false

0000066004

0000066004

2024-01-23

2024-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report:

January 23, 2024

MIDDLESEX WATER COMPANY

(Exact name of registrant as specified

in its charter)

| New Jersey |

0-422 |

22-1114430 |

| (State or other jurisdiction of |

(Commission |

(I.R.S. Employer |

| incorporation or organization) |

File Number) |

Identification No.) |

485C Route 1 South, Suite 400, Iselin,

New Jersey 08830

(Address of Principal Executive Offices)

(Zip Code)

732-634-1500

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

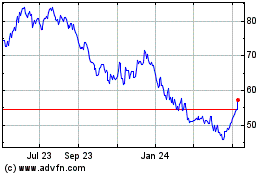

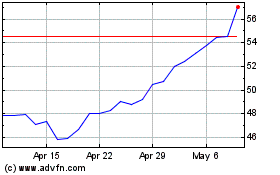

| Common

Stock, No Par Value |

MSEX |

The NASDAQ Stock Market, LLC |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item. 5.02. |

Departure of Director or Principal Officers; Election of Directors; Appointment of Certain Officers. |

Announcement of the appointment of Nadine Duchemin-Leslie as

President & Chief Executive Officer of Middlesex Water Company and her appointment to the Board as a Director, effective March 1,

2024, as per the attached release.

Press Release

Middlesex Water Company has announced

the appointment of Nadine Leslie as President & Chief Executive Officer and a Director of Middlesex Water Company, effective March

1, 2024. A copy of the Company’s press release dated January 23, 2024, is filed herewith as Exhibit 99.1 and is hereby incorporated

herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf of the undersigned hereunto duly authorized.

| |

MIDDLESEX WATER COMPANY |

| |

(Registrant) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

/s/A. Bruce O’Connor |

| |

A. Bruce O’Connor |

| |

Sr. Vice President, Treasurer and |

| |

Chief Financial Officer |

Dated: January 23, 2024

Exhibit 99.1

MIDDLESEX WATER COMPANY NAMES NEW PRESIDENT & CEO

Iselin, NJ (January 23, 2024) -- Middlesex Water Company

(NASDAQ: MSEX) has named Nadine Leslie as its new President & CEO effective March 1, 2024. Ms. Leslie joins Middlesex following a

comprehensive search for a successor to outgoing President & CEO Dennis W. Doll, who will retire from the Company February 29, 2024.

Ms. Leslie will also be appointed to the Board of Directors effective March 1, 2024.

Ms. Leslie is an accomplished leader with domestic

and international experience in the Water Industry. She previously served as Chief Executive Officer of SUEZ North America from 2019 to

2022. In this capacity, she was responsible for overseeing one of North America’s leading environmental companies, with revenues

over $1.1 billion, providing water and recycling and recovery services to 6.6 million people in the United States and Canada. The scope

of her responsibilities included 15 regulated water utilities, 65 municipal contracts through innovative public-private partnerships and

the long-term asset management contracts for water storage facilities, serving more than 4,000 municipal and industrial clients.

Prior to her appointment as CEO of SUEZ North America,

Ms. Leslie served as Executive Vice President - Health & Safety for the Paris-based SUEZ Group. In this capacity, she was responsible

for directing and providing Health & Safety oversight to all business units of the Group. She also led the development and implementation

of behavior-based safety practices, audited Health and Safety procedure implementation and compliance consistent with corporate and regulatory

requirements and monitored the effectiveness of safety control measures used throughout SUEZ business units around the world.

Ms. Leslie has more than 25 years of industry experience

in operations, management, compliance, client relations and due diligence. Since joining the SUEZ North America team in 2000, she has

held leadership positions of increasing responsibility within the company’s regulated, contract and corporate segments. She served

as part of the management team at projects located in Georgia and New Jersey in 2003 before being appointed Vice President and General

Manager for the regulated utility business in the Toms River, NJ division in 2006. Ms. Leslie also headed the SUEZ corporate internal

audit department from 2009 until 2011 and then served as President of SUEZ North America’s Environmental Services from 2011 until

2016. In this capacity, she was responsible for overseeing the operations and management of contract operations throughout the United

States and Canada. This included more than 80 projects affiliated with municipal and industrial water and wastewater systems as well as

two solid waste treatment facilities.

Mr. Doll will remain Chairman of the Middlesex Board

of Directors through the expiration of his current term at the Annual Meeting of Shareholders on May 21, 2024. Mr. Doll has also entered

into a consulting agreement with the Company to aid in a seamless transfer of leadership. The consulting agreement is effective commensurate

with Mr. Doll’s retirement and expires May 21, 2024.

“I and the rest of the Middlesex Board of Directors

are thrilled to have Nadine join our company. Her breadth of knowledge and experience bring a fresh perspective to the numerous opportunities

and challenges facing our company and our industry,” said Doll. “The search committee of our Board of Directors led a very

comprehensive and thoughtful recruiting process to ensure we could identify a leader to further the Company’s mission to provide

operational and financial excellence.” added Doll.

“I am thrilled to join the Middlesex Water Company

team and grateful for the trust and confidence placed in me by the Middlesex Board of Directors” said Ms. Leslie, incoming President

and CEO. “I am confident with the support of our talented team and Board members, we will navigate challenges, capitalize on opportunities

and create additional value for our customers and shareholders. Congratulations to Dennis on his successful tenure and I look forward

to working with him during the transition period.”

About Middlesex Water Company

Established in 1897, Middlesex Water Company serves

as a trusted provider of life-sustaining high quality water service for residential, commercial, industrial and fire protection purposes.

The Company and its subsidiaries form the Middlesex family of companies, which collectively serve a population of nearly half a million

people in New Jersey and Delaware. We offer a full range of water, wastewater utility and related services including municipal and industrial

contract operations and water and wastewater system technical operations and maintenance. We are focused on meeting and balancing the

needs of our employees, customers, and shareholders. We invest in our people, our infrastructure and the communities we serve to support

reliable and resilient utility services, economic growth and quality of life.

This release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, including, among others, our long-term strategy and expectations, the status

of our acquisition program, the impact of our acquisitions, the impact of current and projected rate requests and the impact of our capital

program on our environmental compliance. There are important factors that could cause actual results to differ materially from those expressed

or implied by such forward-looking statements including: general economic business conditions, unfavorable weather conditions, the success

of certain cost-containment initiatives, changes in regulations or regulatory treatment, availability and the cost of capital, the success

of growth initiatives and other factors discussed in our filings with the Securities and Exchange Commission.

Contact:

Bernadette Sohler

Middlesex Water Company

(732) 638-7549

www.middlesexwater.com

Exhibit 99.2

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT

AGREEMENT (the “Agreement”) is entered into by and between Nadine Duchemin- Leslie (“Executive”),

and Middlesex Water Company, a corporation organized and existing under the laws of the State of New Jersey (the “Company”)

as of the 1st day of March, 2024.

WHEREAS, the Board

of Directors of Company (“Board of Directors or Board”) wishes to enter into an Employment Agreement to employ Executive

to serve as President and Chief Executive Officer (“CEO”) of the Company on the terms set forth herein.

