0001564708false00015647082024-08-082024-08-080001564708us-gaap:CommonClassAMember2024-08-082024-08-080001564708us-gaap:CommonClassBMember2024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

NEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-35769 | | 46-2950970 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1211 Avenue of the Americas, New York, New York 10036

(Address of principal executive offices, including zip code)

(212) 416-3400

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

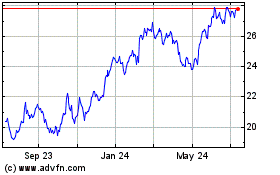

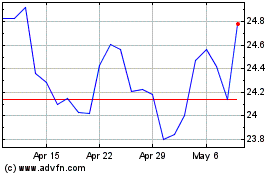

| Class A Common Stock, par value $0.01 per share | | NWSA | | The Nasdaq Global Select Market |

| Class B Common Stock, par value $0.01 per share | | NWS | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, News Corporation (the “Company”) released its financial results for the quarter and fiscal year ended June 30, 2024. A copy of the Company’s press release is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| | NEWS CORPORATION

(REGISTRANT) |

| | | |

| | | |

| | By: | | /s/ Michael L. Bunder |

| | | | Michael L. Bunder |

| | | | Senior Vice President, Deputy General Counsel and Corporate Secretary |

Dated: August 8, 2024

NEWS CORPORATION REPORTS FOURTH QUARTER AND FULL YEAR RESULTS FOR FISCAL 2024

FISCAL 2024 FOURTH QUARTER AND FULL YEAR KEY FINANCIAL HIGHLIGHTS

•Fourth quarter revenues were $2.58 billion, a 6% increase compared to $2.43 billion in the prior year, driven by growth at the Digital Real Estate Services, Book Publishing and Dow Jones segments

•Net income in the quarter was $71 million, a significant improvement compared to a net loss of $(32) million in the prior year

•Total Segment EBITDA was the highest for a fourth quarter since separation at $380 million, compared to $341 million in the prior year

•In the quarter, reported EPS were $0.09 as compared to $(0.01) in the prior year - Adjusted EPS were $0.17 compared to $0.14 in the prior year

•At the Dow Jones segment, for the quarter and full fiscal year, the professional information business was the largest contributor to segment profitability driven by robust revenue growth at Risk & Compliance and Dow Jones Energy

•Book Publishing revenues grew 15% in the quarter, while Segment EBITDA increased $41 million, driven by higher physical and digital book sales combined with improved return rates. Digital audiobooks revenue was larger than e-books revenue for the first time this quarter

•REA Group posted exceptional results for the quarter, with revenues of $305 million, a 37% increase compared to the prior year, primarily driven by robust Australian residential performance and higher financial services revenue

•At the Subscription Video Services segment, Foxtel Group saw strong streaming performance, with both Kayo and BINGE achieving record paying subscribers, and ended the fiscal year at over 3.2 million total paying streaming subscribers

•Announced landmark multi-year global partnership with OpenAI

NEW YORK, NY – August 8, 2024 – News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) today reported financial results for the three months and fiscal year ended June 30, 2024.

Commenting on the results, Chief Executive Robert Thomson said:

“Fiscal 2024 was an outstanding year for News Corp, as we not only delivered robust earnings growth and created substantial shareholder value, but took a significant step to prepare the Company to prosper in the AI age.

Our landmark agreement with OpenAI is not only expected to be lucrative, but will enable us to work closely with a trusted, pre-eminent partner to fashion a future for professional journalism and for provenance. Meanwhile, we have begun to take legal steps against AI aggressors, the egregious aggregators, who are predatory in the confiscation of our content. ‘Open source’ can never be a justification for ‘open slather.’

For the quarter, revenues grew 6 percent to almost $2.6 billion, while net income improved significantly and profitability advanced by 11 percent to a fourth quarter record. Our core pillars of growth - Book Publishing, Digital Real Estate Services and Dow Jones - inspired the increasing profitability, and their strength augurs well for Fiscal 2025.

We are confident in the Company’s long-term prospects and are continuing to review our portfolio with a focus on maximizing returns for shareholders. That review has coincided recently with third-party interest in a potential transaction involving the Foxtel Group, which has been positively transformed in recent years. We are evaluating options for the business with our advisors in light of that external interest.

I would like to express our sincere gratitude to all who contributed to the emancipation of Evan Gershkovich. His freedom was made possible by the concerted efforts of concerned, principled people who recognized that his incarceration was unjust and immoral. Many thanks to our leaders at Dow Jones and News Corp, who campaigned vigorously for Evan, and to the U.S. Government and other enlightened Governments, whose divine interventions played a pivotal role in his release.”

FOURTH QUARTER RESULTS

The Company reported fiscal 2024 fourth quarter total revenues of $2.58 billion, a 6% increase compared to $2.43 billion in the prior year period, primarily driven by higher Australian residential revenues at REA Group, higher physical and digital book sales combined with lower return rates at the Book Publishing segment and continued growth in the professional information business at the Dow Jones segment. The increase was partly offset by lower advertising and circulation and subscription revenues at the News Media segment, in addition to a $15 million, or 1%, negative impact from foreign currency fluctuations. Adjusted Revenues (which excludes the foreign currency impact, acquisitions and divestitures as defined in Note 2) increased 6% compared to the prior year.

Net income for the quarter was $71 million, a $103 million increase compared to a net loss of $(32) million in the prior year, primarily driven by improved losses from equity affiliates due to the absence of a non-cash write-down of REA Group’s investment in PropertyGuru in the prior year, higher Total Segment EBITDA and lower impairment and restructuring charges. These impacts were partially offset by higher income tax expense and lower Other, net.

The Company reported fourth quarter Total Segment EBITDA of $380 million, an 11% increase compared to $341 million in the prior year primarily due to strong contributions from the Book Publishing segment and REA Group. The increase was partly offset by Hubbl launch costs at Foxtel Group and lower contributions from the News Media segment and Move. Adjusted Total Segment EBITDA (as defined in Note 2) increased 13%.

Net income (loss) per share attributable to News Corporation stockholders was $0.09 as compared to $(0.01) in the prior year.

Adjusted EPS (as defined in Note 3) were $0.17 compared to $0.14 in the prior year.

FULL YEAR RESULTS

The Company reported fiscal 2024 full year total revenues of $10.09 billion, a 2% increase compared to $9.88 billion in the prior year, driven by higher Australian residential revenues at REA Group, improved returns combined with higher digital sales at the Book Publishing segment and continued growth in the professional information business at the Dow Jones segment. The increase was partly offset by lower advertising revenues at the News Media segment and lower revenues at Move due to ongoing challenging housing market conditions in the U.S., in addition to a $37 million negative impact from foreign currency fluctuations. Adjusted Revenues increased 2%.

Net income for the full year was $354 million, a $167 million, or 89%, increase compared to $187 million in the prior year. The increase was primarily driven by improved losses from equity affiliates due to the absence of a non-cash write-down of REA Group’s investment in PropertyGuru in the prior year and higher Total Segment EBITDA. These impacts were partially offset by higher income tax expense and lower Other, net.

Total Segment EBITDA for the full year was $1.54 billion, a $119 million, or 8%, increase compared to $1.42 billion in the prior year primarily driven by improved performance at REA Group and the Book Publishing and Dow Jones segments primarily as a result of higher revenues, as discussed above, in addition to gross cost savings related to the announced 5% headcount reduction initiative and savings due to lower production costs at News UK and Book Publishing. The increase was partially offset by higher costs related to the launch of Hubbl and higher sports programming rights costs due to contractual increases at the Subscription Video Services segment, higher employee costs at the Book Publishing segment and REA Group, increased marketing costs at Move, increased

technology and marketing costs at the Dow Jones segment and a $17 million, or 2%, negative impact from foreign currency fluctuations. Adjusted Total Segment EBITDA increased 8%.

Diluted net income per share attributable to News Corporation stockholders was $0.46 as compared to $0.26 in the prior year.

Adjusted diluted EPS were $0.70 compared to $0.49 in the prior year.

