false

0001676047

0001676047

2024-01-04

2024-01-04

0001676047

us-gaap:CommonStockMember

2024-01-04

2024-01-04

0001676047

NTRB:WarrantsMember

2024-01-04

2024-01-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 4, 2024

Nutriband Inc.

| Nevada |

|

001-40854 |

|

81-1118176 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

121 S. Orange Ave. Suite 1500

Orlando, Florida |

|

32801 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(407) 377-6695

Registrant’s Telephone Number, Including

Area Code

(Former name or former address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

NTRB |

|

The Nasdaq Stock Market LLC |

| Warrants |

|

NTRBW |

|

The Nasdaq Stock Market LLC |

Item 7.01. Regulation FD Disclosure.

See Press Release attached as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are being filed with this Current Report

on Form 8-K:

SIGNATURES

PURSUANT TO THE REQUIREMENTS OF THE SECURITIES

EXCHANGE ACT OF 1934, THE REGISTRANT HAS DULY CAUSED THIS REPORT TO BE SIGNED ON ITS BEHALF BY THE UNDERSIGNED THEREUNTO DULY AUTHORIZED.

| Date: January 11, 2024 |

By: |

/s/ Gareth Sheridan |

| |

|

R: Gareth Sheridan |

| |

|

Chief Executive Officer |

2

Exhibit

99.1

NUTRIBAND SIGNS COMMERCIAL DEVELOPMENT AND CLINICAL SUPPLY

AGREEMENT WITH KINDEVA DRUG DELIVERY FOR AVERSA™ FENTANYL, AN ABUSE DETERRENT FENTANYL PATCH

ORLANDO, FL / ACCESSWIRE / January 4, 2024 / Nutriband

Inc. (NASDAQ:NTRB) (NASDAQ:NTRBW), a company engaged in the development of transdermal pharmaceutical products, today announced it has

signed a commercial development and clinical supply agreement for their lead product, Aversa™ Fentanyl, with their partner, Kindeva

Drug Delivery, a leading global contract development and manufacturing organization (CDMO) focused on drug-device combination products.

Under this agreement, Kindeva will perform commercial manufacturing process development and manufacture clinical supplies for the human

abuse liability clinical study required by the FDA in support of a New Drug Application (NDA). This new agreement replaces the previous

feasibility agreement between the two companies which was focused on adapting Kindeva’s commercial transdermal manufacturing process

to incorporate AVERSA™ abuse deterrent transdermal technology.

AVERSA™ Fentanyl combines Nutriband’s proprietary

AVERSA™ abuse-deterrent transdermal technology with Kindeva’s FDA-approved transdermal fentanyl patch system with the potential

to become the world’s first opioid patch with abuse deterrent properties. AVERSA™ Fentanyl is estimated to have the potential

to reach peak annual US sales of $80M - $200M.1

“Execution of this commercial development agreement

with our partner, Kindeva, will enable us to rapidly commercialize AVERSA™ Fentanyl and capitalize on its significant market potential.

Aversa™ abuse-deterrent technology has the potential to improve the safety profile of transdermal drugs susceptible to abuse, such

as fentanyl, while making sure that these drugs remain accessible to those patients who really need them,” said Gareth Sheridan,

CEO, Nutriband.

“Transdermal

drug-delivery technologies continue to create positive health outcomes for patients globally,” said Kindeva Global Chief

Commercial Officer David Stevens. “Kindeva brings more than a half a century of expertise in transdermal capabilities and

innovation, and we appreciate Nutriband’s expertise and partnership in this next step in development to continue to bring new

solutions to patients.”

| 1 | Health Advances Aversa Fentanyl market analysis report 2022 |

About AVERSA™ Abuse Deterrent Transdermal Technology

Nutriband’s

AVERSA™ abuse-deterrent transdermal technology can be utilized to incorporate aversive agents into transdermal patches to

prevent the abuse, diversion, misuse, and accidental exposure of drugs with abuse potential. The AVERSA™ abuse-deterrent

technology has the potential to improve the safety profile of transdermal drugs susceptible to abuse, such as fentanyl, while making

sure that these drugs remain accessible to those patients who really need them. The technology is covered by a broad intellectual

property portfolio with patents granted in the United States, Europe, Japan, Korea, Russia, Canada, Mexico, and Australia.