NOW, THEREFORE,

in consideration of the mutual covenants and obligations contained herein, and intending to be legally bound, the parties, subject to

the terms and conditions set forth herein, agree as follows:

1. Employment

and Term. Executive hereby agrees to continue to serve as President and CEO from March 1, 2024 (the “Commencement Date”)

through December 31, 2030 (the “Term”), and the Company hereby employs Executive as President and CEO pursuant to the

terms of this Agreement. By executing this Agreement, the Company confirms that the Board of Directors has approved this Agreement. This

Agreement shall terminate at the end of the Term, unless terminated earlier as provided in this Agreement.

2. Duties.

During the Term, Executive will have the titles of President and CEO. Executive shall report exclusively to, and receive instructions

from, the Board of Directors and shall have such duties and responsibilities customary for the positions of President and CEO of publicly

traded companies similarly situated. While serving as President and CEO, Executive shall have full authority and discretion relating to

the general and day-to-day management of the affairs of the Company. Compensation matters relative to executive Officers of the Company

other than Executive shall be recommended by Executive to the Compensation Committee of the Board of Directors (the “Compensation

Committee”) for final approval by the Board of Directors. The authority and responsibility of the President and CEO includes,

but is not limited to, personnel and compensation matters (other than such matters that relate to the Executive), operating and capital

budgeting, operations, financial management, intellectual property, investor relations, retention of professionals and strategic planning

and implementation. Executive will be the most senior executive Officer of the Company and all other executives and businesses of the

Company will report to Executive or Executive’s designee. The foregoing language shall not be construed to limit the duties and

responsibilities of the Board of Directors, as described in the Company’s Articles of Incorporation, Bylaws, and corporate governance

guidelines. If, or when, Executive may serve as a member of the Board of Directors, such role shall include no additional compensation

and shall include such duties as set forth in the Bylaws and any corporate governance policies, procedures or guidelines.

3. Other

Business Activities. Executive shall serve the Company faithfully and shall devote reasonable best efforts and substantially all

business time, attention, skill and efforts to the performance of the duties required by, or appropriate for, the position of President

and CEO. In furtherance of the foregoing, and not by way of limitation, for so long as Executive remains President and CEO, Executive

shall not directly or indirectly engage in any other business, except for those businesses arising from positions held as of the date

hereof, as set forth on Appendix A of this Agreement or, such other activities as would not materially interfere with Executive’s

ability to carry out the duties under this Agreement. Notwithstanding the foregoing, Executive shall be permitted to engage in activities

in connection with (i) service as a volunteer, officer or director or in a similar capacity of any charitable, trade or civic organization;

(ii) serving as a director, executor, trustee or in another similar fiduciary capacity for a non-commercial entity; or (iii) serving as

a director of a business organization; provided, however, that Executive has disclosed the intention to engage in such activities to the

Board of Directors and the Board of Directors concludes that such activities do not materially interfere with Executive’s performance

of the responsibilities and obligations pursuant to this Agreement.

4. Base

Salary. The Company shall pay Executive an initial annual base salary (the “Base Salary”) of$ 725,000,

payable pursuant to the Company’s normal payroll practices. The Base Salary shall be inclusive of all applicable income,

Social Security and other taxes and charges which are required by law or requested to be withheld by Executive, and which shall be

withheld and paid in accordance with Company’s normal payroll practices as in effect from time to time for its similarly

situated executives. The Compensation Committee, in consultation with Executive, shall periodically review Executive’s Base

Salary during the Term, at least annually, for changes based on Executive’s performance and other factors deemed relevant by

the Compensation Committee.

5. Annual

Short-Term Incentive Compensation. During the Term of this Agreement, Executive shall be eligible for annual cash incentive compensation

based on performance criteria developed and evaluated by the Compensation Committee of the Board of Directors in consultation with Executive.

The target annual cash incentive compensation shall be 50% of Executive’s Base Salary (“Bonus”)), initially $362,500.

6. Annual

Long-Term Equity Incentive. During the Term of this Agreement, Executive shall be eligible for annual equity-based long-term incentive

compensation under any long-term incentive compensation programs in effect from time-to-time, as determined by the Board of Directors,

based on performance criteria developed and evaluated by the Compensation Committee of the Board of Directors in consultation with Executive.

The target annual equity grant shall be 50% of Executive’s Base Salary, initially $362,500.

7. Supplemental

Equity Grant. As of the effective date of this agreement, Executive shall be awarded shares of Middlesex Water Company common

stock having a market value of $250,000, based on the most recent closing stock price. On March 1, 2025, Executive shall be awarded additional

shares of Middlesex Water Company common stock, based on overall satisfactory performance as determined by the Board of Directors, having

a market value of $250,000, and based on the closing stock price on February 28, 2025. On March 1, 2026, Executive shall be awarded additional

shares of Middlesex Water Company common stock, based on overall satisfactory performance as determined by the Board of Directors, having

a market value of $250,000, and based on the closing stock price on February 27, 2026. Such shares shall be awarded under the Company’s

2018 Restricted Stock Plan. As such shares are unregistered, they will be initially deposited with the Company’s transfer agent,

Broadridge Corporate Issuer Solutions, Inc. and will bear a restricted legend. The shares shall fully vest one day subsequent to award.

Any subsequent transfer or disposition of the shares is subject to Rule 144(a) of the Securities Act of 1933, as amended.

8. Other

Benefits. Nothing in this Agreement shall preclude Executive’s participation in standard Company benefit plans or programs

generally available to all employees. The level of those and any other benefits shall be at least as favorable as those provided to all

other executives generally.

9.

Payments Upon Termination of Employment.

(a) If

the Company terminates Executive’s employment and this Agreement for Cause, or if Executive terminates Executive’s employment

without Good Reason or without Change In Control (CIC) Good Reason, where such terms are defined in Section 10 below or, Executive’s

employment is terminated due to death or Disability, Executive shall receive (or Executive’s estate in the event of death) any accrued

but unpaid Base Salary under this Agreement. Such payment shall be made in a lump sum and paid in connection with the payroll period in

which the termination date arises.

(b) If

the Company terminates Executive’s employment and this Agreement without Cause or if Executive terminates Executive’s employment

for Good Reason, Executive shall receive any accrued but unpaid Base Salary pursuant to the Company’s payroll practice, 50% of the

annual target Bonus and 50% of the annual target long-term equity incentive under this Agreement, all in a lump sum cash payment, within

thirty (30) days of the effective date of the release referenced in clause (f) of this Section 9. Executive shall also receive (i) an

amount equal to twenty (24) months of the Consolidated Omnibus Budget Reconciliation Act (COBRA) rate in effect at the Executive’s

termination of employment (Severance Benefits”). Such severance payments shall be made consistent with the Company’s

payroll practice during the period which begins on the effective date of the release described in clause (f) of this Section 9 and continuing

for the period for which the restrictive covenants continue under Section 11 of this Agreement, and the remainder in a lump sum, with

such lump sum payment to be paid on the thirtieth day following the date the restrictive covenants period ends.

