As

filed with the Securities and Exchange Commission on June 4, 2024

Registration

No. 333-278970

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT #1

TO

FORM

S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

OPTIMUMBANK

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

Florida

(Exact

name of registrant as specified in its charter)

55-0865043

(I.R.S.

Employer Identification Number)

2929

East Commercial Boulevard, Suite 303

Ft.

Lauderdale, Florida 33308

(954)

900-2800

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Timothy

Terry

President

and Chief Executive Officer

OptimumBank

Holdings, Inc.

2929

East Commercial Boulevard, Suite 303

Ft.

Lauderdale, Florida 33308

(954)

900-2800

(Name,

address, including zip code, and telephone number, including area code of agent for service)

Please

send copies of all communications, including copies of all communications sent to agent for service, to:

Richard

Pearlman, Esq.

Christina

Ahrens, Esq.

Igler

and Pearlman, P.A.

2457

Care Drive, Suite 203

Tallahassee,

Florida 32308

From

time to time after the effective date of this registration statement

(Approximate

date of commencement of proposed sale to the public)

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| |

Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to section 7(a)(2)(B) of the Securities Act. ☐

If

applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange

Act Rule 14e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange

Act Rule 14d-1(d) (Cross-Border Third-party Tender Offer) ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED June 4, 2024

PROSPECTUS

1,381,025

Shares of Common Stock

OPTIMUMBANK

HOLDINGS, INC.

Pursuant

to this prospectus, the selling stockholders identified herein (the “Selling Stockholders”) are offering for resale an aggregate

of 1,381,025 shares of our common stock.

The

shares offered for resale were acquired in a private placement transaction pursuant to securities purchase agreements by and between

us and each of the Selling Stockholders, dated March 28, 2024 (the “Purchase Agreements”). See “Prospectus Summary

– Private Placement of Shares of Common Stock and Series C Preferred Shares” for additional information regarding the private

placement transaction and the Purchase Agreements.

We

are registering the shares on behalf of the Selling Stockholders, to be offered and sold by the Selling Stockholders from time to time.

Sales

of the shares by the Selling Stockholders may occur at fixed prices, at market prices prevailing at the time of sale, at prices related

to prevailing market prices, at negotiated prices, and/or at varying prices determined at the time of sale. The Selling Stockholders

may sell shares directly or to or through underwriters, broker-dealers, or agents, who may receive compensation in the form of discounts,

concessions, or commissions from the Selling Stockholders, the purchasers of the shares, or both. The Selling Stockholders may sell any,

all, or none of the shares offered by this prospectus and we do not know when or in what amount the Selling Stockholders may sell their

shares following the effective date of the registration statement of which this prospectus is a part. We provide more information about

how the Selling Stockholders may sell or otherwise dispose of their shares in the section titled “Plan of Distribution” on

page 19.

We

are paying the cost of registering the shares of common stock covered by this prospectus as well as various related expenses. The Selling

Stockholders are responsible for all selling commissions, transfer taxes, and other costs related to the offer and sale of their shares.

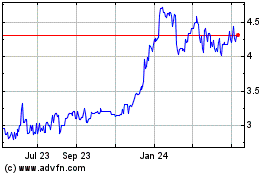

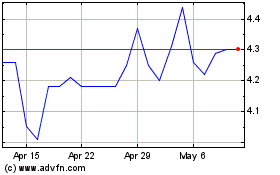

Our

common stock is listed on The Nasdaq Capital Market under the symbol “OPHC.” On May 30, 2024, the last reported sale

price for our common stock was $4.35 per share.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” on page 2 for a discussion of information that should

be considered in connection with an investment in our common stock.

None

of the Securities and Exchange Commission (the “SEC”), the Federal Deposit Insurance Corporation (the “FDIC”),

the Board of Governors of the Federal Reserve System (the “Federal Reserve”) or any state securities commission or any other

federal regulatory agency has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

These

shares of common stock are not savings accounts, deposits, or other obligations of our bank subsidiary and are not insured by the FDIC

or any other governmental agency.

The

date of this prospectus is _______, 2024

Until

[____________________], 2024 (the 25th day after the date of this prospectus), all dealers effecting transactions in our common stock,

whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the

obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

TABLE

OF CONTENTS

[____________],

2024

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement that we filed with the SEC using a “shelf” registration process. Under this

shelf registration process, we may sell, from time to time, any of the securities described in this prospectus in one or more offerings.

This prospectus only provides you with a general description of the securities we may offer. Each time we offer to sell securities, we

will provide a supplement to this prospectus that contains specific information about the terms of the securities and the offering. A

prospectus supplement may include a discussion of any risk factors or other special considerations applicable to those securities or

to us. The supplement also may add, update or change information contained in this prospectus. If there is any inconsistency between

the information in this prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement.

You should carefully read both this prospectus and any supplement, together with the additional information described under the heading

“Where You Can Find More Information” below.

Unless

the context requires otherwise, references to “Optimum”, the “Company”, “we”, “our”,

“ours” and “us” are to OptimumBank Holdings, Inc. and its subsidiaries.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed a registration statement with the SEC, of which this prospectus is a part, with respect to the securities being offered hereby.

This prospectus does not contain all of the information set forth in the registration statement and the exhibits and schedules thereto.

We refer you to the registration statement and the exhibits and schedules thereto for further information. Statements contained in this

prospectus as to the contents of any contract or other document filed as an exhibit are qualified in all respects by reference to the

actual text of the exhibit.

We

are subject to the information requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and file

annual, quarterly and current reports, proxy and information statements, and other information with the SEC. Our SEC filings, the registration

statement, including the exhibits and schedules to the registration statement, as well as the documents incorporated herein by reference,

are available to the public over the Internet at the SEC’s website at www.sec.gov.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “OPHC We also maintain an Internet site where you can

find additional information. The address of our Internet site is https://www.optimumbank.com. All internet addresses provided in

this prospectus or in any accompanying prospectus supplement are for informational purposes only and are not intended to be

hyperlinks. In addition, the information on our Internet website, or any other Internet site described herein, is not a part of, and

is not incorporated or deemed to be incorporated by reference in, this prospectus or any accompanying prospectus supplement or other

offering materials.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC’s rules allow us to incorporate by reference information into this prospectus. This means that we can disclose important information

to you by referring you to another document. Any information referred to in this way is considered part of this prospectus from the date

we file that document. Any reports filed by us with the SEC after the date of this prospectus will automatically update and, where applicable,

supersede any information contained in this prospectus or incorporated by reference in this prospectus. We incorporate by reference the

following documents (other than information “furnished” and not “filed”):

| ● | Our

Annual Report on Form

10-K for the year ended December 31, 2023 (the “2023 Form 10-K”), filed on

March 8, 2024, including the portions of our Revised Definitive Proxy Statement on

