FALSE000101473900010147392025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 26, 2025

OPTION CARE HEALTH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-11993 | 05-0489664 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

3000 Lakeside Dr. Suite 300N, Bannockburn, IL 60015

(Address of principal executive offices)

(312) 940-2443

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | OPCH | Nasdaq Global Select Market |

Item 2.02. Results of Operations and Financial Condition.

On February 26, 2025, Option Care Health, Inc. (the "Company") issued a press release reporting its fourth quarter and full-year 2024 financial results. A copy of the press release is furnished with this Form 8-K and attached hereto as Exhibit 99.1.

The press release includes certain non-GAAP financial measures described therein. Reconciliation between any non-GAAP financial measures presented and the most directly comparable GAAP financial measures is also provided.

The information in this Form 8-K and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Option Care Health, Inc. |

| | |

| | | |

| Date: | February 26, 2025 | By: | /s/ Michael Shapiro |

| | | Michael Shapiro |

| | | Chief Financial Officer |

Exhibit 99.1

OPTION CARE HEALTH REPORTS FINANCIAL RESULTS FOR FOURTH QUARTER AND FULL YEAR 2024

BANNOCKBURN, IL., February 26, 2025 - Option Care Health, Inc. (the “Company” or “Option Care Health”) (Nasdaq: OPCH), the nation’s largest independent provider of home and alternate site infusion services, announced today financial results for the fourth quarter and full year ended December 31, 2024.

Fourth Quarter 2024 Financial Highlights

•Net revenue of $1,346.4 million, up 19.7% compared to $1,124.4 million in the fourth quarter of 2023

•Gross profit of $268.4 million, or 19.9% of net revenue, up 8.6% compared to $247.1 million, or 22.0% of net revenue, in the fourth quarter of 2023

•Net income of $60.1 million, compared to net income of $57.2 million, in the fourth quarter of 2023 and diluted earnings per share of $0.35, up 9.4% compared to diluted earnings per share of $0.32 in the fourth quarter of 2023

•Adjusted net income of $75.5 million, compared to adjusted net income of $66.7 million in the fourth quarter of 2023 and adjusted diluted earnings per share of $0.44, up 15.8% compared to adjusted diluted earnings per share of $0.38 in the fourth quarter of 2023

•Adjusted EBITDA of $121.6 million, up 8.9% compared to $111.6 million in the fourth quarter of 2023

•Cash flow from operations of $36.1 million, down 29.1% compared to cash flow from operations of $51.0 million in the fourth quarter of 2023

•Repurchased approximately $90.0 million of stock in the fourth quarter of 2024

Full Year 2024 Financial Highlights

•Net revenue of $4,998.2 million, up 16.2% compared to $4,302.3 million in full year 2023

•Gross profit of $1,013.0 million, or 20.3% of revenue, up 3.2% compared to $981.2 million, or 22.8% of revenue, in full year 2023

•Net income of $211.8 million, compared to net income of $267.1 million in full year 2023 and diluted earnings per share of $1.23, down 16.9% compared to diluted earnings per share of $1.48, inclusive of the impact from non-operating income, in full year 2023

•Adjusted net income of $272.8 million, compared to adjusted net income of $257.7 million in full year 2023 and adjusted diluted earnings per share of $1.58, up 10.5% compared to adjusted diluted earnings per share of $1.43 in full year 2023

•Adjusted EBITDA of $443.8 million, up 4.4% compared to $425.2 million in full year 2023

•Cash flow from operations of $323.4 million, down 12.9% compared to $371.3 million in full year 2023

John C. Rademacher, Chief Executive Officer, commented, “The Option Care Health team’s execution produced solid financial results in the fourth quarter and full year 2024, demonstrating resilience in a dynamic and challenging period, while continuing to place the patient at the center of everything that we do. I am excited about the road ahead and the opportunity to leverage our capabilities to provide more patients high quality, affordable care, in a setting in which they wish to receive it.”

Full Year 2025 Financial Guidance

For the full year 2025, Option Care Health expects to deliver the following financial results:

•Net revenue of $5.3 billion to $5.5 billion

•Adjusted diluted earnings per share of $1.59 to $1.69

•Adjusted EBITDA of $450 million to $470 million

•Cash flow from operations of at least $320 million

•Effective tax rate of 25% - 27%

•Net interest expense of approximately $55 million to $60 million

Conference Call

Option Care Health will host a conference call to discuss its financial results later today at 8:30 a.m. EST. The conference call can be accessed via a live audio webcast that will be available online at investors.optioncarehealth.com. A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call, at the same web link, and will remain available for approximately 90 days.

