| As filed with the Securities and Exchange Commission on April 14, 2023 |

| Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

NioCorp Developments Ltd.

(Exact name of registrant as specified in its

charter)

| British Columbia,

Canada |

|

98-1262185 |

(State or other jurisdiction

of incorporation or organization) |

|

(IRS Employer Identification

No.) |

7000 South Yosemite Street, Suite 115

Centennial, Colorado 80112

Tel: (855) 264-6267

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

13th Floor

New York, New York 10011

Tel: (800) 624-0909

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies of all communications, including communications

sent to agent for service, should be sent to:

| |

Christopher M. Kelly

Joel T. May

Andrew C. Thomas

Jones Day

1221 Peachtree Street, N.E.

Suite 400

Atlanta, Georgia 30361

(404) 581-8967 |

Bob Wooder

Kyle Misewich

Blake, Cassels & Graydon LLP

595 Burrard Street

Suite 2600

Vancouver, British Columbia

V7X 1L3 |

|

Approximate date of commencement of proposed sale

to the public:

From time to time after the effectiveness of this

registration statement.

If the only securities

being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

☐

If any of the

securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

☒

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is

a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is

a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED APRIL 14, 2023

PROSPECTUS

NioCorp Developments Ltd.

16,123,149 Common Shares

5,666,667 Warrants

This prospectus relates to the offer and sale

from time to time by the selling shareholders identified herein (collectively, the “Selling Shareholders”) of (i) up to an

aggregate of 16,123,149 of our common shares, without par value (“Common Shares”), and (ii) up to an aggregate of 5,666,667

warrants issued in connection with the Transactions (as defined herein) (the “NioCorp Assumed Warrants”).

The Common Shares covered by this prospectus

consist of (a) 83,770 Common Shares that were issued to BTIG, LLC in connection with the Closing (as defined herein) in respect of shares

of shares of Class A common stock of GX Acquisition Corp. II (“GXII”) that were issued to BTIG, LLC in lieu of payment in

cash of $761,000 of advisory fees due to BTIG, LLC; (b) up to 4,565,808 Common Shares issuable upon exchange of shares of Class B

common stock of Elk Creek Resources Corp. (formerly known as GXII), a Delaware corporation and our indirect, majority-owned subsidiary

(“ECRC”), that are vested as of the date hereof (the “Vested Shares”); (c) up to 1,695,798 Common Shares

issuable upon exchange of shares of Class B common stock of ECRC that will vest in connection with the Tranche I Earnout (as defined herein)

(the “Tranche I Earnout Shares”); (d) up to 1,695,798 Common Shares issuable upon exchange of shares of Class B common stock

of ECRC that will vest in connection with the Tranche II Earnout (as defined herein) (the “Tranche II Earnout Shares”); (e)

up to 6,336,981 Common Shares issuable upon exercise of the NioCorp Assumed Warrants covered by this prospectus; and (f) 1,744,994 Common

Shares that are issued and outstanding and were issued to certain executive officers of NioCorp at prices per share ranging from C$1.50

to C$7.50. Pursuant to the Business Combination Agreement, the Sponsor Support Agreement and the Exchange Agreement (each, as defined

herein), after the Closing, the shares of Class B common stock of ECRC are exchangeable for Common Shares on a one-for-one basis, subject

to certain equitable adjustments, under certain conditions. All of the shares of Class B common stock of ECRC were issued to GX Sponsor

II LLC (the “Sponsor”) in respect of shares of Class B common stock of GXII that were originally issued to the Sponsor for

$25,000 in the aggregate. In connection with the Closing, the Sponsor distributed all of the outstanding ECRC Class B Shares to its members

for no additional consideration.

The NioCorp Assumed Warrants covered by this

prospectus were issued to GX Sponsor II LLC (the “Sponsor”) in respect of an equal number of GXII Warrants (as defined herein)

that it acquired in a private placement that occurred simultaneously with the closing of the initial public offering of GX Acquisition

Corp. II (“GXII”) at a purchase price of $1.50 per GXII Warrant. In connection with the Closing, the Sponsor distributed all

of its NioCorp Assumed Warrants to its members for no additional consideration. Each NioCorp Assumed Warrant is exercisable for 1.11829212

Common Shares for cash or, as permitted in certain circumstances in accordance with their terms and the NioCorp Assumed Warrant Agreement

(as defined herein), on a cashless basis at a price per 1.11829212 Common Shares of $11.50, and will expire five years after the Closing

Date (as defined herein), at 5:00 p.m., New York City time, or earlier upon redemption or liquidation. If, upon exercise of the NioCorp Assumed Warrants, a holder would be entitled to receive a fractional interest in a share, the Company will, upon exercise, round down to the nearest whole number of Common Shares to be issued to the NioCorp Assumed Warrant holder.

We are not selling any securities under this

prospectus and will not receive any of the proceeds from the sale of our Common Shares or the NioCorp Assumed Warrants by the Selling

Shareholders. However, upon exercise, we will receive the cash exercise price of the NioCorp Assumed Warrants (assuming that they are

not exercised on a cashless basis). We believe the likelihood that NioCorp Assumed Warrant holders will exercise their NioCorp Assumed

Warrants, and therefore the amount of cash proceeds that we would receive, is, among other things, dependent upon the market price of

our Common Shares. For so long as the market price for our Common Shares is less than the exercise price of the NioCorp Assumed Warrants

(as is the case as of the date of this prospectus), we believe such holders will be unlikely to exercise their NioCorp Assumed Warrants.

We expect to use the net proceeds that we receive from the exercise of the NioCorp Assumed Warrants, if any, for working capital and general

corporate purposes, including to advance our efforts to launch construction of the Elk Creek Project and move it to commercial operation.

See “Use of Proceeds.”

Our registration of the Common Shares and the

NioCorp Assumed Warrants covered by this prospectus does not mean that the Selling Shareholders will offer or sell any Common Shares or

NioCorp Assumed Warrants. The Selling Shareholders may offer the Common Shares and the NioCorp Assumed Warrants in one or more transactions

at fixed prices, at prevailing market prices at the time of sale, at varying prices determined at the time of sale, at negotiated prices,

or in trading markets for our Common Shares and the NioCorp Assumed Warrants. The Securities and Exchange Commission (the “SEC”)

may take the position that the Selling Shareholders are deemed “underwriters” within the meaning of Section 2(a)(11) of the

Securities Act of 1933 (the “Securities Act”), in connection with such sales. Any profits realized by the Selling Shareholders

and the compensation of any broker-dealer may be deemed to be underwriting discounts and commissions.

Additional information on the Selling Shareholders,

and the times and manner in which they may offer and sell Common Shares and NioCorp Assumed Warrants under this prospectus, is provided

under “Selling Shareholders” and “Plan of Distribution” beginning on pages 16 and 39, respectively, of this

prospectus.

The Selling Shareholders will pay all brokerage

fees and commissions and similar expenses in connection with the offer and sale of the Common Shares and the NioCorp Assumed Warrants

by the Selling Shareholders pursuant to this prospectus. We will pay the expenses (except brokerage fees and commissions and similar expenses)

incurred in registering under the Securities Act the offer and sale of the Common Shares and the NioCorp Assumed Warrants included in

this prospectus by the Selling Shareholders. See “Plan of Distribution.”