Schedule 14A filed on May 23, 2024, and incorporated by reference into Part

III of our 2023 Form 10-K; |

| | | |

| | ● | Our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed on May 13, 2024; |

| ● | Our

Current Reports on Form 8-K and Form 8-K/A, as applicable, filed on March

28, 2024 , April

22, 2024 , May

6, 2024, May

16, 2024, and May

31, 2024; and |

| ● | The

description of our securities registered with the SEC pursuant to Section 12 of the Exchange

Act included as Exhibit 4.2 to the 2023 Form 10-K, and any amendments or reports filed for

the purpose of updating such description. |

All

documents we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and prior

to the termination of the offering of the securities to which this prospectus relates (other than information in such documents that

is furnished and not deemed to be filed) shall also be deemed to be incorporated by reference into this prospectus and to be part hereof

from the date of filing of those documents.

We

will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written

or oral request, a copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus,

excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. You may request a

copy of these filings, at no cost, by writing or telephoning us at our principal executive office:

OptimumBank

Holdings, Inc.

Attn:

Mary Franco

2929

East Commercial Boulevard, Suite 303

Fort

Lauderdale, FL 33308

(954)

900-2805

You

should rely only on the information contained or incorporated by reference in this prospectus and the applicable prospectus supplement.

Neither we nor the Selling Stockholders, nor any underwriters, dealers or agents have authorized anyone else to provide you with additional

or different information. Neither we nor the Selling Stockholders are making an offer of these securities in any state where the offer

is not permitted. You should not assume that the information in this prospectus or the applicable prospectus supplement or any document

incorporated by reference is accurate as of any date other than the dates of the applicable documents.

CAUTIONARY

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

We

have made forward-looking statements in this prospectus about the financial condition, results of operations, and business of our company.

These statements are not historical facts and include expressions concerning the future that are subject to risks and uncertainties.

Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among

other things, the following possibilities:

| ● | general

economic conditions, either nationally or regionally, that are less favorable than expected

resulting in, among other things, a deterioration in credit quality and an increase in credit

risk-related losses and expenses; |

| | ● | changes

in the interest rate environment that reduce margins; |

| | ● | competitive

pressure in the banking industry that increases significantly; |

| | ● | changes

that occur in the regulatory environment; and |

| | ● | changes

that occur in business conditions and the rate of inflation. |

When

used in this prospectus, the words “believes,” “estimates,” “plans,” “expects,” “should,”

“may,” “might,” “outlook,” and “anticipates,” as well as similar expressions, as they

relate to us or our management, are intended to identify forward-looking statements.

PROSPECTUS

SUMMARY

Overview

of our Company

OptimumBank

Holdings, Inc. is a Florida corporation formed in 2004 as a bank holding company for OptimumBank (the “Bank”). The Company’s

only business is the ownership and operation of the Bank. The Bank is a Florida state-chartered bank established in 2000, with deposits

insured by FDIC. The Bank offers a variety of community banking services to individual and corporate customers through its two banking

offices located in Broward County, Florida.

The

Company is subject to the supervision and regulation of the Federal Reserve. The Bank is subject to the supervision and regulation of

the Florida Office of Financial Regulation and the FDIC. The Bank is a member of the Federal Home Loan Bank of Atlanta.

The

Company’s common stock is registered with the SEC under the Exchange Act, and files periodic reports with the SEC. The Company’s

common stock trades on The Nasdaq Capital Market under the symbol “OPHC.”

Private

Placement of Shares of Common Stock

On

March 28, 2024, we entered into securities purchase agreements with several institutional and accredited investors for the sale by the

Company of shares of common stock in a private placement offering (the “Private Placement”). The purchase price was $3.90

per share. The Private Placement also closed on March 28, 2024.

In

connection with the Purchase Agreements, the Company and certain of the investors in the Private Placement entered in Registration Rights

Agreements. Pursuant to such agreements, the Company agreed to file within 30 days of closing, a registration statement with the SEC

covering all shares of common stock sold in the Private Placement which were subject to a Registration Rights Agreement, and to use its

best efforts to cause the registration statement to be declared effective no later than August 25, 2024.

The

shares were sold and issued in the Private Placement without registration under the Securities Act of 1933, as amended (the “Securities

Act”), in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering

and Rule 506 of Regulation D promulgated under the Securities Act as sales to accredited investors, and in reliance on similar exemptions

under applicable state laws.

The

representations, warranties, and covenants contained in the Purchase Agreements were made solely for the benefit of the parties to the

Purchase Agreements. In addition, such representations, warranties, and covenants: (i) are intended as a way of allocating the risk between

the parties to the Purchase Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different

from what may be viewed as material by stockholders of, or other investors in, the Company. Accordingly, the Purchase Agreement is filed

with this prospectus only to provide investors with information regarding the terms of the transaction, and not to provide investors

with any other factual information regarding the Company. Information concerning the subject matter of the representations and warranties

may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public disclosures.

On

March 28, 2024, the Company entered into a Placement Agency Agreement with Compass Point Research and Trading, LLC (“Compass Point”

or the “Placement Agent”) pursuant to which the Company agreed to pay the Placement Agent (i) a cash fee equal to 5.0% of

the gross proceeds received by the Company in the Private Placement, (ii) reimbursement of the Placement Agent’s expenses in an

amount up to $125,000.

RISK

FACTORS

Our

business and results of operations are subject to numerous risks and uncertainties, many of which are beyond our control. The material

risks and uncertainties that management believes affect the Company are described below. Additional risks and uncertainties that management

is not aware of or that management currently deems immaterial may also impair the Company’s business operations. This report is

qualified in its entirety by these risk factors. If any of the following risks actually occur, our business, financial condition and

results of operations could be materially and adversely affected. If this were to happen, the value of our securities could decline significantly,

and you could lose all or part of your investment. Some statements in the following risk factors constitute forward-looking statements.

Please refer to “Cautionary Note Regarding Forward-Looking Statements” on page iii of this prospectus.

These

risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations and financial

condition.

