false 0001577916 0001577916 2024-02-05 2024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 5, 2024

Premier, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36092 |

|

35-2477140 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

13034 Ballantyne Corporate Place

Charlotte, NC 28277

(Address of principal executive offices) (Zip Code)

(704) 357-0022

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Class A Common Stock, $0.01 Par Value |

|

PINC |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry Into a Material Definitive Agreement |

Accelerated Share Repurchase

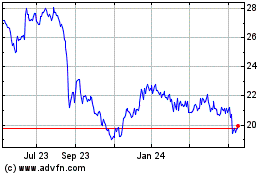

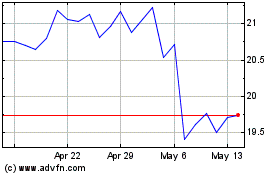

On February 5, 2024 Premier, Inc. (the “Company”) entered into an Issuer Forward Repurchase Transaction agreement (the “ASR Agreement”) with Bank of America, N.A. (“BofA”) to repurchase an aggregate of $400 million of shares of the Company’s Class A common stock (the “common stock”). The accelerated share repurchase transaction under the ASR Agreement (the “ASR Transaction”) is being consummated as part of the Company’s new $1.0 billion Share Repurchase Authorization described in Item 7.01 of this report.

Under the terms of the ASR Agreement, the Company will make a payment of $400 million to BofA, and by February 9, 2024 will receive from BofA initial deliveries of (and will then retire) $320 million worth of common stock based on the closing price of the common stock on February 7, 2024. The final number of shares of common stock to be repurchased and retired under the ASR Transaction will be determined on completion of the transaction and will generally be based on the volume-weighted average share price of the common stock during the term of the ASR Transaction, less a discount and subject to adjustments pursuant to the terms and conditions of the ASR Agreement. The final settlement of the ASR Transaction is expected to be completed in the first quarter of the Company’s 2025 fiscal year. At settlement, under certain circumstances, BofA may be required to deliver additional shares of common stock to the Company, or, under certain circumstances, the Company may be required to make a cash payment or to deliver shares of its common stock to BofA.

The ASR Agreement contains the terms and provisions governing the ASR Transaction, which are customary for these types of transactions, and which include, but are not limited to, the mechanism used to determine the number of shares of common stock or the amount of cash that will be delivered at settlement, the required timing of delivery of the shares, the circumstances under which BofA is permitted to make adjustments to valuation and calculation periods, various acknowledgements, representations and warranties made by the parties to one another, and the circumstances under which the ASR Agreement may be terminated early.

The foregoing description of the ASR Agreement and ASR Transaction is a summary and is qualified in its entirety by reference to the ASR Agreement, a copy of which is filed hereto as Exhibit 10.1 and incorporated herein by reference.

| Item 2.02. |

Results of Operations and Financial Condition |

On February 5, 2024, the Company issued a press release reporting the financial results of the Company for the three and six months ended December 31, 2023. A copy of the press release is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

As discussed in the financial results press release, the Company held a conference call and webcast on February 6, 2024. Supplemental slides referenced during the conference call and webcast were available on the Company’s website for viewing by call participants. A transcript of the call together with supplemental slides referenced during the conference call are attached as Exhibit 99.3 and Exhibit 99.4, respectively, to this report and are incorporated herein by reference.

| Item 7.01. |

Regulation FD Disclosure |

As noted in Item 2.02 of this report, the Company held a conference call and webcast on February 6, 2024, to discuss the Company’s operating results for the three and six months ended December 31, 2023, as reported in the Company’s February 5, 2024 financial results press release. A copy of the press release, which contains additional information regarding how to access the conference call and webcast and how to listen to a recorded playback of the call, is attached as Exhibit 99.1 to this report. A transcript of the call together with supplemental slides referenced during the conference call are attached as Exhibit 99.3 and Exhibit 99.4, respectively, to this report and are incorporated herein by reference.

On February 5, 2024, the Company issued a press release announcing that the Company’s Board of Directors (the “Board”) has concluded its exploration of strategic alternatives. On February 5, 2024, in the same press release, the Company also announced that the Board has approved a new share repurchase authorization for up to $1 billion of the Company’s common stock (the “Share Repurchase Authorization”) and that the Company has entered into the ASR Transaction described in Item 1.01 of this report pursuant to the Share Repurchase Authorization.

A copy of the press release announcing the conclusion of the strategic review, the Share Repurchase Authorization, and the ASR Transaction is attached to this report as Exhibit 99.2 and is incorporated herein by reference.

* * * *

The information discussed under Item 2.02 and Item 7.01 of this report, including Exhibits 99.1, 99.2, 99.3, and 99.4, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Statements made in this report that are not statements of historical or current facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this report include, but are not limited to those related to: The Company’s ability to advance its long-term strategies and develop innovations for and transform healthcare; the Company’s ability to identify partners for its S2S Global and Contigo Health businesses and the potential benefits thereof to the Company, its business, financial condition, or financial results; the potential for share repurchases pursuant to the Share Repurchase Authorization, the ability to fund those share repurchases, and the potential benefits thereof; and the ability to complete the ASR Transaction, the number of shares of common stock purchased pursuant to that transaction, the expected completion date, and the potential benefits thereof, all of which could be affected by volatility or disruption in the capital markets or other factors. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of the Company to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to the Company’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the Company’s control. More information on risks and uncertainties that could affect the Company’s business, achievements, performance, financial condition, and financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including those discussed under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” section of the Company’s Form 10-K for the year ended June 30, 2023 and subsequent Quarterly Reports on Form 10-Q, including the Form 10-Q for the quarter ended December 31, 2023, all of which are made available on the Company’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise.

| Item 9.01. |

Financial Statements and Exhibits |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Issuer Forward Repurchase Transaction agreement dated February 5, 2024, between Premier, Inc. and Bank of America, N.A. |

|

|

| 99.1 |

|

Press release of Premier, Inc. dated February 5, 2024 |

|

|

| 99.2 |

|

Press release of Premier, Inc. dated February 5, 2024 |

|

|

| 99.3 |

|

Transcript of fiscal 2024 second quarter earnings call of Premier, Inc. |

|

|

| 99.4 |

|

Supplemental slides referenced during the fiscal 2024 second quarter earnings call of Premier, Inc. |

|

|

| 104 |

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Premier, Inc. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Michael J. Alkire |

|

|

|

|

Name: |

|

Michael J. Alkire |

|

|

|

|

Title: |

|

President and Chief Executive Officer |

|

|

|

|

| Date: February 7, 2024 |

|

|

|

|

|

|

Exhibit 10.1

Execution Version

|

|

|

|

|

February 5, 2024 |

|

|

| To: |

|

Premier, Inc. 13034 Ballantyne Corporate

Place Charlotte, NC 28277 Attn: Craig McKasson, Chief

Administrative and Financial Officer Email: craig_mckasson@premierinc.com |

|

|

| From: |

|

Bank of America, N.A. Bank of America Tower at

One Bryant Park New York, New York 10036 Attention: Strategic

Equity Solutions Group Telephone: 646-855-8900

Email: dg.issuer_derivatives_notices@bofa.com |

|

|

| Re: |

|

Issuer Forward Repurchase Transaction |

Ladies and Gentlemen:

The purpose of this communication (this “Confirmation”) is to confirm the terms and conditions of the Transaction entered into

between Bank of America, N.A. (“BofA”) and Premier, Inc. (“Counterparty”) on the Trade Date specified below (the “Transaction”). The terms of the Transaction shall be set forth in this Confirmation.

This Confirmation shall constitute a “Confirmation” as referred to in the ISDA Master Agreement specified below.