If all of the Common Shares covered by this

prospectus were issued and outstanding, they would represent a substantial percentage of our public float and of our outstanding Common

Shares. As of April 11, 2023, the Common Shares covered by this prospectus would represent approximately 36.33% of the total

number of outstanding Common Shares (assuming all of the Common Shares covered by this prospectus were issued and outstanding and not

including Common Shares issuable upon exercise of outstanding stock options, or reserved for future issuance, under the NioCorp Developments

Ltd. Long-Term Incentive Plan (the “LTIP”), Common Shares issuable in respect of the Commitment Amount (as defined herein)

pursuant to the Yorkville Equity Facility Financing Agreement (as defined herein) or Common Shares issuable upon conversion, exercise

or exchange of other outstanding securities, as described herein). Upon their acquisition of the Common Shares covered by this prospectus,

the Selling Shareholders will be able to sell such Common Shares for so long as the registration statement of which this prospectus is

a part is available for use. Accordingly, the sale of the Common Shares covered by this prospectus, or the perception that such sales

may occur, could result in a significant decline in the public trading price of our Common Shares. Moreover, the sale of additional Common

Shares by us or by other security holders, or the perception that such sales may occur, could result in a further decline in the public

trading price of our Common Shares. See “Risk Factors—Additional Risks Related to this Offering and Our Common Shares.”

In addition, as described herein,

some of the Common Shares covered by this prospectus were or may be acquired by the Selling Shareholders for no consideration

or for prices below the prevailing market price of the Common Shares. Accordingly, subject to the “lock-up”

restrictions pursuant to the Registration Rights and Lockup Agreement, the Selling Shareholders may have an incentive to sell

such Common Shares, even if the market price of our Common Shares declines, that is not shared by other shareholders because

the price at which they acquired or will be deemed to have acquired such Common Shares may still be lower than the

then-prevailing market price of the Common Shares. As a result, the Selling Shareholders may experience a positive rate of

return on the Common Shares covered by this prospectus due to the potential differences between the prices of at which they

acquired or will be deemed to have acquired such securities and the market price of the underlying Common Shares, and other

shareholders may not experience a similar rate of return due to the differences in the purchase prices and the

then-prevailing market price of the Common Shares. For example, the shares of Class B common stock of GXII that were

exchanged for shares of ECRC Class B common stock in connection with the Closing were initially purchased by the Sponsor at a

price of $0.003 per share. Based on the last reported sale price of the Common Shares on The Nasdaq Global Market on April

11, 2023, as disclosed below, the Selling Shareholders who beneficially own the ECRC Class B common stock would experience a

potential profit of approximately $6.82 per share, or approximately $31,125,113 in the aggregate, assuming they exchange all

of their Vested Shares for Common Shares and sold them pursuant to this prospectus. Because of the Common Share market price

vesting conditions of the Tranche I Earnout Shares and Tranche II Earnout Shares, as described herein, the Selling

Shareholders who beneficially own such shares of ECRC Class B common stock would not be able to exchange such Tranche I

Earnout Shares or Tranche II Earnout Shares at the current market price for the Common Shares. In addition, based on the last

reported sale price of the Common Shares on The Nasdaq Global Market on April 11, 2023 and based on the CAD:USD exchange

ratio of CAD$1.3483:USD$1.00 on April 11, 2023 as reported by the Bank of Canada, the executive officers of

NioCorp that may resell their Common Shares pursuant to this prospectus would experience a potential profit per share of

between approximately $1.26 per share and approximately $5.71 per share, or approximately $7,985,400 in the aggregate,

assuming they sold their Common Shares pursuant to this prospectus. See “Risk Factors—Additional Risks

Related to this Offering and Our Common Shares.”

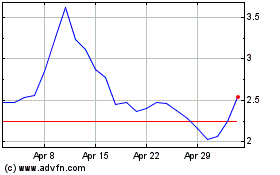

Our Common Shares trade on The

Nasdaq Global Market under the symbol “NB” and on the Toronto Stock Exchange (the “TSX”) under the

symbol “NB.” On April 11, 2023, the last reported sale price of our Common Shares on The Nasdaq Global Market and

the TSX was $6.82 per Common Share and C$9.02 per Common Share, respectively. The public NioCorp Assumed Warrants trade on

The Nasdaq Capital Market under the symbol “NIOBW.” On April 11, 2023, the last reported sale price of

the public NioCorp Assumed Warrants on The Nasdaq Capital Market

was $0.792 per public NioCorp Assumed Warrant. Our principal executive office is located

at 7000 South Yosemite Street, Suite 115, Centennial, Colorado 80112, and our telephone number is (855) 264-6267.

Investing in our Common Shares or the NioCorp

Assumed Warrants involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading

“Risk Factors” beginning on page 6 of this prospectus.

Neither the SEC nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is ,

2023.

TABLE

OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form S-3 that we filed with the SEC using a “shelf” registration process. The Selling Shareholders may, from time to time,

sell the Common Shares and the NioCorp Assumed Warrants described in this prospectus.

You should rely only on the information provided

in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement.

Neither we nor the Selling Shareholders have authorized anyone to provide you with different information. Neither we nor the Selling Shareholders

have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus

or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you.

Neither we nor the Selling Shareholders take responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate

as of any date other than the date of the applicable document. Since the date of this prospectus and the documents incorporated by reference

into this prospectus, our business, financial condition, results of operations and prospects may have changed. Neither we nor the Selling

Shareholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement

or post-effective amendment to the registration statement of which this prospectus is a part to add information to, or update or change

information contained in, this prospectus and the registration statement of which this prospectus is a part. You should read this prospectus

and any applicable prospectus supplement or post-effective amendment to the registration statement of which this prospectus is a part

together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More

Information” and “Incorporation of Documents by Reference.”

Unless we state otherwise or the context

otherwise requires, the terms “we,” “us,” “our,” “our business” “NioCorp,”

“the Company” and similar references refer to NioCorp Developments Ltd. and its consolidated subsidiaries.

Unless we state otherwise or the context

otherwise requires, the term “ECRC” refers to Elk Creek Resources Corp. (formerly known as GX Acquisition Corp. II), a Delaware

corporation and a majority-owned subsidiary of NioCorp, as the surviving entity of the mergers that occurred on the Closing Date (as defined

herein) as part of the Transactions, and the term “GXII” refers to GX Acquisition Corp. II, a Delaware corporation, as it

existed prior to the Closing (as defined herein).

This prospectus contains our registered and

unregistered trademarks and service marks, as well as trademarks and service marks of third parties. Solely for convenience, these trademarks

and service marks are referenced without the ®, ™ or similar symbols, but such references are not intended to indicate, in anyway,

that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and service marks. All brand names,

trademarks and service marks appearing in this prospectus are the property of their respective holders.

WHERE YOU CAN

FIND MORE INFORMATION

This prospectus is part of a registration statement

on Form S-3 that we filed with the SEC under the Securities Act and does not contain all the information set forth or incorporated by

reference in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other

documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement of which

this prospectus is a part or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy

of such contract, agreement or other document. You may obtain copies of the registration statement and its exhibits via the SEC’s

EDGAR database.

We file annual, quarterly and current reports,

proxy statements and other information with the SEC under the Securities Exchange Act of 1934 (the “Exchange Act”). The SEC

maintains a website that contains reports, proxy and information statements and other information regarding issuers, including us, that

file electronically with the SEC. You may obtain documents that we file with the SEC at www.sec.gov.

