UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR

13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

Profire Energy, Inc.

(Name of Subject Company (Issuer))

Combustion Merger Sub, Inc.

(Names of Filing Persons—Offeror)

CECO Environmental Corp.

(Names of Filing Persons—Other)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

74316X101

(CUSIP Number of Class of Securities)

Lynn Watkins-Asiyanbi

CECO Environmental Corp.

14651 North Dallas Parkway

Suite 500

Dallas, Texas 75254

(214) 357-6181

(Name, Address and Telephone Numbers of Person

Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copy to:

Clyde W. Tinnen

Foley & Lardner LLP

777 E. Wisconsin Avenue

Milwaukee, Wisconsin 53202

(414) 271-2400

| x |

Check the box if the filing

relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| x |

third-party

tender offer subject to Rule 14d-1. |

| ¨ |

issuer tender offer subject

to Rule 13e-4. |

| ¨ |

going-private

transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D

under Rule 13d-2. |

Check the following box if the filing

is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border

Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border

Third Party Tender Offer) |

This filing relates solely to preliminary communications made before

the commencement of a planned tender offer by Combustion Merger Sub, Inc., a Delaware corporation (“Merger Sub”) and

a wholly-owned CECO Environmental Corp., a Delaware corporation (“Parent”), for all of the outstanding common stock of Profire

Energy, Inc., a Nevada corporation (“PFIE”), to be commenced pursuant to the Agreement and Plan of Merger, dated as

of October 28, 2024 among Parent, Merger Sub and PFIE.

The tender offer for the outstanding shares of common stock of PFIE

has not yet commenced. Each communication filed herewith is for informational purposes only and is neither an offer to purchase nor a

solicitation of an offer to sell shares of PFIE common stock, nor is it a substitute for the tender offer materials that Merger Sub will

file with the Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. At the time the tender

offer is commenced, Merger Sub will file a tender offer statement on Schedule TO with the SEC, and thereafter PFIE will file a solicitation/recommendation

statement on Schedule 14D-9 with respect to the offer.

THE TENDER OFFER STATEMENT (INCLUDING AN OFFER TO PURCHASE, A RELATED

LETTER OF TRANSMITTAL AND OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT (AS EACH MAY BE AMENDED OR SUPPLEMENTED

FROM TIME TO TIME) WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY PFIE’S STOCKHOLDERS BEFORE

ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER.

Both the tender offer statement and the solicitation/recommendation

statement will be mailed to PFIE’s stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation

statement will also be made available to all stockholders of PFIE by contacting investor relations at shooser@threepa.com. In addition,

the tender offer statement, the related letter of transmittal and certain other tender offer documents and the solicitation/recommendation

statement (and all other documents filed with the SEC) will be available for free at www.sec.gov, upon filing with the SEC. In addition

to these documents, PFIE files annual, quarterly and current reports and other information with the SEC, which are also available for

free at www.sec.gov. In addition, the solicitation/recommendation statement and the other documents filed by PFIE with the SEC will be

available for free at https://ir.profireenergy.com/sec-filings.

PFIE’S STOCKHOLDERS ARE ADVISED TO READ THE SCHEDULE TO AND

THE SCHEDULE 14D-9 CAREFULLY, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO, AS WELL AS IMPORTANT INFORMATION THAT HOLDERS OF SHARES OF PFIE COMMON

STOCK SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES.

