NAL Achieves Steady-State Production; Shipments

Shift to Contract Customers

- NAL set quarterly records in Q2’24 for production (up 23% QoQ),

lithium recovery (68%), and mill utilization (83%)

- NAL achieved steady-state production in June 2024; H2’24

production forecast supports Piedmont shipping guidance

- Piedmont revenue of $13.2 million on sales of approximately

14,000 dmt of spodumene concentrate in Q2’24

- Piedmont plans H2’24 customer shipments of approximately 96,500

dmt of spodumene concentrate

- $59.0 million in cash as of June 30, 2024; capital expenditures

and investments to significantly decrease in H2’24

- Carolina Lithium mining permit received in Q2’24 from the state

of North Carolina, renewing funding discussions

- U.S. lithium hydroxide production strategy consolidated to

leverage capital and technical resources

Piedmont Lithium Inc. (“Piedmont,” the “Company,” “we,” “our,”

or “us”) (Nasdaq: PLL; ASX: PLL), a leading North American supplier

of lithium products critical to the U.S. electric vehicle supply

chain, today reported its second quarter 2024 financial

results.

Piedmont shipped approximately 14,000 dry metric tons (“dmt”) of

spodumene concentrate (~5.5% Li2O) associated with long-term

customer contracts in Q2’24. Realized price per ton was $945 in

Q2’24 versus $865 in Q1’24. Included in the realized price per ton

in Q1’24, and to a lesser extent in Q2’24, were downward

provisional pricing adjustments associated with spot shipments

originating in H2’23 and January 2024. The Company expects to ship

approximately 96,500 dmt of spodumene concentrate in H2’24,

resulting in total shipments of approximately 126,000 dmt in 2024,

with potential quarterly variations due to shipping constraints and

customer requirements. The majority of our H2’24 shipments are

expected to be long-term customer shipments or spot shipments

structured to minimize downside risk. The achievement of

steady-state production at North American Lithium (“NAL”) supports

the H2’24 shipment guidance.

NAL, North America’s largest operating spodumene mine, continued

to achieve quarterly production records as the operation reached

steady-state production in June 2024. NAL produced approximately

49,700 dmt of spodumene concentrate in Q2’24, up 23% from Q1’24.

Lithium recovery and mill utilization achieved new quarterly highs

of 68% and 83%, respectively. The crushed ore dome was commissioned

in Q2’24 and steady-state production is expected to continue during

H2’24. NAL is jointly owned by Piedmont (25%) and Sayona Mining

Limited (“Sayona Mining”) (75%).

Following the receipt of our Carolina Lithium state mining

permit in Q2’24, and in response to changing market conditions, we

have consolidated our U.S. project development strategy to deploy

capital and technical resources more efficiently and leverage the

Company’s foundational North Carolina project. As part of our

strategy, we plan to shift the proposed Tennessee Lithium

conversion capacity to Carolina Lithium to include two lithium

hydroxide trains constructed in a phased approach. The timing of

the phased development will depend on several factors including

prevailing market conditions. The bulk of previously completed

front-end engineering work for the Tennessee Lithium facility will

be transferred to Carolina Lithium. The Company currently has an

air permit application under review with North Carolina’s Division

of Air Quality that will allow for up to 60,000 tons per year of

lithium hydroxide production.

For our Ewoyaa Lithium Project (“Ewoyaa”) in Ghana, Piedmont has

mandated a financial advisor to help secure the Company’s share of

construction capital. We are considering several funding

alternatives with a preference toward securing funding via an

offtake-partnering process using a portion of our life-of-mine

rights to 50% of Ewoyaa’s spodumene concentrate production. We are

working to complete this process in advance of the start of

Ewoyaa’s construction, which remains subject to receipt of

government and regulatory approvals as well as the prevailing

market conditions at the time those approvals are achieved.

“NAL continues to demonstrate its potential as an excellent

asset, achieving steady-state production, and exhibiting future

promise with new, high-grade drill results and the completion of

the crushed ore dome. In H2’24, we expect to sell the majority of

our 2024 NAL offtake, prioritizing contract customers and

structuring spot shipments to limit our downside exposure. Capital

allocations and investments in affiliates are anticipated to be

modest given the completion of the NAL ramp-up and expected timing

of Ewoyaa development,” said Keith Phillips, President and CEO of

Piedmont Lithium.