Risk

Factor Summary

Our

business is subject to uncertainties and risks and our risk factors can be broadly summarized by the following:

| ● | Our

ability to grow the size and geographic scope of our loan generation, loan sale, and deposit

gathering business, and the infrastructure needed to support it; |

| ● | Possible

loan defaults, devaluation of collateral, adverse political, environmental, or economic events,

and competition; |

| ● | Interest

rates and available sources of liquidity; |

| ● | Our

ability to raise capital and the effects of doing so on our shareholders; |

| ● | The

potential that we are subject to fraud, incorrect judgments, or other bad acts of third parties; |

| ● | Laws,

regulations, rules, and standards to which we are subject and the government agencies with

which we interact; |

| ● | Recruitment,

retention, development, performance, and potential bad acts of our key executives and other

employees, as well as transactions with them and our directors; |

| ● | Rapidly

developing technology; |

| ● | Estimates

used in certain valuations, including our credit loss reserve; and |

| ● | Features

of our stock, such as liquidity, dilution, the lack of preemptive rights, our SEC reporting

status, and the concentration of ownership among our insiders. |

Risk

Factors Related to Our Business

Liquidity

risk could impair our ability to fund operations and jeopardize our financial condition.

Liquidity

is essential to our business. Actions by the Federal Home Loan Bank of Atlanta or the Board of Governors of the Federal Reserve System

may reduce our borrowing capacity. Additionally, we may not be able to attract deposits at competitive rates. Our inability to raise

funds through traditional deposits, brokered deposits, borrowings, the sale of investment securities or loans, and other sources could

negatively affect our liquidity or result in increased funding costs. Liquidity may also be adversely impacted by bank supervisory and

regulatory authorities mandating changes in the composition of our balance sheet to asset classes that are less liquid.

Changes

in interest rates affect our profitability and assets.

Our

profitability depends to a large extent on the Bank’s net interest income, which is the difference between income on interest-earning

assets, such as loans and investment securities, and expenses on interest-bearing liabilities, such as deposits and borrowings. We are

unable to predict changes in market interest rates, which are affected by many factors beyond our control including inflation, economic

recession, unemployment, money supply, domestic and international events, and changes in the United States and other financial markets.

At

December 31, 2023, and at March 31, 2024, our one-year interest rate sensitivity position was asset sensitive, such that a gradual

increase in interest rates during the next twelve months would have a positive impact on our net interest income. Our results of operations

are affected by changes in interest rates and our ability to manage this risk. The difference between interest rates charged on interest-earning

assets and interest rates paid on interest-bearing liabilities may be affected by changes in market interest rates, changes in relationships

between interest rate indices, and changes in the relationships between long-term and short-term market interest rates. Our net interest

income may be reduced if: (i) more interest-earning assets than interest-bearing liabilities reprice or mature during a time when interest

rates are declining; or (ii) more interest-bearing liabilities than interest-earning assets reprice or mature during a time when interest

rates are rising. In addition, the mix of assets and liabilities could change as varying levels of market interest rates might present

our customer base with more attractive options.

Loss

of deposits or a change in deposit mix could increase our funding costs and adversely affect our performance.

Deposits

are a low cost and stable source of funding. We compete with banks and other financial institutions for deposits and as a result, the

Company could lose deposits in the future, clients may shift their deposits into higher cost products, or the Company may need to raise

interest rates to avoid deposit attrition. Funding costs may also increase if deposits lost are replaced with wholesale funding. Higher

funding costs reduce our net interest margin, net interest income, and net income. In recent months, the environment for maintaining

and growing deposits has become more challenging. This is partially attributable to the FRB reducing the size of its balance sheet through

quantitative tightening and continues to increase interest rates giving depositors an incentive to move deposits to money market funds

and other higher-yielding alternatives. In addition, recent unusually high levels of withdrawals from other, larger banks, which in some

cases has resulted in bank failure, may result in similar withdrawal patterns at the Company. Should we experience any of these events,

we may need to rely on higher cost wholesale funding, which would adversely affect our financial performance and net income.

Our

operations are growing at a rapid pace and our training programs and operational protocols may lag behind our growth.

Our

branch network and government guaranteed lending operations are expanding at a rapid pace. As a result, we may not be able to provide

comprehensive or timely training to staff.

We

may also not develop appropriate operational protocols as we expand our products and services. If we fail to do so, our employees may

not have a set of standards and expectations pursuant to which they perform their assigned duties. If we are not able to fully and promptly

provide training to our employees, or develop appropriate protocols, our employees may be susceptible to mistakes, fail to recognize

fraud or other weaknesses in our operations, or fail to recognize or mitigate other risks.

Changes

in economic and political conditions could adversely affect our earnings through declines in deposits, loan demand, the ability of our

customers to repay loans and the value of the collateral securing our loans.

Our

success depends to a significant extent upon local and national economic and political conditions, as well as governmental fiscal and

monetary policies. Conditions such as inflation, recession, unemployment, changes in interest rates, fiscal and monetary policy, an increasing

federal government budget deficit, slowing gross domestic product, tariffs, a U.S. withdrawal from or significant renegotiation of trade

agreements, trade wars, and other factors beyond our control may adversely affect our deposit levels and composition, the quality of

investment securities available for purchase, demand for loans, the ability of our borrowers to repay their loans, and the value of the

collateral securing loans. Recent political developments in Russia, Ukraine, the Middle East, and South America may result in substantial

changes in economic and political conditions for the U.S. and the remainder of the world. Disruptions in U.S. and global financial markets,

and changes in oil production and supply in the those or other areas, also affect the economy and stock prices in the U.S., which can

affect our earnings, capital, as well as the ability of our customers to repay loans.

We

may not be able to retain or grow our core deposit base, which could adversely impact our funding costs.

We

rely on client deposits as our primary source of funding for our lending activities. Our future growth will largely depend on our ability

to retain and grow our core deposit base. Our retention and acquisition of customer deposits are subject to potentially dramatic fluctuations

in availability or price due to certain factors outside of our control, such as increasing competitive pressures for deposits, changes

in interest rates and returns on other investment classes, client perceptions of our financial health and general reputation, or a loss

of confidence by clients in us or the banking sector generally. Such factors could result in significant outflows of deposits within

short periods of time or significant changes in pricing necessary to maintain current client deposits or attract additional deposits.

Additionally, any such loss of funds could result in lower loan originations or the need to sell investment securities at a loss, which

could have a material adverse effect on our business, financial condition and results of operations.

We

are dependent on our management team and any of their departure, or subsequent employment with a competitor could adversely affect our

operations.