We make available, free of charge, on our website

at www.niocorp.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements

and amendments to those reports and statements as soon as reasonably practicable after they are filed with the SEC. We do not incorporate

the information on or accessible through any website into this prospectus or any prospectus supplement, and you should not consider any

information on, or that can be accessed through, any website as part of this prospectus or any prospectus supplement. Our website address

and the SEC’s website address are included in this prospectus as inactive textual references only.

INCORPORATION

OF DOCUMENTS BY REFERENCE

SEC rules permit us to incorporate information

by reference into this prospectus and any applicable prospectus supplement. This means that we can disclose important information to you

by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part

of this prospectus and any applicable prospectus supplement, except for information superseded by information contained in this prospectus

or the applicable prospectus supplement itself or in any subsequently filed incorporated document. This prospectus and any applicable

prospectus supplement incorporate by reference the documents set forth below that we have previously filed with the SEC, other than information

in such documents that is deemed to be furnished and not filed. These documents contain important information about us and our business

and financial condition. Any report or information within any of the documents referenced below that is furnished, but not filed, shall

not be incorporated by reference into this prospectus:

| ● | our Annual Report on Form 10-K for the fiscal

year ended June 30, 2022, filed with the SEC on September 6, 2022, as amended by Amendment No. 1 to our Annual Report on Form 10-K/A for

the fiscal year ended June 30, 2022, filed with the SEC on October 31, 2022; |

| ● | our Quarterly Reports on Form 10-Q for the quarter

ended September 30, 2022, filed with the SEC on November 14, 2022, and for the quarter ended December 31, 2022, filed with the SEC on

February 13, 2023; |

| ● | our

Current Reports on Form 8-K, filed with the SEC on September 29, 2022, October 21, 2022, December 15, 2022 (as amended by our

Current Report on Form 8-K/A filed on April 3, 2023), January 27, 2023 (Items 1.01, 2.03, 3.02 and 9.01 (Exhibits 4.1, 4.2, 4.3,

4.4 and 10.1) only), February 13, 2023, February 24, 2023, February 28, 2023, March 1, 2023, March 6, 2023, March 10, 2023, March

14, 2023 and March 17, 2023 (Items 1.01, 2.01, 3.01, 3.02, 3.03, 5.02, 8.01 and 9.01 (Exhibits 2.1, 3.1, 4.1, 4.2, 4.3, 10.1,

10.2, 10.3 and 10.4) only); and |

| ● | a description of our Common Shares, contained

in our Registration Statement on Form 8-A, filed with the SEC on March 17, 2023, and any subsequently filed amendments and reports filed

for the purpose of updating that description. |

We also incorporate by reference any future

filings made by us with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information furnished to, rather

than filed with, the SEC), including after the date of the initial registration statement of which this prospectus is a part and prior

to effectiveness of the registration statement, and after effectiveness of the registration statement and prior to the termination of

the offering of the securities made by this prospectus. Information in such future filings updates and supplements the information provided

in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in

any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that

statements in the later filed document modify or replace such earlier statements.

You may request a copy of these filings, at

no cost, by writing or calling us at the following address or telephone number below:

NioCorp Developments Ltd.

7000 South Yosemite Street, Suite 115

Centennial, Colorado 80112

Phone: (855) 264-6267

Those copies will not include exhibits, unless

the exhibits have specifically been incorporated by reference in this document or you specifically request them.

SUMMARY

This summary highlights selected information

appearing in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand

this offering fully, you should read this entire prospectus carefully, including the information set forth in the section entitled “Risk

Factors” contained in this prospectus and under similar headings in the other documents that are incorporated by reference into

this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our consolidated

financial statements and related notes and the exhibits to the registration statement of which this prospectus is a part, before making

an investment decision. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Cautionary

Note Regarding Forward-Looking Statements.”

NioCorp Developments Ltd.

NioCorp is a mineral exploration company engaged

in the acquisition, exploration, and development of mineral properties. NioCorp, through its indirect, majority-owned subsidiary, ECRC,

is developing a superalloy materials project that, if and when developed, will produce niobium, scandium, and titanium products. Known

as the “Elk Creek Project,” it is located near Elk Creek, Nebraska, in the southeast portion of the state.

| ● | Niobium is used to produce various superalloys that are extensively used in high performance aircraft and jet turbines. It also is

used in high-strength low-alloy steel, a stronger steel used in automobiles, bridges, structural systems, buildings, pipelines, and other

applications that generally enables those applications to be stronger and lighter in mass. This “lightweighting” benefit often

results in environmental benefits, including reduced fuel consumption and material usage, which can result in fewer air emissions. |

| ● | Scandium can be combined with aluminum to make super-high-performance alloys with increased strength and improved corrosion resistance.

Scandium also is a critical component of advanced solid oxide fuel cells, an environmentally preferred technology for high-reliability,

distributed electricity generation. |

| ● | Titanium is a component of various superalloys and other applications that are used for aerospace applications, weapons systems, protective

armor, medical implants and many others. It also is used in pigments for paper, paint, and plastics. |

During fiscal year 2022, the Company also advanced

work on the determination of the economic potential of expanding its currently planned product suite from the Elk Creek Project to include

rare earth elements.

Our primary business strategy is to advance

our Elk Creek Project to commercial production. We are focused on obtaining additional funds to carry out our near-term planned work programs

associated with securing the project financing necessary to complete mine development and construction of the Elk Creek Project.

Background

Completion of the Transactions

On March 17, 2023 (the “Closing Date”),

NioCorp consummated the transactions contemplated by the previously-announced Business Combination Agreement, dated as of September 25,

2022 (the “Business Combination Agreement”), among NioCorp, GXII and Big Red Merger Sub Ltd (the “Closing”). The

transactions contemplated by the Business Combination Agreement, including the reverse stock split at a ratio of 10-for-1 effectuated

by each of NioCorp and ECRC on the Closing Date (the “Reverse Stock Split”), are referred to, collectively, as the “Transactions.”

In connection with the Closing, GXII, as the

surviving entity of the mergers that occurred on the Closing Date as part of the Transactions, changed its name to Elk Creek Resources

Corp. and became an indirect, majority-owned subsidiary of NioCorp, with the pre-combination public shareholders of GXII receiving Common

Shares based on a fixed exchange ratio of 11.1829212 (or 1.11829212 after giving effect to the Reverse Stock Split) (the “Exchange

Ratio”) Common Shares for each Class A common share of GXII held and not redeemed, and the GXII founders receiving shares of Class

B common stock of ECRC based on the Exchange Ratio. Pursuant to the Business Combination Agreement, the Sponsor Support Agreement, dated

as of September 25, 2022 (as amended,

supplemented or otherwise modified, the “Sponsor Support Agreement”),

by and among GXII, NioCorp, the Sponsor and certain other stockholders of GXII, and the Exchange Agreement, dated as of March 17, 2023

(as amended, supplemented or otherwise modified, the “Exchange Agreement”), by and among NioCorp, ECRC and the Sponsor, after

the Closing, the GXII founders have the right to exchange such shares of Class B common stock of ECRC for Common Shares on a one-for-one

basis, subject to certain equitable adjustments, under certain conditions. Such shares that constitute Vested Shares are exchangeable

at any time, and from time to time, until the tenth anniversary of the Closing Date. Such shares that constitute Tranche I Earnout Shares

are not exchangeable until the volume-weighted average price of the Common Shares on the principal securities exchange for the Common

Shares as reported by Bloomberg (“VWAP”) equals or exceeds approximately $12.00 per share for 20 of any 30 consecutive trading

days during the period from the Closing through, and including, the tenth anniversary of the Closing Date (such period, the “Earnout

Share Period”) on any stock exchange on which the Common Shares are then trading (the “Tranche I Earnout”). Such shares

that constitute Tranche II Earnout Shares are not exchangeable until the VWAP of the Common Shares equals or exceeds approximately $15.00

per share for 20 of any 30 consecutive trading days during the Earnout Share Period on any stock exchange on which the Common Shares are

then trading (the “Tranche II Earnout”). All of the shares of Class B common stock of ECRC were issued to GX Sponsor II LLC

(the “Sponsor”) in respect of shares of Class B common stock of GXII that were originally issued to the Sponsor for $25,000

in the aggregate. In connection with the Closing, the Sponsor distributed all of the outstanding ECRC Class B Shares to its members for

no additional consideration.

