Today, FCM MM HOLDINGS, LLC (“FCM”) notifies shareholders that it

has formally filed a complaint (the “Complaint”) with the

Securities and Exchange Commission (the “SEC”) and will file a

referral to the Department of Justice regarding allegations against

Mind Medicine (MindMed) Inc. (NASDAQ:MNMD) (“MindMed”, the

“Company”). The Complaint focuses on the following allegations:

self-dealing, lack of material disclosure, false statements/public

statement fraud, and if the allegations are true, criminal

activities, by CEO Robert Barrow, under Sarbanes-Oxley.

The Complaint presents and analyses the

allegations in the lawsuit Freeman v. Burbank et al. (the

“Lawsuit”) that MindMed’s intellectual property was mishandled due

to a one-sided deal (the “Deal”) negotiated by Mr. Stephen Hurst,

then MindMed’s CEO, and Mr. Carey Turnbull, CEO of Ceruvia

Lifesciences LLC (“Ceruvia”). Mr. Hurst founded Ceruvia’s

predecessor, purportedly in secret. If the Deal occurred, Ceruvia

has undisclosed freedom to operate on MindMed’s IP surrounding LSD

and its derivatives, and MindMed is not able to research or compete

on BOL-148. The Complaint also lists Ceruvia executives who

concurrently worked for MindMed during Messrs. Hurst and Barrow’s

tenure and the implications for MindMed’s IP and trade secrets.

Additionally, the Complaint scrutinizes whether

MindMed adequately disclosed to investors the significant risk of

MM-110’s failure in gaining full Food and Drug Administration

(“FDA”) product approval. After MindMed terminated the MM-110

program in August of 2022, FCM conducted a rigorous review of

publicly available data of MM-110, a core drug of MindMed, from

primarily both MM-110’s patent application and protocol of the

Phase I trial (the “Study”), which were available prior to the

initiation the Study. The Complaint addresses FCM’s conclusion that

it is highly unlikely the FDA would have allowed the Study to be

performed in the US as written – i.e. patients would be treated at

a dose thirty-five times higher than the comparable dose which

caused death in mice. Ultimately, MindMed instead performed the

Study in Australia, and in May 2022, reported that the Study’s

topline results (the “Results”) were favorable regarding safety and

tolerability and builds on “encouraging” results from pre-clinical

studies. The Results were then presented to the FDA, and MindMed

later disclosed that the FDA now requires MindMed to complete a

myriad of pre-clinical safety studies (the “Pre-Clinical Studies”)

prior to instituting additional clinical trials in the US. Mr.

Barrow stated that the Pre-Clinical Studies could take years, and

MindMed subsequently shuttered the program.

“The FDA is the regulatory gold standard to

ensure patient safety in clinical trials. Although it is a common

practice to ‘offshore’ clinical trials, it is not acceptable to

skirt known FDA required pre-clinical safety studies by going to

another country,” said FCM’s Chad Boulanger.

The Complaint also examines the departures of

several high-profile executives of the Company right before they

were required to sign off on MindMed’s SEC filings. Similar to

Chief Legal Officer Cynthia Hu who left one month prior to being

required to sign MindMed’s stock offering, Chief Financial Officer

David Guebert resigned from MindMed the business day before he was

obligated to make his first Sarbanes-Oxley certification of

MindMed’s financials. The Complaint further notes that MindMed’s

auditor Ernst & Young was fired shortly after reporting that

MindMed had a material weakness in its internal controls under

Sarbanes-Oxley.

FCM will continue to provide extensive

information to the SEC and a litany of supporting documents to

assist the SEC in their investigation. FCM thanks the countless

sources who have assisted in its investigation and encourages any

person with information to come forward either to FCM or directly

to the SEC.

FCM also announces that it has sent MindMed’s

Board of Directors (the “Board”) a letter (the “Letter”) that

demands MindMed immediately take action to investigate the origins

of the Medihuasca entities. Medihuasca is a recently discovered

rival company whose website, which went public in May 2021, uses

proprietary MindMed IP and lists Nico Forte, MindMed’s Chief of

Staff and associate of Mr. Hurst, as its CEO. The Letter demands an

investigation to determine if any MindMed employee was involved, if

any nefarious purpose existed, to what extent has MindMed’s IP been

compromised, and what measures need to be implemented to ensure

that MindMed adequately polices its IP going forward. FCM

calls for these investigations to be done by a third-party

independent law firm with a public report.

Moreover, the Letter calls for the immediate

termination of:

- CEO Robert

Barrow who has been employed by MindMed for twenty-eight months

during which time the mishandling of MindMed IP and alleged

transgressions occurred;

- Chief of Staff

Nico Forte who, in addition to being listed as CEO of Medihuasca,

serves on the Board of a competitor company (Savant HWP, Inc. which

founded Ceruvia); and

- Board Member

Brigid Makes, a decades long associate of Mr. Hurst, who allegedly

took compensation from Savant HWP, Inc. while the alleged

activities occurred.

“Let me be clear; we continue to see significant

value in MindMed; however, executives and complicit board members

must go immediately, so we can unleash the potential of MindMed,”

said FCM’s Chief Executive Manager Jake Freeman.

A copy of the Letter is available at:

https://mindmed.zone/board-letter-11-3-2022

To stay informed as to the latest developments,

FCM encourages MindMed stakeholders to sign up for its newsletter

at: https://mindmed.zone/signup

About FCM

FCM is managed by Mr. Jake Freeman and

represents an investment of 4.9% of MindMed's shares outstanding.

