SOUTHFIELD, Mich., Nov. 6 /PRNewswire-FirstCall/ -- Origen

Financial, Inc. (NASDAQ:ORGN), a real estate investment trust that

manages residual interests in securitized manufactured housing loan

portfolios, today announced a net loss of $1.2 million, or $0.04

per share, for the quarter ended September 30, 2008, compared with

net income of $2.8 million, or $0.11 per share, for the quarter

ended September 30, 2007. No dividend was declared by Origen's

Board of Directors for the third quarter 2008. Financial Summary *

Interest income was $23.5 million for the third quarter 2008, the

same as the 2007 quarter. Interest-earning assets declined over

this period as a result of events which occurred during the first

quarter 2008. Such events included the sales of mortgage-backed

bonds and whole loans to retire repurchase agreements and a loan

warehouse facility, as well as a decision to cease loan

originations for our own account. Despite the decline in

interest-earning assets, reported interest income remained at the

2007 level due to a reporting change necessitated by the sale of

our loan servicing rights to Green Tree Servicing LLC in July 2008.

Fees associated with such servicing rights were recorded as

non-interest income with a corresponding reduction in loan interest

income during the periods the rights were owned by Origen. However,

the loan servicing fees paid to Green Tree subsequent to the sale

of the servicing rights are recorded as non-interest expense, and

the gross amount of interest received on the underlying loans is

recorded as interest income by Origen. Servicing fees paid to Green

Tree for the third quarter 2008 totaled $3.1 million. * Interest

expense for the 2008 quarter decreased $1.4 million, or 9.0 percent

to $14.2 million as a result of a decrease in average

interest-costing liabilities of $173.0 million, offset by an

increase in average effective interest rates of approximately 58

basis points. * The provision for credit losses was $4.6 million

for the third quarter 2008 compared with $2.2 million for the same

quarter 2007, an increase of 109.0 percent. The increase was the

result of the aging of our loan portfolio through its expected peak

loss years as well as a reduction in the realization of net

proceeds from the disposition of repossessed houses. * Non-interest

income for the quarter, after allocations to discontinued

operations, increased $0.2 million, from $0.8 million to $1.0

million. * Third quarter 2008 non-interest expenses, after

allocations to discontinued operations, were $12.1 million, an

increase of $6.2 million. The increase was the result of an accrual

for change of control payments of $4.8 million triggered by the

execution of the shareholder-approved Asset Disposition and

Management Plan ("the Plan") and the $3.1 million in loan servicing

fees paid to Green Tree, offset by a decrease in personnel costs

and other costs of $1.8 million reflecting a reduction in the

number of full time employees by approximately 88% as we continue

to execute the Plan. * Income from discontinued operations for

third quarter 2008, net of income taxes, increased $3.3 million

primarily due to a $6.4 million gain on the sale of servicing

rights offset by the lack of loan servicing fee revenue as compared

to the 2007 quarter. * At the time of the servicing rights sale, a

fair market value allocation was made between the servicing rights

sold and the underlying loans retained resulting in a recorded loan

discount of $19.4 million. This discount will be amortized into

interest income from continuing operations as an adjustment to the

yield of the loans. Portfolio Performance At September 30, 2008,

loans more than 60 days delinquent were 1.2 percent of the owned

loan portfolio compared to 0.9 percent at December 31, 2007. The

increase was due to the sale of approximately $175.7 million of

performing loans during the first quarter 2008, the cessation of

new loan originations for our own account, and the aging of our

loan portfolio through its expected peak loss years. Ronald A.

Klein, Origen's Chief Executive Officer, stated, "Our portfolio

performance remained strong through the third quarter 2008 as our

30 day and greater delinquency rate declined versus the second

quarter 2008. The portfolio is a static pool with no new loan

originations and as the pool ages and approaches its peak default

years we expect to see an ongoing increase in both delinquency and

default. Given the current economic environment, we would also

expect to see increased pressure on our borrowers which could lead

to a period of increased defaults as compared to our modeled

expected performance. To date, our solid underwriting has led to

results that have outperformed management's projections upon which

our plan to manage our portfolio, as detailed in our 2008 proxy

statement, was based. This performance has allowed the Company to

pay off more debt than anticipated. Currently the outstanding

principal of our related-party debt is $30 million as compared to

the $36 million projected by our plan." Mr. Klein added, "We do

anticipate numerous challenges in the months ahead as housing

prices continue to decline and unemployment rates increase.

Additionally, Ambac's recent downgrade by Moody's will cause our

cost of funds to increase on our 2006-A and 2007-A asseted-backed

securitization transactions for a period of time. We will continue

to actively pursue all opportunities to reduce the impact of

Ambac's downgrade." Earnings Call and Webcast A conference call and

webcast have been scheduled for November 7, 2008, at 11:00 a.m. EST

to discuss third quarter results. The call may be accessed on

Origen's web site at http://www.origenfinancial.com/ or by dialing

877-548-7914. A replay will be available through November 17, 2008

by dialing 888-203-1112, passcode 5839914. You may also access the

replay on Origen's website for 90 days after the event.

