Porch Group, Inc. (“Porch” or “the Company”) (NASDAQ: PRCH), a

homeowners insurance and vertical software platform, today

announced the Texas Department of Insurance (“TDI”) has approved

its application to form and license Porch Insurance Reciprocal

Exchange, a new homeowners insurance reciprocal exchange (“the

Reciprocal” or “PIRE”).

Forming PIRE is a key step in Porch's strategy to increase

profitability and stabilize earnings in its go-forward Insurance

reporting segment by reducing direct exposure to claims and weather

risks. A reciprocal insurer is owned by its policyholders, much

like how Farmers Insurance and Erie Insurance operate. Porch will

be the operator (also known as the attorney-in-fact) managing

PIRE’s operations.

The terms and structure of the transaction approved by the TDI

provide for an exciting and sustainable opportunity ahead for Porch

shareholders. After the TDI completes customary administrative

closing procedures, Porch will contribute $10 million cash in

exchange for a surplus note to capitalize PIRE. On or around

January 1, 2025, Porch will sell Homeowners of America Insurance

Company (“HOAIC”) to PIRE, including all its policies, premium,

assets, and liabilities. In exchange, Porch will receive an

incremental surplus note1 equal to HOAIC’s end-of-year surplus less

Porch’s existing $49 million surplus note which will be assigned to

PIRE and continue forward. Ongoing, as the operator, Porch will

earn commissions and fees that blend to a take rate of

approximately 20% of Gross Written Premium and PIRE will manage to

an appropriate risk based capital and surplus. HOAIC is expected to

maintain its “A” financial stability rating from Demotech.

Porch does not expect PIRE’s approval to impact its 2024

financials. Further details will be shared at the Q3 2024 earnings

announcement on November 7, 2024 and at an investor day in early

December 2024.

“I would like to thank the TDI for their partnership throughout

this process and to the Porch team for consistently living our

values as we worked toward this moment. It has taken great effort,

and we are pleased to have achieved this key milestone on our

journey to become ‘A New Kind of Homeowners Insurance Company.’

This is an important step for us to protect the homes of more

homeowners in Texas and around the country where we plan to

continue to be a great partner for both policyholders and insurance

agents alike. With this change, Porch will be a simpler and more

predictable business over time that has higher margins and growth

potential. We believe this transaction and go-forward operation

will create significant value for shareholders. We are looking

forward to sharing more about our 2024 results, forward-looking

financials, and details into our plans soon.” Matt Ehrlichman,

Chief Executive Officer.

Porch Group was advised by Eversheds Sutherland LLP and

Mitchell, Williams, Selig, Gates & Woodyard, P.L.L.C

- A surplus note is a subordinated financial instrument that pays

an interest-bearing coupon with excess surplus generated by the

Reciprocal.

About Porch Group

Porch Group, Inc., ("Porch") is a homeowners insurance and

vertical software platform. Porch's strategy to win in homeowners

insurance is to leverage unique data for advantaged underwriting,

provide the best services for homebuyers, and protect the whole

home. The long-term competitive moats that create this

differentiation come from Porch's leadership in home services

software-as-a-service and its deep relationships with approximately

30 thousand companies that are key to the home-buying transaction,

such as home inspectors, mortgage, and title companies.

To learn more about Porch, visit ir.porchgroup.com.

Forward-Looking Statements

Certain statements in this release may be considered

forward-looking statements as defined by the Private Securities

Litigation Reform Act of 1995. These statements are based on the

beliefs and assumptions of management. Although we believe that our

plans, intentions, and expectations reflected in or suggested by

these forward-looking statements are reasonable, we cannot assure

you that we will achieve or realize these plans, intentions, or

expectations. Forward-looking statements are inherently subject to

risks, uncertainties, and assumptions. Generally, statements that

are not historical facts, including statements concerning our

possible or assumed future actions, business strategies, events, or

results of operations, are forward-looking statements. These

statements may be preceded by, followed by, or include the words

“believe,” “estimate,” “expect,” “project,” “forecast,” “may,”

“will,” “should,” “seek,” “plan,” “scheduled,” “anticipate,”

“intend,” or similar expressions.

Forward-looking statements are not guarantees of performance.

