Raises 2024 guidance

Record quarterly volume up 25% year-over-year,

including 57% B2B growth

Record quarterly revenue and increasing

profitability year-over-year

Payoneer Global Inc. (“Payoneer” or the “Company”) (NASDAQ:

PAYO), the financial technology company empowering the world’s

small and medium-sized businesses to transact, do business and grow

globally, today reported financial results for its third quarter

ended September 30, 2024.

Third Quarter 2024 Financial

Highlights

($ in mm)

3Q

2023

4Q

2023

1Q

2024

2Q

2024

3Q

2024

YoYChange Revenue ex. interest income

$147.6

$159.4

$162.9

$173.7

$183.1

24%

Interest income

60.4

64.9

65.3

65.8

65.2

8%

Revenue

$208.0

$224.3

$228.2

$239.5

$248.3

19%

Transaction costs as a % of revenue

14.6%

16.2%

14.9%

15.4%

15.3%

70 bps Net income

$12.8

$27.0

$29.0

$32.4

$41.6

224%

Adjusted EBITDA

58.2

52.2

65.2

72.8

69.3

19%

Operational Metrics Volume

($bn)

$16.3

$19.0

$18.5

$18.7

$20.4

25%

Active Ideal Customer Profiles (ICPs) ('000s)1

502

516

530

547

557

11%

Revenue as a % of volume ("Take Rate")

127 bps

118 bps 124 bps 128 bps 122 bps -5 bps SMB customer take rate2 107

bps 100 bps 108 bps 111 bps 109 bps 2 bps

1. Active ICPs are defined as customers

with a Payoneer Account that have on average over $500 per month in

volume and were active over the trailing twelve-month period.

2. SMB customer take rate represents

revenue from SMBs who sell on marketplaces, B2B SMBs, and Merchant

Services, divided by the associated volume from each respective

channel.

“Payoneer delivered record quarterly

volume and revenue, and significant profitability in the third

quarter. We are building a full-service financial stack for global

cross-border SMBs and accelerating growth and profitability across

our business. We have increased our growth rate for ICPs for four

consecutive quarters to 11% year-over-year, and for ARPU excluding

interest income for five consecutive quarters to 20%. We are at the

beginning of our growth trajectory and are focused on consistent

execution to capture the opportunity ahead of us.”

John Caplan, Chief Executive Officer

Third Quarter 2024 Business

Highlights

- 25% volume growth year-over-year reflects:

- B2B volume of $2.8 billion increased 57% year-over-year, driven

by continued strong customer acquisition and increased average

transaction sizes

- SMBs that sell on marketplaces volume of $12 billion increased

17% year-over-year led by strong performance with large ecommerce

sellers

- Merchant Services (Checkout) volume of $153 million increased

142% year-over-year

- Enterprise payouts volume of $5.5 billion increased 29%

year-over-year

- 11% active ICP growth year-over-year, including 2% growth in

larger ICPs who have on average over $10,000 per month in volume.

Both volume and revenue growth from $10K+ ICPs are accelerating and

increased more than 25% year-over-year as we acquire and grow

volumes from larger customers

- $1.4 billion of spend on Payoneer cards, up 41% year-over-year,

as customers increasingly use our card product for their global

accounts payable needs and as we continue to drive adoption across

all regions

- $6.1 billion of customer funds (including both short-term and

long-term funds) as of September 30, 2024, up 13%

year-over-year

- $21 million of share repurchases at a weighted average price of

$5.67

- Completed repurchase and redemption of all 25 million

outstanding public warrants for $21 million

2024 Guidance

“Payoneer is building on the significant

momentum across our business with another record quarter of

financial results. We have delivered seven consecutive quarters of

accelerating volume growth and in the third quarter accelerated

revenue growth excluding interest income to 24%. We are increasing

our 2024 guidance to reflect our strong third quarter performance

as well as higher expectations for both growth and profitability

for the final quarter of the year. We are executing on our

strategic priorities. Our repurchase of the 25 million outstanding

public warrants, which had a strike price of $11.50, underscores

our conviction in our ability to create long term value for

shareholders.”

Bea Ordonez, Chief Financial Officer

2024 guidance is as follows:

Revenue

$950 million - $960 million

Transaction costs

~16.0% of revenue

Adjusted EBITDA (1)

$255 million to $265 million

(1) Guidance for fiscal year, where

adjusted, is provided on a non-GAAP basis, which Payoneer will

continue to identify as it reports its future financial results.