Cautionary Notes Regarding Forward Looking Statements

Certain statements in this communication are forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act

of 1934, both as amended, which are intended to be covered by the safe harbor for “forward-looking statements” provided

by the Private Securities Litigation Reform Act of 1995. Any statements contained in this communication, other than statements of

historical fact, including statements about management’s beliefs and expectations, are forward-looking statements and should

be evaluated as such. These statements are made on the basis of management’s views and assumptions regarding future events and

business performance. We use words such as “believe,” “expect,” “anticipate,”

“intends,” “estimate,” “forecast,” “project,” “will,”

“plan,” “should” and similar expressions to identify forward-looking statements. Forward-looking statements

involve risks and uncertainties that may cause actual results to differ materially from any future results, performance or

achievements expressed or implied by such statements. Potential risks and uncertainties, among others, that could cause actual

results to differ materially are discussed under “Item 1A. Risk Factors” of the Parent’s Quarterly Reports on

Form 10-Q and in the Parent’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and

include, but are not limited to:

| · | the

parties’ ability to complete the proposed transactions contemplated by the Merger Agreement

in the anticipated timeframe or at all; |

| · | the

effect of the announcement or pendency of the proposed transaction on business relationships,

operating results, and business generally; |

| · | risks

that the proposed transactions disrupt current plans and operations and potential difficulties

in employee retention as a result of the proposed transactions; |

| · | risks

related to diverting management’s attention from ongoing business operations; |

| · | the

outcome of any legal proceedings that may be instituted related to the proposed transactions; |

| · | the

amount of the costs, fees, expenses and other charges related to the proposed transactions; |

| · | the

risk that competing offers or acquisition proposals will be made; |

| · | the

sensitivity of the Parent’s business to economic and financial market conditions generally

and economic conditions in the Parent’s service areas; |

| · | dependence

on fixed price contracts and the risks associated therewith, including actual costs exceeding

estimates and method of accounting for revenue; |

| · | the

effect of growth on the Parent’s infrastructure, resources and existing sales; |

| · | the

ability to expand operations in both new and existing markets; |

| · | the

potential for contract delay or cancellation as a result of on-going or worsening supply

chain challenges; |

| · | liabilities

arising from faulty services or products that could result in significant professional or

product liability, warranty or other claims; |

| · | changes

in or developments with respect to any litigation or investigation; |

| · | failure

to meet timely completion or performance standards that could result in higher cost and reduced

profits or, in some cases, losses on projects; |

| · | the

potential for fluctuations in prices for manufactured components and raw materials, including

as a result of tariffs and surcharges, and rising energy costs; |

| · | inflationary

pressures relating to rising raw material costs and the cost of labor; |

| · | the

substantial amount of debt incurred in connection with the Parent’s strategic transactions

and its ability to repay or refinance it or incur additional debt in the future; |

| · | the

impact of federal, state or local government regulations; |

| · | the

Parent’s ability to repurchase shares of its common stock and the amounts and timing

of repurchases; |

| · | the

Parent’s ability to successfully realize the expected benefits of its restructuring

program; |

| · | economic

and political conditions generally; |

| · | the

Parent’s ability to optimize its business portfolio by identifying acquisition targets,

executing upon any strategic acquisitions or divestitures, integrating acquired businesses

and realizing the synergies from strategic transactions; and |

| · | unpredictability

and severity of catastrophic events, including cybersecurity threats, acts of terrorism or

outbreak of war or hostilities or public health crises, as well as management’s response

to any of the aforementioned factors. |

Many of these risks are beyond management’s ability to control

or predict. Should one or more of these risks or uncertainties materialize, or should any related assumptions prove incorrect, actual

results may vary in material aspects from those currently anticipated. Investors are cautioned not to place undue reliance on such forward-looking

statements as they speak only to the Parent’s views as of the date the statement is made. Furthermore, the forward-looking statements

speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the

Securities and Exchange Commission (the “SEC”), the Parent undertakes no obligation to update or review any forward-looking

statements, whether as a result of new information, future events or otherwise.

Exhibit Index

Exhibit 99.1

|  |

| | |

| | Press

Release |

CECO ENVIRONMENTAL TO ACQUIRE PROFIRE ENERGY

FOR $125 MILLION

Advances CECO’s Position as the Leading

Environmental Solutions Provider in Industrial Markets

| · | Expands CECO’s

leadership position in niche energy and industrial markets with expanded environmental solutions

for mission critical applications |

| · | Provides cost synergies

and enhances Profire’s strategic growth by utilizing CECO’s established international

operations and customer relationships |

| · | CECO to host its Quarterly

Earnings call today at 8:30 a.m. ET including further commentary regarding the transaction |

DALLAS,

TX and LINDON, UT (Oct. 29, 2024) -- CECO Environmental Corp. (Nasdaq: CECO) (“CECO”), a leading environmentally

focused, diversified industrial company whose solutions protect people, the environment and industrial equipment, and Profire Energy, Inc.

