UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File No. 001-35996

ORGANOVO HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

27-1488943 |

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

|

|

11555 Sorrento Valley Rd, Suite 100 San Diego, CA |

|

92121 |

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: 858-224-1000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

ONVO |

The Nasdaq Capital Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “accelerated filer”, “large accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

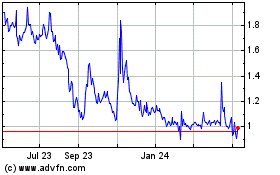

The aggregate market value of the voting and non-voting common equity held by non-affiliates based on the closing stock price as reported on the Nasdaq Capital Market on September 30, 2023, the last trading day of the registrant’s second fiscal quarter, was $10,340,301. For purposes of this computation only, shares of common stock held by each executive officer, director, and 10% or greater stockholders have been excluded in that such persons may be deemed affiliates.

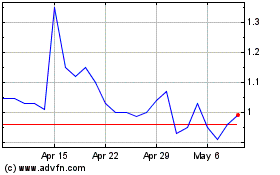

The number of outstanding shares of the registrant’s common stock, as of July 20, 2024 was 14,373,076.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

|

|

|

|

|

Auditor Firm Id: |

89 |

Auditor Name: |

Rosenberg Rich Baker Berman, P.A. |

Auditor Location: |

Somerset, NJ |

EXPLANATORY NOTE

Organovo Holdings, Inc. (“Organovo,” the “Company,” “we,” “our” or “us”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to its Annual Report on Form 10-K for the fiscal year ended March 31, 2024 (“Fiscal 2024”), as filed with the Securities and Exchange Commission (the “SEC”) on May 31, 2024 (the “Original Form 10-K”).

The purpose of this Amendment is solely to disclose the information required in Part III (Items 10, 11, 12, 13 and 14) of Form 10-K, which information was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K. Accordingly, we hereby amend and restate in its entirety Part III of the Original Form 10-K.

In addition, pursuant to the rules of the SEC, Item 15 of Part IV has been amended and restated in its entirety to include the currently dated certifications of the Company’s principal executive officer and principal financial officer required under Section 302 of the Sarbanes-Oxley Act of 2002. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. In addition, this Amendment does not include the certificate under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Amendment.

Except as described above or as otherwise expressly provided by the terms of this Amendment, no other changes have been made to the Original Form 10-K. Except as otherwise indicated herein, this Amendment continues to speak as of the date of the Original Form 10-K, and we have not updated the disclosure contained therein to reflect any events that occurred subsequent to the filing date of the Original Form 10-K. This Amendment should be read in conjunction with the Original Form 10-K and with our filings with the SEC subsequent to the filing date of the Original Form 10-K.

Organovo Holdings, Inc.

Annual Report on Form 10-K

For the Year Ended March 31, 2024

Table of Contents

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Board of Directors Information

Our Board of Directors ("Board") is comprised of six directors. Our Board is divided into three classes, with one class standing for election each year for a three-year term. There are currently two Class I directors, two Class II directors, and two Class III directors.

In addition to the information set forth below regarding our directors and the skills that led our Board to conclude that these individuals should serve as directors, we also believe that all of our directors have a reputation for integrity, honesty and adherence to the highest ethical standards. We believe they each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our Company and to their Board duties.

Information About Our Directors

The following sets forth information regarding the business experience of our current directors:

|

|

|

|

|

|

|

Name |

|

Age(1) |

|

Position(s) |

|

Director Class |

Keith Murphy |

|

52 |

|

Director and Executive Chairman |

|

Class III |

Adam Stern |

|

60 |

|

Director |

|

Class III |

Douglas Jay Cohen |

|

53 |

|

Lead Independent Director |

|

Class II |

David Gobel |

|

71 |

|

Director |

|

Class II |

Alison Tjosvold Milhous |

|

45 |

|

Director |

|

Class I |

Vaidehi Joshi |

|

38 |

|

Director and Director of Discovery Biology |

|

Class I |

__________________

Class I Directors Continuing in Office until the 2024 Annual Meeting of Stockholders

Alison Tjosvold Milhous, Director, has served on our Board since September 2020. She has 20 years of audit and technical accounting experience and is a certified public accountant. She is currently the Vice President of Accounting at Erasca, Inc., a clinical-stage precision oncology company. Prior to joining Erasca, she was an independent consultant assisting public and private companies with accounting and reporting needs primarily within the life sciences and technology industries. Ms. Milhous was previously an audit partner at Grant Thornton LLP from August 2015 through September 2019 and held various positions with increasing responsibility at Grant Thornton from June 2002 as an audit associate through July 2015 as an audit senior manager. She began her career in June 2000 at Arthur Andersen LLP. Ms. Milhous served on the membership committee of Athena San Diego, a professional women’s leadership organization with a STEM focus, from August 2012 through September 2019 and was on the Pinnacle steering committee from September 2013 through April 2015. Ms. Milhous received a Bachelor of Science degree in Business Administration with a dual concentration in Accounting and Finance from California State Polytechnic University, San Luis Obispo.

We believe Ms. Milhous’ extensive financial and accounting experience and her experience providing audit and consulting services to life sciences companies qualify her to serve as a member of our Board.

Vaidehi Joshi, Director, has served on our Board since March 2022 and as our Director of Discovery Biology since April 2022. Ms. Joshi has over a decade of experience in early-stage biotech companies developing unique therapeutic solutions, cutting-edge research products, and cell-based therapies. Since November 2020, Ms. Joshi has served as Director of Discovery Biology at Viscient Biosciences, Inc., where she leads the MASH small molecule drug discovery program as well as 3D model development for other tissue programs. Prior to joining Viscient, Ms. Joshi worked her way up at Organovo, Inc., where she led the pre-clinical research program for the design, development, and manufacture of 3D bioprinted therapeutic human liver tissues targeted towards the treatment of inborn errors of metabolism and genetic diseases. She received her Bachelor of Engineering in Biotechnology at the Rashtreeya Vidyalaya College of Engineering (RVCE) in Bangalore, India and received a Master of Science in Biomedical Engineering from University of California, Los Angeles (UCLA), with a specialization in Tissue Engineering and Biomaterials. While at UCLA, her focus was on primary intestinal epithelial stem cell isolations and 3D cultures for intestinal tissue regeneration for short gut syndrome. Ms. Joshi is an experienced speaker, panelist, and presenter at several biomedical conferences both in the U.S and internationally. Ms. Joshi has co-authored several published peer reviewed articles, and is an inventor on multiple Organovo patents and patent applications.

We believe Ms. Joshi’s extensive scientific background, previous experience in the biotechnology field, and her educational experience qualify her to serve as a member of our Board.

Class II Directors Continuing in Office Until the 2025 Annual Meeting of Stockholders

Douglas Jay Cohen, Lead Independent Director, has served on our Board since September 2020 and has served as our Lead Independent Director since September 2022. He has served as president and Chief Executive Officer of IR Medtek LLC since January 2019, a medical device company developing a non-invasive probe for cancer detection by primary care physicians using a technology licensed from the Ohio State University. Prior to IR Medtek, Mr. Cohen served as President and Chief Executive Officer of Beacon Street Innovations, an advanced technology printing company from September 2016 to present. From January 1994 to September 2016, Mr. Cohen served as Vice President of Operations and Engineering at Screen Machine Industries, an industrial and construction heavy equipment manufacturer. As an active investor in startup companies, Mr. Cohen has invested in more than 20 biotech startups in the past 10 years, including investing in Organovo in 2013 and maintaining a position in the company ever since. Mr. Cohen received a B.S. from the Massachusetts Institute of Technology.