The Company cannot reconcile its expected adjusted EBITDA to

expected net income under “2024 Guidance” without unreasonable

effort because certain items that impact net income and other

reconciling metrics are out of the Company's control and/or cannot

be reasonably predicted at this time, which unavailable information

could have a significant impact on the Company’s GAAP financial

results. Please refer to “Financial Information; Non-GAAP Financial

Measures” below for a description of the calculation of adjusted

EBITDA.

Webcast

Payoneer will host a live webcast of its earnings on a

conference call with the investment community beginning at 8:30

a.m. ET today, November 5, 2024. To access the webcast, go to the

investor relations section of the Company’s website at

https://investor.payoneer.com. A replay will be available on the

investor relations website following the call.

About Payoneer

Payoneer is the financial technology company empowering the

world’s small and medium-sized businesses to transact, do business,

and grow globally. Payoneer was founded in 2005 with the belief

that talent is equally distributed, but opportunity is not. It is

our mission to enable any entrepreneur and business anywhere to

participate and succeed in an increasingly digital global economy.

Since our founding, we have built a global financial stack that

removes barriers and simplifies cross-border commerce. We make it

easier for millions of SMBs, particularly in emerging markets, to

connect to the global economy, pay and get paid, manage their funds

across multiple currencies, and grow their businesses.

Forward-Looking

Statements

This press release includes, and oral statements made from time

to time by representatives of Payoneer, may be considered

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

relate to future events or Payoneer’s future financial or operating

performance. For example, projections of future revenue,

transaction cost and adjusted EBITDA are forward-looking

statements. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “expect,”

“intend,” “plan,” “will,” “estimate,” “anticipate,” “believe,”

“predict,” “potential” or “continue,” or the negatives of these

terms or variations of them or similar terminology. Such

forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially

from those expressed or implied by such forward-looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Payoneer and its

management, as the case may be, are inherently uncertain. Factors

that may cause actual results to differ materially from current

expectations include, but are not limited to: (1) changes in

applicable laws or regulations; (2) the possibility that Payoneer

may be adversely affected by geopolitical events and conflicts,

such as Israel’s ongoing conflicts in the region, and other

economic, business and/or competitive factors; (3) changes in the

assumptions underlying our financial estimates; (4) the outcome of

any known and/or unknown legal or regulatory proceedings; and (5)

other risks and uncertainties set forth in Payoneer’s Annual Report

on Form 10-K for the period ended December 31, 2023 and future

reports that Payoneer may file with the SEC from time to time.

Nothing in this press release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Payoneer does not

undertake any duty to update these forward-looking statements.

Financial Information; Non-GAAP

Financial Measures

Some of the financial information and data contained in this

press release, such as adjusted EBITDA, have not been prepared in

accordance with United States generally accepted accounting

principles (“GAAP”). Payoneer uses these non-GAAP measures to

compare Payoneer’s performance to that of prior periods for

budgeting and planning purposes. Payoneer believes these non-GAAP

measures of financial results provide useful information to

management and investors regarding certain financial and business

trends relating to Payoneer’s results of operations. Payoneer's

method of determining these non-GAAP measures may be different from

other companies' methods and, therefore, may not be comparable to

those used by other companies and Payoneer does not recommend the

sole use of these non-GAAP measures to assess its financial

performance. Payoneer management does not consider these non-GAAP

measures in isolation or as an alternative to financial measures

determined in accordance with GAAP. The principal limitation of

these non-GAAP financial measures is that they exclude significant

expenses and income that are required by GAAP to be recorded in

Payoneer’s financial statements. In addition, they are subject to

inherent limitations as they reflect the exercise of judgments by

management about which expense and income are excluded or included

in determining these non-GAAP financial measures. In order to

compensate for these limitations, management presents non-GAAP

financial measures in connection with GAAP results. You should

review Payoneer’s financial statements, which are included in

Payoneer’s Annual Report on Form 10-K for the year ended December

31, 2023 and its subsequent Quarterly Reports on Form 10-Q, and not

rely on any single financial measure to evaluate Payoneer’s

business.

Non-GAAP measures include the following item:

Adjusted EBITDA: We provide

adjusted EBITDA, a non-GAAP financial measure that represents our

net income (loss) adjusted to exclude, as applicable: M&A

related expense (income), stock-based compensation expenses,

restructuring charges, share in losses (gain) of associated

company, loss (gain) from change in fair value of warrants and

warrant repurchase/redemption, other financial expense (income),

net, taxes on income, and depreciation and amortization.

Other companies may calculate the above measure differently, and

therefore Payoneer’s measures may not be directly comparable to

similarly titled measures of other companies.