1. This

Confirmation is subject to, and incorporates, the definitions and provisions of the 2006 ISDA Definitions (including the Annex thereto) (the “2006 Definitions”) and the definitions and provisions of the 2002 ISDA Equity Derivatives

Definitions (the “Equity Definitions”, and together with the 2006 Definitions, the “Definitions”), in each case as published by the International Swaps and Derivatives Association, Inc. (“ISDA”). In

the event of any inconsistency between the 2006 Definitions and the Equity Definitions, the Equity Definitions will govern.

This

Confirmation evidences a complete and binding agreement between BofA and Counterparty as to the terms of the Transaction to which this Confirmation relates. This Confirmation shall be subject to an agreement (the “Agreement”) in the

form of the 2002 ISDA Master Agreement as if BofA and Counterparty had executed an agreement in such form (without any Schedule but with (i) the election that the Cross Default provisions of Section 5(a)(vi) shall apply to BofA as if

(x) the Threshold Amount with respect to BofA were equal to 3% of Bank of America Corporation’s shareholders equity as of the Trade Date (provided that (a) the phrase “or becoming capable at such time of being declared”,

shall be deleted from clause (1) of such Section 5(a)(vi) of the Agreement, and (b) the following sentence shall be added to the end thereof: “Notwithstanding the foregoing, an Event of Default shall not occur under either

(1) or (2) above if (a) the event or condition referred to in (1) or the failure to pay referred to in (2) is caused by an error or omission of an administrative or operational nature, (b) funds were available to BofA to

enable it to make the relevant payment when due, and (c) such payment is made within three Local Business Days after notice of such failure is given by Counterparty.” and (y) Specified Indebtedness had the meaning specified in

Section 14 of the Agreement, except that such term shall not include obligations in respect of deposits received in the ordinary course of BofA banking business; and (ii) the other elections set forth in this Confirmation). The Transaction

shall be the only Transaction under the Agreement.

All provisions contained in, or incorporated by reference to, the Agreement will

govern this Confirmation except as expressly modified herein. In the event of any inconsistency between this Confirmation and either the Definitions or the Agreement, this Confirmation shall govern. The Transaction is a Share Forward Transaction

within the meaning set forth in the Equity Definitions.

2. The terms of the particular Transaction to which this Confirmation relates are as follows:

General Terms:

|

|

|

|

|

| |

|

Trade Date: |

|

February 5, 2024 |

|

|

|

|

|

Effective Date: |

|

February 8, 2024 |

|

|

|

|

|

Seller: |

|

BofA |

|

|

|

|

|

Buyer: |

|

Counterparty |

|

|

|

|

|

Shares: |

|

The common stock of Counterparty, par value USD 0.01 per share (Ticker Symbol: “PINC”) |

|

|

|

|

|

Prepayment: |

|

Applicable |

|

|

|

|

|

Prepayment Amount: |

|

As provided in Annex B to this Confirmation. |

|

|

|

|

|

Prepayment Date: |

|

The Effective Date |

|

|

|

|

|

Exchange: |

|

Nasdaq Global Select |

|

|

|

|

|

Related Exchange(s): |

|

All Exchanges |

|

|

|

|

|

Calculation Agent: |

|

BofA, provided that, notwithstanding anything to the contrary, all determinations, adjustments and calculations performed by BofA in its capacity as Calculation Agent, as well as any determinations, adjustments or

calculations by BofA in any other capacity, pursuant to this Confirmation, the Agreement and the Equity Definitions shall be made in good faith and in a commercially reasonable manner, including, without limitation, with respect to calculations,

adjustments and determinations that are made in its sole discretion or otherwise. In the event the Calculation Agent or BofA makes any calculation, adjustment or determination pursuant to this Confirmation, the Agreement or the Equity Definitions,

the Calculation Agent or BofA shall, within a commercially reasonable period of time, and in any event within five Local Business Days, notify Counterparty of such determination, adjustment or calculation and provide an explanation in reasonable

detail of the basis for any such determination, adjustment or calculation (including any quotations, market data or information from external sources used in making such calculation, adjustment or determination, as the case may be, but without

disclosing Calculation Agent’s or BofA’s proprietary models or other information that is subject to contractual, legal or regulatory obligations to not disclose such information); provided that following the occurrence of an Event of

Default pursuant to Section 5(a)(vii) of the Agreement with respect to which BofA is the Defaulting Party, Counterparty shall have the right to designate a nationally recognized dealer in over-the-counter corporate equity derivatives to act, during the period commencing on the date such Event of Default occurred and ending on the Early Termination Date with respect to such Event of Default, as

the Calculation Agent. |

2

|

|

|

|

|

|

|

|

|

The Calculation Agent shall use commercially reasonable efforts to make any adjustment required or, to the extent it makes any such adjustment, permitted to be made to the terms of the Transaction as promptly as reasonably

practicable following the occurrence of the event giving rise to any such adjustment, and the Calculation Agent shall use commercially reasonable efforts to notify Counterparty of the event giving rise to such adjustment, the terms being adjusted

and, for each term so adjusted, such term as so adjusted, in each case, as promptly as reasonably practicable after giving effect to such adjustment. |

|

|

| Valuation Terms: |

|

|

|

|

|

| |

|

Averaging Dates: |

|

Each of the consecutive Exchange Business Days commencing on, and including, the Effective Date and ending on, and including, the Final Averaging Date. |

|

|

|

|

|

Final Averaging Date: |

|

The Scheduled Final Averaging Date; provided that BofA shall have the right, in its absolute discretion, at any time to accelerate the Final Averaging Date, in whole or in part, to any date that is on or after the Scheduled

Earliest Acceleration Date by written notice to Counterparty no later than 6:00 P.M., New York City time, on the Exchange Business Day immediately following the accelerated Final Averaging Date. |

|

|

|

|

|

|

|

In the case of any acceleration of the Final Averaging Date in part (a “Partial Acceleration”), BofA shall specify in its written notice to Counterparty accelerating the Final Averaging Date the corresponding

percentage of the Prepayment Amount that is subject to valuation on the related Valuation Date, and Calculation Agent shall adjust the terms of the Transaction as it deems appropriate, in a commercially reasonable manner, in order to take into

account the occurrence of such Partial Acceleration (including cumulative adjustments to take into account all Partial Accelerations that occur during the term of the Transaction). |

|

|

|

|

|

Scheduled Final Averaging Date: |

|

As provided in Annex B to this Confirmation. |

|

|

|

|

|

Scheduled Earliest Acceleration Date: |

|

As provided in Annex B to this Confirmation. |

|

|

|

|

|

Valuation Date: |

|

The Final Averaging Date. |

|

|

|

|

|

Averaging Date Disruption: |

|

Modified Postponement, provided that notwithstanding anything to the contrary in the Equity Definitions, if a Market Disruption Event occurs on any Averaging Date, the Calculation Agent shall, acting in good faith and

commercially reasonable manner, take any or all of the following actions: (i) determine that such Averaging Date is a Disrupted Day in full, in which case, the VWAP Price for such Disrupted Day shall not be included for purposes of determining

the Settlement Price and the Scheduled Final Averaging Date shall be postponed in accordance with Modified Postponement (as modified herein) and/or (ii) determine that such Averaging Date is a Disrupted Day only in part, in which case the

Calculation Agent shall (x) determine the VWAP Price for such Disrupted Day based on Rule 10b-18 under the Exchange Act (“Rule 10b-18”) eligible

transactions in the Shares on such Disrupted Day taking into account the nature and duration of such Market Disruption Event and (y) determine the |

