OMNIQ Corp. (NASDAQ: OMQS) (“OMNIQ” or the “Company”), a provider

of Artificial Intelligence (AI) and IoT–based solutions will

release Full Year 2023 Earnings after the market close

on Monday, April 1st, 2024. The announcement will be

followed by a live earnings call with management the following

morning, Tuesday, April 2nd, 2024, at 9:00 AM EST.

- Reduction in General Administrative

expenses by $4.7 million, or 17% YoY

- Reduction of thirty-four employees

compared to December 31st, 2022.

- Increased Cash Assets by $300

Thousand.

- Decrease in current liabilities by

$836 Thousand.

- For the year ended December 31,

2023, no customer accounted for more than 10% of the Company’s

revenues. For the year ended December 31, 2022, one customer

accounted for 30% of the Company’s revenues.

- Losses reported are largely

impacted by non-cash impairments*, our non-cash Goodwill impairment

expenses amounted to $14.7 million for December 31st, 2023.

Fourth Quarter 2023 Financial Results

OMNIQ reported revenue of $16 million for the

quarter ended December 31, 2023. Our Gross Margin was 13% compared

to 2022 which had a gross margin of 17%. As a result of

management’s effort to reduce costs. The total operating expenses

for the quarter before the non-cash impairment expenses were $6.5M,

compared with $7.6 million in the fourth quarter of 2022. These

results resulted in savings of $1.2M for the quarter. The total

expenses including the $14.7M impairment were $19.1M.

Net loss for the quarter was $17.8 million,

compared with a loss of $4 million, or a loss of $0.53 per basic

share, for the fourth quarter of last year. The loss was largely

impacted by the $14.7 impairment expense. Adjusted EBITDA (Adjusted

Earnings Before Interest, Taxes, Depreciation, and Amortization)

for the fourth quarter of 2023 amounted to a loss of $3.6 million

compared with an adjusted EBITDA loss of $1.4 million in the fourth

quarter of 2022.

Cash balance on December 31, 2023, was

approximately $1.7 million compared with $1.1 million on December

31, 2022.

FY 2023 Financial Results

OMNIQ reported revenue of $81.1 million for the

year ended December 31, 2023, a decrease of $19.6 million from

$100.8 million for the year ended December 31, 2022. Our Gross

Profit decreased to $15.7 million in the year that ended December

31, 2023, compared to $22.1 million in 2022. Total operating

expenses excluding the Impairment cost for the year ended December

31, 2023, were $27.2M a decrease of $4.5M compared with $31.7

million in the year ended December 31, 2022. While including the

non-cash impairment the expenses were $41.9M for the year ended

December 31st, 2023.

Net loss for the year ended December 31, 2022,

was $29.4 million, or a loss of $3.45 per basic share, compared

with a loss of $13.6 million, or a loss of $1.82 per basic share,

for the year ended December 31, 2022.

Adjusted EBITDA (Adjusted Earnings Before

Interest, Taxes, Depreciation and Amortization) for the year ended

December 31, 2023, amounted to a loss of $7.4 million compared with

an adjusted EBITDA loss of $2.9 million in 2022.

Additional Q4 2023 and recent events:

- Multi-year contract for Israel’s

largest logistics center.

- AI-machine vision ordered for La

Guardia, NY Stewart, and Newark Airports.

- Addition of AI based in-car face

detection.

- Acquisition of Codeblocks; a

fintech company ensuring proprietary unique features.

- Fintech solution ordered for

Israel’s largest fast-food chain.

- Self-Service Taxi kiosks ordered

for Ben-Gurion Airport to improve service, safety, and regulate

pricing for travelers.

- Fintech solution ordered for

U.S.-owned restaurant chain.

- Contract to upgrade 450 sporting

goods stores in the US.

- Recent purchase order from Nestle

for logistic operations.

Shareholder update

The Company dealt with the challenge of the need

to conduct cost cuts mainly attributable to the temporary weakness

in the market conditions combined with the need to maintain and

improve its position in the huge markets it is involved with to

support future growth and profitability. So far, management has

taken, and is still taking, aggressive measures reducing annual

SG&A costs by $4.7M and working on further measures to achieve

profitability as soon as practically possible. Ultimately, we plan

to prioritize timely and cost-effective development and business

with the highest margins, while continuing cost reductions.