(c) If

the Company does not renew Executive’s employment upon expiration of the Term, Executive shall receive any accrued but unpaid

Base Salary pursuant to the Company’s payroll practice, any earned but unpaid Short-Term Incentive Compensation and any earned

but unpaid Long-Term Incentive Compensation, all in the form of a lump sum cash payment, within thirty (30) days of the effective

date of the release referenced in clause (f) of this Section 9. To the extent any unpaid incentive compensation may be due to

Executive, the extent to which any such incentive compensation is determined to be earned is at the sole discretion of the Board of

Directors. In addition, any unvested restricted common stock previously awarded but held by the company in escrow, shall immediately

vest and therefore, any restrictions shall lapse, and the common stock shall be released to Executive, subject to execution of the

release described in clause (f) of this Section 9.

(d) If

during a Change in Control (CIC) Period, as defined in a separately executed Change In Control Agreement, the Company terminates Executive’s

employment and this Agreement without Cause or, if Executive terminates Executive’s employment for CIC Good Reason, as defined in

the separately executed Change In Control Agreement, Executive shall receive all amounts due and owing in accordance with the provisions

of such Change in Control Agreement and the Company shall have no further obligations to Executive under this Agreement.

(e) For

the avoidance of doubt, if Executive receives CIC Severance Benefits under clause (d) of this Section 9, Executive shall not be entitled

to receive Severance Benefits or other benefits under this Agreement. The Company does not intend for Executive to be eligible for any

duplicate payments upon termination of employment.

(f) For

the avoidance of doubt, the payment of Severance Benefits or CIC Severance Benefits under this Agreement shall be conditioned upon Executive

executing a general release of all claims in a form provided by the Company containing customary terms and conditions, and not revoking

such release during the seven (7) day period following Executive’s execution.

10. Defined Terms. For purposes of this Agreement:

(a) “Affiliate”

and “Associate” have the respective meanings ascribed to such terms in Rule 12b- 2 of the General Rules and Regulations

under the Securities & Exchange Act.

(b) “Beneficial

Owner” A Person shall be deemed a “Beneficial Owner” of any securities: (i) that such Person or any of such

Person’s Affiliates or Associates, directly or indirectly, has the right to acquire (whether such right is exercisable

immediately or only after the passage of time) pursuant to any agreement, arrangement or understanding (whether or not in writing)

or upon the exercise of conversion rights, exchange rights, rights, warrants or options, or otherwise; provided, however, that a

Person shall not be deemed the “Beneficial Owner” of securities tendered pursuant to a tender or exchange offer made by

such Person or any of such Person’s Affiliates or Associates until such tendered securities are accepted for payment, purchase

or exchange; (ii) that such Person or any of such Person’s Affiliates or Associates, directly or indirectly, has the right to

vote or dispose of or has “beneficial ownership” of (as determined pursuant to Rule 13d-3 of the General Rules and

Regulations under the Securities & Exchange Act), including without limitation pursuant to any agreement, arrangement or

understanding, whether or not in writing; provided, however, that a Person shall not be deemed the “Beneficial Owner” of

any security under this clause (ii) as a result of an oral or written agreement, arrangement or understanding to vote such security

if such agreement, arrangement or understanding (A) arises solely from a revocable proxy given in response to a public proxy or

consent solicitation made pursuant to, and in accordance with, the applicable provisions of the General Rules and Regulations under

the Exchange Act, and (B) is not then reportable by such Person on Schedule 13D under the Exchange Act (or any comparable or

successor report); or (iii) that are beneficially owned, directly or indirectly, by any other Person (or any Affiliate or Associate

thereof) with which such Person (or any of such Person’s Affiliates or Associates) has any agreement, arrangement or

understanding (whether or not in writing) for the purpose of acquiring, holding, voting (except pursuant to a revocable proxy as

described in the proviso to clause (ii) above) or disposing of any voting securities of the Company; provided, however, that nothing

in this definition shall cause a Person engaged in business as an underwriter of securities to be the “Beneficial Owner”

of any securities acquired through such Person’s participation in good faith in a firm commitment underwriting until the

expiration of forty days after the date of such acquisition.

(c) “Cause”

shall mean that the Board reasonably determines that Executive engaged in: (i) fraud, misappropriation, embezzlement or willful misconduct

by Executive; (ii) willful failure by Executive to perform any duties after a written notification by the Board which identifies such

failure and permits thirty (30) days to rectify such failure; (iii) Executive being convicted of a felony, or any crime or offense involving

the Company; (iv) pleading guilty or nolo contendere or being convicted of any other criminal act, not including traffic offenses; (v)

failure to follow the lawful directions of the Board which, if curable in the judgement of the Board, is not cured within thirty (30)

days after Executive’s receipt of written notice of his failure to follow such lawful directions; (vi) a material breach of this

Agreement; which is not cured within ten (10) days after Executive’s receipt of written notice of such material breach; or (vii)

a determination by the Board that Executive has violated a written policy of the Company against unlawful discrimination or harassment.

No act, or failure to act, on the Executive’s part shall be deemed “willful” unless committed or omitted by the Executive

in bad faith and without reasonable belief that the Executive’s act or failure to act was in, or not opposed to, the best interest

of the Company.

(d) “Change

in Control” as defined under the provisions of a separately executed Change in Control Agreement.

(e) “Change

in Control Period” as defined under the provisions of a separately executed Change in Control Agreement.

(f) “CIC

Good Reason” as defined under the provisions of a separately executed Change in Control Agreement.

(g) “Disability”

means Executive’s mental or physical incapacity that entitles Executive to long- term disability benefits under the Company’s

long-term disability plan applicable to Executive after reasonable accommodation.

(h) “Good Reason” as defined

under the provisions of a separately-executed Change in Control Agreement.

(i) “Person”

means any individual, firm, corporation, partnership or other entity except the Company, any subsidiary of the Company, any employee benefit

plan of the Company or of any subsidiary, or any Person or entity organized, appointed or established by the Company for or pursuant to

the terms of any such employee benefit plan.

11.

Restrictive Covenants.

(a) Executive

agrees that on and after the effective date of this Agreement, and for a period of twelve (12) months after termination of employment

under this Agreement, Executive will not, directly or indirectly, individually, or in association or in combination with any other person

or entity, whether as a shareholder of a corporation, or a manager or member of a limited liability company, or as an employee, agent,

independent contractor, consultant, advisor, joint venture partner or otherwise:

(i) employ,

engage or solicit for employment any person who is, or was, at any time during the twelve (12) months after termination of Executive’s

employment under this Agreement and the immediately preceding twelve (12) month period, an employee of the Company or otherwise seek to

adversely influence or alter such person’s relationship with the Company (without written consent of the Board of Directors); or

(ii) solicit,

entice, broker or encourage any person or entity that is, or was, at any time during the twelve (12) months after termination of Executive’s

employment under this Agreement and the immediately preceding twelve (12) month period, a prospective Affiliate of the Company or a customer,

client or vendor or prospective customer, client or vendor of the Company, to terminate or otherwise alter his, her or its relationship

with Company.

