Nautilus Biotechnology, Inc. (NASDAQ: NAUT; or “Nautilus”), a

company pioneering a single molecule proteome analysis platform,

today reported financial results for the second quarter ended

June 30, 2023.

“I’m excited by the solid progress we made in Q2 against some of

our foundational scientific and development goals and in the ways

we continue to prepare ourselves for our commercial launch,” said

Sujal Patel, CEO of Nautilus. “The type of transformational

innovation that Nautilus plans to bring to market next year

requires that a significant number of platform elements weave

together into a seamless whole: sample preparation, affinity

reagent probes, chips, flow cells, the instrument, multi-cycle

assay, and software. In Q2, we demonstrated the ability to bring

all of those elements together leading to routine and stable assays

with higher numbers of probes and cycles. I’m especially proud of

the team’s ability to execute well while maintaining exceptional

fiscal discipline, preserving our balance sheet, which we now

believe will fund operations through 2025 and into 2026.”

Second Quarter 2023 Financial

Results

Operating expenses were $19.0 million for the

second quarter of 2023, a 23% increase from $15.5 million for the

three months ended June 30, 2022. The increase in operating

expenses was driven primarily by an increase in headcount to

support ongoing development of our products.

Net loss was $15.8 million for the second

quarter of 2023, as compared to a net loss of $14.7 million for the

corresponding prior year period.

Cash, cash equivalents, and investments were

$286.7 million as of June 30, 2023.

Webcast and Conference Call

Information

Nautilus will host a conference call to discuss

the second quarter 2023 financial results, business developments

and outlook before market open on Wednesday, August 2, 2023 at

5:30 AM Pacific Time / 8:30 AM Eastern Time. Live audio of the

webcast will be available on the “Investors” section of the company

website at: www.nautilus.bio.

About Nautilus Biotechnology,

Inc.

With its corporate headquarters in Seattle,

Washington and its research and development headquarters in San

Carlos, California, Nautilus is a development stage life sciences

company working to create a platform technology for quantifying and

unlocking the complexity of the proteome. Nautilus’ mission is to

transform the field of proteomics by democratizing access to the

proteome and enabling fundamental advancements across human health

and medicine. To learn more about Nautilus, visit

www.nautilus.bio

Special Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of federal securities laws.

Forward-looking statements in this press release include, but are

not limited to, statements regarding Nautilus’ expectations

regarding the company’s business operations, financial performance

and results of operations; expectations with respect to any revenue

timing or projections, expectations with respect to the timing of

the launch of Nautilus’ product platform and full commercial

availability, the functionality and performance of Nautilus’

product platform, its potential impact on providing proteome

access, pharmaceutical development and drug discovery, expanding

research horizons, and enabling scientific explorations and

discovery, and the present and future capabilities and limitations

of emerging proteomics technologies. These statements are based on

numerous assumptions concerning the development of Nautilus’

products, target markets, and other current and emerging proteomics

technologies, and involve substantial risks, uncertainties and

other factors that may cause actual results to be materially

different from the information expressed or implied by these

forward-looking statements. Risks and uncertainties that could

materially affect the accuracy of Nautilus’ assumptions and its

ability to achieve the forward-looking statements set forth in this

press release include (without limitation) the following: Nautilus’

product platform is not yet commercially available and remains

subject to significant scientific and technical development, which

is inherently challenging and difficult to predict, particularly

with respect to highly novel and complex products such as those

being developed by Nautilus. Even if our development efforts are

successful, our product platform will require substantial

validation of its functionality and utility in life science

research. In the course of Nautilus’ scientific and technical

development and associated product validation and

commercialization, we may experience material delays as a result of

unanticipated events. We cannot provide any guarantee or assurance

with respect to the outcome of our development, collaboration, and

commercialization initiatives or with respect to their associated

timelines. For a more detailed description of additional risks and

uncertainties facing Nautilus and its development efforts,

investors should refer to the information under the caption “Risk

Factors” in our Annual Report on Form 10-K as well as in our

Quarterly Report on Form 10-Q to be filed for the quarter ended

June 30, 2023 and our other filings with the SEC. The

forward-looking statements in this press release are as of the date

of this press release. Except as otherwise required by applicable

law, Nautilus disclaims any duty to update any forward-looking

statements. You should, therefore, not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

Disclosure Information

Nautilus uses filings with the Securities and Exchange

Commission, its website (www.nautilus.bio), press releases, public

conference calls, public webcasts, and its social media accounts as

means of disclosing material non-public information and for

complying with Regulation FD. Therefore, Nautilus encourages

investors, the media, and others interested in Nautilus to review

the information it makes public in these locations, as such

information could be deemed to be material information.

Media Contactpress@nautilus.bio

Investor

Contactinvestorrelations@nautilus.bio

Nautilus Biotechnology, Inc. Condensed

Consolidated Balance SheetsAs of June 30,

2023 and December 31, 2022 (Unaudited)