SEGMENT REVIEW

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended

June 30, | | For the fiscal years ended

June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| (in millions) | | Better/ (Worse) | | (in millions) | | Better/ (Worse) |

| Revenues: | | | | | | | | | | | |

| Digital Real Estate Services | $ | 448 | | | $ | 369 | | | 21 | % | | $ | 1,658 | | | $ | 1,539 | | | 8 | % |

| Subscription Video Services | 506 | | | 501 | | | 1 | % | | 1,917 | | | 1,942 | | | (1) | % |

| Dow Jones | 566 | | | 546 | | | 4 | % | | 2,231 | | | 2,153 | | | 4 | % |

| Book Publishing | 512 | | | 446 | | | 15 | % | | 2,093 | | | 1,979 | | | 6 | % |

| News Media | 545 | | | 571 | | | (5) | % | | 2,186 | | | 2,266 | | | (4) | % |

| Other | — | | | — | | | — | % | | — | | | — | | | — | % |

| Total Revenues | $ | 2,577 | | | $ | 2,433 | | | 6 | % | | $ | 10,085 | | | $ | 9,879 | | | 2 | % |

| | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | |

| Digital Real Estate Services | $ | 135 | | | $ | 108 | | | 25 | % | | $ | 508 | | | $ | 457 | | | 11 | % |

| Subscription Video Services | 74 | | | 78 | | | (5) | % | | 310 | | | 347 | | | (11) | % |

| Dow Jones | 137 | | | 133 | | | 3 | % | | 542 | | | 494 | | | 10 | % |

| Book Publishing | 57 | | | 16 | | | 256 | % | | 269 | | | 167 | | | 61 | % |

| News Media | 28 | | | 45 | | | (38) | % | | 120 | | | 156 | | | (23) | % |

| Other | (51) | | | (39) | | | (31) | % | | (210) | | | (201) | | | (4) | % |

| Total Segment EBITDA | $ | 380 | | | $ | 341 | | | 11 | % | | $ | 1,539 | | | $ | 1,420 | | | 8 | % |

| | | | | | | | | | | |

Digital Real Estate Services

Fourth Quarter Segment Results

Revenues in the quarter increased $79 million, or 21%, compared to the prior year, driven by strong performance at REA Group. Segment EBITDA in the quarter increased $27 million, or 25%, compared to the prior year, including a $2 million, or 2%, negative impact from foreign currency fluctuations, due to higher contribution from REA Group partly offset by $11 million in increased costs at Move primarily driven by higher marketing spend. Adjusted Revenues and Adjusted Segment EBITDA (as defined in Note 2) increased 21% and 28%, respectively.

In the quarter, revenues at REA Group increased $82 million, or 37%, to $305 million, primarily driven by higher Australian residential revenues due to price increases, increased depth penetration, favorable geographic mix and an increase in national listings, higher financial services revenue, which includes the benefit from the absence of a negative valuation adjustment related to expected future trail commissions in the prior year, and higher revenue from REA India. The increase was slightly offset by a $4 million, or 2%, negative impact from foreign currency

fluctuations. Australian national residential buy listing volumes in the quarter increased 16% compared to the prior year, with listings in Sydney and Melbourne up 26% and 32%, respectively.

Move’s revenues in the quarter decreased $3 million, or 2%, to $143 million, primarily as a result of lower real estate revenues. Real estate revenues, which represented 80% of total Move revenues, decreased 2%, driven by the ongoing impact of the macroeconomic environment on the housing market, including higher mortgage rates, which led to lower transaction volumes. Revenues from the referral model, which includes the ReadyConnect Concierge℠ product, and the core lead generation product decreased due to these factors. The decline was partially offset by strong growth in seller, new homes and rentals including the partnership with Zillow. Based on Move’s internal data, average monthly unique users of Realtor.com®’s web and mobile sites for the fiscal fourth quarter was flat compared to the prior year at 74 million. Lead volume was flat year over year as it continues to be impacted by high mortgage rates.

Full Year Segment Results

Fiscal 2024 full year revenues increased $119 million, or 8%, compared to the prior year, primarily due to the strong performance from REA Group, partly offset by lower revenues at Move and a $28 million, or 2%, negative impact from foreign currency fluctuations. Segment EBITDA for fiscal 2024 increased $51 million, or 11%, compared to the prior year, primarily due to the higher revenues, partially offset by higher employee costs and broker commissions at REA Group, higher REA India costs, a $13 million, or 3%, negative impact from foreign currency fluctuations and slightly higher costs at Move. Adjusted Revenues and Adjusted Segment EBITDA increased 9% and 15%, respectively.

In the fiscal year, REA Group’s revenues increased $177 million, or 19%, to $1.11 billion, primarily driven by higher Australian residential revenues due to price increases, increased depth penetration, favorable geographic mix and an increase in national listings, higher financial services revenue, which includes the benefit from the absence of a negative valuation adjustment related to expected future trail commissions in the prior year, and higher revenues from REA India, partially offset by a $28 million, or 3%, negative impact from foreign currency fluctuations.

Move’s revenues in the fiscal year decreased $58 million, or 10%, to $544 million, primarily due to lower real estate revenues. Move’s real estate revenues, which represented 80% of total Move revenues, declined 11%, primarily due to declines in both the referral model and the core lead generation product, partially offset by revenue growth in seller, new homes and rentals through the partnership with Zillow. The market downturn resulted in lower lead volumes, which decreased 3%, and lower transaction volumes.

Subscription Video Services

Fourth Quarter Segment Results

Revenues of $506 million in the quarter increased $5 million, or 1%, compared with the prior year, primarily driven by higher revenues from Kayo and BINGE from increases in both volume and pricing, mostly offset by the impact from fewer residential broadcast subscribers and a $7 million, or 1%, negative impact from foreign currency fluctuations. Adjusted Revenues of $513 million increased 2% compared to the prior year. Foxtel Group streaming subscription revenues represented 32% of total circulation and subscription revenues in the quarter, as compared to 29% in the prior year.

As of June 30, 2024, Foxtel’s total closing paid subscribers were nearly 4.7 million, a 1% increase compared to the prior year, driven by growth in Kayo and BINGE subscribers, partly offset by fewer residential broadcast subscribers. Broadcast subscriber churn in the quarter was 11.7% compared to 11.1% in the prior year partly driven by the price and packaging simplification. Broadcast ARPU for the quarter increased 6% year-over-year to A$90 (US$59).

| | | | | | | | | | | |

| As of June 30, |

| 2024 | | 2023 |

| (in 000's) |

| Broadcast Subscribers | | | |

| Residential | 1,210 | | | 1,341 | |

| Commercial | 242 | | | 233 | |

Streaming Subscribers - Total (Paid) | | | |

| Kayo | 1,606 (1,550) | | 1,411 (1,401) |

| BINGE | 1,552 (1,529) | | 1,541 (1,487) |

Foxtel Now | 147 (142) | | 177 (170) |

| | | |

| | | |

Total Subscribers - Total (Paid) | 4,776 (4,690) | | 4,723 (4,650) |

Segment EBITDA of $74 million in the quarter decreased $4 million, or 5%, compared with the prior year, primarily due to $28 million of Hubbl launch costs, partially offset by lower entertainment programming rights and transmission costs and the higher revenues discussed above. Adjusted Segment EBITDA decreased 4%.

Full Year Segment Results

Fiscal 2024 full year revenues declined $25 million, or 1%, compared with the prior year, due to a $52 million, or 2%, negative impact from foreign currency fluctuations. Adjusted Revenues increased 1% compared to the prior year. Higher streaming revenues, primarily from Kayo and BINGE, and higher advertising revenues more than offset the revenue declines from lower residential broadcast subscribers. Foxtel Group streaming subscription revenues represented approximately 30% of total circulation and subscription revenues in the fiscal year compared to 27% in the prior year.

Segment EBITDA for fiscal 2024 decreased $37 million, or 11%, compared to the prior year, primarily due to $51 million of costs related to the launch of Hubbl, higher sports programming costs due to contractual increases and the $9 million, or 3%, negative impact from foreign currency fluctuations, partly offset by the revenue drivers discussed above and declines in other costs including lower technology, entertainment programming rights and marketing. Adjusted Segment EBITDA decreased 8%.

Dow Jones

Fourth Quarter Segment Results

Revenues in the quarter increased $20 million, or 4%, compared to the prior year, driven by growth in circulation and subscription revenues underpinned by the professional information business. Digital revenues at Dow Jones in the quarter represented 81% of total revenues compared to 79% in the prior year. Adjusted Revenues increased 4%.

Circulation and subscription revenues increased $17 million, or 4%, primarily driven by an 8% increase in professional information business revenues, led by 12% growth in Risk & Compliance revenues to $76 million and 14% growth in Dow Jones Energy revenues to $65 million. Circulation revenues increased 1% compared to the prior year, as the continued growth in digital-only subscriptions was mostly offset by lower print volume. Digital circulation revenues accounted for 71% of circulation revenues for the quarter, compared to 70% in the prior year.