“Given the prevailing market realities, we have taken steps to

help ensure our long-term competitive position and the preservation

of the upside of our assets. These steps include the decision to

consolidate our U.S. lithium hydroxide development strategy by

moving our planned Tennessee Lithium conversion capacity to

Carolina Lithium. The receipt of the mining permit in Q2 has made

Carolina Lithium the focus of our U.S. development and allowed us

to actively engage with potential strategic partners interested in

a project-level investment. These conversations, as well as those

related to the Ewoyaa offtake-partnering process, have been

positive, and we look forward to their continuation,” said

Phillips. “However, we are progressing our development of Carolina

Lithium on a conservative timeline, monitoring dynamic market

conditions, and focusing on strategic partnerships and our funding

strategy.”

Phillips continued, “While lithium prices have remained

depressed, we are encouraged by the growth across the

electrification sector and the long-term potential of the lithium

market. The world continues to move toward electrification, which

will require exponentially more lithium than is produced today in

the U.S. and globally. Piedmont is well positioned with active

production offtake, an effective cost management plan, and a

prudent project development and funding strategy, all in alignment

with the goal of maintaining long-term shareholder value.”

Second Quarter 2024 Financial Highlights

All references to dry metric tons (“dmt”) in this release relate

to spodumene concentrate.

Units

Q2’24

Q1’24

Q2’23

Sales

Concentrate shipped

dmt thousands

14.0

15.5

—

Revenue

$ millions

13.2

13.4

—

Realized price(1)

$/dmt

945

865

—

Li2O content(2)

%

5.5

5.5

—

Realized cost of sales(3)

$/dmt

900

820

—

Profitability

Gross profit

$ millions

0.6

0.7

—

Gross profit margin

%

4.7

5.2

—

Net loss

$ millions

(13.3)

(23.6)

(10.6)

Diluted EPS

$

(0.69)

(1.22)

(0.55)

Adjusted net loss(4)

$ millions

(12.7)

(11.9)

(14.3)

Adjusted diluted EPS(4)

$

(0.65)

(0.61)

(0.75)

Adjusted EBITDA(4)

$ millions

(13.2)

(12.4)

(14.8)

Cash

Cash and cash equivalents(5)

$ millions

59.0

71.4

88.7

___________________________________________________________

(1)

Realized price is the average estimated

price, net of certain distribution and other fees, which includes

reference pricing data up to the respective period end and is

subject to final adjustment. The final adjusted price may be higher

or lower than the estimated average realized price based on future

price movements.

(2)

Weighted average Li2O content for

shipments made during the respective period.

(3)

Realized cost of sales is the average cost

of sales including Piedmont’s offtake pricing agreement with Sayona

Quebec Inc. (“Sayona Quebec”) for the purchase of spodumene

concentrate at a market price subject to a floor of $500 per dmt

and a ceiling of $900 per dmt, adjustments for product grade,

freight, and insurance.

(4)

See non-GAAP Financial Measures at the end

of this release for a reconciliation of non-GAAP measures.

(5)

Cash and cash equivalents are reported as

of the end of the period.

Second Quarter and Recent Business Highlights

Piedmont Lithium

- Shipped approximately 14,000 dmt (~5.5% Li2O) of spodumene

concentrate from NAL to customers in Q2’24.

- In July 2024, Piedmont streamlined its U.S. lithium hydroxide

production plans in favor of deploying capital and technical

resources more efficiently by shifting our proposed Tennessee

Lithium conversion capacity to Carolina Lithium. We plan to

leverage the North Carolina project by adding a second lithium

hydroxide production train as part of a phased development approach

on a measured timeline subject to market conditions.

North American Lithium (Quebec, Canada)

- In Q2’24, NAL achieved record quarterly production of

approximately 49,700 dmt and shipped approximately 27,700 dmt, of

which approximately 14,000 dmt were sold to Piedmont.

- In Q2’24, production at NAL increased nearly 23% compared to

the prior quarter, recovery rates improved to 68%, and mill

utilization increased to 83%, up 10% from the previous quarter.

Commissioning of the crushed ore dome was completed, and operations

are expected to produce at steady-state for the remainder of

2024.

- In Q2’24, high-grade drill results from the 2023-2024 drill

program at NAL demonstrated the potential for a significant upgrade

to the mineral resource estimate. Assays identified multiple new,

high-grade lithium zones beyond the planned pit shell model, with

intercepts at thicker and higher grades than previously

encountered. Mineralization within the pit shell model showed

continuity and consistency in grade and thickness.

