- 17% growth in operating cash flow for full year 2023 totaling a

record $561 million

- 300% growth in number of AI deals for full year 2023

- Company expects to cross $2.7 billion in total revenue, exceed

$2 billion in cloud revenue and significantly increase EPS for full

year 2024

NICE (NASDAQ: NICE) today announced results for the

fourth quarter ended December 31, 2023, as compared to the

corresponding period of the previous year.

Fourth Quarter 2023 Financial Highlights *

GAAP

Non-GAAP

Total revenue was $623.2 million and

increased 10%

Total revenue was $623.2 million and

increased 10%

Cloud revenue was $429.0 million and

increased 20%

Cloud revenue was $429.0 million and

increased 20%

Cloud gross margin was 65.8% compared to

64.5% last year

Cloud gross margin was 71.1% compared to

70.5% last year

Operating income was $122.7 million and

increased 40%

Operating income was $186.9 million and

increased 15%

Operating margin was 19.7% compared to

15.4% last year

Operating margin was 30.0% compared to

28.6% last year

Diluted EPS was $1.24 and increased

16%

Diluted EPS was $2.36 and increased

16%

Operating cash flow was $180.5 million and

increased 2%

Full Year 2023 Financial Highlights *

GAAP

Non-GAAP

Total revenue was $2,377.5 million and

increased 9%

Total revenue was $2,377.5 million and

increased 9%

Cloud revenue was $1,581.8 million and

increased 22%

Cloud revenue was $1,581.8 million and

increased 22%

Cloud gross margin was 65.0% compared to

63.5% last year

Cloud gross margin was 70.5% compared to

70.0% last year

Operating income was $435.2 million and

increased 30%

Operating income was $703.8 million and

increased 13%

Operating margin was 18.3% compared to

15.4% last year

Operating margin was 29.6% compared to

28.7% last year

Diluted EPS was $5.11 and increased

28%

Diluted EPS was $8.79 and increased

15%

Operating cash flow was $561.4 million and

increased 17%

* There was no contribution to NICE’s income statement from

LiveVox in 2023.

“Our excellent fourth quarter helped fuel another year of great

financial results, including $2.4 billion of total revenue, 22%

cloud revenue growth and nearly 30% operating margin, resulting in

profitability and operating cash flow that continues to outperform

our competitors by a wide margin,” said Barak Eilam, CEO of

NICE.

Mr. Eilam continued, “As we enter 2024 following the outstanding

success of last year it is now clear that AI has become an

overarching catalyst unlocking multiple vectors of growth. Our

leading-edge AI bolstered by our unique data assets is increasing

NICE’s cloud win rates across the board, it is the bedrock of our

rapid expansion into digital engagement, it is the convergence

power igniting the adoption of our platform and it is a source for

a growing number of brand-new AI-based solutions with incremental

revenue streams.”

GAAP Financial Highlights for the

Fourth Quarter and Full Year Ended December 31:

Revenues:

Fourth quarter 2023 total revenues increased 10% to $623.2

million compared to $568.6 million for the fourth quarter of

2022.

Full year 2023 total revenues increased 9% to $2,377.5 million

compared to $2,181.3 million for the full year 2022.

Gross Profit:

Fourth quarter 2023 gross profit was $422.3 million compared to

$387.6 million for the fourth quarter of 2022. Fourth quarter 2023

gross margin was 67.8% compared to 68.2% for the fourth quarter of

2022.

Full year 2023 gross profit was $1,609.3 million compared to

$1,497.6 million for the full year 2022. Full year 2023 gross

margin was 67.7% compared to 68.7% for the full year 2022.

Operating Income:

Fourth quarter 2023 operating income increased 40% to $122.7

million compared to $87.8 million for the fourth quarter of 2022.

Fourth quarter 2023 operating margin was 19.7% compared to 15.4%

for the fourth quarter of 2022.

Full year 2023 operating income was $435.2 million compared to

$335.2 million for the full year 2022. Full year 2023 operating

margin was 18.3% compared to 15.4% for the full year 2022.