During the fourth quarter, total average subscriptions to Dow Jones’ consumer products were over 5.8 million, an 11% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 16% to over 5.2 million. Total subscriptions to The Wall Street Journal grew 7% compared to the prior year, to nearly

4.3 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 11% to almost 3.8 million average subscriptions in the quarter, and represented 89% of total Wall Street Journal subscriptions.

| | | | | | | | | | | | | | | | | |

| For the three months ended June 30, |

| 2024 | | 2023 | | % Change |

| (in thousands, except %) | | | | | Better/(Worse) |

| The Wall Street Journal | | | | | |

| Digital-only subscriptions | 3,788 | | | 3,406 | | | 11 | % |

| Total subscriptions | 4,256 | | | 3,966 | | | 7 | % |

| Barron’s Group | | | | | |

| Digital-only subscriptions | 1,290 | | | 1,018 | | | 27 | % |

| Total subscriptions | 1,419 | | | 1,168 | | | 21 | % |

| Total Consumer | | | | | |

| Digital-only subscriptions | 5,226 | | | 4,510 | | | 16 | % |

| Total subscriptions | 5,842 | | | 5,242 | | | 11 | % |

Advertising revenues increased $2 million, or 2%, primarily due to 12% growth in digital advertising revenues, partly offset by a 13% decline in print advertising revenues. Digital advertising accounted for 66% of total advertising revenues in the quarter, compared to 60% in the prior year.

Segment EBITDA for the quarter increased $4 million, or 3%, primarily as a result of the higher revenues discussed above, partially offset by higher marketing costs and higher employee costs, which includes a retroactive payment related to the ratification of a new union agreement. Adjusted Segment EBITDA increased 3%.

Full Year Segment Results

Fiscal 2024 full year revenues increased $78 million, or 4%, compared to the prior year, primarily driven by growth in professional information business revenues and a $7 million, or 1%, positive impact from foreign currency fluctuations. Adjusted Revenues grew 3% compared to the prior year. Digital revenues at Dow Jones represented 80% of total revenues for the year compared to 78% in the prior year.

Circulation and subscription revenues increased $82 million, or 5%, which includes a $7 million, or 1%, positive impact from foreign currency fluctuations. Professional information business revenues grew 11%, driven by 16% growth in Risk & Compliance products, which reached nearly $300 million in revenues in fiscal 2024, and 16% growth in Dow Jones Energy. Circulation revenues grew 1% compared to the prior year, reflecting continued strong growth in digital-only subscriptions at The Wall Street Journal, offset by lower print volumes. Digital circulation revenues accounted for 71% of circulation revenues for the year, compared to 69% in the prior year.

Advertising revenue decreased $8 million, or 2%, primarily due to a 10% decrease in print advertising, partly offset by a 4% increase in digital advertising. Digital advertising revenues accounted for 64% of total advertising revenues for the year, compared to 61% in the prior year.

Segment EBITDA for fiscal 2024 increased $48 million, or 10%, compared to the prior year, primarily due to higher revenues, as noted above, and lower newsprint, production and distribution costs, partially offset by higher technology and marketing costs. Adjusted Segment EBITDA increased 10%.

Book Publishing

Fourth Quarter Segment Results

Revenues in the quarter increased $66 million, or 15%, compared to the prior year, primarily driven by higher physical and digital book sales and improved returns. Key titles in the quarter included The Bridgerton Series by Julia Quinn, The Midnight Feast by Lucy Foley and When the Moon Hatched by Sarah A. Parker. Bible sales were also strong. Adjusted Revenues increased 15%.

Digital sales increased 12% compared to the prior year, driven by 28% growth from audiobook sales, which benefited from the continued contribution from the new Spotify partnership and strong market conditions. Digital sales represented 24% of Consumer revenues for the quarter compared to 25% in the prior year with audiobooks, for the first time, accounting for more than half of digital revenues for the quarter. Backlist sales represented approximately 62% of Consumer revenues in the quarter compared to 59% in the prior year.

Segment EBITDA for the quarter increased $41 million, to $57 million compared to $16 million in the prior year, primarily due to the higher revenues discussed above and lower manufacturing costs driven by product mix, partially offset by higher employee costs.

Full Year Segment Results

Fiscal 2024 full year revenues increased $114 million, or 6%, compared to the prior year, primarily due to improved returns in the U.S. driven by recovering consumer demand industry-wide and the absence of the impact of Amazon’s reset of its inventory levels and rightsizing of its warehouse footprint in the prior year, as well as higher digital book sales and a $16 million, or 1%, positive impact from foreign currency fluctuations. These improvements were partially offset by lower physical book sales. Adjusted Revenues increased 5% compared to the prior year. Digital sales increased 9% compared to the prior year, driven by 18% growth in audiobooks, which benefited from strong market growth, including the contribution from the new Spotify partnership. Digital sales represented 23% of Consumer revenues for the year compared to 22% in the prior year. Backlist sales represented approximately 61% of Consumer revenues in the year compared to 60% in the prior year.

Segment EBITDA for fiscal 2024 increased $102 million, or 61%, from the prior year primarily due to higher revenues, as discussed above, and lower manufacturing, freight and distribution costs driven by product mix and the absence of prior year supply chain challenges and inventory and inflationary pressures, partially offset by higher employee costs. Adjusted Segment EBITDA increased 59%.

News Media

Fourth Quarter Segment Results

Revenues in the quarter decreased $26 million, or 5%, as compared to the prior year, primarily driven by lower advertising revenues and lower circulation and subscription revenues. Within the segment, revenues at News Corp Australia decreased 5%, driven by lower circulation and subscription revenues, and included a $4 million, or 1%, negative impact from foreign currency fluctuations, while News UK revenues decreased 5% driven by lower advertising revenues. Adjusted Revenues for the segment decreased 4% compared to the prior year.

Circulation and subscription revenues decreased $9 million, or 3%, compared to the prior year, primarily due to lower print volumes and lower digital circulation and subscription revenue at News Corp Australia due to the expiration of the Meta content licensing deal, partially offset by price increases and digital subscriber growth at News UK.

Advertising revenues decreased $11 million, or 5%, compared to the prior year, primarily due to lower print advertising at News UK and News Corp Australia and lower digital advertising mainly driven by a decline in traffic

at some mastheads due to platform-related changes, partly offset by growth in digital advertising at Wireless Group.

In the quarter, Segment EBITDA decreased $17 million, or 38%, compared to the prior year, driven by lower contribution from News Corp Australia. Adjusted Segment EBITDA decreased 38%.

Digital revenues represented 37% of News Media segment revenues in the quarter, compared to 36% in the prior year, and represented 35% of the combined revenues of the newspaper mastheads. Digital subscribers and users across key properties within the News Media segment are summarized below:

•Closing digital subscribers at News Corp Australia as of June 30, 2024 were 1,117,000 (968,000 for news mastheads), compared to 1,059,000 (943,000 for news mastheads) in the prior year (Source: Internal data)

•The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of June 30, 2024 were 594,000, compared to 565,000 in the prior year (Source: Internal data).

•The Sun’s digital offering reached 112 million global monthly unique users in June 2024, compared to 159 million in the prior year (Source: Meta Pixel)

•New York Post’s digital network reached 117 million unique users in June 2024, compared to 145 million in the prior year (Source: Google Analytics)

Full Year Segment Results

Fiscal 2024 full year revenues decreased $80 million, or 4%, compared to the prior year, which includes a $20 million positive impact from foreign currency fluctuations. Within the segment, revenues at News Corp Australia decreased 7%, driven by lower advertising and a $25 million, or 3%, negative impact from foreign currency fluctuations, while revenues at News UK were flat, reflecting a $39 million, or 5%, positive impact from foreign currency fluctuations. In constant currency, News UK revenues were down 5%. Adjusted Revenues for the segment decreased 4% compared to the prior year.

Circulation and subscription revenues increased $10 million, or 1%, compared to the prior year, primarily due to a $15 million, or 1%, positive impact from foreign currency fluctuations, as cover price increases and digital subscriber growth were more than offset by print volume declines.

Advertising revenues decreased $73 million, or 8%, compared to the prior year, driven by lower print and digital advertising at both News Corp Australia and News UK.

Segment EBITDA for fiscal 2024 decreased $36 million, or 23%, compared to the prior year, which includes $6 million of one-time costs at News UK pertaining to the combination of printing operations with DMG Media. The decrease is primarily due to the lower contribution from News Corp Australia. Adjusted Segment EBITDA decreased 24% compared to the prior year.

CASH FLOW

The following table presents a reconciliation of net cash provided by operating activities to free cash flow:

| | | | | | | | | | | |

| For the fiscal years ended June 30, |

| 2024 | | 2023 |

| (in millions) |

| Net cash provided by operating activities | $ | 1,098 | | | $ | 1,092 | |

| Less: Capital expenditures | (496) | | | (499) | |

| Free cash flow | $ | 602 | | | $ | 593 | |

Net cash provided by operating activities of $1,098 million for the fiscal year ended June 30, 2024 was $6 million higher than $1,092 million in the prior year, primarily due to higher Total Segment EBITDA, as noted above, largely offset by higher working capital and higher restructuring payments.

Free cash flow in the fiscal year ended June 30, 2024 was $602 million compared to $593 million in the prior year. The improvement in free cash flow was primarily due to higher cash provided by operating activities, as mentioned above. Foxtel’s capital expenditures for the fiscal year ended June 30, 2024 were $139 million compared to $152 million in the prior year.

