SOUTHFIELD, Mich., July 31 /PRNewswire-FirstCall/ -- Origen

Financial, Inc. (NASDAQ:ORGN), a real estate investment trust that

manages residual interests in securitized manufactured housing loan

portfolios, today announced a net loss of $4.8 million, or $0.19

per share, for the quarter ended June 30, 2008, compared with net

income of $2.8 million, or $0.11 per share, for the quarter ended

June 30, 2007. No dividend was declared by Origen's Board of

Directors for the second quarter 2008. Highlights for Quarter * A

$46.0 million secured financing transaction with a related party

was completed and the proceeds were used to pay off the outstanding

balance of a supplemental advance credit facility with our former

loan warehouse lender, which was then terminated. * New loan

originations for the quarter decreased 97 percent to $3.4 million

compared to $104.6 million for the second quarter 2007, due to the

suspension of loan origination activities for our own account in

the first quarter of 2008. * Loans processed for third parties

totaled $51.5 million for the quarter as compared to $31.9 million

for the year ago quarter, an increase of 61 percent. *

Non-performing loans as a percent of average outstanding loan

principal balances increased to 0.8 percent at June 30, 2008, from

0.6 percent a year ago. * At the annual meeting of our

stockholders, held June 25, 2008, an Asset Disposition and

Management Plan was approved, which included the sale of our loan

servicing business to Green Tree Servicing LLC, pursuant to an

agreement entered into on April 30, 2008. Financial Summary *

Interest income was $20.6 million for the second quarter 2008, a

decrease of 8 percent, primarily due to the sale of approximately

$175.7 million of performing loans in the first quarter of 2008,

and the cessation of new loan originations for Origen's own

account. * Interest expense increased $1.9 million, or 14 percent

to $16.0 million as a result of an increase in the interest rate on

total debt outstanding from 5.9 percent to 7.0 percent. * The

provision for credit losses was $3.3 million for the second quarter

2008 compared with $1.8 million for the same quarter 2007, an

increase of 83 percent. The increase was the result of the aging of

our loan portfolio through its expected peak loss years. *

Non-interest income, after allocations to discontinued operations,

decreased $0.7 million, or 44 percent, from $1.6 million to $0.9

million primarily due to $0.7 million of losses on loans held for

sale. * Non-interest expenses, after allocations to discontinued

operations, were $7.8 million, an increase of $1.2 million, or 18

percent. However, excluding $2.2 million of non-cash accelerated

restricted stock vesting and $1.1 million of severance costs

included in the second quarter 2008, non-interest expenses declined

$2.1 million, or 32 percent, primarily due to significant headcount

reductions. Subsequent Events * The second quarter financial

statements are presented to reflect the approved sale of our loan

servicing operations to Green Tree Servicing LLC as giving rise to

a discontinued operation. Income from discontinued operations net

of income taxes for the second quarter 2008 was $1.0 million as

compared to $1.3 million for the year ago quarter. The sale was

completed on July 1, 2008, and accordingly will be recorded in our

third quarter. Proceeds from the sale were approximately $36.7

million. * Proceeds from the sale of our servicing operations were

used to retire a $15 million loan to a related party and to pay $13

million of a $46 million loan to the same party, with the balance

of the sale proceeds to provide working capital. * On July 31,

2008, a sale of certain assets of our origination and insurance

business was completed to a newly formed venture, the managing

member of which is a wholly-owned affiliate of ManageAmerica, a

nationally recognized provider of services to the manufactured

housing industry. Portfolio Performance At June 30, 2008, loans

more than 60 days delinquent were 1.2 percent of the owned loan

portfolio compared to 0.9 percent at December 31, 2007. The

increase was due to the sale of approximately $175.7 million of

performing loans during the first quarter 2008, the cessation of

new loan originations for our own account, and the aging of our

loan portfolio through its expected peak loss years. Ronald A.

Klein, Origen's Chief Executive Officer, stated, "During the

quarter our $1 billion loan portfolio continued to perform

exceptionally well, especially in light of the ongoing turmoil in

the residential housing market. As part of the Asset Disposition

and Management Plan adopted by our shareholders we completed the

sales of our loan origination and servicing platforms. We will

continue to manage our loan portfolio to preserve shareholder

value." Earnings Call and Webcast A conference call and webcast

have been scheduled for August 1, 2008, at 11:00 a.m. EST to

discuss second quarter results. The call may be accessed on

Origen's web site at http://www.origenfinancial.com/ or by dialing

877-545-1489. A replay will be available through August 10, 2008 by

dialing 888-203-1112, passcode 9459985. You may also access the

replay on Origen's website for 90 days after the event.

Forward-Looking Statements This press release contains various

"forward-looking statements" within the meaning of the Securities

Act of 1933 and the Securities Exchange Act of 1934, and Origen

intends that such forward-looking statements will be subject to the

safe harbors created thereby. The words "will," "may," "could,"

"expect," "anticipate," "believes," "intends," "should," "plans,"

"estimates," "approximate" and similar expressions identify these

forward-looking statements. These forward-looking statements

reflect Origen's current views with respect to future events and

financial performance, but involve known and unknown risks and

uncertainties, both general and specific to the matters discussed

in this press release. These risks and uncertainties may cause

Origen's actual results to be materially different from any future

results expressed or implied by such forward-looking statements.