Our

growth and development are particularly dependent upon the personal efforts and abilities of our executive officers and other qualified

personnel. The loss or unavailability of such officers or employees could have a material adverse effect on our operations and prospects.

Such adverse effect may be magnified if any such officer or employee were to become employed with a competitor of ours.

We

may engage in transactions with our directors and their related interests, which creates the potential for conflicts of interest.

From

time to time, in the ordinary course of business, the Company has entered into transactions with certain members of its Board of Directors

for various professional and other services. Such insider transactions present reputational and corporate governance risks to Optimum

and the Bank. Insider transactions often draw the scrutiny of regulators and shareholders. If they were to identify terms of the transactions,

or aspects of the process through which we entered into them, that they deemed to be inappropriately unfavorable to Optimum or the Bank,

such regulators or shareholders might take enforcement or legal action against us. Similarly, insider transactions may present an opportunity

for taking advantage of Optimum or the Bank. If any such events were to occur, Optimum and the Bank may incur expenses or become engaged

in time consuming enforcement or legal processes that could negatively affect our performance.

Our

Internet-based systems and online commerce activities are subject to security threats that could adversely affect our business.

Third

party, or internal, systems and networks may fail to operate properly or become disabled due to deliberate attacks or unintentional events.

Our operations are vulnerable to disruptions from human error, natural disasters, power loss, computer viruses, spam attacks, denial

of service attacks, unauthorized access, and other unforeseen events. Undiscovered data corruption could render our customer information

inaccurate. These events may obstruct our ability to provide services, underwrite loans, and process transactions. Any such incident

could put confidential customer information at risk, which may result in significant liability to us, subject us to additional regulatory

scrutiny, damage our reputation, result in a loss of customers, cause us to incur significant expense to remediate any damage and inhibit

current and potential customers from using our online banking services, any or all of which could have a material adverse effect on our

results of operations and financial condition.

A

failure or breach, including cyberattacks, of our computer systems or other technologies could disrupt our business, result in the disclosure

of confidential information, and create significant financial and legal exposure.

There

is no assurance that our computer systems and other technologies will provide absolute security. In the case of a failure or breach of

such systems, their functionality may be disabled. In addition, the confidentiality and integrity of our and our clients’ information

may be compromised. Further, to access our products and services, our clients may use computers and mobile devices that are beyond our

security systems. Our clients’ or our websites or systems may be subject to attacks intended to obtain unauthorized access to confidential

information, destroy data, or disable or sabotage services, often through the introduction of computer viruses or malware, cyberattacks,

and other means.

Furthermore,

the methods of cyberattacks change frequently and may not be recognized until or after launch. Therefore, we may not be able to anticipate

or implement effective preventive measures against all possible security breaches. Any successful cyberattack or other security breach

may result in the misappropriation, loss, or other unauthorized disclosure of confidential customer information. Such an event may also

compromise our ability to function and could severely damage our reputation, erode confidence in the security of our systems, products,

and services, expose us to the risk of litigation and liability, and disrupt our operations. Any successful cyberattack may subject us

to regulatory investigations, litigation or enforcement, or require the payment of regulatory penalties or require us to undertake costly

remediation efforts. All or any of these could adversely affect our business, financial condition, or results of operations and damage

our reputation.

Changes

in business and economic conditions, in particular those of the Florida markets in which we operate, could lead to lower asset quality

and decreased earnings.

Unlike

larger national or regional banks that are more geographically diversified, our business and earnings are closely tied to general business

and economic conditions in our market area. The local economy is heavily influenced by tourism, real estate, and other service-based

industries. Factors that could affect the local economy include declines in tourism, higher energy costs, reduced consumer or corporate

spending, natural disasters or adverse weather and a significant decline in real estate values. A sustained economic downturn could adversely

affect the quality of our assets, credit losses, and the demand for our products and services, which could lead to lower revenue and

lower earnings.

Most

expansion activities require approval of our regulators, which we may not be able to obtain, or that may impose conditions that we find

to be unacceptable.

Branch

openings, and other expansion activities, generally require the approval of our regulators. We may not be able to obtain such approvals

if our regulators do not believe we are financially or managerially strong enough to integrate or manage such activities. In addition,

our regulators consider our capital, liquidity, profitability, regulatory compliance, including with the Community Reinvestment Act and

the Bank Secrecy Act, and levels of goodwill and intangibles when considering acquisition and expansion proposals. Our regulators may

also impose conditions in approvals that we find to be unacceptable, prohibitive, or otherwise undesirable. In any of those instances,

we may be unable or unwilling to consummate a transaction or undertake an expansionary activity.

We

are subject to numerous laws designed to protect consumers, including the Community Reinvestment Act and fair lending laws, and failure

to comply with these laws could lead to material penalties and have negative effects on our business.

The

Community Reinvestment Act, the Equal Credit Opportunity Act, the Fair Housing Act, and other fair lending laws and regulations impose

obligations and nondiscriminatory lending requirements on financial institutions. The banking regulators and the U.S. Department of Justice

are responsible for enforcing these laws and regulations. A successful regulatory challenge to an institution’s performance under

the Community Reinvestment Act or fair lending laws and regulations could result in a wide variety of sanctions, including damages and

civil money penalties, injunctive relief, restrictions on branch expansion, merger and acquisition activity, and restrictions on entering

new business lines. Private parties may also have the ability to challenge our performance under fair lending laws in private class action

litigation. Such actions could have a material adverse effect on our business, financial condition, results of operations, and future

prospects.

We

may be required to make increases in our credit loss reserve and to charge off loans in the future, which could adversely affect our

results of operations.

The

determination of the appropriate level of the credit loss reserve involves a high degree of subjectivity and judgment and requires us

to make significant estimates of current credit risks, which may undergo material changes. Changes in economic conditions affecting borrowers,

new information regarding existing loans, identification of additional problem loans and other factors within and outside of our control,

may require an increase in the credit loss reserve. In addition, our regulators periodically review our credit loss reserve and may request

an increase in the provision for credit losses or the recognition of loan charge-offs, based on judgments different than those of management.

Furthermore, the Financial Accounting Standards Board has issued a current expected credit loss rule, which requires us to record, at

the time of origination, credit losses expected throughout the life of loans, held-to-maturity investment securities, and certain other

assets and off-balance sheet credit exposures as opposed to the prior practice of recording losses when it is probable that a loss event

has occurred. Also, if charge-offs in future periods exceed the allowance, we will need additional provisions to increase the allowance,

which would result in a decrease in net income and capital, and could have a material adverse effect on our financial condition and results

of operations.