About Option Care Health

Option Care Health is the nation’s largest independent provider of home and alternate site infusion services. With over 8,000 team members, including more than 5,000 clinicians, we work compassionately to elevate standards of care for patients with acute and chronic conditions in all 50 states. Through our clinical leadership, expertise and national scale, Option Care Health is reimagining the infusion care experience for patients, customers and teammates. To learn more, please visit our website at optioncarehealth.com.

Investor Contact

| | |

| Mike Shapiro |

| Chief Financial Officer |

| T: (312) 940-2538 |

| mike.shapiro@optioncare.com |

Forward-Looking Statements - Safe Harbor

This press release may contain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,” “expect,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we may make regarding future revenues, future earnings, regulatory developments, market developments, new products and growth strategies, integration activities and the effects of any of the foregoing on our future results of operations or financial conditions.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: changes in laws and regulations applicable to our business model; changes in market conditions and receptivity to our services and offerings; pending and future litigation; potential liability for claims not covered by insurance; and loss of relationships with managed care organizations and other non-governmental third party payers. For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our periodic reports as filed with the SEC.

Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Note Regarding Use of Non-GAAP Financial Measures

In addition to reporting financial information in accordance with generally accepted accounting principles (GAAP), the Company is also reporting Adjusted net income, Adjusted EBITDA and Adjusted earnings per share ("Adjusted EPS"), which are non-GAAP financial measures. These adjusted measures are not measurements of financial performance under GAAP and should not be used in isolation or as a substitute or alternative to net income, earnings per share, or any other performance measure derived in accordance with GAAP, or as a substitute or alternative to cash flow from operating activities or a measure of the Company’s liquidity. In addition, the Company's definitions of Adjusted net income, Adjusted EBITDA, and Adjusted EPS may not be comparable to similarly titled non-GAAP financial measures reported by other companies. As defined by the Company: (i) Adjusted net income represents net income before intangible asset amortization expense, stock-based compensation expense, and restructuring, acquisition, integration and other expenses, net of tax adjustments (ii) Adjusted EBITDA represents net income before net interest expense, income tax expense, depreciation and amortization, stock-based compensation expense, loss on extinguishment of debt, and restructuring, acquisition, integration and other expenses, and (iii) Adjusted earnings per share represents Adjusted net income divided by weighted average common shares outstanding, diluted. As part of restructuring, acquisition, integration and other expenses, the Company may incur significant charges such as the write down of certain long‑lived assets, temporary redundant expenses, professional fees, certain litigation expenses and reserves related to acquired businesses, potential retention and severance costs and potential accelerated payments or termination costs for certain of its contractual obligations. Management believes that these adjusted measures provide useful supplemental information regarding the performance of Option Care Health’s business operations and facilitate comparisons to the Company’s historical operating results. We have not reconciled Adjusted EBITDA or Adjusted diluted earnings per share guidance to net income as management believes creation of this reconciliation would not be practicable due to the uncertainty regarding, and potential variability of, material reconciling items. Full reconciliations of each adjusted measure to the most comparable GAAP financial measure are set forth below.

Schedule 1

OPTION CARE HEALTH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS)(UNAUDITED)

| | | | | | | | | | | |

| December 31, |

| 2024 | | 2023 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 412,565 | | | $ | 343,849 | |

| Accounts receivable, net | 409,733 | | | 377,658 | |

| Inventories | 388,131 | | | 274,004 | |

| Prepaid expenses and other current assets | 112,198 | | | 98,744 | |

| Total current assets | 1,322,627 | | | 1,094,255 | |

| | | |

| NONCURRENT ASSETS: | | | |

| Property and equipment, net | 127,367 | | | 120,630 | |

| Intangible assets, net | 16,993 | | | 20,092 | |

| Referral sources, net | 284,017 | | | 315,304 | |

| Goodwill | 1,540,246 | | | 1,540,246 | |

| Other noncurrent assets | 130,493 | | | 126,508 | |

| Total noncurrent assets | 2,099,116 | | | 2,122,780 | |

| TOTAL ASSETS | $ | 3,421,743 | | | $ | 3,217,035 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 610,779 | | | $ | 426,513 | |