In addition, in this earnings release, we reference volume,

which is an operational metric. Volume refers to the total dollar

value of transactions successfully completed or enabled by our

platform, not including orchestration transactions. For a customer

that both receives and later sends payments, we count the volume

only once. We also reference ARPU (Average Revenue Per User), which

is defined as the Revenue from Active Customers divided by the

number of Active Customers over the period in which the Revenue was

earned. Active Customers for these purposes are defined as Payoneer

accountholders with at least 1 financial transaction over the

period. Revenue from Active Customers represents revenue attributed

to Active Customers based on their use of the Payoneer platform,

including interest income earned from their balances, and excluding

revenues unrelated to their activities.

TABLE - 1

PAYONEER GLOBAL INC.

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (UNAUDITED)

(U.S. dollars in thousands,

except share and per share data)

(Unaudited)

Three months ended

September 30,

2024

2023

Revenues $

248,274

$

208,035

Transaction costs (Exclusive of depreciation and

amortization shown separately below andinclusive of $401 and $437

in interest expense and fees associated with related

partytransactions during the three months ended September 30, 2024

and 2023, respectively)

38,058

30,393

Other operating expenses

44,892

40,301

Research and development expenses

34,616

26,950

Sales and marketing expenses

52,311

48,664

General and administrative expenses

29,725

25,112

Depreciation and amortization

13,510

7,116

Total operating expenses

213,112

178,536

Operating income

35,162

29,499

Financial income (expense): Loss from change in fair

value of Warrants

—

(7,799)

Loss on Warrants repurchase/redemption

(14,746)

—

Other financial income, net

1,674

1,137

Financial expense, net

(13,072)

(6,662)

Income before taxes on income

22,090

22,837

Tax benefit (expense) on income

19,484

(10,012)

Net income $

41,574

$

12,825

Other comprehensive income Unrealized gain on

available-for-sale debt securities, net

12,256

-

Tax expense on unrealized gains on available-for-sale debt

securities, net

(2,816)

-

Unrealized gain on cash flow hedges, net

1,168

-

Tax expense on unrealized gains on cash flow hedges, net

(211)

-

Other comprehensive income, net of tax

10,397

-

Comprehensive income $

51,971

$

12,825

Per Share Data Net income per share attributable to

common stockholders — Basic earnings per share $

0.12

$

0.04

— Diluted earnings per share $

0.11

$

0.03

Weighted average common shares outstanding — Basic

357,297,824

357,429,113

Weighted average common shares outstanding — Diluted

374,303,470

381,845,099

Disaggregation of revenue

The following table presents revenue recognized from contracts

with customers as well as revenue from other sources:

Three months ended September

30,

2024

2023

Revenue recognized at a point in time $

179,641

$

144,665

Revenue recognized over time

719

537

Revenue from contracts with customers $

180,360

$

145,202

Interest income on customer balances $

65,162

$

60,416

Capital advance income

2,752

2,417

Revenue from other sources $

67,914

$

62,833

Total revenues $

248,274

$

208,035

The following table presents the Company’s revenue disaggregated

by primary regional market, with revenues being attributed to the

country (in the region) in which the billing address of the

transacting customer is located, with the exception of global bank

transfer revenues, where revenues are disaggregated based on the

billing address of the transaction funds source.

Three months ended September

30,

2024

2023

Primary regional markets Greater China(1) $

85,111

$

72,513

Europe(2)

48,666

42,378

Asia-Pacific(2)

37,770

29,145

North America(3)

25,162

22,358

South Asia, Middle East and North Africa(2)

26,809

22,181

Latin America(2)

24,756

19,460

Total revenues $

248,274

$

208,035

1.

Greater China is inclusive of mainland China, Hong Kong, Macao and

Taiwan. 2. No single country included in any of these regions

generated more than 10% of total revenue. 3. The United States is

the Company’s country of domicile. Of North America revenues, the

U.S. represents $24,030 and $21,348 during the three months ended

September 30, 2024 and 2023, respectively.

TABLE - 2

PAYONEER GLOBAL INC.