(b) Executive

agrees that on and the after effective date of this Agreement, and for a period of twelve (12) months after termination of employment

under this Agreement, Executive agrees not to, unless acting pursuant with the prior written consent of the Board of Directors, which

consent will not be unreasonably withheld, directly or indirectly, own, manage, operate, join, control, finance or participate in the

ownership, management, operation, control or financing of, or be connected as an officer, director, employee, partner, principal, agent,

representative, consultant or otherwise with or use or permit Executive’s name to be used in connection with, any Competing Business

located in the Geographic Area. For purposes of this Agreement, a “Competing Business” is any business or enterprise

actively engaged (i) in a business from which the consolidated Company (the Company and its subsidiaries), taken as a whole, derived at

least ten percent of its annual gross revenues for the twelve (12) months immediately preceding the date of termination, or (ii) in any

strategic initiative of the Company commenced in the twelve (12) months immediately preceding the date of termination, or actively being

considered by the Company on the date of termination. “Geographic Area” means the states in which the Company and its

subsidiaries are operating as of the date of termination. It is recognized by Executive that the business of the Company and its subsidiaries

and Executive’s connection therewith is, or will be, involved in activity throughout the Geographic Area, and that more limited

geographical limitations on this non-competition covenant are therefore not appropriate. The foregoing restriction shall not be construed

to prohibit the ownership by Executive of less than one percent of any class of securities of any corporation which is engaged in any

of the foregoing businesses having a class of securities registered pursuant to the Securities Exchange Act of 1934, provided that such

ownership represents a passive investment and that neither Executive nor any group of persons including Executive in any way, either directly

or indirectly, manages or exercises control of any such corporation, guarantees any of its financial obligations, otherwise takes any

part in its business, other than exercising his rights as a shareholder, or seeks to do any of the foregoing.

(c) Executive

acknowledges that the restrictions contained in paragraph (a) and (b) are reasonable and necessary to protect the legitimate interests

of the Company and its subsidiaries and Affiliates, and that any violation of those provisions will result in irreparable injury to the

Company. Executive represents that Executive’s experience and capabilities are such that the restrictions contained in paragraphs

(a) and (b) will not prevent Executive from obtaining employment or otherwise earning a living at the same general level of economic benefit

as is the case as of the date hereof. Executive agrees that the Company shall be entitled to preliminary and permanent injunctive relief,

without the necessity of proving actual damages, which right shall be cumulative and in addition to any other rights or remedies to which

the Company may be entitled. In the event any of the provisions of paragraph (a) or (b) should ever be adjudicated to exceed the time,

geographic, service, or other limitations permitted by applicable law in any jurisdiction, then such provisions shall be deemed reformed

in such jurisdiction to the maximum time, geographic, service, or other limitations permitted by applicable law. Executive further agrees

to reimburse Company for its expenses incurred in enforcing this Agreement, if Company prevails in any suit under this Agreement or if

Executive is found to have breached or threatened to breach any term of this Agreement, including without limitation, Company’s

attorneys’ fees and costs. Executive agrees that in the event the Company finds it necessary to enforce this Agreement

in a court of law or equity, the twelve (12) month restriction

referred to in clauses (a) and (b)above shall begin from the date of entry of the final order of the court.

12. Other Agreements. Executive represents and warrants to Company that:

(a) Executive

has informed the Company in writing of any restrictions, agreements or understandings whatsoever to which Executive is a party or by which

Executive is bound that could prevent or make unlawful Executive’s execution of this Agreement or Executive’s employment hereunder,

or which could be inconsistent or in conflict with this Agreement or Executive’s employment hereunder, or could prevent, limit or

impair in any way the performance by Executive of the obligations hereunder.

(b) Executive

shall disclose the existence and terms of the restrictive covenants set forth in Section 11 to any employer by whom Executive may be employed

during the Term (which employment is not hereby authorized) or any period during which Executive’s activities are restricted by

virtue of the covenants described in Section 11 hereof.

13. Survival

of Provisions. The provisions of this Agreement shall survive the termination of Executive’s employment hereunder and the

payment of all amounts payable and delivery of all post-termination compensation and benefits pursuant to this Agreement incident to any

such termination of employment.

14. Successors

and Assigns. This Agreement shall inure to the benefit of, and be binding upon, the Company and its successors or permitted assigns

and Executive and Executive’s executors, administrators or heirs. The Company shall require any successor or successors expressly

to assume the obligations of the Company under this Agreement. For purposes of this Agreement, the term “successor” shall

include the ultimate parent corporation of any corporation involved in a merger, consolidation, or reorganization with or including the

Company that results in the stockholders of Company immediately before such merger, consolidation or reorganization owning, directly or

indirectly, immediately following such merger, consolidation or reorganization, securities of another corporation. Executive may not assign

any obligations or responsibilities under this Agreement or any interest herein, by operation of law or otherwise, without the prior written

consent of the Company. If a successor or assign of the Company refused to accept this Agreement, Executive shall be entitled to receive

CIC Severance Benefits from the Company.

15. Notices.

All notices required to be given to any of the parties of this Agreement shall be in writing and shall be deemed to have been sufficiently

given, subject to the further provisions of this Section 15, for all purposes when presented personally to such party, or sent by any

national overnight delivery service, or certified or registered mail, to such party at its address set forth below:

Nadine Duchemin-Leslie

XXXXXXXXXXXXXX

XXXXXXXXXXXXXX

Middlesex Water Company

485C Route 1 South, Suite 400

Iselin, New Jersey 08830

Attn: Lead Independent Director c/o Corporate Secretary

Such notice shall be deemed to be received

when delivered if delivered personally, upon electronic or other confirmation of receipt if delivered by electronic mail or facsimile

transmission, the next business day after the date sent if sent by a national overnight delivery service, or three (3) business days after

the date mailed if mailed by certified or registered mail. Any notice of any change in such address shall also be given in the manner

set forth above. Whenever the giving of notice is required, the giving of such notice may be waived in writing by the party entitled to

receive such notice.

16. Entire

Agreement; Amendments. This Agreement and any other documents, instruments or other writings delivered or to be delivered in connection

with this Agreement as specified herein constitute the entire agreement among the parties with respect to the subject matter of this Agreement

and supersede all prior and contemporaneous agreements, understandings, and negotiations, whether written or oral, with respect to the

terms of Executive’s employment by the Company. This Agreement may be amended or modified only by a written instrument signed by

all parties hereto.

17. Waiver.

The waiver of the breach of any term or provision of this Agreement shall not operate as, or be construed to be, a waiver of any other

or subsequent breach of this Agreement.

18. Governing

Law. This Agreement shall be governed and construed as to its validity, interpretation and effect by the laws of the State of

New Jersey.

19. Severability.

Any provision of this Agreement that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective

to the extent of such prohibition or unenforceability without invalidating the remaining provisions of this Agreement or such provisions,

and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other

jurisdiction.

20. Section

Headings. The section headings in this Agreement are for convenience only; they form no part of this Agreement and shall not affect

its interpretation.

21. Counterparts.

This Agreement may be executed in any number of counterparts, and each such counterpart, including in .pdf format, shall be deemed to

be an original instrument, but all such counterparts together shall constitute one and the same instrument.

22. Indemnification.

During the Term and thereafter, the Company agrees to indemnify and hold Executive harmless in connection with actual, potential or threatened

actions or investigations related to Executive’s services for, or employment by, the Company and/or its subsidiaries in the same

manner as other officers and directors to the extent provided in the Company’s Bylaws.