| (in thousands, except share

and per share amounts) |

June 30,2023 |

|

December 31,2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash

equivalents |

$ |

72,139 |

|

|

$ |

114,523 |

|

|

Short-term

investments |

|

91,156 |

|

|

|

69,948 |

|

|

Prepaid expenses and other current

assets |

|

3,408 |

|

|

|

2,738 |

|

|

Total current

assets |

|

166,703 |

|

|

|

187,209 |

|

| Property and equipment,

net |

|

4,178 |

|

|

|

3,700 |

|

| Operating lease right-of-use

assets |

|

34,684 |

|

|

|

28,866 |

|

| Long-term investments

|

|

123,433 |

|

|

|

129,169 |

|

| Other long-term

assets |

|

1,769 |

|

|

|

1,108 |

|

|

Total assets |

$ |

330,767 |

|

|

$ |

350,052 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts

payable |

$ |

1,222 |

|

|

$ |

1,272 |

|

|

Accrued expenses and other

liabilities |

|

3,411 |

|

|

|

3,528 |

|

|

Current portion of operating lease

liability |

|

3,257 |

|

|

|

1,991 |

|

|

Total current

liabilities |

|

7,890 |

|

|

|

6,791 |

|

|

Operating lease liability, net of current

portion |

|

33,204 |

|

|

|

28,337 |

|

|

Total

liabilities |

|

41,094 |

|

|

|

35,128 |

|

| |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred

stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

12 |

|

|

|

12 |

|

|

Additional paid-in

capital |

|

461,387 |

|

|

|

455,330 |

|

|

Accumulated other comprehensive

loss |

|

(2,389 |

) |

|

|

(1,854 |

) |

|

Accumulated

deficit |

|

(169,337 |

) |

|

|

(138,564 |

) |

|

Total stockholders’

equity |

|

289,673 |

|

|

|

314,924 |

|

|

Total liabilities and stockholders’

equity |

$ |

330,767 |

|

|

$ |

350,052 |

|

|

|

|

|

|

|

|

|

|

Nautilus Biotechnology, Inc.Condensed

Consolidated Statements of OperationsThree and Six

Months Ended June 30, 2023 and 2022 (Unaudited)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

(in thousands, except share and per share amounts) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating expenses |

|

|

|

|

|

|

|

| Research and

development |

$ |

11,912 |

|

|

$ |

8,856 |

|

|

$ |

22,789 |

|

|

$ |

18,514 |

|

| General and

administrative |

|

7,104 |

|

|

|

6,616 |

|

|

|

14,287 |

|

|

|

12,980 |

|

|

Total operating

expenses |

|

19,016 |

|

|

|

15,472 |

|

|

|

37,076 |

|

|

|

31,494 |

|

| Other income (expense),

net |

|

3,208 |

|

|

|

783 |

|

|

|

6,303 |

|

|

|

1,042 |

|

| Net

loss |

$ |

(15,808 |

) |

|

$ |

(14,689 |

) |

|

$ |

(30,773 |

) |

|

$ |

(30,452 |

) |

| Net loss per share

attributable to common stockholders, basic and

diluted |

$ |

(0.13 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.24 |

) |

|

Weighted-average shares used in computing net loss per share

attributable to common stockholders, basic and

diluted |

|

124,603,181 |

|

|

|

124,494,036 |

|

|

|

124,601,762 |

|

|

|

124,456,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nautilus Biotechnology, Inc. Condensed

Consolidated Statements of Cash FlowsSix Months

Ended June 30, 2023 and 2022 (Unaudited)

| |

Six Months Ended June 30, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

| Cash flows from

operating activities |

|

|

|

| Net

loss |

$ |

(30,773 |

) |

|

$ |

(30,452 |

) |

| Adjustments to reconcile net

loss to net cash used in operating

activities |

|

|

|

|

Depreciation |

|

826 |

|

|

|

562 |

|

|

Stock-based

compensation |

|

5,958 |

|

|

|

4,677 |

|

|

Amortization (accretion) of premium (discount) on securities,

net |

|

(1,412 |

) |

|

|

(147 |

) |

|

Amortization of operating lease right-of-use assets |

|

1,806 |

|

|

|

1,073 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Prepaid expenses and other

assets |

|

(787 |

) |

|

|

(503 |

) |

|

Accounts

payable |

|

(199 |

) |

|

|

(643 |

) |

|

Accrued expenses and other

liabilities |

|

(117 |

) |

|

|

(11 |

) |

|

Operating lease

liabilities |

|

(1,375 |

) |

|

|

(420 |

) |

|

Net cash used in operating

activities |

|

(26,073 |

) |

|

|

(25,864 |

) |

| Cash flows from

investing activities |

|

|

|

| Proceeds from maturities of

securities |

|

32,249 |

|

|

|

105,575 |

|

| Purchases of securities

|

|

(46,844 |

) |

|

|

(54,185 |

) |

| Purchases of property and

equipment |

|

(1,155 |

) |

|

|

(1,132 |

) |

|

Net cash (used in) provided by investing

activities |

|

(15,750 |

) |

|

|

50,258 |

|

| Cash flows from

financing activities |

|

|

|

| Proceeds from exercise of

stock options |

|

7 |

|

|

|

188 |

|

| Proceeds from issuance of

common stock under employee stock purchase

plan |

|

92 |

|

|

|

153 |

|

|

Net cash provided by financing

activities |

|

99 |

|

|

|

341 |

|

|

Net (decrease) increase in cash, cash equivalents and restricted

cash |

|

(41,724 |

) |

|

|

24,735 |

|

| |

|

|

|

| Cash, cash equivalents and

restricted cash at beginning of

period |

|

115,477 |

|

|

|

186,461 |

|

| Cash, cash equivalents and

restricted cash at end of

period |

$ |

73,753 |

|

|

$ |

211,196 |

|

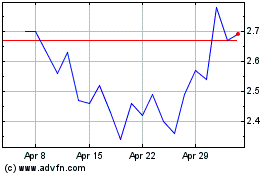

Nautilus Biotechnology (NASDAQ:NAUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

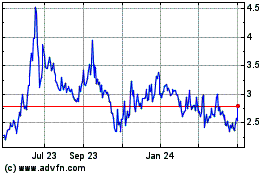

Nautilus Biotechnology (NASDAQ:NAUT)

Historical Stock Chart

From Jul 2023 to Jul 2024