In connection with the Closing, pursuant to

the Business Combination Agreement, the Company assumed the Warrant Agreement, dated as of March 17, 2021 (the “GXII Warrant Agreement”),

by and between GXII and Continental Stock Transfer & Trust Company (“CST”), as warrant agent, and each share purchase

warrant of GXII thereunder (the “GXII Warrants”) that was issued and outstanding immediately prior to the Closing Date was

converted into one NioCorp Assumed Warrant pursuant to the GXII Warrant Agreement, as amended by an assignment, assumption and amendment

agreement, dated the Closing Date (the GXII Warrant Agreement, as so amended, the “NioCorp Assumed Warrant Agreement”), among

NioCorp, GXII, CST, as existing warrant agent, and Computershare Inc. and its affiliate Computershare Trust Company, N.A., together as

successor warrant agent (the “NioCorp Assumed Warrant Agent”). In connection with the Closing, NioCorp issued (a) 9,999,959

public NioCorp Assumed Warrants in respect of the GXII Warrants that were publicly traded prior to the Closing and (b) 5,666,667 NioCorp

Assumed Warrants to the Sponsor in respect of an equal number of GXII Warrants that it held prior to the Closing, which NioCorp Assumed

Warrants were subsequently distributed by the Sponsor to its members in connection with the Closing for no additional consideration.

The Sponsor acquired the GXII Warrants in respect of which the NioCorp Assumed Warrants covered by this prospectus were issued in a private

placement that occurred simultaneously with the closing of the initial public offering of GXII at a purchase price of $1.50 per GXII Warrant.

Both the public NioCorp Assumed Warrants and

the NioCorp Assumed Warrants issued to the Sponsor are subject to the terms of the NioCorp Assumed Warrant Agreement and are identical,

with certain exceptions applicable to the NioCorp Assumed Warrants issued to the Sponsor for so long as such NioCorp Assumed Warrants

are held by the Sponsor, its members, or their respective affiliates and other permitted transferees. In accordance with the NioCorp Assumed

Warrant Agreement, any NioCorp Assumed Warrants issued to the Sponsor that are not held by the Sponsor, its members, or their respective

affiliates and other permitted transferees, are treated as public NioCorp Assumed Warrants. See “Description of Capital Stock—NioCorp

Assumed Warrants” for a description of certain terms of the NioCorp Assumed Warrants.

Immediately prior to the Closing, GXII issued

in a private placement to BTIG, LLC shares of GXII Class A common stock in lieu of payment in cash of $761,000 of advisory fees due to

BTIG, LLC. In connection with the closing, such shares were exchanged for Common Shares at the Exchange Ratio, and after giving effect

to the Reverse Stock Split, BTIG, LLC holds 83,770 Common Shares.

Pursuant to the Business Combination Agreement,

at the Closing, NioCorp, ECRC, the Sponsor, the pre-Closing directors and officers of NioCorp and the other parties thereto, including

the Selling Shareholders (collectively, the “RRA Shareholders”), entered into the Amended and Restated Registration Rights

Agreement, dated March 17, 2023 (the “Registration Rights and Lockup Agreement”), pursuant to which, among other things, NioCorp

became obligated to file a shelf registration statement to register the resale of (i) outstanding Common Shares, (ii) Common Shares exchangeable

for the shares of Class B common stock of ECRC, (iii) NioCorp Assumed Warrants and (iv) Common Shares issuable upon exercise of the NioCorp

Assumed Warrants, in each case, held by the RRA Shareholders immediately after the Closing. The Registration Rights and Lockup Agreement

also provides

the RRA Shareholders with certain “demand” and “piggy-back”

registration rights, subject to certain requirements and customary conditions, and provides for certain “lock-up” restrictions

on transfer by the RRA Shareholders of such securities held by them after the Closing.

We are filing the registration statement of

which this prospectus is a part, among other reasons, to satisfy our obligations under the Registration Rights and Lockup Agreement with

respect to registering the securities held by the RRA Shareholders immediately after the Closing.

Yorkville Financings

In connection with the entry into the

Business Combination Agreement, the Company announced the signing of non-binding letters of intent for two separate financing

packages with Yorkville Advisors Global, LP. On January 26, 2023, the Company entered into definitive agreements with respect to

these financings, including a Securities Purchase Agreement, dated January 26, 2023 (as amended the "Yorkville Convertible Debt

Financing Agreement"), between the Company and YA II PN, Ltd. ("YA"), a fund managed by Yorkville Advisors Global,

LP, and a Standby Equity Purchase Agreement, dated January 26, 2023 (the “Yorkville Equity Facility Financing

Agreement”), between the Company and YA. Pursuant to the Yorkville Equity Facility Financing Agreement, YA has committed to

purchase up to $65.0 million of our Common Shares (the “Commitment Amount”), at our direction from time to time for a

period commencing upon the Closing Date and ending on the earliest of (i) the first day of the month next following the 36-month

anniversary of the Closing, (ii) the date on which YA shall have made payment of the full Commitment Amount and (iii) the date that

the Yorkville Equity Facility Financing Agreement otherwise terminates in accordance with its terms (the “Commitment

Period”), subject to certain limitations and the satisfaction of the conditions in the Yorkville Equity Facility Financing

Agreement. Pursuant to the terms of the Yorkville Equity Facility Financing Agreement, we issued 81,213 of our Common Shares (the

“Commitment Shares”) to YA as consideration for its irrevocable commitment to purchase Common Shares under the Yorkville

Equity Facility Financing Agreement. Additionally, we are required to pay YA an aggregate fee of $1,500,000 in cash (the “Cash

Fee”), including $500,000 that we paid on the Closing Date and the remainder that we will pay in installments over a 12-month

period following the Closing Date, provided that, we will have the right to prepay without penalty all or part of the remaining

installments of the Cash Fee at any time.

Pursuant to the Yorkville Convertible Debt

Financing Agreement, at the Closing, YA advanced a total amount of $15.36 million to NioCorp in consideration of the issuance by

NioCorp to YA of (i) $16.0 million aggregate principal amount of unsecured convertible debentures (the “Convertible Debentures”)

and (ii) Common Share purchase warrants, exercisable for up to 1,789,267 Common Shares for cash or, if at any time there is no effective

registration statement registering, or no current prospectus available for, the resale of the underlying Common Shares, on a cashless

basis, at the option of the holder, at a price per Common Share of approximately $8.9422, subject to adjustment to give effect to any

stock dividend, stock split, reverse stock split or similar transaction (the “Financing Warrants”). See “Description

of Capital Stock—Yorkville Convertible Debentures” and “Description of Capital Stock—Financing Warrants,”

respectively, for descriptions of certain terms of the Convertible Debentures and the Financing Warrants.

