Oportun Announces Series of Corporate Governance Enhancements

October 11 2023 - 4:05PM

Oportun Financial Corporation (Nasdaq: OPRT) (“Oportun” or the

“Company”), a mission-driven fintech, announced today that its

Board of Directors (the “Board”) approved a series of proactive

corporate governance enhancements that reflect the Company’s

commitment to drive stockholder value.

The Company announced the following:

- Adoption of a majority voting

standard in uncontested director elections;

- Elimination of the supermajority

vote provision in the Company’s bylaws related to amendments to the

bylaws; and

- The submission to stockholders of a

proposal to eliminate the supermajority vote provisions in the

Company’s certificate of incorporation.

The two amendments to the bylaws were effective upon approval by

the Board in October 2023. The proposal, which requires stockholder

approval, will be presented to stockholders at Oportun’s 2024

Annual Meeting of Stockholders (the “2024 Annual Meeting”).

“Over the past several months, we have conducted an extensive

review of our governance structure to ensure that it aligns with

today’s best practices,” said Ginny Lee, the Chair of the

Nominating, Governance and Social Responsibility Committee of the

Board. “These enhancements reflect the Board’s ongoing commitment

to strong corporate governance and best position the Company to

continue to enhance long-term shareholder value.”

The amended bylaws have been filed with the Securities and

Exchange Commission (the “SEC”) and are available at www.sec.gov.

The full text of the proposal requiring stockholder approval will

be included in Oportun’s proxy statement to be filed with the SEC

prior to the 2024 Annual Meeting.

About Oportun

Oportun (Nasdaq: OPRT) is a mission-driven fintech that puts its

2 million members' financial goals within reach. With intelligent

borrowing, savings, and budgeting capabilities, Oportun empowers

members with the confidence to build a better financial future.

Since inception, Oportun has provided more than $16.6 billion in

responsible and affordable credit, saved its members more than $2.4

billion in interest and fees, and helped its members save an

average of more than $1,800 annually. For more information, visit

Oportun.com.

Forward Looking Statements

This press release contains forward-looking statements. These

forward-looking statements are subject to the safe harbor

provisions under the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements other than statements of historical fact contained in

this press release, including statements as to the Board’s and

management’s plans regarding the Company’s intended corporate

governance enhancements and when any revised voting standards will

become effective, are forward-looking statements. Many, but not

all, of these statements can be identified by terms such as

“expect,” “plan,” “anticipate,” “project,” "outlook,” “continue,”

“may,” “believe,” or “estimate” and similar expressions or the

negative versions of these words or comparable words, as well as

future or conditional verbs such as “will,” “should,” “would,”

“likely” and “could.” These statements involve known and unknown

risks, uncertainties, assumptions and other factors that may cause

Oportun’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including the possibility that not all of the corporate

governance enhancements will be proposed or approved on the terms

discussed or at all. Oportun has based these forward-looking

statements largely on its current expectations and projections

about future events and financial trends that it believes may

affect its business, financial condition and results of operations.

These risks and uncertainties include those risks described in

Oportun's filings with the SEC, including Oportun's most recent

annual report on Form 10-K and most recent quarterly report on Form

10-Q. The forward-looking statements speak only as of the date on

which they are made and, except to the extent required by federal

securities laws, Oportun disclaims any obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which the statement is made or to reflect the

occurrence of unanticipated events. In light of these risks and

uncertainties, there is no assurance that the events or results

suggested by the forward-looking statements will in fact occur, and

you should not place undue reliance on these forward-looking

statements.

Oportun Investor ContactDorian Hare(650)

590-4323ir@oportun.com

Oportun Media ContactUsher Lieberman(650)

769-9414usher.lieberman@oportun.com

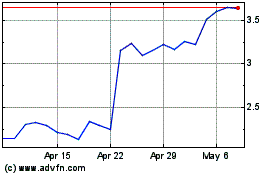

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

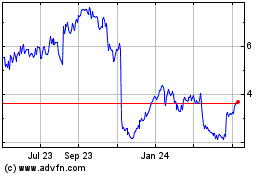

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Nov 2023 to Nov 2024