0000723125DEF 14Afalseiso4217:USD00007231252023-09-012024-08-2900007231252022-09-022023-08-3100007231252021-09-032022-09-0100007231252020-09-042021-09-020000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-09-012024-08-290000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-09-022023-08-310000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-09-032022-09-010000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-09-042021-09-020000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-09-012024-08-290000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-09-022023-08-310000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-09-032022-09-010000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-09-042021-09-020000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-09-012024-08-290000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-09-022023-08-310000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-09-032022-09-010000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-09-042021-09-020000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-09-012024-08-290000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-09-022023-08-310000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-09-032022-09-010000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-09-042021-09-020000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-09-012024-08-290000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-09-022023-08-310000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-09-032022-09-010000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-09-042021-09-020000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-09-012024-08-290000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-09-022023-08-310000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-09-032022-09-010000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-09-042021-09-020000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-09-012024-08-290000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-09-022023-08-310000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-09-032022-09-010000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-09-042021-09-020000723125ecd:EqtyAwrdsAdjsMemberecd:PeoMember2023-09-012024-08-290000723125ecd:EqtyAwrdsAdjsMemberecd:PeoMember2022-09-022023-08-310000723125ecd:EqtyAwrdsAdjsMemberecd:PeoMember2021-09-032022-09-010000723125ecd:EqtyAwrdsAdjsMemberecd:PeoMember2020-09-042021-09-020000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-09-042021-09-020000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-09-042021-09-020000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-09-042021-09-020000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-09-042021-09-020000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-09-042021-09-020000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-09-042021-09-020000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-09-042021-09-020000723125ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2023-09-012024-08-290000723125ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2022-09-022023-08-310000723125ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2021-09-032022-09-010000723125ecd:EqtyAwrdsAdjsMemberecd:NonPeoNeoMember2020-09-042021-09-02000072312512023-09-012024-08-29000072312522023-09-012024-08-29000072312532023-09-012024-08-29000072312542023-09-012024-08-29000072312552023-09-012024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) | | | | | | | | |

Filed by the Registrant ☒ |

Filed by a party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

| | | | | | | | |

| Micron Technology, Inc. |

| (Name of Registrant as Specified in Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | |

| Payment of Filing Fee (Check all boxes that apply): |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of Fiscal 2024 Annual Meeting of Shareholders

January 16, 2025

To the Shareholders of Micron Technology, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of Micron Technology, Inc., a Delaware corporation for the fiscal year ended August 29, 2024 (“Fiscal 2024”), will be held virtually on January 16, 2025, at 9:00 a.m., Pacific Standard Time, for the purposes listed below. As used herein, “we,” “our,” “us,” “Micron,” the “Company,” and similar terms refer to Micron Technology, Inc., unless the context indicates otherwise.

| | | | | | | | | | | |

| 1 | To elect eight (8) directors to our Board of Directors (the “Board”) to serve for the ensuing year and until their successors are elected and qualified; |

| 2 | To approve, on a non-binding basis, the compensation of our named executive officers; |

| 3 | To approve the 2025 Equity Incentive Plan; |

| 4 | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending August 28, 2025 (“Fiscal 2025”); and |

| 5 | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

Shareholders of record at the close of business on November 18, 2024 are entitled to receive notice of and to vote at the meeting and any postponements or adjournments of the meeting. A complete list of shareholders entitled to vote at the meeting will be available for inspection by any shareholder, for any purpose related to the meeting, for ten days prior to the meeting at our principal business offices during ordinary business hours. Please contact our Corporate Secretary at corporatesecretary@micron.com to schedule an appointment to review the list.

The Securities and Exchange Commission (“SEC”) permits proxy materials to be furnished over the Internet rather than in paper form. Accordingly, unless otherwise requested, we are sending our shareholders a notice (the “Notice”) regarding the availability of this proxy statement (the “Proxy Statement”), our Annual Report on Form 10-K for Fiscal 2024, and other proxy materials (together, the “proxy materials”) via the Internet. This electronic process gives you fast, convenient access to the proxy materials, reduces the impact on the environment, and reduces our printing and mailing costs. If you received the Notice by mail, you will not receive a printed copy of the proxy materials in the mail. The Notice instructs you on how to access and review the proxy materials. The Notice also instructs you on how you may submit your vote over the Internet. If you received a Notice by mail and would like to receive a copy of our proxy materials by electronic mail or mail, you should follow the instructions for requesting such proxy materials included in the Notice.

We are pleased to provide shareholders with the opportunity to participate in the Annual Meeting online via the Internet in a virtual-only meeting format to facilitate shareholder attendance and provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the Annual Meeting at www.virtualshareholdermeeting.com/MU2024, where you will also be able to submit questions and vote online. You will not be able to attend the Annual Meeting at a physical location.

To ensure your representation at the meeting, you are urged to vote, whether or not you attend the Annual Meeting. You may vote by telephone or electronically via the Internet by following the instructions on the Notice. Alternatively, if you received a paper copy, you may sign, date, and return the proxy card in the postage-prepaid envelope enclosed for that purpose. Please refer to the instructions included with the proxy card for additional details. Shareholders attending the Annual Meeting may vote using the virtual meeting platform even if they have already submitted their proxy, and any previous votes that were submitted by the shareholder, whether by Internet, telephone, or mail, will be superseded by the vote that such shareholder casts at the Annual Meeting.

We began distributing a Notice of Internet Availability of proxy materials, the Proxy Statement, the Annual Report on Form 10-K for Fiscal 2024, and proxy card, as applicable, to shareholders on November 26, 2024.

| | | | | | | | |

| | By Order of the Board of Directors |

Boise, Idaho November 26, 2024 | | Michael Ray Senior Vice President, Chief Legal Officer and Corporate Secretary |

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY PROMPTLY.

1

1

PROXY ROADMAP

| | | | | | | | | | | | | | |

Proposal 1 | To elect eight (8) directors to our Board | ☑ | The Board recommends that you vote “FOR” each director nominee. |

| | | | | | | | | | | | | | |

To elect eight (8) directors to serve for the ensuing year and until their successors are elected and qualified. Upon the recommendation of our Governance and Sustainability Committee, our Board has nominated eight (8) current directors for election to serve as directors. See “Proposal 1—Election of Directors” on page 6. |

| | | | |

OUR BOARD NOMINEES |

| | | | |

| Richard M. Beyer | | | Mary Pat McCarthy |

| | |

| Former Chairman and Chief Executive Officer of Freescale Semiconductor, Inc. | | Former Vice Chair of KPMG LLP |

|

|

| | | | |

| Lynn A. Dugle | | | Sanjay Mehrotra |

| | |

| Former Chairman, Chief Executive Officer, and President of Engility Holdings Inc. | | Micron’s President and Chief Executive Officer |

|

|

| | | | |

| Steven J. Gomo | | | Robert Swan |

| | |

| Former Executive Vice President, Finance and Chief Financial Officer of NetApp, Inc. | | Operating Partner at Andreessen Horowitz; Former Chief Executive Officer and Chief Financial Officer of Intel Corporation |

|

|

| | | | |

| Linnie M. Haynesworth | | | MaryAnn Wright |

| | |

| Former Sector Vice President, Cyber and Intelligence of Mission Solutions Division at Northrop Grumman | | Former Group Vice President of Engineering and Product Development of Johnson Controls International |

|

|

| | | | |

| | | | | | | | | | | | | | |

Proposal 2 | To approve, on a non-binding basis, the compensation of our named executive officers | ☑ | The Board recommends that you vote “FOR” Proposal 2. |

