false

0000716605

0000716605

2024-12-16

2024-12-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

The Securities Exchange Act of 1934

December 17, 2024 (December 16, 2024)

Date of Report (Date of earliest event reported)

PENNS WOODS BANCORP, INC.

(Exact name of registrant as specified in

its charter)

| Pennsylvania |

|

000-17077 |

|

23-2226454 |

(State or

other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Ident. No.) |

| |

|

|

|

|

| 300

Market Street, P.O.

Box 967, Williamsport,

Pennsylvania |

|

17703-0967 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

(570)

322-1111

Registrant’s

telephone number, including area code |

| |

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, $5.55 par value |

PWOD |

The

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On December 17, 2024, Penns Woods Bancorp, Inc. (“Penns Woods”)

released a presentation to investors about the transactions described in the Merger Agreement (defined below). The presentation is attached

to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference. The preceding information shall not be deemed

“filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On December 17, 2024, Penns Woods announced that

it has entered into an Agreement and Plan of Merger dated December 16, 2024 (“Merger Agreement”) with Northwest Bancshares,

Inc. (“Northwest”). The Merger Agreement calls for Penns Woods to merge with and into Northwest, and for each of Penns Woods’

wholly-owned subsidiary banks, Luzerne Bank and Jersey Shore State Bank, to merge with and into Northwest’s wholly-owned subsidiary,

Northwest Bank, with Northwest Bank as the bank surviving each merger.

A copy of the press release is attached hereto

as Exhibit 99.2 and is incorporated herein by reference.

Important Additional Information about the Merger

This communication does not constitute an offer to sell or the solicitation

of an offer to buy securities of Penns Woods. Northwest will file a registration statement on Form S-4 and other documents regarding the

proposed merger with Penns Woods with the Securities and Exchange Commission (“SEC”). The registration statement will include

a proxy statement/prospectus which will be sent to the shareholders of Penns Woods in advance of its special meetings of shareholders

to be held to consider the proposed merger. Investors and security holders are urged to read the proxy statement/prospectus and any other

relevant documents to be filed with the SEC in connection with the proposed transaction because they contain important information about

Northwest, Penns Woods and the proposed merger.

Investors and security holders may obtain a free copy of these documents

(when available) through the website maintained by the SEC at www.sec.gov. These documents may also be obtained, free of charge, on Penns

Woods’ website at https://www.pwod.com/financial-information/filings-news-and-events/sec-filings or by contacting Penns

Woods’ Investor Relations Department at: Penns Woods Bancorp, Inc., 300 Market Street, Williamsport, Pennsylvania 17701, Attn: Investor

Relations.

Northwest, Penns Woods, and certain of their directors and executive

officers may be deemed to be participants in the solicitation of proxies from the shareholders of Penns Woods in connection with the proposed

merger. Information regarding the interests of those participants and other persons who may be deemed participants in the transaction

may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Additional information

about the directors and executive officers of Penns Woods is set forth in the proxy statement for Penns Woods’ 2024 annual meeting

of shareholders, as filed with the SEC on Schedule 14A on March 26, 2024.

Cautionary Statements Regarding Forward-Looking Information

Statements in this communication which are not historical are “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange

Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not

limited to, certain plans, expectations, goals, projections and benefits related to the transactions described in this communication.

The information contained in this communication should be read in conjunction

with Penns Woods’ Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Annual Report”),

filed with the Securities and Exchange Commission (“SEC”) and available on the SEC’s website (www.sec.gov) or at Penns

Woods’ website (https://www.pwod.com/financial-information/filings-news-and-events/sec-filings).

Investors are cautioned that forward-looking statements, which are

not historical fact, involve risks and uncertainties, including those detailed in the 2023 Annual Report filed with the SEC under the

section, “Risk Factors” in Part I, Item 1A. Additional risks and uncertainties include, but are not limited to: the possibility

that Northwest’s merger with Penns Woods will be unsuccessful or more difficult, time-consuming or costly than expected; the possibility

that Northwest is unable to obtain regulatory approvals of the proposed merger with Penns Woods on the proposed terms and schedule; and

the possibility that Penns Woods is unable to obtain the approval of the merger by its shareholders. As such, actual results could differ

materially from those contemplated by forward-looking statements made in this communication. Management believes that the expectations

in these forward-looking statements are based upon reasonable assumptions within the bounds of management's knowledge of Penns Woods’

business and operations. Penns Woods disclaims any responsibility to update these forward-looking statements to reflect events or circumstances

after the date of this presentation.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PENNS WOODS BANCORP, INC. |

| |

|

|

| Dated: December 17, 2024 |

|

|

| |

|

|

| |

By: |

/s/ Brian L. Knepp |

| |

|

Brian L. Knepp |

| |

|

President and Chief Financial Officer |

Exhibit 99.1

& Merger Investor Presentation Acquisition of Penns Woods Bancorp, Inc. December 17, 2024 NASDAQ: NWBI | NASDAQ: PWOD