(NASDAQ: PFIE) (“Profire”), a technology company providing solutions that enhance the efficiency, safety, and reliability

of industrial combustion appliances, today announced a definitive agreement where CECO will acquire Profire, in an all-cash transaction.

Profire is a leader in burner management technology and combustion

control systems that provide mission-critical combustion automation and control solutions and services to improve environmental efficiency,

safety and reliability for industrial thermal applications globally. Profire estimates its 2024 sales to be greater than $60 million

with adjusted EBITDA margins of approximately 20 percent.

“I am excited to announce the acquisition of Profire and we

look forward to welcoming their tremendous organization to our portfolio of leading solution companies,” said Todd Gleason, CECO’s

Chief Executive Officer. “With an installed base approaching 100,000 burner management systems and a growing industrial market

product offering, we look forward to accelerating their global market expansion and introducing their high-efficiency solutions to more

customers in industrial air and water. We are also confident that the increased scale and combined corporate organizations will generate

meaningful efficiencies and synergies. The addition of Profire is another important step in our ongoing execution of programmatic M&A

and we expect it will further advance our position as the leading environmental solutions provider in industrial markets.”

“We are extremely pleased to announce this transaction with

CECO which is a testament to the value that has been created for Profire employees, customers and shareholders,” said Cameron Tidball

and Ryan Oviatt, co-CEOs of Profire. “The combination of our well-established leadership in niche energy and industrial mission

critical applications with CECO’s proven track record of acquiring and investing in companies to enhance their growth and create

scale will unlock even more value for all constituents.”

Transaction Details and Timing

Under the terms of the agreement, a subsidiary of CECO (“Merger

Sub”) will commence a tender offer to acquire all issued and outstanding shares of Profire common stock at a price of $2.55 per

share, in cash, without interest and subject to applicable withholding tax. The tender offer will initially remain open for

20 business days from the date of commencement of the tender offer, subject to extension under certain circumstances. The transaction,

which has been unanimously approved by Profire’s Board of Directors, implies an equity value of approximately $125 million and

a total enterprise value for Profire of approximately $108 million.

The tender offer is subject to customary closing conditions, including

that at least a majority of the outstanding shares of Profire’s common stock are tendered and not withdrawn in the tender offer

and the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

The price represents a 46.5% premium over Profire’s

closing share price of $1.74 on October 25, 2024 and a premium of 60.3% to Profire’s 30-day volume weighted average share

price on October 25, 2024.

Following a successful completion of the tender

offer, including the satisfaction of certain customary conditions, CECO will acquire all remaining untendered shares of Profire common

stock at the same price of $2.55 per share in cash through a merger of Merger Sub with Profire, with Profire continuing as the surviving

corporation.

Upon completion

of the transaction, Profire will become a wholly-owned subsidiary of CECO and shares of Profire’s common stock will no longer be

listed on any public market. The parties anticipate that the combination will be completed in the first quarter of 2025.

##

Advisors

Stephens Inc. is serving as financial advisor

and Mayer Brown LLP is serving as legal counsel to Profire.

CECO Environmental Corp.

is being advised by Foley & Lardner LLP (Legal), and KPMG (tax).

ABOUT CECO ENVIRONMENTAL

CECO

Environmental is a leading environmentally focused, diversified industrial company, serving a broad landscape of industrial air, industrial

water, and energy transition markets across the globe through its key business segments: Engineered Systems and Industrial Process Solutions.