23. Taxes.

Any payment required under this Agreement shall be subject to all requirements of federal and state law with regard to the withholding

of taxes, filing, making of reports and the like, and the Company shall use its best efforts to satisfy promptly all such requirements.

24.

Coordination with Release and Delay Required by the Internal Revenue Code.

(a) Notwithstanding

anything to the contrary in this Agreement, if the Executive is a “disqualified individual” (as defined in Internal Revenue

Code Section 280G(c)), and the payments and benefits provided for in this Agreement or any other payments and benefits which the Executive

has the right to receive from the Company (collectively, the “Payments”), would constitute a “parachute payment”

(as defined in Internal Revenue Code Section 280G(b)(2)), then the Payments shall be either (a) reduced (but not below zero) so that the

present value of such total amounts and benefits received by the Executive from the Company will be one dollar ($1.00) less than three

(3) times Executive’s “base amount” (as defined in Internal Revenue Code Section 280G(b)(3)) and so that no portion

of such amounts and benefits received by the Executive shall be subject to the excise tax imposed by Internal Revenue Code Section 4999

or (b) paid in full, after taking into account the applicable federal, state and local income taxes and the excise tax imposed by Internal

Revenue Code Section 4999, whichever produces the better net-after-tax position to the Executive. The reduction of Payments, as applicable,

shall be made by (a) first, reducing any severance payments due pursuant to Section 4 paid in cash, with later payments being reduced

first; (b) next, the waiver of accelerated vesting of equity awards, with awards having a later vesting date being reduced first; and

(d) lastly, reducing all other Payments, with later payments being reduced first, in each case, in accordance with Internal Revenue Code

Section 409A. The determination as to whether any such reduction in the amount of the payments and benefits provided hereunder is necessary

shall be made by the Board of Directors in good faith. If a reduced Payment is made or provided and through error or otherwise that Payment,

when aggregated with other Payments from the Company used in determining if a parachute payment exists, exceeds one dollar ($1.00) less

than three (3) times the Executive’s base amount, then the Executive shall immediately repay such excess to the Company upon notification

that an overpayment has been made. In the event any reduction under this Agreement is disputed by the Executive, then determinations required

to be made under this Section 19, including the assumptions to be utilized in arriving at such determination, shall be made by an outside

accounting or consulting firm mutually selected by the Executive and the Company or the Board of Directors, in their reasonable discretion

(the “Accounting Firm”), which shall provide detailed supporting calculations both to the Company and the Executive within

15 business days of the receipt of notice from the Executive that there has been a payment hereunder, or such earlier time as is requested

by the Company

or the Board of Directors, as applicable.

In no event shall the Accounting Firm be an accounting firm that was, or is, serving as accountant or auditor for the individual, entity

or group affecting the change of ownership or effective control of the Company. Nothing in this Section 19 shall require the Company to

be responsible for, or have any liability or obligation with respect to, the Executive’s excise tax liabilities under Internal Revenue

Code Section 4999.

(b) To

the maximum extent possible, all amounts payable hereunder are intended to be exempt from the requirements of Section 409A of the Internal

Revenue Code (“Code Section 409A”) and this Agreement shall be construed and administered in accordance with such intention.

To the extent any continuing benefit (or reimbursement thereof) to be provided is not “deferred compensation” for purposes

of Code Section 409A, then such benefit shall commence or be made immediately after the date the release of claims required under Section

8(e) of this Agreement becomes effective. To the extent any continuing benefit (or reimbursement thereof) to be provided is “deferred

compensation” for purposes of Code Section 409A, then such benefits shall be reimbursed or commence upon the earliest later date

as may be required in order to comply with the requirements of Code Section 409A. The delayed benefits shall in any event expire at the

time such benefits would have expired had the benefits commenced immediately upon Executive’s termination of employment.

(c) Notwithstanding

any other payment schedule provided herein to the contrary, if the Executive is deemed on the date of termination to be a Specified Employee,

then, once the release required by Section 9(f) is executed and delivered and no longer subject to revocation, any payment that is considered

deferred compensation under Code Section 409A payable on account of a “separation from service” shall be made on the date

which is the earlier of (A) the expiration of the six (6)-month period measured from the date of such “separation from service”

of Executive, and (B) the date of Executive’s death (the “Delay Period”) to the extent required under Code Section

409A. Upon the expiration of the Delay Period, all payments delayed pursuant to this Section 23 (whether they would have otherwise been

payable in a single sum or in installments in the absence of such delay) shall be paid to Executive in a lump sum, and any remaining payments

due under this Agreement shall be paid or provided in accordance with the normal payment dates specified for them herein.

IN WITNESS WHEREOF, the parties

have caused this Agreement to be executed the day and year first written above.

| |

By: |

/s/ Dennis W. Doll |

| |

|

Dennis W. Doll |

| |

|

President & CEO |

| |

|

|

| ATTEST: |

|

|

| |

|

|

| /s/ Jay L. Kooper |

|

|

| Jay L. Kooper, Vice President, |

|

|

| General Counsel & Secretary |

|

|

| |

|

/s/ Nadine Duchemin Leslie |

| |

|

Nadine Duchemin-Leslie |

Appendix A

Business and Charitable

Activities

Board of Trustees – Hackensack Meridian Health

Board of Directors – Provident Bank and Provident Financial

Services

Exhibit 99.3

CHANGE IN CONTROL AGREEMENT

This Change in Control Termination Agreement (the

“Agreement”) is entered into as of March 1, 2024, between Middlesex Water Company (the “Company”), a New Jersey

corporation, and Nadine Duchemin-Leslie (referred to as “You” in this Agreement).

Recitals

A. The Company considers it essential

to the best interests of its shareholders to foster the continuous employment of key management personnel. In this

connection, the Board of Directors of the Company (the “Board”)

recognizes that, as is the case with many publicly held Companies, the possibility of a Change in Control may exist. This possibility,

and the uncertainty and questions that it may raise among management, may result in the departure or distraction of management personnel

to the detriment of the Company and its shareholders.

B. The Board has determined

that appropriate steps should be taken to reinforce and encourage the continued attention and dedication of members of the Company’s

management, including You, to the assigned duties without distraction in the face of circumstances arising from the possibility of a Change

in Control of the Company.

C. To induce You to remain in

the employ of the Company, while simultaneously representing the best interests of the Company’s shareholders, and in consideration

of your agreement set forth below, the Company agrees that You shall receive the severance benefits set forth in this Agreement in the

event your employment with the Company is terminated by the Company, or is terminated by You for “Good Reason,” as defined

herein, in connection with a “Change in Control of the Company” (as defined in Section 2 below.

Therefore, in consideration

of your continued employment and the parties’ agreement to be bound by the terms contained in this Agreement, the parties agree

as follows:

1. Term

of Agreement. This Agreement shall commence as of March 1, 2024 and shall continue in effect through the term of a separately

executed Employment Agreement. Notwithstanding the foregoing, if a Change

in Control of the Company shall be proposed to occur, or have occurred, during the original or any extended term of this Agreement, this

Agreement shall continue in effect until your termination of employment with the Company or its successor or, when all amounts due under

this Agreement following a termination have been paid, whichever is later.