Forward - looking Statements and Additional Information This presentation contains forward - looking statements within the meaning of the federal securities laws relating to the proposed merger with Penns Woods Bancorp, Inc. (“PWOD”) by Northwest Bancshares, Inc. (“Northwest” or “NWBI”), the integration of PWOD with NWBI, the combination of their businesses and projected or pro forma financial information and metri cs. All statements other than statements of historical fact are statements that could be deemed forward - looking statements, including all statements regarding the intent, belief or current expectations of NWBI and PWOD and members of the ir respective board of directors and senior management teams. Investors and security holders are cautioned that such statements are predictions, and are not guarantees of future performance. Actual events or results may differ materially. Com ple tion of the proposed merger, expected financial results or other plans are subject to a number of known and unknown risks, uncertainties and assumptions that are difficult to assess and are subject to change based on factors which ar e, in many instances, beyond NWBI's control. Additional risks and uncertainties may include, but are not limited to, the risk that expected cost savings, revenue synergie s a nd other financial benefits from the proposed merger may not be realized or take longer than expected to realize, the failure to obtain required regulatory or shareholder approvals, the failure of the closing conditions in the merger agreement to be satisfied or any unexpected delay in closing the transaction. For further information regarding these risks and uncertainties and additional factors that could cause results to differ mat eri ally from those contained in the forward - looking statements, see “Risk Factors” and the forward - looking statement disclosure contained in the Annual Report on Form 10 - K for the most recently ended fiscal year of NWBI and PWOD, as well as the proxy statement/prospectus described below, and other documents subsequently filed by NWBI and PWOD with the Securities and Exchange Commission. Due to these and other possible uncertainties and risks, NWBI and PWOD can give no assura nce that the results contemplated in the forward - looking statements will be realized, and readers are cautioned not to place undue reliance on the forward - looking statements contained in this presentation. Forward - looking statements are based o n information currently available to NWBI and PWOD, and the parties assume no obligation and disclaim any intent to update any such forward - looking statements. All forward - looking statements, express or implied, included in the presentation are qualified in their entirety by this cautionary statement. NON - GAAP FINANCIAL MEASURES In addition to results presented in accordance with GAAP, this presentation includes certain non - GAAP financial measures. NWBI a nd PWOD believe these non - GAAP financial measures provide additional information that is useful to investors in helping to understand underlying financial performance and condition and trends of NWBI. Non - GAAP financial measures have inherent limitations. Readers should be aware of these limitations and should be cautious with respect to the use of such measures. To compensate for these limitations, non - GAAP measures are used as comparative tools, together with GAAP measures, to assist in the evaluation of operating performance or financial condition. The se measures are also calculated using the appropriate GAAP or regulatory components in their entirety and are computed in a manner intended to facilitate consistent period - to - period comparisons. NWBI’s method of calculating these non - GAAP measures may differ from methods used by other companies. These non - GAAP measures should not be considered in isolation or as a substitute or an alternative for those financial measures prepared in accordance with GAAP or in - effect regulatory requirements. Numbers in this presentation may not sum due to rounding. Where non - GAAP financial measures are used, the most directly comparable GAAP or regulatory financial measure, as well as the re conciliation to the most directly comparable GAAP or regulatory financial measure, can be found in this presentation. 2

Forward - looking Statements and Additional Information This communication is being made in respect of the proposed merger transaction involving NWBI and PWOD. This material is not a s olicitation of any vote or approval of the NWBI or PWOD shareholders and is not a substitute for the proxy statement/prospectus or any other documents that NWBI and PWOD may send to their respective shareholders in connection with t he proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. The proposed merger transaction will be submitted to the shareholders of PWOD for their consideration. In connection therewit h, NWBI intends to file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a Registration Statement on Form S - 4, which will include the proxy statement of PWOD that also will constitute a prospectus of NWB I (the “proxy statement/prospectus”), as well as other relevant documents concerning the proposed transaction. However, such materials are not currently available. The proxy statement/prospectus will be mailed to the shareholders of PWO D w hen available. BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER REL EVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT IN FORMATION ABOUT NWBI, PWOD, THE PROPOSED TRANSACTION AND RELATED MATTERS. Shareholders are also urged to carefully review and consider NWBI’s and PWOD’s public filings with the SEC, including, but no t l imited to, its proxy statements, its Annual Reports on Form 10 - K, its Quarterly Reports on Form 10 - Q and its Current Reports on Form 8 - K. Investors and security holders may obtain free copies of the proxy statement/prospectus, any amendments or supplements thereto and other documents containing important information about NWBI or PWOD and/or the proposed transaction, once such documents are filed with the SEC, at the SEC’s website at www.sec.gov. In addition, copies of th e documents filed with the SEC by NWBI, including the proxy statement/prospectus and the SEC filings that will be incorporated by reference in the proxy statement/prospectus, will be available free of charge on the NWBI’s website at www.no rth west.bank under the heading “Investor Relations.” Participants in the Solicitation NWBI, PWOD and certain of their respective directors, executive officers and other members of management and employees may, u nde r the SEC’s rules, be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of NWBI is set forth in its proxy statement for its 2024 ann ual meeting of shareholders, which was filed with the SEC on March 8, 2024, its annual report on Form 10 - K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 23, 2024, and in other documents filed with the SEC, e ach of which can be obtained free of charge from the sources indicated above. Information about the directors and executive officers of PWOD is set forth in its proxy statement for its 2024 annual meeting of shareholders, which was filed w ith the SEC on March 26, 2024, its annual report on Form 10 - K for the fiscal year ended December 31, 2023, which was filed with the SEC on March 13, 2024, and in other documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitation, including a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy stateme nt/ prospectus and other relevant materials to be filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph. 3

Northwest Bancshares At A Glance 4 1 Non - GAAP financial measure; See “Non - GAAP Financial Measures” and Non - GAAP reconciliations herein FOUNDED 1896 TOTAL ASSETS $ 14.4B TOTAL DEPOSITS $ 12.1B TOTAL LOANS $ 11.3B FINANCIAL CENTERS 130 ROAA 0.93% LTM Core ROATCE 11.6% 1 NIM 3.33 % Diluted EPS $0.26 For the quarter ended September 30, 2024