3

|

|

|

|

|

| |

|

|

|

Settlement Price based on an appropriately weighted average instead of the arithmetic average described under “Settlement Price” below. Any Exchange Business Day on which, as of the date hereof, the Exchange is scheduled

to close prior to its normal close of trading shall be deemed not to be an Exchange Business Day; if a closure of the Exchange prior to its normal close of trading on any Exchange Business Day is scheduled following the date hereof, then such

Exchange Business Day shall be deemed to be a Disrupted Day in full. |

|

|

|

|

|

Market Disruption Events: |

|

Section 6.3(a) of the Equity Definitions is hereby amended (A) by deleting the words “during the one hour period that ends at the relevant Valuation Time, Latest Exercise Time,

Knock-in Valuation Time or Knock-out Valuation Time, as the case may be” in clause (ii) thereof, and (B) by replacing the words “or (iii) an

Early Closure.” therein with “(iii) an Early Closure or (iv) a Regulatory Disruption.” |

|

|

|

|

|

|

|

Section 6.3(d) of the Equity Definitions is hereby amended by deleting the remainder of the provision following the term “Scheduled Closing Time” in the fourth line thereof. |

|

|

|

|

|

|

|

Notwithstanding the foregoing, any Market Disruption Event that does not have a material impact on the ability of BofA to maintain, establish or unwind a commercially reasonable hedge position shall be deemed not to constitute a

Market Disruption Event. |

|

|

|

|

|

Regulatory Disruption: |

|

In the event that BofA concludes based on commercially reasonable means and upon the advice of counsel that it is appropriate with respect to any legal, regulatory or self-regulatory requirements or related policies and procedures

for BofA (whether or not such requirements, policies or procedures are imposed by law or have been voluntarily adopted by BofA and provided that such policies and procedures are related to legal and regulatory issues and are generally applicable

hereunder and in similar situations and applied to the Transaction in a nondiscriminatory manner), to refrain from or decrease any market activity in connection with the Transaction in order to maintain, establish or unwind a commercially reasonable

hedge position, BofA shall, no later than the close of business on any affected day, notify Counterparty as soon as reasonably practicable that a Regulatory Disruption has occurred and the Averaging Dates affected by it. |

|

|

|

|

|

Liquidity Event: |

|

A Liquidity Event shall occur if, on any Scheduled Trading Day during the Relevant Period, the “ADTV” (as defined in Rule 10b-18) applicable to Shares on such Scheduled Trading Day

is less than 75% of the “ADTV” (as defined in Rule 10b-18) applicable to the Shares on the Trade Date, in each case as determined by the Calculation Agent. Where Liquidity Event occurs, the

Calculation Agent shall immediately notify the parties and the parties shall promptly determine in good faith whether the Scheduled Final Averaging Date shall be postponed to the next Valuation Date as a result of such Liquidity Event

occurring. |

|

|

| Settlement Terms: |

|

|

|

|

|

|

|

Initial Share Delivery: |

|

On each Initial Share Delivery Date, BofA shall deliver to Counterparty the Initial Shares. |

4

|

|

|

|

|

| |

|

Initial Share Delivery Date: |

|

The Effective Date and the immediately following Exchange Business Day. |

|

|

|

|

|

Initial Shares: |

|

As provided in Annex B to this Confirmation. The Initial Shares shall be delivered in equal installments on each Initial Share Delivery Date, subject to rounding up or down to the nearest Share but provided that the aggregate

delivery across both Initial Share Delivery Dates equals the Initial Shares. |

|

|

|

|

|

Settlement Date: |

|

The date that falls one Settlement Cycle following the Valuation Date. |

|

|

|

|

|

Settlement: |

|

On the Settlement Date, BofA shall deliver to Counterparty the Number of Shares to be Delivered, if a positive number. If the Number of Shares to be Delivered is a negative number, the Counterparty Settlement Provisions in Annex A

shall apply. |

|

|

|

|

|

Number of Shares to be Delivered: |

|

A number of Shares equal to (a) the Prepayment Amount divided by (b) (i) the Settlement Price minus (ii) the Price Adjustment Amount; provided that the Number of Shares to be Delivered as so determined

shall be reduced by the number of Shares delivered on the Initial Share Delivery Date. |

|

|

|

|

|

Settlement Price: |

|

The arithmetic average of the VWAP Prices for all Averaging Dates. |

|

|

|

|

|

VWAP Price: |

|

For any Averaging Date, the Rule 10b-18 dollar volume weighted average price per Share for such day based on transactions executed during such day, as reported on Bloomberg Page “PINC

<Equity> AQR SEC” (or any successor thereto) or, in the event such price is not so reported on such day for any reason or is manifestly incorrect, as reasonably determined by the Calculation Agent using a volume weighted method. |

|

|

|

|

|

Price Adjustment Amount: |

|

As provided in Annex B to this Confirmation. |

|

|

|

|

|

Excess Dividend Amount: |

|

For the avoidance of doubt, all references to the Excess Dividend Amount in Section 9.2(a)(iii) of the Equity Definitions shall be deleted. |

|

|

|

|

|

Other Applicable Provisions: |

|

To the extent either party is obligated to deliver Shares hereunder, the provisions of the last sentence of Section 9.2 and Sections 9.8, 9.9, 9.10, 9.11 (except that the Representation and Agreement contained in

Section 9.11 of the Equity Definitions shall be modified by excluding any representations therein relating to restrictions, obligations, limitations or requirements under applicable securities laws arising as a result of the fact that

Counterparty is the Issuer of the Shares) and 9.12 of the Equity Definitions will be applicable as if “Physical Settlement” applied to the Transaction. |

|

|

| Dividends: |

|

|

|

|

|

|

|

Dividend: |

|

Any dividend or distribution on the Shares other than any dividend or distribution of the type described in Sections 11.2(e)(i), 11.2(e)(ii)(A) or 11.2(e)(ii)(B) of the Equity Definitions. |

|

|

| Share Adjustments: |

|

|

|

|

|

|

|

Method of Adjustment: |

|

Calculation Agent Adjustment; provided that the declaration or payment of Dividends shall not be a Potential Adjustment Event. |

5

|

|

|

|

|

|

|

|

| |

|

|

|

It shall constitute an additional Potential Adjustment Event if the Scheduled Final Averaging Date is postponed pursuant to “Averaging Date Disruption” above, in which case the Calculation Agent may, in its commercially

reasonable discretion, adjust any relevant terms of the Transaction as the Calculation Agent determines appropriate to account for the economic effect on the Transaction of such postponement. |

|

|

| Extraordinary Events: |

|

|

|

|

|

|

|

Consequences of Merger Events: |

|

|

|

|

|

|

|

(a) Share-for-Share: |

|

Modified Calculation Agent Adjustment |

|

|

|

|

|

(b) Share-for-Other: |

|

Cancellation and Payment |

|

|

|

|

|

(c) Share-for-Combined: |

|

Cancellation and Payment |

|

|

|

|

|

Tender Offer: |

|

Applicable; provided that the definition of Tender Offer in Section 12.1(d) of the Equity Definitions will be amended by replacing 10% with 25% in the third and fourth line thereof. |

|

|

|

|

|

Consequences of Tender Offers: |

|

|

|

|

|

|

|

(a) Share-for-Share: |

|

Modified Calculation Agent Adjustment |

|

|

|

|

|

(b) Share-for-Other: |

|

Modified Calculation Agent Adjustment |

|

|

|

|

|

(c) Share-for-Combined: |

|

Modified Calculation Agent Adjustment |

|

|

|

|

|

Composition of Combined Consideration: |

|

Not Applicable |

|

|

|

|

|

Consequences of Announcement Events: |

|

Modified Calculation Agent Adjustment as set forth in Section 12.3(d) of the Equity Definitions; provided that references to “Tender Offer” shall be replaced by references to “Announcement Event” and

references to “Tender Offer Date” shall be replaced by references to “Announcement Date.” An Announcement Event shall be an “Extraordinary Event” for purposes of the Equity Definitions, to which Article 12 of the Equity