Free cash flow is a non-GAAP financial measure. Free cash flow is defined as net cash provided by (used in) operating activities, less capital expenditures. Free cash flow may not be comparable to similarly titled measures reported by other companies, since companies and investors may differ as to what items should be included in the calculation of free cash flow.

Free cash flow does not represent the total increase or decrease in the cash balance for the period and should be considered in addition to, not as a substitute for, the net change in cash and cash equivalents as presented in the Company’s consolidated statements of cash flows prepared in accordance with GAAP, which incorporates all cash movements during the period. The Company believes free cash flow provides useful information to management and investors about the Company’s liquidity and cash flow trends.

OTHER ITEMS

Dividends

The Company declared today a semi-annual cash dividend of $0.10 per share for Class A Common Stock and Class B Common Stock. This dividend is payable on October 9, 2024 to stockholders of record as of September 11, 2024.

Strategic Review

In response to third party interest, the Company is assessing strategic and financial options for the Foxtel Group, including its capital structure and assets. There is no assurance regarding the timing of any action or transaction, nor that the strategic review will result in a transaction or other strategic change.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment EBITDA, Adjusted Segment EBITDA, adjusted net income attributable to News Corporation stockholders, Adjusted EPS, constant currency revenues and free cash flow are non-GAAP financial measures contained in this earnings release. The Company believes these measures are important tools for investors and analysts to use in assessing the Company’s underlying business performance and to provide for more meaningful comparisons of the Company’s operating performance between periods. These measures also allow investors and analysts to view the Company’s business from the same perspective as Company management. These non-GAAP measures may be different than similar measures used by other companies and should be considered in addition to, not as a substitute for, measures of financial performance calculated in accordance with GAAP. Reconciliations for the differences between non-GAAP measures used in this earnings release and comparable financial measures calculated in accordance with U.S. GAAP are included in Notes 1, 2, 3 and 4 and the reconciliation of net cash provided by operating activities to free cash flow is included above.

Conference call

News Corporation’s earnings conference call can be heard live at 5:00 p.m. EDT on August 8, 2024. To listen to the call, please visit http://investors.newscorp.com.

Cautionary Statement Concerning Forward-Looking Statements

This document contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding trends and uncertainties affecting the Company’s business, results of operations and financial condition, the Company’s strategy and strategic initiatives, including potential acquisitions, investments and dispositions, the Company’s cost savings initiatives and the outcome of contingencies such as litigation and investigations. These statements are based on management’s views and assumptions regarding future events and business performance as of the time the statements are made. Actual results may differ materially from these expectations due to the risks, uncertainties and other factors described in the Company’s filings with the Securities and Exchange Commission. More detailed information about factors that could affect future results is contained in our filings with the Securities and Exchange Commission. The “forward-looking statements” included in this document are made only as of the date of this document and we do not have and do not undertake any obligation to publicly update any “forward-looking statements” to reflect subsequent events or circumstances, and we expressly disclaim any such obligation, except as required by law or regulation.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. The company comprises businesses across a range of media, including: digital real estate services, subscription video services in Australia, news and information services and book publishing. Headquartered in New York, News Corp operates primarily in the United States, Australia, and the United Kingdom, and its content and other products and services are distributed and consumed worldwide. More information is available at: www.newscorp.com.

Contacts:

| | | | | |

| Investor Relations | Corporate Communications |

| Michael Florin | Arthur Bochner |

| 212-416-3363 | 646-422-9671 |

| mflorin@newscorp.com | abochner@newscorp.com |

| |

| Anthony Rudolf |

|

| 212-416-3040 | |

| arudolf@newscorp.com |

|

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited; in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended

June 30, | | For the fiscal years ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Circulation and subscription | $ | 1,140 | | | $ | 1,129 | | | $ | 4,509 | | | $ | 4,447 | |

| Advertising | 420 | | | 424 | | | 1,607 | | | 1,687 | |

| Consumer | 487 | | | 425 | | | 2,000 | | | 1,899 | |

| Real estate | 345 | | | 293 | | | 1,284 | | | 1,189 | |

| Other | 185 | | | 162 | | | 685 | | | 657 | |

| Total Revenues | 2,577 | | | 2,433 | | | 10,085 | | | 9,879 | |

| Operating expenses | (1,261) | | | (1,271) | | | (5,053) | | | (5,124) | |

| Selling, general and administrative | (936) | | | (821) | | | (3,493) | | | (3,335) | |

| Depreciation and amortization | (192) | | | (178) | | | (734) | | | (714) | |

| Impairment and restructuring charges | (52) | | | (85) | | | (138) | | | (150) | |

| Equity losses of affiliates | (1) | | | (84) | | | (6) | | | (127) | |

| Interest expense, net | (18) | | | (22) | | | (85) | | | (100) | |

| Other, net | (7) | | | 11 | | | (30) | | | 1 | |

Income (loss) before income tax expense | 110 | | | (17) | | | 546 | | | 330 | |

| Income tax expense | (39) | | | (15) | | | (192) | | | (143) | |

| Net income (loss) | 71 | | | (32) | | | 354 | | | 187 | |

| Net (income) loss attributable to noncontrolling interests | (21) | | | 24 | | | (88) | | | (38) | |

| Net income (loss) attributable to News Corporation stockholders | $ | 50 | | | $ | (8) | | | $ | 266 | | | $ | 149 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 570 | | | 573 | | | 571 | | | 576 | |

| Diluted | 573 | | | 573 | | | 574 | | | 579 | |

| | | | | | | |

| Net income (loss) attributable to News Corporation stockholders per share: | | | | | | | |

| Basic | $ | 0.09 | | | $ | (0.01) | | | $ | 0.47 | | | $ | 0.26 | |

| Diluted | $ | 0.09 | | | $ | (0.01) | | | $ | 0.46 | | | $ | 0.26 | |

NEWS CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited; in millions)

| | | | | | | | | | | |

| As of June 30, 2024 | | As of June 30, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,960 | | | $ | 1,833 | |

| Receivables, net | 1,503 | | | 1,425 | |

| Inventory, net | 296 | | | 311 | |

| Other current assets | 613 | | | 484 | |

| Total current assets | 4,372 | | | 4,053 | |

| | | |

| Non-current assets: | | | |

| Investments | 430 | | | 427 | |

| Property, plant and equipment, net | 1,914 | | | 2,042 | |

| Operating lease right-of-use assets | 958 | | | 1,036 | |

| Intangible assets, net | 2,322 | | | 2,489 | |

| Goodwill | 5,186 | | | 5,140 | |

Deferred income tax assets, net | 332 | | | 393 | |

| Other non-current assets | 1,170 | | | 1,341 | |

| Total assets | $ | 16,684 | | | $ | 16,921 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 314 | | | $ | 440 | |

| Accrued expenses | 1,231 | | | 1,123 | |

| Deferred revenue | 551 | | | 622 | |

| Current borrowings | 54 | | | 27 | |

| Other current liabilities | 905 | | | 953 | |

| Total current liabilities | 3,055 | | | 3,165 | |

| | | |

| Non-current liabilities: | | | |

| Borrowings | 2,855 | | | 2,940 | |

| Retirement benefit obligations | 125 | | | 134 | |

Deferred income tax liabilities, net | 119 | | | 163 | |

| Operating lease liabilities | 1,027 | | | 1,128 | |

| Other non-current liabilities | 492 | | | 446 | |

| Commitments and contingencies | | | |

| | | |

| | | |

| Equity: | | | |

| Class A common stock | 4 | | | 4 | |

| Class B common stock | 2 | | | 2 | |

| Additional paid-in capital | 11,254 | | | 11,449 | |

| Accumulated deficit | (1,889) | | | (2,144) | |

| Accumulated other comprehensive loss | (1,251) | | | (1,247) | |

| Total News Corporation stockholders' equity | 8,120 | | | 8,064 | |

| Noncontrolling interests | 891 | | | 881 | |

| Total equity | 9,011 | | | 8,945 | |

| Total liabilities and equity | $ | 16,684 | | | $ | 16,921 | |

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; in millions)

| | | | | | | | | | | |

| For the fiscal years ended June 30, |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net income | $ | 354 | | | $ | 187 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 734 | | | 714 | |

| Operating lease expense | 96 | | | 109 | |

| Equity losses of affiliates | 6 | | | 127 | |

| Impairment charges | 44 | | | 25 | |

| Deferred income taxes | 17 | | | 6 | |

| Other, net | 34 | | | 6 | |

| Change in operating assets and liabilities, net of acquisitions: | | | |

| | | |

| Receivables and other assets | (120) | | | (146) | |

| Inventories, net | 54 | | | (2) | |

| Accounts payable and other liabilities | (121) | | | 66 | |

| Net cash provided by operating activities | 1,098 | | | 1,092 | |

| Investing activities: | | | |

| Capital expenditures | (496) | | | (499) | |

| Proceeds from sales of property, plant and equipment | — | | | 37 | |

| Acquisitions, net of cash acquired | (38) | | | (17) | |

| | | |

| Purchases of investments in equity affiliates and other | (96) | | | (124) | |

| | | |

| | | |

| Proceeds from sales of investments in equity affiliates and other | 81 | | | 50 | |