($ in 000's, unless otherwise indicated) LTM CAGR (%) Q3'24 2019 – Q3'24 Balance Sheet and Capital Total Assets $2,259,250 6.63 Total Gross Loans $1,884,141 7.11 Total Deposits $1,700,321 5.41 Tangible Common Equity $187,111 6.79 Loans / Deposits (%) 110.3 TCE / TA (%) 8.3 CET1 Ratio (%) 10.2 Profitability Average (%) Net Interest Margin (%) 2.78 2.98 Efficiency Ratio (%) 65.8 65.6 Core ROAA (%) 0.90 0.87 Core ROATCE (%) 1 11.49 11.26 Credit and Asset Quality NPAs / Assets (%) 0.20 0.54 NCOs / Average Loans (%) 0.01 0.07 Loan Loss Reserves / Gross Loans (%) 0.62 0.85 Overview of Penns Woods Bancorp, Inc. 5 Source: S&P Capital IQ Pro 1 Non - GAAP financial measure; See “Non - GAAP Financial Measures” and Non - GAAP reconciliations herein Key Financial Highlights Company Overview • Headquartered in Williamsport, PA, Penns Woods Bancorp, Inc. (“Penns Woods”) is the bank holding company for Jersey Shore State Bank (“JSSB”) and Luzerne Bank (“Luzerne”), both of which are full - service community banking institutions offering consumer and business banking products and services across North Central and Northeast Pennsylvania. • Jersey Shore State Bank was founded in 1936; Luzerne Bank was founded in 1907. • JSSB operates 16 bank branch offices across Blair, Centre, Clinton, Lycoming, Montour, and Union counties. Luzerne operates 8 bank branch offices across Luzerne County. • Penns Woods is one of the largest banking institutions in North Central Pennsylvania by both deposit market share and number of branches. Blair Centre Montour Luzerne Lycoming Union Clinton Total PA Deposits: $1.6 Billion Jersey Shore State Bank 0.6% of Total Deposits ▪ Blair County 4.0% of Total Deposits ▪ Centre County 23.8% of Total Deposits ▪ Clinton County 21.8% of Total Deposits ▪ Lycoming County 15.5% of Total Deposits ▪ Montour County 2.7% of Total Deposits ▪ Union Luzerne Bank 7.0% of Total Deposits ▪ Luzerne County

A Noteworthy Transaction: Significant and Financially Appealing 6 1 Excluded rate marks include: loans, deposits and borrowings 2 For illustrative purposes, assumes transaction closes on July 1, 2025, cost savings are 75% phased - in during the first full ye ar of operations and excludes one - time deal costs The combination creates significant value for both NWBI and PWOD shareholders by… » Bridging the gap between NWBI’s Northwestern and Southeastern Pennsylvania locations » Increasing the product offerings across both platforms » Enabling significant cross selling potential » Providing PWOD with additional resources to expand existing relationships and a significantly higher lending limit » Gaining additional market share in State College and expanding into attractive neighboring markets » Strengthening the financial performance of the combined organization » Enhancing NWBI’s pro forma ROATCE and lowering its dividend payout ratio » Broadening the combined organization’s talent pool and providing retained PWOD team members expanded career growth opportunities Benefits of the Transaction Expected Financial Impact 7.6% 2026 EPS Accretion 2 23.4% 2026 EPS Accretion 2 3.7% TBV Dilution 9.0% TBV Dilution 2.5 Years TBV Dilution Earnback 2.9 Years TBV Dilution Earnback Excluding Rate Marks 1 GAAP Metrics 7.6% TCE / TA 10.8% CET1 Ratio 13.9% Total Risk - Based Capital Ratio Capital Ratios at Closing

Pennsylvania DMS (Top 20) Geographically Attractive Combined Company 7 Source: S&P Capital IQ Pro Note: Deposit market share is as of June 30, 2024, and is pro forma for pending acquisitions 1 Includes anticipated branch consolidations Penns Woods provides a strategic opportunity for geographic expansion within Pennsylvania, reinforcing NWBI's competitive strength in the State College market. This well - aligned, in - footprint expansion capitalizes on NWBI’s established brand presence, positioning the company to unlock new growth opportunities. The combined entity creates one of the largest banks by deposit market share in Pennsylvania as well as #1 for all banks in Williamsport and Lock Haven. The Bank will also be well - positioned to take additional market share from its larger regional competitors. As a comprehensive financial services provider, NWBI is committed to offering Penns Woods customers an extensive array of solutions and expertise. These expanded offerings will allow NWBI to strengthen its relationships with Penns Woods customers, leading to increased revenue opportunities.

$61,769 $68,331 $64,441 $61,545 $65,466 $80,121 $72,348 $74,855 Blair, PA Centre, PA Clinton, PA Luzerne, PA Lycoming, PA Montour, PA Union, PA Pennsylvania 37.7 41.5 PWOD KRE Banks 78,408 56,926 135,334 Combined Geographically Attractive Combined Company (Continued) 8 Source: S&P Capital IQ Pro and Company Documents 1 Deposit beta calculated as the change in the Company’s deposit costs as a % of the change in the Federal Funds Rate 2 Pro forma uninsured deposits are as of September 30, 2024, for each company and exclude intercompany deposits and collaterali z ed public funds 3 Average branch size as of September 30, 2024; planned branch consolidations reflect the average branch size of anticipated br a nch closures Bolsters Significant Market Share Across Pennsylvania Positioned in Attractive and Complementary Markets Notable Employers and Attractions in Penns Woods Markets Median Household Income by County Average Branch Size ($000s) 3 70,847 92,854 1 2 Planned Branch Consolidations ($000s) 3 PWOD Contributes Low Cost, Granular Deposit Base Top 10 Pro Forma Deposit Market Share in 23 Counties Ranked #1 – #2 Ranked #3 – #5 Not Ranked Ranked #6 – #10 Ranked Greater Than #10 Cambria Clearfield Centre Lancaster Lebanon Cameron Butler Erie Armstrong Clarion Clinton Crawford Elk McKean Mercer Potter Tioga Venango Warren Montour Lycoming Blair Luzerne Union Dauphin York Allegheny Washington 2.27 2.40 PWOD KRE Banks $1.7 Billion Total Deposits 12.9% Pro Forma Uninsured Deposits 2 ~$25K Average Account Size 93.1% of Time Deposits Reprice within 12 Months MRQ Cost of Deposits (%) Current Cycle Deposit Beta (%) Q1’22 – Q3’24 1

