false

0001093691

0001093691

2024-07-18

2024-07-18

0001093691

dei:FormerAddressMember

2024-07-18

2024-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): July 18, 2024

Plug Power Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-34392 |

|

22-3672377 |

| (State

or other jurisdiction |

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation) |

|

Number) |

|

Identification

No.) |

| |

|

|

|

|

125 Vista Boulevard,

Slingerlands, New York |

|

12159 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(518) 782-7700

Registrant’s telephone

number, including area code:

968 Albany Shaker Road, Latham, New York 12110

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock, par value $0.01 per share |

|

PLUG |

|

The

Nasdaq Capital

Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On July 18, 2024, Plug Power Inc. (the “Company,” “we,”

“our” or “us”) disclosed that the Company had cash and cash equivalents of approximately $62.4 million and restricted

cash of approximately $956.5 million as of June 30, 2024.

The foregoing estimates are preliminary as the

Company is in the process of completing its closing procedures for the quarter ended June 30, 2024. The preliminary estimates are based

solely upon information available to the Company as of the date of this Current Report on Form 8-K and actual results may differ from

these estimates subject to the completion of the Company’s quarter-end closing procedures, final adjustments and developments that

may arise between now and the time the financial results for the second quarter ended June 30, 2024 are finalized. Investors should refer

to the actual results included in the Company’s financial statements for the quarter ended June 30, 2024 once it becomes available

upon filing of the Company’s Quarterly Report on Form 10-Q.

The Company’s independent registered public accounting firm has

not reviewed or performed any procedures with respect to these preliminary estimates and, accordingly, does not express an opinion or

any other form of assurance about them.

The information furnished under this Item 2.02 shall not be deemed

to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

Item 7.01 Regulation FD Disclosure.

On July 18, 2024, the Company filed a preliminary

prospectus supplement with the Securities and Exchange Commission under its effective shelf registration statement on Form S-3 (Registration

No. 333-265488) (the “Preliminary Prospectus Supplement”) in connection with a proposed underwritten public offering of common

stock. The Preliminary Prospectus Supplement contains information relating to the Company’s business strategy and recent developments

concerning the Company’s business and includes the following disclosure:

Our Business Strategy

We are pursuing distinct strategies to increase the

Company’s revenue and expand gross margins. In an effort to achieve these revenue and gross margin goals, our business

strategy is focused on the following initiatives.

Revenue Initiatives: The Company has a broad offering of products

and services. Given the substantial momentum in the hydrogen market, the Company will seek to continue to increase sales of its products

and services by executing on a number of key initiatives:

| · | Green Hydrogen Production: The Company has construction underway for potential green hydrogen plants. The new production capacity

is expected to enable greater sales volumes of hydrogen, supported by the increased demand for the Company’s fuel cell products. |

| · | Diversification of New Products: The Company has launched multiple new products, such as electrolyzers, liquefiers, cryogenic,

stationary power generation and on-road vehicles. The Company is currently manufacturing each of these new products at its facilities.

The Company seeks to increase its revenues by combining this expanded product offering with significant government incentives which promote

expansion of the hydrogen economy. |

| · | Increased Scale of Material Handling Manufacturing: Access to lower-cost hydrogen and significant government incentives promoting

the use of green hydrogen and fuel cells is expected to drive increased demand for the Company’s material handling products. The

Company has over 1 billion hours of operating history for its material handling products and is a leader in the industry. |

| · | Expanding into New Regions: The Company is focused on expanding into new regions that require decarbonization, including in

the EMEA and APAC regions. The Company’s formation of joint ventures, including joint ventures with Renault in France, Acciona in