| Other, net | 25 | | | (21) | |

| Net cash used in investing activities | (524) | | | (574) | |

| Financing activities: | | | |

| Borrowings | 1,268 | | | 514 | |

| Repayment of borrowings | (1,375) | | | (589) | |

| Repurchase of shares | (117) | | | (243) | |

| Dividends paid | (172) | | | (174) | |

| | | |

| Other, net | (45) | | | (9) | |

Net cash used in financing activities | (441) | | | (501) | |

| Net change in cash and cash equivalents | 133 | | | 17 | |

| | | |

| Cash and cash equivalents, beginning of year | 1,833 | | | 1,822 | |

| Effect of exchange rate changes on cash and cash equivalents | (6) | | | (6) | |

| Cash and cash equivalents, end of year | $ | 1,960 | | | $ | 1,833 | |

| | | |

NOTE 1 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses and selling, general and administrative expenses. Segment EBITDA does not include: depreciation and amortization, impairment and restructuring charges, equity losses of affiliates, interest (expense) income, net, other, net and income tax (expense) benefit. Management believes that Segment EBITDA is an appropriate measure for evaluating the operating performance of the Company’s business segments because it is the primary measure used by the Company’s chief operating decision maker to evaluate the performance of and allocate resources within the Company’s businesses. Segment EBITDA provides management, investors and equity analysts with a measure to analyze the operating performance of each of the Company’s business segments and its enterprise value against historical data and competitors’ data, although historical results may not be indicative of future results (as operating performance is highly contingent on many factors, including customer tastes and preferences).

Total Segment EBITDA is a non-GAAP measure and should be considered in addition to, not as a substitute for, net income (loss), cash flow and other measures of financial performance reported in accordance with GAAP. In addition, this measure does not reflect cash available to fund requirements and excludes items, such as depreciation and amortization and impairment and restructuring charges, which are significant components in assessing the Company’s financial performance. The Company believes that the presentation of Total Segment EBITDA provides useful information regarding the Company’s operations and other factors that affect the Company’s reported results. Specifically, the Company believes that by excluding certain one-time or non-cash items such as impairment and restructuring charges and depreciation and amortization, as well as potential distortions between periods caused by factors such as financing and capital structures and changes in tax positions or regimes, the Company provides users of its consolidated financial statements with insight into both its core operations as well as the factors that affect reported results between periods but which the Company believes are not representative of its core business. As a result, users of the Company’s consolidated financial statements are better able to evaluate changes in the core operating results of the Company across different periods. The following tables reconcile net income (loss) to Total Segment EBITDA for the three months and fiscal years ended June 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended June 30, |

| 2024 | | 2023 | | Change | | % Change |

| (in millions) | | |

| Net income (loss) | $ | 71 | | | $ | (32) | | | $ | 103 | | | ** |

| Add: | | | | | | | |

Income tax expense | 39 | | | 15 | | | 24 | | | 160 | % |

| Other, net | 7 | | | (11) | | | 18 | | | ** |

| Interest expense, net | 18 | | | 22 | | | (4) | | | (18) | % |

| Equity losses of affiliates | 1 | | | 84 | | | (83) | | | (99) | % |

| Impairment and restructuring charges | 52 | | | 85 | | | (33) | | | (39) | % |

| Depreciation and amortization | 192 | | | 178 | | | 14 | | | 8 | % |

| Total Segment EBITDA | $ | 380 | | | $ | 341 | | | $ | 39 | | | 11 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal years ended June 30, |

| 2024 | | 2023 | | Change | | % Change |

| (in millions) | | |

| Net income | $ | 354 | | | $ | 187 | | | $ | 167 | | | 89 | % |

| Add: | | | | | | | |

| Income tax expense | 192 | | | 143 | | | 49 | | | 34 | % |

| Other, net | 30 | | | (1) | | | 31 | | | ** |

| Interest expense, net | 85 | | | 100 | | | (15) | | | (15) | % |

| Equity losses of affiliates | 6 | | | 127 | | | (121) | | | (95) | % |

| Impairment and restructuring charges | 138 | | | 150 | | | (12) | | | (8) | % |

| Depreciation and amortization | 734 | | | 714 | | | 20 | | | 3 | % |

| Total Segment EBITDA | $ | 1,539 | | | $ | 1,420 | | | $ | 119 | | | 8 | % |

**Not meaningful

NOTE 2 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment EBITDA excluding the impact of acquisitions, divestitures, fees and costs, net of indemnification, related to the claims and investigations arising out of certain conduct at The News of the World (the “U.K. Newspaper Matters”), charges for other significant, non-ordinary course legal or regulatory matters (“litigation charges”) and foreign currency fluctuations (“Adjusted Revenues,” “Adjusted Total Segment EBITDA” and “Adjusted Segment EBITDA,” respectively) to evaluate the performance of the Company’s core business operations exclusive of certain items that impact the comparability of results from period to period such as the unpredictability and volatility of currency fluctuations. The Company calculates the impact of foreign currency fluctuations for businesses reporting in currencies other than the U.S. dollar by multiplying the results for each quarter in the current period by the difference between the average exchange rate for that quarter and the average exchange rate in effect during the corresponding quarter of the prior year and totaling the impact for all quarters in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA may not be comparable to similarly titled measures reported by other companies, since companies and investors may differ as to what type of events warrant adjustment. Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA are not measures of performance under generally accepted accounting principles and should not be construed as substitutes for amounts determined under GAAP as measures of performance. However, management uses these measures in comparing the Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following tables reconcile reported revenues and reported Total Segment EBITDA to Adjusted Revenues and Adjusted Total Segment EBITDA for the three months and fiscal years ended June 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | Total Segment EBITDA |

| For the three months ended June 30, | | | For the three months ended June 30, |

| 2024 | | 2023 | | Difference | | | 2024 | | 2023 | | Difference |

| (in millions) | | | (in millions) |

| As reported | $ | 2,577 | | | $ | 2,433 | | | $ | 144 | | | | $ | 380 | | | $ | 341 | | | $ | 39 | |

| Impact of acquisitions | (5) | | | — | | | (5) | | | | 1 | | | (3) | | | 4 | |

| | | | | | | | | | | | |

| Impact of foreign currency fluctuations | 15 | | | — | | | 15 | | | | 3 | | | — | | | 3 | |

| | | | | | | | | | | | |

| Net impact of U.K. Newspaper Matters | — | | | — | | | — | | | | 1 | | | 3 | | | (2) | |

| As adjusted | $ | 2,587 | | | $ | 2,433 | | | $ | 154 | | | | $ | 385 | | | $ | 341 | | | $ | 44 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | Total Segment EBITDA |

| For the fiscal years ended June 30, | | | For the fiscal years ended June 30, |

| 2024 | | 2023 | | Difference | | | 2024 | | 2023 | | Difference |

| (in millions) | | | (in millions) |

| As reported | $ | 10,085 | | | $ | 9,879 | | | $ | 206 | | | | $ | 1,539 | | | $ | 1,420 | | | $ | 119 | |

| Impact of acquisitions | (21) | | | — | | | (21) | | | | 1 | | | 7 | | | (6) | |

| | | | | | | | | | | | |

| Impact of foreign currency fluctuations | 37 | | | — | | | 37 | | | | 17 | | | — | | | 17 | |

| | | | | | | | | | | | |

| Net impact of U.K. Newspaper Matters | — | | | — | | | — | | | | 8 | | | 16 | | | (8) | |

| As adjusted | $ | 10,101 | | | $ | 9,879 | | | $ | 222 | | | | $ | 1,565 | | | $ | 1,443 | | | $ | 122 | |

| | | | | | | | | | | | |

Foreign Exchange Rates

Average foreign exchange rates used in the calculation of the impact of foreign currency fluctuations for each of the three month periods in the fiscal years ended June 30, 2024 and 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2024 |

| Q1 | | Q2 | | Q3 | | Q4 |

| U.S. Dollar per Australian Dollar | $0.65 | | $0.65 | | $0.66 | | $0.66 |

| U.S. Dollar per British Pound Sterling | $1.27 | | $1.24 | | $1.27 | | $1.26 |

| | | | | | | |

| Fiscal Year 2023 |

| Q1 | | Q2 | | Q3 | | Q4 |

| U.S. Dollar per Australian Dollar | $0.68 | | $0.66 | | $0.68 | | $0.67 |

| U.S. Dollar per British Pound Sterling | $1.17 | | $1.17 | | $1.22 | | $1.25 |

Adjusted Revenues and Adjusted Segment EBITDA by segment for the three months and fiscal years ended June 30, 2024 and 2023 are as follows:

| | | | | | | | | | | | | | | | | |

| For the three months ended June 30, |

| 2024 | | 2023 | | % Change |

| (in millions) | | Better/(Worse) |

| Adjusted Revenues: | | | | | |

| Digital Real Estate Services | $ | 447 | | | $ | 369 | | | 21 | % |

| Subscription Video Services | 513 | | | 501 | | | 2 | % |

| Dow Jones | 567 | | | 546 | | | 4 | % |

| Book Publishing | 512 | | | 446 | | | 15 | % |

| News Media | 548 | | | 571 | | | (4) | % |

| Other | — | | | — | | | — | % |

| Adjusted Total Revenues | $ | 2,587 | | | $ | 2,433 | | | 6 | % |

| | | | | |

| Adjusted Segment EBITDA: | | | | | |

| Digital Real Estate Services | $ | 138 | | | $ | 108 | | | 28 | % |

| Subscription Video Services | 75 | | | 78 | | | (4) | % |

| Dow Jones | 137 | | | 133 | | | 3 | % |

| Book Publishing | 57 | | | 16 | | | 256 | % |

| News Media | 28 | | | 45 | | | (38) | % |

| Other | (50) | | | (39) | | | (28) | % |

| Adjusted Total Segment EBITDA | $ | 385 | | | $ | 341 | | | 13 | % |

| | | | | |

| | | | | | | | | | | | | | | | | |

| For the fiscal years ended June 30, |

| 2024 | | 2023 | | % Change |

| (in millions) | | Better/(Worse) |

| Adjusted Revenues: | | | | | |

| Digital Real Estate Services | $ | 1,671 | | | $ | 1,539 | | | 9 | % |

| Subscription Video Services | 1,969 | | | 1,942 | | | 1 | % |

| Dow Jones | 2,224 | | | 2,153 | | | 3 | % |

| Book Publishing | 2,071 | | | 1,979 | | | 5 | % |

| News Media | 2,166 | | | 2,266 | | | (4) | % |

| Other | — | | | — | | | — | % |

| Adjusted Total Revenues | $ | 10,101 | | | $ | 9,879 | | | 2 | % |

| | | | | |

| Adjusted Segment EBITDA: | | | | | |

| Digital Real Estate Services | $ | 524 | | | $ | 457 | | | 15 | % |

| Subscription Video Services | 319 | | | 347 | | | (8) | % |

| Dow Jones | 541 | | | 494 | | | 10 | % |

| Book Publishing | 265 | | | 167 | | | 59 | % |

| News Media | 118 | | | 156 | | | (24) | % |

| Other | (202) | | | (178) | | | (13) | % |

| Adjusted Total Segment EBITDA | $ | 1,565 | | | $ | 1,443 | | | 8 | % |

| | | | | |

The following tables reconcile reported revenues and Segment EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA by segment for the three months and fiscal years ended June 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended June 30, 2024 |

| As Reported | | Impact of Acquisitions | | | Impact of Foreign Currency Fluctuations | | | Net Impact of U.K. Newspaper Matters | | As Adjusted |

| (in millions) |

| Revenues: | | | | | | | | | | | |

| Digital Real Estate Services | $ | 448 | | | $ | (5) | | | | $ | 4 | | | | $ | — | | | $ | 447 | |

| Subscription Video Services | 506 | | | — | | | | 7 | | | | — | | | 513 | |

| Dow Jones | 566 | | | — | | | | 1 | | | | — | | | 567 | |

| Book Publishing | 512 | | | — | | | | — | | | | — | | | 512 | |

| News Media | 545 | | | — | | | | 3 | | | | — | | | 548 | |

| Other | — | | | — | | | | — | | | | — | | | — | |

| Total Revenues | $ | 2,577 | | | $ | (5) | | | | $ | 15 | | | | $ | — | | | $ | 2,587 | |

| | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | |

| Digital Real Estate Services | $ | 135 | | | $ | 1 | | | | $ | 2 | | | | $ | — | | | $ | 138 | |

| Subscription Video Services | 74 | | | — | | | | 1 | | | | — | | | 75 | |

| Dow Jones | 137 | | | — | | | | — | | | | — | | | 137 | |

| Book Publishing | 57 | | | — | | | | — | | | | — | | | 57 | |

| News Media | 28 | | | — | | | | — | | | | — | | | 28 | |

| Other | (51) | | | — | | | | — | | | | 1 | | | (50) | |

| Total Segment EBITDA | $ | 380 | | | $ | 1 | | | | $ | 3 | | | | $ | 1 | | | $ | 385 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended June 30, 2023 |

| As Reported | | Impact of Acquisitions | | | Impact of Foreign Currency Fluctuations | | | Net Impact of U.K. Newspaper Matters | | As Adjusted |

| (in millions) |

| Revenues: | | | | | | | | | | | |

| Digital Real Estate Services | $ | 369 | | | $ | — | | | | $ | — | | | | $ | — | | | $ | 369 | |

| Subscription Video Services | 501 | | | — | | | | — | | | | — | | | 501 | |

| Dow Jones | 546 | | | — | | | | — | | | | — | | | 546 | |

| Book Publishing | 446 | | | — | | | | — | | | | — | | | 446 | |

| News Media | 571 | | | — | | | | — | | | | — | | | 571 | |

| Other | — | | | — | | | | — | | | | — | | | — | |

| Total Revenues | $ | 2,433 | | | $ | — | | | | $ | — | | | | $ | — | | | $ | 2,433 | |

| | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | |

| Digital Real Estate Services | $ | 108 | | | $ | — | | | | $ | — | | | | $ | — | | | $ | 108 | |

| Subscription Video Services | 78 | | | — | | | | — | | | | — | | | 78 | |

| Dow Jones | 133 | | | — | | | | — | | | | — | | | 133 | |

| Book Publishing | 16 | | | — | | | | — | | | | — | | | 16 | |

| News Media | 45 | | | — | | | | — | | | | — | | | 45 | |

| Other | (39) | | | (3) | | | | — | | | | 3 | | | (39) | |

| Total Segment EBITDA | $ | 341 | | | $ | (3) | | | | $ | — | | | | $ | 3 | | | $ | 341 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal year ended June 30, 2024 |

| As Reported | | Impact of Acquisitions | | | | Impact of Foreign Currency Fluctuations | | | | Net Impact of U.K. Newspaper Matters | | As Adjusted |

| (in millions) |

| Revenues: | | | | | | | | | | | | | |

| Digital Real Estate Services | $ | 1,658 | | | $ | (15) | | | | | $ | 28 | | | | | $ | — | | | $ | 1,671 | |

| Subscription Video Services | 1,917 | | | — | | | | | 52 | | | | | — | | | 1,969 | |

| Dow Jones | 2,231 | | | — | | | | | (7) | | | | | — | | | 2,224 | |

| Book Publishing | 2,093 | | | (6) | | | | | (16) | | | | | — | | | 2,071 | |

| News Media | 2,186 | | | — | | | | | (20) | | | | | — | | | 2,166 | |

| Other | — | | | — | | | | | — | | | | | — | | | — | |

| Total Revenues | $ | 10,085 | | | $ | (21) | | | | | $ | 37 | | | | | $ | — | | | $ | 10,101 | |

| | | | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | | | |

| Digital Real Estate Services | $ | 508 | | | $ | 3 | | | | | $ | 13 | | | | | $ | — | | | $ | 524 | |

| Subscription Video Services | 310 | | | — | | | | | 9 | | | | | — | | | 319 | |

| Dow Jones | 542 | | | — | | | | | (1) | | | | | — | | | 541 | |

| Book Publishing | 269 | | | (2) | | | | | (2) | | | | | — | | | 265 | |

| News Media | 120 | | | — | | | | | (2) | | | | | — | | | 118 | |

| Other | (210) | | | — | | | | | — | | | | | 8 | | | (202) | |

| Total Segment EBITDA | $ | 1,539 | | | $ | 1 | | | | | $ | 17 | | | | | $ | 8 | | | $ | 1,565 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal year ended June 30, 2023 |

| As Reported | | Impact of Acquisitions | | | | Impact of Foreign Currency Fluctuations | | | | Net Impact of U.K. Newspaper Matters | | As Adjusted |

| (in millions) |

| Revenues: | | | | | | | | | | | | | |

| Digital Real Estate Services | $ | 1,539 | | | $ | — | | | | | $ | — | | | | | $ | — | | | $ | 1,539 | |

| Subscription Video Services | 1,942 | | | — | | | | | — | | | | | — | | | 1,942 | |

| Dow Jones | 2,153 | | | — | | | | | — | | | | | — | | | 2,153 | |

| Book Publishing | 1,979 | | | — | | | | | — | | | | | — | | | 1,979 | |

| News Media | 2,266 | | | — | | | | | — | | | | | — | | | 2,266 | |

| Other | — | | | — | | | | | — | | | | | — | | | — | |

| Total Revenues | $ | 9,879 | | | $ | — | | | | | $ | — | | | | | $ | — | | | $ | 9,879 | |

| | | | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | | | |

| Digital Real Estate Services | $ | 457 | | | $ | — | | | | | $ | — | | | | | $ | — | | | $ | 457 | |

| Subscription Video Services | 347 | | | — | | | | | — | | | | | — | | | 347 | |

| Dow Jones | 494 | | | — | | | | | — | | | | | — | | | 494 | |

| Book Publishing | 167 | | | — | | | | | — | | | | | — | | | 167 | |

| News Media | 156 | | | — | | | | | — | | | | | — | | | 156 | |

| Other | (201) | | | 7 | | | | | — | | | | | 16 | | | (178) | |

| Total Segment EBITDA | $ | 1,420 | | | $ | 7 | | | | | $ | — | | | | | $ | 16 | | | $ | 1,443 | |