| Other current liabilities | 169,367 | | | 191,796 | |

| Total current liabilities | 780,146 | | | 618,309 | |

| | | |

| NONCURRENT LIABILITIES: | | | |

| Long-term debt, net of discount, deferred financing costs and current portion | 1,104,641 | | | 1,056,650 | |

| Other noncurrent liabilities | 132,718 | | | 120,404 | |

| Total noncurrent liabilities | 1,237,359 | | | 1,177,054 | |

| Total liabilities | 2,017,505 | | | 1,795,363 | |

| | | |

| STOCKHOLDERS' EQUITY | 1,404,238 | | | 1,421,672 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 3,421,743 | | | $ | 3,217,035 | |

Schedule 2

OPTION CARE HEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| NET REVENUE | $ | 1,346,418 | | | $ | 1,124,390 | | | $ | 4,998,202 | | | $ | 4,302,324 | |

| COST OF REVENUE | 1,078,039 | | | 877,267 | | | 3,985,209 | | | 3,321,101 | |

| GROSS PROFIT | 268,379 | | | 247,123 | | | 1,012,993 | | | 981,223 | |

| | | | | | | |

| OPERATING COSTS AND EXPENSES: | | | | | | | |

| Selling, general and administrative expenses | 164,727 | | | 147,783 | | | 630,251 | | | 607,427 | |

| Depreciation and amortization expense | 16,615 | | | 14,784 | | | 60,909 | | | 59,201 | |

| Total operating expenses | 181,342 | | | 162,567 | | | 691,160 | | | 666,628 | |

| OPERATING INCOME | 87,037 | | | 84,556 | | | 321,833 | | | 314,595 | |

| | | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | |

| Interest expense, net | (10,879) | | | (12,432) | | | (49,029) | | | (51,248) | |

| Other, net | 4,891 | | | 6,801 | | | 10,795 | | | 95,395 | |

| Total other (expense) income | (5,988) | | | (5,631) | | | (38,234) | | | 44,147 | |

| | | | | | | |

| INCOME BEFORE INCOME TAXES | 81,049 | | | 78,925 | | | 283,599 | | | 358,742 | |

| INCOME TAX EXPENSE | 20,916 | | | 21,748 | | | 71,776 | | | 91,652 | |

| NET INCOME | $ | 60,133 | | | $ | 57,177 | | | $ | 211,823 | | | $ | 267,090 | |

| | | | | | | |

| Earnings per share, basic | $ | 0.36 | | | $ | 0.32 | | | $ | 1.23 | | | $ | 1.49 | |

| Earnings per share, diluted | $ | 0.35 | | | $ | 0.32 | | | $ | 1.23 | | | $ | 1.48 | |

| | | | | | | |

| Weighted average common shares outstanding, basic | 168,816 | | | 176,055 | | | 171,567 | | | 178,973 | |

| Weighted average common shares outstanding, diluted | 169,980 | | | 177,743 | | | 172,845 | | | 180,375 | |

Schedule 3

OPTION CARE HEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)(UNAUDITED)

| | | | | | | | | | | |

| Year Ended

December 31, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 211,823 | | | $ | 267,090 | |

| Adjustments to reconcile net income to net cash provided by operations: | | | |

| Depreciation and amortization expense | 63,498 | | | 62,200 | |

| Deferred income taxes - net | 12,656 | | | 12,766 | |

| Other non-cash adjustments | 55,661 | | | 50,684 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | (32,075) | | | 224 | |

| Inventories | (114,127) | | | (51,000) | |

| Accounts payable | 183,395 | | | 47,703 | |

| Other | (57,439) | | | (18,372) | |

| Net cash provided by operating activities | 323,392 | | | 371,295 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Acquisition of property and equipment | (35,606) | | | (41,866) | |

| Proceeds from sale of assets | — | | | 3,743 | |

| Business acquisitions, net of cash acquired | — | | | (12,494) | |

| Other investing activities | (864) | | | (5,889) | |

| Net cash used in investing activities | (36,470) | | | (56,506) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from issuance of debt | 49,959 | | | — | |

| Purchase of company stock and related excise taxes | (252,726) | | | (250,261) | |

| Other financing activities | (15,439) | | | (14,865) | |

| Net cash used in financing activities | (218,206) | | | (265,126) | |

| | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | 68,716 | | | 49,663 | |

| Cash and cash equivalents - beginning of the period | 343,849 | | | 294,186 | |

| CASH AND CASH EQUIVALENTS - END OF PERIOD | $ | 412,565 | | | $ | 343,849 | |

Schedule 4

OPTION CARE HEALTH, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP MEASURES

