SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the Securities Exchange Act of 1934

PROFIRE ENERGY, INC.

(Name of Subject Company)

PROFIRE ENERGY, INC.

(Name of Persons Filing Statement)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

74316X101

(CUSIP Number of Class of Securities)

Ryan W. Oviatt & Cameron M. Tidball

Co-Chief Executive Officers

Profire Energy, Inc.

321 South 1250 West, Suite 1

Lindon, Utah 84042

(801) 209-7767 & (780) 722-7340

(Name, address, and telephone numbers of persons authorized to receive notices and communications

on behalf of the persons filing statement)

Copies to

Sam Gardiner

Mayer Brown LLP

201 South Main Street, Suite 1100

Salt Lake City, Utah 84111

(801) 907-2701

and

Ryan Ferris

71 S. Wacker Dr.

Chicago, Illinois 60606

(312) 701-7199

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

TABLE OF CONTENTS

| |

|

|

|

|

|

1

|

|

|

| |

|

|

|

|

|

1

|

|

|

| |

|

|

|

|

|

2

|

|

|

| |

|

|

|

|

|

9

|

|

|

| |

|

|

|

|

|

32

|

|

|

| |

|

|

|

|

|

32

|

|

|

| |

|

|

|

|

|

32

|

|

|

| |

|

|

|

|

|

33

|

|

|

| |

Item 9. Exhibits

|

|

|

|

|

35

|

|

|

Item 1. Subject Company Information.

Name and Address

The name of the subject company to which this Solicitation/Recommendation Statement on Schedule 14D-9 (together with any exhibits and annexes attached hereto, this “Schedule 14D-9”) relates is Profire Energy, Inc., a Nevada corporation (“Profire” or the “Company”). Unless the context indicates otherwise, we use the terms “us,” “we” and “our” to refer to Profire. The address of Profire’s principal executive office is 321 South 1250 West, Suite 1 Lindon, Utah 84042. The telephone number of Profire’s principal executive office is (801) 796-5127.

Securities

The title of the class of equity securities to which this Schedule 14D-9 relates is Profire’s common stock (the “Company Common Stock”), par value $0.001 per share (each such share, a “Share,” and, collectively, the “Shares”).

As of November 25, 2024, there were (a) 46,199,725 Shares issued and outstanding and (b) 1,930,558 restricted stock units relating to Shares outstanding under the Company’s 2014 Equity Incentive Plan and 2023 Equity Incentive Plan (“Company RSUs”).

Item 2. Identity and Background of Filing Person.

Name and Address

Profire, the subject company, is the person filing this Schedule 14D-9. The name, business address and business telephone number of Profire are set forth in “Item 1. Subject Company Information — Name and Address” above.

Tender Offer and Merger

This Schedule 14D-9 relates to the tender offer (the “Offer”) by CECO Environmental Corp., a Delaware corporation (“Parent”), and Combustion Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Parent (“Purchaser”), to purchase all of the outstanding Shares (other than Shares held by the Company or any wholly-owned subsidiary of the Company, Parent, Purchaser or any other wholly-owned subsidiary of Parent, in each case, as of immediately prior to the commencement of the Offer (such Shares, the “Cancelled Shares”)) at an offer price per Share of $2.55 (the “Offer Price”), net to the seller thereof in cash, without interest, and subject to any applicable withholding taxes, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated December 3, 2024 (as it may be amended or supplemented from time to time, the “Offer to Purchase”), and in the related Letter of Transmittal (as it may be amended or supplemented from time to time, the “Letter of Transmittal”). Parent and Purchaser filed a Tender Offer Statement on Schedule TO in respect of the Offer (together with the exhibits thereto, as it or they may be amended or supplemented from time to time, the “Schedule TO”) with the U.S. Securities and Exchange Commission (the “SEC”) on December 3, 2024. The Offer to Purchase and form of Letter of Transmittal are being mailed to the Company’s stockholders together with this Schedule 14D-9.

The Offer is being made pursuant to the Agreement and Plan of Merger, dated as of October 28, 2024 (as it may be amended or supplemented from time to time in accordance with its terms, the “Merger Agreement”), by and among Parent, Purchaser and Profire. Subject to the satisfaction, or waiver (to the extent permitted by law) by Parent and/or Purchaser, of the conditions to the Offer (other than the Minimum Tender Condition (as defined in the Merger Agreement)) which may not be waived by Parent or Purchaser), Purchaser shall (Parent shall cause Purchaser to) (a) irrevocably accept for payment all Shares validly tendered and not validly withdrawn pursuant to the Offer immediately after the expiration of the Offer (the time of such acceptance, the “Acceptance Time”) and (b) as promptly as practicable after the Acceptance Time (and in any event within three (3) business days) pay for such Shares, in each case, in accordance with the procedures set forth in the Offer to Purchase. The Offer will expire at one minute after 11:59 p.m. Eastern Time on December 31, 2024, unless Purchaser extends the Offer in accordance with the terms of the Merger Agreement.

The Merger Agreement further provides that, among other things, as soon as practicable following (but in any event on the same date as) the Acceptance Time and subject to the satisfaction or waiver of the applicable conditions set forth in the Merger Agreement, and in accordance with the Nevada Revised Statutes, as amended (the “NRS”), and the General Corporation Law of the State of Delaware, as amended (the “DGCL”), Purchaser will merge with and into the Company (the “Merger”), with the Company surviving as a wholly owned subsidiary of Parent (the “Surviving Corporation”). The Merger will be governed by Section 92A.133 of the NRS and, consequently, no meeting or vote of the Company’s stockholders will be required to consummate the Merger. At the effective time of the Merger (the “Effective Time”), each Share (other than Cancelled Shares) will be converted into the right to receive an amount equal to the Offer Price (the “Merger Consideration”), in cash and without interest (and subject to any withholding of taxes required by applicable law), and each Cancelled Share will be cancelled and no consideration will be delivered in exchange therefor. The Offer, the Merger and the other transactions contemplated by the Merger Agreement are collectively referred to as the “Transactions.”

See the section titled “Item 3. Past Contacts, Transactions, Negotiations and Agreements — Arrangements with Current Executive Officers and Directors of the Company — Treatment of Company RSUs in the Transactions” for a discussion of the treatment of the Company RSUs.

The foregoing summary of the Offer is qualified in its entirety by reference to the more detailed description and explanation contained in the Merger Agreement, the Offer to Purchase, the Letter of Transmittal and other related materials, as well as the full text of the Merger Agreement. Copies of the Merger Agreement, the Offer to Purchase and the Letter of Transmittal are filed as Exhibits (e)(1), (a)(1)(A) and (a)(1)(B), respectively, to this Schedule 14D-9 and are incorporated herein by reference. In addition, information relating to the Offer, including this Schedule 14D-9 and other related documents, will be available at no charge from the SEC through its website at www.sec.gov.

As set forth in the Schedule TO, Parent and Purchaser’s business address is 5080 Spectrum Drive, Suite 800E, Addison, Texas 75001. The telephone number of Parent and Purchaser is (214) 357-6181.

Item 3. Past Contacts, Transactions, Negotiations and Agreements.

Except as set forth or incorporated by reference in this Schedule 14D-9, to the knowledge of Profire, as of the date of this Schedule 14D-9, there is no material agreement, arrangement or understanding, nor any actual or potential conflict of interest, between Profire or its affiliates, on the one hand, and (a) any of Profire’s executive officers, directors or affiliates, or (b) Parent, Purchaser or their respective executive officers, directors or affiliates, on the other hand.