We believe Mr. Cohen’s experience in the life sciences industry, his experience in managing emerging growth companies and his experience in developing business strategies qualifies him to serve as a member of our Board.

David Gobel, Director, has served on our Board since September 2020. He has served as Chief Executive Officer of Methuselah Fund LLC since December 2016 and as Chief Executive Officer of Methuselah Foundation since September 2001, promoting increasing the healthy human lifespan by various means including: performance prizes, targeted grant making, education, and the creation/funding of biotech startups. Mr. Gobel became Chief Venture Strategist at Transportation Security Administration from January 2009 until March 2013, where he was responsible for strategic planning, innovation management and creation of a novel Venture Capital capability for TSA and then Department of Homeland Security by partnering with In-Q-Tel. Mr. Gobel was a member of the board of Volumetric Biotechnologies, a company that focuses on the development of bioholographic human tissue printing, from April 2018 to January 2020. Since July 2018, Mr. Gobel served as member of the board for Turn Bio, and since May 2020 as chairman of the board of Turn Bio. Mr. Gobel served as a board member of Leucadia Therapeutics from October 2015 to August 2022, and as an independent founding board member of Oisin Therapeutics since December 2014.

We believe Mr. Gobel’s previous services as chief executive officer for other biotechnology companies, his experience and expertise with human tissue printing companies and his extensive board experience qualify him to serve as a member of our Board.

Class III Directors Continuing in Office Until the 2026 Annual Meeting of Stockholders

Keith Murphy, Director and Executive Chairman, re-joined our Board in July 2020 and has served as our Executive Chairman since September 2020. Mr. Murphy is the Chief Executive Officer and Chairman of Viscient Biosciences, Inc. (“Viscient”), a private company that he founded in 2017 that is focused on drug discovery and development utilizing 3D tissue technology and multi-omics (genomics, transcriptomics, metabolomics). Mr. Murphy previously served as the President and Chief Executive Officer of Organovo from February 2012 through April 2017, and as Chairman from February 2012 through August 2017. Mr. Murphy also previously served as President, Chief Executive Officer, and Chairman of Organovo, Inc., Organovo’s primary operating company prior to its going-public transaction, from August 2007 to February 2012. Prior to founding Organovo, Mr. Murphy served in various roles at Amgen, Inc. from August 1997 to July 2007 including as Global Operations Leader for the osteoporosis/bone cancer drug Prolia/Xgeva (denosumab). Prior to joining Amgen, Mr. Murphy served at Alkermes, Inc., a biotechnology company, from July 1993 to July 1997, where he played a role on the development team for their first approved product, Nutropin (hGH) Depot. Mr. Murphy served as a member of the board of directors of Kintara Therapeutics, Inc. from August 2020 to February 2022, and served on its compensation committee and nominating and corporate governance committee. He holds a B.S. in Chemical Engineering from MIT and is an alumnus of the UCLA Anderson School of Management.

We believe Mr. Murphy’s previous experience in the biotechnology field, especially in developing novel products, his experience and expertise with our 3D bioprinting technology and product development opportunities and strategy, and his educational experience qualify him to be a member of our Board.

Adam Stern, Director, re-joined our Board in July 2020. Mr. Stern is currently the Chief Executive Officer of SternAegis Ventures, the private equity group at Aegis Capital Corp. responsible for venture capital and private equity financing, and has been the Head of Private Equity Banking at Aegis Capital Corp., a full-service investment banking firm, since December 2012. Prior to SternAegis, Mr. Stern served as Senior Managing Director at Spencer Trask Ventures, Inc., a private equity and venture firm, from 1997 to 2012, where he managed the structured finance group focusing primarily on technology and life sciences companies. From 1989 to 1997, Mr. Stern was at Josephthal & Co., Inc., Members of the New York Stock Exchange, where he served as Head of Private Equity and Managing Director. He has been a FINRA licensed securities broker since 1987 and a Registered General Securities Principal since

1991. Mr. Stern previously served as a director of Organovo from February 2012 to June 2013. Mr. Stern is a current director at DarioHealth Corp. (Nasdaq: DRIO), privately held Amplifica Holdings, Group, Inc., and Aerami Therapeutics Holdings Inc. Mr. Stern is a former director of Adgero Biopharmaceuticals Holdings, Matinas BioPharma Holdings, Inc. (NYSE: MTNB), Hydrofarm Holdings Group Inc. (Nasdaq: HYFM), InVivo Therapeutics, Inc. (Nasdaq: NVIV) and PROLOR Biotech prior to its sale in 2013 to Opko Health, Inc. (Nasdaq: OPK). Mr. Stern graduated with a Bachelor of Arts degree from the University of South Florida in 1987.

We believe Mr. Stern’s extensive experience in corporate finance, his expertise in the life sciences industries and his previous experience as a member of our Board qualify him to be a member of our Board.

No Family Relationships

There are no family relationships between any of our officers and directors.

Executive Officers

The following persons are our executive officers and hold the positions set forth opposite their names as of July 25, 2024:

|

|

|

|

|

Name |

|

Age |

|

Position |

Keith Murphy |

|

52 |

|

Executive Chairman |

Thomas Hess |

|

60 |

|

President and Chief Financial Officer |

See the section entitled “Board of Directors Information”, above, for a description of the business experience and educational background of Mr. Murphy.

Thomas Hess, President and Chief Financial Officer, joined us in October 2021. Mr. Hess is currently employed by Danforth Advisors, LLC (“Danforth”), a professional financial consulting services firm. He has over twenty years of experience and has been with Danforth since September 2021. Mr. Hess recently served as Chief Financial Officer and Senior Vice President of Finance of Genomind, Inc., until his retirement in May 2021. From September 2011 until its sale in April 2014, Mr. Hess served as Chief Financial Officer and Executive Vice President of Finance of The Keane Organization. Mr. Hess also previously served in various other capacities including, but not limited to, Chief Financial Officer and Senior Vice President of Yaupon Therapeutics, Inc.; Chief Financial Officer and Vice President, Finance of Adolor Corporation; Corporate Controller of Vicuron Pharmaceuticals, Inc.; and Senior Manager, Accounting and Audit of KPMG. Mr. Hess received his B.S. in accounting from The Pennsylvania State University and his MBA from Katz Graduate School of Business, University of Pittsburgh and is a Certified Public Accountant in the State of Pennsylvania. He currently serves on the Alumni Council of Penn State.

Code of Business Conduct

We have adopted the Organovo Holdings, Inc. Code of Business Conduct (the “Code of Business Conduct”) that applies to all of our officers, directors, employees and consultants. Among other matters, our Code of Business Conduct is designed to deter unlawful or unethical behavior and to promote the following:

•Prohibiting conflicts of interest (including protecting corporate opportunities);

•Protecting our confidential and proprietary information and that of our customers and vendors;

•Treating our employees, customers, suppliers and competitors fairly;

•Encouraging full, fair, accurate, timely and understandable disclosure;

•Protecting and properly using company assets;

•Conducting research activities with honesty, objectivity, transparency and accountability;

•Complying with laws, rules and regulations (including insider trading laws); and

•Encouraging the reporting of any unlawful or unethical behavior.