If

real estate values in our markets decline, we could experience losses upon foreclosure of the loan or sale of the real estate.

A

material portion of our loan portfolio consists of mortgages secured by real estate located in Broward, Miami-Dade, and Palm Beach Counties,

Florida. Real estate values in our market may decline due to changes in national, regional or local economic conditions; fluctuations

in interest rates and the availability of loans to potential purchasers; changes in the tax laws and other governmental statutes, regulations

and policies; and acts of nature. If real estate values decline in our market, the value of the real estate collateral securing our loans

will likely be reduced. Any reduction in the value of the collateral securing our loans could reduce the amount of money we could realize

on the sale of any collateral and thereby adversely affect our financial performance.

Hurricanes

or other adverse weather events, as well as climate change, could negatively affect our local economies or disrupt our operations, which

could have an adverse effect on our business and results of operations.

Our

market areas in Florida are susceptible to hurricanes, tropical storms, and related flooding and wind damage. Such weather events can

disrupt operations, result in damage to properties and negatively affect the local economies in the markets where we operate. Such weather

events could result in a decline in loan originations, a decline in the value, or destruction of properties securing our loans and an

increase in delinquencies, foreclosures, or credit losses. Our business and results of operations may be adversely affected by these

and other negative effects of future hurricanes, tropical storms, related flooding and wind damage and other similar weather events.

Climate change may be increasing the severity and frequency of adverse weather conditions, making the impact from these types of natural

disasters on us or customers worse.

Further,

concerns over the long-term impacts of climate change have led and may continue to lead to governmental efforts around the world to mitigate

those impacts. Investors, consumers, and businesses also may change their behavior on their own as a result of these concerns. The State

of Florida could be disproportionately impacted by long-term climate changes. We and our customers may face cost increases, asset value

reductions, and changes in supply or demand for products and services resulting from new laws, regulations, and changing consumer and

investor preferences regarding responses to climate change.

The

Florida property insurance market is in crises and our borrowers may have difficulty obtaining insurance, at reasonable rates or at

all, on properties securing our loans, which may adversely affect the value of our collateral, the performance of our

loan portfolio, and our ability to make loans secured by real estate.

Florida

is susceptible to hurricanes, tropical storms, tornadoes, and related flooding and wind damage, and other similar weather

events. Such events can disrupt operations, result in damage to properties and negatively affect the local economies in our markets.

As a result of the potential for such weather events, many of our customers have incurred significantly higher insurance premiums, and

if rates continue to increase or carriers leave certain markets or limit their participation in such markets, may become unable to

secure insurance at all, on their properties. Such difficulties currently exist primarily with respect to wind hazard coverage.

Widespread inability to obtain insurance coverages may adversely affect real estate sales and values in our markets and leave our

borrowers without funds to repay their loans in the event of destructive weather events. Such events could result in a decline in loan

originations, a decline in the value or destruction of properties securing loans, and a decrease in credit quality. As of March

31, 2024, all real estate collateral is insured and at least to the levels required by our loan agreements. However, because approximately

75% of our loan portfolio is secured by real estate located within Florida, rate increases or borrowers’ inability to obtain insurance,

could negatively impact our credit quality or ability to make loans, and, therefore, our business and results of operations.

Public

health emergencies could hurt our business.

The

COVID pandemic and the governmental and public response disrupted day-to-day life and the normal functioning of the domestic and global

economy. Future developments or new emergencies will be highly uncertain and cannot be predicted, including the effectiveness of remote

working arrangements, third party providers’ abilities to continue to support our and our customer’s operations, and any

further actions taken by governmental authorities and other third parties. Accordingly, public health crises could materially and adversely

affect our business, operations, operating results, financial condition, liquidity or capital levels. Further, it is impossible to effectively

predict future events relative to the nature, duration, or severity of recent events. Therefore, we cannot provide guidance as to the

effect a global pandemic or other health crises may have on us, Florida, the remainder of the U.S., or the global economy.

Our

real estate loan portfolios are exposed if weakness in the Florida real estate market or general economy arises.

As

of March 31, 2024, approximately 66.13% of our net loan portfolio is secured by commercial real estate, and an additional 25.23% is secured

by residential, multi-family, and land and construction real estate collateral located within Florida, Florida has historically experienced

deeper recessions and more dramatic slowdowns in economic activity than other states and a decline in real estate values in Florida can

be significantly larger than the national average. Declines in home prices and the volume of home sales in Florida, along with the reduced

availability of certain types of mortgage credit, can result in increases in delinquencies and losses in our portfolios of home equity

lines and loans, and commercial loans related to residential real estate acquisition, construction and development. Declines in home

prices coupled with high or increased unemployment levels or increased interest rates can cause losses which adversely affect our earnings

and financial condition, including our capital and liquidity.

We

are subject to lending concentration risk.

Our

loan portfolio contains certain industry and collateral concentrations including, but not limited to, commercial real estate generally

and loans to secured nursing facilities, specifically. Due to the exposure in these concentrations, disruptions in markets, economic

conditions, changes in laws or regulations or other events could cause a significant impact on the ability of borrowers to repay and

may have a material adverse effect on our business, financial condition and results of operations.

A

significant portion of our loan portfolio is secured by real estate, and events that negatively impact the real estate market could hurt

our business.

A

significant portion of our loan portfolios are secured by real estate. As of March 31, 2024, approximately 91.36% of such loans had real

estate as a primary or secondary component of collateral. The real estate collateral in each case provides an alternate source of repayment

in the event of default by the borrower and may deteriorate in value during the time the credit is extended. There can be no assurance

that our local markets will not experience another economic decline. A decline in local economic conditions may have a greater effect

on our earnings and capital than on the earnings and capital of other financial institutions whose real estate loan portfolios are more

geographically diverse. Any weakening of the real estate market may increase the likelihood of default of these loans, which could negatively

impact our loan portfolio’s performance and asset quality. Such a determination may lead to an additional increase in our allowance

for credit losses, which could also adversely affect our business, financial condition, and results of operations.

We

have a large concentration of commercial real estate loans, which present significant risks that could negatively impact our ability

to collect on such loans should property values decrease or the businesses occupying such real estate encounter problems.