2. Change

In Control. No benefits shall be payable under this Agreement unless there shall have been a Change in Control of the Company,

as set forth herein. For purposes of this Agreement, a “Change in Control” of the Company shall be deemed to occur if any

party or group acquires beneficial ownership of 20 percent or more of the voting shares of the Company; or if shareholder approval is

obtained for a transaction involving the acquisition of the Company through the purchase or exchange of the stock or assets of the Company

by merger or otherwise; or if one-third or more of the Board elected in a 12-month period or less are so elected without the approval

of a majority of the Board as constituted at the beginning of such period; or a liquidation or dissolution of Company.

3. Termination

Following Change In Control. If any of the events described in Section 2 above constituting a Change in Control of the Company

shall have occurred, then unless the termination is (A) because of your death, Disability or Retirement, (B) by the Company for Cause,

or (C) by You other than for Good Reason, on the subsequent termination of your employment during the term of this Agreement, You shall

be entitled to the severance benefits provided in Section 4.3 below if such termination occurs on or before the third (3rd)

anniversary of the Change in Control date (the “Change in Control Period”) .

3.1 Disability.

If, as a result of your incapacity due to physical or mental illness during the Change in Control Period You shall have been absent from

the full-time performance of your duties with the Company for six consecutive months, and within 30 days after written notice of termination

is given You shall not have returned to the full-time performance of your duties, your employment may be terminated for "Disability"

whereby, You would not be entitled to receive severance benefits in relation to a Change in Control.

3.2 Cause.

Termination by the Company of your employment for "Cause" shall mean termination as a result of:

3.2.1 The

willful and continued failure by You to substantially perform your duties with the Company as such employment was performed by You prior

to the Change in Control or any such actual or anticipated failure after the issuance by You of a Notice of Termination for Good Reason

as defined herein after a written demand for substantial performance is delivered to You by the Board of Directors, which demand specifically

identifies the manner in which the Board believes that You have not substantially performed your duties; or

3.2.2 The

willful act by You in conduct that is demonstrably and materially injurious to the Company, and which the Board deems to cause or will

cause substantial economic damage to the Company or injury to the business reputation of the Company, monetarily or otherwise. For purposes

of this Section,

no act, or failure to act, on your part shall be deemed “willful"

unless done, or omitted to be done, by You not in good faith and without a reasonable belief that your action or omission was in the best

interest of the Company. Notwithstanding the foregoing, You shall not be deemed to have been terminated for Cause unless and until there

shall have been delivered to You a copy of a resolution duly adopted by the affirmative vote of not less than three-quarters of the entire

membership of the Board at a meeting of the Board called and held for such purpose (after reasonable notice to You and an opportunity

for You, together with your counsel, to be heard before the Board), finding that in the good faith opinion of the Board You were guilty

of conduct set forth above in clauses 3.2.1 or 3.2.2 of this Section and specifying the particulars in detail.

3.3 CIC

Good Reason. You shall be entitled to receive severance benefits as provided in this Agreement if You terminate your employment

with the Company for “Good Reason.” For purposes of this Agreement, "CIC Good Reason" shall mean, without your consent,

the occurrence in connection with a Change in Control of the Company of any of the following circumstances unless, in the case of Sections

3.3.1, 3.3.5, 3.3.6, 3.3.7, or 3.3.8, the circumstances are fully corrected prior to the Date of Termination specified in the Notice of

Termination, as defined in Sections 3.5 and 3.4, respectively, given in respect of them. If You terminate your employment with the Company

for Good Reason, as provided below, your employment with the Company shall be considered to have been involuntarily terminated by the

Company:

3.3.1 The

assignment to You of any significant employment duties which are inconsistent with your status and position (i) prior to the Change in

Control where such change is a direct result of any pending Change in Control; or

(ii) as such status exists immediately prior to the Change in

Control of the Company, or (iii) which are a substantial adverse alteration in the nature or status of your responsibilities from those

in effect immediately prior to the Change in Control of the Company whichever is applicable;

3.3.2 A

reduction by the Company in your annual base salary or participation in any incentive compensation programs as in effect on the initial

date of this Agreement, or as same may be increased from time to time irrespective of future Company policies including any across-the-board

salary reductions similarly affecting all key employees of the Company;

3.3.3 Your

relocation, without your consent, to an employment location not within twenty-five (25) miles of your present designated office or job

location, except for required travel on the Company's business to an extent substantially consistent with your present business travel

obligations;

3.3.4 The

failure by the Company, without your consent, to pay to You any part of your current compensation, or to pay to You any part of an

installment of deferred compensation under any deferred compensation

program of the Company, within fourteen (14) days of the date the compensation is due;

3.3.5 The

failure by the Company to continue in effect any bonus to which You were entitled, or any compensation plan in which You participate

(i) prior to the Change in Control where such change is a direct result of any pending Change in Control, or (ii) immediately prior to

the Change in Control of the Company that is material to your total compensation, including but not limited to the Company's Restricted

Stock Plan, 401(k) Plan, and other Benefit Plans, or any substitute plans adopted prior to the Change in Control of the Company for which

you are entitled under a separately executed employment agreement, unless an equitable arrangement (embodied in an ongoing substitute

or alternative plan) has been made with respect to the plan, or the failure by the Company to continue your participation in it (or in

such substitute or alternative plan) on a basis not materially less favorable, both in terms of the amount of benefits provided and the

level of your participation relative to other participants, as existed at the time of the Change in Control;

3.3.6 The failure by the Company to

continue to provide You with( i) benefits substantially similar to those enjoyed by You under any of the Company's life insurance,

medical, health and accident, or disability plans in which You were participating at the time of the Change in Control of the

Company was in effect for the employees of the Company generally at the time of the Change in Control, (ii) the failure to continue

to provide You with a Company automobile or allowance in lieu of it at the time of the Change in Control of the Company, (iii) the

taking of any action by the Company that would directly or indirectly materially reduce any of such benefits or deprive You of any

material fringe benefit enjoyed by You at the time of the Change in Control of the Company, or (iv) the failure by the Company to

provide You with the number of paid vacation days to which You are entitled with the Company's normal vacation policy or other

vacation allowance provided to you by written agreement in effect at the time of the Change in Control of the Company;

3.3.7 The

failure of the Company to obtain a satisfactory agreement from any successor to assume and agree to perform this Agreement, as contemplated

in Section 5 of this Agreement; or

3.3.8 Any

purported termination of your employment that is not effected pursuant to a Notice of Termination satisfying the requirements of Section

3.4 below (and, if applicable, the requirements of Section 3.2 above); for purposes of this Agreement, no such purported termination shall

be effective.

3.4 Notice

of Termination. Any purported termination of your employment by the Company or by You shall be communicated by written Notice

of Termination to the other party to this Agreement in accordance with Section 6

of this Agreement. For purposes of this Agreement, a "Notice

of Termination" shall mean a notice that shall indicate the specific termination provision in this Agreement relied on, and shall

set forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of your employment under the provision

so indicated. Your rights to terminate your employment pursuant to this Section shall not be affected by your incapacity due to Disability.