The Company’s board of directors (the “Board”) was aware of all such contracts, agreements, arrangements or understandings and any actual or potential conflicts of interest set forth or incorporated by reference in this Schedule 14D-9 and considered them along with other matters described below in “Item 4. The Solicitation or Recommendation — Reasons for the Recommendation” during its deliberations on the merits of the Merger Agreement and the Transactions and in determining to make the recommendation set forth in this Schedule 14D-9.

Arrangements between Profire, Parent and Purchaser

Merger Agreement

The summary of the material terms of the Merger Agreement set forth in Section 11 of the Offer to Purchase and the description of the terms and conditions of the Offer set forth in Section 1 of the Offer to Purchase and the related procedures and withdrawal rights set forth in the Offer to Purchase, in each case, are incorporated herein by reference. Such summaries and descriptions do not purport to be complete and are qualified in their entirety by reference to the full text of the Merger Agreement, the Offer to Purchase and the Letter of Transmittal, which are filed as Exhibits (e)(1), (a)(1)(A) and (a)(1)(B), respectively, to this Schedule 14D-9.

The Merger Agreement governs the contractual rights among the Company, Parent and Purchaser in relation to the Offer and the Merger. The Merger Agreement has been included as an exhibit to this

Schedule 14D-9 to provide the Company’s stockholders with information regarding the terms of the Merger Agreement and is not intended to modify or supplement any factual disclosures about the Company, Parent or Purchaser made in the Company’s public reports filed with the SEC. In particular, the assertions embodied in the representations and warranties contained in the Merger Agreement are qualified by information in a confidential disclosure letter provided by the Company to Parent and Purchaser in connection with the signing of the Merger Agreement. The disclosure letter contains information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Merger Agreement. The representations and warranties contained in the Merger Agreement were made as of specified dates and may be subject to limitations agreed upon by the contracting parties. Certain representations and warranties in the Merger Agreement may have been made for the purpose of allocating contractual risk among the Company, Parent and Purchaser, rather than establishing matters of fact. Accordingly, the representations and warranties in the Merger Agreement may not represent the actual state of facts about the Company, Parent or Purchaser. Other than the indemnification provisions of the Merger Agreement (which are discussed in “Director and Officer Exculpation Indemnification and Insurance” below), the rights of the Company’s stockholders to receive the Offer Price and the holders of Company RSUs to receive the consideration described in the Merger Agreement and the rights of the Company (on behalf of stockholders) to pursue certain equitable remedies on stockholders’ behalf, nothing in the Merger Agreement confers any rights or remedies upon any person other than the parties to the Merger Agreement. The Company’s stockholders should not rely on the representations, warranties and covenants contained in the Merger Agreement or any descriptions thereof as characterizations of the actual state of facts or conditions of the Company, Parent, Purchaser or any of their respective subsidiaries or affiliates.

The foregoing summary of the terms of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit (e)(1) to this Schedule 14D-9 and is incorporated herein by reference.

Exclusivity Agreement

On September 25, 2024, Parent and the Company entered into an exclusivity agreement (the “Exclusivity Agreement”), which provided for exclusive negotiations between Parent and the Company until 5:00 p.m., Eastern Time, on November 9, 2024.

The foregoing summary of the Exclusivity Agreement does not purport to be complete and is qualified in its entirety by reference to the Exclusivity Agreement, a copy of which is filed as Exhibit (e)(2) to this Schedule 14D-9 and is incorporated herein by reference.

Support Agreements

Concurrently with the execution and delivery of the Merger Agreement, on October 28, 2024, Brenton Hatch (and certain of his affiliates), the Chairman of the Board, Ryan Oviatt, the Co-Chief Executive Officer and Chief Financial Officer of the Company, and Cameron Tidball, the Co-Chief Executive Officer of the Company (collectively, the “Supporting Stockholders”), each entered into a Tender and Support Agreement (the “Support Agreements”) with Parent and Purchaser. The Support Agreements provide, among other things, that the Supporting Stockholders will tender, or cause to be tendered, in the Offer (a) all Shares beneficially owned, as defined in Rule 13d-3 under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), by each Supporting Stockholder, respectively, as of the date of the Support Agreements and (b) all Shares or other voting securities of the Company that are issued to or otherwise directly or indirectly acquired by and become owned by such Supporting Stockholder after the execution of the Support Agreement (clauses (a) and (b), the “Owned Shares”). By entering into the Support Agreements, the Supporting Stockholders also agreed to other customary terms and conditions, including certain restrictions on transferring their Owned Shares and issuing public statements or press releases. Each of the Supporting Stockholders’ respective obligations under the Support Agreement will automatically terminate upon the earliest to occur of (i) the termination of the Merger Agreement in accordance with it terms, (ii) upon the occurrence of the Acceptance Time, provided that each Supporting Stockholder has tendered all of its Owned Shares and complied with the covenants in the Support Agreement, (iii) the making of a Company Adverse Recommendation Change (as defined in the Merger Agreement) in accordance with the Merger Agreement, (iv) the entry of Parent or Purchaser, without the prior written consent of the

Supporting Stockholders, into any amendment or modification of the Merger Agreement that decreases the Offer Price or changes the form of Merger Consideration and (v) the termination of the Support Agreement by written notice from Parent and Purchaser.

The foregoing summary and description of the Support Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Support Agreements, which are filed as Exhibits (e)(3), (e)(4) and (e)(5) to this Schedule 14D-9 and incorporated herein by reference.

Confidentiality Agreement

On August 9, 2024, Parent and the Company entered into a mutual non-disclosure agreement (the “Confidentiality Agreement”), pursuant to which each of Parent and the Company agreed, subject to certain customary exceptions, to protect the confidentiality of, and restrict the use of, certain confidential information of the other party to be disclosed thereunder in connection with evaluating, negotiating and consummating a possible transaction between the Company and Parent. The term of the Confidentiality Agreement extends to the earlier of (a) August 9, 2026, and (b) the consummation of a potential transaction between Parent and the Company, subject to certain exceptions. The Confidentiality Agreement also includes a customary standstill provision for the benefit of both Parent and the Company that expires on February 9, 2026 (or as of the date of the termination of the Confidentiality Agreement, if terminated prior to such date in accordance with its terms) and permits a proposing party to, among other things, make a private offer or proposal to the board of directors of the other party during the standstill period.

The foregoing summary and description of the Confidentiality Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Confidentiality Agreement, which is filed as Exhibit (e)(6) to this Schedule 14D-9 and incorporated herein by reference.

Arrangements with Current Executive Officers and Directors of the Company

In considering the recommendation of the Board set forth under the section entitled “Item 4. The Solicitation or Recommendation — Recommendation of the Board,” the Company’s stockholders should be aware that certain of the Company’s executive officers and directors may be considered to have interests in the Transactions that may be different from, or in addition to, those of the Company’s stockholders generally. The Board was aware of these interests and considered them, along with other matters, in evaluating and approving the Merger Agreement and the Transactions and recommending that the Company’s stockholders accept the Offer and tender their Shares pursuant to the Offer.

Consideration for Profire Common Stock in the Offer and the Merger

If the Company’s executive officers and directors who own Shares tender their Shares for purchase pursuant to the Offer, they will receive the same consideration on the same terms and conditions as the other stockholders of the Company. If such executive officers and directors do not tender their Shares for purchase pursuant to the Offer, but the conditions of the Offer are otherwise satisfied or waived in accordance with the terms of the Merger Agreement and the Merger is consummated, such executive officers and directors will also receive the same consideration for their Shares on the same terms and conditions as the other stockholders of the Company. As of November 25, 2024, the executive officers and directors of the Company beneficially owned, in the aggregate, 12,032,731 Shares, excluding any Company RSUs which are discussed separately under the section titled “Item 3. Past Contacts, Transactions, Negotiations and Agreements — Arrangements with Current Executive Officers and Directors of the Company — Treatment of Company RSUs in the Transactions.” Of those 12,032,731 Shares, 9,124,279 Shares are beneficially owned by Mr. Brenton Hatch, the Chairman of the Board, and certain of his affiliates. If the Company’s executive officers and directors were to tender all 12,032,731 Shares beneficially owned, directly or indirectly, by them as of November 25, 2024 for purchase pursuant to the Offer and those Shares were accepted for purchase and purchased by Purchaser, then such executive officers and directors would receive, in aggregate, approximately $30,683,464.05 in cash pursuant to the Offer, before deduction of applicable withholding taxes and without interest. As indicated below, to the knowledge of the Company, each of the Company’s executive officers and directors currently intends to tender all of his or her Shares in the Offer.

