false

0001499961

0001499961

2023-11-02

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

| Date

of Report (Date of earliest event reported): |

November

2, 2023 |

|

MULLEN

AUTOMOTIVE INC.

_____________________________________________________________

(Exact name of registrant as specified in its

charter)

| Delaware |

001-34887 |

86-3289406 |

(State

or other jurisdiction of

incorporation) |

(Commission

File Number) |

(IRS

Employer Identification No.) |

1405

Pioneer Street, Brea, California

92821

(Address, including

zip code, of principal executive offices)

| Registrant’s

telephone number, including area code |

(714)

613-1900 |

|

| |

|

|

(Former name or former

address, if changed since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act: |

| |

| Title

of each class |

Trading

symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

MULN |

The

Nasdaq Stock Market, LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On November 2, 2023,

Mullen Automotive Inc. (the “Company”) announced the availability of an interview video on its YouTube Channel in which David

Michery, the Company’s Chief Executive Officer, discussed among other things, the Company’s Nasdaq compliance status, a recent

prospectus filing, the stock buyback program, the production status of Mullen One and Mullen Three vans, the potential collaboration between

Mullen and other car companies, and answered other questions addressed to him. A copy of the interview transcript is attached hereto as

Exhibit 99.1 and is incorporated herein by reference.

The information furnished with this Item 7.01

and Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act, or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or

the Exchange Act, regardless of any general incorporation language in such filing.

Forward-Looking Statements

This Current

Report on Form 8-K contains forward-looking statements that involve substantial risks and uncertainties. The words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “target,” “potential,” “will,” “would,” “could,” “should,”

“continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. These statements involve known and unknown risks, uncertainties and other important factors

that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Important factors that could cause actual results to differ materially from the

forward-looking statements we make in this Current Report include risks and uncertainties, including, but are not limited to, those listed

under “Risk Factors” in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year September 30,

2022, the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These forward-looking statements are only predictions

and we may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, so you should not place

undue reliance on our forward-looking statements. We have based these forward-looking statements largely on our current expectations and

projections about future events and trends that we believe may affect our business, financial condition and operating results. If one

or more of these or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual results

may vary materially from what we anticipate. We undertake no obligation to publicly update or review any forward-looking statement, whether

as a result of new information, future developments or otherwise.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits

| Exhibit No. |

Description |

| 99.1 |

Interview Transcript |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MULLEN AUTOMOTIVE INC. |

| |

|

|

| Date: November 2, 2023 |

By: |

/s/ David Michery |

| |

|

David Michery |

| |

|

Chief Executive Officer |

Exhibit 99.1

Question 1: Can you Provide an update on the recent Nasdaq Extension

that was granted?

Nasdaq, as part of their panel request, was that Mullen get to a dollar,

which is the minimum bid requirement to maintain your listing qualification, which means that Nasdaq gives you approximately a specific

amount of time to regain that compliance, which includes trading at a dollar for 20 trading days and/or above a dollar for 20 trading

days and if you can do that prior to the expiration of the extension date, then you continue on Nasdaq as a current company, meaning with

no deficiencies. So from our perspective, we were granted the extension, which we're very grateful for and again, Nasdaq doesn't really

care how you get to a dollar and trade 20 consecutive days at a dollar as long as you get there.

Now, obviously, we committed to doing a reverse if we can't get to

that point, because other than that, there's really no way to get above a dollar. So we have a timeframe that they've given us that allows

us to regain compliance. And how we do that is going to be based on our efforts and how we do that to regain compliance and if we get

to that point where you have to trade 20 trading days above a buck and you're not above a buck, then you have no choice but to execute

on the commitment we made to Nasdaq, which was that if we could not get to a dollar prior to the drop dead date, and then we would affect

a reverse and an amount that would allow us to regain compliance and trade for those 20 trading days.

So the ball is in our court. We have to perform. We have to get out

there. We have to deliver. We have to execute and hopefully the market rewards us with getting us above a buck.

Question 2: With the recent prospectus that was filed, can you please

explain what that is for?

So there's been a lot of controversy and a lot of questions surrounding

that filing of that pro sup. People, retail shareholders, out there for whatever reason, believe that that's a new financing and it's

not. It's clearly stated that it's a supplement to the original transaction that was executed in February of 2023 and these are the

supplements that allow us to issue additional or register additional shares to cover the obligation pursuant to that 2023 February financing.