Definitions is applicable. |

|

|

|

|

|

Announcement Event: |

|

The occurrence of an Announcement Date in respect of a potential Acquisition Transaction (as defined in Section 9 below). |

|

|

|

|

|

Announcement Date: |

|

The date of the first public announcement in relation to an Acquisition Transaction, or any publicly announced change or amendment to the announcement giving rise to an Announcement Date. |

|

|

|

|

|

Provisions applicable to Merger Events and Tender Offers: |

|

The consequences set forth opposite “Consequences of Merger Events” and “Consequences of Tender Offers” above shall apply regardless of whether a particular Merger Event or Tender Offer relates to an Announcement

Date for which an adjustment has been made pursuant to Consequences of Announcement Events, without duplication of any such adjustment. |

|

|

|

|

|

New Shares: |

|

In the definition of New Shares in Section 12.1(i) of the Equity Definitions, the text in clause (i) thereof shall be deleted in its entirety (including the word “and” following such clause (i)) and replaced with

“publicly quoted, traded or listed on any of the New York Stock Exchange, The NASDAQ Global Select Market or The NASDAQ Global Market (or their respective successors)”. |

6

|

|

|

|

|

| |

|

Nationalization, Insolvency or Delisting: |

|

Cancellation and Payment (Calculation Agent Determination); provided that in addition to the provisions of Section 12.6(a)(iii) of the Equity Definitions, it shall also constitute a Delisting if the Exchange is located

in the United States and the Shares are not immediately re-listed, re-traded or re-quoted on any of the New York Stock Exchange,

The NASDAQ Global Market or The NASDAQ Global Select Market (or their respective successors); if the Shares are immediately re-listed, re-traded or re-quoted on any such exchange or quotation system, such exchange or quotation system shall thereafter be deemed to be the Exchange. |

|

|

|

|

|

Additional Disruption Events: |

|

|

|

|

|

|

|

Change in Law: |

|

Applicable |

|

|

|

|

|

Failure to Deliver: |

|

Applicable |

|

|

|

|

|

Insolvency Filing: |

|

Applicable |

|

|

|

|

|

Hedging Disruption: |

|

Applicable |

|

|

|

|

|

Increased Cost of Hedging: |

|

Applicable |

|

|

|

|

|

Loss of Stock Borrow: |

|

Applicable |

|

|

|

|

|

Maximum Stock Loan Rate: |

|

As provided in Annex B to this Confirmation. |

|

|

|

|

|

Increased Cost of Stock Borrow: |

|

Applicable |

|

|

|

|

|

Initial Stock Loan Rate: |

|

As provided in Annex B to this Confirmation. |

|

|

|

|

|

Hedging Party: |

|

For all applicable Potential Adjustment Events and Extraordinary Events, BofA |

|

|

|

|

|

Determining Party: |

|

For all Extraordinary Events, BofA |

|

|

|

|

|

Non-Reliance: |

|

Applicable |

|

|

|

|

|

Agreements and Acknowledgments Regarding Hedging Activities: |

|

Applicable |

|

|

|

|

|

Additional Acknowledgments: |

|

Applicable |

|

|

|

| 3. |

|

Account Details: |

|

|

|

|

|

|

|

(a) Account for payments to Counterparty: |

|

To be provided upon request |

|

|

|

|

|

(b) Account for payments to BofA: |

|

|

|

|

|

|

|

Bank of America |

|

|

|

|

New York, NY |

|

|

|

|

SWIFT: BOFAUS3N |

|

|

|

|

Bank Routing: 026-009-593 |

|

|

|

|

Account Name: Bank of America |

|

|

Account No.: 0012334-61892 |

|

|

|

|

| 4. |

|

Offices: |

|

|

|

|

(a) The Office of Counterparty for the Transaction is: Counterparty is not a Multibranch Party |

|

|

|

|

(b) The Office of BofA for the Transaction is: New York |

7

|

|

|

|

|

|

|

| 5. |

|

Notices: For purposes of this Confirmation: |

|

|

| |

|

(a) Address for notices or communications to Counterparty: |

|

|

|

|

|

Premier, Inc. |

|

|

|

|

13034 Ballantyne Corporate Place |

|

|

Charlotte, NC 28277 |

|

|

|

|

Attn: Craig McKasson, Chief Administrative and Financial Officer |

|

|

Email: craig_mckasson@premierinc.com |

|

|

|

|

(b) Address for notices or communications to BofA: |

|

|

|

|

|

Bank of America, N.A. |

|

|

|

|

One Bryant Park, 8th Floor |

|

|

New York, New York 10036 |

|

|

Attention: Strategic Equity Solutions Group |

|

|

Telephone:

646-855-8900 |

|

|

Email: dg.issuer_derivatives_notices@bofa.com |

| 6. |

Additional Provisions Relating to Transactions in the Shares. |

(a) Counterparty acknowledges and agrees that the Initial Shares delivered on the Initial Share Delivery Date may be sold short to

Counterparty. Counterparty further acknowledges and agrees that BofA may, during (i) the period from the date hereof to the Valuation Date or, if later, the Scheduled Earliest Acceleration Date without regard to any adjustment thereof pursuant

to “Special Provisions regarding Transaction Announcements” below, and (ii) the period from and including the first Settlement Valuation Date to and including the last Settlement Valuation Date, if any (together, the “Relevant

Period”), purchase Shares in connection with the Transaction, which Shares may be used to cover all or a portion of such short sale or may be delivered to Counterparty. Such purchases will be conducted independently of Counterparty. The

timing of such purchases by BofA, the number of Shares purchased by BofA on any day, the price paid per Share pursuant to such purchases and the manner in which such purchases are made, including without limitation whether such purchases are made on

any securities exchange or privately, shall be within the absolute discretion of BofA. It is the intent of the parties that the Transaction comply with the requirements of Rule 10b5-1(c)(1)(i)(B) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the parties agree that this Confirmation shall be interpreted to comply with the requirements of Rule 10b5-1(c), and

Counterparty shall not take any action that results in the Transaction not so complying with such requirements. Without limiting the generality of the preceding sentence, Counterparty acknowledges and agrees that (A) Counterparty does not have,

and shall not attempt to exercise, any influence over how, when or whether BofA effects any purchases of Shares in connection with the Transaction, (B) during the period beginning on (but excluding) the date of this Confirmation and ending on

(and including) the last day of the Relevant Period, neither Counterparty nor its officers or employees shall, directly or indirectly, communicate any information regarding Counterparty or the Shares to any employee of BofA or its Affiliates

responsible for trading the Shares in connection with the transactions contemplated hereby, (C) Counterparty is entering into the Transaction in good faith and not as part of a plan or scheme to evade compliance with federal securities laws

including, without limitation, Rule 10b-5 promulgated under the Exchange Act and (D) Counterparty will not alter or deviate from this Confirmation or enter into or alter a corresponding hedging

transaction with respect to the Shares. Counterparty also acknowledges and agrees that any amendment, modification, waiver or termination of this Confirmation must be effected in accordance with the requirements for the amendment or termination of a

“plan” as defined in Rule 10b5-1(c) under the Exchange Act. Without limiting the generality of the foregoing, any such amendment, modification, waiver or termination shall be made in good faith and

not as part of a plan or scheme to evade the prohibitions of Rule 10b-5 under the Exchange Act, and no such amendment, modification or waiver shall be made at any time at which Counterparty or any officer or

director of Counterparty is aware of any material nonpublic information regarding Counterparty or the Shares.