Any waiver of the Code of Business Conduct for our executive officers, directors or employees may be made only by our Nominating and Corporate Governance Committee and will be promptly disclosed on our website. We have posted a copy of our Code of Business Conduct, and intend to post amendments to this code, on our website as permitted under SEC rules and regulations. The full text of our Code of Business Conduct is available on our website at www.organovo.com.

Audit Committee. Our Audit Committee currently consists of Ms. Milhous (Chair), Mr. Cohen and Mr. Stern. The functions of the Audit Committee include the retention of our independent registered public accounting firm, reviewing and approving the planned

scope, proposed fee arrangements and results of the Company’s annual audit, reviewing the adequacy of the Company’s accounting and financial controls and reviewing the independence of the Company’s independent registered public accounting firm. The Board has determined that each member of the Audit Committee is an “independent director” under the Nasdaq listing standards, is financially literate under Nasdaq listing standards, and at least one member has financial sophistication under Nasdaq listing standards. The Board has also determined that Ms. Milhous is an “audit committee financial expert” within the applicable definition of the SEC. The Audit Committee is governed by a written charter approved by the Board, a copy of which is available on our website at www.organovo.com.

Consideration of Director Nominees

General. In evaluating nominees for membership on our Board, our Nominating and Corporate Governance Committee applies the Board membership criteria set forth in our Corporate Governance Guidelines. Under these criteria, the Nominating and Corporate Governance Committee takes into account many factors, including an individual’s business experience and skills (including skills in core areas such as operations, management, technology, relevant industry knowledge (e.g., research tools, contract research services, therapeutics, drug discovery, reimbursement, medical/surgical), accounting and finance, regulatory matters and clinical trials, leadership, strategic planning and international markets), independence, judgment, professional reputation, integrity and ability to represent the best interests of the Company and its stockholders. In addition, the Nominating and Corporate Governance Committee will consider the ability of the nominee to commit sufficient time and attention to the activities of the Board, as well as the absence of any potential conflicts with the Company’s interests. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The Board does not have a formal policy with respect to diversity of nominees. Rather, our Nominating and Corporate Governance Committee considers these Board membership criteria as a whole and seeks to achieve diversity of occupational and personal backgrounds on the Board. Our Board will be responsible for selecting candidates for election as directors based on the recommendation of the Nominating and Corporate Governance Committee.

Our Nominating and Corporate Governance Committee regularly assesses the appropriate size of our Board, and whether any vacancies on our Board are expected due to retirement or other reasons. In the event that vacancies are anticipated, or otherwise arise, the Committee will consider various potential nominees who may come to the attention of the Committee through current Board members, professional search firms, stockholders or other persons. Each potential nominee brought to the attention of the Committee, regardless of who recommended such potential nominee, is considered on the basis of the criteria set forth in our Corporate Governance Guidelines.

Stockholder Nominees. The Nominating and Corporate Governance Committee will review a reasonable number of candidates for director recommended by a single stockholder who has held more than 1.0% of our common stock for more than one year and who satisfies the notice, information and consent provisions set forth in our Bylaws and Rule 14a-19 of the Exchange Act (“Rule 14a-19”). The Board will use the same evaluation criteria and process for director nominees recommended by stockholders as it uses for other director nominees. A stockholder wishing to formally nominate an individual for election to the Board must do so by following the procedures described in the Bylaws and Rule 14a-19.

Item 11. Executive Compensation.

The following discussion is designed to provide our stockholders with an understanding of our compensation philosophy and objectives as well as an overview of the analysis that our Compensation Committee performed in setting the compensation of our executive officers for Fiscal 2024 (i.e., the period from April 1, 2023 to March 31, 2024).

This discussion summarizes the Compensation Committee’s determination of how and why, in addition to what, compensation actions were taken for our named executive officers, as follows:

•Keith Murphy, our Executive Chairman and Principal Executive Officer;

•Thomas Hess, our Chief Financial Officer;

•Thomas Jurgensen, our former General Counsel and Corporate Secretary(1); and

•Jeffrey Miner, our former Chief Scientific Officer(2).

(1)Mr. Jurgensen’s employment with the Company was terminated as of August 25, 2023 in connection with Company’s reduction in force announced on August 18, 2023.

(2)Dr. Miner’s employment with the Company was terminated as of August 25, 2023 in connection with Company’s reduction in force announced on August 18, 2023.

Other than Mr. Murphy, Mr. Hess was the only executive officer serving at the end of Fiscal 2024. These four individuals are collectively referred to in this Annual Report as our “named executive officers”.

Recent “Say-on-Pay” Votes

Our recent stockholder advisory votes, commonly referred to as a “Say-on-Pay” vote, to approve the compensation of our named executive officers for Fiscal 2023 (i.e., the period from April 1, 2022 to March 31, 2023) was approved by our stockholders, with approximately 85% of stockholder votes cast in favor of the proposal.

During Fiscal 2024, our Executive Chairman, former General Counsel, and Chief Financial Officer maintained significant stockholder engagement efforts to monitor how our investors vote, obtain their views on key corporate governance and disclosure matters and determine how best to respond to feedback each year going forward. Specifically, we reached out to our stockholders representing over 95% of our institutional stock holdings multiple times. None of the stockholders indicated a need or desire to engage with the Company to discuss or express any concerns.

Going forward, we plan to continue to:

•at least annually, reach out to institutional stockholders representing a majority of the shares held by our institutional stockholders; and

•invite them to engage and participate in calls to discuss our executive compensation programs, their feedback and questions and how we may best address them.

One or more members of executive management are expected to be active participants on all such calls, as will one or more members of our Compensation Committee. All such feedback will be shared with our Board.

In evaluating potential changes to our executive compensation programs’ structure and disclosure, the Compensation Committee will closely examine, and aim to understand further, our stockholders’ feedback, including any common themes from our stockholders’ feedback. The Compensation Committee will also seek the advice of independent compensation consultants with respect to the design of our executive compensation program.

Compensation Philosophy and Objectives

Our executive compensation program focuses on creating alignment between our stockholders and executive officers by including both performance- and incentive-based compensation elements. Our compensation package also combines both short- and long-term components (cash and equity, respectively) at the levels the Compensation Committee determined to be appropriate to motivate, reward, and retain our executive officers. Our executive compensation program is designed to achieve the following key objectives:

•Attract, retain, and reward talented executives and motivate them to contribute to the Company’s success and to build long-term stockholder value;

•Establish financial incentives for executives to achieve our key financial, operational, and strategic goals;

•Enhance the relationship between executive pay and stockholder value by utilizing long-term equity incentives; and

•Recognize and reward executives for superior performance.

Use of Market Data and Benchmarking

The Compensation Committee endeavors to set compensation at competitive levels. In order to do this, the Compensation Committee compares our compensation packages with the packages offered by other peer companies that are similarly situated, and with which we compete for talent. Selection criteria includes:

•Industry, specifically biotechnology and medical research,

•Company focus, with an emphasis on technology platforms,

•Stage of leading drug candidate, with an emphasis on Phase II/III,

•Market capitalization, targeting less than $100 million,

•Number of employees, targeting less than 50 employees, and

•Location, specifically nationwide.