NOTE 3 – ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO NEWS CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) attributable to News Corporation stockholders and diluted earnings per share (“EPS”) excluding expenses related to U.K. Newspaper Matters, litigation charges, impairment and restructuring charges and “Other, net”, net of tax, recognized by the Company or its equity method investees, as well as the settlement of certain pre-Separation tax matters (“adjusted net income (loss) attributable to News Corporation stockholders” and “adjusted EPS,” respectively), to evaluate the performance of the Company’s operations exclusive of certain items that impact the comparability of results from period to period, as well as certain non-operational items. The calculation of adjusted net income (loss) attributable to News Corporation stockholders and adjusted EPS may not be comparable to similarly titled measures reported by other companies, since companies and investors may differ as to what type of events warrant adjustment. Adjusted net income (loss) attributable to News Corporation stockholders and adjusted EPS are not measures of performance under generally accepted accounting principles and should not be construed as substitutes for consolidated net income (loss) attributable to News Corporation stockholders and net income (loss) per share as determined under GAAP as a measure of performance. However, management uses these measures in comparing the Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following tables reconcile reported net income (loss) attributable to News Corporation stockholders and reported diluted EPS to adjusted net income attributable to News Corporation stockholders and adjusted EPS for the three months and fiscal years ended June 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended June 30, 2024 | | For the three months ended June 30, 2023 |

| (in millions, except per share data) | Net income attributable to stockholders | | EPS | | Net (loss) income attributable to stockholders | | EPS |

| Net income (loss) | $ | 71 | | | | | $ | (32) | | | |

| Net (income) loss attributable to noncontrolling interests | (21) | | | | | 24 | | | |

| Net income (loss) attributable to News Corporation stockholders | $ | 50 | | | $ | 0.09 | | | $ | (8) | | | $ | (0.01) | |

| U.K. Newspaper Matters | 1 | | | — | | | 3 | | | — | |

| | | | | | | |

Impairment and restructuring charges(a) | 52 | | | 0.09 | | | 85 | | | 0.15 | |

Equity losses of affiliates(b) | — | | | — | | | 81 | | | 0.14 | |

| Other, net | 7 | | | 0.01 | | | (11) | | | (0.02) | |

| Tax impact on items above | (11) | | | (0.02) | | | (37) | | | (0.06) | |

| Impact of noncontrolling interest on items above | — | | | — | | | (35) | | | (0.06) | |

| As adjusted | $ | 99 | | | $ | 0.17 | | | $ | 78 | | | $ | 0.14 | |

(a)During the three months ended June 30, 2024, the Company recognized non-cash impairment charges of $20 million primarily related to the impairment of an indefinite-lived intangible asset and goodwill during the Company’s annual impairment assessment.

During the three months ended June 30, 2023, the Company recognized non-cash impairment charges of $25 million related to the impairment of certain indefinite-lived intangible assets during the Company’s annual impairment assessment.

(b)During the three months ended June 30, 2023, the Company recognized a non-cash write-down of REA Group’s investment in PropertyGuru of approximately $81 million.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the fiscal year ended June 30, 2024 | | For the fiscal year ended June 30, 2023 |

| (in millions, except per share data) | Net income attributable to stockholders | | EPS | | Net income attributable to stockholders | | EPS |

| Net income | $ | 354 | | | | | $ | 187 | | | |

| Less: Net income attributable to noncontrolling interests | (88) | | | | | (38) | | | |

| Net income attributable to News Corporation stockholders | $ | 266 | | | $ | 0.46 | | | $ | 149 | | | $ | 0.26 | |

| U.K. Newspaper Matters | 8 | | | 0.02 | | | 16 | | | 0.02 | |

| | | | | | | |

Impairment and restructuring charges (a) | 138 | | | 0.24 | | | 150 | | | 0.26 | |

Equity losses of affiliates (b) | — | | | — | | | 81 | | | 0.14 | |

| Other, net | 30 | | | 0.05 | | | (1) | | | — | |

| Tax impact on items above | (41) | | | (0.07) | | | (76) | | | (0.13) | |

| Impact of noncontrolling interest on items above | 2 | | | — | | | (36) | | | (0.06) | |

| As adjusted | $ | 403 | | | $ | 0.70 | | | $ | 283 | | | $ | 0.49 | |

(a)During the fiscal year ended June 30, 2024, the Company recognized non-cash impairment charges of $44 million primarily related to the write-down of fixed assets associated with the proposed combination of certain U.K. printing operations with those of a third party and the impairment of an indefinite-lived intangible asset and goodwill during the Company’s annual impairment assessment.

During the fiscal year ended June 30, 2023, the Company recognized non-cash impairment charges of $25 million related to the impairment of certain indefinite-lived intangible assets during the Company’s annual impairment assessment.

(b)During the fiscal year ended June 30, 2023, the Company recognized a non-cash write-down of REA Group’s investment in PropertyGuru of approximately $81 million.

NOTE 4 – CONSTANT CURRENCY REVENUES

The Company believes that the presentation of revenues excluding the impact of foreign currency fluctuations (“constant currency revenues”) provides useful information regarding the performance of the Company’s core business operations exclusive of distortions between periods caused by the unpredictability and volatility of currency fluctuations. The Company calculates the impact of foreign currency fluctuations for businesses reporting in currencies other than the U.S. dollar as described in Note 2.

Constant currency revenues are not measures of performance under generally accepted accounting principles and should not be construed as substitutes for revenues as determined under GAAP as measures of performance. However, management uses these measures in comparing the Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following tables reconcile reported revenues to constant currency revenues for the three months and fiscal year ended June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 Fiscal 2023 | | Q4 Fiscal 2024 | | FX impact | | Q4 Fiscal 2024 constant currency | | % Change - reported | | % Change - constant currency |

| ($ in millions) | | Better/(Worse) |

| Consolidated results: | | | | | | | | | | | |

| Circulation and subscription | $ | 1,129 | | | $ | 1,140 | | | $ | (7) | | | $ | 1,147 | | | 1 | % | | 2 | % |

| Advertising | 424 | | | 420 | | | (3) | | | 423 | | | (1) | % | | — | % |

| Consumer | 425 | | | 487 | | | — | | | 487 | | | 15 | % | | 15 | % |

| Real estate | 293 | | | 345 | | | (4) | | | 349 | | | 18 | % | | 19 | % |

| Other | 162 | | | 185 | | | (1) | | | 186 | | | 14 | % | | 15 | % |

| Total revenues | $ | 2,433 | | | $ | 2,577 | | | $ | (15) | | | $ | 2,592 | | | 6 | % | | 7 | % |

| | | | | | | | | | | |

| Digital Real Estate Services: | | | | | | | | | | | |

| Circulation and subscription | $ | 3 | | | $ | 2 | | | $ | — | | | $ | 2 | | | (33) | % | | (33) | % |

| Advertising | 37 | | | 37 | | | — | | | $ | 37 | | | — | % | | — | % |

| Real estate | 293 | | | 345 | | | (4) | | | $ | 349 | | | 18 | % | | 19 | % |

| Other | 36 | | | 64 | | | — | | | $ | 64 | | | 78 | % | | 78 | % |

| Total Digital Real Estate Services segment revenues | $ | 369 | | | $ | 448 | | | $ | (4) | | | $ | 452 | | | 21 | % | | 22 | % |

| | | | | | | | | | | |

| REA Group revenues | $ | 223 | | | $ | 305 | | | $ | (4) | | | $ | 309 | | | 37 | % | | 39 | % |

| | | | | | | | | | | |

| Subscription Video Services: | | | | | | | | | | | |

| Circulation and subscription | $ | 422 | | | $ | 426 | | | $ | (6) | | | $ | 432 | | | 1 | % | | 2 | % |