- Concentrate produced and shipped by NAL and concentrate shipped

by Piedmont:

Share

Units

Q2’24

Q1’24

Q2’23

Piedmont Lithium

Concentrate shipped

100%

dmt thousands

14.0

15.5

—

North American Lithium

Concentrate produced

100%(1)

dmt thousands

49.7

40.4

29.6

Concentrate shipped

100%(2)

dmt thousands

27.7

58.0

—

___________________________________________________________ (1)

Concentrate produced represents 100% of NAL’s production. (2)

Concentrate shipped represents 100% of NAL’s shipments, inclusive

of shipments to Piedmont.

Note: The table above reports quarterly

and year-to-date information in accordance with Piedmont’s fiscal

year reporting, which is on a calendar-year basis. Concentrate

produced and concentrate shipped (above) are reported in the

periods in which activities actually occurred. For financial

statement purposes, Piedmont reports income (loss) from its 25%

ownership in Sayona Quebec, which includes NAL, on a one-quarter

lag.

Carolina Lithium (North Carolina)

- Management is actively engaging in discussions with potential

strategic partners who have expressed interest in project-level

funding for Carolina Lithium. The goal of our partnership process

is to advance the project through ongoing permitting and rezoning

activities. The Carolina Lithium funding strategy also includes

potential government financing options.

- In May 2024, we received the finalized mining permit for the

construction, operation, and reclamation of Carolina Lithium,

allowing us to renew discussions with potential funding

parties.

- Piedmont is considering the timing of the local rezoning

process, which is dependent upon the funding strategy, potential

partnerships, project development plans, and market dynamics.

Engagement continues with community stakeholders, including the

Gaston County Board of Commissioners.

Ewoyaa Lithium Project (Ghana)

- In July 2024, the application to grant the Ewoyaa mining lease

was submitted to the Ghanaian parliament to undergo the

ratification process. In addition to parliamentary ratification,

the project is subject to the receipt of a mine operating permit

and approval by the Environmental Protection Agency of Ghana.

- In July 2024, Piedmont mandated a financial advisor to develop

a funding strategy that includes an offtake-partner process to

support our share of Ewoyaa construction capital and minimize

dilution to Piedmont shareholders. Negotiations have advanced in

Atlantic Lithium’s competitive offtake partnering process to secure

funding for a portion of the joint venture’s annual production

share.

Tennessee Lithium

- Piedmont has converted the proposed Tennessee Lithium project

plans to a second lithium hydroxide train as part of a phased

development for Carolina Lithium. The combined conversion

facilities should allow Piedmont to significantly increase U.S.

lithium hydroxide production capacity while deploying capital and

technical resources more efficiently.

2024 Outlook

Units

H1’24

Q3’24

Q4’24

Full Year 2024

Shipments(1)

dmt thousands

30

30 — 34

63 — 67

126

Capital expenditures

$ millions

9

2 — 3

1 — 2

12 — 14

Investments in and advances to

affiliates

$ millions

23

5 — 7

5 — 6

33 — 36

_____________________________________

(1)

Quarterly shipping targets are rounded to

the nearest thousand tons and may not total to 126,000 dmt due to

rounding.

NAL achieved full run-rate production in June 2024. Under our

offtake agreement with Sayona Quebec, Piedmont has the right to

purchase the greater of 50% of production or 113,000 dmt/year.

Based on the production projection and per the Company’s offtake

agreement, Piedmont expects to ship approximately 126,000 dmt of

spodumene concentrate in 2024, with potential quarterly variations

due to shipping constraints and customer requirements. A shipment

totaling approximately 14,000 dmt was delayed from late Q2’24 to

early Q3’24. As such, Piedmont is targeting approximately 96,500

dmt of spodumene concentrate shipments in H2’24; forecasted NAL

production supports the shipping guidance. We are prioritizing

contract customer shipments and structuring spot shipments to limit

downside exposure.

We expect modest capital expenditures in H2’24, mainly related

to Carolina Lithium. Investments in and advances to affiliates

reflect cash contributions to Sayona Quebec and advances to

Atlantic Lithium for the Ewoyaa project. With the restart capital

program at NAL completed, and approvals at Ewoyaa ongoing, we

expect advances to affiliates to substantially reduce in H2’24. Our

outlook for forecasted capital expenditures and investments in and

advances to affiliates is subject to market conditions.