For Fiscal 2024, the Compensation Committee engaged Anderson, an independent compensation consultant, as the Compensation Committee’s advisor reporting directly to the chair of the Compensation Committee. The Compensation Committee determined that no conflict of interest exists that would preclude Anderson from serving as an independent consultant to the Compensation Committee.

The Compensation Committee requested Anderson conduct a review and analysis of our executive compensation programs as compared against competitive benchmarks. This included a benchmarking analysis against prevailing market practices of a peer group of comparable companies approved by the Compensation Committee and broader industry trends and benchmarks. The analysis included a review of the “Total Direct Compensation” (which includes salary, cash incentives, and equity awards) of our executive officers, and was based on an assessment of market trends covering available public information as well as proprietary information provided by Anderson.

For Fiscal 2024, based on recommendations from Anderson, our Compensation Committee determined that our peer group should be modified to better reflect our current market valuation as well as the growing importance of our therapeutics program to our overall business model. With input from Anderson, our Compensation Committee added a group of companies focused on technology platforms, with comparable size, revenues, market valuations, and stage of leading drug candidate. Our Compensation Committee also replaced some of the companies previously included in our peer group because their market valuations had grown too high for direct comparison to our Company, and/or their business focus had become less relevant for direct comparison to our Company. Our Compensation Committee then used the compensation data from this revised peer group in setting executive compensation for Fiscal 2024.

The peer group for Fiscal 2024 included:

|

|

|

Aceragen* |

Cohbar Inc.* |

Onconova Therapeutics, Inc. |

Aligos Therapeutics, Inc.* |

Fresh Tracks Therapeutics Inc.* |

OncoSec Medical Incorporated |

Aprea Therapeutics, Inc. |

Galectin Therapeutics Inc.* |

Pulmatrix, Inc. |

aTyr Pharma, Inc. |

Galmed Pharmaceuticals Ltd.* |

Regulus Therapeutics Inc. |

Ayala Pharmaceuticals* |

Hepion Pharmaceuticals, Inc.* |

Seelos Therapeutics, Inc. |

Bellicum Pharmaceuticals, Inc. |

Imunon, Inc.* |

Soligenix, Inc. |

Capricor Therapeutics, Inc. |

LadRx Corp* |

Theriva Biologics, Inc.* |

* Indicates addition to peer group from Fiscal 2023.

Determination of Executive Compensation

In addition to peer group data, the Compensation Committee considered relevant publicly available market data and surveys and the compensation reports it received from Anderson. The Compensation Committee also reviewed and considered the compensation recommendations of our Executive Chairman, the Company’s overall performance during Fiscal 2024, the Company’s financial status and operating runway, each executive officer’s responsibilities and contribution to the Company’s achievement of the Fiscal 2024 corporate goals, and each executive officer’s individual performance during Fiscal 2024. With respect to new hires, our

Compensation Committee considered the executive officer’s background and historical compensation in lieu of prior year performance in addition to benchmark data for the newly hired executive’s position.

Commitment to Good Compensation Governance Practices

In designing our executive compensation program, our Compensation Committee intends to create alignment between our stockholders and executive officers and to implement good compensation governance by:

•Annual Advisory Vote on the Compensation of our Named Executive Officers – We provide our stockholders with the ability to vote annually on the compensation of our named executive officers.

•Independent Compensation Consultant – The Compensation Committee engaged Anderson during Fiscal 2023 to serve as its independent compensation consultant. Anderson did not provide any other services to the Company during the periods it served as a consultant to the Compensation Committee.

•Performance and Incentive Based – Previously, approximately 40% of the Total Direct Compensation our executive officers could earn was performance and incentive based, thereby aligning the interests of our executive officers with our stockholders’ interests. As our current executive officers are retained through consulting firms, neither are eligible for performance based compensation.

•Compensation Risk Assessment – The Compensation Committee oversees and evaluates an annual risk assessment of the Company’s compensation program. The Compensation Committee believes that the performance goals established for incentives do not encourage excessive risk-taking or have the potential to encourage behavior that may have a material adverse effect on the Company.

•Prohibitions on Hedging, Pledging and Margin Activities– Our insider trading policy prohibits hedging transactions by Company employees. Under the policy, all short-term, speculative or hedging transactions in Organovo securities are prohibited by all employees. In addition, the policy specifically prohibits the use of Organovo securities for pledging and margin activities.

•No Single Trigger Change in Control Vesting- We do not provide for the acceleration of vesting solely upon the occurrence of a change in control in our equity awards for our directors and executive officers.

•No Excise Tax Gross Ups – We do not include excise tax gross ups for any change in control payments.

•Director and Executive Officer Stock Ownership Guidelines – We have adopted stock ownership guidelines that require each director and executive officer to accumulate and hold a specified value of our stock within five years of most recently starting employment with us or becoming a director.

The Compensation Committee believes that the program and policies described above demonstrate the Company’s commitment to, and consistent execution of, an effective performance-oriented executive compensation program.

Components of Executive Compensation

The framework established by the Compensation Committee, based on the data provided by Anderson, for our executive compensation program consists of a base salary, performance-based cash incentives and long-term equity-based incentives. The Compensation Committee endeavors to combine these compensation elements to develop a compensation package that provides competitive pay, rewards our executive officers for achieving our commercial, operational and strategic objectives and aligns the interests of our executive officers with those of our stockholders.

Salary. The Compensation Committee has provided, and will continue to provide, our executive officers with a base salary to compensate them for services provided during the fiscal year. In addition to benchmark data from our peer group, our Compensation Committee considers the Company’s overall performance during the prior fiscal year, cash burn, the Company’s financial status and operating profile, each executive officer’s responsibilities and contribution to the achievement of the prior year’s corporate goals, and each executive officer’s individual performance during the prior fiscal year. The evaluations and recommendations proposed by our Executive Chairman are also considered (other than with respect to determining his own compensation). With respect to new hires, the Compensation Committee considers an executive’s background and historical compensation in lieu of prior year performance as well as benchmark data for the new hire’s position. Our Compensation Committee evaluates and sets the base salaries for our executives following annual performance evaluations, as well as upon a promotion or other change in responsibility. Our Compensation Committee expects to continue to utilize these policies going forward.

For Fiscal 2024, the Compensation Committee determined that it was in the best interests of the Company and its stockholders to freeze Mr. Jurgensen’s and Dr. Miner’s salaries for Fiscal 2024 at Fiscal 2023 levels, or $381,600 for Mr. Jurgensen and $238,500 for Dr. Miner.

Pursuant to the terms of our consulting agreement with Multi Dimensional Bio Insight LLC (“MDBI”), a biotechnology consulting firm through which we retain Mr. Murphy, MDBI has the right, on an annual basis, to increase hourly consultant rates by up to 4%. From January 1, 2021 to May 1, 2022, the hourly rate for Mr. Murphy’s services was $375, which was increased to $413 effective May 1, 2022 and remained the same throughout the remainder of Fiscal 2023 and Fiscal 2024. The cash amount paid to MDBI increased from $543,781 for Fiscal 2023 to $657,984 for Fiscal 2024, with approximately a 21% increase in Mr. Murphy’s hours for Fiscal 2024 as compared to Fiscal 2023.