The following table sets forth the number of Shares beneficially owned as of November 25, 2024 by each of our executive officers and directors, excluding Company RSUs, and the aggregate consideration that would be payable for such Shares pursuant to the Offer based on the Offer Price. These numbers do not reflect any future Share issuances or dispositions that may occur between the close of business on November 25, 2024 and the Effective Time.

|

Name of Executive Officer or Director

|

|

|

Number of

Shares

Beneficially

Owned

(#)

|

|

|

Implied Cash

Consideration

for

Shares

($)

|

|

|

Brenton W. Hatch

|

|

|

|

|

9,124,279 |

|

|

|

|

|

23,266,911.45 |

|

|

|

Daren J. Shaw

|

|

|

|

|

613,437 |

|

|

|

|

|

1,564,264.35 |

|

|

|

Colleen Larkin Bell

|

|

|

|

|

313,070 |

|

|

|

|

|

798,328.50 |

|

|

|

Ryan W. Oviatt

|

|

|

|

|

544,357 |

|

|

|

|

|

1,388,110.35 |

|

|

|

Ronald R. Spoehel

|

|

|

|

|

590,601 |

|

|

|

|

|

1,506,032.55 |

|

|

|

Cameron M. Tidball

|

|

|

|

|

650,184 |

|

|

|

|

|

1,657,969.20 |

|

|

|

Patrick D. Fisher

|

|

|

|

|

196,803 |

|

|

|

|

|

501,847.65 |

|

|

|

All directors and executive officers as a group (7 persons)

|

|

|

|

|

12,032,731 |

|

|

|

|

|

30,683,464.05 |

|

|

Treatment of Company RSUs in the Transactions

Treatment of Company RSUs

Pursuant to the Merger Agreement, at the Effective Time, each Company RSU that is outstanding immediately prior to the Effective Time, whether or not then vested, shall be, by virtue of the Merger and without any action on the part of the holder thereof, cancelled and converted into the right to receive, as promptly as reasonably practicable after the Effective Time, an amount in cash, without interest, equal to the product of: (a) the aggregate number of Shares subject to such Company RSU, and assuming with respect to any Company RSU the vesting of which is subject to the achievement of one or more performance goals, that such goals had been met at the maximum level of performance, and (b) the Merger Consideration, less any withholding taxes.

Table of Estimated Consideration for Executive Officer and Director Equity Awards

The table below sets forth, for each of our executive officers and directors holding Company RSUs as of November 25, 2024, (a) the aggregate number of Shares subject to such Company RSUs, and (b) the value of cash amounts payable in respect of such Company RSUs on a pre-tax basis as of the consummation of the Merger, calculated by multiplying the Merger Consideration by the number of Shares subject to such Company RSU. The table below does not take into account any vesting, exercise or forfeiture of equity awards, nor any additional equity awards that may be granted, in each case, between November 25, 2024 and the closing of the Transactions.

|

Name of Executive Officer or Director

|

|

|

Number of

Company

RSUs

(#)

|

|

|

Cash

Consideration

for Company

RSUs

($)

|

|

|

Brenton W. Hatch

|

|

|

|

|

0 |

|

|

|

|

|

0 |

|

|

|

Daren J. Shaw

|

|

|

|

|

32,117 |

|

|

|

|

|

81,898.35 |

|

|

|

Colleen Larkin Bell

|

|

|

|

|

32,117 |

|

|

|

|

|

81,898.35 |

|

|

|

Ryan W. Oviatt

|

|

|

|

|

638,900 |

|

|

|

|

|

1,629,195.00 |

|

|

|

Ronald R. Spoehel

|

|

|

|

|

32,117 |

|

|

|

|

|

81,898.35 |

|

|

|

Cameron M. Tidball

|

|

|

|

|

638,900 |

|

|

|

|

|

1,629,195.00 |

|

|

|

Patrick D. Fisher

|

|

|

|

|

114,874 |

|

|

|

|

|

292,928.70 |

|

|

|

All directors and executive officers as a group (7 persons)

|

|

|

|

|

1,489,025 |

|

|

|

|

|

3,797,013.75 |

|

|

Golden Parachute Compensation

The table set forth below provides information required by Item 402(t) of Regulation S-K regarding certain compensation for each of the Company’s named executive officers that is based on or otherwise relates to the Merger. For purposes of this table the Company has assumed that the Merger and any qualifying termination of employment of any of the named executive officers will occur contemporaneously with the closing of the Merger on January 2, 2025, the Company’s stock price is $2.55 per Share (which is the Offer Price), and all amounts received by the named executive officers are gross amounts prior to any reductions for withholding taxes or potential golden parachute excise taxes.

The table below describes the estimated potential payments to Ryan Oviatt, Cameron Tidball and Patrick Fisher under the terms of their respective employment or severance agreements in connection with a qualifying termination of employment contemporaneously with the closing of the Merger, together with the value of the unvested Company RSUs that will be accelerated in connection with the Merger. The amounts shown below do not include the value of payments or benefits that would have been earned, or any amounts associated with equity awards that would have vested pursuant to their terms, at or prior to the closing of the Merger or the value of the payments or benefits that are not based on or otherwise related to the Offer.

The amounts shown in the table below are estimates only and are based on assumptions and information available as of the date of the filing of this Schedule 14D-9. These estimates are based on multiple assumptions that may not actually occur, including assumptions described in this Schedule 14D-9.

Golden Parachute Compensation

|

Name

|

|

|

Cash

($)(1)

|

|

|

Equity

($)(2)

|

|

|

Perquisites /

Benefits

($)(3)

|

|

|

Total Value

($)

|

|

|

Ryan Oviatt

|

|

|

|

|

546,058 |

|

|

|

|

|

878,750 |

|

|

|

|

|

27,740 |

|

|

|

|

|

1,452,548 |

|

|

|

Cameron Tidball

|

|

|

|

|

539,526 |

|

|

|

|

|

878,750 |

|

|

|

|

|

3,376 |

|

|

|

|

|

1,421,652 |

|

|

|

Patrick Fisher

|

|

|

|

|

99,397 |

|

|

|

|

|

155,584 |

|

|

|

|

|

2,250 |

|

|

|

|

|

257,231 |

|

|

(1)

The amounts in this column reflect the sum of the following cash payments that the named executive officers would be entitled to receive on a termination of employment by the Company without “cause” or by the named executive officer for “good reason” on the assumed termination date of January 2, 2025: (i) aggregate cash severance payments of (A) 1.5 times base salary continuation for 12 months post-termination for Ryan Oviatt and Cameron Tidball and (B) 8 months’ base salary continuation for Patrick Fisher; and (ii) the accelerated value of the executive’s annual incentive plan bonus.

(2)

The amounts in this column represent the value of the accelerated vesting and payment in respect of Company RSUs held by each named executive officer.

(3)

The amounts in this column represent the value of continued health insurance benefits to which each named executive is entitled in the event of a qualifying termination of employment.