Safety and Sustainability

In Q2’24, Piedmont released its 2023 Sustainability Report,

summarizing our environmental, social, and governance (“ESG”)

achievements as a development-stage company building a diverse,

integrated portfolio of lithium projects. The report outlines the

sustainable development of Piedmont’s planned, wholly owned lithium

projects and the progress the Company has made in advancing its

long-term ESG strategy.

During the quarter, Piedmont continued policy development and

training to support the long-term objective of establishing a

robust safety and health management system. Employee engagement in

safety events remained strong and identification and reporting of

hazards, unsafe acts, conditions, and safety observations, and near

misses continued to improve.

Q2 2024 Piedmont Lithium Earnings Call

Date:

Thursday, August 8, 2024

Time:

8:30 a.m. Eastern Standard Time

Dial-in (Toll Free):

1 (800) 715-9871

Dial-in (Toll):

1 (646) 307-1963

Conference ID:

6860456

Participant URL:

https://events.q4inc.com/attendee/941918360

Piedmont’s earnings presentation and supporting material are

available at: https://piedmontlithium.com/investors-overview.

About Piedmont

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a

world-class, multi-asset, integrated lithium business focused on

enabling the transition to a net zero world and the creation of a

clean energy economy in North America. Our goal is to become one of

the largest lithium hydroxide producers in North America by

processing spodumene concentrate produced from assets where we hold

an economic interest. Our projects include our Carolina Lithium and

Tennessee Lithium projects in the United States and partnerships in

Quebec with Sayona Mining (ASX: SYA) and in Ghana with Atlantic

Lithium (AIM: ALL; ASX: A11). We believe these geographically

diversified operations will enable us to play a pivotal role in

supporting America’s move toward energy independence and the

electrification of transportation and energy storage.

Cautionary Note to U.S. Investors

Piedmont’s public disclosures are governed by the U.S. Exchange

Act of 1934, as amended, including Regulation S-K 1300 thereunder,

whereas NAL discloses estimates of “measured,” “indicated,” and

“inferred” mineral resources as such terms are used in the JORC

Code and Canada’s National Instrument 43-101. Although S-K 1300,

the JORC Code, and NI 43-101 have similar goals in terms of

conveying an appropriate level of confidence in the disclosures

being reported, they at times embody different approaches or

definitions. Consequently, investors are cautioned that public

disclosures by NAL prepared in accordance with the JORC Code or NI

43-101 may not be comparable to similar information made public by

companies, including Piedmont, subject to S-K 1300 and the other

reporting and disclosure requirements under the U.S. federal

securities laws and the rules and regulations thereunder.

The statements in the link below were prepared by, and made by,

NAL. The following disclosures are not statements of Piedmont and

have not been independently verified by Piedmont. NAL is not

subject to U.S. reporting requirements or obligations, and

investors are cautioned not to put undue reliance on these

statements. NAL’s original announcements can be found here:

https://www.asx.com.au/markets/company/sya

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of or as described in securities legislation in the

United States and Australia, including statements regarding

exploration, development, construction, and production activities

of Sayona Mining, Atlantic Lithium, and Piedmont; current plans for

Piedmont’s mineral and chemical processing projects; Piedmont’s

potential acquisition of an ownership interest in Ewoyaa; and

strategy. Such forward-looking statements involve substantial and

known and unknown risks, uncertainties, and other risk factors,

many of which are beyond our control, and which may cause actual

timing of events, results, performance, or achievements and other

factors to be materially different from the future timing of

events, results, performance, or achievements expressed or implied

by the forward-looking statements. Such risk factors include, among

others: (i) that Piedmont, Sayona Mining, or Atlantic Lithium may

be unable to commercially extract mineral deposits, (ii) that

Piedmont’s, Sayona Mining’s, or Atlantic Lithium’s properties may

not contain expected reserves, (iii) risks and hazards inherent in

the mining business (including risks inherent in exploring,

developing, constructing, and operating mining projects,

environmental hazards, industrial accidents, weather, or

geologically related conditions), (iv) uncertainty about Piedmont’s

ability to obtain required capital to execute its business plan,

(v) Piedmont’s ability to hire and retain required personnel, (vi)