Pursuant to the terms of our consulting agreement with Danforth Advisors, LLC (“Danforth”), a financial consulting firm through which we retain Mr. Hess, Danforth has the right, on an annual basis, to increase hourly consultant rates by up to 4%. From April 1, 2022 to March 31, 2023, the hourly rate for Mr. Hess’ services was $433, which was increased to $450 effective January 1, 2024 and remained the same throughout the remainder of Fiscal 2024. The cash amount paid to Danforth decreased from $269,402 for Fiscal 2023 to $199,322 for Fiscal 2024, with approximately a 29% decrease in Mr. Hess’ hours for Fiscal 2024 as compared to Fiscal 2023.

The base salaries of our named executive officers for Fiscal 2024 as compared to Fiscal 2023 are set forth in the following table:

|

|

|

|

|

|

|

|

|

Name and Title |

|

Fiscal 2024 Base Salary |

|

|

Fiscal 2023 Base Salary |

|

Keith Murphy, Executive Chairman(1) |

|

$ |

657,984 |

|

|

$ |

543,781 |

|

Thomas Hess, Chief Financial Officer(2) |

|

|

199,322 |

|

|

|

269,402 |

|

Thomas Jurgensen, Former General Counsel and Corporate Secretary(3) |

|

|

381,262 |

|

|

|

381,262 |

|

Jeffrey Miner, Former Chief Scientific Officer(4) |

|

|

238,292 |

|

|

|

238,292 |

|

______________________

(1)Mr. Murphy was appointed our Executive Chairman on September 15, 2020. The Company retains Mr. Murphy through MDBI, a biotechnology consulting firm, pursuant to the terms of a consulting agreement, pursuant to which Company has agreed to pay MDBI $375-390 per hour of services provided by Mr. Murphy, with an annual increase in rates by up to 4%. The amounts reported under “Fiscal 2024 Base Salary” and “Fiscal 2023 Base Salary” are comprised of the actual amounts paid to MDBI for its consulting services. Mr. Murphy did not directly receive a base salary from the Company in Fiscal 2024 or Fiscal 2023. Mr. Murphy’s increase in base salary was primarily due to additional time commitment of Mr. Murphy in his consulting role as Executive Chairman of the Company.

(2)Mr. Hess was appointed our Chief Financial Officer on October 6, 2022. The Company retains Mr. Hess through Danforth, a financial consulting firm, pursuant to the terms of a consulting agreement, pursuant to which Company has agreed to pay Danforth $400 per hour of services provided by Mr. Hess, with an annual increase in rates by up to 4%. The amounts reported under “Fiscal 2024 Base Salary” and “Fiscal 2023 Base Salary” are comprised of the actual amounts paid to Danforth for its consulting services. Mr. Hess did not directly receive a base salary from the Company in Fiscal 2024 or Fiscal 2023. Mr. Hess’s decrease in base salary was primarily due to reduced time commitment of Mr. Hess in his consulting role as Chief Financial Officer of the Company.

(3)Mr. Jurgensen’s employment with the Company was terminated as of August 25, 2023 in connection with Company’s reduction in force announced on August 18, 2023.

(4)Dr. Miner’s employment with the Company was terminated as of August 25, 2023 in connection with Company’s reduction in force announced on August 18, 2023

Performance-Based Cash Incentive Awards. Our executive compensation program includes an annual performance-based cash incentive award, which provides our executive officers with an annual cash incentive opportunity as a percentage of their base salaries based upon the achievement of corporate and individual performance goals evaluated and approved by the Compensation Committee. For Fiscal 2024, the Compensation Committee determined that the annual target bonus opportunity expressed as a percentage of base salary for each of Mr. Jurgensen and Dr. Miner should be 40% of each of their respective base salaries. The Company continues to use an objectives and key results goal-setting framework (“OKRs”) used by individuals, teams, and the Company to define measurable goals and track their outcomes, originally developed and implemented by Andrew Grove at Intel. See: http://www.whatmatters.com. Each executive officer was eligible to receive an increase in his target bonus amount based on the achievement of individual and corporate OKRs. For Fiscal 2024, the Compensation Committee did not award bonuses to Mr. Jurgensen or Dr. Miner.

Mr. Murphy is retained through MDBI, a biotechnology consulting firm, pursuant to the terms of a consulting agreement. As such, Mr. Murphy is not eligible to receive a bonus for services provided during the fiscal year.

Mr. Hess is retained through Danforth, a financial consulting firm, pursuant to the terms of a consulting agreement. As such, Mr. Hess is not eligible to receive a bonus for services provided during the fiscal year.

Equity-Based Incentive Awards. In addition to base salaries and annual performance-based cash incentives, the Compensation Committee has provided long-term, equity-based incentive awards to our executive officers. In determining the size and terms of the

awards, the Compensation Committee considered benchmark data from our peer group, publicly available market and survey data and the individual performance of the named executive officers. The Compensation Committee did not grant any awards for Fiscal 2024.

Other Benefits

In order to attract and retain qualified individuals and pay market levels of compensation, we have historically provided, and will continue to provide, our executives with the following benefits:

•Health Insurance – We provide each of our executives and their spouses and children the same health, dental, and vision insurance coverage we make available to our other eligible employees.

•Life and Disability Insurance – We provide each of our executives with the same life and disability insurance as we make available to our other eligible employees.

•Pension Benefits – We do not provide pension arrangements or post-retirement health coverage for our executives or employees. We implemented a 401(k) Plan effective January 1, 2014. We provide a company matching contribution up to 3.5% of compensation for all participants in the 401(k) plan, including our executive officers, to help attract and retain top talent.

•Nonqualified Deferred Compensation – We do not provide any nonqualified defined contribution or other deferred compensation plans to any of our employees.

•Perquisites – We limit the perquisites that we make available to our executive officers. In certain cases, we have reimbursed our executive officers for their relocation expenses on their initial hire.

Severance Arrangements

As of November 10, 2020, the Company implemented a change in control arrangement, which provides that, in the event an executive is terminated in connection with a Change in Control: the executive will receive (a) in the case of our Executive Chairman, 18 months of base salary or consulting fees, as applicable, and (b) in the case of our other executives, 12 months of base salary.

On September 7, 2023, in connection with Mr. Jurgensen’s termination, the Company entered into a Separation Agreement and General Release (the “Jurgensen Separation Agreement”) with Mr. Jurgensen, to be effective as of September 15, 2023. Pursuant to the Jurgensen Separation Agreement, Mr. Jurgensen released any claims against the Company and the Company paid Mr. Jurgensen an aggregate of $345,000 (less applicable federal, state, and local withholdings), in three separate installment payments of $115,000 on or before September 28, 2023, October 16, 2023 and January 5, 2024.

