APEI Expected to Beat 1Q Earnings - Analyst Blog

May 07 2013 - 9:40AM

Zacks

We expect higher education

provider, American Public Education, Inc. (APEI)

to beat expectations when it reports the first-quarter 2013 results

on May 9.

Why a Likely Positive

Surprise?

Our proven model shows that

American Public is likely to beat earnings because it has the right

combination of two key ingredients.

Positive Zacks

ESP: Earnings Surprise Prediction or ESP, which represents

the difference between the Most Accurate estimate and the Zacks

Consensus Estimate, is at 1.75%. This is very meaningful and a

leading indicator of a likely positive earnings surprise for

shares.

Zacks #3 Rank

(Neutral): American Public carries a Zacks Rank #3

(Hold).Note that stocks with Zacks Ranks of #1, #2 and #3 have a

significantly higher chance of beating earnings. The sell rated

stocks (#4 and #5) should never be considered going into an

earnings announcement.

The combination of American

Public’s Zacks Rank #3 (Hold) and +1.75% ESP makes us confident in

looking for a positive earnings beat on May 9th.

What is Driving the

Better than Expected Earnings?

Strategic initiatives like ePress

initiative, information and technology upgrades, Title IV

processing automation and lower bad-debt expense are expected to

lead to a positive earnings surprise in the upcoming quarter, even

though new student starts are expected to decline. Moreover, the

company intends to spend less on traditional media advertising,

which are relatively expensive and easily attract fund abusers.

This will further lower operating costs.

The positive trend is seen in the

trailing four-quarter average surprise of almost 12.0%, which was

greatly helped by the 10.5% positive surprise in the last-reported

quarter. This was possible because American Public did a good job

of controlling costs owing to its strategic initiatives. Top line

growth and brisk student enrollments also helped.

Other Stocks to

Consider

American Public is not the only

firm looking up this earnings season. We also see likely earnings

beats coming from these three industry peers:

Giant Interactive Group,

Inc. (GA), with an Earnings ESP of +4.76% and a Zacks Rank

#2 (Buy)

Perion Network Ltd

(PERI), with an Earnings ESP of +8.57% and a Zacks Rank #2

(Buy)

K12, Inc. (LRN),

with an Earnings ESP of +4.35% and a Zacks Rank #3 (Hold)

AMER PUB EDUCAT (APEI): Free Stock Analysis Report

GIANT INTERACTV (GA): Free Stock Analysis Report

K12 INC (LRN): Free Stock Analysis Report

PERION NETWORK (PERI): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

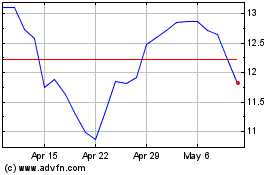

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

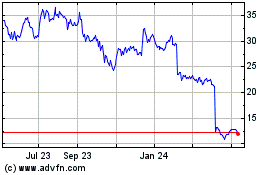

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024