Net Income:

Fourth quarter 2023 net income increased 15% to $81.7 million

compared to $71.2 million for the fourth quarter of 2022. Fourth

quarter 2023 net income margin was 13.1% compared to 12.5% for the

fourth quarter of 2022.

Full year 2023 net income was $338.3 million compared to $265.9

million for the full year 2022. Full year 2023 net income margin

was 14.2% compared to 12.2% for the full year 2022.

Fully Diluted Earnings Per Share:

Fully diluted earnings per share for the fourth quarter of 2023

increased 16% to $1.24 compared to $1.07 in the fourth quarter of

2022.

Fully diluted earnings per share for the full year 2023

increased 28% to $5.11 compared to $4.00 for the full year

2022.

Cash Flow and Cash Balance:

Fourth quarter 2023 operating cash flow was $180.5 million and

full year 2023 operating cash flow was $561.4 million.

In the fourth quarter 2023, $69.0 million was used for share

repurchases and for the full year 2023, $288.4 million were used

for share repurchases.

As of December 31, 2023, total cash and cash equivalents, and

short-term investments were $1,407.8 million. Our debt, net of a

hedge instrument, was $544.4 million, resulting in net cash and

investments of $863.4 million.

Non-GAAP Financial Highlights for the

Fourth Quarter and Full Year Ended December 31:

Revenues:

Fourth quarter 2023 Non-GAAP total revenues increased 10% to

$623.2 million compared to $568.6 million for the fourth quarter of

2022.

Full year 2023 Non-GAAP total revenues increased 9% to $2,377.5

million compared to $2,181.3 million for the full year 2022.

Gross Profit:

Fourth quarter 2023 Non-GAAP gross profit increased to $448.2

million compared to $412.6 million for the fourth quarter of 2022.

Fourth quarter 2023 Non-GAAP gross margin was 71.9% compared to

72.6% for the fourth quarter of 2022.

Full year 2023 gross profit was $1,708.8 million compared to

$1,594.6 million for the full year 2022. Full year 2023 gross

margin was 71.9% compared to 73.1% for the full year 2022.

Operating Income:

Fourth quarter 2023 Non-GAAP operating income increased 15% to

$186.9 million compared to $162.8 million for the fourth quarter of

2022. Fourth quarter 2023 Non-GAAP operating margin was 30.0%

compared to 28.6% for the fourth quarter of 2022.

Full year 2023 operating income increased 13% to $703.8 million

compared to $625.1 million for the full year 2022. Full year 2023

operating margin was 29.6% compared to 28.7% for the full year

2022.

Net Income:

Fourth quarter 2023 Non-GAAP net income increased 14% to $154.9

million compared to $135.3 million for the fourth quarter of 2022.

Fourth quarter 2023 Non-GAAP net income margin totaled 24.9%

compared to 23.8% for the fourth quarter of 2022.

Full year 2023 net income increased 15% to $582.7 million

compared to $506.8 million for the full year 2022. Full year 2023

net income margin was 24.5% compared to 23.2% for the full year

2022.

Fully Diluted Earnings Per Share:

Fourth quarter 2023 Non-GAAP fully diluted earnings per share

increased 15% to $2.36 compared to $2.04 for the fourth quarter of

2022.

Fully diluted earnings per share for the full year 2023

increased 15% to $8.79 compared to $7.62 for the full year

2022.

First Quarter and Full Year 2024

Guidance:

First-Quarter 2024:

First-quarter 2024 Non-GAAP total revenues are expected to be in

a range of $650 million to $660 million, representing 15% growth

year over year at the midpoint.

First-quarter 2024 Non-GAAP fully diluted earnings per share are

expected to be in a range of $2.40 to $2.50, representing 21%

growth year over year at the midpoint.

Full-Year 2024:

Full-year 2024 Non-GAAP total revenues are expected to be in a

range of $2,715 million to $2,735 million, representing 15% growth

at the midpoint compared to full-year 2023.