Effect of the Merger on Employee Benefits

Parent has agreed that, for a period commencing at the Effective Time and ending December 31, 2025, Parent shall provide, or cause to be provided, to each individual who is employed by the Company or any of its subsidiaries as of immediately prior to the Effective Time and who continues to be employed immediately after the Effective Time (a “Continuing Employee”) a total compensation and employee benefits package, in the aggregate, substantially similar to that provided to such Continuing Employees immediately prior to the Effective Time.

Parent has also agreed that, with respect to any benefit plan of Parent or any of its subsidiaries that the Continuing Employees will participate in effective as of or after the Effective Time (except for any retiree welfare plans or programs, any defined benefit retirement plans or programs, and any equity compensation arrangements) (“Parent Benefit Plans”), Parent will ensure that the Parent Benefit Plans will credit Continuing Employees for service prior to the Effective Time with the Company or any of its subsidiaries and their

affiliates or their respective predecessors; provided that, service will not be credited to the extent that such crediting would result in a duplication of benefits or such service was not credited under the corresponding benefit plan of the Company or its subsidiaries.

In addition, with respect to any Parent Benefit Plans in which any Continuing Employee will participate in effective as of or after the Effective Time, Parent shall, or shall cause the Surviving Corporation to, (a) waive or cause to be waived all pre-existing conditions limitations, exclusions, eligibility waiting periods, and all evidence of insurability and actively at work requirements with respect to participation and coverage requirements applicable to Continuing Employees under any Parent Benefit Plan in which such Continuing Employees and their covered dependents may be eligible to participate after the Effective Time, to the extent that such limitations, exclusions, waiting periods and requirements would have been waived or satisfied under the corresponding Company Employee Plan (as defined in the Merger Agreement) prior to the Effective Time; provided, that if the benefits under any such Parent Benefit Plan are provided under an insured arrangement, then Parent’s obligation to do so be subject to the approval of the relevant insurance carrier, which Parent will take reasonable commercial efforts to obtain, and (b) provide or cause to be provided to each Continuing Employee and their covered dependents credit under any Parent Benefit Plan for any co-payments, coinsurance, out-of-pocket maximums and deductibles paid prior to the Effective Time, in respect of the plan year in which the Effective Time occurs.

The Company will take all actions that may be necessary under the Company’s 401(k) plan to terminate the Company’s 401(k) plan no later than one day prior to the Closing Date (as defined in the Merger Agreement). Effective as of the Effective Time, Parent shall designate a Parent 401(k) plan that either (a) currently provides for the receipt from the Continuing Employees of “eligible rollover distributions” (as such term is defined in Section 401(a)(31) of the Internal Revenue Code of 1986, as amended, including notes representing plan loans), or (b) shall be amended as soon as practicable following the Effective Time to provide for the receipt from the Continuing Employees of eligible rollover distributions (including loan notes). Parent will, and will cause its affiliates to, take any and all actions needed to permit each Continuing Employee to immediately participate in Parent’s 401(k) plan, and to permit each Continuing Employee with an outstanding loan balance under the Company’s 401(k) plan as of the Effective Time to continue to make scheduled loan payments to the Company’s 401(k) plan after the Effective Time, pending the distribution and in-kind rollover of the notes evidencing such loans from the Company’s 401(k) plan to Parent’s 401(k) plan so as to prevent a deemed distribution or loan offset with respect to such outstanding loans.

For each Continuing Employee who is eligible to receive an annual cash bonus, Parent will, and will cause the Surviving Corporation to, pay to such Continuing Employee any annual bonuses under the Company’s or any of its subsidiaries’ annual incentive plans in cash for the performance period ending December 31, 2024, to the extent earned and not paid as of the Effective Time. If the Effective Time occurs during 2025, then, except as mutually agreed by Parent and the Company, Parent shall set the performance goals for 2025 generally consistent with the Company’s long-term forecast metrics provided to Parent. To the extent such goals and metrics are achieved, in no event shall the 2025 annual bonus amounts be paid out at less than the target amounts disclosed to Parent.

The foregoing is a summary of certain of the terms of the Merger Agreement, does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit (e)(1) to this Schedule 14D-9 and is incorporated herein by reference.

Director and Officer Exculpation, Indemnification and Insurance

Section 78.751 of the NRS permits a Nevada corporation to include in its organizational documents and in agreements between the corporation and its directors, officers, employees or agents, provisions expanding the scope of indemnification beyond that specifically provided by current law.

The Company’s articles of incorporation includes provisions that limit the liability of its directors and officers for monetary damages for breach of their fiduciary duty as directors or officers, except for liability that cannot be eliminated under the NRS. Accordingly, the Company’s directors will not be personally liable for monetary damages for breach of their fiduciary duty as directors, except for liabilities:

•

for acts or omissions which involve intentional misconduct, fraud or knowing violation of law; or

•

for unlawful payments of dividends, as provided under Section 78.300 of the NRS.

The Company’s articles of incorporation and amended and restated bylaws also provide that the Company will indemnify its directors and officers to the fullest extent permitted by the NRS.

The Merger Agreement contains provisions with respect to indemnification, advancement of expenses and exculpation from liabilities in favor of each person who as of the date of the Merger Agreement, was previously, or during the period from the date of the Merger Agreement through the Effective Time will be, serving as a director or officer of the Company or any of its subsidiaries (each such person, an “Indemnified Party”). Specifically, Parent has agreed that to honor and fulfill rights of indemnification, advancement of expenses and exculpation provisions contained in the Company’s organizational documents or indemnification agreements of the Company, in each case as in effect on the date of the Merger Agreement, with respect to actions or omissions occurring at or prior to the Effective Time.

In addition, Parent has agreed that, for six (6) years following the Effective Time, it will cause the certificate of incorporation and bylaws (or comparable organizational documents) of the Surviving Corporation and its subsidiaries to contain provisions no less favorable with respect to indemnification, advancement of expenses and exculpation of Indemnified Parties as are presently set forth in the articles of incorporation and bylaws of the Company and such subsidiaries, and such provisions shall not be amended, repealed or otherwise modified in any manner that would adversely affect any right thereunder of any person benefited by such provisions without such person’s prior written consent.

The rights to advancement, exculpation and indemnification above will survive the consummation of the Merger, are intended to benefit, and will be enforceable by, each Indemnified Party and are in addition to, and not in substitution for, any other rights to indemnification or contribution that any such Indemnified Party may have by contract or otherwise.

Pursuant to the Merger Agreement, Parent, Purchaser and the Company agreed that prior to the Closing (as defined in the Merger Agreement), the Company shall purchase as of the Effective Time, “tail” insurance policies with a claims period of six (6) years from the Effective Time with at least the same coverage and amounts and containing terms and conditions that are not less advantageous to each Indemnified Party, in each case with respect to claims arising out of or relating to events which occurred before or at the Effective Time (including in connection with the Transactions) and being fully prepaid by Parent; provided, however, that if the cost for such “tail” insurance policies exceeds $1,547,550, the Surviving Corporation will be obligated to obtain the greatest coverage available for a cost not exceeding an annual premium equal to $1,547,550.

The foregoing is a summary of certain of the terms of the Merger Agreement, does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit (e)(1) to this Schedule 14D-9 and is incorporated herein by reference.

Section 16 Matters

Prior to the Effective Time, the Company shall take all such steps as may be required to cause to be exempt under Rule 16b-3 promulgated under the Exchange Act any dispositions of Shares (including derivative securities with respect to such Shares) that are treated as dispositions under such rule and result from the Transactions by each director or officer of the Company who is subject to the reporting requirements of Section 16(a) of the Exchange Act with respect to the Company immediately prior to the Effective Time.