On September 19, 2023, in connection with Dr. Miner’s termination, the Company entered into a Separation Agreement and General Release (the “Miner Separation Agreement”) with Dr. Miner, to be effective as of September 27, 2023. Pursuant to the Miner Separation Agreement, Dr. Miner released any claims against the Company and the Company (i) provided Dr. Miner a consulting contract for a period of six months, pursuant to which the Company paid Dr. Miner an aggregate of $169,250 for his consulting services, and (ii) granted Dr. Miner a stock option to purchase 40,000 shares of common stock of the Company (the “Option”). The Option will vest as follows: 13,000 shares vested immediately upon issuance, 13,500 shares will vest on the one year anniversary of the Miner Separation Agreement and 13,500 shares will vest on the two year anniversary of the Miner Separation Agreement. The exercise price is equal to the closing price of a share of common stock on the date the Option was approved by the Board.

Potential Payments upon Termination or Change in Control

The following table sets forth the amounts payable to each of our named executive officers based on an assumed termination as of March 31, 2024 based upon certain designated events.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Cash Severance ($) |

|

Health and Other Insurance Benefits ($) |

|

Stock Options (Unvested and Accelerated) ($) |

|

Restricted Stock Units (Unvested and Accelerated) ($) |

|

Fiscal Year 2024 Total ($) |

|

Keith Murphy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination in connection with a Change in Control |

|

$ |

1,288,560 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

1,288,560 |

|

Thomas Hess |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination in connection with a Change in Control |

|

$ |

936,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

936,000 |

|

Thomas Jurgensen |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination in connection with a Change in Control(1) |

|

$ |

345,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

345,000 |

|

Jeffrey Miner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination in connection with a Change in Control(2) |

|

$ |

169,250 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

169,250 |

|

(1)Mr. Jurgensen’s employment was terminated as of August 25, 2023. Pursuant to the Jurgensen Separation Agreement, the Company paid Mr. Jurgensen an aggregate of $345,000.

(2)Dr. Miner’s employment was terminated as of August 25, 2023. Pursuant to the Miner Separation Agreement, for his consulting services, the Company paid Dr. Miner an aggregate of $169,250, and granted Dr. Miner a stock option to purchase 40,000 shares of common stock of the Company (the “Option”). The Option vests as follows: 13,000 shares vested immediately upon issuance, 13,500 shares will vest on the one year anniversary of the Miner Separation Agreement and 13,500 shares will vest on the two year anniversary of the Miner Separation Agreement.

Death or Disability Benefits

The outstanding equity awards held by our executive officers provide such executive officers with accelerated vesting if the executive officer terminates services with the Company as a result of death or disability. In order for an equity award to be eligible for accelerated vesting, the executive officer’s death or disability must occur more than 90 days after the date the equity award was granted. With respect to performance-based equity awards, an executive officer will vest at target levels upon the executive officer’s death or disability.

Summary Compensation Table

The following table summarizes the total compensation paid to or earned by each named executive officer for Fiscal 2024 and Fiscal 2023.

|

|

|

|

|

|

|

|

|

Name and Principal Position |

Year or Period |

Salary

($) |

Bonus ($) |

Stock Awards

($) |

Option Awards

($)(1) |

Non-Equity Incentive Plan Compensation

($)(2) |

All Other Compensation

($) |

Total

($) |

Keith Murphy(3) Executive Chairman |

2024 |

657,984 |

— |

— |

— |

— |

23,152(4) |

681,136 |

2023 |

543,781 |

— |

— |

73,921 |

— |

3,746(4) |

621,448 |

Thomas Hess(5) Chief Financial Officer |

2024 |

199,322 |

— |

— |

— |

— |

— |

199,322 |

Thomas Jurgensen Former General Counsel and

Corporate Secretary |

2024 |

161,446 |

— |

— |

— |

— |

348,454(6) |

509,900 |

2023 |

381,263 |

— |

— |

73,921 |

— |

10,790(7) |

465,974 |

Jeffrey Miner Former Chief Scientific Officer |

2024 |

100,904 |

— |

— |

46,337(8) |

— |

172,790(9) |

320,031 |

2023 |

238,292 |

— |

— |

73,921 |

— |

3,540(7) |

315,753 |

______________________

(1)These amounts represent the grant date fair value of time-based stock option awards granted by the Company during the periods presented, determined in accordance with FASB ASC Topic 718. All awards are amortized over the vesting life of the award. For the assumptions used in our valuations, see “Note 7 – Stockholders’ Equity” of the Notes to Consolidated Financial Statements included elsewhere in this Annual Report.

(2)Includes amounts paid under the Company’s Performance-Based Cash Incentive Award program based on the achievement of corporate and individual performance goals established and measured by the Compensation Committee.

(3)Mr. Murphy was appointed our Executive Chairman on September 15, 2020. The amounts reported under “Salary” are comprised of the amounts paid to MDBI for its consulting services. Mr. Murphy did not receive a base salary from the Company in Fiscal 2024 or Fiscal 2023. Mr. Murphy also received compensation for services as a member of the Board, which is included in the section entitled “Director Compensation Table” on page 12 of this Amendment.

(4)This amount includes $14,777 for expense reimbursements, $1,775 for administrative services and $6,600 for office rent in Fiscal 2024 and $1,996 for expense reimbursements, $1,200 for administrative services and $550 for office rent in Fiscal 2023.

(5)Mr. Hess was appointed our Chief Financial Officer on October 6, 2022. The amounts reported under “Salary” are comprised of the amounts paid to Danforth for its consulting services. Mr. Hess did not receive a base salary from the Company in Fiscal 2024. Mr. Hess’ compensation for Fiscal 2023 has been omitted from this table as Mr. Hess was not a named executive officer for Fiscal 2023.

(6)Pursuant to the Separation Agreement and General Release entered into on September 7, 2023 with Mr. Jurgensen, the Company agreed to pay Mr. Jurgensen an aggregate of $345,000. In addition, this amount includes $3,454 in matching contributions to the 401(k) Plan for Fiscal 2024. The formula for determining the matching contributions is the same for named executive officers as it is for all salaried employees (and are subject to the same statutory maximum). Excludes payments made for the reimbursement of medical insurance premiums and life insurance available for all salaried employees. For more information regarding these benefits, see above under “Other Benefits.”

(7)Consists of matching contributions to the 401(k) Plan. The formula for determining the matching contributions is the same for named executive officers as it is for all salaried employees (and are subject to the same statutory maximum). Excludes payments made for the reimbursement of medical insurance premiums and life insurance available for all salaried employees.

(8)Pursuant to the Separation Agreement entered into on September 10, 2023 with Dr. Miner, the Company granted Dr. Miner a stock option to purchase 40,000 shares of common stock, which will vest as follows: 13,000 shares will be vested immediately upon issuance, 13,500 shares will vest on the one year anniversary of the Separation Agreement and 13,500 shares will vest on the two year anniversary of the Separation Agreement.

(9)Pursuant to the Separation Agreement entered into on September 10, 2023 with Dr. Miner, the Company agreed to pay Dr. Miner an aggregate of $169,250 for his consulting services. In addition, this amount includes $3,540 in matching contributions to the 401(k) Plan for Fiscal 2024. The formula for determining the matching contributions is the same for named executive officers as it is for all salaried employees (and are subject to the same statutory maximum). Excludes payments made for the reimbursement of medical insurance premiums and life insurance available for all salaried employees. For more information regarding these benefits, see above under “Other Benefits.”