Forward-Looking Statements This press release contains various

"forward-looking statements" within the meaning of the Securities

Act of 1933 and the Securities Exchange Act of 1934, and Origen

intends that such forward-looking statements will be subject to the

safe harbors created thereby. The words "will," "may," "could,"

"expect," "anticipate," "believes," "intends," "should," "plans,"

"estimates," "approximate" and similar expressions identify these

forward-looking statements. These forward-looking statements

reflect Origen's current views with respect to future events and

financial performance, but involve known and unknown risks and

uncertainties, both general and specific to the matters discussed

in this press release. These risks and uncertainties may cause

Origen's actual results to be materially different from any future

results expressed or implied by such forward-looking statements.

Such risks and uncertainties include, among others, the foregoing

assumptions and those risks referenced under the headings entitled

"Factors That May Affect Future Results" or "Risk Factors"

contained in Origen's filings with the Securities and Exchange

Commission. The forward-looking statements contained in this press

release speak only as of the date hereof and Origen expressly

disclaims any obligation to provide public updates, revisions or

amendments to any forward- looking statements made herein to

reflect changes in Origen's expectations or future events. About

Origen Financial, Inc. Origen is an internally managed and

internally advised company that has elected to be taxed as a real

estate investment trust. Origen is based in Southfield, Michigan.

ORGN-E For more information about Origen, please visit

http://www.origenfinancial.com/. Financial Tables Follow ... ORIGEN

FINANCIAL, INC. CONSOLIDATED BALANCE SHEETS (Dollars in thousands)

ASSETS (Unaudited) September 30, December 31, 2008 2007 Assets Cash

and Equivalents $13,852 $10,791 Restricted Cash 14,436 16,290

Investment Securities 9,748 32,393 Loans Receivable 941,046

1,193,916 Servicing Advances - 6,298 Servicing Rights - 2,146

Furniture, Fixtures and Equipment, Net 479 2,974 Repossessed Houses

4,148 4,981 Other Assets 11,904 14,412 Total Assets $995,613

$1,284,201 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities

Warehouse Financing $- $173,072 Securitization Financing 799,836

884,650 Repurchase Agreements - 17,653 Note Payable-Related Party

29,280 14,593 Other Liabilities 46,974 45,848 Total Liabilities

876,090 1,135,816 Equity 119,523 148,385 Total Liabilities and

Equity $995,613 $1,284,201 ORIGEN FINANCIAL, INC. CONSOLIDATED

STATEMENT OF OPERATIONS (Dollars in thousands, except for share

data) (Unaudited) Three Months Ended Nine Months Ended September

30, September 30, 2008 2007 2008 2007 Interest Income Total

Interest Income $23,471 $23,471 $67,896 $66,586 Total Interest

Expense 14,222 15,622 46,739 42,618 Net Interest Income Before Loan

Losses and Impairment 9,249 7,849 21,157 23,968 Provision for Loan

Losses 4,649 2,191 11,021 5,785 Impairment of Purchased Loan Pool

329 - 596 - Net Interest Income After Loan Losses and Impairment

4,271 5,658 9,540 18,183 Non-interest Income (Loss) Servicing

Income - 620 1,303 1,803 Losses on Loans Held for Sale - - (22,377)

- Other 991 201 (3,919) 625 Total Non-interest Income (Loss) 991

821 (24,993) 2,428 Non-interest Expenses Total Personnel 7,254

3,995 16,696 13,046 Total Loan Origination & Servicing 3,252

318 3,871 1,045 State Taxes 96 105 378 327 Total Other Operating

1,452 1,568 5,470 4,692 Total Non-interest Expenses 12,054 5,986

26,415 19,110 Income (Loss) From Continuing Operations Before

Income Taxes (6,792) 493 (41,868) 1,501 Income Tax Expense 12 (17)

75 (17) Income (Loss) From Continuing Operations (6,804) 510

(41,943) 1,518 Income From Discontinued Operations Net of Income

Taxes 5,631 2,320 11,004 5,846 Net Income (Loss) $(1,173) $2,830

$(30,939) $7,364 Weighted Average Common Shares Outstanding, Basic

25,926,149 25,365,778 25,610,227 25,289,680 Weighted Average Common

Shares Outstanding, Diluted 25,926,149 25,431,398 25,610,227

25,382,607 Basic Earnings Per Common Share: Income (Loss) From

Continuing Operations $(0.26) $0.02 $(1.64) $0.06 Income From

Discontinued Operations 0.22 0.09 0.43 0.23 Net Income (Loss)

$(0.04) $0.11 $(1.21) $0.29 DATASOURCE: Origen Financial, Inc.

CONTACT: W. Anderson Geater, Chief Financial Officer of Origen

Financial, Inc., 1-866-4 ORIGEN; or Leslie Loyet of Financial

Relations Board, +1-312-640-6672, , for Origen Financial, Inc. Web

site: http://www.origenfinancial.com/

Copyright

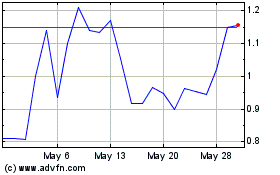

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jun 2024 to Jul 2024

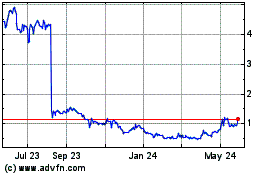

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jul 2023 to Jul 2024