Spain, and SK E&S in South Korea, support this initiative and are expected to provide the Company with increased sales in these new

markets. The Company plans to continue to leverage its direct sales force, its relationships with OEMs and their dealer networks, and

its network of integrators and contract manufacturers to provide its products and solutions worldwide. The European Union (the “EU”)

has rolled out ambitious targets for the hydrogen economy as part of the EU strategy for energy integration. The Company is seeking to

execute on its strategy to become one of the leaders in the European hydrogen economy, including by creating a targeted account strategy

for material handling, securing strategic partnerships with European OEMs, energy companies and utility leaders and accelerating its electrolyzer

business. |

Cost Initiatives: The Company is also focused on a range of

cost initiatives which, if realized, are expected to drive gross margin expansion.

| · | Product Mix and Pricing Increase: Given the launch of multiple new products (electrolyzers, liquefiers, cryogenic, stationary

power generation and on road vehicles, among others) and a backlog of new product orders, new product sales are anticipated to grow at

a higher compounded annual growth rate than lower margin products. The Company expects that the shift in product mix will be accretive

to its overall margin profile. In addition, to better reflect the economic value of the Company’s product offering, the Company

recently worked with customers to put in place price increases across its entire product portfolio with a specific focus on hydrogen pricing

which is expected to improve gross margins. |

| · | Volume Leverage: Increased production volume is expected to drive lower product and services costs through production scale,

supply chain leverage and increased automation. The Company is scaling production of its electrolyzer and fuel cell products. In 2021,

the Company opened a 155,000-square-foot gigafactory in Rochester, New York. In 2022, the Company expanded manufacturing capacity at its

Rochester location and, in 2023, opened its facility in Slingerlands, New York, which includes a world-class fuel cell manufacturing facility

to support the growing demand for fuel cells. |

| · | Investments: The Company has invested in a global team with broad capabilities to scale the varied commercial propositions

across the hydrogen ecosystem and the Company continues to make investments to drive down the cost of parts and service costs. The Company

estimates that it deployed over $200 million in projects and services in the second quarter of 2024. This estimate is preliminary and

the actual result may differ from this estimate subject to the Company’s quarter-end closing procedures, final adjustments and developments

that may arise between now and the time the financial results for the second quarter ended June 30, 2024 are finalized. |

| · | Hydrogen Plants and Production: The Company has historically purchased the majority of hydrogen it has sold to its customers

from third parties. Producing hydrogen internally is anticipated to reduce its costs and such reductions, coupled with its production

goals, if realized, could drive significant gross margin expansion in the fuel segment. In addition, the Company has entered into, and

expects to continue to enter into, hedge or power purchase agreements in the ordinary course of business, which could reduce its exposure

to price fluctuations in our electricity prices. Furthermore, its PEM electrolyzers allow it to curtail electricity use when prices are

unfavorable. Moreover, as a result of the experience and information the Company acquired while constructing the Georgia facility, including

information about permitting and the amount of cabling, piping, labor, and testing that has to be done onsite, the Company believes that

it is well-equipped to de-risk and optimize the construction of future hydrogen plants, lowering its cost of capital expenditure associated

with the construction process, and allowing for greater scalability and easier integration of future hydrogen plants to capture synergies. |

In addition, to operate more

efficiently and control its expenditures, the Company recently implemented a broad range of cost-saving measures, including operational

consolidation, strategic workforce reductions and various other cost reduction initiatives which are expected to drive gross margin

expansion. The Company expects to see some gross margin improvement sequentially from the first quarter of 2024 to the second quarter

of 2024, in particular as a result of price increases and ramping of the Company’s hydrogen facilities, but such improvement is

expected to be dampened by the implementation costs associated with such initiatives.

In addition to the Company’s efforts to increase its revenue

and expand gross margins, the Company is pursuing opportunities to monetize on the sale of certain assets and the transfer of renewable

energy tax incentives to third parties which, if successful, could provide the Company with additional liquidity. While we believe these

opportunities provide us with additional avenues for liquidity, there can be no assurance that these initiatives will provide us with

sufficient liquidity to meet our operating and capital needs.