Outstanding Equity Awards at Fiscal Year End

The following table shows certain information regarding outstanding equity awards as of March 31, 2024 for our named executive officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards |

|

|

Stock Awards |

Name |

|

No. of Securities Underlying Unexercised Options (#) Exercisable |

|

|

No. of Securities Underlying Unexercised Options (#) Unexercisable |

|

|

Option Exercise Price ($) |

|

|

Option Expiration Date |

|

|

No. of Shares or Units of Stock That Have Not Vested (#) |

|

Market Value of Shares or Units of Stock That Have Not Vested ($) |

|

Keith Murphy |

|

15,000 |

(1) |

|

|

25,000 |

|

|

$ |

2.36 |

|

|

8/30/2032 |

|

|

5,000 |

(2) |

$ |

5,150 |

|

Jeffrey Miner |

|

13,000 |

(3) |

|

|

27,000 |

|

|

|

7.64 |

|

|

11/13/2033 |

|

|

|

|

|

|

|

______________________

(1)The option shares vest in 16 equal quarterly installments beginning August 31, 2022.

(2)25% of the shares subject to the restricted stock unit vested on March 8, 2022 and the remaining shares vest in 12 equal quarterly installments thereafter.

(3)Pursuant to the Separation Agreement entered into on September 10, 2023 with Dr. Miner, the Company granted Dr. Miner a stock option to purchase 40,000 shares of common stock, which will vest as follows: 13,000 shares will be vested immediately upon issuance beginning November 13, 2023, 13,500 shares will vest on the one year anniversary of the Separation Agreement and 13,500 shares will vest on the two year anniversary of the Separation Agreement.

As of March 31, 2024, neither Mr. Hess nor Mr. Jurgensen held any outstanding equity awards.

Director Compensation

Our directors play a critical role in guiding our strategic direction and overseeing the management of our Company. Ongoing developments in corporate governance and financial reporting have resulted in an increased demand for such highly qualified and productive public company directors. The many responsibilities and risks and the substantial time commitment of being a director of a public company require that we provide adequate incentives for our directors’ continued performance by paying compensation commensurate with our directors’ workload. Our directors are compensated based upon their respective levels of Board participation and responsibilities, including service on Board committees.

Our director compensation is overseen by the Compensation Committee, which makes recommendations to our Board on the appropriate structure for our director compensation program and the appropriate amount of compensation. Our Board is responsible for final approval of our director compensation program and the compensation paid to our directors.

In connection with establishing our director compensation for the fiscal year ended March 31, 2024 (“Fiscal 2024”), the Compensation Committee retained Anderson Pay Advisors (“Anderson”) as its independent compensation consultant. With the assistance of Anderson, the Board and Compensation Committee conducted a formal review of our director compensation and incentive programs relative to the same peer group used in benchmarking the compensation for our executive officers.

Fiscal 2024 Director Compensation Framework

For Fiscal 2024, our Director Compensation Framework provided to both non-employee and employee directors annual cash retainers for Board service and for service as the chair or member of one of the standing Board committees. Our directors are not entitled to any Board meeting fees or Board committee meeting fees.

Annual Cash Retainers. For Fiscal 2024, each of our directors was eligible to receive an annual cash retainer of $66,300 for Board membership.

In addition, each of our directors are eligible to receive the applicable annual retainers set forth below for serving as committee chairs and for service as a member of a Board committee, with total cash compensation for each director not to exceed $105,000 per fiscal year:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position |

|

Audit Committee |

|

Compensation Committee |

|

Nominating and Corporate Governance Committee |

|

Science and Technology Committee |

|

Committee Chair |

|

$ |

25,500 |

|

$ |

25,500 |

|

$ |

25,500 |

|

$ |

25,500 |

|

Committee Member (excluding Chair) |

|

$ |

15,300 |

|

$ |

15,300 |

|

$ |

15,300 |

|

$ |

15,300 |

|

No additional meeting fees were paid to our directors for Fiscal 2024.

Equity Awards. In addition, in November 2023, each director received a restricted stock unit award with respect to 19,607 shares of common stock (a value of approximately $27,200), which will vest in full on the earlier of (i) November 17, 2024 or (ii) the date of our next annual meeting of the stockholders, subject to acceleration in the event of a change of control.

Reimbursement. Our directors are entitled to reimbursement for their reasonable travel and lodging expenses for attending Board and Board committee meetings.

Director Compensation Table

The following table sets forth the compensation earned and paid to each member of our Board for service as a director during Fiscal 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Fees Earned or Paid in Cash ($) |

|

Stock Awards ($)(1) |

|

Option Awards ($) |

|

|

All Other Compensation ($) |

|

Total ($) |

|

Douglas Jay Cohen |

|

$ |

105,000 |

|

$ |

27,254 |

|

$ |

— |

|

|

$ |

— |

|

$ |

132,254 |

|

David Gobel |

|

|

105,000 |

|

|

27,254 |

|

|

— |

|

|

|

— |

|

|

132,254 |

|

Alison Tjosvold Milhous |

|

|

105,000 |

|

|

27,254 |

|

|

— |

|

|

|

— |

|

|

132,254 |

|

Adam Stern |

|

|

96,900 |

|

|

27,254 |

|

|

— |

|

|

|

— |

|

|

121,154 |

|

Keith Murphy |

|

|

81,600 |

|

|

27,254 |

|

|

— |

|

|

|

— |

|

|

108,854 |

(2) |

Vaidehi Joshi |

|

|

91,800 |

|

|

27,254 |

|

|

— |

|

|

|

— |

|

|

119,054 |

|

______________________

(1)These amounts represent the grant date fair value of time-based restricted stock unit awards granted by the Board, determined in accordance with FASB ASC Topic 718. All awards are amortized over the vesting life of the award. For the assumptions used in our valuations, see “Note 7 – Stockholders’ Equity” of our notes to consolidated financial statements included elsewhere in this Annual Report.

(2)Comprised solely of the compensation received by Mr. Murphy for his service as a member of the Board. Mr. Murphy’s additional compensation for Fiscal 2024 is included in the section entitled “Summary Compensation Table” on page 10 of this Amendment.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee has at any time been our employee. None of our executive officers serves, or has served during the last fiscal year, as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or our Compensation Committee.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Security Ownership of Certain Beneficial Owners and Management

The following tables set forth certain information regarding the beneficial ownership of our common stock as of July 1, 2024 by (i) each of our directors and named executive officers (as disclosed in this Annual Report); (ii) all of our current executive officers and directors as a group; and (iii) each holder of more than 5% of our common stock. Unless otherwise indicated in the table or the footnotes to the following table, each person named in the table has sole voting and investment power and such person’s address is c/o Organovo Holdings, Inc., 11555 Sorrento Valley Rd., Suite 100, San Diego, CA 92121.

We determined the number of shares of common stock beneficially owned by each person under rules promulgated by the SEC, based on information obtained from Company records and filings with the SEC on or before July 1, 2024. In cases of holders who are not directors or named executive officers, Schedules 13G or 13D filed with the SEC, as applicable (and, consequently, ownership reflected here), often reflect holdings as of a date prior to July 1, 2024. The information is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and also any shares which the individual or entity had the right to acquire within 60 days of July 1, 2024. These shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person or entity.