(b) Counterparty agrees

that neither Counterparty nor any of its Affiliates or agents shall take any action that would cause Regulation M to be applicable to any purchases of Shares, or any security for which the Shares are a reference security (as defined in Regulation

M), by Counterparty or any of its affiliated purchasers (as defined in Regulation M) during the Relevant Period.

8

(c) Counterparty shall, at least one day prior to the first day of the Relevant Period,

notify BofA of the total number of Shares purchased in Rule 10b-18 purchases of blocks pursuant to the once-a-week block

exception contained in Rule 10b-18(b)(4) by or for Counterparty or any of its affiliated purchasers during each of the four calendar weeks preceding the first day of the Relevant Period and during the calendar

week in which the first day of the Relevant Period occurs (“Rule 10b-18 purchase”, “blocks” and “affiliated purchaser” each being used as defined in Rule 10b-18).

(d) During the Relevant Period, Counterparty shall (i) notify BofA prior to the opening

of trading in the Shares on any day on which Counterparty makes, or expects to be made, any public announcement (as defined in Rule 165(f) under the Securities Act of 1933, as amended (the “Securities Act”) of any merger,

acquisition, or similar transaction involving a recapitalization relating to Counterparty (other than any such transaction in which the consideration consists solely of cash and there is no valuation period), (ii) promptly notify BofA following any

such announcement that such announcement has been made, and (iii) promptly deliver to BofA following the making of any such announcement a certificate indicating (A) Counterparty’s average daily Rule

10b-18 purchases (as defined in Rule 10b-18) during the three full calendar months preceding the date of the announcement of such transaction and

(B) Counterparty’s block purchases (as defined in Rule 10b-18) effected pursuant to paragraph (b)(4) of Rule 10b-18 during the three full calendar months

preceding the date of the announcement of such transaction. In addition, Counterparty shall promptly notify BofA of the earlier to occur of the completion of such transaction and the completion of the vote by target shareholders. Counterparty

acknowledges that any such public announcement may result in a Regulatory Disruption and may cause the Relevant Period to be suspended. Accordingly, Counterparty acknowledges that its actions in relation to any such announcement or transaction must

comply with the standards set forth in Section 6(a) above.

(e) Without the prior written consent of BofA, Counterparty shall not,

and shall cause its Affiliates and affiliated purchasers (each as defined in Rule 10b-18) not to, directly or indirectly (including, without limitation, by means of a cash-settled or other derivative

instrument) purchase, offer to purchase, place any bid or limit order that would effect a purchase of, or commence any tender offer relating to, any Shares (or an equivalent interest, including a unit of beneficial interest in a trust or limited

partnership or a depository share) or any security convertible into or exchangeable for Shares during the Relevant Period, provided that the foregoing restriction shall not apply to (A) privately negotiated,

off-market purchases that are not solicited by or on behalf of Counterparty, its Affiliates or affiliated purchasers and that would not be reasonably expected to result in transactions on the Exchange,

(B) purchases of Shares pursuant to exercises of stock options granted to former or current employees, officers, directors, or other affiliates of Counterparty, including the withholding and/or purchase of Shares from holders of such options to

satisfy payment of the option exercise price and/or satisfy tax withholding requirements in connection with the exercise of such options; (C) purchases of Shares from holders of performance shares or units or restricted shares or units to

satisfy tax withholding requirements in connection with vesting; (D) the conversion or exchange by holders of any convertible or exchangeable securities of the Counterparty previously issued; (E) purchases of Shares effected by or for a

plan by an agent independent of Counterparty that satisfy the requirements of Rule10b-18(a)(13)(ii); and (F) purchases executed by or through BofA or an Affiliate of BofA;

| 7. |

Representations, Warranties and Agreements. |

(a) In addition to the representations, warranties and agreements in the Agreement and those contained elsewhere herein, Counterparty

represents and warrants to and for the benefit of, and agrees with, BofA as follows:

(i) As of the Effective Date, and as

of the date of any election by Counterparty of the Share Termination Alternative under (and as defined in) Section 10(a) below, (A) none of Counterparty and its officers and directors is aware of any material nonpublic information

regarding Counterparty or the Shares and (B) all reports and other documents filed by Counterparty with the Securities and Exchange Commission pursuant to the Exchange Act when considered as a whole (with the more recent such reports and

documents deemed to amend inconsistent statements contained in any earlier such reports and documents), do not contain any untrue statement of a material fact or any omission of a material fact required to be stated therein or necessary to make the

statements therein, in the light of the circumstances in which they were made, not misleading.

(ii) Without limiting the

generality of Section 13.1 of the Equity Definitions, Counterparty acknowledges that BofA is not making any representations or warranties or taking any position or expressing any view with respect to the treatment of the Transaction under any

accounting standards including ASC Topic 260, Earnings Per Share, ASC Topic 815, Derivatives and Hedging, or ASC Topic 480, Distinguishing Liabilities from Equity and ASC 815-40,

Derivatives and Hedging – Contracts in Entity’s Own Equity (or any successor issue statements) or under FASB’s Liabilities & Equity Project.

9

(iii) Without limiting the generality of Section 3(a)(iii) of the

Agreement, the Transaction will not violate Rule 13e-1 or Rule 13e-4 under the Exchange Act.

(iv) Prior to the Trade Date, Counterparty shall deliver to BofA a resolution of Counterparty’s board of directors

authorizing the Transaction and such other certificate or certificates as BofA shall reasonably request. Counterparty has publicly disclosed its intention to institute a program for the acquisition of Shares.

(v) Counterparty is not entering into this Confirmation to create actual or apparent trading activity in the Shares (or any

security convertible into or exchangeable for Shares) or to raise or depress or otherwise manipulate the price of the Shares (or any security convertible into or exchangeable for Shares) or otherwise in violation of the Exchange Act, and will not

engage in any other securities or derivative transaction to such ends.

(vi) Counterparty is not, and after giving effect

to the transactions contemplated hereby will not be, required to register as an “investment company” as such term is defined in the Investment Company Act of 1940, as amended.

(vii) On the Effective Date, the Prepayment Date, the Initial Share Delivery Date and the Settlement Date, Counterparty is not,

or will not be, “insolvent” (as such term is defined under Section 101(32) of the U.S. Bankruptcy Code (Title 11 of the United States Code) (the “Bankruptcy Code”)) and Counterparty would be able to purchase the

Shares hereunder in compliance with the corporate laws of the jurisdiction of its incorporation.

(viii) No state or local

(including non-U.S. jurisdictions) law, rule, regulation or regulatory order applicable to the Shares would give rise to any reporting, consent, registration or other requirement (including without limitation

a requirement to obtain prior approval from any person or entity) as a result of BofA or its affiliates owning or holding (however defined) Shares.

(ix) Counterparty shall not declare or pay any Dividend (as defined above) to holders of record as of any date occurring prior

to the Settlement Date or, if the provisions of Annex A apply, the Cash Settlement Payment Date, other than an ordinary cash dividend of USD 0.21 per Share to holders of record on each of March 1, 2024, and June 1, 2024 (or, in each case,

any later date within the same quarterly fiscal period of Counterparty). Any declaration or payment of a Dividend in contravention of the prior sentence shall be an immediate Additional Termination Event, with respect to which Counterparty shall be

the sole Affected Party and BofA shall be the party entitled to designate an Early Termination Date pursuant to Section 6(b) of the Agreement.