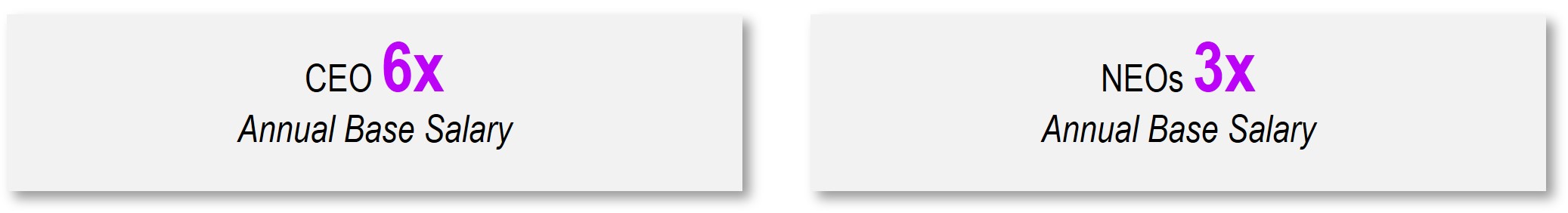

For additional details on compensation of our named executive officers (the “Named Executive Officers” or the “NEOs” as defined in the section “Executive Compensation and Related Information —Compensation Discussion and Analysis—Named Executive Officers”), see “Proposal 2—Say-on-Pay” on page 35. EXECUTIVE COMPENSATION HIGHLIGHTS

3

3

| | | | | | | | | | | | | | |

Proposal 3 | To approve the 2025 Equity Incentive Plan | ☑ | The Board recommends that you vote “FOR” Proposal 3. |

Equity compensation is a critical component of our compensation program, please refer to page 83 for more details on the Board’s recommendation. |

Proposal 4 | Ratification of Appointment of Independent Registered Public Accounting Firm | ☑ | The Board recommends that you vote “FOR” Proposal 4. |

The Board recommends ratifying the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm. Please see page 95 for additional information. |

| | | | | | | | | | | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting |

| to be held on January 16, 2025: | |

| | | |

The Proxy Statement and Annual Report on Form 10-K for Fiscal 2024 are available at www.proxyvote.com. |

We began distributing a Notice of Internet Availability of proxy materials, the Proxy Statement, the Annual Report on Form 10-K for Fiscal 2024, and proxy card, as applicable, to shareholders on November 26, 2024. |

|

TABLE OF CONTENTS

| | | | | | | | | | | | | | | | | |

Proxy Section | Page | Frequently Requested Information | Page |

| Notice of Annual Meeting | | | |

| | | |

Corporate Governance | | | |

| | | |

Board of Directors | | | |

| Nominees for Election | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Compensation Committee Report | | | |

Compensation Tables | | | |

Summary Compensation Table | | | |

Grants of Plan-Based Awards | | | |

Outstanding Equity Awards | | | |

Option Exercises and Stock Vested | | | |

Nonqualified Deferred Compensation | | | |

Chief Executive Officer Pay Ratio | | | |

Potential Payments Upon Termination or Change in Control | | | |

Equity Compensation Plan Information | | | |

Pay Versus Performance | | | |

Proposal 3 - Approval of the 2025 Equity Incentive Plan | | | |

Proposal 4 - Ratification of Appointment of PricewaterhouseCoopers LLP | | | |

Principal Shareholders | | | |

Information Concerning Solicitation and Voting | | | |

Incorporation by Reference of Certain Financial Information | | | |

Householding of Proxy Statements and Annual Reports | | | |

Cautionary Note on Forward-Looking Statements | | | |

Deadline for Receipt of Shareholder Proposals | | | |

Appendix A - 2025 Equity Incentive Plan | | | | |

| | | | |

5

5

| | |

CORPORATE GOVERNANCE |

|

PROPOSAL 1 - ELECTION OF DIRECTORS |

•All directors elected annually by a simple majority of votes cast •Independent Board Chair or Lead Independent Director •Seven of eight director nominees are independent |

|

|

Our Board has nominated eight (8) individuals for election as directors at the Annual Meeting. Each of the nominees is currently a member of our Board and each nominee was elected to our Board at the Annual Meeting of Shareholders for the fiscal year ended August 31, 2023 (“Fiscal 2023”), except for Mr. Swan, who was appointed to the Board in March 2024 and was recommended to the Governance and Sustainability Committee by our Chief Executive Officer (“CEO”).

In October 2024, Mr. Switz, the current Chair of our Board provided notice that he would retire from the Board and would not seek re-election at the Annual Meeting. Mr. Switz will continue to serve as a director and as Chair through the end of his term at the Annual Meeting.

Each director elected at the Annual Meeting will serve until our Annual Meeting of Shareholders for Fiscal 2025 and until a successor is duly elected and qualified, except in the case of death, resignation or removal of such director. Each of the nominees has consented to be named in this Proxy Statement and to serve as a director if elected. If any nominee is unable or unwilling to stand for election or serve as a director if elected, the persons named as proxies may vote for a substitute nominee designated by our existing Board, or our Board may choose to reduce its size.

The Board recommends voting “FOR” the election of each of the nominees.

| | | | | |

| VOTE REQUIRED FOR APPROVAL | |

| |

Each director nominee will be elected as a director if such nominee receives the affirmative vote of a majority of the votes cast with respect to his or her election (in other words, the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” that director). Shareholders are not permitted to cumulate votes with respect to the election of directors.

If a nominee who is serving as a director is not elected at the Annual Meeting by the requisite majority of votes cast, Delaware law provides that the director would continue to serve on our Board as a holdover director. However, under our Corporate Governance Guidelines, each incumbent nominee is required to submit a contingent resignation to the Chair of the Governance and Sustainability Committee. If the incumbent nominee fails to receive a majority of the votes cast in an election that is not a “contested election” (as defined in our Amended and Restated Bylaws (as currently in effect, the “Bylaws”)), the Governance and Sustainability Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will act on the resignation, taking into account the Governance and Sustainability Committee’s recommendation, and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified.

| | |

BOARD OF DIRECTORS |

NOMINEES FOR ELECTION |

| | | | | | | | |

Richard M. Beyer Independent

Age | 76 Director Since | 2013

Committees Compensation (Chair), Governance and Sustainability, Security | Professional Experience |

• | Chairman and Chief Executive Officer of Freescale Semiconductor, Inc., a semiconductor manufacturer, from 2008 through June 2012; director from 2008 to 2013. |

| • | Prior to Freescale, Mr. Beyer was President, Chief Executive Officer and a director of Intersil Corporation, a semiconductor company, from 2002 to 2008. |

| • | Mr. Beyer previously served in executive management roles at FVC.com, VLSI Technology, and National Semiconductor Corporation, and served three years as an officer in the United States Marine Corps. |

| • | Within the past five years, Mr. Beyer served on the Board of Directors of Dialog Semiconductor. |

| Other Current Public Company Directorships |

| • | None |

| Board Skills, Qualifications, and Expertise |

Mr. Beyer’s experience as the chief executive officer and a director at leading technology companies provides our Board expertise in the technology industry and also in corporate strategy, financial management, operations, marketing, and research and development, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Mr. Beyer to serve as a member of our Board. |

| | | | | | | | |

Lynn A. Dugle Independent

Age | 65 Director Since | 2020

Committees Governance and Sustainability, Security | Professional Experience |

• | Chairman, Chief Executive Officer, and President of Engility Holdings Inc., an NYSE-listed engineering services firm, from March 2016 to January 2019. |