| Advertising | 67 | | | 72 | | | (1) | | | $ | 73 | | | 7 | % | | 9 | % |

| Other | 12 | | | 8 | | | — | | | $ | 8 | | | (33) | % | | (33) | % |

| Total Subscription Video Services segment revenues | $ | 501 | | | $ | 506 | | | $ | (7) | | | $ | 513 | | | 1 | % | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 Fiscal 2023 | | Q4 Fiscal 2024 | | FX impact | | Q4 Fiscal 2024 constant currency | | % Change - reported | | % Change - constant currency |

| ($ in millions) | | Better/(Worse) |

| Dow Jones: | | | | | | | | | | | |

| Circulation and subscription | $ | 432 | | | $ | 449 | | | $ | (1) | | | $ | 450 | | | 4 | % | | 4 | % |

| Advertising | 100 | | | 102 | | | — | | | $ | 102 | | | 2 | % | | 2 | % |

| Other | 14 | | | 15 | | | — | | | $ | 15 | | | 7 | % | | 7 | % |

| Total Dow Jones segment revenues | $ | 546 | | | $ | 566 | | | $ | (1) | | | $ | 567 | | | 4 | % | | 4 | % |

| | | | | | | | | | | |

| Book Publishing: | | | | | | | | | | | |

| Consumer | 425 | | | 487 | | | — | | | $ | 487 | | | 15 | % | | 15 | % |

| Other | 21 | | | 25 | | | — | | | $ | 25 | | | 19 | % | | 19 | % |

| Total Book Publishing segment revenues | $ | 446 | | | $ | 512 | | | $ | — | | | $ | 512 | | | 15 | % | | 15 | % |

| | | | | | | | | | | |

| News Media: | | | | | | | | | | | |

| Circulation and subscription | $ | 272 | | | $ | 263 | | | $ | — | | | $ | 263 | | | (3) | % | | (3) | % |

| Advertising | 220 | | | 209 | | | (2) | | | $ | 211 | | | (5) | % | | (4) | % |

| Other | 79 | | | 73 | | | (1) | | | $ | 74 | | | (8) | % | | (6) | % |

| Total News Media segment revenues | $ | 571 | | | $ | 545 | | | $ | (3) | | | $ | 548 | | | (5) | % | | (4) | % |

| | | | | | | | | | | |

| News UK | | | | | | | | | | | |

| Circulation and subscription | $ | 138 | | | $ | 140 | | | $ | 1 | | | $ | 139 | | | 1 | % | | 1 | % |

| Advertising | 72 | | | 63 | | | — | | | $ | 63 | | | (13) | % | | (13) | % |

| Other | 29 | | | 25 | | | — | | | $ | 25 | | | (14) | % | | (14) | % |

| Total News UK revenues | $ | 239 | | | $ | 228 | | | $ | 1 | | | $ | 227 | | | (5) | % | | (5) | % |

| | | | | | | | | | | |

| News Corp Australia | | | | | | | | | | | |

| Circulation and subscription | $ | 109 | | | $ | 101 | | | $ | (1) | | | $ | 102 | | | (7) | % | | (6) | % |

| Advertising | 96 | | | 94 | | | (2) | | | $ | 96 | | | (2) | % | | — | % |

| Other | 44 | | | 41 | | | (1) | | | $ | 42 | | | (7) | % | | (5) | % |

| Total News Corp Australia revenues | $ | 249 | | | $ | 236 | | | $ | (4) | | | $ | 240 | | | (5) | % | | (4) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2023 | | Fiscal 2024 | | FX impact | | Fiscal 2024 constant currency | | % Change - reported | | % Change - constant currency |

| ($ in millions) | | Better/(Worse) |

| Consolidated results: | | | | | | | | | | | |

| Circulation and subscription | $ | 4,447 | | | $ | 4,509 | | | $ | (23) | | | $ | 4,532 | | | 1 | % | | 2 | % |

| Advertising | 1,687 | | | 1,607 | | | (2) | | | 1,609 | | | (5) | % | | (5) | % |

| Consumer | 1,899 | | | 2,000 | | | 16 | | | 1,984 | | | 5 | % | | 4 | % |

| Real estate | 1,189 | | | 1,284 | | | (22) | | | 1,306 | | | 8 | % | | 10 | % |

| Other | 657 | | | 685 | | | (6) | | | 691 | | | 4 | % | | 5 | % |

| Total revenues | $ | 9,879 | | | $ | 10,085 | | | $ | (37) | | | $ | 10,122 | | | 2 | % | | 2 | % |

| | | | | | | | | | | |

| Digital Real Estate Services: | | | | | | | | | | | |

| Circulation and subscription | $ | 12 | | | $ | 10 | | | $ | — | | | $ | 10 | | | (17) | % | | (17) | % |

| Advertising | 140 | | | 136 | | | (1) | | | $ | 137 | | | (3) | % | | (2) | % |

| Real estate | 1,189 | | | 1,284 | | | (22) | | | $ | 1,306 | | | 8 | % | | 10 | % |

| Other | 198 | | | 228 | | | (5) | | | $ | 233 | | | 15 | % | | 18 | % |

| Total Digital Real Estate Services segment revenues | $ | 1,539 | | | $ | 1,658 | | | $ | (28) | | | $ | 1,686 | | | 8 | % | | 10 | % |

| | | | | | | | | | | |

| REA Group revenues | $ | 937 | | | $ | 1,114 | | | $ | (28) | | | $ | 1,142 | | | 19 | % | | 22 | % |

| | | | | | | | | | | |

| Subscription Video Services: | | | | | | | | | | | |

| Circulation and subscription | $ | 1,671 | | | $ | 1,643 | | | $ | (45) | | | $ | 1,688 | | | (2) | % | | 1 | % |

| Advertising | 227 | | | 232 | | | (6) | | | $ | 238 | | | 2 | % | | 5 | % |

| Other | 44 | | | 42 | | | (1) | | | $ | 43 | | | (5) | % | | (2) | % |

| Total Subscription Video Services segment revenues | $ | 1,942 | | | $ | 1,917 | | | $ | (52) | | | $ | 1,969 | | | (1) | % | | 1 | % |

| | | | | | | | | | | |

| Dow Jones: | | | | | | | | | | | |

| Circulation and subscription | $ | 1,689 | | | $ | 1,771 | | | $ | 7 | | | $ | 1,764 | | | 5 | % | | 4 | % |

| Advertising | 413 | | | 405 | | | — | | | $ | 405 | | | (2) | % | | (2) | % |

| Other | 51 | | | 55 | | | — | | | $ | 55 | | | 8 | % | | 8 | % |

| Total Dow Jones segment revenues | $ | 2,153 | | | $ | 2,231 | | | $ | 7 | | | $ | 2,224 | | | 4 | % | | 3 | % |

| | | | | | | | | | | |

| Book Publishing: | | | | | | | | | | | |

| Consumer | 1,899 | | | 2,000 | | | 16 | | | $ | 1,984 | | | 5 | % | | 4 | % |

| Other | 80 | | | 93 | | | — | | | $ | 93 | | | 16 | % | | 16 | % |

| Total Book Publishing segment revenues | $ | 1,979 | | | $ | 2,093 | | | $ | 16 | | | $ | 2,077 | | | 6 | % | | 5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2023 | | Fiscal 2024 | | FX impact | | Fiscal 2024 constant currency | | % Change - reported | | % Change - constant currency |

| ($ in millions) | | Better/(Worse) |

| News Media: | | | | | | | | | | | |

| Circulation and subscription | $ | 1,075 | | | $ | 1,085 | | | $ | 15 | | | $ | 1,070 | | | 1 | % | | — | % |

| Advertising | 907 | | | 834 | | | 5 | | | $ | 829 | | | (8) | % | | (9) | % |

| Other | 284 | | | 267 | | | — | | | $ | 267 | | | (6) | % | | (6) | % |

| Total News Media segment revenues | $ | 2,266 | | | $ | 2,186 | | | $ | 20 | | | $ | 2,166 | | | (4) | % | | (4) | % |

| | | | | | | | | | | |

| News UK | | | | | | | | | | | |

| Circulation and subscription | $ | 536 | | | $ | 569 | | | $ | 25 | | | $ | 544 | | | 6 | % | | 1 | % |

| Advertising | 288 | | | 262 | | | 10 | | | $ | 252 | | | (9) | % | | (13) | % |

| Other | 109 | | | 98 | | | 4 | | | $ | 94 | | | (10) | % | | (14) | % |

| Total News UK revenues | $ | 933 | | | $ | 929 | | | $ | 39 | | | $ | 890 | | | — | % | | (5) | % |

| | | | | | | | | | | |

| News Corp Australia | | | | | | | | | | | |

| Circulation and subscription | $ | 440 | | | $ | 419 | | | $ | (11) | | | $ | 430 | | | (5) | % | | (2) | % |