Providing innovative technology and application expertise, CECO helps companies grow their business with safe, clean, and more efficient

solutions that help protect people, the environment and industrial equipment. In regions around the world, CECO works to improve air

quality, optimize the energy value chain, and provide custom solutions for applications including power generation, petrochemical processing,

general industrial, refining, midstream oil and gas, electric vehicle production, polysilicon fabrication, battery recycling, beverage

can, and water/wastewater treatment along with a wide range of other applications. CECO is listed on Nasdaq under the ticker symbol "CECO."

Incorporated in 1966, CECO’s global headquarters is in Dallas, Texas. For more information, please visit www.cecoenviro.com.

ABOUT

PROFIRE ENERGY, INC.

Profire Energy is a technology company providing solutions that enhance

the efficiency, safety, and reliability of industrial combustion appliances while mitigating potential environmental impacts related

to the operation of these devices. It is primarily focused in the upstream, midstream, and downstream transmission segments of the oil

and gas industry. However, in recent years, Profire has completed many installations of burner-management solutions in other industries

that will be applicable to expand the addressable market over time. Profire specializes in the engineering and design of burner and combustion

management systems and solutions used on a variety of natural and forced draft applications. Its products and services are sold primarily

throughout North America. It has an experienced team of sales and service professionals that are strategically positioned across the

United States and Canada. Profire has offices in Lindon, Utah; Victoria, Texas; Midland-Odessa, Texas; Homer, Pennsylvania; Greeley,

Colorado; Millersburg, Ohio; and Acheson, Alberta, Canada. For additional information, visit www.profireenergy.com.

##

SAFE HARBOR STATEMENT

Any statements contained in this Press Release, other than statements

of historical fact, including statements about management's beliefs and expectations, are forward-looking statements and should be evaluated

as such. These statements are made on the basis of management's views and assumptions regarding future events and business performance

and include, but are not limited to, statements regarding CECO's full year 2024 outlook, statements about CECO's expectations regarding

the integration of Profire Energy, Inc., into CECO; the benefits of the acquisition of Profire Energy, Inc., and the expectations

regarding the transaction's impact on CECO's strategic growth plan. We use words such as "believe," "expect," "anticipate,"

"intends," "estimate," "forecast," "project," "will," "plan," "should"

and similar expressions to identify forward-looking statements. Forward-looking statements involve risks and uncertainties that may cause

actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Potential

risks and uncertainties that could cause actual results to differ materially include risks regarding the parties’ ability to complete

the proposed transactions in the anticipated timeframe or at all, the occurrence of any event, change or other circumstance that could

give rise to the termination of the transaction agreement between the parties, the effect of the announcement or pendency of the proposed

transaction on business relationships, operating results, and business generally, disruption of current plans and operations and potential

difficulties in employee retention as a result of the proposed transaction, diversion of management’s attention from ongoing business

operations, the outcome of any legal proceedings that may be instituted related to the proposed transaction, the amount of the costs,

fees, expenses and other charges related to the proposed transaction, for CECO the risk that competing offers or acquisition proposals

will be made, the achievement of the anticipated benefits of the acquisition, the ability of Profire to achieve its 2024 earnings guidance,

CECO’s ability to successfully integrate acquired businesses and realize the synergies from acquisitions, as well as a number of

factors related to CECO’s business, including the sensitivity of our business to economic and financial market conditions generally

and economic conditions in our service areas; dependence on fixed price contracts and the risks associated therewith, including actual

costs exceeding estimates and method of accounting for revenue; the effect of growth on CECO’s infrastructure, resources, and existing

sales; the ability to expand operations in both new and existing markets; the potential for contract delay or cancellation as a result

of on-going or worsening supply chain challenges; liabilities arising from faulty services or products that could result in significant

professional or product liability, warranty, or other claims; changes in or developments with respect to any litigation or investigation;

failure to meet timely completion or performance standards that could result in higher cost and reduced profits or, in some cases, losses