Rule 14d-10(d) Matters

Prior to the closing of the Offer, the Company (acting through the compensation committee of the Board) shall take all such steps as may be required to cause each agreement, arrangement, or understanding entered into by the Company or a subsidiary of the Company on or after the date hereof with any of its officers, directors, or employees pursuant to which consideration is paid to such officer, director, or employee to be approved as an “employment compensation, severance, or other employee benefit arrangement” within the meaning of Rule 14d-10(d)(1) under the Exchange Act and to satisfy the requirements of the non-exclusive safe harbor set forth in Rule 14d-10(d) under the Exchange Act.

Item 4. The Solicitation or Recommendation.

Recommendation of the Board

At a meeting held on October 28, 2024, the Board unanimously (a) determined that the Merger Agreement and the Transactions, are fair to and in the best interests of the Company and its stockholders; (b) declared it advisable to enter into the Merger Agreement and approved the execution, delivery, and performance of the Merger Agreement; (c) approved and declared advisable the Transactions; (d) resolved to recommend that the stockholders of the Company accept the Offer and tender their Shares to Purchaser pursuant to the Offer; and (e) resolved that the Merger shall be governed by and effected pursuant to Section 92A.133 of the NRS and Section 252 of the DGCL and that the Merger shall be consummated as soon as practicable following the consummation of the Offer.

Accordingly, and for the reasons described below in the section titled “Item 4. The Solicitation or Recommendation — Reasons for the Recommendation,” the Board unanimously recommends that the stockholders of the Company accept the Offer and tender their Shares to Purchaser pursuant to the Offer.

Background of the Offer and the Merger

Set forth below is a description of what we believe are the material aspects of the background and history of the Offer and the Merger. This description may not contain all the information that is important to you. The Company encourages you to read carefully the entirety of this Schedule 14D-9, including the Merger Agreement attached as Exhibit (e)(1) to this Schedule 14D-9, and the Offer to Purchase, attached as Exhibit (a)(1)(A) to this Schedule 14D-9, for a more complete understanding of the Offer and the Merger.

The Board, together with Company management, regularly reviews and assesses the performance, future growth prospects, business plans and overall strategic direction of the Company, and considers a variety of strategic alternatives that may be available to the Company, including continuing to pursue the Company’s strategy as a stand-alone company or pursuing potential strategic or financing transactions with third parties, in each case with the goal of maximizing stockholder value.

On May 30, 2024, a representative of ThreePart Advisors (“ThreePart”), the Company’s investor relations advisor, indicated to Company management that ThreePart had been informed by Parent, also a client of ThreePart, that Parent was interested in discussing strategic alternatives, including a possible acquisition of the Company by Parent.

In early June 2024, representatives of ThreePart, the Company and Parent finalized arrangements for a meeting between representatives of Company management and the Board and representatives of Parent management and Parent’s board of directors to discuss Parent’s interest in potentially acquiring the Company. The parties agreed on a meeting date of June 13, 2024.

On June 13, 2024, Brenton Hatch, Chairman of the Board, Ryan Oviatt, Co-Chief Executive Officer and Chief Financial Officer of the Company and a member of the Board, and Cameron Tidball, Co-Chief Executive Officer of the Company, met in-person with Jason Dezwirek, Chairman of the board of directors of Parent, Todd Gleason, Chief Executive Officer of Parent, and Peter Johansson, Chief Financial and Strategy Officer of Parent. At the meeting, the parties discussed high-level, introductory facts regarding their respective businesses and Parent’s interest in a potential acquisition of the Company. The representatives of Parent did not propose any terms regarding such a potential acquisition.

On July 2, 2024, Mr. Hatch had a call with Mr. Gleason to discuss Parent’s continuing interest in a potential acquisition of the Company. On the call, Mr. Gleason indicated that Parent would be submitting an offer to purchase the Company, but Mr. Gleason did not specify the terms Parent would propose for such a potential acquisition.

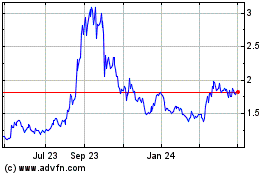

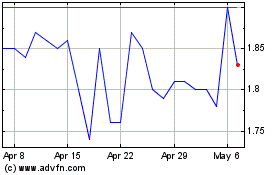

On July 3, 2024, Parent sent the Company a letter reflecting a proposal (“Parent’s Initial Offer”) to purchase all of the issued and outstanding Shares at a price of $2.00 per Share paid for in both cash and newly issued shares of common stock of Parent at a ratio of 75% in cash to 25% of newly issued shares of common stock of Parent. Parent’s Initial Offer also requested that the Company provide Parent with exclusivity for 60 days. As of the close market on July 3, 2024, the market price per Share was $1.50.

On July 8, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown LLP, the Company’s outside legal counsel (“Mayer Brown”), were present. At such meeting, a representative of Mayer Brown reviewed with the Board their fiduciary duties of the Board under Nevada law in respect of Parent’s Initial Offer and exploring a potential sale of the Company and other strategic alternatives available to the Company. Messrs. Oviatt and Tidball provided the Board with a summary of their understanding of Parent’s business. Messrs. Oviatt and Tidball also provided the Board with an overview of the Company’s then-current financial performance and Company management’s preliminary projections of the Company’s future financial performance and business strategy. The Board discussed whether any of the members of the Board or Company management had any conflict of interest with respect to the potential transaction with Parent. The Board determined that, based on the information available to it at that time, each of the members of the Board and Company management were disinterested and independent in respect of the potential transaction with Parent and there was no conflict of interest. After discussion and deliberation, the Board (a) determined to explore a potential acquisition of the Company by Parent and to engage a financial advisor in connection with such exploration, and (b) instructed Company management to (i) communicate to Parent that the Company was interested in further exploring a potential sale transaction with Parent but would first need to engage a financial advisor, (ii) solicit a reasonable number of proposals from potential financial advisors who have the resources and experience to adequately advise the Company, and (iii) negotiate, finalize and execute a confidentiality agreement with Parent.

On July 9, 2024, Company management provided to the Board a list of five (5) potential financial advisors to advise the Board and requested that the Board confirm which of such potential financial advisors the Board would like to meet with and interview.

On July 10, 2024, the Board instructed Company management to solicit proposals from and arrange interviews with Stephens Inc. (“Stephens”), a middle-market financial advisor (“Financial Advisor A”) and a growth-stage company financial advisor (“Financial Advisor B”).

Also on July 19, 2024, Messrs. Oviatt and Tidball had a call with Mr. Gleason to provide Mr. Gleason with an update on the ongoing process of the Company selecting and engaging a financial advisor. Mr. Gleason indicated that, in light of this update, Parent would no longer expect a written response from the Company by July 19, 2024.

Between July 11 and July 22, 2024, each of Stephens, Financial Advisor A and Financial Advisor B delivered the proposed terms of their engagement to Company management, which Company management delivered to the Board.

On July 19 and July 22, 2024, the Board held telephonic meetings, at which representatives of Mayer Brown were present, to interview each of Stephens, Financial Advisor A and Financial Advisor B.

On July 23, 2024, the Board held a telephonic meeting at which representatives of Mayer Brown were present to discuss. At such meeting, the Board discussed and considered the qualifications and experience of each of the financial advisors interviewed by the Board and determined to continue their evaluation of each such financial advisor. In addition, the Board instructed Company management to negotiate the engagement terms proposed by each of the financial advisors and ask each of them to submit revised terms.

By July 25, 2024, each of Stephens, Financial Advisor A and Financial Advisor B delivered to Company management their proposed revised engagement terms, which Company management delivered to the Board.

