.

Forward Looking Statements

Except for the historical information contained

herein, this document contains forward looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding our strategy, plans,

objectives and initiatives, including our expectation to enter into

new agreements for Pharmaloz, our expectations regarding the future

revenue growth potential of each of our subsidiaries, our

expectations regarding future liquidity events and the prospects of

raising additional equity capital, the expected timeline for

commercializing our BE-Smart Esophageal Cancer Test, our ability to

enter into new domestic and international long-term contracts for

our Nebula Genomics business and the financial impact of any such

contracts, the anticipated timing for the receipt of new equipment

and installation of additional lozenge lines and their ability to

increase capacity and revenue, our anticipated expenses, ability to

obtain funding for our operations and the sufficiency of our cash

resources, and the expected timeline for the launch of Equivir

capsules. Management believes that these forward-looking statements

are reasonable as and when made. However, such forward-looking

statements involve known and unknown risks, uncertainties, and

other factors that may cause actual results to differ materially

from those projected in the forward-looking statements. These risks

and uncertainties include but are not limited to our ability to

obtain and maintain necessary regulatory approvals, general

economic conditions, consumer demand for our products and services,

challenges relating to entering into and growing new business

lines, the competitive environment, and the risk factors listed

from time to time in our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q and any other SEC filings. The Company

undertakes no obligation to update forward-looking statements

except as required by applicable securities laws. Readers are

cautioned that forward-looking statements are not guarantees of

future performance and are cautioned not to place undue reliance on

any forward-looking statements.

For more information, visit

www.ProPhaseLabs.com.

ProPhase Media Relations and Institutional Investor

Contact:

ProPhase Labs,

Inc.267-880-1111investorrelations@prophaselabs.com

ProPhase Retail Investor Relations Contact:

Renmark Financial CommunicationsJohn

Boidman514-939-3989Jboidman@renmarkfinancial.com

Source: ProPhase Labs, Inc.

ProPhase Labs, Inc. and

SubsidiariesCondensed Consolidated Balance

Sheets(in thousands, except share and per share

amounts)

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,175 |

|

|

$ |

1,609 |

|

|

Restricted cash |

|

|

561 |

|

|

|

540 |

|

|

Marketable debt securities, available for sale |

|

|

58 |

|

|

|

3,127 |

|

|

Accounts receivable, net |

|

|

35,116 |

|

|

|

36,313 |

|

|

Inventory, net |

|

|

3,758 |

|

|

|

3,841 |

|

|

Prepaid expenses and other current assets |

|

|

4,377 |

|

|

|

2,155 |

|

| Total current assets |

|

|

45,045 |

|

|

|

47,585 |

|

| |

|

|

|

|

|

|

|

|

| Property, plant and equipment,

net |

|

|

12,797 |

|

|

|

12,898 |

|

| Prepaid expenses, net of

current portion |

|

|

732 |

|

|

|

832 |

|

| Operating lease right-of-use

asset, net |

|

|

4,462 |

|

|

|

4,572 |

|

| Intangible assets, net |

|

|

11,687 |

|

|

|

12,333 |

|

| Goodwill |

|

|

5,231 |

|

|

|

5,231 |

|

| Deferred tax asset |

|

|

9,762 |

|

|

|

7,313 |

|

| Other assets |

|

|

316 |

|

|

|

1,163 |

|

| TOTAL

ASSETS |

|

$ |

90,032 |

|

|

$ |

91,927 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

11,759 |

|

|

$ |

9,383 |

|

|

Accrued diagnostic services |

|

|

268 |

|

|

|

314 |

|

|

Accrued advertising and other allowances |

|

|

8 |

|

|

|

24 |

|

|

Finance lease liabilities |

|

|

1,840 |

|

|

|

1,840 |

|

|

Operating lease liabilities |

|

|

959 |

|

|

|

953 |

|

|

Short-term loan payable, net of discount of $396 |

|

|

2,381 |

|

|

|

— |

|

|

Deferred revenue |

|

|

1,630 |

|

|

|

2,382 |

|

|

Income tax payable |

|

|

3,005 |

|

|

|

3,278 |

|

|

Other current liabilities |

|

|

2,057 |

|

|

|

2,683 |

|

| Total current liabilities |

|

|

23,907 |

|

|

|

20,857 |

|

| |

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Secured long-term debt, net of discount of $334 and $340 |