changes in the market prices of lithium and lithium products, (vii)

changes in technology or the development of substitute products,

(viii) the uncertainties inherent in exploratory, developmental,

and production activities, including risks relating to permitting,

zoning, and regulatory delays related to our projects as well as

the projects of our partners in Quebec and Ghana, (ix)

uncertainties inherent in the estimation of lithium resources, (x)

risks related to competition, (xi) risks related to the

information, data, and projections related to Sayona Mining or

Atlantic Lithium, (xii) occurrences and outcomes of claims,

litigation, and regulatory actions, investigations, and

proceedings, (xiii) risks regarding our ability to achieve

profitability, enter into and deliver product under supply

agreements on favorable terms, our ability to obtain sufficient

financing to develop and construct our projects, our ability to

comply with governmental regulations, and our ability to obtain

necessary permits, and (xiv) other uncertainties and risk factors

set out in filings made from time to time with the U.S. Securities

and Exchange Commission (“SEC”) and the Australian Securities

Exchange, including Piedmont’s most recent filings with the SEC.

The forward-looking statements, projections, and estimates are

given only as of the date of this press release and actual events,

results, performance, and achievements could vary significantly

from the forward-looking statements, projections, and estimates

presented in this press release. Readers are cautioned not to put

undue reliance on forward-looking statements. Piedmont disclaims

any intent or obligation to update publicly such forward-looking

statements, projections, and estimates, whether as a result of new

information, future events or otherwise. Additionally, Piedmont,

except as required by applicable law, undertakes no obligation to

comment on analyses, expectations or statements made by third

parties in respect of Piedmont, its financial or operating results

or its securities.

PIEDMONT LITHIUM INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share

amounts) (Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Revenue

$

13,227

$

—

$

26,628

$

—

Costs of sales

12,601

—

25,311

—

Gross profit

626

—

1,317

—

Exploration costs

9

440

62

1,197

Selling, general and administrative

expenses

9,330

11,987

19,204

20,608

Total operating expenses

9,339

12,427

19,266

21,805

Loss from equity method investments

(4,910)

(2,675)

(10,350)

(5,417)

Loss from operations

(13,623)

(15,102)

(28,299)

(27,222)

Interest income

653

1,165

1,480

1,928

Interest expense

(76)

(11)

(298)

(26)

Gain (loss) on sale of equity method

investments

—

3,975

(13,886)

7,250

Other (loss) gain

(288)

(17)

965

(66)

Total other income (loss)

289

5,112

(11,739)

9,086

Loss before income taxes

(13,334)

(9,990)

(40,038)

(18,136)

Income tax (benefit) expense

(2)

649

(3,095)

1,142

Net loss

$

(13,332)

$

(10,639)

$

(36,943)

$

(19,278)

Basic and diluted:

Loss per share

$

(0.69)

$

(0.55)

$

(1.91)

$

(1.02)

Weighted-average shares outstanding

19,370

19,187

19,348

18,857

PIEDMONT LITHIUM INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except per share

amounts) (Unaudited)

June 30, 2024

December 31,

2023

Assets

Cash and cash equivalents

$

58,978

$

71,730

Accounts receivable

13,320

595

Other current assets

11,395

3,829

Total current assets

83,693

76,154

Property, plant and mine development,

net

134,270

127,086

Advances to affiliates

37,093

28,189

Other non-current assets

1,865

2,164

Equity method investments

82,719

147,662

Total assets

$

339,640

$

381,255

Liabilities and Stockholders’

Equity

Accounts payable and accrued expenses

$

5,894

$

11,580

Payables to affiliates

81

174

Current portion of long-term debt

642

149

Deferred revenue

24,347

—

Other current liabilities

5,053

29,463

Total current liabilities

36,017

41,366

Long-term debt, net of current portion

2,067

14

Operating lease liabilities, net of

current portion

951

1,091

Other non-current liabilities

980

431

Deferred tax liabilities

—

6,023

Total liabilities

40,015

48,925

Stockholders’ equity:

Common stock; $0.0001 par value, 100,000

shares authorized; 19,371 and 19,272 shares issued and outstanding

as of June 30, 2024 and December 31, 2023, respectively

2

2

Additional paid-in capital

467,808

462,899

Accumulated deficit

(163,787)

(126,844)

Accumulated other comprehensive loss

(4,398)

(3,727)