One challenge is that we are experiencing a

working capital deficit of $45 million and an accumulated deficit

of $114 million. We have also seen a year-over-year decrease in

sales and a reduction of goodwill. To mitigate this, we have placed

a strategic focus on increasing sales with prime customers. No

customer accounted for more than 10% of the revenues in 2023 vs

year end 2022 when one customer accounted for 30% of the Company’s

revenues. Additionally, our sales efforts are focused on the most

profitable product lines.

To ensure we have sufficient working capital, in

October 2023, management finalized an equity raise which resulted

in $2.5 million in net cash received from investors. Management

also finalized a new line of credit with a new financial

institution.

“In navigating

through the complex landscape shaped by global and market events,

it has provided us with a valuable opportunity to reflect deeply on

our core operations and values. It's like looking in a mirror, not

to critique what we see with harshness, but to understand where our

strengths lie and where we need to evolve. These insights are now

guiding us toward making significant, forward-thinking changes. We

are not just addressing the immediate issues at hand; we are laying

down the foundation for a healthier, more robust future for our

company. This period of transformation, though demanding, is an

investment in our collective future, ensuring we emerge not just

intact but stronger and more aligned with our mission than ever

before.” – Shai Lustgarten, CEO

OMNIQ Fourth Quarter 2023 Earnings Call

Details

Tuesday, April 02, 2024 - 9:00 AM Eastern Time

Participant Numbers: Toll Free: 888-506-0062International:

973-528-0011Participant Access Code: 102048

Participants will be greeted by an operator and

asked for the access code. If a caller does not have the code, they

can reference the company name. We have found that using access

codes expedites entry into the call and suggest the code be

distributed with the dial in numbers.

Teleconference Replay Number:Toll Free:

877-481-4010International: 919-882-2331Replay Passcode: 50290

Webcast URL:

https://www.webcaster4.com/Webcast/Page/2310/50290

About OMNIQ Corp.

OMNIQ Corp. excels in providing state-of-the-art

computerized and machine vision image processing technologies,

anchored in its proprietary and patented artificial intelligence

innovations. The Company's extensive range of services spans

advanced data collection systems, real-time surveillance, and

monitoring capabilities catered to various sectors, including

supply chain management, homeland security, public safety, as well

as traffic and parking management. These innovative solutions are

strategically designed to secure and optimize the movement of

individuals, assets, and information across essential

infrastructures such as airports, warehouses, and national

borders.

The Company serves a broad spectrum of clients,

including government agencies and esteemed Fortune 500 corporations

across several industries—manufacturing, retail, healthcare,

distribution, transportation, logistics, food and beverage, and the

oil, gas, and chemical sectors. By adopting OMNIQ Corp.'s advanced

solutions, these organizations are better equipped to manage the

intricacies of their domains, thereby enhancing their operational

effectiveness.

OMNIQ Corp. has established a significant

footprint in rapidly expanding markets. This includes the Global

Safe City sector, predicted to reach $67.1 billion by 2028, the

smart parking industry, expected to escalate to $16.4 billion by

2030, and the fast-casual restaurant market, projected to hit $209

billion by 2027. These engagements reflect the Company's strategic

alignment with industries that are witnessing a growing need for

cutting-edge AI technology solutions.

For additional information, please visit www.OMNIQ.com.

Information about forward-looking

statements

This press release includes forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995, specifically under Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

These statements, which address expected future events, economic

performance, and financial outcomes, are not historical facts but

predictions based on current expectations and projections.

Such forward-looking statements, identifiable by

terms like "anticipate," "expect," "may," "believe," and similar

expressions, should not be seen as guarantees of future results.

They are based on the information available at the time of making

and reflect management's current expectations about future events.

These statements are subject to various risks and uncertainties

that could cause actual results to differ significantly from those

projected or implied. Some of these risks include fluctuations in

product demand, the introduction of new offerings, maintaining

customer and strategic relationships, competitive pressures, market

growth, financial liquidity, debt management, and the ability to

integrate new acquisitions effectively.

Specific forward-looking statements in this

release include expectations regarding financial strategies,

revenue growth, and operational improvements. For a detailed

discussion of risks and uncertainties that could affect OMNIQ

Corp.'s future performance, please refer to our recent filings with

the Securities and Exchange Commission at https://www.sec.gov.

OMNIQ Corp. does not commit to updating these forward-looking

statements unless required by law.