Later on July 25, 2024, the Board held a telephonic meeting at which representatives of Mayer Brown were present to discuss and select a financial advisor. At such meeting, Company management reviewed with the Board the revised engagement terms delivered by each of the financial advisors previously interviewed by the Board. Following discussion and deliberation, the Board determined to engage Stephens as the Company’s financial advisor, subject to Stephens’ confirmation that it did not have any potential conflict of interest arising from its engagement by the Company in connection with the potential transaction, and instructed Company management and Mayer Brown to negotiate a mutually acceptable form of engagement letter with Stephens. The Board also instructed Company management to contact representatives of Parent to indicate that the Board had determined to engage Stephens and would need time to consider Parent’s Initial Offer with its financial advisor before the Company could provide a response to Parent.

On July 26, 2024, representatives of Stephens delivered an initial draft of its engagement letter and confirmed that Stephens did not have any material relationships with Parent or any conflicts of interest in connection with the potential acquisition of the Company by Parent.

From July 26 through August 14, 2024, representatives of the Company, Stephens and Mayer Brown negotiated the terms of Stephens’ engagement letter to act as financial advisor to the Board.

On July 31, 2024, Messrs. Oviatt and Tidball had a call with Mr. Gleason to inform Mr. Gleason that the Board had selected Stephens to act as financial advisor to the Company and that the Board would need to consider Parent’s Initial Offer with Stephens before the Company could provide a response to Parent.

On August 6, 2024, Parent sent the Company an updated letter contemplating Parent’s Initial Offer. The letter reflected identical terms to the letter delivered by Parent on July 3, 2024, except that Parent requested a written response from the Company by August 16, 2024.

On August 9, 2024, Parent executed the Confidentiality Agreement with the Company, which contained customary provisions, including a customary standstill provision that, for a period of 18 months, prohibits each of Parent and the Company, without the prior written consent of the Board, in the case of Parent, or Parent’s board of directors, in the case of the Company, from making a proposal for a business combination or similar transaction involving the other party, either publicly or privately, but did not reflect any provision prohibiting Parent or the Company from asking the other party to amend or waive such standstill provisions (often referred to as a “don’t ask, don’t waive” provision). The standstill provision expressly permitted Parent and the Company to make a proposal to the other party with respect to a business combination involving such other party so long as it is made privately and not made in a manner that would require such other party to make a public disclosure regarding such proposal under applicable law.

On August 14, 2024, the Company and Stephens executed Stephens’ engagement letter.

On August 15, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present. At the meeting, representatives of Stephens reviewed and discussed with the Board the terms of Parent’s Initial Offer and Stephens’ preliminary financial analysis of the Company’s standalone valuation and potential transaction proposed by Parent. The Board discussed Parent’s Initial Offer at length, including the potential benefit of securing certain value for the Company’s stockholders, the Company’s standalone prospects and the risks and challenges associated with executing the Company’s strategic plan. The Board received advice from representatives of Stephens and Mayer Brown on various potential strategic responses to Parent. Also at the meeting, the Board discussed with Company management and representatives of Stephens whether it would be beneficial to solicit acquisition interest from other third parties, and again that the likelihood of any such interest existing was small, and that it was appropriate to negotiate for and rely on customary rights in the Merger Agreement to accept superior proposals after announcement of a transaction. At the conclusion of the meeting, the Board determined that the valuation proposed in Parent’s Initial Offer was not sufficient and directed Company management and Stephens to attempt to elicit a higher offer from Parent without offering a specific counterproposal. The Board also requested that Company management provide to the Board an updated long-term financial forecast and strategic plan for the Company to assist it in its assessment of Parent’s proposals.

On August 16, 2024, Messrs. Oviatt and Tidball had a call with Mr. Gleason and informed him that, while the Board remained interested in exploring a potential transaction with Parent, the Board had determined that the valuation proposed in Parent’s Initial Offer was not sufficient and that Parent would need to propose a higher purchase price for the Company. The participants also discussed certain financial due diligence information that would need to be produced by the Company to support a higher valuation from Parent.

On August 18, 2024, Mr. Gleason requested certain due diligence information from Company management to facilitate a potential increase in Parent’s proposed purchase price for the Company.

On August 20, 2024, representatives of Parent delivered to Company management certain preliminary financial due diligence requests regarding the Company.

On August 21, 2024, Messrs. Oviatt, Tidball and Gleason had a call to discuss Parent’s proposed revisions to its initial offer. Mr. Gleason indicated that Parent’s updated proposal would reflect a purchase

price of $2.25 per Share paid for in both cash and newly issued shares of common stock of Parent at a ratio of 75% in cash to 25% of newly issued shares of common stock of Parent. Mr. Gleason also indicated that Parent would deliver a letter to the Company reflecting such terms.

Later, on August 21, 2024, Parent delivered to the Company an updated offer letter reflecting the terms that Mr. Gleason had relayed to Company management earlier that day (“Parent’s First Revised Offer”). Parent’s First Revised Offer also requested that the Company provide Parent with exclusivity for 60 days. As of the close market on August 21, 2024, the market price per Share was $1.66.

On August 22, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present. At the meeting, Messrs. Oviatt and Tidball described Parent’s First Revised Offer to the Board and representatives of Stephens provided financial analysis regarding such offer. The Board received advice from representatives of Stephens and Mayer Brown on potential strategic responses to Parent. Since Board had not yet received from Company management an update to the Company’s long-term financial forecast and strategic plan, the Board instructed Company management to communicate to Parent that it would not be able to respond to Parent’s First Revised Offer until it received such information from Company management which information would assist the Board in assessing Parent’s First Revised Offer.

On August 23, 2024, Mr. Oviatt informed Mr. Gleason by email that the Board would not respond to Parent’s First Revised Offer until the Board received the Company’s long-term financial forecast and strategic plan being prepared by Company management.

On August 28, 2024, the Company and representatives of Stephens granted Parent and its representatives access to an online virtual data room which contained certain limited financial due diligence materials regarding the Company.

On August 29, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present. At the meeting, Messrs. Oviatt and Tidball provided the Board with a detailed overview of a long-term financial forecast and strategic plan of the Company prepared by Company management, which the Board had requested at the August 15, 2024 meeting. After discussion, the directors provided certain comments regarding such forecast and strategic plan and instructed Messrs. Oviatt and Tidball to update it to reflect such comments and present a revised version of such forecast and strategic plan to the Board once ready. The Board also discussed and deliberated Parent’s First Revised Offer, including the valuation of the consideration offered by Parent, the tax impact to the Company’s stockholders if part of the consideration included shares of Parent common stock, the due diligence the Company would be required to undertake with respect to Parent if the transaction consideration included Parent common stock and the exclusivity requested by Parent.

On September 3, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present. At the meeting, Messrs. Oviatt and Tidball provided the Board with a detailed overview of the updated long-term financial forecast and strategic plan of the Company prepared by Company management reflecting the comments provided by the directors at the August 29, 2024 meeting (the “Company Projections”). After discussion, the Board determined the Company Projections were reasonable and appropriate and adopted the Company Projections. The Board discussed and deliberated Parent’s First Revised Offer and received advice from representatives of Stephens and Mayer Brown on various potential strategic responses to Parent. At the conclusion of the meeting, the Board determined that the valuation proposed in Parent’s First Revised Offer was not sufficient and directed Company management and Stephens to (a) deliver the Company Projections to Parent, (b) attempt to elicit a higher offer from Parent without offering a specific counterproposal, (c) inform Parent that, if shares of Parent common stock were used as part of the transaction consideration, the Company would need to conduct some due diligence on Parent and the resulting tax impact on the Company’s stockholders, and (d) inform Parent that the Company would not yet provide exclusivity to Parent.

On September 5, 2024, representatives of Stephens delivered the Company Projections to Parent. Also, on September 5, 2024, representatives of Stephens informed Parent that the Board was not yet prepared to provide Parent exclusivity.

