Novavax, Inc. (NASDAQ: NVAX), a late-stage biotechnology company

developing next-generation vaccines for serious infectious

diseases, today announced its financial results and operational

highlights for the fourth quarter and twelve months ended December

31, 2019.

“We remain on track to announce top-line results

from our pivotal Phase 3 clinical trial for NanoFlu by the end of

this month. Positive clinical data from this trial would support a

subsequent U.S. BLA using the FDA’s accelerated approval pathway,”

said Stanley C. Erck, President and Chief Executive Officer of

Novavax. “We continue to make progress towards partnering our

ResVax program and recently announced progress in our efforts to

develop a vaccine against COVID-19, with the goal of moving one or

more optimized COVID- 19 candidates into the clinic by the end

of this spring.”

Fourth Quarter 2019 and Subsequent

Operational Highlights

NanoFlu™ Program

- Results of the pivotal Phase 3 clinical trial for NanoFlu,

Novavax’ recombinant quadrivalent seasonal influenza vaccine

candidate, are expected later this month. The trial includes 2,652

healthy older adults across 19 U.S. clinical sites. The primary

objective of the randomized, observer-blinded, active-controlled

trial is to demonstrate non-inferior immunogenicity as measured by

hemagglutination inhibition (HAI) titers of vaccine homologous

influenza strains and safety compared against a licensed vaccine,

Fluzone® Quadrivalent.

- Positive top-line results from this Phase 3 clinical trial

would support a subsequent U.S. biologics license application (BLA)

and licensure of NanoFlu using the U.S. Food and Drug

Administration’s (FDA) accelerated approval pathway. In addition,

in January 2020, the FDA granted Fast Track designation for

NanoFlu.

COVID-19 Program

- Novavax recently announced that the Coalition for Epidemic

Preparedness Innovations (CEPI) awarded an initial funding of $4

million to support its effort to develop a COVID-19 vaccine. CEPI

and Novavax are having ongoing discussions on additional funding

from CEPI to address Novavax’ costs through Phase 1.

- Novavax began efforts to develop a novel vaccine to protect

against COVID-19 in January. Novavax has produced and is currently

assessing multiple nanoparticle vaccine candidates in animal models

prior to advancing to clinical trials. Initiation of Phase I

clinical testing is expected in May or June 2020. Novavax expects

to utilize its proprietary Matrix-M™ adjuvant with its COVID-19

vaccine candidate to enhance immune responses.

ResVax™ Program

- Novavax is continuing its discussions with both global

regulatory authorities and potential partners to explore the

opportunity to bring ResVax to market.

Matrix-M Partnership

- Earlier today, Novavax announced a commercial license agreement

related to its Matrix-M vaccine adjuvant. Matrix-M is a key

component of Serum Institute of India’s malaria vaccine candidate,

which it licensed from Jenner Institute at Oxford University. The

vaccine candidate is currently in a Phase 2b clinical trial being

conducted in Burkina Faso with top-line data expected in the second

quarter of 2020.

Corporate

- Through utilization of At-the-market (ATM) offerings during the

fourth quarter of 2019, Novavax raised net proceeds of $30 million.

For the twelve months of 2019, Novavax raised net proceeds of $97

million. Subsequent to year-end, through March 6, 2020, Novavax

raised additional net proceeds of $156 million.

Financial Results for the Three and

Twelve Months Ended December 31, 2019

Share and per share data have been restated to

reflect the reverse stock split that was completed in May 2019.

Novavax reported a net loss of $31.8 million, or

$1.13 per share, for the fourth quarter of 2019, compared to a net

loss of $49.3 million, or $2.57 per share, for the fourth quarter

of 2018. For the twelve months ended December 31, 2019, the net

loss was $132.7 million, or $5.51 per share, compared to a net loss

of $184.7 million, or $9.99 per share, for the same period in

2018.

Novavax revenue in the fourth quarter of 2019

was $8.8 million, compared to $6.1 million in the same period in

2018. This 44% increase was driven by $7.5 million in revenue for

the recovery of additional costs under the closeout of the HHS

BARDA contract, partially offset by lower revenue from the

completion of enrollment of participants in the Prepare™ trial in

second quarter of 2018.