• Northwest Bancshares, Inc. to acquire 100% of Penns Woods Bancorp, Inc. outstanding common stock • At closing Jersey Shore State Bank and Luzerne Bank will merge with and into Northwest Bank • 100% stock consideration • Fixed exchange ratio of 2.385x NWBI shares for each PWOD share • Outstanding stock options to be exchanged for cash Transaction Structure • Aggregate Transaction Value: approximately $270.4 million • Per Share Consideration: approximately $34.44 • Price / Tangible Book Value Per Share of 139.0% • Price / LTM Core EPS of 12.8x • 0.91x Pay - to - Trade ratio Transaction Value & Multiples 1,2,3 • Richard Grafmyre, CEO of PWOD, to be added to the NWBI board for a combined total of 12 • Projected ownership of approximately 87.6% NWBI / 12.4% PWOD Personnel and Projected Ownership • Conducted extensive due diligence process across all business functions • Subject to the receipt of PWOD shareholder approvals and required regulatory approvals and other customary closing conditions • Anticipated closing during the third quarter of 2025 Diligence, Expected Timing & Approvals Transaction Structure 1 Based on PWOD common shares outstanding of 7,554,488 2 Based on NWBI's closing stock price of $14.44 per share, as of December 16, 2024 3 Based on PWOD outstanding stock options of 1,094,000 with a weighted average strike price of $25.13 to be exchanged for cash 9

• Net income for NWBI based on consensus analyst estimates through 2026 • Net income estimates for PWOD were developed in conjunction with NWBI and PWOD management teams • Cost savings of 40% of PWOD’s noninterest expense base (75% realized in the first full year of combined operations, 100% ther eaf ter) • Additional expenses and Durbin impact included in model • Four overlapping branches will be consolidated • Revenue synergies identified but not modeled Earnings, Synergies & Cost Savings • $28.1 million gross loan credit mark or 1.4% of PWOD’s total loans and 2.4x PWOD’s existing ALLL » $6.9 million (~25%) allocated to purchase credit deteriorated (PCD) loans » $21.3 million (~75%) allocated to non - PCD loans (accreted into earnings over five years, straight - line method) • Day two CECL reserve of $21.3 million non - PCD credit mark (CECL “double - count”) Loan Mark & CECL • Pre - tax one - time expenses of $36.2 million fully reflected in projected tangible book value per share at closing • An incremental $2.6 million of capitalized expense is associated with branch renovations (depreciated over 10 years, straight - li ne method) • Core deposit intangible of 3.6% of PWOD's core deposits (amortized over 10 years, sum - of - years - digits) Transaction Expenses & CDI • Loan interest rate mark of $94.6 million pre - tax, or 4.7% of PWOD’s gross loan balances (accreted into earnings over four years, sum - of - years - digits) • PWOD’s pre - tax loss on AFS securities of $6.7 million accreted through earnings over five years, sum - of - years - digits • Other pre - tax fair value adjustments totaling approximately $0.7 million amortized based on estimated remaining life FMV Assumptions & Other Financial Assumptions 10

0.05% 0.02% 0.03% - 0.03% 0.02% 2020 2021 2022 2023 Q3'24 YTD Strong Credit Profile and Thorough Due Diligence Process 11 Source: S&P Capital IQ Pro 0.90% 0.60% 0.46% 0.08% 0.20% 2020 2021 2022 2023 Q3'24 PWOD – Net Charge - offs / Average Loans PWOD – NPAs / Assets 131.3% 253.1% 157.6% NWBI PWOD Pro Forma Due Diligence Overview Comprehensive Credit Review & Other Areas of Focus • Extensive due diligence team including > 50 internal and external professionals • Engaged third - party advisors to thoroughly review purchase accounting, credit, contracts, etc. • Collaborative two - month due diligence process with a significant amount of information • Consumer mortgage and indirect auto portfolios have average FICO scores of 747 and 766, respectively Scope of the credit review included: • Very granular book with average loan size under $72,000 • Overall, 20% total bank book reviewed • All loans greater than $1.0 million • All commercial loans Watch or worse risk rated and all nonaccrual loans Other areas of focus: Human Resources, Finance & Accounting, Credit & Loan Review, Tax, Legal, Operations, Compliance, Technology, Marketing, Risk Management Pro Forma CRE Concentration

Transaction 14.3% MMDA + Savings 62.9% Retail Time (<$100K) 13.1% Jumbo Time (>$100K) 9.7% Noninterest - bearing Deposits 22.0% $14.1B Deposits MRQ & Combined Balance Sheet Composition 12 Source: S&P Capital IQ Pro, bank regulatory data as of September 30, 2024; deposit costs and loan yields are from consolidated G AAP financials as of September 30, 2024 Note: Bank regulatory data for PWOD combines both subsidiaries PWOD Deposit Composition NWBI Deposit Composition NWBI Loan Composition PWOD Loan Composition Combined Deposit Composition Combined Loan Composition Transaction 15.4% MMDA + Savings 62.7% Retail Time (<$100K) 12.6% Jumbo Time (>$100K) 9.3% Noninterest - bearing Deposits 21.3% $12.4B Deposits Transaction 6.9% MMDA + Savings 64.0% Retail Time (<$100K) 16.7% Jumbo Time (>$100K) 12.4% Noninterest - bearing Deposits 26.7% $1.7B Deposits 1 - 4 Family 40.2% MultiFamily & CRE 21.9% Consumer 17.6% Commercial 16.4% Construction 2.9% Farm & Ag. 0.7% Unearned Income & Other 0.3% $11.3B Loans 1 - 4 Family 44.1% MultiFamily & CRE 29.0% Consumer 13.5% Commercial 6.7% Construction 2.2% Farm & Ag. 0.6% Unearned Income & Other 3.8% $1.9B Loans 1 - 4 Family 40.7% MultiFamily & CRE 22.9% Consumer 17.0% Commercial 15.1% Construction 2.8% Farm & Ag. 0.7% Unearned Income & Other 0.8% $13.2B Loans Loans / Deposits: 91.4% Cost of Deposits: 1.79% CRE / Total Capital: 131.3% Yield on Loans: 5.57% Loans / Deposits: 109.4% Cost of Deposits: 2.27% CRE / Total Capital: 253.1% Yield on Loans: 5.46% Loans / Deposits: 93.6% Cost of Deposits: 1.85% CRE / Total Capital: 157.6% Yield on Loans: 5.55%