on projects; the potential for fluctuations in prices for manufactured components and raw materials, including as a result of tariffs

and surcharges, and rising energy costs; inflationary pressures relating to rising raw material costs and the cost of labor; the substantial

amount of debt incurred in connection with our strategic transactions and CECO’s ability to repay or refinance it or incur additional

debt in the future; the impact of federal, state or local government regulations; CECO’s ability to repurchase shares of its common

stock and the amounts and timing of repurchases, if any; CECO’s ability to successfully realize the expected benefits of its restructuring

program; CECO’s ability to successfully integrate acquired businesses and realize the synergies from strategic transactions; the

unpredictability and severity of catastrophic events, including cyber security threats, acts of terrorism or outbreak of war or hostilities

or public health crises, as well as management's response to any of the aforementioned factors; and CECO’s ability to remediate

its material weakness, or any other material weakness that we may identify in the future that could result in material misstatements

in CECO’s financial statements. Additional risks and uncertainties are discussed under "Part I – Item 1A. Risk

Factors" of CECO's Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and may be included in

subsequently filed Quarterly Reports on Form 10-Q. Many of these risks are beyond management's ability to control or predict.

Should one or more of these risks or uncertainties materialize, or should the assumptions prove incorrect, actual results may vary in

material aspects from those currently anticipated. Investors are cautioned not to place undue reliance on such forward-looking statements

as they speak only to our views as of the date the statement is made. Except as required under the federal securities laws or the rules and

regulations of the Securities and Exchange Commission, each of CECO and PFIE undertake no obligation to update or review any forward-looking

statements, whether as a result of new information, future events or otherwise.

Additional Information about the Transaction and Where to Find

It

The tender offer has not yet commenced. This communication is neither

an offer to buy nor a solicitation of an offer to sell any securities of Profire Energy, Inc., nor is it a recommendation by Profire

Energy, Inc., its management or board of directors that any investors sell or otherwise tender any securities of Profire Energy, Inc.

in connection with the transactions described elsewhere in this communication. The solicitation and the offer to buy shares of Profire

Energy, Inc.’s common stock will only be made pursuant to a tender offer statement on Schedule TO, including an offer to purchase,

a letter of transmittal and other related materials that a subsidiary of CECO Environmental Corp. intends to file with the SEC. In addition,

Profire Energy, Inc. will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender

offer. Once filed, investors will be able to obtain the tender statement on Schedule TO, the offer to purchase, the Solicitation/Recommendation

Statement of Profire Energy, Inc. on Schedule 14D-9 and related materials filed with the SEC with respect to the tender offer and

the merger, free of charge at the website of the SEC at www.sec.gov or from the information agent named in the tender offer materials.

Investors are advised to read these documents when they become available, including the Solicitation/Recommendation Statement of Profire

Energy, Inc. and any amendments thereto, as well as any other documents relating to the tender offer and the merger that are filed

with the SEC, carefully and in their entirety prior to making any decisions with respect to whether to tender their shares in the tender

offer because such documents contain important information, including the terms and conditions of the tender offer.

CECO Company Contact:

Peter Johansson

Chief Financial and Strategy Officer

888-990-6670

PFIE Company Contact:

Ryan Oviatt

Co-CEO & CFO

(801) 796-5127

Investor Relations Contact:

Steven Hooser

Three Part Advisors

214-872-2710

Investor.Relations@OneCECO.com

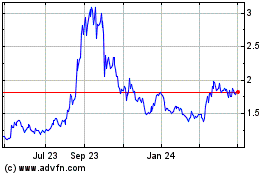

Profire Energy (NASDAQ:PFIE)

Historical Stock Chart

From Dec 2024 to Jan 2025

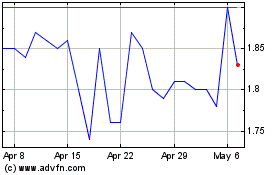

Profire Energy (NASDAQ:PFIE)

Historical Stock Chart

From Jan 2024 to Jan 2025