Your continued employment shall not constitute consent to, or a waiver of rights with respect to, any circumstance constituting Good Reason

under this Agreement. In the event You deliver Notice of Termination based on circumstances set forth in Sections 3.3.1, 3.3.5, 3.3.6,

3.3.7, or 3.3.8 above, which are fully corrected prior to the Date of Termination set forth in your Notice of Termination, the Notice

of Termination shall be deemed withdrawn and of no further force or effect.

3.5 Date of Termination, etc.

"Date of Termination" shall mean( A) if your employment is terminated for Disability, 30 days after Notice of Termination

is given (provided that You shall not have returned to the full-time performance of your duties during such 30-day period), and (B)

if your employment is terminated pursuant to Section 3.2 or 3.3 above or for any other reason (other than Disability), the date

specified in the Notice of Termination (which, in the case of a termination pursuant to Section 3.2 above shall not be less than 30

days, and in the case of a termination pursuant to Section 3.3 above shall not be less than 15 nor more than 60 days, respectively,

from the date the Notice of Termination is given). However, if within 15 days after any Notice of Termination is given, or, if

later, prior to the Date of Termination (as determined without regard to this provision), the party receiving the Notice of

Termination notifies the other party that a dispute exists concerning the termination, then the Date of Termination shall be the

date on which the dispute is finally determined, either by mutual written agreement of the parties, by a binding arbitration award,

or by a final judgment, order, or decree of a court of competent jurisdiction (which is not appealable or with respect to which the

time for appeal has expired and no appeal has been perfected). The Date of Termination shall be extended by a notice of dispute only

if the notice is given in good faith and the party giving the notice pursues the resolution of the dispute with reasonable

diligence. Notwithstanding the pendency of any such dispute, the Company will continue to pay You your full compensation in effect

when the notice giving rise to the dispute was given (including, but not limited to, base salary) and continue You as a participant

in all compensation, benefit, and insurance plans in which You were participating when the notice giving rise to the dispute was

given, until the dispute is finally resolved in accordance with this Section. Amounts paid under this Section are in addition to all

other amounts due under this Agreement and shall not be offset against or reduce any other amounts due under this Agreement.

4. Compensation

on Termination or During Disability. Following a Change in Control of the Company, as defined by Section 2, on termination of

your employment or during a period of Disability You shall be entitled to the following benefits:

4.1 During

any period that You fail to perform your full-time duties with the Company as a result of incapacity due to Disability, You shall continue

to receive your base salary at the rate in effect at the commencement of any such period, together with all amounts payable to You under

any compensation plan of the Company during the period, until this Agreement is terminated pursuant to section 3.1 above. Thereafter,

or in the event your employment shall be terminated by the Company or by You for Retirement, or by reason of your death, your benefits

shall be determined under the Company's retirement, insurance, and other compensation programs then in effect in accordance with the terms

of those programs.

4.2 If your

employment shall be terminated by the Company for Cause or by You other than for Good Reason, Disability, death, or Retirement during

a Change In Control Period, the Company shall pay You your full base salary through the Date of Termination at the rate in effect at the

time Notice of Termination is given, plus all other amounts and benefits to which You are entitled under any compensation plan of the

Company at the time the payments are due. The Company shall have no obligations to You under this Agreement.

4.3 On

or before the third anniversary of the Change in Control, if your employment by the Company shall be terminated (a) by the Company other

than for Cause or Disability, or (b) by You for Good Reason (as defined in Section 3.3 herein), then You shall be entitled to the benefits

provided below:

4.3.1 The

Company shall pay You your full salary through the Date of Termination at the rate in effect at the time Notice of Termination is given,

plus all other amounts and benefits to which You are entitled under any compensation plan of the Company, at the time the payments are

due, except as otherwise provided below.

4.3.2 In

lieu of any further salary payments to You for periods severance pay the following: (i) a lump sum severance payment equal to three (3)

times the average of your Compensation for the five (5) years prior to the occurrence of the circumstance giving rise to the Notice of

Termination (or if employed less than 5 years, the average annualized compensation of the period worked to date), plus (ii) the amounts

in the forms set forth in paragraphs 4.3.3,

4.3.4 and 4.3.5 (the “Severance Payments”). Such Severance

Payments are further subject to any limitations which may apply in the context of a Change In Control as referenced in a separately executed

Employment Agreement.

4.3.3 The

Company shall continue coverage for You and your dependents under any health or welfare benefit plan under which You and your dependents

were participating prior to the Change in Control for a period ending on the earlier to occur of (i) the date You become covered

by a new employer’s health and welfare benefit plan, (ii) the date You become covered by Medicare, or

(iii) the date which is thirty-six (36) months from

the Date of Termination. The coverage for your dependents shall end earlier than (i), (ii) or (iii) if required by the health or welfare

benefit plan due to age eligibility.

4.3.4 The

Company shall pay to You any deferred compensation, including, but not limited to deferred bonuses, allocated or credited to You or your

account as of the Date of Termination.

4.3.5 Outstanding

stock options or Restricted Stock grants, if any, granted to You under the Company's Stock Plans which are not vested on Termination shall

immediately vest.

4.3.6 Where

You shall prevail in any action against the Company to recover benefits hereunder, the Company shall also pay to You all reasonable legal

and accounting fees and expenses incurred by You as a result of the termination, including all such fees and expenses incurred by You

as a result of the termination, (including all such fees and expenses, if any, incurred in contesting or disputing any termination or

in seeking to obtain or enforce any right or benefit provided by this Agreement or in connection with any tax audit or proceeding to the

extent attributable to the application of Code Section 4999 to any payment or benefit provided under this Agreement) or any other agreement

with the Company.

4.3.7 The

amount of Severance Payments due to You under this or any other relevant agreement with the Company shall be determined by a third

party agreed to by You and the Company. If You cannot agree on a third party, then both third parties shall determine the amounts

due under this Agreement. If the third parties do not agree on the amount to be paid to You, then either party may submit the

calculation of the amounts which are in dispute to Arbitration in accordance with this Agreement. The payments provided for in

Paragraphs 4.3.2, 4.3.4 and 4.3.5 above, shall be made no later than the thirtieth (30th) day following the Date of

Termination. However, if the amounts of the payments cannot be finally determined on or before that day, the Company shall pay to

You on that day an estimate, as determined in good faith by the Company, of the minimum amount of such payments and shall pay the

remainder of those payments (together with interest at the rate provided in Section 1274(b)(2)(B) of the Code) as soon as the amount

can be determined but in no event later than the 30th day after the Date of Termination. In the event that the amount of the

estimated payments exceeds the amount subsequently determined to have been due, the excess shall constitute a loan by the Company to

You payable on the 30th day after demand by the

Company (together with interest at the rate provided in Section

1274(b)(2)(B) of the Code).

4.4 For

purposes of this Agreement, “Compensation” shall mean the gross earnings reported on Form W-2 during a calendar year (which

may include but is not limited to the value of the personal use of an automobile, any third-party sick pay, and any fees paid to You for

serving as a Director of the Company or its subsidiaries); awards under the Company’s Restricted Stock Plan or other equity awards;

and Company contributions to your 401(k) account.

4.5 You

shall not be required to mitigate the amount of any payment provided for in this Section 4 by seeking other employment or otherwise, nor

shall the amount of any payment or benefit provided for in this Section 4 be reduced by any compensation earned by You as the result of

employment by another employer, by retirement benefits, by offset against any amount claimed to be owed by You to the Company, or otherwise

except as specifically provided in this Section 4.