|

|

2,926 |

|

|

|

2,924 |

|

|

Unsecured promissory notes, net of discount of $232 and $266 |

|

|

7,368 |

|

|

|

7,334 |

|

|

Due to sellers (see Note 3) |

|

|

2,000 |

|

|

|

2,000 |

|

|

Deferred revenue, net of current portion |

|

|

1,100 |

|

|

|

1,100 |

|

|

Operating lease liabilities, net of current portion |

|

|

4,122 |

|

|

|

4,237 |

|

|

Finance lease liabilities, net of current portion |

|

|

3,742 |

|

|

|

4,092 |

|

| Total non-current

liabilities |

|

|

21,258 |

|

|

|

21,687 |

|

| Total liabilities |

|

|

45,165 |

|

|

|

42,544 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Preferred stock authorized 1,000,000, $0.0005 par value, no shares

issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock authorized 50,000,000, $0.0005 par value, 18,045,029

and 18,045,029 shares outstanding, respectively |

|

|

18 |

|

|

|

18 |

|

|

Additional paid-in capital |

|

|

120,283 |

|

|

|

118,694 |

|

|

Accumulated deficit |

|

|

(11,294 |

) |

|

|

(5,029 |

) |

|

Treasury stock, at cost, 18,940,967 and 18,940,967 shares,

respectively |

|

|

(64,000 |

) |

|

|

(64,000 |

) |

|

Accumulated other comprehensive loss |

|

|

(140 |

) |

|

|

(300 |

) |

|

Total stockholders’ equity |

|

|

44,867 |

|

|

|

49,383 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

90,032 |

|

|

$ |

91,927 |

|

ProPhase Labs, Inc. and

SubsidiariesCondensed Consolidated Statements of

Operations and Comprehensive Income (Loss)(in

thousands, except per share

amounts)(unaudited)

| |

|

For the three months ended |

|

| |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

| Revenues, net |

|

$ |

3,634 |

|

|

$ |

19,303 |

|

| Cost of revenues |

|

|

4,067 |

|

|

|

8,783 |

|

| Gross (loss) profit |

|

|

(433 |

) |

|

|

10,520 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Diagnostic expenses |

|

|

— |

|

|

|

1,203 |

|

| General and

administration |

|

|

7,593 |

|

|

|

8,298 |

|

| Research and development |

|

|

272 |

|

|

|

144 |

|

| Total operating expenses |

|

|

7,865 |

|

|

|

9,645 |

|

| (Loss) Income from

operations |

|

|

(8,298 |

) |

|

|

875 |

|

| |

|

|

|

|

|

|

|

|

| Interest income, net |

|

|

— |

|

|

|

11 |

|

| Interest expense |

|

|

(515 |

) |

|

|

(215 |

) |

| Other expense |

|

|

(18 |

) |

|

|

(107 |

) |

| (Loss) Income from operations

before income taxes |

|

|

(8,831 |

) |

|

|

564 |

|

| Income tax benefit

(expense) |

|

|

2,566 |

|

|

|

(14 |

) |

| (Loss) income from

operations after income taxes |

|

|

(6,265 |

) |

|

|

550 |

|

| Net (loss)

income |

|

$ |

(6,265 |

) |

|

$ |

550 |

|

| |

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

| Unrealized gain (loss)

on marketable debt securities |

|

|

160 |

|

|

|

(665 |

) |

| Total comprehensive

loss |

|

$ |

(6,105 |

) |

|

$ |

(115 |

) |

| |

|

|

|

|

|

|

|

|

| Earnings (loss) per

share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.07 |

) |

|

$ |

0.03 |

|

| Diluted |

|

$ |

(0.07 |

) |

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

|

90,423 |

|

|

|

16,748 |

|

| Diluted |

|

|

90,423 |

|

|

|

18,061 |

|

ProPhase Labs, Inc. and

SubsidiariesCondensed Consolidated Statements of

Cash Flows(in

thousands)(unaudited)