Contact Info:IR@OMNIQ.com

* Impairment of Goodwill – During the year ended

December 31, 2023, the Company experienced significant decline in

our stock price and sustained losses from operations. Therefore, we

completed a quantitative goodwill impairment analysis as of

December 31, 2023. The results of the analysis indicated an

impairment loss for goodwill related to acquisitions prior to 2021,

and we recorded a non-cash impairment of $14.7 million.

OMNIQ CORP.CONSOLIDATED BALANCE SHEETSAs of

December 31,

| (In thousands, except share

and per share data) |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,678 |

|

|

$ |

1,311 |

|

|

Accounts receivable, net |

|

|

18,654 |

|

|

|

23,893 |

|

|

Inventory |

|

|

6,028 |

|

|

|

8,726 |

|

|

Prepaid expenses |

|

|

969 |

|

|

|

1,268 |

|

|

Other current assets |

|

|

25 |

|

|

|

473 |

|

|

Total current assets |

|

|

27,354 |

|

|

|

35,671 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net of accumulated depreciation of $1,166

and $1,030 respectively |

|

|

1,066 |

|

|

|

1,086 |

|

|

Goodwill |

|

|

1,788 |

|

|

|

16,542 |

|

|

Trade name, net of accumulated amortization of $4,850 and $4,458,

respectively |

|

|

1,377 |

|

|

|

1,826 |

|

|

Customer relationships, net of accumulated amortization of $11,814

and $10,762, respectively |

|

|

3,777 |

|

|

|

4,967 |

|

|

Other intangibles, net of accumulated amortization of $1,669 and

$1,541, respectively |

|

|

504 |

|

|

|

675 |

|

|

Right of use lease asset |

|

|

1,862 |

|

|

|

2,300 |

|

|

Other assets |

|

|

1,758 |

|

|

|

1,744 |

|

| Total

Assets |

|

$ |

39,486 |

|

|

$ |

64,811 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

56,741 |

|

|

$ |

53,701 |

|

|

Line of credit |

|

|

240 |

|

|

|

1,971 |

|

|

Accrued payroll and sales tax |

|

|

1,537 |

|

|

|

2,633 |

|

|

Notes payable, related parties – current portion |

|

|

- |

|

|

|

293 |

|

|

Notes payable – current portion |

|

|

10,196 |

|

|

|

11,572 |

|

|

Lease liability – current portion |

|

|

885 |

|

|

|

942 |

|

|

Other current liabilities |

|

|

3,106 |

|

|

|

2,429 |

|

|

Total current liabilities |

|

|

72,705 |

|

|

|

73,541 |

|

| |

|

|

|

|

|

|

|

|

| Long term

liabilities |

|

|

|

|

|

|

|

|

|

Notes payable, related party, less current portion |

|

|

- |

|

|

|

0 |

|

|

Accrued interest and accrued liabilities, related party |

|

|

73 |

|

|

|

72 |

|

|

Notes payable, less current portion |

|

|

265 |

|

|

|

55 |

|

|

Lease liability |

|

|

1,011 |

|

|

|

1,404 |

|

|

Other long term liabilities |

|

|

452 |

|

|

|

265 |

|

| Total

liabilities |

|

|

74,506 |

|

|

|

75,337 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

|

|

Series A Preferred stock; $0.001 par value; 2,000,000 shares

designated, 0 shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Series B Preferred stock; $0.001 par value; 1 share designated, 0

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Series C Preferred stock; $0.001 par value; 3,000,000 shares

designated, 502,000 and 544,500 shares issued and outstanding,

respectively |

|

|

1 |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

Common stock; $0.001 par value; 15,000,000 shares authorized;

10,675,802 and 7,714,780 shares issued and outstanding,

respectively. |

|

|

11 |

|

|

|

8 |

|

|

Additional paid-in capital |

|

|

78,339 |

|

|

|

73,714 |

|

|

Accumulated (deficit) |

|

|

(113,923 |

) |

|

|

(84,460 |

) |

|

Accumulated other comprehensive income |

|

|

551 |

|

|

|

211 |

|

|

Total OmniQ stockholders’ equity (deficit) |

|

|

(35,020 |

) |

|

|

(10,526 |

) |

| |

|

|

|

|

|

|

|

|

|

Total liabilities and equity (deficit) |

|

$ |

39,486 |

|

|

$ |

64,811 |

|

OMNIQ CORP. CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSSFor the Years Ended December 31,