(IN THOUSANDS)(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 60,133 | | | $ | 57,177 | | | $ | 211,823 | | | $ | 267,090 | |

| Interest expense, net | 10,879 | | | 12,432 | | | 49,029 | | | 51,248 | |

| Income tax expense | 20,916 | | | 21,748 | | | 71,776 | | | 91,652 | |

| Depreciation and amortization expense | 17,469 | | | 15,777 | | | 63,498 | | | 62,200 | |

| EBITDA | 109,397 | | | 107,134 | | | 396,126 | | | 472,190 | |

| | | | | | | |

| EBITDA adjustments | | | | | | | |

| Stock-based incentive compensation expense | 8,523 | | | 7,571 | | | 36,143 | | | 30,479 | |

| Loss on extinguishment of debt | — | | | — | | | 377 | | | — | |

| Restructuring, acquisition, integration and other (1) | 3,639 | | | (3,103) | | | 11,143 | | | (77,486) | |

| Adjusted EBITDA | $ | 121,559 | | | $ | 111,602 | | | $ | 443,789 | | | $ | 425,183 | |

| | | | | | | |

| Net income | $ | 60,133 | | | $ | 57,177 | | | $ | 211,823 | | | $ | 267,090 | |

| Intangible asset amortization expense | 8,596 | | | 8,629 | | | 34,405 | | | 34,381 | |

| Stock-based incentive compensation expense | 8,523 | | | 7,571 | | | 36,143 | | | 30,479 | |

| Restructuring, acquisition, integration and other (1) | 3,639 | | | (3,103) | | | 11,143 | | | (77,486) | |

| Total pre-tax adjustments | 20,758 | | | 13,097 | | | 81,691 | | | (12,626) | |

| Tax adjustments (2) | (5,356) | | | (3,615) | | | (20,668) | | | 3,220 | |

| Adjusted net income | $ | 75,535 | | | $ | 66,659 | | | $ | 272,846 | | | $ | 257,684 | |

| | | | | | | |

| Earnings per share, diluted | $ | 0.35 | | | $ | 0.32 | | | $ | 1.23 | | | $ | 1.48 | |

| Adjusted earnings per share, diluted | $ | 0.44 | | | $ | 0.38 | | | $ | 1.58 | | | $ | 1.43 | |

| Weighted average common shares outstanding, diluted | 169,980 | | | 177,743 | | | 172,845 | | | 180,375 | |

(1) Restructuring, acquisition, integration and other for the year ended December 31, 2023 includes the Amedisys merger termination fee, net of merger-related expenses

(2) Tax adjustments for the three months and year ended December 31, 2024 and 2023 includes the estimated income tax effect on non-GAAP adjustments based on the effective tax rate

v3.25.0.1

Cover

|

Feb. 26, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

OPTION CARE HEALTH, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-11993

|

| Entity Tax Identification Number |

05-0489664

|

| Entity Address, Address Line One |

3000 Lakeside Dr.

|

| Entity Address, Address Line Two |

Suite 300N

|

| Entity Address, City or Town |

Bannockburn

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60015

|

| City Area Code |

312

|

| Local Phone Number |

940-2443

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

OPCH

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001014739

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

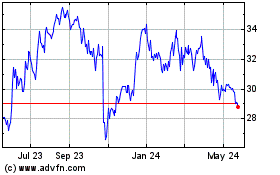

Option Care Health (NASDAQ:OPCH)

Historical Stock Chart

From Feb 2025 to Mar 2025

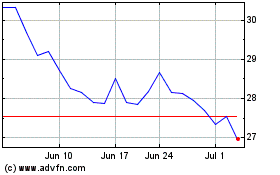

Option Care Health (NASDAQ:OPCH)

Historical Stock Chart

From Mar 2024 to Mar 2025