Acquisitions of Common Shares by Certain Executive Officers

of NioCorp

Certain

executive officers of NioCorp are Selling Shareholders. Such executive officers purchased or otherwise acquired their Common Shares

covered by this prospectus in connection with private placements of NioCorp between 2013 and 2016, upon exercise of Common Share

purchase warrants acquired in such private placements or upon exercise of stock options, at prices per share ranging from C$1.50 to C$7.50.

Corporate Information

Our Common Shares trade on The Nasdaq Global

Market under the symbol “NB” and on the TSX under the symbol “NB.” The public NioCorp Assumed Warrants trade on

The Nasdaq Capital Market under the symbol “NIOBW.” Our principal executive office is located at 7000 South Yosemite Street,

Suite 115, Centennial, CO 80112, and our telephone number is (855) 264-6267. Our website address is www.niocorp.com. This website

address is not intended to be an active link, and information on, or accessible through, our website is not incorporated by reference

into this prospectus and you should not consider any information on, or that can be accessed from, our website as part of this prospectus

or any accompanying prospectus supplement.

SECURITIES OFFERED

| Common

Shares Offered by the Selling Shareholders |

Up to an

aggregate of 16,123,149 Common Shares, consisting of:

(a) 83,770

Common Shares that are issued and outstanding and were issued to BTIG, LLC;

(b) up to

4,565,808 Common Shares issuable upon exchange of the Vested Shares;

(c) up

to 1,695,798 Common Shares issuable upon exchange of the Tranche I Earnout Shares;

(d) up to

1,695,798 Common Shares issuable upon exchange of the Tranche II Earnout Shares;

(e) up to

6,336,981 Common Shares issuable upon exercise of NioCorp Assumed Warrants covered by this prospectus; and

(f) 1,744,994

Common Shares that are issued and outstanding and were issued to certain executive officers of NioCorp. |

| NioCorp Assumed Warrants

Offered by the Selling Shareholders |

Up

to an aggregate of 5,666,667 NioCorp Assumed Warrants. |

| Common Shares Outstanding

Prior to this Offering(1) |

30,081,655

Common Shares (as of April 11, 2023). |

| Common Shares Outstanding

After this Offering(1) |

44,376,040

Common Shares, assuming the issuance of (i) 4,565,808 Common Shares issuable upon exchange of the Vested Shares, (ii) 1,695,798

Common Shares issuable upon exchange of the Tranche I Earnout Shares, (iii) 1,695,798 Common Shares issuable upon exchange of the

Tranche II Earnout Shares and (iv) 6,336,981 Common Shares issuable upon exercise of NioCorp Assumed Warrants. |

| Use of Proceeds |

We

will not receive any proceeds from the sale of Common Shares or NioCorp Assumed Warrants included in this prospectus by the Selling

Shareholders. However, upon exercise, we will receive the cash exercise price of the NioCorp Assumed Warrants covered by this prospectus

(assuming that the holders do not exercise their NioCorp Assumed Warrants on a cashless basis). We believe the likelihood that NioCorp

Assumed Warrant holders will exercise their NioCorp Assumed Warrants, and therefore the amount of cash proceeds that we would receive,

is, among other things, dependent upon the market price of our Common Shares. For so long as the market price for our Common Shares

is less than the exercise price of the NioCorp Assumed Warrants (as is the case as of the date of this prospectus), we believe such

holders will be unlikely to exercise their NioCorp Assumed Warrants. We expect to use the net proceeds that we receive from the exercise

of the NioCorp Assumed Warrants, if any, for working capital and general corporate purposes, including to advance our efforts to

launch construction of the Elk Creek Project and move it to commercial operation. See “Use of Proceeds.” |

| Market

for Common Shares |

Our

Common Shares trade on The Nasdaq Global Market under the symbol “NB” and on the TSX under the symbol “NB.” |

| Market for NioCorp

Assumed Warrants |

The

public NioCorp Assumed Warrants trade on The Nasdaq Capital Market under the symbol “NIOBW.” |

| Risk

Factors |

See

“Risk Factors” and other information included in this prospectus for a discussion of factors you should consider before

investing in our securities. |

(1) Does not include:

| ● | Common Shares issuable upon exercise of outstanding stock options under the

LTIP; |

| ● | Common Shares reserved for future issuance under the LTIP; |

| ● | Common Shares issuable in respect of the Commitment Amount pursuant to the

Yorkville Equity Facility Financing Agreement; |

| ● | Common Shares issuable upon conversion of the Convertible Debentures; |

| ● | an aggregate of 1,789,267 Common Shares issuable upon exercise of the Financing

Warrants; |

| ● | an aggregate of 11,182,875 Common Shares issuable upon exercise of public

NioCorp Assumed Warrants; and |

| ● | an aggregate of 1,801,622 Common Shares issuable upon exercise of other outstanding

Common Share purchase warrants with a weighted-average exercise price of approximately C$11.68. |

RISK FACTORS

Investing in our Common Shares and the NioCorp

Assumed Warrants involves a high degree of risk. Before making a decision to invest in our Common Shares or the NioCorp Assumed Warrants,

you should carefully consider the risks described below and under the heading “Risk Factors” in the applicable prospectus

supplement, and discussed under Part I, Item 1A. “Risk Factors” contained in our most recent Annual Report on Form 10-K, and

Part II, Item 1A. “Risk Factors” contained in our subsequent Quarterly Reports on Form 10-Q, as well as any amendments thereto,

which are incorporated by reference into this prospectus and the applicable prospectus supplement in their entirety, together with other

information in this prospectus and the applicable prospectus supplement and the documents incorporated by reference herein and therein.

See the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Documents by

Reference.” Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our

business, financial condition or results of operations. The occurrence of any of these known or unknown risks might cause you to lose

all or part of your investment in our Common Shares or the NioCorp Assumed Warrants.

Additional Risks Related to this Offering

and Our Common Shares and the NioCorp Assumed Warrants

Future sales, or the

perception of future sales, of Common Shares covered by this prospectus by the Selling Shareholders could adversely affect prevailing

market prices for the Common Shares.

Under this prospectus, the Selling Shareholders

may sell (a) 83,770 Common Shares that were issued to BTIG, LLC in connection with the Closing in respect of shares of shares of Class

A common stock of GXII that were issued to BTIG, LLC in lieu of payment in cash of $761,000 of advisory fees due to BTIG, LLC; (b) up

to 4,565,808 Common Shares issuable upon exchange of the Vested Shares; (c) up to 1,695,798 Common Shares issuable upon exchange

of the Tranche I Earnout Shares; (d) up to 1,695,798 Common Shares issuable upon exchange of the Tranche II Earnout Shares; (e) up to

6,336,981 Common Shares issuable upon exercise of the NioCorp Assumed Warrants covered by this prospectus; and (f) 1,744,994 Common Shares

that are issued and outstanding and were issued to certain executive officers of NioCorp at prices per share ranging from C$1.50 to C$7.50.

All of the shares of Class B common stock of ECRC were issued to the Sponsor in respect of shares of Class B common stock of GXII that

were originally issued to the Sponsor for $25,000 in the aggregate. In connection with the Closing, the Sponsor distributed all of the

outstanding ECRC Class B Shares to its members for no additional consideration. The NioCorp Assumed Warrants covered by this prospectus

were issued to the Sponsor in respect of an equal number of GXII Warrants that it acquired in a private placement that occurred simultaneously

with the closing of the initial public offering of GXII at a purchase price of $1.50 per GXII Warrant. In connection with the Closing,

the Sponsor distributed all of its NioCorp Assumed Warrants to its members for no additional consideration.