(x) Counterparty understands no obligations of BofA to it hereunder will be entitled to the benefit of deposit insurance and

that such obligations will not be guaranteed by any affiliate of BofA or any governmental agency.

(xi) Counterparty is

(i) a corporation for U.S. federal income tax purposes and is organized under the laws of Delaware and (ii) a “U.S. person” (as that term is used in section 1.1441-4(a)(3)(ii) of United

States Treasury Regulations) for U.S. federal income tax purposes.

(b) Each of BofA and Counterparty agrees and represents that it is an

“eligible contract participant” as defined in Section 1a(18) of the U.S. Commodity Exchange Act, as amended.

(c)

Counterparty acknowledges that the offer and sale of the Transaction to it is intended to be exempt from registration under the Securities Act, by virtue of Section 4(a)(2) thereof. Accordingly, Counterparty represents and warrants to BofA that

(i) it has the financial ability to bear the economic risk of its investment in the Transaction and is able to bear a total loss of its investment, (ii) it is an “accredited investor” as that term is defined in Regulation D as

promulgated under the Securities Act, (iii) it is entering into the Transaction for its own account and without a view to the distribution or resale thereof, and (iv) the assignment, transfer or other disposition of the Transaction has not

been and will not be registered under the Securities Act and is restricted under this Confirmation, the Securities Act and state securities laws.

10

(d) Counterparty agrees and acknowledges that BofA is a “financial institution,”

“swap participant” and “financial participant” within the meaning of Sections 101(22), 101(53C) and 101(22A) of the Bankruptcy Code. The parties hereto further agree and acknowledge that it is the intent of the parties that

(A) this Confirmation is (i) a “securities contract,” as such term is defined in Section 741(7) of the Bankruptcy Code, with respect to which each payment and delivery hereunder or in connection herewith is a

“termination value,” “payment amount” or “other transfer obligation” within the meaning of Section 362 of the Bankruptcy Code and a “settlement payment,” within the meaning of Section 546 of the

Bankruptcy Code and (ii) a “swap agreement,” as such term is defined in Section 101(53B) of the Bankruptcy Code, with respect to which each payment and delivery hereunder or in connection herewith is a “termination

value,” “payment amount” or “other transfer obligation” within the meaning of Section 362 of the Bankruptcy Code and a “transfer,” as such term is defined in Section 101(54) of the Bankruptcy Code and a

“payment or other transfer of property” within the meaning of Sections 362 and 546 of the Bankruptcy Code, and (B) BofA is entitled to the protections afforded by, among other sections, Sections 362(b)(6), 362(b)(17), 362(o), 546(e),

546(g), 548(d)(2), 555, 560 and 561 of the Bankruptcy Code.

| 8. |

Agreements and Acknowledgements Regarding Hedging. |

(a) Counterparty acknowledges and agrees that:

(i) During the Relevant Period, BofA and its Affiliates may buy or sell Shares or other securities or buy or sell options or

futures contracts or enter into swaps or other derivative securities in order to adjust its hedge position with respect to the Transaction;

(ii) BofA and its Affiliates also may be active in the market for Shares other than in connection with hedging activities in

relation to the Transaction;

(iii) BofA shall make its own determination as to whether, when or in what manner any hedging

or market activities in Counterparty’s securities shall be conducted and shall do so in a manner that it deems appropriate to hedge its price and market risk with respect to the Settlement Price and/or the VWAP Price; and

(iv) Any market activities of BofA and its Affiliates with respect to Shares may affect the market price and volatility of

Shares, as well as the Settlement Price and/or the VWAP Price, each in a manner that may be adverse to Counterparty.

(b) During the

Relevant Period, BofA agrees to use commercially reasonable efforts to make all purchases of Shares in connection with the Transaction in a manner that would comply with the limitations set forth in clauses (b)(1), (b)(2), (b)(3), (b)(4) and

(c) of Rule 10b-18, in each case as if such rule was applicable to such purchases (in each case, other than purchases made by BofA as part of its dynamic adjustment of its hedge of the options embedded in

the Transaction or that BofA reasonably determines are attributable solely to BofA during such period). Without limiting the foregoing, BofA shall effect all purchases of Shares in connection with the Transaction in a manner that BofA reasonably

believes is in compliance with applicable legal and regulatory requirements.

| 9. |

Special Provisions regarding Transaction Announcements. |

(a) If a Transaction Announcement occurs on or prior to the Settlement Date, then the Calculation Agent shall make such adjustment to the

exercise, settlement, payment or any of the other terms of the Transaction (including without limitation, the Number of Shares to be Delivered and the Price Adjustment Amount) as the Calculation Agent determines appropriate to account for the

economic effect of the Transaction Announcement (and, for the avoidance of doubt, in such event the Number of Shares to be Delivered may be reduced below zero pursuant to the proviso to such definition). If a Transaction Announcement occurs after

the Effective Date but prior to the Scheduled Earliest Acceleration Date, the Scheduled Earliest Acceleration Date shall be adjusted to be the date of such Transaction Announcement.

11

(b) “Transaction Announcement” means (i) the announcement of an

Acquisition Transaction, (ii) an announcement that Counterparty or any of its subsidiaries has entered into an agreement, a letter of intent or an understanding to enter into an Acquisition Transaction, (iii) the announcement of an

intention to solicit or enter into, or to explore strategic alternatives or other similar undertaking that may include, an Acquisition Transaction, or (iv) any other announcement that in the reasonable judgment of the Calculation Agent may

result in an Acquisition Transaction. For the avoidance of doubt, announcements as used in this definition of Transaction Announcement refer to any public announcement whether made by the Issuer or a third party.

“Acquisition Transaction” means (i) any Merger Event (and for purposes of this definition the definition of Merger Event

shall be read with the references therein to “100%” being replaced by “25%” and to “50%” by “80%” and as if the clause beginning immediately following the definition of Reverse Merger therein to the end of

such definition were deleted) or Tender Offer, or any other transaction involving the merger of Counterparty with or into any third party, (ii) the sale or transfer of all or substantially all of the assets of Counterparty, (iii) a

recapitalization, reclassification, binding share exchange or other similar transaction, (iv) any acquisition, lease, exchange, transfer, disposition (including by way of spin-off or distribution) of

assets (including any capital stock or other ownership interests in subsidiaries) or other similar event by Counterparty or any of its subsidiaries where the aggregate consideration transferable or receivable by or to Counterparty or its

subsidiaries exceeds 20% of the market capitalization of Counterparty and (v) any transaction in which Counterparty or its board of directors has a legal obligation to make a recommendation to its shareholders in respect of such transaction

(whether pursuant to Rule 14e-2 under the Exchange Act or otherwise).