So these are the remaining warrants that we talked about when we announced publicly a while back that there were no longer any additional

options or rights to the series D holders and that there were only some warrants remaining and so these are now the warrants that they're

executing on, which we're obligated to file a registration statement for. So this is the what they call pro sup to the registration statement

that was filed in February of 2023 and it is not and I reiterate, is not a new financing.

Question 3: Regarding the buyback, has Mullen bought back any shares

since August and do you still plan on completing the remaining buyback?

Mullen has purchased approximately 5.7 million common shares of its

stock and has retired them back into inventory. Mullen currently hasn't purchased any additional shares because it's currently in a blackout

period which began on the last day of the fiscal year end, which is September 30th, and will continue until we file our 10-K. One

day after we file our 10-K on December 29th, we can then resume purchasing shares. What we will do is we will extend the buyback

period for an additional six months to give us additional leverage to utilize our dry powder to repurchase our shares and retire them.

That's what we intend on doing.

Question 4: Can you provide an production update with regards how

many M1 and M3’s have been built and do you still believe the 2023 delivery targets are still accurate?

Yes. So in the end, let's just say in under 12 months, right. Mullen

has successfully completed two commercial launches for the Mullen One and the Mullen Three. The Mullen Three began production with the

first units off the line in August and the Mullen One production units will roll off the line this month as of today.

In response to customer demands, the fourth quarter sale forecast is

450 units for the Mullen Three and 300 units for the Mullen One. With the start of production, the focus is now on vehicle sales and infrastructure

preparation to support units as they move from the factory to the end user. So to be clear, Mullen has put itself in a position to not

only deliver on the commitments that it's made in its prior PR, but is building on opportunities to expand on those numbers as we move

forward and as we adjust to the current market conditions as well as customer demands.

Question 5: Is there anything in the works between Mullen and GM?

That's a question that I think is in the public forum right now. And

what I can address is that Mullen has a partnership with Wuling, who provides us our SKD, and it's public knowledge that GM is in a relationship

with SAIC and WULING and so you have SAIC, GM and WULING, and their partnership then translates from WULING, obviously to Mullen and so,

no, Mullen is not in any direct relationship with General Motors, but Mullen does have a partnership with Wuling, who is a call it a partner

of GM and SAIC. Now are the vehicles of a high quality that would support U.S. sale of those vehicles. Obviously, we're seeing that now

because we're talking about a fully certified and homologated vehicle. Our Class Three was homologated previously for sale in the

U.S. and we obviously announced and multiple features that we've obtained not only EPA certificate of conformity, but we've also received

all of the crash testing requirements that are put forth as it relates to vehicles that are sold in the United States. So again, they

are quality vehicles. Are they of the highest standards? Yes, they are. Do they meet U.S. requirements? Yes. Is there an opportunity to

explore potential opportunities? There's always many opportunities that present themselves. Now, you know, again, you can come up with

your own conclusions, but answer right now is no. There is no direct correlation or relationship between Mullen and GM other than sharing

the Wuling relationship.

Question 6: Can you provide updates on Bollinger?

Well, I can give you information that Bollinger has already publicly

disclosed, which are very positive. They're in the pilot program now. They got vehicles that are on the road and they're very you know,

they're very optimistic that they're going to be able to capture a good piece of the market share in Class Four. They're going to

start with their vehicles hitting the streets come July of 2024. We anticipate or expect them to be a good piece of the market as

it relates to Class Four and when you take our Class One and Class Three, you consolidate with their class four think we're

pretty big force to be reckoned with.

Question 7: Can you provide an update on international markets and

any possibly government contracts?

From our presence currently in Ireland and our commitment to the EU,

to the European Union, we've now expanded our presence of the Mullen product line and respond to international demand on an immediate

basis. MullenGo has been shipped to European distribution partners in Ireland and in France. Mullen is now in talks with dealer groups

in Central America, as well as partners in Mexico and the Caribbean. Now this is for the MullenGo product and we're excited that we can

expand that outside of the European Union and into South America. We you know, we think that that would give us opportunity to capture,

obviously, a tremendous amount of sales for that for that specific vehicle.

As far as the government sales update that you're asking, Mullen Automotive,

in conjunction with our RRDS – Rapid Response Defense Systems – has met the next milestone in the process to obtain a government

contract, RRDS will submit the joint request to the Customs and Border Protection Regulatory Board seeking their approval of the Mullen

One van to having met the requirements for substantial transformation. Timing for this submission is expected to take place no later than

November 10th, with the CBP’s response back to RRDS and Mullen is 45 days of receipt of the submission. We thought that was

really important. Mullen Automotive and RRDS are moving ahead with plans to display the Mullen One van and participate in an electric

vehicle ride event at the upcoming Fed Fleet Conference in Washington, D.C. during the week of January 22nd, 2024.