Because some of the Common Shares covered by

this prospectus were or may be acquired by the Selling Shareholders for no consideration or for prices below the prevailing market price

of the Common Shares, subject to the “lock-up” restrictions pursuant to the Registration Rights and Lockup Agreement, the

Selling Shareholders may have an incentive to sell such Common Shares, even if the market price of our Common Shares declines. Similarly,

to the extent that the NioCorp Assumed Warrants covered by this prospectus are exercised, the holders of the Common Shares issued upon

exercise thereof may have an incentive to sell such Common Shares because the Common Shares issued upon the exercise of such NioCorp Assumed

Warrants may have been purchased for less than the then-prevailing market price of the Common Shares. However, for so long as the market

price for our Common Shares is less than the exercise price of the NioCorp Assumed Warrants (as is the case as of the date of this prospectus),

we believe holders of the NioCorp Assumed Warrants will be unlikely to exercise their NioCorp Assumed Warrants.

Pursuant to the Registration Rights and Lockup

Agreement, the RRA Shareholders are subject to “lock-up” restrictions. The provisions of these “lock-up” restrictions

may be waived under limited circumstances and allow the directors and officers of NioCorp or its shareholders, including the Selling Shareholders,

to sell their Common Shares at any time. There are no pre-established conditions for the grant of such a waiver by the relevant parties,

and any decision by the applicable parties to waive those conditions may depend on a number of factors, which might include market conditions,

the performance of the Common Shares in the market and our financial condition at that

time. If the “lock-up” restrictions of the applicable

shareholders, including the Selling Shareholders, or the directors and officers of NioCorp are waived, additional Common Shares will be

available for sale into the public market, subject to applicable securities laws, which, in both cases, could reduce the prevailing market

price for the Common Shares.

If all of the Common Shares

covered by this prospectus were issued and outstanding, they would represent a substantial percentage of our public float and

of our outstanding Common Shares. As of April 11, 2023, the Common Shares covered by this prospectus would represent

approximately 36.33% of the total number of outstanding Common Shares (assuming all of the Common Shares covered by this

prospectus were issued and outstanding and not including Common Shares issuable upon exercise of outstanding stock options,

or reserved for future issuance, under the LTIP, Common Shares issuable in respect of the Commitment Amount pursuant to the

Yorkville Equity Facility Financing Agreement or Common Shares issuable upon conversion, exercise or exchange of other

outstanding securities). Upon their acquisition of the Common Shares covered by this prospectus, the Selling Shareholders

will be able to sell such Common Shares into the public market for so long as the registration statement of which this

prospectus is a part is available for use. Accordingly, the sale of the Common Shares covered by this prospectus, or the

perception that such sales may occur, could result in a significant decline in the public trading price of our Common

Shares.

We may not recognize the full value of the

Yorkville Equity Facility Financing Agreement and may not receive any proceeds from the exercise of the NioCorp Assumed Warrants, the

Financing Warrants and our other outstanding Common Share purchase warrants, and the potential adverse effect on the prevailing market

prices for our Common Shares as a result of sales, or the perception of future sales, of Common Shares covered by this prospectus by the Selling Shareholders could

adversely affect our ability to raise additional capital and you could lose all or part of your investment.

Although we have entered into the Yorkville

Equity Facility Financing Agreement, we may not recognize the full value thereof. Specifically, our ability to sell Common Shares to YA

pursuant to the Yorkville Equity Facility Financing Agreement is subject to certain restrictions and limitations, which may prevent us

from selling the full Commitment Amount prior to the expiration of the Commitment Period. Our ability to recognize the full value of the

Yorkville Equity Facility Financing Agreement may be further impeded by the potential negative pressure on the market price of our Common

Shares as a result of sales, or the perception of future sales, of the Common Shares covered by this prospectus by the Selling Shareholders. As a result, there can

be no assurance that we will receive all or even a significant portion of the proceeds that we expect to receive in connection with the

Yorkville Equity Facility Financing Agreement.

In addition, we are not selling any securities

under this prospectus and will not receive any of the proceeds from the sale of our Common Shares by the Selling Shareholders. However,

upon exercise, we will receive the cash exercise price of the NioCorp Assumed Warrants covered by this prospectus (assuming that the holders

do not exercise their NioCorp Assumed Warrants on a cashless basis). Further, we will receive the cash exercise price of the public NioCorp

Assumed Warrants, the Financing Warrants and our other outstanding Common Share purchase warrants upon exercise (assuming, with respect

to the public NioCorp Assumed Warrants and the Financing Warrants, that they are not exercised on a cashless basis). We believe the likelihood

that holders of the NioCorp Assumed Warrants, the Financing Warrants or other outstanding Common Share purchase warrants will exercise

their NioCorp Assumed Warrants, Financing Warrants or other outstanding Common Share purchase warrants, and therefore the amount of cash

proceeds that we would receive, is, among other things, dependent upon the market price of our Common Shares. For so long as the market

price for our Common Shares is less than the applicable exercise price of the NioCorp Assumed Warrants, the Financing Warrants or other

outstanding Common Share purchase warrants (as is the case as of the date of this prospectus), we believe such holders will be unlikely

to exercise their NioCorp Assumed Warrants, Financing Warrants or other outstanding Common Share purchase warrants. The potential adverse

effect on the prevailing market price of our Common Shares as a result of sales of Common Shares covered by this prospectus by the Selling

Shareholders, or the perception that such sales may occur, could keep the market price for our Common Shares below the applicable exercise

price of the NioCorp Assumed Warrants, the Financing Warrants or other outstanding Common Share purchase warrants. Accordingly, the holders

of the NioCorp Assumed Warrants, the Financing Warrants or other outstanding Common Share purchase warrants may not exercise their NioCorp

Assumed Warrants, Financing Warrants or other outstanding Common Share

purchase warrants before they expire, and we may not receive any

proceeds from the exercise of the NioCorp Assumed Warrants, the Financing Warrants or other outstanding Common Share purchase warrants.

We incurred significant debt in connection

with the Transactions, including upon issuance of the Convertible Debentures, and we require significant additional capital to operate

our business. For example, notwithstanding whether we are able to recognize the full value of the Yorkville Equity Facility Financing

Agreement or receive the cash exercise price of the NioCorp Assumed Warrants, the Financing Warrants or other outstanding Common Share

purchase warrants, we are obligated to repay or issue Common Shares upon settlement of the full $16.0 million aggregate principal amount

of the Convertible Debentures. Such significant additional debt could adversely affect our business, which may prevent us from fulfilling

our obligations with respect to our existing debt or obtaining future financing. Further, the Yorkville Convertible Debt Financing Agreement

restricts us from pursuing certain variable rate financing transactions, which could impair our ability to obtain additional financing

on terms that are favorable, or at all. In addition, if the market price of the Common Shares were to drop as a result of sales, or the

perception of future sales, of the Common Shares covered by this prospectus, this might impede our ability to raise additional capital.

Our inability to obtain additional financing on terms that are favorable, or at all, could have a material adverse effect on our financial

condition, results of operations and prospects, and you may lose all or part of your investment.

Future sales, or the

perception of future sales, of Common Shares by existing shareholders or by us, or future dilutive issuances of Common Shares by us, could

adversely affect prevailing market prices for the Common Shares.