Comparison With $10B - $20B Midwest & Mid - Atlantic Peers 1 0.00 5.00 10.00 15.00 20.00 25.00 30.00 NWBI Pro Forma Median NWBI Standalone 0.00 0.50 1.00 1.50 2.00 Median NWBI Pro Forma NWBI Standalone Strong Combined Profitability 13 Source: S&P Capital IQ Pro as of December 9, 2024 Note: Core figures remove net income attributable to realized gain/loss on securities, intangible amortization and nonrecurring items 1 Peers include all Midwest and Mid - Atlantic banks with total assets between $10B - $20B and traded on major exchanges LTM Core Return on Average Assets (%) LTM Core Return on Average Tangible Common Equity (%) Median NWBI Standalone NWBI Pro Forma 2026

$7.7 $8.1 $9.4 $9.6 $9.9 $11.7 $14.5 $14.1 $14.4 $14.4 $1.2 $1.6 $0.6 $2.1 $2.3 $9.0 $9.6 $9.4 $9.6 $10.5 $13.8 $14.5 $14.1 $14.4 $16.6 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q3'24 NWBI Assets ($B) Acquired Assets ($B) Disciplined Yet Opportunistic Growth Strategy 14 Source: S&P Capital IQ Pro Note: Assumes combined assets for NWBI and PWOD as of September 30, 2024 (18 Branches)

& Appendix

($ in millions) Equity Consideration to PWOD 1,2 $260.2 (+) Cash Consideration for PWOD Options 3 10.2 Aggregate Consideration $270.4 PWOD Tangible Book Value at Close 196.5 (+) After-Tax Merger Costs Attributable to PWOD (17.6) (+) Pre-Tax Fair Value Adjustments (108.9) (+) Net Deferred Tax Asset / (Liability) 25.0 Adjusted Tangible Common Equity with After-Tax Fair Value Adjustments $95.0 Excess Over Adjusted Tangible Book Value 175.3 (-) Core Deposit Intangible Created 44.0 (-) Deferred Tax Liability Created on Core Deposit Intangible (9.9) Goodwill Created $141.2 (+) Core Deposit Intangible Created 44.0 Total Intangibles Created $185.2 ($ in millions, except per share data) NWBI Tangible Common Equity at Close $1,228.8 NWBI Tangible Book Value per Share at Close $9.65 Equity Consideration to PWOD 1,2 $260.2 Goodwill Created (141.2) Core Deposit Intangible Created (44.0) After-Tax Merger Costs Attributable to NWBI (10.8) After-Tax Impact of Non-PCD Credit Mark and Other Adjustments (16.5) NWBI Pro Forma Tangible Common Equity at Close $1,276.5 Pro Forma Common Shares Outstanding 145.4 Pro Forma Tangible Book Value per Share $8.78 NWBI Tangible Book Value per Share Dilution ($) ($0.87) NWBI Tangible Book Value per Share Dilution (%) (9.0%) Tangible Book Value Earnback — Crossover Method 2.9 Years Tangible Book Value Dilution Reconciliation 16 Source: S&P Capital IQ Pro Note(s): Pro forma metrics projected to closing based on financial data as of September 30, 2024; Market data is as of December 16, 2024. Estimated financial impact is presented for illustrative purposes only. Pro forma financial data is subject to various assum pt ions and uncertainties. See disclaimer on “Forward - looking Statements and Additional Information.” 1 Based on PWOD common shares outstanding of 7,554,488 2 Based on NWBI's closing stock price of $14.44 per share, as of December 16, 2024 3 Based on PWOD outstanding stock options of 1,094,000 with a weighted average strike price of $25.13 to be exchanged for cash Goodwill Reconciliation Illustrative Tangible Book Value Dilution Impact

($ in millions, except per share data) 2026 Estimated Pro Forma NWBI Net Income to Common (Consensus) $142.9 PWOD Net Income to Common (Management) 22.9 Combined Net Income $165.8 After-Tax Acquisition Adjustments Cost Savings $13.0 Core Deposit Intangible Amortization (5.9) Purchase Accounting Fair Value Adjustments 30.6 Opportunity Cost of Cash (1.4) All Other Adjustments (0.9) Combined Net Income $201.3 Pro Forma Diluted Shares Outstanding 145.4 Pro Forma EPS $1.38 NWBI Standalone EPS $1.12 Accretion / (Dilution) to NWBI ($) $0.26 Accretion / (Dilution) to NWBI (%) 23.4% Illustrative Pro Forma Net Income & EPS Accretion Reconciliations 17 Source: S&P Capital IQ Pro Note(s): Pro forma metrics projected to closing based on financial data as of September 30, 2024 Estimated financial impact is presented for illustrative purposes only. Pro forma financial data is surject to various assum pt ions and uncertainties. See disclaimer on “Forward - looking Statements and Additional Information.” Illustrative Tangible Book Value Dilution Impact