Research and development expenses decreased 32%

to $29.3 million in the fourth quarter of 2019, compared to $43.4

million in the same period in 2018. This decrease was primarily due

to decreased development activities of ResVax, lower

employee-related costs and other cost savings due to the Catalent

transaction, partially offset by NanoFlu’s Phase 3 clinical trial

and development activities.

General and administrative expenses decreased to

$8.2 million in the fourth quarter of 2019, compared to $9.2

million for the same period in 2018.

Interest income (expense), net for the fourth

quarter of 2019 was ($3.1) million, compared to ($2.8) million for

the same period of 2018.

As of December 31, 2019, Novavax had $82.2

million in cash, cash equivalents, marketable securities and

restricted cash, compared to $103.9 million as of December 31,

2018. Net cash used in operating activities for the twelve months

of 2019 was $136.6 million, compared to $184.8 million for same

period in 2018.

Conference Call

Novavax will host its quarterly conference call

today at 4:30 p.m. ET. The dial-in numbers for the conference call

are (877) 212-6076 (Domestic) or (707) 287-9331 (International),

passcode 5695528. A replay of the conference call will be available

starting at 7:30 p.m. ET on March 11, 2020 until 7:30 p.m. ET on

March 18, 2020. To access the replay by telephone, dial (855)

859-2056 (Domestic) or (404) 537-3406 (International) and use

passcode 5695528.

A webcast of the conference call can also be

accessed via a link on the home page of the Novavax website

(novavax.com) or through the “Investor Info”/“Events” tab on the

Novavax website. A replay of the webcast will be available on the

Novavax website until June 11, 2020.

About NanoFlu™ and

Matrix-M™

NanoFlu is a recombinant hemagglutinin (HA)

protein nanoparticle influenza vaccine produced by Novavax in its

SF9 insect cell baculovirus system. NanoFlu uses HA amino acid

protein sequences that are the same as the recommended wild-type

circulating virus HA sequences. NanoFlu contains Novavax’ patented

saponin-based Matrix-M adjuvant, which has demonstrated a potent

and well-tolerated effect by stimulating the entry of

antigen-presenting cells into the injection site and enhancing

antigen presentation in local lymph nodes. Top-line data from

Novavax’ ongoing Phase 3 clinical trial of NanoFlu is expected late

in the first quarter of 2020.

About COVID-19

A new strain of coronavirus first appeared in

late 2019 in China before beginning its rapid spread across the

globe. The disease, named COVID-19, continues to cause severe

pneumonia-like symptoms in many of those infected. Coronaviruses,

so named for their “crown-like” appearance, are a large family of

viruses that spread from animals to humans and include diseases

such as Middle East Respiratory Syndrome (MERS) and Severe Acute

Respiratory Syndrome (SARS) in addition to COVID-19. While much

remains unknown about the new coronavirus, it is known that the

virus can spread via human-to-human transmission before any

symptoms appear.

About Novavax

Novavax, Inc. (Nasdaq:NVAX), is a late-stage

biotechnology company that drives improved health globally through

the discovery, development, and commercialization of innovative

vaccines to prevent serious infectious diseases. NanoFlu™, its

quadrivalent influenza nanoparticle vaccine, is currently in a

pivotal Phase 3 clinical trial to address key factors that can lead

to the poor effectiveness of currently approved flu vaccines.

ResVax™, its RSV vaccine for infants via maternal immunization, is

the only vaccine in a Phase 3 clinical program and is designed to

prevent severe lower respiratory tract infection, which is the

second leading cause of death in children under one year of age

worldwide. Novavax is a leading innovator of recombinant vaccines;

its proprietary recombinant technology platform combines the power

and speed of genetic engineering to efficiently produce a new class

of highly immunogenic nanoparticles addressing urgent global health

needs.

For more information, visit www.novavax.com and

connect with us on Twitter and LinkedIn.

Forward-Looking Statements

Statements herein relating to the future of

Novavax and the ongoing development of its vaccine and adjuvant

products are forward-looking statements. Novavax cautions that

these forward-looking statements are subject to numerous risks and

uncertainties, which could cause actual results to differ

materially from those expressed or implied by such statements.