Question 8: Can you provide a recap of some of the achieves and

milestones from 2023 so far?

So one of the things for us going into the New Year is to look back

at what we did right and what we didn't do right and what I feel really confident in is that in 2023, Mullen has completed over 20 vehicle

pilots across seven industries. Those industries include universities, airlines, utilities, leasing companies, last mile delivery, municipalities,

resulting in five customers ordering over 30 vehicles alone. These pilots have been focused on the Campus Van models. Beginning in the

fourth quarter of this year, Mullen will host 45 additional pilots, ten expected by year end with national and regional fleets –

evidence of the interest and demand for small and commercial products – these pilots will focus on the mall and one in the mall

and three products. So with that, we feel that we are on the cusp of being able to transition from pilots to P.O.s to deliveries and to

the collection of receivables which ultimately result in booking revenues. Those are going to be key factors for us as we go into the

new year.

We're going to be going into the new Year with revenue and revenue

and revenue and revenue. That's the focus. Hopefully that revenue will be rewarded with the shareholders holding our stock and becoming

longs versus shorting our stock. Everybody has a right to short it. It's okay to do that when you bet against somebody. And I like that

because it gives me motivation when you bet against me, you make me work even harder.

Question 9: What would you like shareholders to be aware of?

I want them to be rest assured that I am working as hard as I possibly

can to create shareholder value for them to get out there and do the right thing and to create as much positive momentum. Again, we're

in a very tough market. Look, things at some point adjust when you have fundamentals and you post revenue and you do things that the other

guys can't do, you eventually get rewarded right?

And I believe that we're on the right track to be rewarded. So with

that, I believe that Mullen has persevered and will continue to persevere and will grow and will dominate in the commercial sector.

Question 10: Do you still want to turn shorts long and longs rich?

100%. I'm working diligently. You know, again, I look at this

as a football game, right? I got plenty of time on the clock. I've just started. This is you know, we're in the first quarter of a four

quarter game, you know, So things may not look great right now, not only for Mullen, but for the entire, you know, world and more so for

the EV space that we're all in. Again, things go up, things go down.

They eventually adjust. And when they do, I think that if you

execute, you deliver. It's all about fundamentals, right? Everybody talked about, you know, revenue, revenue, revenue. So, okay, let's

get into revenue. Everybody talked about, hey, you got to be in a space where you have an opportunity to be competitive. Well, we're the

only guy in Class One and basically, for all intents and purposes, the only guy with an all electric Class Three that's out

there today, right now with a vehicle, everybody else is light years behind us.

So, you know, do I think that at some point will the market catch up

to us? And do I think at some point, do we become a, you know, an organization that can transcend a certain segment? I believe, you know,

the effort is there, the willingness, the determination, the persistence to persevere and to succeed and to excel are all there.

So I firmly believe that our actions and delivering on our promises

and creating revenue and the fundamentals behind that will result in us being rewarded by not only the retail community but the institutional

investors out there that will recognize that that we've survived. So many different guys have gone out of business and filed for bankruptcy.

We're still here and we're in a space where, you know, we can call the shots.

We don't have any competition in Class One. So we're going to

get out there. We're just like I said, we're in the first quarter of a four quarter game. So, you know, I don't call it over until

it's over and it's and it's far from over. So we have a lot of bullets to shell. You know, we have a lot of silver bullets that we can

still shoot and, you know, for us, I view this is just the beginning of a great story that will transpire as time progresses and

as the economy gets better and as people realize that we're here to stay, we're not going anywhere.

I'd like to turn everybody into a supporter of Mullen, not only a supporter

of Mullen, but a supporter of being green and going, you know, taking the extra mile to join, you know, jointly push the initiative forward

that we the reliance on fossil fuels and the dependency on those need to end. So is that a challenge? Yes. Is it achievable 100%?

What we turn people that are against us and to supporters, I believe

we will. And how we're going to do that is with delivering on fundamentals.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

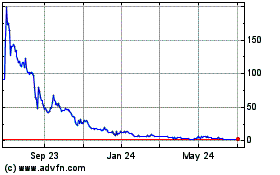

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Oct 2024 to Nov 2024

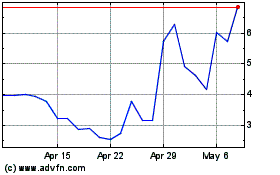

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Nov 2023 to Nov 2024