Full year 2024 Non-GAAP fully diluted earnings per share are

expected to be in a range of $10.40 to $10.60, representing 19%

growth at the midpoint compared to full-year 2023.

The above guidance includes the following expectations:

- Full-year 2024 cloud revenue growth of at least 18% year over

year, exclusive of any contribution from the LiveVox

acquisition.

- LiveVox is expected to contribute incrementally an approximate

$142 million to cloud revenue for full-year 2024.

Quarterly Results Conference Call

NICE management will host its earnings conference call today

February 22, 2024, at 8:30 AM ET, 13:30 GMT, 15:30 Israel, to

discuss the results and the company's outlook. To participate in

the call, please dial into the following numbers: United States

1-877-407-4018 or +1-201-689-8471, United Kingdom 0-800-756-3429,

Israel 1-809-406-247.

The call will be webcast live on the Company’s website at

https://www.nice.com/investor-relations/upcoming-event.

Explanation of Non-GAAP measures

Non-GAAP financial measures are included in this press release.

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude share-based compensation, amortization of

acquired intangible assets, acquisition related expenses,

amortization of discount on debt and loss from extinguishment of

debt and the tax effect of the Non-GAAP adjustments.

The Company believes that these Non-GAAP financial measures,

used in conjunction with the corresponding GAAP measures, provide

investors with useful supplemental information about the financial

performance of our business. We believe Non-GAAP financial measures

are useful to investors as a measure of the ongoing performance of

our business. Our management regularly uses our supplemental

Non-GAAP financial measures internally to understand, manage and

evaluate our business and to make financial, strategic and

operating decisions. These Non-GAAP measures are among the primary

factors management uses in planning for and forecasting future

periods. Our Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

These Non-GAAP financial measures may differ materially from the

Non-GAAP financial measures used by other companies. Reconciliation

between results on a GAAP and Non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income. The

Company provides guidance only on a Non-GAAP basis. A

reconciliation of guidance from a GAAP to Non-GAAP basis is not

available due to the unpredictability and uncertainty associated

with future events that would be reported in GAAP results and would

require adjustments between GAAP and Non-GAAP financial measures,

including the impact of future possible business acquisitions.

Accordingly, a reconciliation of the guidance based on Non-GAAP

financial measures to corresponding GAAP financial measures for

future periods is not available without unreasonable effort.

About NICE

NICE (Nasdaq: NICE) is the worldwide leading provider of both

cloud and on-premises enterprise software solutions that empower

organizations to make smarter decisions based on advanced analytics

of structured and unstructured data. NICE helps organizations of

all sizes deliver better customer service, ensure compliance,

combat fraud and safeguard citizens. Over 25,000 organizations in

more than 150 countries, including over 85 of the Fortune 100

companies, are using NICE solutions. www.nice.com.

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE. All other marks are trademarks of

their respective owners. For a full list of NICE' marks, please

see: http://www.nice.com/nice-trademarks.

Forward-Looking Statements

This press release contains forward-looking statements as that

term is defined in the Private Securities Litigation Reform Act of

1995. In some cases, forward-looking statements may be identified

by words such as “believe,” “expect,” “seek,” “may,” “will,”

“intend,” “should,” “project,” “anticipate,” “plan,” and similar

expressions. Forward-looking statements are based on the current

beliefs, expectations and assumptions of the Company’s management

regarding the future of the Company’s business, future plans and

strategies, projections, anticipated events and trends, the economy

and other future conditions. Examples of forward-looking statements

include guidance regarding the Company’s revenue and earnings and

the growth of our cloud, analytics and artificial intelligence

business.

Forward looking statements are inherently subject to significant

economic, competitive and other uncertainties and contingencies,

many of which are beyond the control of management. The Company

cautions that these statements are not guarantees of future

performance, and investors should not place undue reliance on them.

There are or will be important known and unknown factors and

uncertainties that could cause actual results to differ materially

from those expressed or implied in the forward-looking statements.