These risks and uncertainties include those identified under the

heading “Risk Factors” in the Novavax Annual Report on Form 10-K

for the year ended December 31, 2019, as filed with the Securities

and Exchange Commission (SEC). We caution investors not to place

considerable reliance on the forward-looking statements contained

in this press release. You are encouraged to read our filings with

the SEC, available at sec.gov, for a discussion of these and other

risks and uncertainties. The forward-looking statements in this

press release speak only as of the date of this document, and we

undertake no obligation to update or revise any of the statements.

Our business is subject to substantial risks and uncertainties,

including those referenced above. Investors, potential investors,

and others should give careful consideration to these risks and

uncertainties.

|

NOVAVAX, INC. |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

(in thousands, except per share information) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

December 31 |

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

| Revenue |

$ |

8,816 |

|

|

$ |

6,127 |

|

|

$ |

18,662 |

|

|

$ |

34,288 |

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

Research and

development |

|

29,341 |

|

|

|

43,415 |

|

|

|

113,842 |

|

|

|

173,797 |

|

|

|

Gain on Catalent

transaction |

|

-- |

|

|

|

-- |

|

|

|

(9,016 |

) |

|

|

-- |

|

|

|

General and

administrative |

|

8,180 |

|

|

|

9,224 |

|

|

|

34,417 |

|

|

|

34,409 |

|

|

|

|

Total expenses |

|

37,521 |

|

|

|

52,639 |

|

|

|

139,243 |

|

|

|

208,206 |

|

| Loss from

operations |

|

(28,705 |

) |

|

|

(46,512 |

) |

|

|

(120,581 |

) |

|

|

(173,918 |

) |

| Interest income

(expense), net |

|

(3,127 |

) |

|

|

(2,819 |

) |

|

|

(12,100 |

) |

|

|

(10,938 |

) |

| Other income

(expense) |

|

2 |

|

|

|

(3 |

) |

|

|

(13 |

) |

|

|

108 |

|

| Net loss |

$ |

(31,830 |

) |

|

$ |

(49,334 |

) |

|

$ |

(132,694 |

) |

|

$ |

(184,748 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net

loss per share |

$ |

(1.13 |

) |

|

$ |

(2.57 |

) |

|

$ |

(5.51 |

) |

|

$ |

(9.99 |

) |

| Basic and diluted

weighted average |

|

|

|

|

|

|

|

|

|

number of common

shares outstanding |

|

28,063 |

|

|

|

19,159 |

|

|

|

24,100 |

|

|

|

18,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECTED CONSOLIDATED BALANCE SHEET

DATA (in thousands)

| |

December 31, 2019 |

|

December 31, 2018 |

| |

|

|

|

|

Cash and cash equivalents |

$ |

78,823 |

|

|

$ |

70,154 |

|

| Marketable securities |

|

-- |

|

|

|

21,980 |

|

| Total restricted cash |

|

3,357 |

|

|

|

11,805 |

|

| Total current assets |

|

97,247 |

|

|

|

119,276 |

|

| Working capital |

|

71,452 |

|

|

|

73,737 |

|

| Total assets |

|

172,957 |

|

|

|

207,978 |

|

| Notes payable |

|

320,611 |

|

|

|

319,187 |

|

| Total stockholders’ deficit |

|

(186,017 |

) |

|

|

(167,935 |

) |

Contacts:

InvestorsNovavax, Inc.Erika Trahanir@novavax.com240-268-2022

WestwickeJohn

Woolfordjohn.woolford@westwicke.com 443-213-0506

MediaBrandzone/COGS CommunicationEdna

Kaplankaplan@kogspr.com617-974-8659

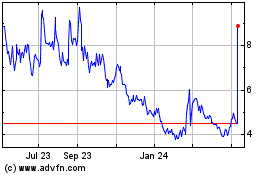

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

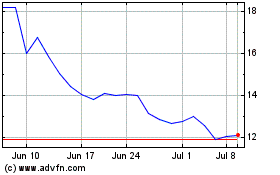

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Dec 2023 to Dec 2024