• | Prior to Engility, Ms. Dugle was Corporate Vice President, President of Intelligence and Information Systems of Raytheon Company, a U.S. defense contractor and industrial corporation, from January 2009 to March 2015. |

• | Within the past five years, Ms. Dugle served on the Board of Directors of State Street Corporation. |

| Other Current Public Company Directorships |

• | EOG Resources, Inc. |

• | KBR, Inc. |

• | TE Connectivity Ltd. |

| Board Skills, Qualifications, and Expertise |

| Ms. Dugle’s experience as chairman and chief executive officer of a public engineering services firm and senior officer of a leading public technology company provides our Board expertise in information, technology, cybersecurity, corporate strategy, operations, and research and development, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Ms. Dugle to serve as a member of our Board. |

7

7

| | | | | | | | |

Steven J. Gomo Independent

Age | 72 Director Since | 2018

Committees Audit, Finance (Chair) | Professional Experience |

• | Executive Vice President, Finance and Chief Financial Officer from October 2004 until his retirement in December 2011, and Senior Vice President, Finance and Chief Financial Officer from August 2002 to September 2004 at NetApp, Inc., a storage and data management company. |

| Other Current Public Company Directorships |

• | Nutanix, Inc. |

• | Enphase Energy, Inc. |

| Board Skills, Qualifications, and Expertise |

| Mr. Gomo’s experience as the chief financial officer of a public technology company provides our Board expertise in the technology industry, particularly in the areas of finance, accounting, treasury, investor relations, and securities, which contribute valuable insights and perspectives to our business and operations. We believe these experiences, qualifications, attributes, and skills qualify Mr. Gomo to serve as a member of our Board. |

| | | | | | | | |

Linnie M. Haynesworth Independent

Age | 67 Director Since | 2021

Committees Audit, Security (Chair) | Professional Experience |

• | Sector Vice President, Cyber and Intelligence Mission Solutions Division from January 2016 to 2019, and Sector Vice President and General Manager from December 2013 to 2019 at Northrop Grumman, a defense and space company. |

| Other Current Public Company Directorships |

• | Truist Financial Corporation |

• | Automatic Data Processing, Inc. |

• | Eastman Chemical Company |

| Board Skills, Qualifications, and Expertise |

| Ms. Haynesworth’s experience as the sector vice president and general manager of a public defense and space company provides our Board expertise in technology integration, cybersecurity (including a Certificate in Cybersecurity Oversight), enterprise strategy, risk management, and large complex system development, delivery, and deployment, and contributes valuable insights and perspectives to our business and operations. Additionally, Ms. Haynesworth became a Member of the Defense Business Board of the United States Department of Defense in November 2021. We believe these experiences, qualifications, attributes, and skills qualify Ms. Haynesworth to serve as a member of our Board. |

| | | | | | | | |

Mary Pat McCarthy Independent

Age | 69 Director Since | 2018

Committees Audit (Chair), Finance | Professional Experience |

• | Vice Chair of KPMG LLP, the U.S. member firm of the global audit, tax, and advisory services firm, from July 1998 until her retirement in December 2011. Ms. McCarthy joined KPMG in 1977, became a partner in 1987, and held numerous senior leadership positions with the firm during her tenure. |

| Other Current Public Company Directorships |

• | Palo Alto Networks, Inc. |

| Board Skills, Qualifications, and Expertise |

| Ms. McCarthy’s experience advising numerous companies on financial and accounting matters as a Certified Public Accountant (ret.) provides our Board deep technical expertise in financial and accounting matters, and contributes valuable insights and perspectives to our business and operations. We believe these experiences, qualifications, attributes, and skills qualify Ms. McCarthy to serve as a member of our Board. |

| | | | | | | | |

Sanjay Mehrotra Chief Executive Officer

Age | 66 Director Since | 2017

Committees Finance | Professional Experience |

• | Mr. Mehrotra has served as Micron’s President, Chief Executive Officer, and Director since May 2017. |

• | Prior to that, Mr. Mehrotra co-founded and led SanDisk Corporation as a start-up in 1988 until its eventual sale in May 2016, serving as its President and Chief Executive Officer from January 2011 to May 2016 and as a member of its Board of Directors from July 2010 to May 2016. |

| Other Current Public Company Directorships |

• | CDW Corporation |

| Board Skills, Qualifications, and Expertise |

Mr. Mehrotra has more than 40 years of experience in the semiconductor memory industry, and as a co-founder of SanDisk, he offers a unique perspective on the industry and has significant senior leadership and technological expertise. In addition, Mr. Mehrotra’s experience provides our Board expertise in finance, corporate development, corporate governance, and business strategy, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Mr. Mehrotra to serve as a member of our Board. |

9

9

| | | | | | | | |

Robert Swan Independent

Age | 64 Director Since | 2024

Committees Audit, Finance | Professional Experience |

• | Operating Partner at Andreessen Horowitz since July 2021. Prior to that, Mr. Swan served at Intel Corporation as CEO from February 2019 to February 2021, as Interim CEO and Executive Vice President, CFO from June 2018 to January 2019 and as Executive Vice President, CFO from October 2016 to June 2018. Prior to joining Intel, Mr. Swan held several senior management roles at other companies, including CFO at eBay Inc., Electronic Data Systems Corp., TRW Inc., and Webvan Group, Inc., where he additionally served as COO and CEO. |

• | Within the past five years, Mr. Swan served on the Board of Directors of eBay and Intel and served on the Board of Commissioners of GoTo Group. |

| Other Current Public Company Directorships |

• | Nike, Inc. |

| Board Skills, Qualifications, and Expertise |

Mr. Swan’s experience as a former CEO and CFO of public technology companies in the semiconductor memory industry, including Intel, provides our Board expertise in our industry and technology as well as finance, business development, manufacturing, operations, corporate governance and information security expertise. We believe these experiences, qualifications, attributes, and skills qualify Mr. Swan to serve as a member of our Board. |

| | | | | | | | |

MaryAnn Wright Independent

Age | 62 Director Since | 2019

Committees Compensation, Governance and Sustainability (Chair) | Professional Experience |

• | Group Vice President of Engineering and Product Development of Johnson Controls International from 2013 to 2017. Ms. Wright also served as Vice President and General Manager for Johnson Controls’ Hybrid Systems business and as CEO of Johnson Controls-Saft from 2007 to 2009. |

• | Prior to joining Johnson Controls, Ms. Wright served in the Office of the Chair and was EVP Engineering, Sales and Program Management at Collins & Aikman Corporation from 2006 to 2007. |

• | Prior to that, Ms. Wright held several executive positions at Ford Motor Company, including Chief Engineer, from 2003 to 2005, and Director of Sustainable Mobility Technologies and Hybrid and Fuel Cell Vehicle Programs from 2004 to 2005. |