These factors, include, but are not limited to, risks associated

with changes in economic and business conditions, competition,

successful execution of the Company’s growth strategy, success and

growth of the Company’s cloud Software-as-a-Service business,

difficulties in making additional acquisitions or effectively

integrating acquired operations, products, technologies and

personnel, the Company’s dependency on third-party cloud computing

platform providers, hosting facilities and service partners,

rapidly changing technology, cyber security attacks or other

security breaches against the Company, privacy concerns and

legislation impacting the Company’s business, changes in currency

exchange rates and interest rates, the effects of additional tax

liabilities resulting from our global operations, the effect of

unexpected events or geo-political conditions, such as the impact

of conflicts in the Middle East, that may disrupt our business and

the global economy and various other factors and uncertainties

discussed in our filings with the U.S. Securities and Exchange

Commission (the “SEC”).

You are encouraged to carefully review the section entitled

“Risk Factors” in our latest Annual Report on Form 20-F and our

other filings with the SEC for additional information regarding

these and other factors and uncertainties that could affect our

future performance. The forward-looking statements contained in

this press release speak only as of the date hereof, and the

Company undertakes no obligation to update or revise them, whether

as a result of new information, future developments or otherwise,

except as required by law.

NICE LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

U.S. dollars in thousands

December 31,

December 31,

2023

2022

Unaudited

Audited

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

511,795

$

529,596

Short-term investments

896,044

1,041,943

Trade receivables

585,154

518,517

Debt hedge option

121,922

122,323

Prepaid expenses and other current assets

197,967

204,754

Total current assets

2,312,882

2,417,133

LONG-TERM ASSETS:

Property and equipment, net

174,414

159,285

Deferred tax assets

178,971

116,889

Other intangible assets, net

305,501

209,605

Operating lease right-of-use assets

104,565

102,893

Goodwill

1,821,969

1,617,118

Prepaid expenses and other long-term assets

219,332

231,496

Total long-term assets

2,804,752

2,437,286

TOTAL ASSETS

$

5,117,634

$

4,854,419

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES:

Trade payables

$

66,036

$

56,019

Deferred revenues and advances from customers

302,649

338,930

Current maturities of operating leases

13,747

13,525

Debt

209,229

209,292

Accrued expenses and other liabilities

528,660

523,451

Total current liabilities

1,120,321

1,141,217

LONG-TERM LIABILITIES:

Deferred revenues and advances from customers

52,458

57,211

Operating leases

102,909

99,262

Deferred tax liabilities

8,596

7,336

Debt

457,081

455,382

Other long-term liabilities

21,769

38,588

Total long-term liabilities

642,813

657,779

SHAREHOLDERS' EQUITY

Nice Ltd's equity

3,341,132

3,042,085

Non-controlling interests

13,368

13,338

Total shareholders' equity

3,354,500

3,055,423

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

$

5,117,634

$

4,854,419

NICE LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

U.S. dollars in thousands (except per

share amounts)

Quarter ended

Year to date

December 31,

December 31,

2023

2022

2023

2022

Unaudited

Audited

Unaudited

Audited

Revenue:

Cloud

$

428,986

$

358,850

$

1,581,825

$

1,295,323

Services

162,365

161,208

641,387

650,116

Product

31,841

48,502

154,296

235,855

Total revenue

623,192

568,560

2,377,508

2,181,294

Cost of revenue:

Cloud

146,510

127,309

553,654

472,805

Services

48,674

46,339

188,890

183,938

Product

5,694

7,332

25,629

26,945

Total cost of revenue

200,878

180,980

768,173

683,688

Gross profit

422,314

387,580

1,609,335

1,497,606

Operating expenses:

Research and development, net

81,119

81,964

322,708

306,073

Selling and marketing

154,500

148,198

599,114

609,833

General and administrative

64,030

69,594

252,286

246,527

Total operating expenses

299,649

299,756

1,174,108

1,162,433

Operating income

122,665

87,824

435,227

335,173

Financial expenses (income) and other,

net

2,635

(9,127

)

(22,473

)

(10,159

)