RECONCILIATION OF NET INCOME

TO ADJUSTED EBITDA (UNAUDITED)

(U.S. dollars in thousands)

Three months ended

September 30,

2024

2023

Net income $

41,574

$

12,825

Depreciation and amortization

13,510

7,116

Tax (benefit) expense on income

(19,484)

10,012

Other financial income, net

(1,674)

(1,137)

EBITDA

33,926

28,816

Stock based compensation expenses(1)

17,430

15,330

M&A related expense(2)

3,166

1,745

Loss from change in fair value of Warrants(3)

—

7,799

Loss on Warrants repurchase/redemption(4)

14,746

—

Restructuring charges(5)

—

4,488

Adjusted EBITDA $

69,268

$

58,178

Three months ended,

Sept. 30, 2023

Dec. 31, 2023

Mar. 31, 2024

June 30, 2024

Sept. 30, 2024

Net income $

12,825

$

27,021

$

28,974

$

32,425

$

41,574

Depreciation and amortization

7,116

8,750

9,408

10,712

13,510

Tax (benefit) expense on income

10,012

14,272

13,910

15,866

(19,484)

Other financial income, net

(1,137)

(3,763)

(2,747)

(976)

(1,674)

EBITDA

28,816

46,280

49,545

58,027

33,926

Stock based compensation expenses(1)

15,330

17,338

15,077

13,666

17,430

M&A related expense(2)

1,745

451

2,375

2,091

3,166

(Gain) loss from change in fair value of Warrants(3)

7,799

(11,824)

(1,761)

(1,006)

—

Loss on Warrants repurchase/redemption(4)

—

—

—

—

14,746

Restructuring charges(5)

4,488

—

—

—

—

Adjusted EBITDA $

58,178

$

52,245

$

65,236

$

72,778

$

69,268

1. Represents non-cash charges associated with stock-based

compensation expense, which has been, and will continue to be for

the foreseeable future, a significant recurring expense in our

business and an important part of our compensation strategy. 2.

Amounts relate to M&A-related third-party fees, including

related legal, consulting and other expenditures. Additionally,

amounts for the three months ended September 30, 2024 include $0.2

million in non-recurring fair value adjustment of the Skuad

contingent consideration liability. 3. Changes in the estimated

fair value of the warrants are recognized as gain or loss on the

condensed consolidated statements of comprehensive income. The

impact is removed from EBITDA as it represents market conditions

that are not in our control. 4. Amounts relate to a non-recurring

loss on the repurchase and redemption of outstanding public

warrants. 5. The Company initiated a plan to reduce its workforce

during the three months ending September 30, 2023 and had

non-recurring costs related to severance and other employee

termination benefits.

TABLE - 3

PAYONEER GLOBAL INC.

EARNINGS PER SHARE

(UNAUDITED)

(U.S. dollars in thousands,

except share and per share data)

(Unaudited)

Three months ended September

30,

2024

2023

Numerator: Net income $

41,574

$

12,825

Denominator: Weighted average common shares outstanding — Basic

357,297,824

357,429,113

Add: Dilutive impact of RSUs, ESPP and options to purchase common

stock

16,222,829

23,678,424

Dilutive impact of private Warrants

782,817

737,562

Weighted average common shares — diluted

374,303,470

381,845,099

Net income per share attributable to common stockholders — Basic

earnings per share $

0.12

$

0.04

Diluted earnings per share $

0.11

$

0.03

TABLE - 4

PAYONEER GLOBAL INC.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(U.S. dollars in thousands,

except share and per share data)

September 30,

December 31,

2024

2023

Assets: Current assets: Cash and cash equivalents $

534,170

$

617,022

Restricted cash

4,994

7,030

Customer funds

5,560,767

6,390,526

Accounts receivable (net of allowance of $407 at September 30, 2024

and $385 at December 31, 2023)

13,529

7,980

Capital advance receivables (net of allowance of $6,094 at

September 30, 2024 and $5,059 at December31, 2023)

56,948

45,493

Other current assets

78,880

40,672

Total current assets

6,249,288

7,108,723

Non-current assets: Property, equipment and software, net

14,469

15,499

Goodwill

76,094

19,889

Intangible assets, net

99,915

76,266

Customer funds

525,000

—

Restricted deposits

16,848

5,780

Deferred taxes

29,556

15,291

Severance pay fund

828

840

Operating lease right-of-use assets

21,585

24,854

Other assets

17,591

15,977

Total assets $

7,051,174

$

7,283,119

Liabilities and shareholders’ equity: Current

liabilities: Trade payables $

45,118

$

33,941

Outstanding operating balances

6,085,767

6,390,526

Short-term debt from related party

13,219

—

Other payables

118,482

117,508

Total current liabilities

6,262,586

6,541,975

Non-current liabilities: Long-term debt from related party

—

18,411

Warrant liability

—

8,555

Deferred taxes

1,471

—

Other long-term liabilities

59,243

49,905

Total liabilities

6,323,300

6,618,846

Commitments and contingencies Shareholders’

equity: Preferred stock, $0.01 par value, 380,000,000 shares

authorized; no shares were issued and outstanding atSeptember 30,

2024 and December 31, 2023.

—

—

Common stock, $0.01 par value, 3,800,000,000 and 3,800,000,000

shares authorized; 390,633,432 and368,655,185 shares issued and

356,575,542 and 357,590,493 shares outstanding at September 30,

2024and December 31, 2023, respectively.

3,906

3,687

Treasury stock at cost, 34,057,890 and 11,064,692 shares as of

September 30, 2024 and December 31,2023, respectively.

(176,043)

(56,936)

Additional paid-in capital

801,687

732,894

Accumulated other comprehensive income (loss)

10,547

(176)

Retained earnings (accumulated deficit)

87,777

(15,196)

Total shareholders’ equity

727,874

664,273

Total liabilities and shareholders’ equity $

7,051,174

$

7,283,119

TABLE - 5

PAYONEER GLOBAL INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED)

(U.S. dollars in thousands)

Nine months ended

September 30,

2024

2023

Cash Flows from Operating Activities Net income $

102,973

$

66,312

Adjustment to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

33,630

19,064

Deferred taxes

(17,073)

(12,024)

Stock-based compensation expenses

46,173

48,429

Gain from change in fair value of Warrants

(2,767)

(5,535)

Loss on Warrant repurchase/redemption

14,746

—

Foreign currency re-measurement (gain) loss

(109)

761

Changes in operating assets and liabilities: Other current

assets

(36,277)

(5,891)

Trade payables

8,904

(6,948)

Deferred revenue

808

1,206

Accounts receivable, net

(1,255)

6,908

Capital advance extended to customers

(260,435)

(207,075)

Capital advance collected from customers

248,980

195,074

Other payables

(6,619)

(880)

Other long-term liabilities

(3,667)

(1,429)

Operating lease right-of-use assets

9,802

7,262

Interest and amortization of discount on investments

(6,401)

—

Other assets

(374)

(3,906)

Net cash provided by operating activities

131,039

101,328

Cash Flows from Investing Activities Purchase of

property, equipment and software

(4,449)

(4,336)

Capitalization of internal use software

(39,666)

(25,322)

Related Party asset acquisition

—

(3,600)

Severance pay fund distributions, net

12

151

Customer funds in transit, net

(80,098)

(20,600)

Purchases of investments in available-for-sale debt securities

(1,255,686)

—

Maturities and sales of investments in available-for-sale debt

securities

214,000

—

Purchases of investments in term deposits

(600,000)

—

Cash paid in connection with acquisition, net of cash and customer

funds acquired

(48,219)

—

Net cash inflow from acquisition of remaining interest in joint

venture

—

5,953

Net cash used in investing activities

(1,814,106)

(47,754)

Cash Flows from Financing Activities Proceeds from

issuance of common stock in connection with stock-based

compensation plan, net of taxespaid related to settlement of equity

awards and proceeds from employee equity transactions to be

remittedto employees

23,015

10,159

Outstanding operating balances, net

(314,764)

(468,146)

Borrowings under related party facility

15,120

19,309

Repayments under related party facility

(20,312)

(19,646)

Warrant repurchase/redemption (Refer to Note 14 for further

information)

(19,534)

Common stock repurchased

(120,457)

(34,408)

Net cash used in financing activities

(436,932)

(492,732)

Effect of exchange rate changes on cash and cash

equivalents

109

(662)

Net change in cash, cash equivalents, restricted cash and

customer funds

(2,119,890)

(439,820)

Cash, cash equivalents, restricted cash and customer funds at

beginning of period

7,018,367

6,386,720

Cash, cash equivalents, restricted cash and customer funds at

end of period $

4,898,477

$

5,946,900

Supplemental information of investing and financing activities

not involving cash flows: Property, equipment, and software

acquired but not paid $

1,569

$

1,078

Internal use software capitalized but not paid $

6,271

$

12,119

Common stock repurchased but not paid $

150

$

350

Right of use assets obtained in exchange for new operating lease

liabilities $

6,533

$

4,398

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105351426/en/

Investor Contact: Michelle Wang investor@payoneer.com

Media Contact: Alison Dahlman PR@payoneer.com

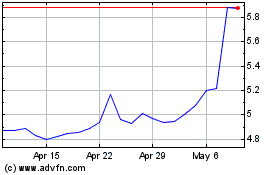

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Payoneer Global (NASDAQ:PAYO)

Historical Stock Chart

From Jan 2024 to Jan 2025