FCM seeks to implement its Value Enhancement Plan detailed in its

letter to Ms. Carol Vallone dated August 11, 2022. The Value

Enhancement Plan seeks to refocus MindMed on its core drugs,

drastically cut spending, and significantly decrease shareholder

dilution. Despite the controversy, FCM has not reduced its stake in

MindMed.

FCM additionally represents other early

investors in MindMed, who all have a strong interest in seeing the

long-term success of MindMed.

For additional disclosures relating to public

broadcast solicitations please see mindmed.zone/disclosure or

read the disclosure herein.

Media ContactJake FreemanChief Executive

ManagerFCM MM HOLDINGS, LLC30 N Gould St. Ste RSheridan, WY

82801Phone: 908-308-2381Email: jake@mindmed.zone

Disclosures

The information contained in this press release

does not and is not meant to constitute a solicitation of a proxy

within the meaning of applicable securities laws. FCM has not

requisitioned a meeting of shareholders to reconsider its

proposals, there is currently no record or meeting date set for a

shareholders’ meeting and shareholders are not being asked at this

time to execute a proxy in favour of FCM. In connection with any

future shareholders’ meeting, FCM may file a dissident information

circular in due course in compliance with applicable securities

laws. Notwithstanding the foregoing, FCM is voluntarily providing

the disclosure required under section 9.2(4) of National Instrument

51-102 – Continuous Disclosure Obligations applicable to public

broadcast solicitations. The information contained herein, and any

solicitation made by FCM in advance of a future shareholders’

meeting is, or will be, as applicable, made by FCM and not by or on

behalf of the management of the Company. All costs incurred for any

solicitation will be borne by FCM, provided that, subject to

applicable law, FCM may in certain circumstances seek reimbursement

from the Company of FCM’s out-of-pocket expenses, including proxy

solicitation expenses and legal fees, incurred in connection with a

new meeting. FCM is not soliciting proxies in connection with a

shareholders’ meeting at this time. FCM may engage the services of

one or more agents and authorize other persons to assist in

soliciting proxies on behalf of FCM. Any solicitation of proxies by

or on behalf of FCM, including by any agent, will be done primarily

by mail, supplemented by telephone, internet, electronic

communication or other means of contact, pursuant to a dissident

information circular or by way of public broadcast, including

through press releases, speeches or publications and by any other

manner permitted under corporate and securities laws. Any such

proxies may be revoked by instrument in writing executed by a

shareholder or by his or her attorney authorized in writing or, if

the shareholder is a body corporate, by an officer or attorney

thereof duly authorized or by any other manner permitted by law.

FCM will not have any material interest, direct or indirect, by way

of beneficial ownership of securities or otherwise, in any matter

to be acted upon at any future requisitioned shareholders’ meeting.

Scott Freeman is a resident of the United States Virgin Islands and

is a citizen of the United States of America. Scott Freeman’s

principal occupation is a consultant and works on behalf of Scott

Freeman Consultant LLC, a limited liability company incorporated in

the State of Nevada. Scott Freeman directly owns 11,643,949 voting

shares of MindMed. Scott Freeman additionally holds an economic

interest in several million shares of MindMed held by Savant HWP

Holdings, LLC and its affiliate entities. Scott Freeman has not

been, within 10 years, a director, chief executive officer, or

chief financial officer of any company, that meets the following

conditions: (1) was subject to an order imposed by a securities

regulator, such as a management cease trade order imposed by

Canadian securities regulators, that was issued while the proposed

director was acting in the capacity as director, chief executive

officer or chief financial officer; or (2) was subject to an order

that was issued after the proposed director ceased to be a

director, chief executive officer or chief financial officer and

which resulted from an event that occurred while that person was

acting in the capacity as director, chief executive officer or

chief financial officer. Scott Freeman has not been, within 10

years, a director or executive officer of any company (including

the company in respect of which the information circular is being

prepared) that, while that person was acting in that capacity, or

within a year of that person ceasing to act in that capacity,

became bankrupt, made a proposal under any legislation relating to

bankruptcy or insolvency or was subject to or instituted any

proceedings, arrangement or compromise with creditors or had a

receiver, receiver manager or trustee appointed to hold its assets,

state the fact. Scott Freeman has not, within 10 years, become

bankrupt, made a proposal under any legislation relating to

bankruptcy or insolvency, or become subject to or instituted any

proceedings, arrangement or compromise with creditors, or had a

receiver, receiver manager or trustee appointed to hold the assets

of the proposed director, state the fact. The registered address of

MindMed is located at 1055 West Hastings Street, Suite 1700,

Vancouver, British Columbia, Canada, V6E 2E9. A copy of this press

release may be obtained on the Company’s SEDAR profile at

www.sedar.com

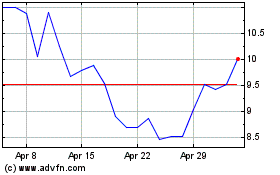

Mind Medicine MindMed (NASDAQ:MNMD)

Historical Stock Chart

From Jun 2024 to Jul 2024

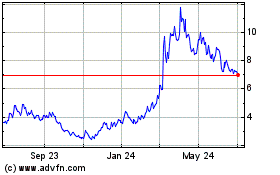

Mind Medicine MindMed (NASDAQ:MNMD)

Historical Stock Chart

From Jul 2023 to Jul 2024