($ in 000's, unless otherwise indicated) As of December 31, MRQ 2019 2020 2021 2022 2023 Q3'24 Tangible common equity to tangible assets Total common stockholders' equity $1,353,285 $1,538,703 $1,583,571 $1,491,486 $1,551,317 $1,591,325 Less: Goodwill 346,103 382,279 380,997 380,997 380,997 380,997 Less: Other intangible assets 23,076 19,936 12,836 8,560 5,290 3,363 Tangible common equity (A) 984,106 1,136,488 1,189,738 1,101,929 1,165,030 1,206,965 Total Assets 10,493,908 13,806,268 14,501,508 14,113,324 14,419,105 14,354,325 Less: Goodwill 346,103 382,279 380,997 380,997 380,997 380,997 Less: Other intangible assets 23,076 19,936 12,836 8,560 5,290 3,363 Tangible assets (B) 10,124,729 13,404,053 14,107,675 13,723,767 14,032,818 13,969,965 Tangible common equity to tangible assets (A)/(B) 9.7% 8.5% 8.4% 8.0% 8.3% 8.6% Tangible common equity per common share Total common stockholders' equity 1,353,285 1,538,703 1,583,571 1,491,486 1,551,317 1,591,325 Less: Goodwill 346,103 382,279 380,997 380,997 380,997 380,997 Less: Other intangible assets 23,076 19,936 12,836 8,560 5,290 3,363 Tangible common equity (C) 984,106 1,136,488 1,189,738 1,101,929 1,165,030 1,206,965 Common shares outstanding (D) (actual) 106,859,088 127,019,452 126,612,183 127,028,848 127,110,453 127,400,199 Tangible common equity per common share (C)/(D) ($) $9.21 $8.95 $9.40 $8.67 $9.17 $9.47 NWBI: Non - GAAP Reconciliations Source: S&P Capital IQ Pro 18

($ in 000's, unless otherwise indicated) For the Year Ended December 31, 5-Year LTM 2019 2020 2021 2022 2023 Median Q3'24 Return on average tangible common equity Net Income $110,432 $74,854 $154,323 $133,666 $134,957 $96,542 Add: Intangible amortization expense (net of tax) 5,169 5,416 4,387 3,379 2,583 2,094 Net Income, excluding intangible amortization expense (E) 115,601 80,270 158,710 137,045 137,540 98,636 Average total equity 1,321,452 1,584,747 1,557,582 1,518,704 1,510,285 1,542,774 Less: Average goodwill 340,230 370,596 381,497 380,997 380,997 380,997 Less: Average other intangible assets 23,461 21,978 16,033 10,595 6,850 3,659 Average tangible common equity (F) 957,761 1,192,173 1,160,052 1,127,112 1,122,439 1,158,119 Return on average tangible common equity (E)/(F) 12.07% 6.73% 13.68% 12.16% 12.25% 12.16% 8.52% Core return metrics Net Income 110,432 74,854 154,323 133,666 134,957 96,542 Less: Realized gain (loss) on securities (net of tax) 40 186 (139) (6) (6,563) (31,137) Less: Nonrecurring income (expense) (net of tax) (3,293) (16,423) 17,280 (3,647) 1,229 (4,161) Add: Intangible amortization expense (net of tax) 5,169 5,416 4,387 3,379 2,583 2,094 Core net income (G) 118,854 96,507 141,568 140,699 142,874 133,933 Core return on average tangible common equity (G)/(F) 12.41% 8.10% 12.20% 12.48% 12.73% 12.41% 11.56% NWBI: Non - GAAP Reconciliations (Continued) 19 Source: S&P Capital IQ Pro Note: Adjustments net of tax assume a 21% tax rate

PWOD: Non - GAAP Reconciliations Source: S&P Capital IQ Pro 20 ($ in 000's, unless otherwise indicated) As of December 31, MRQ 2019 2020 2021 2022 2023 Q3'24 Tangible common equity to tangible assets Total common stockholders' equity $154,960 $164,142 $172,274 $167,665 $191,556 $203,694 Less: Goodwill 17,104 17,104 17,104 16,450 16,450 16,450 Less: Other intangible assets 898 671 480 327 210 133 Tangible common equity (A) 136,958 146,367 154,690 150,888 174,896 187,111 Total Assets 1,665,323 1,834,643 1,940,809 2,000,080 2,204,809 2,259,250 Less: Goodwill 17,104 17,104 17,104 16,450 16,450 16,450 Less: Other intangible assets 898 671 480 327 210 133 Tangible assets (B) 1,647,321 1,816,868 1,923,225 1,983,303 2,188,149 2,242,667 Tangible common equity to tangible assets (A)/(B) 8.3% 8.1% 8.0% 7.6% 8.0% 8.3% Tangible common equity per common share Total common stockholders' equity 154,960 164,142 172,274 167,665 191,556 203,694 Less: Goodwill 17,104 17,104 17,104 16,450 16,450 16,450 Less: Other intangible assets 898 671 480 327 210 133 Tangible common equity (C) 136,958 146,367 154,690 150,888 174,896 187,111 Common shares outstanding (D) (actual) 7,040,515 7,052,351 7,070,047 7,056,585 7,508,994 7,554,488 Tangible common equity per common share (C)/(D) ($) $19.45 $20.75 $21.88 $21.38 $23.29 $24.77

($ in 000's, unless otherwise indicated) For the Year Ended December 31, 5-Year LTM 2019 2020 2021 2022 2023 Median Q3'24 Return on average tangible common equity Net Income $15,686 $15,224 $16,048 $17,422 $16,608 $19,554 Add: Intangible amortization expense (net of tax) 209 179 151 638 92 81 Net Income, excluding intangible amortization expense (E) 15,895 15,403 16,199 18,060 16,700 19,635 Average total equity 150,711 159,528 166,894 162,388 168,721 190,016 Less: Average goodwill 17,104 17,104 17,104 17,022 16,450 16,450 Less: Average other intangible assets 1,026 780 571 399 264 146 Average tangible common equity (F) 132,581 141,644 149,218 144,966 152,007 173,421 Return on average tangible common equity (E)/(F) 11.99% 10.87% 10.86% 12.46% 10.99% 10.99% 11.32% Core return metrics Net Income 15,686 15,224 16,048 17,422 16,608 19,554 Less: Realized gain (loss) on securities (net of tax) 576 1,279 523 (288) (141) (27) Less: Nonrecurring income (expense) (net of tax) (539) 0 0 (201) 301 (261) Add: Intangible amortization expense (net of tax) 209 179 151 638 92 81 Core net income (G) 15,857 14,124 15,676 18,549 16,540 19,922 Core return on average tangible common equity (G)/(F) 11.96% 9.97% 10.51% 12.80% 10.88% 10.88% 11.49% PWOD: Non - GAAP Reconciliations (Continued) 21 Source: S&P Capital IQ Pro Note: Adjustments net of tax assume a 21% tax rate

Exhibit 99.2

Filed by Northwest Bancshares, Inc.

Pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Penns Woods Bancorp, Inc.

Commission File No. 0-17077

| NEWS RELEASE | |

December 17, 2024 |

| Northwest Bancshares, Inc. |

Penns Woods Bancorp, Inc. |

| 3 Easton Oval, Suite 500 |

300 Market Street |

| Columbus, OH 43219 |

Williamsport, PA 17701 |

Northwest Bancshares, Inc. Announces Agreement

to Acquire Penns Woods Bancorp, Inc.

Columbus, Ohio, December 17, 2024 – Northwest

Bancshares, Inc. (“Northwest”) (NASDAQ: NWBI) the bank holding company for Northwest Bank, and Penns Woods Bancorp, Inc. (“Penns

Woods”) (NASDAQ: PWOD), the multi-bank holding company of Jersey Shore State Bank and Luzerne Bank, jointly announced today that

they have entered into a definitive Agreement and Plan of Merger (“Agreement”) whereby Northwest will acquire Penns Woods

in an all-stock transaction valued at approximately $270.4 million. Combining the two organizations will significantly enhance the combined

company’s presence in North Central and Northeastern Pennsylvania.

Headquartered in Williamsport, Pennsylvania, Penns

Woods has approximately $2.3 billion in assets, $1.7 billion in total deposits, and $1.9 billion in total loans as of September 30, 2024.

The combined company is expected to have pro forma total assets in excess of $17 billion and is expected to be one of the nation’s

top 100 largest banks. The combined company’s Pennsylvania banking presence will be enhanced through the addition of 24 branch locations

across Blair, Centre, Clinton, Luzerne, Lycoming, Montour, and Union counties. The complementary footprint of Penns Woods links Northwest's

presence in both eastern and western Pennsylvania. When the transaction is completed, Northwest will have more than 150 financial centers,

as well as loan production offices, across four states.

Under the terms of the Agreement, which has been

unanimously approved by the board of directors of both companies, Northwest will exchange shares of its common stock for all of the outstanding

shares of Penns Woods common stock, in an all-stock transaction. Penns Woods shareholders will be entitled to receive 2.385 shares of

Northwest common stock for each share of Penns Woods common stock they own upon the effective time of the merger. Any unexercised stock

options of Penns Woods will be canceled in exchange for a cash payment at the spread value over the exercise price. Based on Northwest’s

closing stock price of $14.44 as of December 16, 2024, the transaction consideration is valued at $34.44 for each share of Penns Woods

which equates to a 139.0% multiple of tangible book value, a 12.8x multiple on LTM core earnings and a core deposit premium of 5.2% as

of September 30, 2024. Including the consideration paid to option holders, the aggregate consideration is approximately $270.4 million.

The merger is expected to qualify as a tax-free reorganization. Following completion of the transaction, Penns Woods shareholders would

be expected to receive, on a per share equivalent basis, a dividend equal to approximately $0.48 per share based on Northwest's current

quarterly dividend of $0.20 per share. This dividend is approximately 49% higher than Penns Woods' current quarterly dividend of $0.32

per share.

Louis J. Torchio, President and CEO of Northwest,

stated, “We are very excited to announce this partnership with the Penns Woods team as this transaction marks another milestone

in our long-term growth strategy and executes on our strategic plan. Jersey Shore State Bank and Luzerne Bank have outstanding reputations

throughout their respective markets, and we look forward to welcoming our new colleagues and their customers to the Northwest family.

We will be strongly positioned to continue to serve communities that are familiar to Northwest, expand our presence into new markets,

and deliver exceptional banking services across our entire footprint. Through this acquisition, we look forward to building on Northwest’s

rich history of community-focused banking and delivering even greater value to our customers, employees, communities, and shareholders.”

Richard A. Grafmyre, CEO of Penns Woods, added,

“As Lou mentioned, we are very excited to announce this partnership and are looking forward to bringing together two like-minded

institutions. This combination will provide the best path for the long-term success of our organization, employees, customers, and shareholders.

We believe that the combination of our highly compatible organizations will create a catalyst for growth and benefit all of the communities

we serve. The merger will provide increased scale and additional capabilities for our customers, and it will provide greater opportunities

for our employees to advance their careers as a part of a larger organization.”

Upon completion of the merger, the shares issued

to Penns Woods shareholders are expected to comprise approximately 12% of the outstanding shares of the combined company. The Agreement

also provides that Northwest will appoint Richard A. Grafmyre to the boards of Northwest and Northwest Bank after closing.

Excluding one-time transaction costs, Northwest

expects the transaction to be approximately 23% accretive to 2026 fully diluted earnings per share. Tangible book value dilution is expected

to be approximately 9% at closing, with an expected tangible book value earn-back period of under 3 years using the “cross-over”

method. The “pay-to-trade” multiple is 0.91x. Northwest and Northwest Bank capital ratios are expected to be significantly

above “well-capitalized” regulatory thresholds upon closing.

The companies expect to complete the transaction

in the third quarter of 2025, subject to the satisfaction of customary closing conditions, including regulatory approvals and approval

by Penns Woods shareholders. At closing, Jersey Shore State Bank and Luzerne Bank branches will become branches of Northwest Bank.

Janney Montgomery Scott, LLC is acting as financial

advisor to Northwest, and Dinsmore & Shohl LLP is acting as its legal advisor in the transaction. Stephens Inc. is acting as financial

advisor to Penns Woods, and Stevens & Lee, P.C. is acting as its legal advisor in the transaction. An investor presentation that

provides additional details regarding this transaction is available online at investorrelations.northwest.bank.

About Northwest Bancshares, Inc.