Total stockholders’ equity

299,625

332,330

Total liabilities and stockholders’

equity

$

339,640

$

381,255

PIEDMONT LITHIUM INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands) (Unaudited)

Six Months Ended

June 30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(36,943)

$

(19,278)

Adjustments to reconcile net loss to net

cash used in operating activities:

Stock-based compensation expense

4,640

4,311

Loss from equity method investments

10,350

5,417

Loss (gain) on sale of equity method

investments

13,886

(7,250)

Gain on equity securities

(1,594)

—

Deferred taxes

(6,246)

1,142

Depreciation and amortization

156

106

Noncash lease expense

532

96

Loss on sale of assets

656

—

Unrealized foreign currency translation

(gains) losses

(36)

13

Changes in assets and liabilities:

Accounts receivable

(12,725)

—

Other assets

1,950

(2,019)

Operating lease liabilities

(472)

(80)

Accounts payable

(25)

(1,072)

Payables to affiliates

(93)

—

Deferred revenue

24,347

—

Accrued expenses and other liabilities

(27,164)

(1,072)

Net cash used in operating activities

(28,781)

(19,686)

Cash flows from investing

activities:

Capital expenditures

(8,622)

(28,696)

Advances to affiliates

(8,226)

(4,742)

Proceeds from sale of marketable

securities

45

—

Proceeds from sale of shares in equity

method investments

49,103

—

Additions to equity method investments

(14,966)

(28,218)

Net cash provided by (used in) investing

activities

17,334

(61,656)

Cash flows from financing

activities:

Proceeds from issuances of common stock,

net of issuance costs

—

71,084

Payments of long-term debt and insurance

premiums financed

(651)

(239)

Payments to tax authorities for employee

stock-based compensation

(654)

—

Net cash (used in) provided by financing

activities

(1,305)

70,845

Net decrease in cash

(12,752)

(10,497)

Cash and cash equivalents at beginning of

period

71,730

99,247

Cash and cash equivalents at end of

period

$

58,978

$

88,750

Non-GAAP Financial Measures

The following information provides definitions and

reconciliations of certain non-GAAP financial measures to the most

directly comparable financial measures calculated and presented in

accordance with GAAP. The non-GAAP financial measures presented do

not have any standard meaning prescribed by GAAP and may differ

from similarly-titled measures used by other companies. We believe

that these adjusted measures provide meaningful information to

assist management, investors, and analysts in understanding our

financial condition and the results of operations. We believe these

adjusted financial measures are important indicators of our

recurring operations because they exclude items that may not be

indicative of, or are unrelated to, our core operating results, and

provide a better baseline for analyzing trends in our underlying

businesses.

The following are non-GAAP financial measures for Piedmont:

Adjusted net loss is defined as net loss, as calculated

under GAAP, plus or minus the gain or loss from sale of equity

method investments, gain or loss on sale of assets, gain or loss

from equity securities, gain or loss from foreign currency

exchange, severance and severance related costs, and certain other

adjustments we believe are not reflective of our ongoing operations

and performance. These items include asset impairment, acquisition

costs and other fees, and shelf registration costs.

Adjusted diluted earnings per share (or adjusted diluted

EPS) is defined as diluted EPS, as calculated under GAAP,

before gain or loss on sale of equity method investments, gain or

loss on sale of assets, gain or loss from equity securities, gain

or loss from foreign currency exchange, severance and severance

related costs, and certain other costs we believe are not

reflective of our ongoing operations and performance.

EBITDA is defined as net income (loss) before interest

expenses, income tax expense, and depreciation.

Adjusted EBITDA is defined as EBITDA plus or minus the

gain or loss on sale of equity method investments, gain or loss on

sale of assets, gain or loss from equity securities, gain or loss

from foreign currency exchange, severance and severance related

costs, and certain other adjustments we believe are not reflective

of our ongoing operations and performance.

Below are reconciliations of non-GAAP financial measures on a

consolidated basis for adjusted net loss, adjusted diluted EPS,

EBITDA, and adjusted EBITDA.

Adjusted Net Loss and Adjusted Diluted EPS

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

(in thousands, except per share

amounts)

Diluted EPS

Diluted EPS

Diluted EPS

Net loss

$

(13,332)

$

(0.69)

$

(23,611)

$

(1.22)

$

(10,639)

$

(0.55)

Loss (gain) on sale of equity method

investments(1)

—

—

13,886

0.72

(3,975)

(0.20)

Loss on sale of assets

656

0.03

—

—

—

—

Gain on equity securities(2)

(210)

(0.01)

(1,384)

(0.07)

—

—

(Gain) loss from foreign currency

exchange(3)

(158)

(0.01)

131

0.01

17

—

Severance and reorganization related

costs(4)

314

0.02

1,780

0.09

—

—

Other costs(5)

81

—

431

0.02

224

0.01

Tax effect of adjustments(6)

(2)

—

(3,093)

(0.16)

55

—

Adjusted net loss

$

(12,651)

$

(0.65)

$

(11,860)

$

(0.61)

$

(14,318)

$

(0.75)

______________________________________________________

(1)

Loss on sale of equity method investments

in the three months ended March 31, 2024 represents the loss on

sale of equity investments related to the sale of our entire

holdings of Sayona Mining and partial sale of our holdings of

Atlantic Lithium. Gain on sale of equity method investments in the

three months ended June 30, 2023 represents a noncash gain on

dilution recognized primarily due to Piedmont electing not to

participate in Sayona Mining’s share issuances. These shares were

issued at a greater value than the carrying value of our ownership

interest and as a result our interest in Sayona Mining was diluted

and reduced.

(2)

Gain on equity securities represents the

realized and unrealized gain on our equity security holdings in

Atlantic Lithium and Ricca Resources.

(3)

Loss from foreign currency exchange

relates to currency fluctuations in our foreign bank accounts

denominated in Canadian dollars and Australian dollars and

marketable securities denominated in Australian dollars.

(4)

Severance and reorganization related costs

related to our 2024 cost savings plan.

(5)

Other costs include legal and

transactional costs associated with the Department of Energy loan

and grant initiatives, shelf registration costs, and costs related

to certain significant strategic transactions.

(6)

No income tax impacts have been given to any items that were

recorded in jurisdictions with full valuation allowances.

EBITDA and Adjusted EBITDA

Three Months Ended

(in thousands)

June 30, 2024

March 31, 2024

June 30, 2023

Net loss

$

(13,332)

$

(23,611)

$

(10,639)

Interest income, net

(577)

(605)

(1,154)

Income tax (benefit) expense

(2)

(3,093)

649

Depreciation and amortization

75

81

61

EBITDA

(13,836)

(27,228)

(11,083)

Loss (gain) on sale of equity method

investments(1)

—

13,886

(3,975)

Loss on sale of assets

656

—

—

Gain on equity securities(2)

(210)

(1,384)

—

(Gain) loss from foreign currency

exchange(3)

(158)

131

17

Severance and reorganization related

costs(4)

314

1,780

—

Other costs(5)

81

431

224

Adjusted EBITDA

$

(13,153)

$

(12,384)

$

(14,817)

______________________________________________________

(1)

Loss on sale of equity method investments

in the three months ended March 31, 2024 represents the loss on

sale of equity investments related to the sale of our entire

holdings of Sayona Mining and partial sale of our holdings of

Atlantic Lithium. Gain on sale of equity method investments in the

three months ended June 30, 2023 represents a noncash gain on

dilution recognized primarily due to Piedmont electing not to

participate in Sayona Mining’s share issuances. These shares were

issued at a greater value than the carrying value of our ownership

interest and as a result our interest in Sayona Mining was diluted

and reduced.

(2)

Gain on equity securities represents the

realized and unrealized gain on our equity security holdings in

Atlantic Lithium and Ricca Resources.

(3)

(Gain) loss from foreign currency exchange

relates to currency fluctuations in our foreign bank accounts

denominated in Canadian dollars and Australian dollars and

marketable securities denominated in Australian dollars.

(4)

Severance and reorganization related costs

related to our 2024 cost savings plan.

(5)

Other costs include legal and

transactional costs associated with the Department of Energy loan

and grant initiatives, shelf registration costs, and costs related

to certain significant strategic transactions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808334981/en/

Erin Sanders SVP, Corporate Communications & Investor

Relations +1 704 575 2549 esanders@piedmontlithium.com

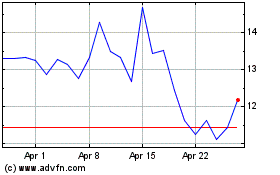

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Feb 2024 to Feb 2025