Our

commercial real estate loans at March 31, 2024, totaled 66.13% of our net loan portfolio. Commercial real estate loans generally carry

larger loan balances and can involve a greater degree of financial and credit risk than other loans. The increased financial and credit

risk associated with these types of loans are a result of several factors, including the concentration of principal in a limited number

of loans and borrowers, the size of loan balances, the effects of general economic conditions on income-producing properties and the

increased difficulty of evaluating and monitoring these types of loans.

Furthermore,

the repayment of loans secured by commercial real estate is typically dependent upon the successful operation of the related real estate

or commercial project. If the cash flows from the project are reduced, a borrower’s ability to repay the loan may be impaired.

This cash flow shortage may result in the failure to make loan payments. In such cases, we may be compelled to modify the terms of the

loan. In addition, the nature of these loans is such that they are generally less predictable and more difficult to evaluate and monitor.

As a result, repayment of these loans may, to a greater extent than residential loans, be subject to adverse conditions in the real estate

market or economy.

In

response to these risks, we have taken certain mitigative actions. One such mitigant is subdividing our commercial real estate portfolio

into subclasses based on property type and having aggregate lending limit by type of property, which permits us to analyze risk on a

more granular level than commercial real estate generally. Another mitigant is performing quarterly stress tests on the portion of the

portfolio that is scheduled to reprice within the following 18 months. In such cases, if the stressed debt coverage ratio is less than

one-to-one, we then evaluate other factors such as the strength of the guarantor and begin working with borrowers and guarantors on their

strategies for debt service and ultimate refinancing.

Our

regulators are focused on commercial real estate lending, which could result in increased regulatory involvement in our business activities.

Banking

regulators give greater scrutiny to lenders with a high concentration of commercial real estate loans in their portfolios, and such lenders

are expected to implement stricter underwriting, internal controls, risk management policies and portfolio stress testing, as well as

maintain higher capital levels and loss allowances. Concentrations in commercial real estate are monitored by regulatory agencies and

subject to especially heightened scrutiny both on a public and confidential basis. Regulators may require banks to maintain elevated

levels of capital or liquidity due to commercial real estate loan concentrations, and could do so, especially if there is a downturn

in our local real estate markets.

Our

loans to skilled nursing facilities are dependent on their successful operation, the performance and financial capacity of their owners

and operators, reimbursement from third parties, and other risks.

At

March 31, 2024, 5.12% of our net loan portfolio was to owners and/or operators of skilled nursing facilities and were secured by such

facilities. Therefore, we are exposed to various risks with respect to such loans. Significantly, such facilities face competition for

patients and residents from other properties in the same or similar markets, which may affect their ability to attract and retain tenants

and operators or may otherwise reduce their ability to make loan payments. If the facilities are unable to attract and retain profitable

tenants and operators, their business, financial position, or results of operations could be materially adversely affected and our borrowers

who own and operate such facilities may be unable to repay our loans.

Further,

compliance with long-term healthcare industry regulations is labor intensive and expensive. The extensive federal, state and local laws

and regulations affecting the healthcare industry include those relating to, among other things, licensure, conduct of operations, ownership

of facilities, addition of facilities and equipment, allowable costs, services, prices for services, qualified beneficiaries, quality

of care, patient rights, fraudulent or abusive behavior, and financial and other arrangements that may be entered into by healthcare

providers. If our skilled nursing facility borrowers fail to comply with such regulation, they could become ineligible to receive reimbursement

from governmental and private third-party payor programs, face bans on admissions of new patients or residents, suffer civil or criminal

penalties or be required to make significant changes to their operations. If such events were to occur, the ability of our borrowers

or their tenants to operate their facilities profitably, with sufficient cash flow to repay their loans could be materially and adversely

affected.

Other

related risks include, but are not limited to, occupancy and private pay rates, labor availability, economic conditions, federal, state,

local, and industry-regulated licensure, certification and inspection laws, regulations, and standards, the availability and increases

in cost of general and professional liability insurance coverage, and lawsuits and other legal proceedings arising out of alleged actions

by the owners or operations of such facilities. Should the operators or owners of these facilities encounter difficulty avoiding or mitigating

the adverse impacts of these items could result in our borrower being unable to pay their loans as agreed or in material reduction to

the value of our collateral.

Our

borrowers or their tenants may also experience a reduction in reimbursement rates or practices from or by third-party payors, including

insurance companies and Medicare and Medicaid, which would result in a reduction in our borrowers’ revenues. Although moderate

reimbursement rate reductions may not affect our borrowers’ ability to meet their financial obligations to us, significant limits

on reimbursement rates or on the services reimbursed could have a material adverse effect on their business, financial position or results

of operations, which could materially adversely affect their ability to meet their financial obligations to us.

Our

use of appraisals in deciding whether to make a loan secured by real property or how to value the loan in the future may not accurately

describe the net value of the collateral that we can realize.

In

considering whether to make a loan secured by real property, we generally require an appraisal of the property. However, an appraisal

is only an estimate of the value of the property at the time the appraisal is made, and, as real estate values may fluctuate over relatively

short periods of time, especially in times of heightened economic uncertainty, this estimate might not accurately describe the net value

of the collateral after the loan has been closed. If the appraisal does not reflect the amount that may be obtained upon any sale or

foreclosure of the property, we may not realize an amount equal to the indebtedness secured by the property. In addition, we rely on

appraisals and other valuations to establish the value of foreclosed real estate and to determine certain loan impairments. If any of

these valuations are inaccurate, our consolidated financial statements may not reflect the correct value of our foreclosed upon real

estate, and our credit loss reserve may not accurately reflect loan impairments. Inaccurate valuations of properties could materially

adversely affect our business, results of operations and financial condition.

We

operate in a highly competitive industry and market area.

We

face substantial competition in all areas of our operations from a variety of different competitors, many of which are larger and may

have more financial resources than we do. Such competitors primarily include Internet banks and national, regional and community banks

within the various markets we serve. We also face competition from many other types of financial institutions, including, without limitation,

savings and loan institutions, credit unions, mortgage companies, other finance companies, brokerage firms, insurance companies, factoring

companies and other financial intermediaries. The financial services industry could become even more competitive as a result of legislative,

regulatory and technological changes, as well as continued consolidation. Many of our competitors have fewer regulatory constraints and

may have lower cost structures. Our success depends on our ability to compete successfully in our market area, and there is no guarantee

that we will be able to do so.

We

may face risks with respect to future expansion.