Headquartered in Columbus, Ohio, Northwest Bancshares,

Inc. is the bank holding company of Northwest Bank. Founded in 1896, Northwest Bank is a full-service financial institution which offers

a complete line of business and consumer banking products, as well as employee benefits and wealth management services. Currently, Northwest

operates 130 full-service financial centers and eleven free standing drive-up facilities in Pennsylvania, New York, Ohio, and Indiana.

Northwest Bancshares, Inc.'s common stock is listed on the NASDAQ Global Select Market under the symbol NWBI. Additional information

regarding Northwest Bancshares, Inc. and Northwest Bank can be accessed online at www.northwest.bank.

About Penns Woods Bancorp, Inc.

Penns Woods Bancorp, Inc. is the bank holding

company for Jersey Shore State Bank and Luzerne Bank. The banks serve customers in North Central and Northeastern Pennsylvania through

their retail banking, commercial banking, mortgage services, and financial services divisions. Penns Woods Bancorp, Inc. stock is listed

on the NASDAQ Global Select Market under the symbol PWOD. Previous press releases and additional information can be obtained from the

company’s website at www.pwod.com.

Forward-Looking Statements

The statements in this press release that are

not historical facts, in particular the statements with respect to the expected timing of and benefits of the proposed merger between

Northwest and Penns Woods, the parties’ plans, obligations, expectations, and intentions, and the statements with respect to accretion

and earn-back of tangible book value dilution, constitute forward-looking statements as defined by federal securities laws. Such statements

are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied

by such statements for a variety of factors including: the businesses of Northwest and Penns Woods may not be integrated successfully

or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the proposed

merger may not be fully realized within the expected timeframes; disruption from the proposed merger may make it more difficult to maintain

relationships with clients, associates, or suppliers; the required governmental approvals of the proposed merger may not be obtained on

the expected terms and schedule; Penns Woods’ shareholders may not approve the proposed merger and the Agreement; and changes in

economic conditions; movements in interest rates; competitive pressures on product pricing and services; success and timing of other business

strategies; the nature, extent, and timing of governmental actions and reforms; and extended disruption of vital infrastructure; and other

factors described in Northwest’s 2023 Annual Report on Form 10-K, Penns Woods’s 2023 Annual Report on Form 10-K, and documents

subsequently filed by Northwest and Penns Woods with the Securities and Exchange Commission (SEC). Annualized, pro forma, projected and

estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. All forward-looking statements

included herein are based on information available at the time of the release. Neither Northwest nor Penns Woods assumes any obligation

to update any forward-looking statement.

Additional Information about the Merger

and Where to Find It

This

news release does not constitute an offer to sell or the solicitation of an offer to buy securities of Northwest. In connection

with the proposed merger, Northwest will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of

Penns Woods, and a prospectus of Northwest, as well as other relevant documents concerning the proposed transaction. INVESTORS AND

SHAREHOLDERS OF PENNS WOODS, AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS

REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Proxy Statement/Prospectus will be mailed to shareholders

of Penns Woods prior to the shareholder meeting, which has not yet been scheduled. In addition, when the Registration Statement on Form

S-4, which will include the Proxy Statement/Prospectus, and other related documents are filed by Northwest with the SEC, it may be obtained

for free at the SEC’s website at www.sec.gov, and from either Northwest’s website at www.northwest.bank or

Penns Woods’ website at www.pwod.com.

Participants in the Solicitation

Northwest, Penns Woods, and their respective executive

officers and directors may be deemed to be participants in the solicitation of proxies from the shareholders of Northwest and Penns Woods

in connection with the proposed merger. Information about the directors and executive officers of Northwest is set forth in the proxy

statement for Northwest’s 2024 annual meeting of shareholders, as filed with the SEC on March 8, 2024. Information about the directors

and executive officers of Penns Woods is set forth in the proxy statement for Penns Woods’s 2024 annual meeting of shareholders,

as filed with the SEC on March 26, 2024. Information about any other persons who may, under the rules of the SEC, be considered participants

in the solicitation of shareholders of Penns Woods in connection with the proposed merger will be included in the Proxy Statement/Prospectus.

You can obtain free copies of these documents from the SEC, Northwest, or Penns Woods using the website information above. This communication

does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction.

PENNS WOODS SHAREHOLDERS AND INVESTORS ARE

URGED TO READ THE PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN IT BECOMES AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS WITH

RESPECT TO THE PROPOSED MERGER.

SOURCE: Northwest Bancshares, Inc. and Penns Woods

Bancorp, Inc.

Northwest Company Contact:

Devin T. Cygnar

Executive Vice President, Chief Marketing &

Communications Officer

3 Easton Oval, Suite 500

Columbus, OH 43219

(614) 934-2797

Penns Woods Company Contact:

Richard A. Grafmyre, Chief Executive Officer

300 Market Street

Williamsport, PA, 17701

(570) 322-1111

(888) 412-5772

v3.24.4

Cover

|

Dec. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 16, 2024

|

| Entity File Number |

000-17077

|

| Entity Registrant Name |

PENNS WOODS BANCORP, INC.

|

| Entity Central Index Key |

0000716605

|

| Entity Tax Identification Number |

23-2226454

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity Address, Address Line One |

300

Market Street

|

| Entity Address, Address Line Two |

P.O.

Box 967

|

| Entity Address, City or Town |

Williamsport

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

17703-0967

|

| City Area Code |

570

|

| Local Phone Number |

322-1111

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $5.55 par value

|

| Trading Symbol |

PWOD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

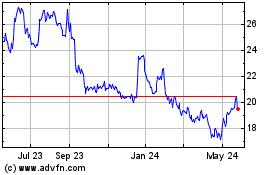

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Dec 2024 to Jan 2025

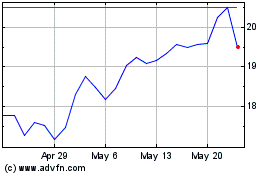

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jan 2024 to Jan 2025