Such risks and uncertainties include, among others, the foregoing

assumptions and those risks referenced under the headings entitled

"Factors That May Affect Future Results" or "Risk Factors"

contained in Origen's filings with the Securities and Exchange

Commission. The forward-looking statements contained in this press

release speak only as of the date hereof and Origen expressly

disclaims any obligation to provide public updates, revisions or

amendments to any forward- looking statements made herein to

reflect changes in Origen's expectations or future events.

ORGN-E,ORGN-D,ORGN-G About Origen Financial, Inc. Origen is an

internally managed and internally advised company that has elected

to be taxed as a real estate investment trust. Origen is based in

Southfield, Michigan. For more information about Origen, please

visit http://www.origenfinancial.com/. Financial Tables Follow ...

ORIGEN FINANCIAL, INC. CONSOLIDATED BALANCE SHEETS (Dollars in

thousands) ASSETS (Unaudited) June 30 December 31, 2008 2007 Assets

Cash and Equivalents $7,773 $10,791 Restricted Cash 15,507 16,290

Investment Securities 9,763 32,393 Loans Receivable 989,267

1,193,916 Furniture, Fixtures and Equipment, Net 994 1,601

Repossessed Houses 5,235 4,981 Assets Held for Sale 8,501 9,817

Other Assets 14,930 14,412 Total Assets $1,051,970 $1,284,201

LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities Warehouse

Financing $- $173,072 Securitization Financing 825,760 884,650

Repurchase Agreements - 17,653 Note Payable-Related Party 60,208

14,593 Other Liabilities 41,420 45,848 Total Liabilities 927,388

1,135,816 Equity 124,582 148,385 Total Liabilities and Equity

$1,051,970 $1,284,201 ORIGEN FINANCIAL, INC. CONSOLIDATED STATEMENT

OF EARNINGS (Dollars in thousands, except for share data)

(Unaudited) Three Months Ended Six Months Ended June 30, June 30,

2008 2007 2008 2007 Interest Income Total Interest Income $20,554

$22,439 $44,425 $43,115 Total Interest Expense 16,043 14,083 32,517

26,996 Net Interest Income Before Loan Losses and Impairment 4,511

8,356 11,908 16,119 Provision for Loan Losses 3,342 1,806 6,372

3,594 Impairment of Purchased Loan Pool 19 - 267 - Net Interest

Income After Loan Losses and Impairment 1,150 6,550 5,269 12,525

Non-interest Income (Loss) Servicing Income 657 1,094 1,305 1,183

Losses on Loans Held for Sale (718) - (22,377) - Other 941 496

(2,395) 1,061 Total Non-interest Income (Loss) 880 1,590 (23,467)

2,244 Non-interest Expenses Total Personnel 5,503 4,557 9,646 9,167

Total Loan Origination & Servicing 268 361 627 731 State Taxes

104 161 293 226 Total Other Operating 1,906 1,535 4,069 3,181 Total

Non-interest Expenses 7,781 6,614 14,635 13,305 Income (Loss) From

Continuing Operations Before Income Taxes (5,751) 1,526 (32,833)

1,464 Income Tax Expense 29 - 62 - Income (Loss) From Continuing

Operations (5,780) 1,526 (32,895) 1,464 Income From Discontinued

Operations Net of Income taxes 1,006 1,303 3,129 3,070 Net Income

(Loss) $(4,774) $2,829 $(29,766) $4,534 Weighted Average Common

Shares Outstanding, Basic 25,491,187 25,292,335 25,450,530

25,251,000 Weighted Average Common Shares Outstanding, Diluted

25,491,187 25,423,422 25,450,530 25,357,808 Basic Earnings Per

Common Share: Income (Loss) From Continuing Operations $(0.23)

$0.06 $(1.29) $0.06 Income From Discontinued Operations 0.04 0.05

0.12 0.12 Net Income (Loss) $(0.19) $0.11 $(1.17) $0.18 DATASOURCE:

Origen Financial, Inc. CONTACT: W. Anderson Geater, Chief Financial

Officer of Origen Financial, Inc., 1-866-4-ORIGEN; or Leslie Loyet

of Financial Relations Board, +1-312-640-6672, , for Origen

Financial, Inc. Web site: http://www.origenfinancial.com/

Copyright

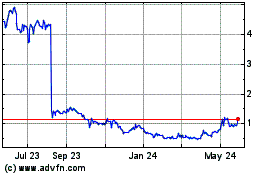

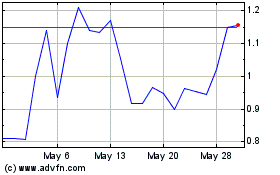

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jul 2023 to Jul 2024