About Nutriband Inc.

We are primarily engaged in the development of a portfolio

of transdermal pharmaceutical products. Our lead product under development is an abuse deterrent fentanyl patch incorporating our AVERSA™

abuse-deterrent technology. AVERSA™ technology can be incorporated into any transdermal patch to prevent the abuse, misuse, diversion,

and accidental exposure of drugs with abuse potential.

The Company’s website is www.nutriband.com. Any material contained

in or derived from the Company’s websites or any other website is not part of this press release.

About Kindeva Drug Delivery

Kindeva is a global contract development manufacturing organization

focused on drug-device combination products. Kindeva develops and manufactures products across a broad range of complex drug-delivery

formats, including pulmonary & nasal, injectable, and transdermal . Its service offerings span early-stage feasibility through commercial

scale drug product fill-finish, container closure system manufacturing, and drug-device product assembly. Kindeva serves a global client

base from its nine manufacturing and research and development facilities located in the U.S. and U.K. For more information, please visit

www.kindevadd.com.

Forward-Looking Statements

Certain statements

contained in this press release, including, without limitation, statements containing the words “believes,”

“anticipates,” “expects” and words of similar import, constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve both known and

unknown risks and uncertainties. The Company’s actual results may differ materially from those anticipated in its

forward-looking statements as a result of a number of factors, including those including the Company’s ability to develop its

proposed abuse deterrent fentanyl transdermal system and other proposed products, its ability to obtain patent protection for its

abuse technology, its ability to obtain the necessary financing to develop products and conduct the necessary clinical testing, its

ability to obtain Federal Food and Drug Administration approval to market any product it may develop in the United States and to

obtain any other regulatory approval necessary to market any product in other countries, including countries in Europe, its ability

to market any product it may develop, its ability to create, sustain, manage or forecast its growth; its ability to attract and

retain key personnel; changes in the Company’s business strategy or development plans; competition; business disruptions;

adverse publicity and international, national and local general economic and market conditions and risks generally associated with

an undercapitalized developing company, as well as the risks contained under “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s

Form S-1, Form 10-K for the year ended January 31, 2023 and Forms 10-Q, and the Company’s other filings with the Securities

and Exchange Commission. Except as required by applicable law, we undertake no obligation to revise or update any forward-looking

statements to reflect any event or circumstance that may arise after the date hereof.

Certain statements contained in this press

release, including, without limitation, statements containing the words “believes,” “anticipates,”

“expects” and words of similar import, constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking statements involve both known and unknown risks and uncertainties.

The Company’s actual results may differ materially from those anticipated in its forward-looking statements as a result of a number

of factors, including those including the Company’s ability to develop its proposed abuse deterrent fentanyl transdermal system and

other proposed products, its ability to obtain patent protection for its abuse technology, its ability to obtain the necessary

financing to develop products and conduct the necessary clinical testing, its ability to obtain Federal Food and Drug Administration

approval to market any product it may develop in the United States and to obtain any other regulatory approval necessary to market

any product in other countries, including countries in Europe, its ability to market any product it may develop, its ability to

create, sustain, manage or forecast its growth; its ability to attract and retain key personnel; changes in the Company’s business

strategy or development plans; competition; business disruptions; adverse publicity and international, national and local general

economic and market conditions and risks generally associated with an undercapitalized developing company, as well as the risks

contained under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in the Company’s Form S-1, Form 10-K for the year ended January, 2022 and Forms 10-Q, and the Company’s other

filings with the Securities and Exchange Commission. Except as required by applicable law, we undertake no obligation to revise or

update any forward-looking statements to reflect any event or circumstance that may arise after the date hereof.

For more information, contact:

Investor Relations

RedChip Companies

Dave Gentry

NTRB@redchip.com

1-800-RED-CHIP (733-2447)

407-491-4498

3

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NTRB_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

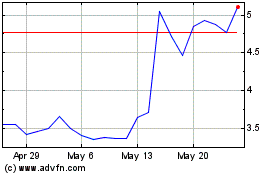

Nutriband (NASDAQ:NTRB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Nutriband (NASDAQ:NTRB)

Historical Stock Chart

From Mar 2024 to Mar 2025