Cooperative Bankshares, Inc. Reports 26% Increase in First Quarter Earnings

May 20 2009 - 4:36PM

Business Wire

Cooperative Bankshares, Inc. (NASDAQ: COOP) (the �Company�), the

parent company of Cooperative Bank (the �Bank�), reported net

income for the quarter ended March 31, 2009 of $949,000, or $0.14

per diluted share, an increase of 26.2% over the same quarter last

year. Net income for the quarter ended March 31, 2008 was $752,000,

or $0.11 per diluted share. The increase in net income during the

first quarter of 2009 compared to the prior year period was mainly

due to a tax benefit recognized as a result of a decrease to the

valuation allowance on the Company�s net deferred tax asset and a

reduction of compensation and fringe benefits, partially offset by

a reduction in net interest income and an increase in the provision

for loan losses. The Company reported a tax benefit of $1.6 million

on an operating loss of $642,000 for the quarter ended March 31,

2009 compared to a tax expense of $359,000 on an operating profit

of $1.1 million for the quarter ended March 31, 2008. Net deferred

tax asset before any valuation allowance decreased from $13.8

million at December 31, 2008 to $12.8 million at March 31, 2009,

primarily as a result of a decrease to the allowance for loan

losses during this period due to net charge offs exceeding the

provision for loan losses. The Company recorded a tax benefit of

$1.0 million due to a reduction of the valuation allowance on the

decreased balance of the net deferred tax asset. The Company was

also able to record a tax benefit on its operating loss for the

first quarter of 2009. Compensation and fringe benefits decreased

to $1.7 million during the first quarter of 2009 compared to $3.3

million for the same period a year earlier. Most of this decrease

is related to the $1.1 million reversal of the EITF 06-4 accrual as

a result of the Company�s decision, with agreement from the

directors and applicable executive officers, to surrender select

bank-owned life insurance policies during the first quarter of 2009

as disclosed in the Company�s Annual Report on Form 10-K for the

year ended December 31, 2008. The remainder of the decrease in

compensation and fringe benefits is related to salary and benefit

reductions implemented in the fourth quarter of 2008 or in the

first quarter of 2009. Net interest income for the quarter ended

March 31, 2009 was $4.8 million compared to $6.3 million for the

quarter ended March 31, 2008. The decrease in net interest income

for the three months ended March 31, 2009 from the prior year

period was primarily caused by a reduction in the interest rate

spread of 62 basis points. This decrease is primarily attributable

to action taken by the Federal Reserve to reduce interest rates by

400 basis points during 2008, which had a corresponding effect on

market rates of interest, and an increase in non-accrual loans at

March 31, 2009, which accounted for a 27 basis point decrease in

the interest rate spread during the quarter ended March 31, 2009.

As a result of these rate reductions, the Bank�s loan portfolio has

repriced faster than deposits, causing a decline in net interest

income. The provision for loan losses increased to $2.0 million for

the quarter ended March 31, 2009 compared to $855,000 for the

quarter ended March 31, 2008. The increase in the provision for

loan losses during the first quarter of 2009 was primarily the

result of an increase in valuation allowances for the recorded

investment in nonperforming loans compounded by the decline of real

estate collateral values as a result of the deterioration of the

economy. At March 31, 2009 and 2008, the recorded investment in

nonperforming loans was $84.0 million and $8.8 million,

respectively, with corresponding valuation allowances of $8.8

million and $706,000, respectively. The provision for loan losses

was also affected by a decrease in the allowance allocated to the

remainder of the portfolio, primarily due to a decrease in loans

during the quarter ended March 31, 2009. �The decline in real

estate values and the economic environment continues to be a

challenge, but we are beginning to see the benefits in several of

the changes that we have implemented, including cost cutting

measures and working with our troubled assets,� said Todd L.

Sammons, the Company�s Chief Financial Officer and Interim

President and Chief Executive Officer.

