Chevron to Buy PDC Energy in $6.3 Billion Stock Swap

May 22 2023 - 8:48AM

Dow Jones News

By Colin Kellaher

Chevron on Monday said it agreed to buy independent oil-and-gas

company PDC Energy in a $6.3 billion stock swap that bolsters the

energy giant's position in key U.S. production basins.

Chevron said it would issue 0.4638 shares, worth $72 based on

Friday's closing price of $155.23, for each share of Denver-based

PDC, a nearly 11% premium to Friday's closing price of $65.12.

Chevron, based in San Ramon, Calif., said the deal has a total

enterprise value of $7.6 billion, including PDC's debt.

Chevron said the PDC deal would add 10% to its oil-equivalent

proved reserves for under $7 a barrel and adds 275,000 net acres

adjacent to its position in the Denver-Julesburg Basin, along with

25,000 net acres in the prolific Permian Basin, the largest U.S.

oil field.

Chevron said it would issue roughly 41 million shares in the

deal, slated to close by the end of the year, adding that it

expects the transaction to add $1 billion to annual free cash

flow.

Trading in shares of PDC was halted premarket on Monday.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

May 22, 2023 08:33 ET (12:33 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

PDC Energy (NASDAQ:PDCE)

Historical Stock Chart

From Apr 2024 to May 2024

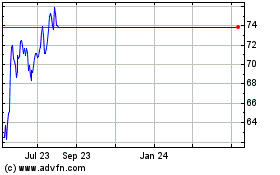

PDC Energy (NASDAQ:PDCE)

Historical Stock Chart

From May 2023 to May 2024