| |

|

For the three months ended |

|

| |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(6,265 |

) |

|

$ |

550 |

|

| Adjustments to reconcile net

(loss) income to net cash (used in) provided by operating

activities: |

|

|

|

|

|

|

|

|

|

Realized loss on marketable debt securities |

|

|

18 |

|

|

|

107 |

|

|

Depreciation and amortization |

|

|

1,686 |

|

|

|

1,292 |

|

|

Amortization of debt discount |

|

|

146 |

|

|

|

20 |

|

|

Amortization on operating lease right-of-use assets |

|

|

110 |

|

|

|

85 |

|

|

Stock-based compensation expense |

|

|

1,589 |

|

|

|

947 |

|

|

Accounts receivable allowances |

|

|

— |

|

|

|

(147 |

) |

|

Credit loss expense, direct write-off |

|

|

— |

|

|

|

230 |

|

|

Inventory reserve |

|

|

(69 |

) |

|

|

1 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

1,197 |

|

|

|

(864 |

) |

|

Inventory |

|

|

152 |

|

|

|

(336 |

) |

|

Prepaid expenses and other current assets |

|

|

(2,122 |

) |

|

|

(2,107 |

) |

|

Deferred tax asset |

|

|

(2,612 |

) |

|

|

(96 |

) |

|

Other assets |

|

|

847 |

|

|

|

— |

|

|

Accounts payable and accrued expenses |

|

|

2,376 |

|

|

|

(2,661 |

) |

|

Accrued diagnostic services |

|

|

(46 |

) |

|

|

(656 |

) |

|

Accrued advertising and other allowances |

|

|

(16 |

) |

|

|

52 |

|

|

Deferred revenue |

|

|

(752 |

) |

|

|

443 |

|

|

Operating lease liabilities |

|

|

(459 |

) |

|

|

(80 |

) |

|

Income tax payable |

|

|

(273 |

) |

|

|

(341 |

) |

|

Other liabilities |

|

|

(626 |

) |

|

|

4,037 |

|

| Net cash (used in) provided by

operating activities |

|

|

(5,119 |

) |

|

|

476 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

Business acquisitions, escrow received |

|

|

— |

|

|

|

478 |

|

|

Asset acquisitions, net of cash acquired |

|

|

— |

|

|

|

(2,904 |

) |

|

Proceeds from sales of marketable securities |

|

|

3,374 |

|

|

|

1,291 |

|

|

Capital expenditures |

|

|

(939 |

) |

|

|

(517 |

) |

| Net cash provided by (used in)

investing activities |

|

|

2,435 |

|

|

|

(1,652 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of note payable |

|

|

2,460 |

|

|

|

7,600 |

|

|

Repurchases of common shares |

|

|

— |

|

|

|

(541 |

) |

|

Repurchase of common stock for payment of statutory taxes due on

cashless exercise of stock option |

|

|

— |

|

|

|

(5,379 |

) |

|

Repayment of note payable |

|

|

(189 |

) |

|

|

— |

|

| Net cash provided by financing

activities |

|

|

2,271 |

|

|

|

1,680 |

|

| |

|

|

|

|

|

|

|

|

| (Decrease) increase in cash,

cash equivalents and restricted cash |

|

|

(413 |

) |

|

|

504 |

|

| Cash, cash equivalents and

restricted cash at the beginning of the period |

|

|

2,149 |

|

|

|

9,109 |

|

| Cash, cash equivalents

and restricted cash at the end of the period |

|

$ |

1,736 |

|

|

$ |

9,613 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures: |

|

|

|

|

|

|

|

|

| Cash paid for income

taxes |

|

$ |

318 |

|

|

$ |

1,500 |

|

| Interest payment on the

promissory notes |

|

$ |

642 |

|

|

$ |

203 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosure of non-cash investing and financing

activities: |

|

|

|

|

|

|

|

|

| Financed capital

expenditures |

|

$ |

— |

|

|

$ |

1,623 |

|

| Common stock issued in asset

acquisition |

|

$ |

— |

|

|

$ |

1,000 |

|

Non-GAAP Financial Measures and

Reconciliation

In an effort to provide investors with

additional information regarding our results of operations as

determined by accounting principles generally accepted in the

United States of America (“GAAP”), we disclose certain non-GAAP

financial measures. The primary non-GAAP financial measures we

disclose are EBITDA and Adjusted EBITDA.