(a) Alternative Calculations and Payment on Early Termination and on Certain Extraordinary Events. If either party would owe the other

party any amount pursuant to Sections 12.2, 12.3, 12.6, 12.7 or 12.9 of the Equity Definitions or pursuant to Section 6(d)(ii) of the Agreement (a “Payment Obligation”), Counterparty shall have the right, in its sole

discretion, to satisfy or to require BofA to satisfy, as the case may be, any such Payment Obligation, in whole or in part, by the Share Termination Alternative (as defined below) by giving irrevocable telephonic notice to BofA, confirmed in writing

within one Scheduled Trading Day, no later than 9:30 A.M. New York City time on the Merger Date, Tender Offer Date, Announcement Date, Early Termination Date or date of cancellation or termination in respect of an Extraordinary Event, as applicable

(“Notice of Share Termination”); provided that if BofA would owe Counterparty the Payment Obligation and Counterparty does not elect to require BofA to satisfy such Payment Obligation by the Share Termination Alternative in

whole, BofA shall have the right, in its sole discretion, to elect to satisfy any portion of such Payment Obligation that Counterparty has not so elected by the Share Termination Alternative, notwithstanding Counterparty’s failure to elect or

election to the contrary; and provided further that Counterparty shall not have the right to so elect (but, for the avoidance of doubt, BofA shall have the right to so elect) in the event of (i) an Insolvency, a Nationalization, a Merger

Event or a Tender Offer, in each case, in which the consideration or proceeds to be paid to holders of Shares consists solely of cash or (ii) an Event of Default in which Counterparty is the Defaulting Party or a Termination Event in which

Counterparty is the Affected Party, which Event of Default or Termination Event resulted from an event or events within Counterparty’s control. Upon such Notice of Share Termination, the following provisions shall apply on the Scheduled Trading

Day immediately following the Merger Date, Tender Offer Date, Announcement Date, Early Termination Date or date of cancellation or termination in respect of an Extraordinary Event, as applicable, with respect to the Payment Obligation or such

portion of the Payment Obligation for which the Share Termination Alternative has been elected (the “Applicable Portion”):

|

|

|

| Share Termination Alternative: |

|

Applicable and means, if delivery pursuant to the Share Termination Alternative is owed by BofA, that BofA shall deliver to Counterparty the Share Termination Delivery Property on the date on which the Payment Obligation would

otherwise be due pursuant to Section 12.7 or 12.9 of the Equity Definitions or Section 6(d)(ii) of the Agreement, as applicable, or such later date as the Calculation Agent may reasonably determine (the “Share Termination Payment

Date”), in satisfaction of the Payment Obligation or the Applicable Portion, as the case may be. If delivery pursuant to the Share Termination Alternative is owed by Counterparty, paragraphs 2 through 5 of Annex A shall apply as if such

delivery were a settlement of the Transaction to which Net Share Settlement (as defined in Annex A) applied, the Cash Settlement Payment Date were the Early Termination Date, the Forward Cash Settlement Amount were zero (0) minus the

Payment Obligation (or the Applicable Portion, as the case may be) owed by Counterparty, and “Shares” as used in Annex A were replaced by “Share Termination Delivery

Units.” |

12

|

|

|

|

|

| Share Termination Delivery Property: |

|

A number of Share Termination Delivery Units, as calculated by the Calculation Agent, equal to the Payment Obligation (or the Applicable Portion, as the case may be) divided by the Share Termination Unit Price. The Calculation Agent

shall adjust the Share Termination Delivery Property by replacing any fractional portion of a security therein with an amount of cash equal to the value of such fractional security based on the values used to calculate the Share Termination Unit

Price. |

|

|

| Share Termination Unit Price: |

|

The value of property contained in one Share Termination Delivery Unit on the date such Share Termination Delivery Units are to be delivered as Share Termination Delivery Property, as determined by the Calculation Agent in its

discretion by commercially reasonable means and notified by the Calculation Agent to the parties at the time of notification of the Payment Obligation. |

|

|

| Share Termination Delivery Unit: |

|

In the case of a Termination Event, Event of Default, Delisting or Additional Disruption Event, one Share or, in the case of an Insolvency, Nationalization, Merger Event or Tender Offer, one Share or a unit consisting of the number

or amount of each type of property received by a holder of one Share (without consideration of any requirement to pay cash or other consideration in lieu of fractional amounts of any securities) in such Insolvency, Nationalization, Merger Event or

Tender Offer. If such Insolvency, Nationalization, Merger Event or Tender Offer involves a choice of consideration to be received by holders, such holder shall be deemed to have elected to receive the maximum possible amount of cash. |

|

|

| Failure to Deliver: |

|

Applicable |

|

|

| Other applicable provisions: |

|

If Share Termination Alternative is applicable, the provisions of Sections 9.8, 9.9, 9.10, 9.11 (except that the Representation and Agreement contained in Section 9.11 of the Equity Definitions shall be modified by excluding

any representations therein relating to restrictions, obligations, limitations or requirements under applicable securities laws arising as a result of the fact that Counterparty is the issuer of the Shares or any portion of the Share Termination

Delivery Units) and 9.12 of the Equity Definitions will be applicable as if “Physical Settlement” applied to the Transaction, except that all references to “Shares” shall be read as references to “Share Termination Delivery

Units”. |

(b) Equity Rights. BofA acknowledges and agrees that this Confirmation is not intended to convey to it

rights with respect to the Transaction that are senior to the claims of common stockholders in the event of Counterparty’s bankruptcy. For the avoidance of doubt, the parties agree that the preceding sentence shall not apply at any time other

than during Counterparty’s bankruptcy to any claim arising as a result of a breach by Counterparty of any of its obligations under this Confirmation or the Agreement. For the avoidance of doubt, the parties acknowledge that this Confirmation is

not secured by any collateral that would otherwise secure the obligations of Counterparty herein under or pursuant to any other agreement.

(c) [reserved]

(d)

Staggered Settlement. If BofA would owe Counterparty any Shares pursuant to the “Settlement Terms” above, BofA may, by notice to Counterparty on or prior to the Settlement Date (a “Nominal Settlement Date”), elect

to deliver the Shares deliverable on such Nominal Settlement Date on two or more dates (each, a “Staggered Settlement Date”) or at two or more times on the Nominal Settlement Date as follows: (i) in such notice, BofA will

specify to Counterparty the related Staggered Settlement Dates (each of which will be on or prior to such Nominal Settlement Date)

13

or delivery times and how it will allocate the Shares it is required to deliver under “Settlement Terms” above among the Staggered Settlement Dates or delivery times; and (ii) the

aggregate number of Shares that BofA will deliver to Counterparty hereunder on all such Staggered Settlement Dates and delivery times will equal the number of Shares that BofA would otherwise be required to deliver on such Nominal Settlement Date.

(e) Adjustments. For the avoidance of doubt, whenever the Calculation Agent is called upon to make an adjustment pursuant to the

terms of this Confirmation or the Definitions to take into account the effect of an event, the Calculation Agent shall make such adjustment in a commercially reasonable manner based on commercially reasonable inputs by reference to the effect of

such event on the Hedging Party, assuming that the Hedging Party maintains a commercially reasonable hedge position.

(f) Transfer and

Assignment. BofA may transfer or assign its rights and obligations hereunder and under the Agreement, in whole or in part, to any of its Affiliates (i) whose senior unsecured credit rating at the time of any such transfer or assignment is

greater than or equal to BofA’s rating, or (ii) whose obligations under this Transaction are subject to a guaranty by Bank of America Corporation provided that such guaranty is reasonably acceptable to Counterparty, and provided further

that Counterparty will not be required to pay or deliver more or receive less hereunder as a result of such transfer or assignment by BofA then in the absence of such transfer or assignment.