On September 10, 2024, Messrs. Oviatt, Tidball and Gleason had a call to discuss Parent’s First Revised Offer, including Parent’s proposal that the potential transaction be paid for in both cash and newly issued shares of common stock of Parent at a ratio of 75% in cash to 25% of newly issued shares of common stock of Parent. On the call, Messrs. Oviatt and Tidball informed Mr. Gleason that, while the Board had not yet made a determination with respect to the composition of the consideration proposed by Parent, if Parent common stock were included as part of the consideration, the Company would need to conduct some due diligence on Parent and the resulting tax impact on the Company’s stockholders.

Also on September 10, 2024, Messrs. Oviatt, Tidball, Gleason and Peter Johansson, the Chief Financial Officer of Parent, other representatives of Parent and representatives of Stephens had a call to discuss Parent’s review of the financial due diligence of the Company and answer Parent’s questions on the due diligence materials.

On September 17, 2024, Parent delivered to the Company an updated offer letter (“Parent’s Second Revised Offer”) which contemplated a purchase price of $2.42 per Share in cash. Parent also indicated that it would require the Company to provide 45 days of exclusivity. As of the close market on September 17, 2024, the market price per Share was $1.54.

On September 18, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present to discuss Parent’s Second Revised Offer. At such meeting, representatives of Stephens provided the Board with a financial analysis of the terms of Parent’s Second Revised Offer. The Board received advice from representatives of Stephens and Mayer Brown on various potential strategic responses to Parent. Also at the meeting, the Board again discussed with Company management and representatives of Stephens whether it would be beneficial to solicit acquisition interest from other third parties, and again determined that the likelihood of any such interest existing was small, and that it was appropriate to negotiate for and rely on customary rights in the merger agreement to accept superior proposals after announcement of a transaction. Following discussion and deliberation, the Board determined to deliver a counterproposal to Parent (the “Company’s Counteroffer”) at a price per Share of $2.62 and to accept Parent’s proposed 45-day exclusivity period. The Board instructed Company management to work with Mayer Brown and Stephens to deliver a letter reflecting the Company’s Counteroffer to Parent. As of the close market on September 18, 2024, the market price per Share was $1.47.

On the morning of September 19, 2024, representatives of the Company delivered a letter reflecting the Company’s Counteroffer to Parent.

On the afternoon of September 19, 2024, Messrs. Oviatt and Tidball had a call with Mr. Gleason to discuss the Company’s Counteroffer. Mr. Gleason indicated that, having considered the Company’s Counteroffer, Parent was prepared to propose a purchase price of $2.55 per Share in cash, which would be its best and final offer (“Parent’s Final Offer”). As of the close market on September 19, 2024, the market price per Share was $1.52.

In the evening of September 19, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present. At the meeting, Messrs. Oviatt and Tidball summarized the terms of Parent’s Final Offer. After discussion and deliberation, the Board determined to further explore a potential transaction with Parent on the terms of Parent’s Final Offer, particularly in light of Parent indicating this was its best and final offer, so long as Parent delivered to the Company a letter confirming Parent was prepared to explore a transaction on such terms. The Board also approved granting Parent a 45-day exclusivity period and instructed Company management to communicate the Board’s decision to Parent and, after Parent delivered a letter reflecting Parent’s Final Offer, negotiate and execute an exclusivity agreement with Parent.

Later on September 19, 2024, Company management communicated the Board’s decision to representatives of Parent.

On September 23, 2024, Parent sent a written offer letter confirming the terms of Parent’s Final Offer to the Company.

Between September 23, 2024 and September 25, 2024, Mayer Brown and Foley & Lardner LLP, Parent’s outside legal counsel (“Foley”), prepared and negotiated a draft of the Exclusivity Agreement.

On September 25, 2024, the Company and Parent executed the Exclusivity Agreement with customary terms and conditions, including, among other things, that the Company was prohibited from soliciting, discussing or negotiating any alternative business combination transactions with third parties other than Parent during the exclusivity period, and reflected an exclusivity period that extended from September 25, 2024 until November 9, 2024.

On September 29, 2024, the Company and representatives of Stephens granted Parent and its representatives access to an online virtual data room containing additional financial and other requested operational, strategic, commercial, legal and administrative due diligence materials regarding the Company.

On October 7, 2024, Foley sent Mayer Brown a draft of the Merger Agreement. Among other things, the draft reflected a termination fee equal to $5,000,000 (approximately 4% of the equity value of the proposed transaction), which would become payable in the event the Company accepted a superior proposal.

On October 10, 2024, Parent’s management team visited the Company’s principal offices in Lindon, Utah. During such visit, Company management gave a presentation on the Company’s business and the management teams discussed, among other things, Parent’s operational strategies, approach to strategic transactions, long-term growth plans and integration strategy. Also during such visit, Company management and Parent’s management team discussed the timing of a closing of the potential transaction and how, if the potential transaction were closed after the end of the 2024 fiscal year rather that during such fiscal year, the taxes payable on parachute payments made to Company management would be reduced and would simplify the closing of the Company’s books and the audit of the Company’s financials for the 2024 fiscal year.

On October 11, 2024, Mayer Brown delivered a markup of the Merger Agreement to Foley. Among other things, the draft reflected a timetable for the commencement of the tender offer that would allow for a closing after the end of the 2024 fiscal year and expressly reserved the Board’s ability to comment on the amount of the termination fee.

On October 14, 2024, representatives of Mayer Brown and Foley had a call to discuss the markup of the Merger Agreement sent by Mayer Brown to Foley on October 11, 2024.

On October 15, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present. At the meeting, Company management and the representatives of Mayer Brown and Stephens summarized for the Board the material developments regarding the potential transaction with Parent, including the negotiation of the Merger Agreement, the status of Parent’s due diligence and a summary of the visit by Parent’s management to the Company’s offices in Lindon, Utah on October 10, 2024. After discussion and deliberation, the Board instructed Company management to continue working with Parent to progress the potential transaction.

On October 16, 2024, Mr. Tidball had a call with a representative of Parent during which Mr. Tidball provided a virtual tour of the Company’s offices in Canada and answered such representative’s questions regarding the Company’s operations in Canada.

On October 17, 2024, Foley delivered a markup of the Merger Agreement to Mayer Brown, requesting, among other things, that Messrs. Hatch, Oviatt and Tidball, in their respective capacities as stockholders of the Company, enter into the Support Agreements.

Also on October 17, 2024, Foley circulated a draft of the Support Agreement.

On October 18, 2024, Mr. Hatch had a call with Mr. Gleason to discuss a potential grant of equity awards to certain executives and employees of the Company in connection with the potential transaction that would fully vest upon the consummation of the potential transaction as a form of transaction bonus to such executives and employees. Following the discussion on October 18, 2024, after consideration, representatives of Parent indicated to Mr. Hatch and other representatives of the Company that Parent was not supportive of granting any such transaction bonus and that it preferred to determine compensatory

arrangements for the Company’s executives and employees following the anticipated signing of the Merger Agreement, and no such pre-signing grants were subsequently made by the Company to any such executives or employees.

On October 20, 2024, Mayer Brown prepared and circulated the markup of the Merger Agreement to Foley. Among other things, the draft reflected a termination fee equal to $3,750,000 (approximately 3% of the equity value of the proposed transaction).

On October 21, 2024, Mayer Brown prepared and circulated the markup of the Support Agreement to Dorsey & Whitney LLP, counsel to Messrs. Hatch, Oviatt and Tidball (“Dorsey”).

On October 22, 2024, representatives of Mayer Brown, Lawson Lundell LP (“Lawson”), outside legal counsel to the Company with respect to Canadian legal matters, Foley and Stikeman Elliott LLP (“Stikeman”), outside legal counsel to Parent with respect to Canadian legal matters, had a call to discuss Canadian law matters relating to the Merger Agreement.