Income before tax

120,030

96,951

457,700

345,332

Taxes on income

38,378

25,765

119,399

79,387

Net income

$

81,652

$

71,186

$

338,301

$

265,945

Earnings per share:

Basic

$

1.29

$

1.11

$

5.32

$

4.17

Diluted

$

1.24

$

1.07

$

5.11

$

4.00

Weighted average shares outstanding:

Basic

63,283

63,961

63,590

63,790

Diluted

65,749

66,285

66,265

66,465

NICE LTD. AND SUBSIDIARIES

CONSOLIDATED CASH FLOW

STATEMENTS

U.S. dollars in thousands

Quarter ended

Year to date

December 31,

December 31,

2023

2022

2023

2022

Unaudited

Audited

Unaudited

Audited

Operating

Activities

Net income

$

81,652

$

71,186

$

338,301

$

265,945

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

41,212

47,469

167,360

176,546

Share-based compensation

46,170

49,015

176,658

182,704

Amortization of premium and discount and accrued interest on

marketable securities

436

1,160

2,480

8,322

Deferred taxes, net

(35,833

)

(28,992

)

(66,620

)

(52,618

)

Changes in operating assets and liabilities: Trade Receivables, net

(16,572

)

(44,077

)

(34,292

)

(129,712

)

Prepaid expenses and other current assets

95,413

8,600

73,052

(31,673

)

Operating lease right-of-use assets

3,833

3,579

12,518

20,393

Trade payables

2,642

18,280

3,426

19,923

Accrued expenses and other current liabilities

(27,012

)

43,967

(55,703

)

33,684

Deferred revenue

(6,285

)

8,749

(45,947

)

6,417

Realized loss on marketable securities, net

12,271

-

12,271

-

Operating lease liabilities

441

(3,703

)

(11,100

)

(26,191

)

Amortization of discount on long-term debt

1,166

1,151

4,615

4,582

Loss from extinguishment of debt

16

-

53

1,206

Change in fair value of contingent consideration

(18,258

)

-

(18,258

)

-

Other

(796

)

322

2,616

187

Net cash provided by operating activities

180,496

176,706

561,430

479,715

Investing Activities

Purchase of property and equipment

(6,079

)

(10,941

)

(29,205

)

(31,893

)

Purchase of Investments

(29,620

)

(30,840

)

(230,263

)

(396,297

)

Proceeds from Investments

129,006

33,156

436,044

355,560

Capitalization of internal use software costs

(13,868

)

(12,826

)

(54,974

)

(49,997

)

Payments for business acquisitions, net of cash acquired

(396,780

)

(30,000

)

(415,185

)

(29,724

)

Net cash provided used in

investing activities

(317,341

)

(51,451

)

(293,583

)

(152,351

)

Financing Activities

Proceeds from issuance of shares upon exercise of options

803

529

2,570

953

Purchase of treasury shares

(69,026

)

(24,543

)

(288,443

)

(144,944

)

Dividends paid to noncontrolling interest

(291

)

-

(1,771

)

(376

)

Repayment of debt

(1,071

)

(4

)

(2,628

)

(20,132

)

Net cash used in financing activities

(69,585

)

(24,018

)

(290,272

)

(164,499

)

Effect of exchange rates on cash and cash

equivalents

3,754

3,877

2,643

(8,425

)

Net change in cash, cash equivalents and

restricted cash

(202,676

)

105,114

(19,782

)

154,440

Cash, cash equivalents and restricted

cash, beginning of period

$

715,990

$

427,982

$

533,096

$

378,656

Cash, cash equivalents and restricted

cash, end of period

$

513,314

$

533,096

$

513,314

$

533,096

Reconciliation of cash, cash equivalents

and restricted cash reported in the consolidated balance sheet:

Cash and cash equivalents

$

511,795

$

529,596

$

511,795

$

529,596

Restricted cash included in other current assets

$

1,519

$

3,500

$

1,519

$

3,500

Total cash, cash equivalents and restricted cash shown in the

statement of cash flows

$

513,314

$

533,096

$

513,314

$

533,096

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP

RESULTS

U.S. dollars in thousands (except per

share amounts)