Recent Developments

Cash and Cash Equivalents

Based upon information available to us as of the

date of this prospectus supplement, we estimate that we had unrestricted cash and cash equivalents of approximately $62.4 million and

restricted cash of approximately $956.5 million as of June 30, 2024. This preliminary financial information is subject to completion of

our financial closing procedures for the quarter ended June 30, 2024. Our independent registered public accounting firm has not conducted

a review of, and does not express an opinion or any other form of assurance with respect to, the preliminary financial information. It

is possible that we or our independent registered public accounting firm may identify items that require us to make adjustments to the

preliminary estimates set forth above. Accordingly, undue reliance should not be placed on the preliminary estimates. The preliminary

estimates are not necessarily indicative of any future period and should be read together with the sections titled “Risk Factors”

and “Cautionary Statements Regarding Forward-Looking Statements” in this prospectus supplement and accompanying prospectus

and the information incorporated by reference herein, including our financial statements, related notes and other financial information

included herein.

Department of Energy Loan

In May 2024, we received a conditional commitment for an up to $1.66

billion loan guarantee from the Department of Energy (the “DOE”) to finance the development, construction, and ownership of

up to six green hydrogen production facilities. The production facilities, which will be selected for financing in accordance with procedures

to be set forth in definitive documentation with the DOE, will supply low-carbon green hydrogen and the hydrogen generated will be used

in applications in the material handling, transportation, and industrial sectors. Certain technical, legal, environmental and financial

conditions, including negotiation of definitive financing documents, must be satisfied before funding of the loan guarantee and there

can be no assurance that we will satisfy all of the conditions on terms acceptable to the DOE to receive the loan guarantee.

The information included in this Item 7.01 of this Current Report

on Form 8-K is not deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities

of that section, nor shall this item be incorporated by reference into the Company’s filings under the Securities Act or the Exchange

Act, except as expressly set forth by specific reference in such future filing.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include statements regarding the Company’s preliminary cash position as of

June 30, 2024, the estimated amount of cash deployed in projects and services in the second quarter of 2024, the Company’s business

strategy and liquidity outlook. The words “may,” “will,” “could,” “would,” “should,”

“expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,”

“predict,” “project,” “potential,” “continue,” “target” and similar expressions

are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Such

statements are based on current assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ

materially. These risks and uncertainties, many of which are beyond the Company’s control, include the risk that our actual financial

results for the quarter ended June 30, 2024 may differ from the estimates presented in this Current Report on Form 8-K, as well

as the other risks set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Report

on Form 10-Q for the quarter ended March 31, 2024, and other filings with the Securities and Exchange Commission. These forward-looking

statements speak only as of the date hereof. The Company undertakes no obligation, other than as required by applicable law, to update

any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Plug Power Inc. |

| |

|

|

| Date: July 18, 2024 |

By: |

/s/ Paul Middleton |

| |

|

Name: Paul Middleton |

| |

|

Title: Chief Financial Officer |

v3.24.2

Cover

|

Jul. 18, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 18, 2024

|

| Entity File Number |

1-34392

|

| Entity Registrant Name |

Plug Power Inc.

|

| Entity Central Index Key |

0001093691

|

| Entity Tax Identification Number |

22-3672377

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

125 Vista Boulevard

|

| Entity Address, City or Town |

Slingerlands

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

12159

|

| City Area Code |

518

|

| Local Phone Number |

782-7700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

PLUG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

968 Albany Shaker Road

|

| Entity Address, City or Town |

Latham

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

12110

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

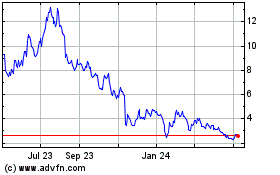

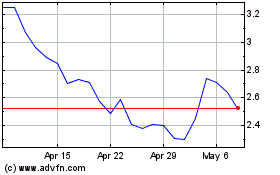

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Jul 2023 to Jul 2024