Later on October 22, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Mayer Brown and Stephens were present. At the meeting, Company management and the representatives of Mayer Brown and Stephens summarized for the Board the material developments regarding the potential transaction with Parent, including the negotiation of the Merger Agreement and the status of Parent’s due diligence. After discussion and deliberation, the Board instructed Company management to continue working with Parent to progress the potential transaction.

On October 23, 2024, Foley circulated a markup of the Merger Agreement to Mayer Brown. Among other things, the draft reverted the termination fee to $5,000,000, which was Parent’s initial position.

Also on October 23, 2024, Dorsey prepared and circulated the markup of the Support Agreement to Mayer Brown, which Mayer Brown relayed to Foley later on October 23, 2024.

Between October 24, 2024 and October 25, 2024, Foley and Dorsey exchanged and finalized the drafts of the Support Agreement for each of Messrs. Hatch, Oviatt and Tidball.

Also on October 25, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Stephens and Mayer Brown were present. A representative of Mayer Brown reviewed with the members of the Board their fiduciary duties under Nevada law. The Board discussed again whether any of the members of the Board or Company management had any conflict of interest with respect to the potential transaction with Parent. The Board determined that, based on the information available to it, each of the members of the Board and Company management remained disinterested and independent in respect of the potential transaction with Parent and there was no conflict of interest. Prior to making their presentation, a representative of Stephens confirmed that Stephens had no business relationships with Parent and, after consideration, the Board determined that Stephens would be able to provide the Board objective advice and concluded it was appropriate for the Board to continue to receive advice from Stephens. At the request of the Board, a representative of Stephens then reviewed with the Board its preliminary financial analysis with respect to the Company and the proposed transaction with Parent. A representative of Mayer Brown provided the Board with both a written and an oral summary of certain key terms of the Merger Agreement and the Support Agreements, noting any items that remained to be resolved. A representative of Mayer Brown also described for the Board the resolutions that the Board would consider adopting to approve the Merger Agreement and the potential transaction with Parent. Following discussion and consideration of the proposed transaction with Parent, the Board determined to continue to pursue such transaction, assuming satisfactory finalization of definitive transaction documentation.

Throughout October 26, 2024 and October 28, 2024, representatives of Mayer Brown and Foley exchanged and finalized the draft of the Merger Agreement. Among other things, the finalized draft reflected a termination fee equal to $4,375,000 (approximately 3.5% of the equity value of the proposed transaction).

On October 28, 2024, the Board held a telephonic meeting at which Mr. Tidball and representatives of Stephens and Mayer Brown were present to, among other things, consider the proposed transaction with Parent. A representative of Mayer Brown reviewed with the Board the resolution of the issues in the Merger

Agreement and the Support Agreements that had been unresolved as of the time of the meeting of the Board on October 25, 2024. At the request of the Board, representatives of Stephens reviewed with the Board its financial analysis with respect to the Company and the proposed transaction Parent. Thereafter, at the request of the Board, Stephens rendered its oral opinion to the Board (which was subsequently confirmed in writing by delivery to the Board of Stephens’ written opinion dated October 28, 2024) to the effect that, as of October 28, 2024, and based upon and subject to certain assumptions, qualifications, limitations and other matters considered in connection with the preparation of the opinion, the purchase price of $2.55 per Share to be received by the holders of Shares is fair to such holders from a financial point of view. The Board then unanimously (a) determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to and in the best interests of the Company and its stockholders; (b) declared it advisable to enter into the Merger Agreement and approved the execution, delivery, and performance of the Merger Agreement; (c) approved and declared advisable the transactions contemplated thereby, including the Offer and the Merger; (d) resolved to recommend that the stockholders of the Company accept the Offer and tender their Shares to Purchaser pursuant to the Offer; and (e) resolved that the Merger shall be governed by and effected pursuant to Section 92A.133 of the NRS and Section 252 of the DGCL and that the Merger shall be consummated as soon as practicable following the consummation of the Offer.

Later in the evening on October 28, 2024, the Company, Parent and Purchaser executed the Merger Agreement, and Parent, Purchaser and each of Messrs. Oviatt, Tidball and Hatch (and certain affiliates of Mr. Hatch) executed the Support Agreements.

Prior to the opening of trading on Nasdaq on October 29, 2024, the Company and Parent issued a press release announcing entry into the Merger Agreement.

Company Projections

The Company does not, as a matter of course, regularly prepare long-term, multi-year projections or publicly disclose long-term, multi-year forecasts or internal projections as to future performance or results of operations, including future earnings, or other results, due to, among other things, the inherent unpredictability of the underlying assumptions, estimates and projections.

However, in connection with the Board’s review and evaluation of the Offer and the Merger, Company management, at the direction of the Board, prepared the Company Projections, which reflect certain risk-adjusted, non-public, unaudited prospective financial information for fiscal years 2024 through 2029 of the Company on a standalone basis (as summarized below), reflecting the best currently available estimates and judgments of Company management on a risk-adjusted basis. The Company Projections were provided to the Board for purposes of considering, analyzing and evaluating the Offer and the Merger. In addition, the Company Projections were provided to Stephens to use in connection with the rendering of its fairness opinion to the Board and in performing its related financial analyses, as described in the section titled “Item 4. The Solicitation or Recommendation — Opinion of Financial Advisor to Profire.” The Company Projections were the only financial projections with respect to the Company used by Stephens in performing its financial analyses. The Company Projections were also provided to Parent in connection with its consideration and evaluation of a transaction with the Company.

Cautionary Statements

The summary of the Company Projections is included in this Schedule 14D-9 solely to provide the Company’s stockholders access to certain financial information that was made available to the Board and Stephens and is not being included in this Schedule 14D-9 to influence the decision of any stockholder of the Company regarding whether to tender Shares in the Offer or for any other purpose. The Company Projections may differ from publicly available analyst estimates and projections and do not take into account any events or circumstances after the date they were prepared, including the announcement of the proposed transaction.

The Company Projections, while presented with numerical specificity, necessarily were based on numerous variables and assumptions that are inherently uncertain and many of which are beyond the Company’s control. The Company Projections reflect numerous estimates and assumptions made by

Company management, based on information available at the time the Company Projections were developed, with respect to industry performance, general business, economic, competitive, regulatory, market and financial conditions and other future events, as well as matters specific to the Company’s business, all of which are difficult to predict and many of which are beyond the Company’s control. Multiple factors, including those described in the section entitled “Item 8. Additional Information — Cautionary Statements Concerning Forward-Looking Statements,” could cause the Company Projections or the underlying assumptions to be inaccurate. As a result, there can be no assurance that the Company Projections will be realized or that actual results will not be significantly higher or lower than projected. Because the Company Projections cover multiple years, such information by its nature becomes less reliable with each successive year. The Company Projections do not take into account any circumstances or events occurring after the date on which they were prepared. Economic and business environments can and do change quickly, which adds an additional significant level of uncertainty as to whether the results portrayed in the Company Projections will be achieved. As a result, the inclusion of the Company Projections herein does not constitute an admission or representation by Company or any other person that the information is material.

The Company Projections were not prepared with a view toward public disclosure or with a view toward complying with U.S. generally accepted accounting principles (“GAAP”), the published guidelines of the SEC regarding projections or the guidelines established by the American Institute of Certified Public Accountants. In addition, no independent registered public accounting firm or any other independent accountant provided any assistance in preparing the Company Projections. Accordingly, no independent registered public accounting firm or independent accountant has audited, reviewed, compiled, examined or otherwise performed any procedures with respect to the Company Projections or expressed any opinion or any form of assurance with respect thereto.