• | Within the past five years, Ms. Wright served on the Board of Directors of Maxim Integrated Products, Inc. and Delphi Technologies. |

| Other Current Public Company Directorships |

• | Group 1 Automotive, Inc. |

• | Brunswick Corporation |

• | Solid Power, Inc. |

| Board Skills, Qualifications, and Expertise |

| Ms. Wright’s extensive experience in, and knowledge of, the automotive industry (OEM and Tier 1 supplier), public board experience and her expertise in vehicle, advance powertrain, and energy storage system technologies, provide our Board expertise in the technology industry as well as business operations, finance, corporate development, corporate governance, and management, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Ms. Wright to serve as a member of our Board. |

10 | 2024 Proxy Statement

| | | | | | | | |

| | |

| | Professional Experience |

Robert E. Switz Independent, Chair of the Board

Age | 78 Director Since | 2006

Committees Compensation, Governance and Sustainability | • | President and Chief Executive Officer of ADC Telecommunications, Inc., a supplier of network infrastructure products and services, from August 2003 until December 2010 and Chairman from 2008 until December 2010, when Tyco Electronics Ltd. acquired ADC. Mr. Switz joined ADC in 1994 and throughout his career there held numerous leadership positions. |

• | Within the past five years, Mr. Switz served on the Board of Directors of Mandiant, Inc. (formerly FireEye, Inc.). |

| Other Current Public Company Directorships |

• | Marvell Technology Group Ltd. |

| Board Skills, Qualifications, and Expertise |

Appointed Chair of Micron’s Board in 2012, Mr. Switz’s experience as Chief Executive Officer and Chairman of a leading technology company and history and leadership on Micron’s Board provide the Board expertise in the technology industry as well as international business operations, finance, corporate development, corporate governance, and management, all of which are critical to achieving our strategic objectives. We believe these experiences, qualifications, attributes, and skills qualify Mr. Switz to serve as a member of our Board. |

|

|

|

|

There are no family relationships between any of our directors or executive officers.

BOARD SNAPSHOT:

11

11

| | | | | |

DIRECTOR SKILLS AND EXPERIENCE

| |

| |

The skills that we value for our Board align with our vision to be a global leader in memory and storage solutions, to transform how the world uses information to enrich life for all. The below table provides an overview of the collective skills of our Board and our nominees and why each is essential to the oversight and successful execution of our strategy and values.

| | | | | | | | |

| Skills and Experience | Alignment to Micron’s Strategy and Values |

| Multinational Experience Experience with businesses with significant global operations | Micron is a global leader in memory with over 48,000 employees spanning multiple countries. Our directors provide valuable business and cultural perspectives aligned to our core vision and mission. |

| Executive Leadership (public or private) Experience in a senior leadership role | The scale and complexity of our industry requires leadership with strategic clarity and an understanding of how to execute our biggest goals. |

| Operations/Manufacturing Experience with global, large-scale complex operations or manufacturing | Our business model involves a complex distribution and supply chain network. Our directors oversee and guide operational efficiencies in various facets of our operations. |

| Strategy/Marketing Experience with sales or marketing strategy | We win by knowing our customers and our Board provides guidance in marketing and sales strategy. |

| Cybersecurity Experience managing cybersecurity, information, and data security risks | Protecting our data and assets requires constant vigilance and awareness of cybersecurity threats. Having directors with a background in cyber oversight allows our Board to assist management in identifying and mitigating these threats. |

| Governance/Public Company Board Service Experience on a public company’s board of directors overseeing corporate governance programs and policies | Our Board emphasizes good board and governance practices and provides valuable oversight in our evolving regulatory environment. |

| Finance Experience overseeing financial reporting | We are a large-scale technology company in a capital-intensive industry, which requires complex financial management. Our Board is an integral part of this function. |

12 | 2024 Proxy Statement

| | | | | | | | |

| Auditing/Accounting Experience overseeing auditing and accounting | Experience with accounting or auditing allows our Board to provide key oversight of our financial reporting processes and internal controls. |

| Strategy/Innovation Experience setting and executing corporate strategies geared towards long-term success | Innovation is at the heart of Micron and our Board’s experience with emerging technologies and strategic planning gives us valuable perspective as we assess and execute on our strategic objectives. |

| Risk Management Experience assessing and responding to enterprise risks | Risk management oversight experience promotes our ability to detect, evaluate, and respond to enterprise risks, including environmental risks. |

| Human Capital Management Experience in human capital management in large global organizations | Our people are integral to our success, and we care about their successes as well. Our Board’s experiences with management, talent retention and development, and corporate culture provides key insights for our continued investment in our people globally. |

| Technology/Semiconductor Experience in the semiconductor industry or other relevant technology industries | We benefit from our Board’s experience and knowledge of the business, technology, products, operations and challenges that impact semiconductor companies or other companies in the technology sector. |

| Public Policy/Political Affairs Experience obtained through substantive engagements with policymakers or government agencies | Experience working with policymakers or government agencies provides the necessary insight into the political and regulatory matters that impact our Company and its stakeholders. Our Board helps to guide our engagement with regulators and policymakers. |

| | |

13

13

SUMMARY OF SKILLS AND EXPERIENCE OF DIRECTORS AND NOMINEES

The Governance and Sustainability Committee oversees the Board’s composition and identifies and continually refines the list of skills, attributes, and experiences that it believes will result in an effective, dynamic, and diverse Board. The Governance and Sustainability Committee uses the insights this matrix provides to recommend committee assignments and inform searches for new director candidates or opportunities to refresh Board composition. During its most recent annual update, the Governance and Sustainability Committee undertook a comprehensive review and refresh of the skills matrix to ensure it is aligned to our business, including defining the skills and adding a statement on the importance of each skill.

The following table highlights the specific skills, experience, qualifications and attributes that each of our directors and nominees brings to the Board. A particular director or nominee may possess other skills, experience, qualifications or attributes even though they are not indicated below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Skills and Experience | Richard M. Beyer | Lynn A. Dugle | Steven J. Gomo | Linnie M. Haynesworth | Mary Pat McCarthy | Sanjay Mehrotra | Robert Swan | Robert E. Switz | MaryAnn Wright |

| Multinational experience | • | • | • | • | • | • | • | • | • |

| Executive leadership (public or private) | • | • | • | • | • | • | • | • | • |

Operations/Manufacturing | • | • | • | • | | • | • | • | • |

Strategy/Marketing | • | |

| • |

| • | • | • | • |

Cybersecurity |

| • | • | • |

| | • | |

|

Governance/Public Company Board Service | • | • | • | • | • | • | • | • | • |

Finance | • | • | • | • |

| • | • | • |

|

Auditing/Accounting |

| | • | | • | | • | • |

|

Strategy/Innovation | • | • | • | • | | • | • | • | • |

Risk Management | • | • | • | • | • | • | • | • | • |

Human Capital Management | • | • | • | | • | • | • | • | • |

Technology/Semiconductor | • | | • | • | • | • | • | • | • |

Public Policy/Political Affairs | • | • |

| |

| • | • | | • |

Gender | | | | | | | | | |

Age | 76 | 65 | 72 | 67 | 69 | 66 | 64 | 78 | 62 |

Director Since | 2013 | 2020 | 2018 | 2021 | 2018 | 2017 | 2024 | 2006 | 2019 |

Tenure (Years) | 11 | 4 | 6 | 3 | 6 | 7 | 0 | 18 | 5 |

14 | 2024 Proxy Statement

The Governance and Sustainability Committee is committed to continuing to identify and recruit highly qualified director candidates with diverse experiences, perspectives, and backgrounds to join our Board. The table below provides certain diversity information regarding the composition of our Board. The diversity table required by the Nasdaq Stock Market LLC (“Nasdaq”) can be found in Appendix B.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity |

Demographic/Diversity Categories | Richard M. Beyer | Lynn A. Dugle | Steven J. Gomo | Linnie M. Haynesworth | Mary Pat McCarthy | Sanjay Mehrotra | Robert Swan | Robert E. Switz | MaryAnn Wright |

African American or Black | | | | • | | | | | |

Alaskan Native or Native American | | | | | | | | | |

Asian | | | | | | • | | | |

Hispanic or Latinx | | |

| |

| | | | |

Native Hawaiian or Pacific Islander |

| |

| |

| | | |

|

White | • | • | • | | • | | • | • | • |

Two or More Races or Ethnicities | | | | |

| | | |

|

LGBTQ+ |

| | | | | | | |

|

Military Veteran | • | | | | | | | | |

15

15

| | | | | |

DIRECTOR NOMINATIONS AND BOARD REFRESHMENT

|

| |

NOMINATION PROCESS

The Governance and Sustainability Committee regularly reviews the appropriate size and composition of the Board, including by anticipating vacancies and required expertise for the effective oversight of the Company. In evaluating the existing Board and any desired characteristics of potential nominees, the Governance and Sustainability Committee considers, among other things, the knowledge, experience, integrity, and judgment of the candidates, their contribution to the diversity of backgrounds, experience and skills on the Board, and their ability to devote sufficient time and effort to their duties as directors and provide appropriate oversight. The Governance and Sustainability Committee considers the following skills and experience particularly relevant: experience in the semiconductor industry or related industries; strong business acumen and judgment; excellent interpersonal skills; business relationships with key individuals in industry, government, and education that may be of assistance to us and our operations; familiarity with accounting rules and practices; and “independence” as defined and required by the Listing Rules of the Nasdaq and relevant rules and regulations of the SEC. The Governance and Sustainability Committee then recommends the selected candidates to the Board.

When the Board decides to add directors to the Board, the Governance and Sustainability Committee may work with a third-party executive search firm to assist in identifying and evaluating potential candidates for which it may pay a fee.

Although the Governance and Sustainability Committee has not established specific diversity guidelines, the Board seeks to maintain a balance of perspectives, qualities, and skills on the Board to obtain a diversity of viewpoints to better understand the technical, economic, political, and social environments in which we operate and to enhance Micron’s performance. Accordingly, the Governance and Sustainability Committee takes into account the personal characteristics, experience, and skills of current and prospective directors, including gender, race, and ethnicity, to ensure that our Board comprises a broad range of perspectives, and measures success by, among other things, the range of viewpoints represented on the Board.

DIRECTOR TIME COMMITMENT POLICY

Our Corporate Governance Guidelines contain the following limits on the number of public company board commitments a director may have.

| | | | | | | | | | | |

| Director Category | Director Time Service Limits |

| Non-Employee Directors | No More than 4 Other Public Company Boards |

| Employee Directors | No More than 2 Other Public Company Boards |

This limitation will not apply if the Board determines that simultaneous service does not impair the ability of the member to effectively serve on the Board. A director’s time commitment is considered as part of the director nomination process and is reviewed annually.

BOARD REFRESHMENT

The Board believes that periodic director refreshment can provide new experiences and fresh perspectives to our Board and is most effective if it is sufficiently balanced with continuity among Board members that will allow for the sharing of historical perspectives and experiences relevant to the Company. Our Board seeks to achieve this balance through its director succession planning process, as well as in response to the annual Board and individual director assessment process discussed below. With the appointments of Mr. Swan in 2024 and Ms.

16 | 2024 Proxy Statement

Haynesworth in 2021, our Board refreshed its composition while maintaining institutional knowledge with directors of varying lengths of tenure.

DIRECTOR ONBOARDING AND CONTINUING EDUCATION

We maintain a comprehensive director onboarding program focused on introducing new directors to our business and facilitating director integration on our Board, which is regularly updated. Our program is designed to familiarize new directors with our business, organization, strategies and policies and assists new directors in developing company and industry knowledge to optimize their service on the Board. Our process also includes one-on-one meetings with several members of our senior management.

Regular continuing education programs enhance the skills and knowledge directors use to perform their responsibilities. These programs may include internally developed materials and presentations, programs presented by third parties and financial and administrative support to attend academic or other independent programs.

BOARD SELF-EVALUATION

The Governance and Sustainability Committee oversees the Board’s ongoing and annual assessments of its effectiveness, including the effectiveness of its committees and directors. All directors complete an evaluation form for the Board and for each committee on which they serve. These forms include ratings for certain key metrics, as well as the opportunity for written comments. The comments provide key insights into the areas in which directors believe the Board can improve or in which its performance is strong. Evaluation topics include number and length of meetings, topics covered, and materials provided, committee structure and activities, Board composition and expertise, succession planning, director participation and interaction with management, and promotion of ethical behavior. Our Board considers the results when making decisions on the composition, structure and responsibilities of our Board and its committees, agendas and meeting schedules for our Board and its committees, and changes in the performance or functioning of our Board, and such evaluations are taken into account when the Board makes decisions regarding nominations of directors.

17

17

| | | | | |

THE BOARD’S ROLES AND RESPONSIBILITIES |

| |

THE BOARD’S ROLE IN RISK OVERSIGHT

Risk Oversight, Assessment and Mitigation

We operate in a dynamic economic, social, and political landscape, making structured and conscientious risk management more important than ever. Our Board reviews and oversees our enterprise risk management program, which is a unified approach to risk management that helps us achieve a shared understanding of risks and make informed business decisions. This approach enhances our capability to address future events that create uncertainty and respond in an efficient and effective manner. It also facilitates prompt action to mitigate identified risks and embeds risk management into our culture.

The Board has delegated primary oversight of our enterprise risk management process to the Audit Committee, which conducts reviews of our risk assessment and enterprise risk management policies as described below, including overseeing the management of risks related to financial reporting and compliance. Other Board committees provide additional insights into our enterprise risk management program in the areas of their core competencies, and report to the Board regularly on matters relating to the following specific areas of risk the committees oversee:

•The Compensation Committee oversees management of risks relating to our compensation plans and programs.

•The Finance Committee oversees the Company’s strategies for management of significant financial risks.

•The Governance and Sustainability Committee oversees risks associated with the Board’s governance, director independence, the Company’s human capital programs and sustainability initiatives, and public policy and government affairs activities.

•The Security Committee oversees risks associated with physical security and cybersecurity.

In performing their oversight responsibilities, the Board and each committee has full access to management, as well as the ability to engage independent advisors. In addition, the Chair of the Board leads regular executive sessions of the independent directors, facilitates cross-committee feedback, and fosters open dialogue and constructive feedback among the independent directors, which further supports the Board’s ability to fulfill its risk oversight duties. Following the conclusion of our Annual Meeting, our Lead Independent Director will fulfill these duties. See “Proposal 1 - Election of Directors—Board’s Roles and Responsibilities—Board Leadership Structure.”