We define “EBITDA” as net income (loss) before

net interest expense, income taxes, depreciation and amortization.

Adjusted EBITDA further adjusts EBITDA by excluding acquisition

costs, other non-cash items, and other unusual or non-recurring

charges (as described in the table below).

Non-GAAP financial measures should not be

considered as a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP. These

non-GAAP financial measures do not reflect a comprehensive system

of accounting, differ from GAAP measures with the same names and

may differ from non-GAAP financial measures with the same or

similar names that are used by other companies. We compute non-GAAP

financial measures using the same consistent method from quarter to

quarter and year to year. We may consider whether other significant

items that arise in the future should be excluded from the non-GAAP

financial measures.

We use EBITDA and Adjusted EBITDA internally to

evaluate and manage the Company’s operations because we believe

they provide useful supplemental information regarding the

Company’s ongoing economic performance. We believe that these

non-GAAP financial measures provide meaningful supplemental

information regarding our operating results primarily because they

exclude amounts that are not considered part of ongoing operating

results when planning and forecasting and when assessing the

performance of the organization. In addition, we believe that

non-GAAP financial information is used by analysts and others in

the investment community to analyze our historical results and in

providing estimates of future performance and that failure to

report these non-GAAP measures could result in confusion among

analysts and others and create a misplaced perception that our

results have underperformed or exceeded expectations.

The following table sets forth the

reconciliations of EBITDA and Adjusted EBITDA excluding other costs

to the most comparable GAAP financial measures (in thousands):

| |

|

For the three months ended |

|

| |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

| GAAP net income (1) |

|

$ |

(6,265 |

) |

|

$ |

550 |

|

| Interest, net |

|

|

515 |

|

|

|

204 |

|

| Income tax (benefit)

expense |

|

|

(2,566 |

) |

|

|

14 |

|

| Depreciation and

amortization |

|

|

1,686 |

|

|

|

1,292 |

|

| EBITDA |

|

|

(6,630 |

) |

|

|

2,060 |

|

| Share-based compensation

expense |

|

|

1,589 |

|

|

|

947 |

|

| Non-cash rent expense (2) |

|

|

169 |

|

|

|

6 |

|

| Bad debt expense |

|

|

— |

|

|

|

74 |

|

| Adjusted EBITDA |

|

$ |

(4,872 |

) |

|

$ |

3,087 |

|

| (1) |

We believe that net income (loss) is the financial measure

calculated and presented in accordance with GAAP that is most

directly comparable to EBITDA and Adjusted EBITDA. EBITDA and

Adjusted EBITDA measure the Company’s operating performance without

regard to certain expenses. EBITDA and Adjusted EBITDA are not

presentations made in accordance with GAAP and the Company’s

computation of EBITDA and Adjusted EBITDA may vary from others in

the industry. EBITDA and Adjusted EBITDA have important limitations

as analytical tools and should not be considered in isolation or as

substitutes for analysis of the Company’s results as reported under

GAAP. |

| |

|

| (2) |

The non-cash portion of rent, which reflects the extent to which

our GAAP rent expense recognized exceeds (or is less than) our cash

rent payments. For newer leases, our rent expense recognized

typically exceeds our cash rent payments, while for more mature

leases, rent expense recognized is typically less than our cash

rent payments. |

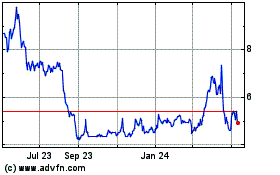

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

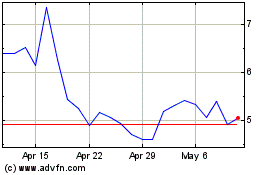

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Nov 2023 to Nov 2024