Total assets increased to $967.3 million at March 31, 2009

compared to $951.0 million at December 31, 2008. Asset growth was

primarily the result of an increase in cash and cash equivalents

from the payoff of loans held for investment, the sales of loans

held for sale, the surrender of select bank-owned life insurance

policies, and an increase in deposits. Cash and cash equivalents

increased to $63.7 million at March 31, 2009 compared to $7.9

million at December 31, 2008, representing an improvement in the

Bank�s liquidity position. Loans decreased to $842.9 million at

March 31, 2009 compared to $871.2 million at December 31, 2008. For

the three-month period ended March 31, 2009, the bulk of the

decrease in the loan portfolio occurred in one-to-four family

loans, which decreased $17.1 million (3.4%), and construction and

land development loans, which decreased $5.4 million (3.5%). The

Bank halted or slowed the origination of loans held for investment

beginning in the last quarter of 2008 to comply with the previously

announced regulatory directives and to improve its capital ratios.

Deposits at March 31, 2009 increased $72.3 million for the quarter,

partially offset by a reduction in borrowings of $56.1 million. The

increase in deposits is primarily the result of growth in internet

deposits which grew by $97.6 million during the first quarter of

2009. Due to the current economic environment, the Company�s

nonperforming assets, which consist of loans ninety days or more

delinquent, non-accrual loans, troubled-debt restructurings,

nonperforming investments, and foreclosed real estate owned,

increased to $99.2 million at March 31, 2009 compared to $91.6

million at December 31, 2008. All foreclosed real estate owned has

been appraised and is recorded at the estimated fair value of the

property less estimated costs to sell. At March 31, 2009,

stockholders� equity was $20.5 million, or $3.11 per share, and

represented 2.12% of assets, compared to $19.6 million, or $2.97

per share, representing 2.06% of assets at December 31, 2008. In

order to achieve compliance with its regulatory directives, among

other things, the Company and the Bank must hire a new chief

executive officer and must either raise capital, sell assets, or

both. The Company is actively engaged in a national search for a

new chief executive officer, has interviewed numerous candidates

and, subject to the approval of its regulators, intends to appoint

a new chief executive officer as soon as possible. Additionally, as

previously reported, the Company is undertaking certain actions

designed to improve its capital position and has engaged financial

advisors to assist with this effort and to evaluate the Company�s

strategic options, including a possible sale or merger of the

Company and/or possible sale of certain of the Bank�s assets. As of

the date of this press release, the Company believes that it needs

to raise a minimum of $30.0 million of additional capital, assuming

no�change in�risk-weighted assets or its capital position, in order

to be capitalized at the levels required by the regulatory

directives. To date, the Company has neither raised any additional

capital nor agreed to a sale of the Company, the Bank, or any Bank

assets (other than Bank loans) and no assurances can be made as to

when or whether such capital will be raised or whether the Company

will be successful in negotiating a sale of the Company or any of

its assets.

Chartered in 1898, Cooperative Bank provides a full range of

financial services through twenty-two offices in North Carolina and

three offices in South Carolina. The Bank�s subsidiary, Lumina

Mortgage, Inc., is a mortgage banking firm, originating and selling

residential mortgage loans through three offices in North

Carolina.

Statements in this news release that are not historical facts

are forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements,

which contain words such as �expects,� �intends,� �believes� or

words of similar import, are subject to numerous risks and

uncertainties disclosed from time to time in documents the Company

files with the SEC, which could cause actual results to differ

materially from the results currently anticipated. Undue reliance

should not be placed on such forward-looking statements.

The Company has filed a Form 8-K with the SEC containing

additional financial information regarding the three-month period

ended March 31, 2009.

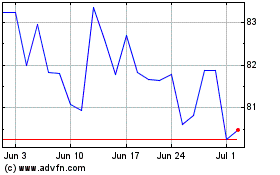

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jun 2024 to Jul 2024

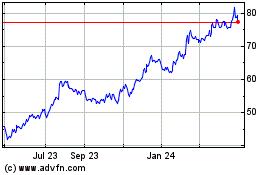

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jul 2023 to Jul 2024