Enterprise Risk Management Process

We designed our enterprise risk management program to clearly identify risk management roles and responsibilities, bring together senior management to discuss risk, promote visibility and constructive dialogue, and facilitate risk response and mitigation strategies. The Audit Committee plays a key role in this process, and the full Board conducts periodic reviews.

Our Vice President of Risk Advisory Services coordinates two enterprise risk management workstreams:

•Quarterly Assessment by Risk Council: This workstream consists of a quarterly meeting of the Risk Council, which is composed of representatives from all our major functions. The Risk Council evaluates our operations and surrounding circumstances, identifying potential events, trends or operational conditions that could result in a risk exposure, referred to as Risk Triggers. Once the most significant Risk Triggers are identified, Risk Advisory Services performs an evaluation of their potential impacts on us, assesses if the existing business processes and controls are sufficient to manage the risk and identifies if

18 | 2024 Proxy Statement

additional risk mitigating actions are needed. Where additional actions are deemed necessary, the Risk Council representative of the relevant function coordinates the implementation of such actions. The results of Risk Council quarterly assessments are presented to the Company’s senior leadership and the Audit Committee for review and discussion, and feedback from these parties is taken into consideration in the implementation of such actions.

•Annual Process Owner Risk Self-Assessment: Annually, Risk Advisory Services facilitates a process where key process owners across the enterprise evaluate their processes’ ability to mitigate related risks and identify necessary improvements. This assessment is presented to each functional head, where process owners and their senior functional leaders discuss the results and determine if any actions, process changes or improvements are necessary. The overall results of the annual self-assessment are presented to the Audit Committee and the Board.

The combination of these two workstreams embeds risk management in our fabric, regularly engaging leaders across the enterprise and focusing the entire organization on the identification of and mitigation of risks.

These workstreams also provide timely information to our Chief Executive Officer’s staff and the Audit Committee that is used as input in the development of the Company’s strategy and direction.

Compensation Risks

The Compensation Committee reviews our compensation programs annually to determine whether risks arising from our compensation policies and practices are reasonably likely to have a material adverse effect on us. In making this assessment, we, with guidance from our outside compensation consultants, reviewed our compensation programs to determine if the programs’ provisions and operations create undesired or unintentional risk of a material nature. The Compensation Committee then reviewed the results of our findings with our outside compensation consultant. This risk assessment process included a review of program policies and practices; program analysis to identify risk and risk-control related to the programs; and determinations as to the sufficiency of risk identification, the balance of potential risk to potential reward, and risk-control. In most cases, our compensation policies and practices are centrally designed and administered and are substantially the same across the Company. Certain internal groups have different or supplemental compensation programs tailored to their specific operations and goals, and programs may differ by country due to variations in local laws and customs. Although the Compensation Committee reviewed all compensation programs, the committee focused on the programs with variability of payout, with the ability of a participant to directly affect payout, and the controls on participant action and payout. Following the review, the Compensation Committee has concluded that our compensation policies and practices are not reasonably likely to create situations that would have a material adverse effect on us.

Cybersecurity Risks

Our Board administers its cybersecurity risk oversight function directly as a whole, as well as through the Security Committee, which is comprised of independent directors. Our Chief Security Officer and our Chief Information Officer report to our Security Committee, which oversees monitoring and incident response, risk mitigation, supply chain security, physical security, product security, insider trust, and other security-related items and are primarily responsible to assess and manage our material risks from cybersecurity threats. Our Chief Security Officer and Chief Information Officer provide quarterly briefings to the Security Committee regarding our Company’s cybersecurity risks and activities, including any recent cybersecurity incidents and related responses, cybersecurity systems testing, activities of third parties, and the like. Our Security Committee provides regular updates to the Board of Directors on such reports. In addition, our Chief Security Officer and our Chief Information Officer provide annual briefings to the Board on cybersecurity risks and activities.

19

19

Our cybersecurity policies and practices follow the cybersecurity framework of the National Institute of Standards and Technology (NIST). We periodically engage assessors, consultants, auditors or other third parties in connection with our risk assessment processes. The results of those assessments are reported to the Security Committee, and we make adjustments to our cybersecurity policies and practices as necessary in light of the assessments. While we have not experienced a material information security (cybersecurity) incident in the past three fiscal years, we maintain an information security (cybersecurity) risk insurance policy as a matter of good practice.

ARTIFICIAL INTELLIGENCE

Our vision is an artificial intelligence (“AI”) governance framework flexible enough to keep pace with emerging opportunities, challenges and risks, as well as the evolving international regulatory environment. In the fall of 2023, with Board support, we launched a generative AI governance initiative. Our governance structure provides for technical and AI risk assessment and executive leadership oversight on the innovative and responsible use of emerging generative AI-enabled solutions. We have established an Executive Committee, comprised of members of our management team, which meets periodically to review key cases escalated by the Operating Committee, and which has reviewed and approved our AI Governance Policy.

Our information technology and security teams, led by our Chief Information Officer, are responsible for our AI governance processes, with close support from our Compliance, Legal, and People teams. The cross-functional Operating Committee drives compliance with AI ethical principles and regulatory requirements in development and usage of AI systems, including generative AI tools. Our Operating Committee, which meets regularly, reports to our Chief Information Officer and provides him regular updates. Our Security Committee of the Board also receives regular updates on our AI governance process and procedures.

HUMAN CAPITAL AND CULTURE

We believe our people are our most important resource and a critical driver of our competitive advantage. Central to our continuous innovation is an ingrained culture of inclusion, well-being, and continuous learning. Our Board considers a diverse and inclusive environment to be a crucial element of the Company’s business strategy, including effectively addressing customer, shareholder, and other stakeholder needs. The Board has tasked the Company’s management team with taking a proactive approach to developing the semiconductor workforce of the future, and periodically reviews our programs and processes to ensure continual improvement. In addition to this proactive approach to improving our Company, the Board encouraged the Company to commit resources to the well-being of our communities around the globe. Such resources include the Company-established Micron Foundation whose purpose is to provide grants that increase access to STEM education and careers and towards resources for basic living needs. In Fiscal 2024, we continued to invest in strategic partnerships to bolster the representation of underrepresented groups, upheld pay equity, and continued our work to strengthen our culture of inclusion. The diversity, equality, and inclusion (“DEI”) commitments set forth in our 2023 DEI Annual Report extend beyond Micron to the broader communities where we work and live, and exemplify our dedication to accelerating inclusive economic prospects, nurturing diverse business ecosystems, and ensuring their sustainable growth. Micron’s business requires the kind of innovation and resilience that can only be delivered by a supply chain that embraces inclusive sourcing practices. That’s why for the last four years, we have developed goals around our diverse supplier representation and spend and have exceeded those goals each year.