Quarter ended

Year to date

December 31,

December 31,

2023

2022

2023

2022

GAAP revenues

$

623,192

$

568,560

$

2,377,508

$

2,181,294

Non-GAAP revenues

$

623,192

$

568,560

$

2,377,508

$

2,181,294

GAAP cost of revenue

$

200,878

$

180,980

$

768,173

$

683,688

Amortization of acquired intangible assets

on cost of cloud

(17,935

)

(18,940

)

(75,667

)

(74,791

)

Amortization of acquired intangible assets

on cost of services

-

-

-

(377

)

Amortization of acquired intangible assets

on cost of product

(255

)

(241

)

(1,021

)

(1,017

)

Valuation adjustment on acquired deferred

cost of cloud

-

13

-

54

Cost of cloud revenue adjustment (1)

(4,605

)

(2,451

)

(10,965

)

(8,840

)

Cost of services revenue adjustment

(1)

(3,142

)

(3,233

)

(11,906

)

(11,497

)

Cost of product revenue adjustment (1)

15

(147

)

121

(548

)

Non-GAAP cost of revenue

$

174,956

$

155,981

$

668,735

$

586,672

GAAP gross profit

$

422,314

$

387,580

$

1,609,335

$

1,497,606

Gross profit adjustments

25,922

24,999

99,438

97,016

Non-GAAP gross profit

$

448,236

$

412,579

$

1,708,773

$

1,594,622

GAAP operating expenses

$

299,649

$

299,756

$

1,174,108

$

1,162,433

Research and development (1)

(6,997

)

(9,736

)

(31,402

)

(33,561

)

Sales and marketing (1,2)

(11,515

)

(13,993

)

(48,048

)

(57,114

)

General and administrative (1,2)

(34,588

)

(20,549

)

(92,291

)

(73,540

)

Amortization of acquired intangible

assets

(3,506

)

(5,748

)

(15,757

)

(28,901

)

Valuation adjustment on acquired deferred

commission

22

43

128

196

Change in fair value of contingent

consideration

18,258

-

18,258

-

Non-GAAP operating expenses

$

261,323

$

249,773

$

1,004,996

$

969,513

GAAP financial and other income, net

$

2,635

$

(9,127

)

$

(22,473

)

$

(10,159

)

Amortization of discount and loss of

extinguishment on debt

(1,182

)

(1,151

)

(4,668

)

(5,788

)

Realized loss on marketable securities,

net

(12,271

)

-

(12,271

)

-

Change in fair value of contingent

consideration

-

-

(817

)

-

Non-GAAP financial and other income,

net

(10,818

)

(10,278

)

(40,229

)

(15,947

)

GAAP taxes on income

$

38,378

$

25,765

$

119,399

$

79,387

Tax adjustments re non-GAAP

adjustments

4,464

12,037

41,937

54,897

Non-GAAP taxes on income

$

42,842

$

37,802

$

161,336

$

134,284

GAAP net income

$

81,652

$

71,186

$

338,301

$

265,945

Valuation adjustment on acquired deferred

cost of cloud revenue

-

(13

)

-

(54

)

Amortization of acquired intangible

assets

21,696

24,929

92,445

105,086

Valuation adjustment on acquired deferred

commission

(22

)

(43

)

(128

)

(196

)

Share-based compensation (1)

47,298

50,061

180,504

185,052

Acquisition related expenses (2)

13,534

48

13,987

48

Amortization of discount and loss of

extinguishment on debt

1,182

1,151

4,668

5,788

Realized loss on marketable securities,

net

12,271

-

12,271

-

Change in fair value of contingent

consideration

(18,258

)

-

(17,441

)

-

Tax adjustments re non-GAAP

adjustments

(4,464

)

(12,037

)

(41,937

)

(54,897

)