Applicable percentages are based on 14,373,076 shares of common stock outstanding as of July 1, 2024, as adjusted as required by the rules promulgated by the SEC. We have deemed shares of our common stock subject to stock options that are currently exercisable or exercisable within 60 days of July 1, 2024, or issuable pursuant to restricted stock units that are subject to vesting conditions expected to occur within 60 days of July 1, 2024, to be outstanding and to be beneficially owned by the person holding the stock option or restricted stock units for the purpose of computing the percentage ownership of that person. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person or entity.

|

|

|

|

|

|

|

|

|

|

Beneficial Ownership(1) |

|

Name of Beneficial Owner |

|

Number of Common Shares |

|

|

|

Percent of Common Shares |

|

Directors and Named Executive Officers |

|

|

|

|

|

|

|

Keith Murphy |

|

119,677 |

|

(2) |

|

* |

|

Douglas Jay Cohen |

|

84,107 |

|

(3) |

|

* |

|

Alison Tjosvold Milhous |

|

72,107 |

|

(4) |

|

* |

|

Adam Stern |

|

72,107 |

|

(4) |

|

* |

|

Vaidehi Joshi |

|

54,428 |

|

(5) |

|

* |

|

David Gobel |

|

52,500 |

|

(6) |

|

* |

|

Jeffrey Miner (7) |

|

13,000 |

|

(6) |

|

* |

|

Thomas Hess |

|

— |

|

|

|

* |

|

Thomas Jurgensen (8) |

|

— |

|

|

|

* |

|

All current executive officers and directors as a group (7 persons) |

|

454,926 |

|

(9) |

|

3.11% |

|

Five Percent Holders |

|

|

|

|

|

|

|

Armistice Capital Master Fund Ltd |

|

1,595,234 |

|

(10) |

|

9.99% |

|

______________________

* Less than one percent.

(1)Beneficial ownership of shares and percentage ownership are determined in accordance with the rules of the SEC. Unless otherwise indicated and subject to community property laws where applicable, the individuals named in the table above have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them.

(2)Represents 102,177 shares of common stock held by Mr. Murphy and 17,500 shares subject to options that are immediately exercisable or exercisable within 60 days of July 1, 2024.

(3)Represents 29,607 shares of common stock held by Mr. Cohen, 2,000 shares held by Mr. Cohen’s children and 52,500 shares subject to options that are immediately exercisable or exercisable within 60 days of July 1, 2024.

(4)Represents 19,607 shares of common stock held and 52,500 shares subject to options that are immediately exercisable or exercisable within 60 days of July 1, 2024.

(5)Represents 19,607 shares of common stock held and 34,821 shares subject to options that are immediately exercisable or exercisable within 60 days of July 1, 2024.

(6)Represents shares subject to options that are immediately exercisable or exercisable within 60 days of July 1, 2024.

(7)Dr. Miner's employment with the Company was terminated as of August 25, 2023 in connection with the Company's reduction in force announced on August 18, 2023.

(8)Mr. Jurgensen's employment with the Company was terminated as of August 25, 2023 in connection with the Company's reduction in force announced on August 18, 2023.

(9)Comprised of shares included under “Directors and Named Executive Officers” other than Dr. Miner and Mr. Jurgensen, as neither is currently an executive officer.

(10)Consists of 1,595,234 shares of common stock issuable upon exercise of a pre-funded warrant (the “Pre-Funded Warrant”), which is currently exercisable, except to the extent such exercise is restricted by a blocker provision which restricts the exercise of such warrant if, as a result of such exercise, the holder, together with its affiliates and any other person whose beneficial ownership of shares of common stock would be aggregated with the holder’s for purposes of Section 13(d) of the Exchange Act would beneficially own in excess of 9.99% of the outstanding shares of common stock,

as such percentage ownership is determined in accordance with the terms of the warrant (the “Beneficial Ownership Limitation”). Excludes (i) 2,025,766 shares of common stock issuable upon exercise of the Pre-Funded Warrant, which is currently exercisable, but such shares have been excluded because the exercise thereof is restricted by the Warrant Beneficial Ownership Limitation and (ii) 6,562,500 shares of common stock issuable upon the exercise of a common warrant, which is currently exercisable, except to the extent such exercise is restricted by a blocker provision which restricts the exercise of such warrant if, as a result of such exercise, the holder, together with its affiliates and any other person whose beneficial ownership of shares of common stock would be aggregated with the holder’s for purposes of Section 13(d) of the Exchange Act would beneficially own in excess of 4.99% of the outstanding shares of common stock, as such percentage ownership is determined in accordance with the terms of the warrant. The reported securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes information about the Company’s equity compensation plans by type as of March 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(C) |

|

|

(A) |

|

|

|

|

Number of |

|

|

Number of |

|

|

|

|

securities available |

|

|

securities to be |

|

(B) |

|

|

for future issuance |

|

|

issued upon |

|

Weighted-average |

|

|

under Equity |

|

|

exercise/vesting |

|

exercise price |

|

|

Compensation Plans |

|

|

of outstanding |

|

of outstanding |

|

|

(excluding securities |

|

|

options, warrants, |

|

options, warrants, |

|

|

reflected in |

Plan category |

|

units and rights |

|

units and rights |

|

|

column (A)) |

Equity compensation plans approved by security holders (1) |

|

770,649 (2) |

|

$ |

4.38 |

|

|

1,686,250 (3) |

Equity compensation plans not approved by security holders (4) |

|

50,000 (5) |

|

$ |

2.75 |

|

|

1,000 (6) |

(1)Includes the 2012 Plan, the 2022 Plan, and the 2023 ESPP.

(2)Includes stock options to purchase 648,007 shares of common stock with a per share weighted-average exercise price of $4.38. Also includes 122,642 restricted stock units with no exercise price.

(3)Includes 45,000 shares of common stock available for purchase under the 2023 ESPP as of March 31, 2024.

(4)Includes the Inducement Plan.

(5)Includes 50,000 stock options with a per share exercise price of $2.75 granted pursuant to the Inducement Plan.

(6)Includes 1,000 shares of common stock reserved for issuance pursuant to the Inducement Plan.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Board Independence

Our shares of common stock are listed for trading on the Nasdaq Capital Market. As a result, our Board utilizes the definition of “independence” as that term is defined by the listing standards of the Nasdaq Capital Market and the rules and regulations of the SEC, including the additional independence requirements for members of our Audit Committee and the Compensation Committee. Our Board considers a director “independent” when the director is not an officer or employee of the Company or its subsidiaries, does not have any relationship which would, or could reasonably appear to, materially interfere with the independent judgment of such director, and the director otherwise meets the independence requirements under the listing standards of the Nasdaq Capital Market and the rules and regulations of the SEC. Our Board has reviewed the materiality of any relationship that each of our directors has with the Company, either directly or indirectly. Based on this review, our Board has affirmatively determined that the following four of our six current directors qualify as “independent” directors: Douglas Jay Cohen, David Gobel, Alison Tjosvold Milhous and Adam Stern. Keith Murphy and Vaidehi Joshi do not qualify as an independent director. Mr. Murphy currently serves as our Executive Chairman and as Chief Executive Officer of Viscient, which has made payments to the Company in sufficient amounts to qualify as related party transactions leading to director non-independence. Please see the section “Certain Relationships and Related Transactions” for additional information. Ms. Joshi is currently our Director of Discovery Biology.

Certain Relationships and Related Transactions