Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 16 2023 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-38851

POWERBRIDGE TECHNOLOGIES CO., LTD.

(Translation of Registrant’s name into English)

Advanced Business Park, 9th Fl, Bldg C2,

29 Lanwan Lane, Hightech District,

Zhuhai, Guangdong 519080, China

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 16, 2023

| |

POWERBRIDGE TECHNOLOGIES CO., LTD. |

| |

|

|

| |

By: |

/s/ Stewart Lor |

| |

|

Stewart Lor |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

Powerbridge Technologies Co., Ltd. Announces

Receipt of Nasdaq Notification Letter Regarding Minimum Bid Price Deficiency

ZHUHAI, China, August 16, 2023 /PRNewswire/ —

Powerbridge Technologies Co., Ltd. (Nasdaq: PBTS) (the “Company” or “PBTS”), a provider of multi-industry technology

solutions, today announced that it has received a notification letter (the “Notification Letter”) from the Nasdaq Stock Market

LLC (the “Nasdaq”) dated August 11, 2023, notifying the Company that it is not in compliance with the minimum bid price requirement

as set forth under Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq. This press release is issued pursuant to Nasdaq

Listing Rule 5810(b), which requires prompt disclosure upon the receipt of a deficiency notification.

Nasdaq Listing Rule 5550(a)(2) requires listed

securities to maintain a minimum bid price of US$1.00 per share, and Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum

bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. Based on the closing bid price

of the Company’s ordinary shares for the 30 consecutive business days from June 28, 2023 to August 10, 2023, the Company no longer meets

the minimum bid price requirement.

In accordance with the Nasdaq Listing Rule 5810(c)(3)(A),

the Company has been provided 180 calendar days, or until February 7, 2024, to regain compliance with Nasdaq Listing Rule 5550(a)(2).

To regain compliance, the Company’s ordinary shares must have a closing bid price of at least US$1.00 for a minimum of 10 consecutive

trading days. In the event that the Company does not regain compliance by February 7, 2024, the Company may be eligible for additional

time to regain compliance or may face delisting.

The receipt of the Notification Letter has no

immediate effect on the Company’s business operations or the listing of the Company’s ordinary shares, which will continue

to trade uninterrupted on the Nasdaq under the ticker “PBTS”. To address this issue, the Company intends to continuously monitor

its closing bid price and is in the process of considering various measures to improve its financial position and results of operations,

which the Company expects to countervail the short-term adverse effects on its trading price and cure the deficiency in due time.

About Powerbridge Technologies

Powerbridge Technologies Co., Ltd. (Nasdaq: PBTS) is a leading provider

of multi-industry technology solutions services. The Company operates in several segments of business, including software and digital

applications for various industries, cross-border trade platforms and global trade systems, digital fintech services for agriculture and

consumer products, and cryptomining machines and cryptocurrency operations.

Safe Harbor Statement

This press release contains forward-looking statements

as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives,

goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical

facts. When the Company uses words such as “may”, “will”, “intend,” “should,” “believe,”

“expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate

solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed

in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following:

the Company’s goals and strategies; the Company’s future business development; product and service demand and acceptance;

changes in technology; economic conditions; reputation and brand; the impact of competition and pricing; government regulations; fluctuations

in general economic and business conditions in China and assumptions underlying or related to any of the foregoing and other risks contained

in reports filed by the Company with the Securities Exchange Commission (the “SEC”). For these reasons, among others, investors

are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed

in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly

revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

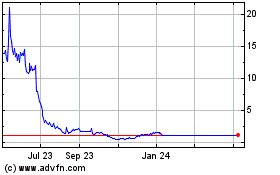

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Nov 2024 to Dec 2024

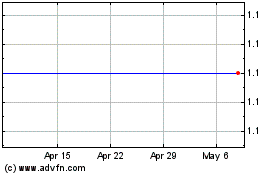

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Dec 2023 to Dec 2024