Diversity

Our Board believes a diverse workforce is a competitive advantage and that diverse teams drive more innovation, delivering value to our customers and increased returns to shareholders. We believe diverse teams expand creativity and problem-solving, lead to better decision-making, and enhance team member engagement and retention. Encouraged by our Board, our proactive strategies tap into latent talent, reaching out to communities of women, veterans, people with disabilities, rural communities, and other underrepresented groups globally. This is bolstered by leveraging cutting-edge technologies, forming robust industry alliances, fostering academic collaborations, and curating innovative avenues for non-traditional talent pathways like apprenticeships and return-to-work programs.

20 | 2024 Proxy Statement

Equality

We believe our vision to enrich life for all includes how we compensate our employees. We analyze our global compensation and benefits to ensure opportunities for all employees because our People value makes it essential that we pay everyone fairly. With the assistance of a third-party specialist and state-of-the-art technology, we analyze and rectify any disparities in compensation. This rigor encompasses all groups: including women, veterans, people with disabilities, and specific racial and ethnic communities. In Fiscal 2024, we reinstated our cash bonus program and, for Fiscal 2024, we proudly achieved global pay equity across base pay, bonus and equity.

Inclusion

We believe that creating an inclusive culture at Micron helps us unleash the full potential of our team members, so everyone feels seen, heard, valued, and respected. These values help us create an environment where team members know they can bring their whole selves to work. To further this mission, we have required comprehensive training for all employees on fostering a respectful workplace, free from harassment or discrimination. We also launched a new initiative this year to provide training for our senior leaders on the four stages of psychological safety, demonstrating our commitment to inclusivity. Furthermore, recognizing the significance of mental health and well-being, we offer a global employee assistance program and provide opportunities for team members to engage in social connection and build relationships through onsite workplace experience events. We also leverage our 10 Employee Resource Groups (“ERGs”), whose members are our ambassadors of inclusion. ERG membership now exceeds more than half our workforce population, with nearly 56% of our global team members belonging to at least one ERG in Fiscal 2024, and we reward our ERG leaders with stock grants for their leadership.

For detailed insight into our DEI initiatives and their global impact, please refer to our latest DEI Annual Report available at micron.com/DEI.

SUSTAINABILITY

Our commitment to understanding and addressing environmental, social, and governance (“ESG”) issues along our value chain and in our communities is a critical part of our culture and our vision to transform how the world uses information to enrich life for all. Our Board considers ESG issues to be an integral part of its business oversight and our corporate strategy and has encouraged a proactive approach toward mitigating our impact on the environment, supporting our team members and the communities in which they live, respecting human rights, driving transparency and accountability in our supply chain, and developing innovative products that support a sustainable future. We have developed and are executing a sustainability strategy in response to these issues that leverages our leading products, responsible sourcing and operations, and engaged team members.

The Board, supported by the Governance and Sustainability Committee and other Board committees as needed, oversees and monitors the development and integration of this strategy and regularly reviews sustainability performance. Board oversight includes, but is not limited to, monitoring material ESG trends and related long- and short-term impacts of the Company’s operations, supply chains, and products, as well as the Company’s activities and annual public reporting on these topics directed by the Company’s Sustainability Council, sustainability staff, and various teams implementing the Company’s sustainability efforts.

The Governance and Sustainability Committee reviews and discusses ESG issues at each regularly scheduled committee meeting. Discussions and reports to the committee include information about significant ESG issues, such as observations from consultations with team members, customers, investors, and other stakeholders about their interests and expectations for us; our social and environmental impacts and benefits; and the impacts of these issues on our business. The Governance and Sustainability Committee regularly reviews the establishment and implementation of our long-term environmental goals and aspirations. As our programs continue to evolve, we revisit these goals to drive greater performance and address the expectations of our stakeholders. In 2020, we set ambitious long-term goals for emissions, energy, water, and waste. In 2022, we expanded our ambitions, setting new goals for our climate initiatives. We expect to allocate about $1 billion of capital expenditures between 2021 and 2028 to support these goals, though we cannot guarantee that our environmental goals and aspirations set forth below will be realized. These goals and initiatives have been developed based in part on feedback from

21

21

investors, customers, and team members, and are a critical component of our management of evolving physical, regulatory, market, supply chain, and other risks and opportunities related to climate change, water availability, and other ESG issues.

| | | | | | | | |

| Our Environmental Goals and Aspirations |

| Goals | Aspirations |

| Emissions: | 75% reduction in greenhouse gas emissions per unit of production in calendar year 2030 vs. calendar year 2018

42% absolute reduction in scope 1 emissions by calendar year 2030 from the calendar year 2020 baseline | Net zero scope 1 and 2 emissions by calendar year 2050 |

| Energy: | 100% renewable electricity in U.S. operations by the end of calendar year 2025

100% renewable electricity in Malaysia (ongoing) | 100% renewable energy globally, where available |

| Water: | 75% water conservation through reuse, recycling, and restoration in calendar year 2030 | 100% water conservation through reuse, recycling, and restoration |

| Waste: | 95% reuse, recycle, and recovery and zero hazardous waste to landfill in calendar year 2030* | Zero waste to landfill through waste minimization, reuse, recycling, and recovery |

* Subject to vendor availability

In Fiscal 2024, the Board also reviewed:

•our annual sustainability report content and processes, which includes indexes and information aligning with the Sustainability Accounting Standards Board (“SASB”) semiconductor industry standard and Taskforce on Climate-related Financial Disclosures (“TCFD”), supporting investor requests to align with the SASB standard and TCFD recommendations;

•our responsible sourcing and human rights efforts, including our conflict minerals report outlining our response to human rights and other concerns related to mineral sourcing as well as our annual modern slavery and human trafficking statement;

•our human capital initiatives, including our talent acquisition, retention, and development policies and practices; and

•findings from team member, customer, investor and other stakeholder engagement exercises.

We strive to make a positive impact on our team members, the communities in which we operate, and the planet, as well as our customers’ sustainability performance. We plan to continue regular consultation with stakeholders regarding environmental and social issues and report annually on our progress in these efforts. Our 2024 Sustainability Report, available at micron.com/sustainability and micron.com/esg, includes more details about the ways we are committed to sustainable practices and supporting our global community.

BOARD STRUCTURE

Director Independence

The Board has determined that directors Beyer, Dugle, Gomo, Haynesworth, McCarthy, Swan, Switz, and Wright qualify as independent directors as defined in the Listing Rules of Nasdaq. None of these directors have a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

22 | 2024 Proxy Statement

Board Leadership Structure

Our Board is currently led by Robert E. Switz, who has served as the Chair of the Board since February 2012. Mr. Switz is an independent director, and as such, the Board has not appointed a Lead Independent Director.

In his role as Chair, Mr. Switz oversees our Board and facilitates the flow of information between it and management. This fosters open dialogue and constructive feedback among our independent Board members and management. In particular, our Chair has the following duties and responsibilities, as determined by the Board and set forth in our Corporate Governance Guidelines:

•serves as a liaison between the Chief Executive Officer and the independent directors;

•presides at, and chairs, Board meetings and meetings of shareholders;

•establishes agendas for each Board meeting in consultation with the chairs of applicable committees of the Board;

•leads executive sessions of the Board;

•has authority to call Board meetings, special meetings of shareholders, and meetings of the independent directors;

•leads the Board in discussions concerning the Chief Executive Officer’s performance and Chief Executive Officer succession;

•approves meeting schedules for the Board;

•approves information sent to the Board;

•if requested by major shareholders, is available for consultation and direct communication; and

•performs such other duties and responsibilities as requested by the Board.