In addition to the Common Shares that may be

sold by the Selling Shareholders under this prospectus, subject to compliance with applicable securities laws, sales of a substantial

number of Common Shares in the public market could occur at any time, including issuances and sales of additional Common Shares by us

and sales by other security holders. These sales, or the market perception that the holders of a large number of Common Shares or securities

convertible, exercisable or exchangeable into Common Shares intend to sell Common Shares, could reduce the prevailing market price of

the Common Shares. The effect, if any, that future public sales of these securities or the availability of these securities for sale will

have on the market price of the Common Shares is uncertain. If the market price of the Common Shares were to drop as a result, this might

impede our ability to raise additional capital and might cause remaining shareholders to lose all or part of their investment.

In addition, pursuant to the Yorkville Convertible

Debt Financing Agreement, YA may convert the Convertible Debentures and exercise the Financing Warrants from time to time, subject to

certain limitations, and we will issue Common Shares to YA upon such conversions and exercises. We have filed a registration

statement under the Securities Act covering resales by YA of the Common Shares issuable upon conversion of the Convertible Debentures

and exercise of the Financing Warrants. Accordingly, any Common Shares that we issue upon conversion of the Convertible Debentures or

exercise of the Financing Warrants will be available for sale into the public market, subject to applicable securities laws, which could

reduce the prevailing market price for the Common Shares.

Additionally, pursuant to the Yorkville Equity

Facility Financing Agreement, YA has committed to purchase up to $65.0 million of our Common Shares, at our direction from time to time

during the Commitment Period, subject to certain limitations and the satisfaction of the conditions in the Yorkville Equity Facility Financing

Agreement. Pursuant to the terms of the Yorkville Equity Facility Financing Agreement, we issued 81,213 Commitment Shares to YA as consideration

for its irrevocable commitment to purchase Common Shares under the Yorkville Equity Facility Financing Agreement. We have filed a registration statement under the Securities Act covering resales by YA of the Common Shares issuable pursuant to the Yorkville Equity

Facility Financing Agreement. Accordingly, any Common Shares that we issue pursuant to the Yorkville Equity Facility Financing Agreement

will be available for sale into the public market, subject to applicable securities laws, which could reduce the prevailing market price

for the Common Shares.

Also, in connection with the Closing, pursuant

to the Business Combination Agreement, the Company issued, in addition to the NioCorp Assumed Warrants covered by this prospectus, an

aggregate of 9,999,959 NioCorp Assumed Warrants, which are publicly traded and exercisable for an aggregate of up to 11,182,875 Common

Shares. Pursuant to the NioCorp Assumed Warrant Agreement, we have filed a registration statement under the Securities Act covering

the offering, issuance and sale of the Common Shares issuable upon exercise of the NioCorp

Assumed Warrants. Accordingly, any Common Shares that we issue upon

exercise of NioCorp Assumed Warrants will be available for sale into the public market, subject to applicable securities laws, which could

reduce the prevailing market price for the Common Shares.

The

Selling Shareholders acquired or may acquire the Common Shares covered by this prospectus at a price below the prevailing market

price of our Common Shares, and may experience a positive rate of return based on such market price. Our future investors may

not experience a similar rate of return.

As

described herein, some of the Common Shares covered by this prospectus were or may be acquired by the Selling Shareholders for

no consideration or for prices below the prevailing market price of the Common Shares. Accordingly, subject to the “lock-up”

restrictions pursuant to the Registration Rights and Lockup Agreement, the Selling Shareholders may have an incentive to sell

such Common Shares, even if the market price of our Common Shares declines, that is not shared by other shareholders because the

price at which they acquired or will be deemed to have acquired such Common Shares may still be lower than the then-prevailing

market price of the Common Shares. As a result, the Selling Shareholders may experience a positive rate of return on the Common

Shares covered by this prospectus due to the potential differences between the prices of at which they acquired or will be deemed

to have acquired such securities and the market price of the underlying Common Shares, and other shareholders may not experience

a similar rate of return due to the differences in the purchase prices and the then-prevailing market price of the Common Shares.

For example, the shares of Class B common stock of GXII that were exchanged for shares of ECRC Class B common stock in connection

with the Closing were initially purchased by the Sponsor at a price of $0.003 per share. Based on the last reported sale price

of the Common Shares on The Nasdaq Global Market on April 11, 2023 of approximately $6.82 per Common Share, the Selling Shareholders

who beneficially own the ECRC Class B common stock would experience a potential profit of approximately $6.82 per share, or approximately

$31,125,113 in the aggregate, assuming they exchange all of their Vested Shares for Common Shares. Because of the Common Share

market price vesting conditions of the Tranche I Earnout Shares and Tranche II Earnout Shares, the Selling Shareholders who beneficially

own such shares of ECRC Class B common stock would not be able to exchange such Tranche I Earnout Shares or Tranche II Earnout

Shares at the current market price for the Common Shares. In addition, based on the last reported sale price of the Common Shares

on The Nasdaq Global Market on April 11, 2023 and based on the CAD:USD exchange ratio of CAD$1.3483:USD$1.00 on April 11, 2023 as reported

by the Bank of Canada, the executive officers of NioCorp that may resell their Common Shares pursuant to this prospectus

would experience a potential profit per share of between approximately $1.26 per share and approximately $5.71 per share, or approximately

$7,985,400 in the aggregate, assuming they sold their Common Shares pursuant to this prospectus.

There can be no assurance

that we will be able to comply with the continued listing standards of The Nasdaq Stock Market LLC (“Nasdaq”).

Our Common Shares are currently listed on The

Nasdaq Global Market under the symbol “NB,” and the public NioCorp Assumed Warrants are currently listed on The Nasdaq Capital

Market under the symbol “NIOBW.” If Nasdaq delists the Common Shares or the public NioCorp Assumed Warrants from trading on

its exchange for failure to meet Nasdaq continued listing standards, the Company and its shareholders could face significant material

adverse consequences, including:

| ● | a limited availability of market quotations for our securities; |

| ● | a determination that our Common Shares are a “penny stock,” which will require brokers trading in Common Shares to adhere

to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for Common Shares; |

| ● | a limited amount of analyst coverage; and |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

The Articles of NioCorp,

as amended in connection with the Transactions (the “Amended Articles”), permit us to issue an unlimited number of Common

Shares without seeking shareholder approval.

The Amended Articles permit us to issue an

unlimited number of Common Shares. It is anticipated that we will, from time to time, issue additional Common Shares in the future. Subject

to the requirements of the British Columbia Business Corporations Act (“BCBCA”), Nasdaq and the TSX, we will not be required

to obtain the approval of the NioCorp shareholders for the issuance of additional Common Shares. Any further issuances of Common Shares

will result in immediate dilution to existing shareholders and may have an adverse effect on the value of their shareholdings.

NioCorp may amend the

terms of the NioCorp Assumed Warrants in a manner that may be adverse to holders of public NioCorp Assumed Warrants with the approval

by the holders of at least a majority of the then outstanding public NioCorp Assumed Warrants. As a result, the exercise price of the

NioCorp Assumed Warrants could be increased, the exercise period could be shortened and the number of Common Shares purchasable upon exercise

of an NioCorp Assumed Warrant could be decreased, all without your approval.