You should not put undue reliance on these statements which speak

only as of the date hereof, and include statements relating to our

strategic initiatives, ability to increase profitability and

stabilize earnings in Porch’s Insurance segment, reducing direct

exposure to claims and weather risks and PIRE’s role in such

reduction, completion of the TDI’s customary administrative closing

procedures, contribution of cash to PIRE, timing and whether Porch

will sell HOAIC, any consideration to be received by Porch for such

sale, Porch’s operation of PIRE and any fees to be received for

such operation, and whether 2024 financials will be impacted by

PIRE . Unless specifically indicated otherwise, the forward-looking

statements in this press release do not reflect the potential

impact of any divestitures, mergers, acquisitions, or other

business combinations that have not been completed as of the date

of this filing. You should understand that the following important

factors, among others, could affect our future results and could

cause those results or other outcomes to differ materially from

those expressed or implied in our forward-looking statements:

(1) expansion plans and opportunities, and managing growth, to

build a consumer brand; (2) the incidence, frequency, and severity

of weather events, extensive wildfires, and other catastrophes; (3)

economic conditions, especially those affecting the housing,

insurance, and financial markets; (4) expectations regarding

revenue, cost of revenue, operating expenses, and the ability to

achieve and maintain future profitability; (5) existing and

developing federal and state laws and regulations, including with

respect to insurance, warranty, privacy, information security, data

protection, and taxation, and management’s interpretation of and

compliance with such laws and regulations; (6) our reinsurance

program, which includes the use of a captive reinsurer, the success

of which is dependent on a number of factors outside management’s

control, along with reliance on reinsurance to protect against

loss; (7) the possibility that a decline in our share price would

result in a negative impact to our insurance carrier subsidiary’s,

Homeowners of America Insurance Company (“HOA”), surplus position

and may require further financial support to enable HOA to meet

applicable regulatory requirements and maintain financial stability

rating; (8) the uncertainty and significance of the known and

unknown effects on our insurance carrier subsidiary, Homeowners of

America Insurance Company (“HOA”), and us due to the termination of

a reinsurance contract following of fraud committed by Vesttoo Ltd.

(“Vesttoo”), including, but not limited to, the outcome of

Vesttoo’s Chapter 11 bankruptcy proceedings; our ability to

successfully pursue claims arising out of the fraud, the costs

associated with pursuing the claims, and the timeframe associated

with any recoveries; HOA's ability to obtain and maintain adequate

reinsurance coverage against excess losses; HOA’s ability to stay

out of regulatory supervision and maintain its financial stability

rating; and HOA’s ability to maintain a healthy surplus (9)

uncertainties related to regulatory approval of insurance rates,

policy forms, insurance products, license applications,

acquisitions of businesses, or strategic initiatives, including the

reciprocal restructuring, and other matters within the purview of

insurance regulators (including the discount associated with the

shares contributed to HOA); (10) the ability of the Company and its

affiliates to consummate the launch of the reciprocal exchange,

including sale of HOA to the reciprocal exchange, and to commence

operations; (11) our ability to successfully operate its businesses

alongside a reciprocal exchange; (12) our ability to implement our

plans, forecasts and other expectations with respect to the

reciprocal exchange business after the completion of the formation

and to realize expected synergies and/or convert policyholders from

its existing insurance carrier business into policyholders of the

reciprocal exchange; (13) potential business disruption following

the formation of the reciprocal exchange; (14) reliance on

strategic, proprietary relationships to provide us with access to

personal data and product information, and the ability to use such

data and information to increase transaction volume and attract and

retain customers; (15) the ability to develop new, or enhance

existing, products, services, and features and bring them to market

in a timely manner; (16) changes in capital requirements, and the

ability to access capital when needed to provide statutory surplus;

(17) our ability to timely repay our outstanding indebtedness; (18)

the increased costs and initiatives required to address new legal

and regulatory requirements arising from developments related to

cybersecurity, privacy, and data governance and the increased costs

and initiatives to protect against data breaches, cyber-attacks,

virus or malware attacks, or other infiltrations or incidents

affecting system integrity, availability, and performance; (19)

retaining and attracting skilled and experienced employees; (20)

costs related to being a public company; and (21) other risks and

uncertainties discussed in Part II, Item 1A, “Risk Factors,” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, as well as those discussed in Part II, Item 1A, “Risk

Factors,” in the Company’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024 and in subsequent reports filed with

the Securities and Exchange Commission (“SEC”), all of which are

available on the SEC’s website at www.sec.gov.

We caution you that the foregoing list may not contain all the

risks to forward-looking statements made in this release.

You should not rely upon on forward-looking statements as

predictions of future events. We have based the forward-looking

statements contained in this release primarily on our current

expectations and projections about future events and trends we

believe may affect our business, financial condition, results of

operations and prospects. The outcome of the events described in

these forward-looking statements is subject to risks,

uncertainties, and other factors, including those described above

and elsewhere in this release. We disclaim any obligation to update

publicly any forward-looking statements, whether in response to new

information, future events, or otherwise, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028729515/en/

Investor Relations Contact: Lois Perkins, Head of

Investor Relations Porch Group, Inc. Loisperkins@porch.com

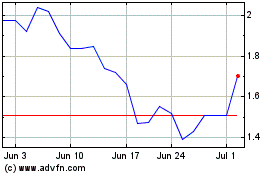

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Jan 2024 to Jan 2025