(g) [reserved]

(h)

Amendments to Equity Definitions. The following amendments shall be made to the Equity Definitions:

(i) Section

11.2(a) of the Equity Definitions is hereby amended by deleting the words “a diluting or concentrative effect on the theoretical value of the relevant Shares” and replacing them with the words “an economic effect on the relevant

Transaction”;

(ii) The first sentence of Section 11.2(c) of the Equity Definitions, prior to clause

(A) thereof, is hereby amended to read as follows: ‘(c) If “Calculation Agent Adjustment” is specified as the Method of Adjustment in the related Confirmation of a Share Option Transaction or Share Forward Transaction, then

following the announcement or occurrence of any Potential Adjustment Event, the Calculation Agent will determine whether such Potential Adjustment Event has a material economic effect on the Transaction and, if so, will (i) make appropriate

adjustment(s), if any, to any one or more of:’ and the portion of such sentence immediately preceding clause (ii) thereof is hereby amended by deleting the words “diluting or concentrative” and replacing such words with

the word “material” and deleting the words “(provided that no adjustments will be made to account solely for changes in volatility, expected dividends, stock loan rate or liquidity relative to the relevant Shares)” and

replacing such latter phrase with the words “(and, for the avoidance of doubt, adjustments may be made to account solely for changes in volatility, stock loan rate or liquidity relative to the relevant Shares)”;

(iii) Section 11.2(e)(vii) of the Equity Definitions is hereby amended by deleting the words “diluting or concentrative

effect on the theoretical value of the relevant Shares” and replacing them with the words “material economic effect on the relevant Transaction”;

(iv) Section 12.9(b)(iv) of the Equity Definitions is hereby amended by (A) deleting (1) subsection (A) in its

entirety, (2) the phrase “or (B)” following subsection (A) and (3) the phrase “in each case” in subsection (B); and (B) deleting the phrase “neither the Non-Hedging

Party nor the Lending Party lends Shares in the amount of the Hedging Shares or” in the penultimate sentence; and

(v)

Section 12.9(b)(v) of the Equity Definitions is hereby amended by (A) adding the word “or” immediately before subsection “(B)” and deleting the comma at the end of subsection (A); and (B)(1) deleting subsection (C) in

its entirety, (2) deleting the word “or” immediately preceding subsection (C) and (3) replacing in the penultimate sentence the words “either party” with “the Hedging Party” and (4) deleting clause

(X) in the final sentence.

14

(i) No Netting and Set-off. Each party waives

any and all rights it may have to set off obligations arising under the Agreement and the Transaction against other obligations between the parties, whether arising under any other agreement, applicable law or otherwise.

(j) Disclosure. Effective from the date of commencement of discussions concerning the Transaction, Counterparty and each of its

employees, representatives, or other agents may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the Transaction and all materials of any kind (including opinions or other tax analyses) that are

provided to Counterparty relating to such tax treatment and tax structure.

(k) Designation by BofA. Notwithstanding any other

provision in this Confirmation to the contrary requiring or allowing BofA to purchase, sell, receive or deliver any Shares or other securities to or from Counterparty, BofA (the “Designator”) may designate any of its Affiliates (the

“Designee”) to deliver or take delivery, as the case may be, and otherwise perform its obligations to deliver, if any, or take delivery of, as the case may be, any such Shares or other securities in respect of the Transaction, and

the Designee may assume such obligations, if any. Such designation shall not relieve the Designator of any of its obligations, if any, hereunder. Notwithstanding the previous sentence, if the Designee shall have performed the obligations, if any, of

the Designator hereunder, then the Designator shall be discharged of its obligations, if any, to Counterparty to the extent of such performance.

(l) Termination Currency. The Termination Currency shall be USD.

(m) Wall Street Transparency and Accountability Act of 2010. The parties hereby agree that none of (i) Section 739 of

the Wall Street Transparency and Accountability Act of 2010 (the “WSTAA”), (ii) any similar legal certainty provision included in any legislation enacted, or rule or regulation promulgated, on or after the Trade Date, (iii) the

enactment of the WSTAA or any regulation under the WSTAA, (iv) any requirement under the WSTAA or (v) any amendment made by the WSTAA shall limit or otherwise impair either party’s right to terminate, renegotiate, modify, amend or

supplement this Confirmation or the Agreement, as applicable, arising from a termination event, force majeure, illegality, increased cost, regulatory change or similar event under this Confirmation, the Equity Definitions or the Agreement

(including, but not limited to, any right arising from any Change in Law, Hedging Disruption, Increased Cost of Hedging or Illegality).

(n) Tax Matters

| |

(i) |

Withholding Tax imposed on payments to non-US counterparties under

the United States Foreign Account Tax Compliance Act. “Tax” and “Indemnifiable Tax”, each as defined in Section 14 of the Agreement, shall not include any U.S. federal withholding tax imposed or collected pursuant to

Sections 1471 through 1474 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), any current or future regulations or official interpretations thereof, any agreement entered into pursuant to Section 1471(b) of the

Code, or any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement entered into in connection with the implementation of such Sections of the Code (a “FATCA Withholding Tax”). For

the avoidance of doubt, a FATCA Withholding Tax is a Tax the deduction or withholding of which is required by applicable law for the purposes of Section 2(d) of the Agreement. |

| |

(ii) |

HIRE Act. To the extent that either party to the Agreement with respect to this Transaction is not an

adhering party to the ISDA 2015 Section 871(m) Protocol published by the International Swaps and Derivatives Association, Inc. on November 2, 2015 and available at www.isda.org, as may be amended, supplemented, replaced or superseded from

time to time (the “871(m) Protocol”), the parties agree that the provisions and amendments contained in the Attachment to the 871(m) Protocol are incorporated into and apply to the Agreement with respect to this Transaction as if set forth

in full herein. The parties further agree that, solely for purposes of applying such provisions and amendments to the Agreement with respect to this Transaction, references to “each Covered Master Agreement” in the 871(m) Protocol will be

deemed to be references to the Agreement with respect to this Transaction, and references to the “Implementation Date” in the 871(m) Protocol will be deemed to be references to the Trade Date of this Transaction. |

15

| |

(iii) |

Tax documentation. Counterparty shall provide to BofA a valid U.S. Internal Revenue Service Form W-9, or any successor thereto, (i) on or before the date of execution of this Confirmation and (ii) promptly upon learning that any such tax form previously provided by Counterparty has become obsolete or

incorrect. Additionally, Counterparty shall, promptly upon request by BofA, provide such other tax forms and documents requested by BofA. |

(o) [reserved]

(p)

U.S. Stay Regulations. The parties agree that (i) to the extent that prior to the date hereof both parties have adhered to the 2018 ISDA U.S. Resolution Stay Protocol (the “Protocol”), the terms of the Protocol are

incorporated into and form a part of this Confirmation, and for such purposes this Confirmation shall be deemed a Protocol Covered Agreement and each party shall be deemed to have the same status as “Regulated Entity” and/or “Adhering

Party” as applicable to it under the Protocol; (ii) to the extent that prior to the date hereof the parties have executed a separate agreement the effect of which is to amend the qualified financial contracts between them to conform with

the requirements of the QFC Stay Rules (the “Bilateral Agreement”), the terms of the Bilateral Agreement are incorporated into and form a part of this Confirmation and each party shall be deemed to have the status of “Covered

Entity” or “Counterparty Entity” (or other similar term) as applicable to it under the Bilateral Agreement; or (iii) if clause (i) and clause (ii) do not apply, the terms of Section 1 and Section 2 and the

related defined terms (together, the “Bilateral Terms”) of the form of bilateral template entitled “Full-Length Omnibus (for use between U.S. G-SIBs and Corporate Groups)” published

by ISDA on November 2, 2018 (currently available on the 2018 ISDA U.S. Resolution Stay Protocol page at www.isda.org and, a copy of which is available upon request), the effect of which is to amend the qualified financial contracts between the

parties thereto to conform with the requirements of the QFC Stay Rules, are hereby incorporated into and form a part of this Confirmation, and for such purposes this Confirmation shall be deemed a “Covered Agreement,” BofA shall be deemed

a “Covered Entity” and Counterparty shall be deemed a “Counterparty Entity.” In the event that, after the date of this Confirmation, both parties hereto become adhering parties to the Protocol, the terms of the Protocol will