Non-GAAP net income

$

154,889

$

135,282

$

582,670

$

506,772

GAAP diluted earnings per share

$

1.24

$

1.07

$

5.11

$

4.00

Non-GAAP diluted earnings per share

$

2.36

$

2.04

$

8.79

$

7.62

Shares used in computing GAAP diluted

earnings per share

65,749

66,285

66,265

66,465

Shares used in computing non-GAAP diluted

earnings per share

65,749

66,285

66,265

66,465

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP

RESULTS (continued)

U.S. dollars in thousands

(1) Share-based Compensation

Quarter ended

Year to date

December 31,

December 31,

2023

2022

2023

2022

Cost of cloud revenue

$

4,605

$

2,451

$

10,965

$

8,840

Cost of services revenue

3,142

3,233

11,906

11,497

Cost of product revenue

(15

)

147

(121

)

548

Research and development

6,997

9,736

31,402

33,561

Sales and marketing

11,515

13,993

48,023

57,114

General and administrative

21,054

20,501

78,329

73,492

$

47,298

$

50,061

$

180,504

$

185,052

(2) Acquisition related expenses

Quarter ended

Year to date

December 31,

December 31,

2023

2022

2023

2022

Sales and marketing

$

-

$

-

$

25

$

-

General and administrative

13,534

48

13,962

48

$

13,534

$

48

$

13,987

$

48

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET INCOME TO

NON-GAAP EBITDA

U.S. dollars in thousands

Quarter ended

Year to date

December 31,

December 31,

2023

2022

2023

2022

Unaudited

Audited

Unaudited

Audited

GAAP net income

$

81,652

$

71,186

$

338,301

$

265,945

Non-GAAP adjustments:

Depreciation and amortization

41,212

47,469

167,360

176,546

Share-based Compensation

46,170

49,015

176,658

182,704

Financial and other expense/ (income), net

2,635

(9,127

)

(22,473

)

(10,159

)

Acquisition related expenses

13,534

48

13,987

48

Change in fair value of contingent consideration

(18,258

)

-

(18,258

)

-

Valuation adjustment on acquired deferred commission

(22

)

(43

)

(128

)

(196

)

Valuation adjustment on acquired deferred cost of cloud

-

(13

)

-

(54

)

Taxes on income

38,378

25,765

119,399

79,387

Non-GAAP EBITDA

$

205,301

$

184,300

$

774,846

$

694,221

NICE LTD. AND SUBSIDIARIES

NON-GAAP RECONCILIATION - FREE CASH

FLOW FROM CONTINUING OPERATIONS

U.S. dollars in thousands

Quarter ended

Year to date

December 31,

December 31,

2023

2022

2023

2022

Unaudited

Audited

Unaudited

Audited

Free cash flow (a)

Net cash provided by operating

activities

$

180,496

$

176,706

$

561,430

$

479,715

Purchase of property and equipment

(6,079

)

(10,941

)

(29,205

)

(31,893

)

Capitalization of internal use software costs

(13,868

)

(12,826

)

(54,974

)

(49,997

)

Free Cash Flow

$

160,549

$

152,939

$

477,251

$

397,825

(a) Free cash flow from continuing operations is defined as

operating cash flows from continuing operations less capital

expenditures of the continuing operations and less capitalization

of internal use software costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240222141561/en/

Investor Relations Marty Cohen, +1 551 256 5354, ET,

ir@nice.com Omri Arens, +972 3 763-0127, CET, ir@nice.com

Media Chris Irwin-Dudek, +1 (551) 256-5140,

Chris.Irwin-Dudek@nice.com

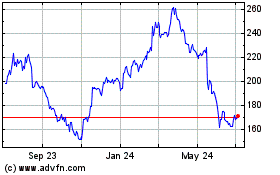

NICE (NASDAQ:NICE)

Historical Stock Chart

From Oct 2024 to Nov 2024

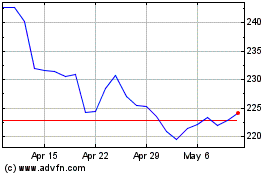

NICE (NASDAQ:NICE)

Historical Stock Chart

From Nov 2023 to Nov 2024