The NioCorp Assumed Warrants were issued in

registered form under the NioCorp Assumed Warrant Agreement. Both the public NioCorp Assumed Warrants and the NioCorp Assumed Warrants

issued to the Sponsor are subject to the terms of the NioCorp Assumed Warrant Agreement and are identical, with certain exceptions applicable

to the NioCorp Assumed Warrants issued to the Sponsor for so long as such NioCorp Assumed Warrants are held by the Sponsor, its members,

or their respective affiliates and other permitted transferees. In accordance with the NioCorp Assumed Warrant Agreement, any NioCorp

Assumed Warrants issued to the Sponsor that are not held by the Sponsor, its members, or their respective affiliates and other permitted

transferees, are treated as public NioCorp Assumed Warrants. The NioCorp Assumed Warrant Agreement provides that the terms of the public

NioCorp Assumed Warrants may be amended without the consent of any holder to cure any ambiguity or correct any defective provision, but

requires the approval by the holders of at least a majority of the then outstanding public NioCorp Assumed Warrants to make any change

that adversely affects the interests of the registered holders of the public NioCorp Assumed Warrants.

Accordingly, NioCorp may amend the terms of

the public NioCorp Assumed Warrants in a manner adverse to a public holder if holders of at least a majority of the then outstanding public

NioCorp Assumed Warrants approve of such amendment. Although NioCorp’s ability to amend the terms of the public NioCorp Assumed

Warrants with the consent of at least a majority of the then outstanding public NioCorp Assumed Warrants is unlimited, examples of such

amendments could be amendments to, among other things, increase the exercise price of the public NioCorp

Assumed Warrants, convert the public NioCorp Assumed Warrants into

cash or stock, shorten the exercise period or decrease the number of Common Shares purchasable upon exercise of the public NioCorp Assumed

Warrants.

NioCorp may redeem

your unexpired public NioCorp Assumed Warrants prior to their exercise at a time that is disadvantageous to you, thereby making your NioCorp

Assumed Warrants worthless.

NioCorp has the ability to redeem outstanding

public NioCorp Assumed Warrants at any time after they become exercisable and prior to their expiration, at a price of $0.01 per NioCorp

Assumed Warrant, provided that the last reported sale price of Common Shares equals or exceeds approximately $16.10 per share (subject

to certain adjustments) for any 20 trading days within a 30 trading-day period ending on the third trading day prior to the date on which

NioCorp gives proper notice of such redemption and provided certain other conditions are met. The NioCorp Assumed Warrants are exercisable

beginning on the 30th day following the Closing Date and NioCorp has not provided separate notice to the holders of NioCorp Assumed Warrants

at the time that they became exercisable (and therefore eligible for redemption). If and when the public NioCorp Assumed Warrants become

redeemable by NioCorp, NioCorp may not exercise its redemption right if the issuance of Common Shares upon exercise of the NioCorp Assumed

Warrants is not exempt from registration or qualification under applicable state blue sky laws or NioCorp is unable to effect such registration

or qualification. NioCorp will use its best efforts to register or qualify Common Shares under the blue sky laws of the state of residence

in those states in which the public NioCorp Assumed Warrants were offered by GXII in its initial public offering. Redemption of the outstanding

public NioCorp Assumed Warrants could force you (i) to exercise your public NioCorp Assumed Warrants and pay the exercise price therefor

at a time when it may be disadvantageous for you to do so, (ii) to sell your public NioCorp Assumed Warrants at the then-current market

price when you might otherwise wish to hold your public NioCorp Assumed Warrants or (iii) to accept the nominal redemption price which,

at the time the outstanding public NioCorp Assumed Warrants are called for redemption, is likely to be substantially less than the market

value of your public NioCorp Assumed Warrants. None of the NioCorp Assumed Warrants issued to the Sponsor will be redeemable by NioCorp

so long as they are held by the Sponsor, its members or their respective affiliates or other permitted transferees.

There is a limited

public market for the NioCorp Assumed Warrants and we cannot guarantee that an active and liquid public market for the NioCorp Assumed

Warrants will develop.

The public NioCorp Assumed Warrants are listed

on Nasdaq under the symbol “NIOBW.” In accordance with the NioCorp Assumed Warrant Agreement, any NioCorp Assumed Warrants

issued to the Sponsor that are not held by the Sponsor, its members, or their respective affiliates and other permitted transferees, are

treated as public NioCorp Assumed Warrants. Nonetheless, the market for the public NioCorp Assumed Warrants is limited.

A liquid trading market for the NioCorp Assumed

Warrants may never develop, or if developed, it may not be sustained. In the absence of a liquid public trading market for the NioCorp

Assumed Warrants:

| ● | you may not be able to liquidate your investment in NioCorp Assumed Warrants; |

| ● | you may not be able to resell your NioCorp Assumed Warrants at favorable prices, or at all; |

| ● | the market price of NioCorp Assumed Warrants may experience significant price volatility; and |

| ● | there may be less efficiency in carrying out your purchase and sale orders. |

NioCorp may be a “passive

foreign investment company” for the current taxable year and for one or more future taxable years, which may result in materially

adverse U.S. federal income tax consequences for U.S. investors.

If NioCorp is a passive foreign investment

company (“PFIC”) for any taxable year, or portion thereof, that is included in the holding period of a U.S. Holder (as defined

in “Certain United States Federal Income Tax Considerations,” below) of Common Shares or NioCorp Assumed Warrants, such U.S.

Holder may be subject to certain adverse U.S. federal income tax consequences and additional reporting requirements. NioCorp believes

it was classified as a PFIC during its taxable years ended June 30, 2022 and June 30, 2021 and, based on the current composition of its

income and assets, as well as current business plans and financial expectations, may be treated as a PFIC for the taxable year in which

the Transactions occurred or in future taxable years. Any conclusion regarding PFIC status is a factual determination that must be made

annually at the close of each taxable year and, thus, is

subject to change. In addition, even if NioCorp concluded it did

not qualify as a PFIC, it is possible that the U.S. Internal Revenue Service (the “IRS”) could assert, and that a court could

sustain, a determination that NioCorp is a PFIC. Accordingly, there can be no assurance that NioCorp will not be treated as a PFIC for

any taxable year. Each holder of Common Shares or NioCorp Assumed Warrants should consult its own tax advisors regarding the PFIC rules

and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of such securities. See “Certain United

States Federal Income Tax Considerations” below, for further details regarding this issue.

The Transactions could

result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences.

Section 7874 and related sections of the U.S.

Internal Revenue Code of 1986, as amended (the “Code”), provide for certain adverse tax consequences when the stock of a U.S.

corporation is acquired by a non-U.S. corporation in certain transactions in which former shareholders of the U.S. corporation come to

own 60% or more of the stock of the non-U.S. corporation (by vote or value, and applying certain specific counting and ownership rules).

These adverse tax consequences include (i) potential additional required gain recognition by the U.S. corporation, (ii) treatment of certain

payments to the non-U.S. corporation that reduce gross income as “base erosion payments,” (iii) an excise tax on certain options

and stock-based compensation of the U.S. corporation, (iv) disallowance of “qualified dividend” treatment for distributions

by the non-U.S. corporation, and (v) if former shareholders of the U.S. corporation come to own 80% or more of the stock of the non-U.S.

corporation, treatment of the non-U.S. corporation as a U.S. corporation subject to U.S. federal income tax on its worldwide income (in

addition to any tax imposed by non-U.S. jurisdictions). If the Transactions result in the application of any of these, or any other, adverse

tax consequences, NioCorp could incur significant additional tax costs. While NioCorp currently does not believe the Transactions will

cause such adverse tax consequences as a result of Section 7874 and related sections of the Code, this determination is subject to significant

legal and factual uncertainty. NioCorp has not sought and will not seek any rulings from the IRS as to the tax treatment of any of the