4.6 In addition

to all other amounts payable to You under this Section 4, You shall be entitled to receive all qualified benefits payable to You under

the Company's 401(k) Plan, Defined Benefit Plan and any other plan or agreement relating to retirement benefits, in accordance with the

terms of those Plans, to the extent you were a participant in such Plan or Plans as of the date of a Change in Control.

| 5. | Successors; Binding Agreement. |

5.1 The

Company will require any successor (whether direct or indirect, by purchase, merger, consolidation, or otherwise) to all or substantially

all of the business and/or assets of the Company to expressly assume and agree to perform this Agreement in the same manner and to the

same extent that the Company would be required to perform it if no such succession had taken place. Failure of the Company to obtain the

assumption and agreement prior to the effectiveness of any succession shall be a breach of this Agreement and shall entitle You to compensation

from the Company in the same amount and on the same terms as You would have been entitled to under this Agreement if You had terminated

your employment for Good Reason following a Change in Control of the Company, except that for purposes of implementing the foregoing,

the date on which any such succession becomes effective shall be deemed the Date of Termination.

5.2 This

Agreement shall inure to the benefit of, and be enforceable by, your personal or legal representatives, executors, administrators, heirs,

distributees, and legatees. If You should die while any amount would still be payable to You if You had continued to live, all such amounts,

unless otherwise

provided in this Agreement, shall be paid in accordance with the

terms of this Agreement to your legatee or other designee or, if there is no such designee, to your estate.

6. Notice.

For the purpose of this Agreement, all notices and other communications provided for in the Agreement shall be in writing and shall be

deemed to have been duly given when delivered or mailed by United States registered or certified mail, return receipt requested, postage

prepaid, addressed to the respective addresses set forth on the first page of this Agreement, provided that all notices to the Company

shall be directed to the attention of the Board with a copy to the President of the Company, or to such other address as either party

may have furnished to the other in writing in accordance this Agreement, except that notice of a change of address shall be effective

only on receipt.

7.1 No

provision of this Agreement may be modified, waived, or discharged unless the waiver, modification, or discharge is agreed to in writing

and signed by You and such officer as may be specifically designated by the Board.

7.2 No

waiver by either party to this Agreement at any time of any breach by the other party of, or compliance with, any condition or provision

of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the

same or at any prior or subsequent time.

7.3 No

agreements or representations, oral or otherwise, express or implied, with respect to the subject matter of this Agreement have been made

by either party that are not expressly set forth in this Agreement.

7.4 Nothing

in this Agreement is intended to reduce any benefits payable to You under any other agreement You may have with the Company or in any

Company plan in which You may participate.

7.5 The

validity, interpretation, construction, and performance of this Agreement shall be governed by the law of New Jersey without reference

to its conflict of laws principles.

7.6 All

references to sections of the Exchange Act or the Code shall be deemed also to refer to any successor provisions to such sections. Any

payments provided for shall be paid net of any applicable withholding or deduction required under federal, state or local law.

7.7 The

obligations of the Company under Section 4 shall survive the expiration of the term of this Agreement.

8. Validity.

The validity or enforceability of any provision of this Agreement shall not affect the validity or unenforceability of any other provision

of this Agreement, which shall remain in full force and effect.

9. Counterparts.

This Agreement may be executed in several counterparts, each of which shall be deemed to be an original but all of which together will

constitute one and the same instrument.

10. Arbitration.

Any dispute or controversy arising under or in connection with this Agreement shall be settled exclusively by arbitration in New Jersey

in accordance with the rules of the American Arbitration Association then in effect. Judgment may be entered on the arbitrator's award

in any court having jurisdiction. However, You shall be entitled to seek specific performance of your right to be paid until the Date

of Termination during the pendency of any dispute or controversy arising under or in connection this Agreement.

11. Entire

Agreement. This Agreement sets forth the entire understanding of the parties with respect to its subject matter and supersedes

all prior written or oral agreements or understandings with respect to the subject matter.

In witness whereof, the parties have executed this

Agreement as of the day and year first above written.

| |

|

MIDDLESEX WATER COMPANY |

| |

|

|

| |

|

|

| |

By: |

/s/ Dennis W. Doll |

| |

|

Dennis W. Doll |

| |

|

President & CEO |

| |

|

|

| ATTEST: |

|

|

| |

|

|

| /s/ Jay L. Kooper |

|

|

| Jay L. Kooper, Vice President, |

|

|

| General Counsel & Secretary |

|

|

| |

|

/s/ Nadine Duchemin Leslie |

| |

|

Nadine Duchemin-Leslie |

Exhibit 99.4

CONSULTING AGREEMENT

This Consulting Agreement (the “Agreement”)

is entered into and effective as of the 1st day of March 2024, by and between Dennis W. Doll (the “Consultant”) and Middlesex

Water Company (the “Company”) (collectively, the “Parties”).

WHEREAS, the Consultant is expected

to serve as President & Chief Executive Officer (“CEO”) of the Company until his retirement on February 29, 2024, and

the Company desires to enter into a consulting agreement with the Consultant following such date upon the terms and conditions set forth

herein as follows;

| 1. | Commencing March 1, 2024, and continuing up to and including May 21, 2024, the Consultant shall provide

consulting services for which he will receive a fee of $33,600, payable in monthly installments of $11,200 within 15 days of the applicable

month. Although the Parties have not specified a fixed amount of time for such consulting services, it is contemplated that the Consultant

will be available to perform any services as may be reasonably requested by the Company as such services relate to effectively transitioning

responsibilities to the successor CEO. |

| 2. | During the period of the consulting agreement, and continuing for a two-year period thereafter, the

Consultant agrees not to directly, or indirectly, in any individual or representative capacity, engage or participate in any business

in the States of New Jersey and Delaware that is in direct competition in any manner whatsoever with the business of the Company, except

as may be expressly agreed in writing by the Company. |

| 3. | This Agreement constitutes the entire agreement of the Parties relating to the subject matter hereof,

and this Agreement supersedes any prior communications, representations or agreements, verbal or written, between the Parties relating

to the subject matter hereof. |

| 4. | This Agreement is for the benefit of the Consultant and the Company and shall be governed in accordance

with the laws of the State of New Jersey. Neither Party may assign or otherwise transfer its rights or delegate its duties under this

Agreement without the prior written consent of the other Party. |

| 5. | Each Party acknowledges that it has had the opportunity to review the provisions of this Agreement with

independent advisors (financial, legal or otherwise) prior to the execution of this Agreement by each such Party. |

IN WITNESS WHEREOF, the undersigned Parties have executed

this Agreement to be effective as of the date first indicated above.

| |

DENNIS W. DOLL |

MIDDLESEX WATER COMPANY |

| |

|

|

|

|

| |

By: |

/s/ Dennis W. Doll |

By: |

/s/ A. Bruce O’Connor |

| |

|

Dennis W. Doll |

|

A. Bruce O’Connor |

| |

|

Consultant |

|

Sr. Vice President, Chief |

| |

|

|

|

Financial Officer & |

| |

|

|

|

Treasurer |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |