Origen Financial Announces Sale of Unsecuritized Loans; Going Concern Raised on Financial Audit

March 17 2008 - 6:11PM

PR Newswire (US)

SOUTHFIELD, Mich., March 17 /PRNewswire-FirstCall/ -- Origen

Financial, Inc. (NASDAQ:ORGN), a real estate investment trust that

is in the business of originating and servicing manufactured

housing loans, today announced that as previously contemplated in

its press release dated March 13, 2008 and discussed on its

earnings call on March 14, 2008, it has completed the sale of its

unsecuritized loans and used the proceeds to pay off its warehouse

facility. Origen sold loans with an aggregate carrying amount of

approximately $176 million for net proceeds of approximately $155

million. In addition to paying off its warehouse facility and

settling the related hedge, Origen reduced the balance of its

supplemental advance residual facility by $4 million, leaving

approximately $46 million outstanding under this facility, and

retained approximately $1 million of the sale proceeds for

additional working capital. As Origen's warehouse facility is now

paid off, excluding bonds issued against its securitization

portfolio, Origen's remaining indebtedness consists of $46 million

under the supplemental advance facility and $15 million under

related party notes secured by Origen's rights to receive servicing

fees on its loan servicing portfolio. Origen also reported that its

audited financial statements for the fiscal year ended December 31,

2007, which statements were included in its Annual Report on Form

10-K filed with the Securities and Exchange Commission on March 17,

2008, contained an unqualified opinion from its independent

registered public accounting firm, Grant Thornton LLP, which

included an explanatory paragraph raising doubt about Origen's

ability to continue as a going concern. This announcement is made

in compliance with Nasdaq Marketplace Rule 4350(b)(1)(B), which

requires disclosure of receipt of an audit opinion that expresses

doubt about the ability of the company to continue as a going

concern for a reasonable period of time. Origen's continued

operations depend on its ability to meet its existing debt

obligations. Based on the intrinsic value of Origen's assets and

discussions it has had with third parties about possible strategic

alternatives, Origen believes it will be able to raise the

additional funds it needs on a timely basis. However, there is no

assurance that such funds will be available or will be available on

reasonable terms. Forward-Looking Statements This press release

contains various "forward-looking statements" within the meaning of

the Securities Act of 1933 and the Securities Exchange Act of 1934,

and Origen intends that such forward-looking statements will be

subject to the safe harbors created thereby. The words "will,"

"may," "could," "expect," "anticipate," "believes," "intends,"

"should," "plans," "estimates," "approximate" and similar

expressions identify these forward-looking statements. These

forward-looking statements reflect Origen's current views with

respect to future events and financial performance, but involve

known and unknown risks and uncertainties, both general and

specific to the matters discussed in this press release. These

risks and uncertainties may cause Origen's actual results to be

materially different from any future results expressed or implied

by such forward-looking statements. Such risks and uncertainties

include, among others, the foregoing assumptions and those risks

referenced under the headings entitled "Factors That May Affect

Future Results" or "Risk Factors" contained in Origen's filings

with the Securities and Exchange Commission. The forward-looking

statements contained in this press release speak only as of the

date hereof and Origen expressly disclaims any obligation to

provide public updates, revisions or amendments to any

forward-looking statements made herein to reflect changes in

Origen's expectations or future events. ORGN-G About Origen

Financial, Inc. Origen is an internally managed and internally

advised company that has elected to be taxed as a real estate

investment trust. Origen is based in Southfield, Michigan, with

significant operations in Ft. Worth, Texas. For more information

about Origen, please visit http://www.origenfinancial.com/.

DATASOURCE: Origen Financial, Inc. CONTACT: W. Anderson Geater,

Chief Financial Officer of Origen, 1-866-4-ORIGEN; or Leslie Loyet

of Financial Relations Board, +1-312-640-6672, , for Origen Web

site: http://www.origenfinancial.com/

Copyright

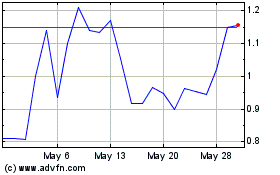

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jun 2024 to Jul 2024

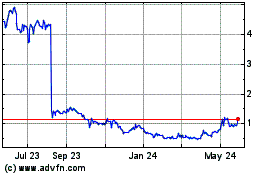

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jul 2023 to Jul 2024