Filed

Pursuant to Rule 433

Registration

Statement No. 333-272616

Issuer

Free Writing Prospectus dated February 3, 2025

Relating

to Prospectus Supplement dated February 3, 2025

MicroVision

Bolsters Financial Position with Debt Reduction and up to $17 Million in New Capital

REDMOND,

WA / ACCESSWIRE / February 3, 2025 / MicroVision, Inc. (NASDAQ:MVIS), a leader in MEMS-based solid-state automotive lidar and

ADAS solutions, today announced that it has bolstered its financial position by entering into an agreement to raise up to $17 million

in new capital and reducing future cash obligations stemming from its $75 million senior secured convertible note facility with High

Trail Capital.

“Strengthening

our financial position through this infusion of new capital and reduction of debt buoys our efforts to advance and secure revenue opportunities

with several industrial customers in the heavy equipment segment. As announced last month, we have increased production capacity with

our manufacturing partner to support high-volume orders from industrial customers in 2025 and beyond,” said Sumit Sharma, Chief

Executive Officer. “At this exciting time for MicroVision, we continue to work to secure multiple partnerships with industrial

customers, as well as advance our partnerships with automotive OEMs, with RFQs in flight and new RFQs expected in 2025. We appreciate

High Trail’s partnership at this pivotal time.”

Continued

Sharma, “With our MAVIN and MOVIA S products, we remain actively engaged with global automotive OEMs in seven high-volume RFQs

and custom development explorations for future passenger vehicle programs. With the size, power, and specifications of our lidar, combined

with our integrated perception software, I believe we remain the solution frontrunner with automotive OEMs. Given automotive OEMs’

latest start-of-production timelines, the opportunity to ramp up significant recurring revenues in 2025 with our industrial customers

puts MicroVision in the best position in the market. We remain the only multifaceted company with potential for significant revenues

from the industrial segment starting in 2025 and much higher automotive revenues expected in the coming years.”

“With

the announcement of this transaction, our overall debt obligation has now been reduced by $12.25 million in principal or over 27% of

the convertible note. In addition, this new round of equity investment by our strategic financing partner provides up to $17 million

in new equity capital and also defers a portion of the remaining repayments. This bolsters MicroVision’s balance sheet and positions

it well with its ongoing customer engagements,”

said Anubhav Verma, Chief Financial Officer. “We believe that our strong balance sheet and strategic financing partner help to

competitively position MicroVision for today’s marketplace and business outlook.”

WestPark

Capital, Inc. and D. Boral Capital LLC acted as co-lead agents for the transaction.

Key

Terms of the Transactions

In

connection with the $45 million senior secured convertible note issued by the Company on October 23, 2024, cash payments totaling approximately

$9.6 million that would have been payable during the period from March 1, 2025 through May 1, 2025 will be converted

into approximately 11.7 million shares of the Company’s common stock. In addition, pursuant to an agreement dated February

3, 2025, the note holder has agreed to defer payments due from June 1, 2025 to August 1, 2025, instead ratably allocating such payments

to the payments due from September 1, 2025 through March 1, 2026. The Company and the note holder entered into a securities purchase

agreement dated February 3, 2025 pursuant to which the Company issued approximately $8 million of shares of the Company’s

common stock to the holder at a 12.5% discount to the market price and warrants to purchase up to an additional $9 million of

common stock at an exercise price per share of $1.57, which warrants expire five years from the initial exercise date.

Disclosures

This

press release shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale

of any securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration

or qualification under the securities laws of any such state or other jurisdiction.

Additional

information, including the full terms of the financing transaction, is available in the Current Report on Form 8-K filed by MicroVision

with the U.S. Securities and Exchange Commission.

About

MicroVision

With

offices in the U.S. and Germany, MicroVision is a pioneering company in MEMS-based laser beam scanning technology that integrates MEMS,

lasers, optics, hardware, algorithms and machine learning software into its proprietary technology to address existing and emerging markets.

The Company’s integrated approach uses its proprietary technology to provide automotive lidar sensors and solutions for advanced

driver-assistance systems (ADAS) and for non-automotive applications including industrial, smart infrastructure and robotics. The Company

has been leveraging its experience building augmented reality micro-display engines, interactive display modules, and consumer lidar

modules.

For

more information, visit the Company’s website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc,

and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision,

MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties

of their respective owners.

Forward-Looking

Statements

Certain

statements contained in this release, including expected benefits and closing of financing transactions; customer engagement and the

likelihood of success; opportunities for revenue and cash; market position; product volumes, performance and capabilities; and expected

revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual

results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially

from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional

capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of

its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors;

its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual

property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the

timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products;

dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to

maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company’s SEC reports,

including the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These

factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized

that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors

set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities

laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information,

future events, changes in circumstances or any other reason.

Investor

Relations Contact

Jeff

Christensen

Darrow

Associates Investor Relations

MVIS@darrowir.com

Media

Contact

Marketing@MicroVision.com

Source:

MicroVision, Inc.

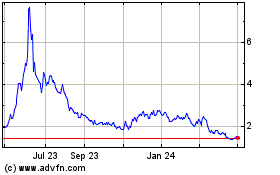

Microvision (NASDAQ:MVIS)

Historical Stock Chart

From Jan 2025 to Feb 2025

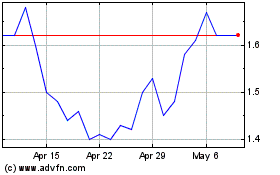

Microvision (NASDAQ:MVIS)

Historical Stock Chart

From Feb 2024 to Feb 2025