Perma-Fix Environmental Services, Inc. (NASDAQ:

PESI) (the “Company”) today announced financial results

for the third quarter ended September 30, 2024, and provided a

business update.

Mark Duff, President and CEO of the Company,

commented, “During the third quarter, we continued to experience

temporary weakness, partly due to ongoing delays in service starts

and waste shipments. Additionally, our Florida facility was

impacted by Hurricane Helene, resulting in extended power outages

and required repairs, which have since been completed. In light of

the headwinds we faced in 2024, we reduced expenses and streamlined

operations outside of R&D, which should result in improved

profitability going forward. Moreover, performance within our

Services Segment and across our treatment plants has steadily

improved in the latter part of the quarter, which we anticipate

should continue into Q4. In addition, an agency of the federal

government recently announced that we were part of a winning team

awarded a service project over a 10-year period. While we cannot

provide specifics at this time, we plan to provide specifics about

this award as soon as practical.”

“Last week, we announced the successful startup

of our first commercial Perma-FAS system for PFAS (Per- and

Polyfluoroalkyl Substances) destruction at our Florida facility. We

are extremely pleased with the performance of this unit, and

feedback from existing and prospective customers has been highly

encouraging. We have already secured approximately 6,000 gallons of

AFFF (Aqueous Film Forming Foam) liquids and anticipate receiving

an additional 20,000 gallons in the coming months. We are also

working to expand this technology into additional applications,

including Granular Activated Carbon (GAC), biosolids, and

soils.”

“Finally, we look forward to providing critical

services to the U.S. Department of Energy’s (DOE) Hanford tank

remediation mission, including the treatment of effluent following

the commissioning of the Direct Feed Low-Activity Waste (DFLAW)

facility, which is currently anticipated to begin in the summer of

2025. We believe these programs will represent opportunities for

Perma-Fix over the coming years.”

The Company also notes that its net loss for the

third quarter of 2024 included a non-cash tax expense recorded in

the amount of approximately $6.4 million as the Company provided

for a full valuation allowance against its U.S deferred tax

assets.

Financial ResultsRevenue for

the third quarter of 2024 was $16.8 million versus $21.9 million

for the same period last year. Revenue for the Treatment Segment

decreased to approximately $9.1 million for the three months ended

September 30, 2024, from $10.8 million for the corresponding period

of 2023. The decrease was attributed to a number of factors which

included: waste shipments that were expected in the third quarter

of 2024 were unexpectedly pushed into the fourth quarter of 2024 by

certain customers; waste shipment delays by certain customers and

reduced revenue production due to temporary shutdown of our Florida

facility from the impact of Hurricane Helene; and delay in revenue

projection due to equipment breakdowns in certain of our facilities

which required replacement or repair. All the equipment is now back

in service. The acceleration in investment of our PFAS technology,

which included the installation of our first full scale commercial

system, continues to require significant management and operation

support which contributed to revenue production delays. Revenue for

the Services Segment decreased to approximately $7.7 million for

the three months ended September 30, 2024, from $11.1 million for

the corresponding period of 2023. The decrease in revenue in the

Services Segment was attributed partly to the temporary

demobilization of a project that was mandated by the customer due

to Hurricane Helene. Additionally, the decrease in revenue in the

Services Segment was due, in part to the completion of two large

projects in late 2023 which were not replaced by new projects with

similar value. These two completed projects together generated

significant amount of revenue in the third quarter of 2023 when

they were in full operational status.

Gross profit for the third quarter of 2024 was

$1.3 million versus $4.5 million for the third quarter of 2023. The

overall decrease in gross profit was primarily attributed to lower

revenue generated in both segments as discussed above. Overall

gross margin for the third quarter of 2024 was approximately 7.9%

versus 20.8% for the third quarter of 2023 primarily due to

decreases in revenue in both segments, overall lower margin

projects and the impact of our fixed cost structure.

Operating loss was approximately $2.6 million in

the third quarter of 2024 versus operating income of $496,000 for

the third quarter of 2023. Net loss for the third quarter of 2024

was approximately $9.0 million or ($0.57) per basic share as

compared to net income of approximately $341,000 for the third

quarter of 2023 or $0.03 per basic share. As noted above, net loss

for the third quarter of 2024 included a non-cash tax expense

recorded in the amount of approximately $6.4 million as the Company

provided for a full valuation allowance against its U.S deferred

tax assets.

The Company reported EBITDA of ($2.1) million

from continuing operations for the quarter ended September 30,

2024, as compared to EBITDA of $1.2 million from continuing

operations for the same period of 2023. The Company defines EBITDA

as earnings before interest, taxes, depreciation and amortization.

EBITDA is not a measure of performance calculated in accordance

with Generally Accepted Accounting Principles in the United States

of America (“GAAP”), and should not be considered in isolation of,

or as a substitute for, earnings as an indicator of operating

performance or cash flows from operating activities as a measure of

liquidity. The Company believes the presentation of EBITDA is

relevant and useful by enhancing the readers’ ability to understand

the Company’s operating performance. The Company’s management

utilizes EBITDA as a mean to measure performance. The Company’s

measurement of EBITDA may not be comparable to similar titled

measures reported by other companies. The table below reconciles

EBITDA, a non-GAAP measures, to GAAP numbers for (loss) income from

continuing operations for the three and nine months ended September

30, 2024, and 2023.

|

|

(Unaudited) |

|

(Unaudited) |

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

(In thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

(Loss) income from continuing operations |

$ |

(8,806 |

) |

|

$ |

246 |

|

|

$ |

(16,049 |

) |

|

$ |

448 |

|

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Depreciation & amortization |

|

433 |

|

|

|

686 |

|

|

|

1,295 |

|

|

|

2,124 |

|

|

Interest income |

|

(292 |

) |

|

|

(146 |

) |

|

|

(679 |

) |

|

|

(445 |

) |

|

Interest expense |

|

121 |

|

|

|

89 |

|

|

|

346 |

|

|

|

189 |

|

|

Interest expense - financing fees |

|

18 |

|

|

|

36 |

|

|

|

47 |

|

|

|

80 |

|

|

Income tax expense |

|

6,417 |

|

|

|

254 |

|

|

|

4,300 |

|

|

|

482 |

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

$ |

(2,109 |

) |

|

$ |

1,165 |

|

|

$ |

(10,740 |

) |

|

$ |

2,878 |

|

|

|

|

|

|

|

|

|

|

The tables below present certain unaudited

financial information for the business segments, which excludes

allocation of corporate expenses.

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2024 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(In thousands) |

|

Treatment |

|

Services |

|

|

Treatment |

|

Services |

|

|

Net revenues |

|

$ |

9,064 |

|

|

$ |

7,748 |

|

|

|

$ |

26,116 |

|

|

$ |

18,299 |

|

|

|

Gross profit (loss) |

|

|

410 |

|

|

|

924 |

|

|

|

|

(839 |

) |

|

|

247 |

|

|

|

Segment loss |

|

|

(4,902 |

) |

|

|

(2,294 |

) |

|

|

|

(7,416 |

) |

|

|

(3,713 |

) |

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2023 |

|

September 30, 2023 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(In thousands) |

|

Treatment |

|

Services |

|

|

Treatment |

|

Services |

|

|

Net revenues |

|

$ |

10,795 |

|

|

$ |

11,082 |

|

|

|

$ |

33,223 |

|

|

$ |

33,793 |

|

|

|

Gross profit |

|

|

1,494 |

|

|

|

3,055 |

|

|

|

|

5,237 |

|

|

|

6,837 |

|

|

|

Segment profit |

|

|

1,014 |

|

|

|

1,120 |

|

|

|

|

2,619 |

|

|

|

2,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference Call

Perma-Fix will host a conference call at 11:00

a.m. ET on Wednesday, November 13, 2024. The call will be available

on the Company’s website at

https://ir.perma-fix.com/conference-calls, or by calling

888-506-0062 for U.S. callers or +1 973-528-0011 for international

callers, and by entering access code: 271776. The conference call

will be led by Mark J. Duff, Chief Executive Officer, Dr. Louis F.

Centofanti, Executive Vice President of Strategic Initiatives, and

Ben Naccarato, Executive Vice President and Chief Financial Officer

of Perma-Fix Environmental Services, Inc.

A webcast will also be archived on the Company’s

website and a telephone replay of the call will be available

approximately one hour following the call, through Wednesday,

November 20 2024, and can be accessed by dialing 877-481-4010 for

U.S. callers or +1 919-882-2331 for international callers and

entering access code: 51652.

About Perma-Fix Environmental

ServicesPerma-Fix Environmental Services, Inc. is a

nuclear services company and leading provider of nuclear and mixed

waste management services. The Company's nuclear waste services

include management and treatment of radioactive and mixed waste for

hospitals, research labs and institutions, federal agencies,

including the DOE, the Department of Defense (DOD), and the

commercial nuclear industry. The Company’s nuclear services group

provides project management, waste management, environmental

restoration, decontamination and decommissioning, new build

construction, and radiological protection, safety and industrial

hygiene capability to our clients. The Company operates four

nuclear waste treatment facilities and provides nuclear services at

DOE, DOD, and commercial facilities, nationwide.

Please visit us at http://www.perma-fix.com.

This press release contains “forward-looking

statements” which are based largely on the Company's expectations

and are subject to various business risks and uncertainties,

certain of which are beyond the Company's control. Forward-looking

statements generally are identifiable by use of the words such as

“believe”, “expects”, “intends”, “anticipate”, “plans to”,

“estimates”, “projects”, and similar expressions. Forward-looking

statements include, but are not limited to: improved financial

results going forward; improved performance continue into Q4;

receipt of additional 20,000 gallons AFFF; providing critical

services to the U.S. DOE’s Hanford tank remediation mission,

including treatment of effluent anticipated to start summer of

2025; and U.S. DOE programs represent opportunities. These

forward-looking statements are intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. While the Company believes the

expectations reflected in this news release are reasonable, it can

give no assurance such expectations will prove to be correct. There

are a variety of factors which could cause future outcomes to

differ materially from those described in this release, including,

without limitation, future economic conditions; industry

conditions; competitive pressures; our ability to apply and market

our new technologies; acceptance of our PFAS technology by the

public; the government or such other party to a contract granted to

us fails to abide by or comply with the contract or to deliver

waste as anticipated under the contract or terminates existing

contracts; Congress fails to provides funding for the DOD’s and

DOE’s remediation projects; inability to obtain new foreign and

domestic remediation contracts; and the additional factors referred

to under “Risk Factors” and "Special Note Regarding Forward-Looking

Statements" of our 2023 Form 10-K and Form 10-Qs for quarters ended

March 31, 2024, June 30, 2024 and September 30, 2024. The Company

makes no commitment to disclose any revisions to forward-looking

statements, or any facts, events or circumstances after the date

hereof that bear upon forward-looking statements.

FINANCIAL TABLES FOLLOW

Contacts:David K. Waldman-US

Investor RelationsCrescendo Communications, LLC (212) 671-1021

Herbert Strauss- European Investor Relationsherbert@eu-ir.com+43

316 296 316

| PERMA-FIX

ENVIRONMENTAL SERVICES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

(Amounts in Thousands, Except for Per Share Amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

$ |

16,812 |

|

|

$ |

21,877 |

|

|

$ |

44,415 |

|

|

$ |

67,016 |

|

|

Cost of goods sold |

|

15,478 |

|

|

|

17,328 |

|

|

|

45,007 |

|

|

|

54,942 |

|

|

Gross profit |

|

1,334 |

|

|

|

4,549 |

|

|

|

(592 |

) |

|

|

12,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

3,632 |

|

|

|

3,933 |

|

|

|

10,631 |

|

|

|

10,969 |

|

|

Research and development |

|

303 |

|

|

|

120 |

|

|

|

872 |

|

|

|

340 |

|

|

Loss on disposal of property and equipment |

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

(Loss) income from operations |

|

(2,601 |

) |

|

|

496 |

|

|

|

(12,096 |

) |

|

|

765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

292 |

|

|

|

146 |

|

|

|

679 |

|

|

|

445 |

|

|

Interest expense |

|

(121 |

) |

|

|

(89 |

) |

|

|

(346 |

) |

|

|

(189 |

) |

|

Interest expense-financing fees |

|

(18 |

) |

|

|

(36 |

) |

|

|

(47 |

) |

|

|

(80 |

) |

|

Other |

|

59 |

|

|

|

(17 |

) |

|

|

61 |

|

|

|

(11 |

) |

|

(Loss) income from continuing operations before taxes |

|

(2,389 |

) |

|

|

500 |

|

|

|

(11,749 |

) |

|

|

930 |

|

|

Income tax expense |

|

6,417 |

|

|

|

254 |

|

|

|

4,300 |

|

|

|

482 |

|

|

(Loss) income from continuing operations, net of taxes |

|

(8,806 |

) |

|

|

246 |

|

|

|

(16,049 |

) |

|

|

448 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from discontinued operations, net of taxes |

|

(173 |

) |

|

|

95 |

|

|

|

(441 |

) |

|

|

(44 |

) |

|

Net (loss) income |

$ |

(8,979 |

) |

|

$ |

341 |

|

|

$ |

(16,490 |

) |

|

$ |

404 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share - basic: |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(.56 |

) |

|

$ |

.02 |

|

|

$ |

(1.09 |

) |

|

$ |

.03 |

|

|

Discontinued operations |

|

(.01 |

) |

|

|

.01 |

|

|

|

(.03 |

) |

|

|

— |

|

|

Net (loss) income per common share |

$ |

(.57 |

) |

|

$ |

.03 |

|

|

$ |

(1.12 |

) |

|

$ |

.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share - diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(.56 |

) |

|

$ |

.02 |

|

|

$ |

(1.09 |

) |

|

$ |

.03 |

|

|

Discontinued operations |

|

(.01 |

) |

|

|

— |

|

|

|

(.03 |

) |

|

|

— |

|

|

Net (loss) income per common share |

$ |

(.57 |

) |

|

$ |

.02 |

|

|

$ |

(1.12 |

) |

|

$ |

.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of common shares used in computing net (loss) income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

15,803 |

|

|

|

13,568 |

|

|

|

14,695 |

|

|

|

13,468 |

|

|

Diluted |

|

15,803 |

|

|

|

13,979 |

|

|

|

14,695 |

|

|

|

13,749 |

|

|

PERMA-FIX ENVIRONMENTAL SERVICES, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEET |

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

|

(Amounts in Thousands, Except for Share and Per Share Amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash |

|

$ |

10,567 |

|

|

$ |

7,500 |

|

|

Account receivable, net of allowance for credit losses of $21 and

$30, respectively |

|

|

8,741 |

|

|

|

9,722 |

|

|

Unbilled receivables |

|

|

7,277 |

|

|

|

8,432 |

|

|

Other current assets |

|

|

5,481 |

|

|

|

4,893 |

|

|

Assets of discontinued operations included in current assets |

|

|

12 |

|

|

|

13 |

|

|

Total current assets |

|

|

32,078 |

|

|

|

30,560 |

|

|

|

|

|

|

|

|

Net property and equipment |

|

|

20,393 |

|

|

|

19,009 |

|

|

Property and equipment of discontinued operations |

|

|

130 |

|

|

|

81 |

|

|

|

|

|

|

|

|

Operating lease right-of-use assets |

|

|

1,778 |

|

|

|

1,990 |

|

|

|

|

|

|

|

|

Intangibles and other assets |

|

|

23,779 |

|

|

|

27,109 |

|

|

Total assets |

|

$ |

78,158 |

|

|

$ |

78,749 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Current liabilities |

|

$ |

22,403 |

|

|

$ |

25,678 |

|

|

Current liabilities related to discontinued operations |

|

|

251 |

|

|

|

269 |

|

|

Total current liabilities |

|

|

22,654 |

|

|

|

25,947 |

|

|

|

|

|

|

|

|

Long-term liabilities |

|

|

12,196 |

|

|

|

12,472 |

|

|

Long-term liabilities related to discontinued operations |

|

|

942 |

|

|

|

953 |

|

|

Total liabilities |

|

|

35,792 |

|

|

|

39,372 |

|

|

Commitments and Contingencies |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Preferred Stock, $.001 par value; 2,000,000 shares authorized, no

shares issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Common Stock, $.001 par value; 30,000,000 shares authorized,

15,817,046 and 13,654,201 shares issued, respectively; 15,809,404

and 13,646,559 shares outstanding, respectively |

|

|

16 |

|

|

|

14 |

|

|

Additional paid-in capital |

|

|

136,047 |

|

|

|

116,502 |

|

|

Accumulated deficit |

|

|

(93,441 |

) |

|

|

(76,951 |

) |

|

Accumulated other comprehensive loss |

|

|

(168 |

) |

|

|

(100 |

) |

|

Less Common Stock held in treasury, at cost: 7,642 shares |

|

|

(88 |

) |

|

|

(88 |

) |

|

Total stockholders' equity |

|

|

42,366 |

|

|

|

39,377 |

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

78,158 |

|

|

$ |

78,749 |

|

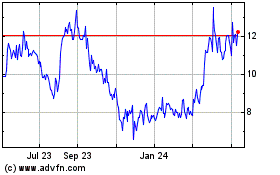

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Dec 2024 to Jan 2025

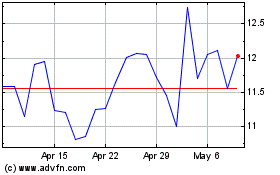

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Jan 2024 to Jan 2025