We

may consider and enter into new lines of business or offer new products or services. We may acquire all or parts of other institutions

and we may engage in additional de novo branch expansion. Expansion involves a number of risks, including the costs associated

with identifying and evaluating potential acquisitions and merger partners, inaccurate estimates and judgments regarding credit, operations,

management and market risks of the target institution, our ability to finance expansion, possible dilution to our existing shareholders,

the diversion of our management’s attention to the negotiation of a transaction, the integration of the operations and personnel

of combining businesses, and the possibility of unknown or contingent liabilities.

We

may need additional capital in the future, but such capital may not be available when needed.

We

may need to obtain additional debt or equity financing to fund future growth and meet our capital needs. We cannot guarantee that such

financing will be available to us on acceptable terms or at all. If our financial performance is unsatisfactory or if negative economic

events or disruptions in the capital markets occur, it may not be possible for us to find sources of sufficient capital for our business

operations. If we are unable to obtain future financing, we may not have the resources available to fund our planned growth.

We

are subject to government regulation and monetary policy that could constrain our growth and profitability.

We

are subject to extensive federal government supervision and regulations that impose substantial limitations with respect to lending activities,

purchases of investment securities, the payment of dividends, and many other aspects of our business. Many of these regulations are intended

to protect depositors, the public, and the FDIC, but not our shareholders. The banking industry is heavily regulated. We are subject

to examinations, supervision and comprehensive regulation by various federal and state agencies. Our compliance with these regulations

is costly and restricts certain activities. The burden imposed by federal and state regulations puts banks at a competitive disadvantage

compared to less regulated competitors such as finance companies, mortgage banking companies, and leasing companies. Federal economic

and monetary policy may also affect our ability to attract deposits, make loans, and achieve our planned operating results. New laws

and regulations may increase costs of regulatory compliance. Further, additional legislation and regulations that could significantly

affect our power and authority, and operations may be enacted or adopted in the future which could have a material adverse effect on

our financial condition and results of operations.

Legislation

and regulatory proposals enacted in response to market and economic conditions may materially adversely affect our business and results

of operations.

Changes

in the laws, regulations, and regulatory practices affecting the banking industry may increase our costs of doing business or otherwise

adversely affect us and create competitive advantages for our competitors. For example, the Dodd-Frank Act in particular represented

a significant overhaul of many aspects of the regulation of the financial services industry, some of which have yet to be implemented.

In addition, because regulation of financial institutions changes regularly and is the subject of constant legislative debate, we cannot

forecast how federal or state regulation of financial institutions may change in the future and impact our operations. Recent and forthcoming

changes to banking regulations may impact the profitability of our business activities, require changes to some of our business practices,

or otherwise adversely affect our business. These changes may also require us to invest significant management attention and resources

to evaluate and make any changes necessary to comply with new statutory and regulatory requirements. It may also require us to hold higher

levels of regulatory capital and/or liquidity and it may cause us to adjust our business strategy and limit our future business opportunities.

We cannot predict the effects of future legislation and new or revised regulations on us, our competitors, or on the financial markets

and economy, although they may significantly increase costs and impede the efficiency of our internal business processes.

Inflation

could negatively impact our business and our profitability.

Significant

or prolonged inflation may impact our profitability by negatively impacting our fixed costs and expenses, including increasing funding

costs and executive and other employee compensation expense, and negatively impacting the demand for banking products and services. Additionally,

inflation may lead to a decrease in client purchasing power and negatively affect the need or demand for loans or deposit accounts. If

significant inflation continues, our business could also be negatively affected by, among other things, increased loan default and losses.

If we experience such effects of inflation, our results of operations could suffer.

ESG

risks could adversely affect our reputation and shareholder, employee, client and third party relationships.

As

a publicly traded company, we face increasing public scrutiny related to ESG activities. If we fail to act responsibly in areas, such

as DEI, environmental stewardship, human capital management, support for our local communities, corporate governance, and transparency,

or fail to consider ESG factors in our business operations, our reputation may be adversely affected. Furthermore, as a result of the

diversity of our clients and business partners, we may face negative publicity because of the identity of our clients or business partners

and the public’s view of those entities. Additionally, we may face pressure to not do business in certain industries that are viewed

as harmful to the environment or are otherwise negatively perceived, which could impact our growth. If we, or our clients or business

partners, become the subject of such negative publicity, our ability to attract and retain clients, employees, and business partners,

may be negatively impacted, which could affect our results of operation or growth prospects. Additionally, investors and shareholder

advocates are increasing their emphasis on how corporations address ESG issues in their business strategies.

An

economic downturn could have a material adverse effect on our capital, financial condition, results of operations, and future growth.

We

monitor market conditions and economic factors throughout, and beyond, our geographic markets. If economic conditions were to worsen

nationally, regionally, or locally, we could experience a decline in credit quality and loan and deposit demand. Such declines could

negatively affect our business and have a material adverse effect on our capital, financial condition, results of operations, and future

growth. In addition, international economic and political uncertainty could impact the U.S. financial markets by potentially suppressing

stock prices, including ours, and adding to overall market volatility, which could adversely affect our business. The effects of any

economic downturn on our business could continue for many years after the downturn is considered to have ended.

We

may incur losses if asset values decline, including due to changes in interest rates and prepayment speeds.

We

have a large portfolio of financial instruments, including loans and loan commitments, debt securities, and certain other assets and

liabilities that we measure at fair value that are subject to valuation and impairment assessments. We determine these values based on

applicable accounting guidance. For financial instruments measured at fair value, this requires us to base fair value on exit price and

to maximize the use of observable inputs and minimize the use of unobservable inputs in fair value measurements. The fair values of financial

instruments include adjustments for market liquidity, credit quality, and other transaction-specific factors, if appropriate. Gains or

losses on these instruments can have a direct impact on our results of operations. Increases in interest rates or changes in spreads

may adversely impact the fair value of loans or debt securities and, accordingly, for debt securities classified as available for sale,

may adversely affect accumulated other comprehensive income and, thus, capital levels. These market factors also may adversely impact

the value of debt securities we hold to meet regulatory liquidity requirements. Decreases in interest rates may increase prepayments

of certain assets, and, therefore, may adversely affect net interest income.

Technological

changes, including online and mobile banking, have the potential of disrupting our business model, and we may have fewer resources than

many competitors to invest in technological improvements.