| (In thousands, except share

and per share data) |

|

2023 |

|

|

2022 |

|

| Revenues |

|

$ |

81,193 |

|

|

$ |

100,758 |

|

| |

|

|

|

|

|

|

|

|

| Cost of goods

sold |

|

|

65,485 |

|

|

|

78,654 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

15,708 |

|

|

|

22,104 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

Research & Development |

|

|

2,154 |

|

|

|

1,826 |

|

|

Selling, general and administrative |

|

|

22,960 |

|

|

|

27,707 |

|

|

Depreciation |

|

|

464 |

|

|

|

324 |

|

|

Amortization |

|

|

1,640 |

|

|

|

1,799 |

|

|

Goodwill impairment expense |

|

|

14,686 |

|

|

|

- |

|

| Total operating expenses |

|

|

41,904 |

|

|

|

31,656 |

|

| |

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(26,196 |

) |

|

|

(9,552 |

) |

| |

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(3,303 |

) |

|

|

(3,496 |

) |

|

Other (expenses) income |

|

|

(1,145 |

) |

|

|

(601 |

) |

| Total other expenses |

|

|

(4,448 |

) |

|

|

(4,097 |

) |

| Net Loss Before Income

Taxes |

|

|

(30,074 |

) |

|

|

(13,649 |

) |

| Provision for Income

Taxes |

|

|

|

|

|

|

|

|

|

Current |

|

|

643 |

|

|

|

35 |

|

| Total Provision for Income

Taxes |

|

|

643 |

|

|

|

35 |

|

| |

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(29,431 |

) |

|

$ |

(13,614 |

) |

| Net income attributable to

noncontrolling interest |

|

|

- |

|

|

|

67 |

|

| Net Loss attributable to OmniQ

Corp |

|

$ |

(29,431 |

) |

|

$ |

(13,681 |

) |

| |

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(29,431 |

) |

|

$ |

(13,614 |

) |

| Foreign currency translation

adjustment |

|

|

340 |

|

|

|

365 |

|

| Comprehensive loss |

|

$ |

(29,091 |

) |

|

$ |

(13,249 |

) |

| Reconciliation of net loss to

net loss attributable to common shareholders |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(29,431 |

) |

|

$ |

(13,614 |

) |

| Less: Dividends attributable

to non-common stockholders’ of OmniQ Corp |

|

|

(32 |

) |

|

|

(206 |

) |

| Net loss attributable to

common stockholders’ of OmniQ Corp |

|

$ |

(29,463 |

) |

|

$ |

(13,820 |

) |

| Net (loss) per share - basic

attributable to common stockholders’ of OmniQ Corp |

|

$ |

(3.50 |

) |

|

$ |

(1.82 |

) |

| Weighted average number of

common shares outstanding - basic |

|

|

8,412,494 |

|

|

|

7,576,434 |

|

OMNIQ

Corp.RECONCILIATION OF

GAAPMEASURES TO NON-GAAP MEASURES

| |

|

The year ended |

|

| (In thousands) |

|

December 31, |

|

|

Adjusted EBITDA Calculation |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Net loss |

|

|

(29,431 |

) |

|

|

(13,614 |

) |

| Depreciation &

amortization |

|

|

2,104 |

|

|

|

2,119 |

|

| Interest expense |

|

|

3,303 |

|

|

|

3,496 |

|

| Income taxes |

|

|

(643 |

) |

|

|

(35 |

) |

| Stock compensation |

|

|

1,955 |

|

|

|

3,323 |

|

| Goodwill impairment |

|

|

14,686 |

|

|

|

- |

|

| Nonrecurring loss events |

|

|

619 |

|

|

|

1,786 |

|

| Adjusted EBITDA |

|

|

(7,407 |

) |

|

|

(2,925 |

) |

| |

|

|

|

|

|

|

|

|

| Total revenues, net |

|

|

81,193 |

|

|

|

100,758 |

|

| Adjusted EBITDA as a % of

total revenues, net |

|

|

(9.12 |

%) |

|

|

(-2.9%) |

|

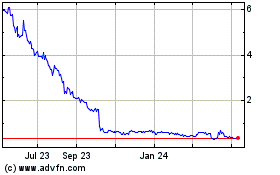

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

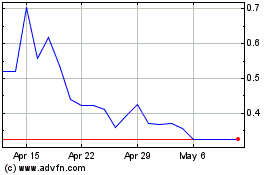

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Feb 2024 to Feb 2025