The

financial services industry continues to undergo rapid technological changes with frequent introductions of new technology-driven products

and services, including mobile and online banking services. Changes in customer behaviors have increased the need to offer these options

to our customers. In addition to serving clients better, the effective use of technology may increase efficiency and may enable financial

institutions to reduce costs. Our future success will depend, in part, upon our ability to invest in and use technology to provide products

and services that provide convenience to customers and to create additional efficiencies in our operations. We may need to make significant

additional capital investments in technology in the future, and we may not be able to effectively implement new technology-driven products

and services in a timely manner in response to changes in customer behaviors, thus adversely impacting our operations. Many of our competitors

have substantially greater resources to invest in technological improvements and banking regulators may permit emerging technology companies

to engage in activities previously reserved to traditional commercial banks. Such competition could adversely affect our performance

and results of operations.

Changes

in accounting standards may affect our performance.

Our

accounting policies and methods are fundamental to how we record and report our financial condition and results of operations. From time

to time, there are changes in the financial accounting and reporting standards that govern the preparation of our financial statements.

These changes can be difficult to predict and can materially impact how we record and report our financial condition and statements of

operations. Future changes in financial accounting and reporting standards could require us to apply a new or revised standard retroactively,

which could result in a material adverse effect on our financial condition or could even require us to restate prior period financial

statements.

We

face risks related to our operational, technological, and organizational infrastructure.

Our

ability to grow and compete is dependent on our ability to build or acquire the necessary operational and technological infrastructure

and to manage the cost of that infrastructure while we expand. Similar to other financial institutions, our operational risk can manifest

itself in many ways, such as errors related to failed or inadequate processes, faulty or disabled computer systems, fraud by employees

or outside persons, and exposure to external events. We are dependent on our operational infrastructure to help manage these risks. In

addition, we are heavily dependent on the strength and capability of our technology systems, which we use both to interface with our

customers and to manage our internal financial and other systems. Our ability to develop and deliver new products that meet the needs

of our existing customers and attract new ones depends on the functionality of our technology systems.

Risks

Related to Our Securities

A

vibrant public trading market for our common stock has not and may not develop, which may hinder your ability to sell the common stock

and may lower the market price of the stock.

Our

common stock is quoted and traded on Nasdaq under the symbol “OPHC.” However, this listing has not yet resulted in a substantially

liquid market for our common stock. We cannot be certain if or when such a market may develop. Accordingly, investors should consider

the potential illiquid and long-term nature of an investment in our common stock. You may, therefore, be required to bear the risks of

this investment for an indefinite period of time.

Shareholders

may face dilution resulting from the issuance of common stock in the future.

We

may issue common stock without shareholder approval, up to the number of authorized shares set forth in our Articles of Incorporation.

Our Board may determine, from time to time, a need to obtain additional capital through the issuance of additional shares of common stock

or other securities. There can be no assurance that such shares will be issued at prices or on terms better than or equal to historical

prices or terms. The issuance of any additional shares of common stock by us in the future may result in a reduction of the book value

or market price, if any, of the then-outstanding common stock. Issuance of additional shares of common stock will reduce the proportionate

ownership and voting power of our existing shareholders.

The

price of our common stock could be volatile.

The

market price of our common stock may be volatile and could be subject to wide fluctuations in price in response to various factors, some

of which are beyond our control. These factors include, among other things: variations in our quarterly results of operations; recommendations

by securities analysts; performance of other companies that investors deem comparable to us; economic factors unrelated to our performance;

general market conditions; and changes in government regulations. In addition, if the market for stocks in our industry, or the stock

market in general, experiences a loss of investor confidence, the trading price of our common stock could decline for reasons unrelated

to our business, financial condition, or results of operations. If any of the foregoing occurs, it could cause our stock price to fall

and may expose us to lawsuits that, even if unsuccessful, could be costly to defend and a distraction to management.

An

investment in our common stock is not an insured deposit.

An

investment in our common stock is not a bank deposit and, therefore, is not insured against loss by the FDIC. Investment in our common

stock is inherently risky for the reasons described herein, and is subject to the same market forces that affect the price of common

stock in any company. As a result, if you acquire our common stock, you could lose some or all of your investment.

Owning

our stock will not give you the right to participate in any future offerings of our capital stock and your ownership could be diluted.

As

a shareholder, you are not automatically entitled to purchase additional shares of common stock in future issuances of our common stock;

therefore, you may not be able to maintain your current percentage of ownership in Optimum. If we decide to issue additional shares of

common stock or conduct an additional offering of stock, your ownership in Optimum could be diluted and your potential share of future

profits may be reduced.

Management

has broad discretion concerning the use of our capital.

We

use our capital to maintain liquidity and to continue to support the growth of the Bank. This growth may include the opening of branch

offices, increasing the size and volume of loans, or other such activities that may require additional capital. Capital may also be used

to service our outstanding debt. Our management may determine that it is in the best interest of the Company or the Bank to apply our

capital in a manner that is inconsistent with a shareholder’s wishes. Failure to use such funds effectively might harm your investment.

If

equity research analysts do not publish research or reports about our business, or if they do publish such reports but issue unfavorable

commentary or downgrade our common stock, the price and trading volume of our common stock could decline.

The

trading market for our common stock could be affected by whether and to what extent equity research analysts publish research or reports

about us and our business. We cannot predict at this time whether any research analysts will cover us and our common stock or whether

they will publish research and reports on us. The price of our stock could decline if one or more securities analysts downgrade our stock

or if those analysts issue other unfavorable commentary or cease publishing reports about us. If any of the analysts who elect to cover

us downgrade their recommendation with respect to our common stock, our stock price could decline rapidly. If any of these analysts ceases

coverage of us, we could lose visibility in the market, which in turn could cause our common stock price or trading volume to decline

and our common stock to be less liquid.

Our

Board of Directors owns a significant percentage of our shares and will be able to make decisions to which you may be opposed.

Our

directors and executive officers are expected to exert a significant influence on the election of Board members and on the direction

of the Company. This influence could negatively affect the price of our shares or be inconsistent with other shareholders’ desires.

We

have outstanding preferred stock and our Board may authorize the issuance of additional series of preferred stock.

We

have a material amount of outstanding preferred stock. Additionally, our Articles of Incorporation provide that our Board of Directors

may authorize additional series of preferred stock without shareholder approval. Accordingly, the issuance of new shares of preferred

stock may adversely affect the rights of the holders of shares of our common stock.

We

are restricted by law and government policy in our ability to pay dividends to our shareholders.

Holders

of shares of our capital stock are only entitled to receive such dividends as our Board may declare out of funds legally available for

such payments. We have not declared cash dividends on our common stock, we are not required to do so, and may never do so. This could