Board Leadership Transition

In October 2024, Mr. Switz, the current Chair of our Board, provided notice that he would retire from the Board and would not seek re-election at the Annual Meeting. Mr. Switz will continue to serve as a director and as Chair through the end of his term at the Annual Meeting.

We do not have a fixed policy on whether the roles of Chair of the Board and Chief Executive Officer should be separate or combined. Our Governance and Sustainability Committee conducts an annual assessment of the Board’s leadership structure and, when appropriate, recommends changes to the Board’s leadership structure to the Board for approval, taking into consideration the needs of the Board and the Company at such time. The Board believes its programs for overseeing risk, as described under “—The Board’s Role in Risk Oversight—Risk Oversight, Assessment, and Mitigation” above, would be effective under a variety of leadership frameworks and therefore do not materially affect its choice of structure.

In light of Mr. Switz’s retirement, the Board reviewed the Board leadership structure, considered the benefits and risks of the current structure, as well as a combined Chair/Chief Executive Officer leadership structure, taking into account the Company’s practices for ensuring independent Board oversight of management. After consideration, our Board determined that combining the roles of Chair and Chief Executive Officer (in combination with a Lead Independent Director) is the most effective leadership structure for the Company at this time, and unanimously appointed Mr. Mehrotra as Chair effective upon Mr. Switz’s retirement.

Since joining Micron in 2017 as President and Chief Executive Officer, Mehrotra has shown strong leadership of the Company’s strategy and business operations and has transformed the Company into a technology, product, and manufacturing leader. During his time as Chief Executive Officer, the Company has introduced multiple generations of both DRAM and NAND ahead of its competitors and delivered industry-leading products acknowledged for their world-class quality. Mr. Mehrotra has been widely recognized for his leadership and contributions to the memory and storage industry and this Board leadership structure will clearly allocate primary

23

23

responsibility for the operational leadership and strategic direction of the Company to our Chair and Chief Executive Officer, while enabling the Lead Independent Director to facilitate our Board’s independent oversight of management, promote communication between management and our Board, and support our Board’s consideration of key governance matters.

Our Corporate Governance Guidelines provide that when the role of the Chair is combined with that of the Chief Executive Officer, the independent directors are required to appoint a lead independent director. Accordingly, the Board unanimously elected Lynn Dugle as our Lead Independent Director, which will be effective upon Mr. Switz’s retirement. Ms. Dugle will provide strong independent leadership, which is essential for our Board to effectively perform its primary oversight functions, and provide the Board with the opportunity to constructively challenge management, while leveraging Mr. Mehrotra’s deep understanding of the business, the semiconductor industry and technology to elevate the right strategic opportunities and key risks and mitigation approaches to the Board’s attention.

In her role as Lead Independent Director, Ms. Dugle will oversee our Board and facilitate the flow of information between it and management. This fosters open dialogue and constructive feedback among our independent Board members and management. In particular, our Lead Independent Director will have duties as set forth in our Corporate Governance Guidelines as follows, as well as such other duties and responsibilities as requested by the Board:

•serve as a liaison between the Chief Executive Officer and the independent directors;

•lead executive sessions of the Board;

•have authority to call Board meetings, special meetings of shareholders, and meetings of the independent directors;

•lead the Board in discussions concerning the Chief Executive Officer’s performance and Chief Executive Officer succession;

•approve meeting agendas and meeting schedules for the Board;

•approve information sent to the Board; and

•if requested by major shareholders, be available for consultation and direct communication.

We believe it is essential that the Board maintain the flexibility to determine its leadership structure based on the particular composition of the Board and continuity of leadership, the individuals serving in leadership positions and the evolving needs and opportunities of the Company and considerations. Accordingly, the Board will continue to consider its leadership structure from time to time.

Board Meetings and Committees

Our Board held seven formal meetings during Fiscal 2024. The Board met in Executive Session (meetings in which only independent directors are present) four times during Fiscal 2024. In Fiscal 2024, the Board had a standing Audit Committee, Compensation Committee, Finance Committee, Governance and Sustainability Committee, and Security Committee. During Fiscal 2024, the Audit Committee met eight times, the Compensation Committee met five times, the Finance Committee met four times, the Governance and Sustainability Committee met four times, and the Security Committee met five times. In addition to formal committee meetings, the chair of each committee engaged in regular discussions with management regarding various issues relevant to their respective committees. All incumbent directors attended 75% or more of the total number of meetings of the Board and the committees on which they served during Fiscal 2024. We expect director attendance at the Annual Meeting of Shareholders, and all then-serving members of our Board were present at our Fiscal 2023 Annual Meeting of Shareholders.

24 | 2024 Proxy Statement

The Audit, Compensation, Finance, Governance and Sustainability, and Security Committees each have written charters that comply with SEC and Nasdaq rules relating to corporate governance matters. The complete duties and responsibilities of each of the committees are set forth in their written charters. Copies of the committee charters as well as our Corporate Governance Guidelines are available on the corporate governance portion of our website at www.micron.com and are also available in print without charge upon request to corporatesecretary@micron.com.

Audit Committee

Mses. McCarthy and Haynesworth and Messrs. Gomo and Swan currently serve, and during Fiscal 2024 served, on the Audit Committee. Ms. Haynesworth joined the Audit Committee in January 2024, replacing Ms. Dugle. Mr. Swan joined the Audit Committee in March 2024. Ms. McCarthy has served as Chair of the Audit Committee since January 2023. The Board has determined that all Audit Committee members are independent under the rules applicable to audit committee members promulgated by the SEC and Nasdaq and that each of these members is sufficiently proficient in reading and understanding our financial statements to serve on the Audit Committee. The Board has determined that each of Ms. McCarthy and Messrs. Gomo and Swan qualifies as an “audit committee financial expert” for purposes of the rules and regulations of the SEC.

| | | | | | | | | | | | | | |

Audit Committee | | Primary Responsibilities |

| | | | |

| 8 | | Assist the Board in overseeing and monitoring: |

Meetings in Fiscal 2024 | | • | the integrity of our financial statements; |

| 4 | | • | the adequacy of our internal controls and procedures; |

Members | | • | the performance of our internal audit function and of our independent registered public accounting firm; |

| |

| Mary Pat McCarthy, Chair | | • | any related party transactions; |

| Steven J. Gomo | | • | the qualifications and independence of our independent registered public accounting firm; and |

| Linnie M. Haynesworth | |

| Robert Swan | | • | our compliance with legal and regulatory requirements. |

| | Prepare the Audit Committee Report that is included in our proxy statement. |

Compensation Committee

Ms. Wright and Messrs. Beyer and Switz currently serve, and during Fiscal 2024 served, on the Compensation Committee. Mr. Beyer has served as Chair of the Compensation Committee since April 2021. Mr. Switz will continue to serve as a member of the Compensation Committee until his term as a director ends at the Annual Meeting. The Board has determined that all Compensation Committee members are independent under the rules applicable to compensation committee members promulgated by the SEC and the Listing Rules of Nasdaq and each qualifies as a “non-employee director” as defined under Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee is responsible for reviewing and approving the compensation of our executive officers. See “Executive Compensation and Related Information—Compensation Discussion and Analysis” and “Executive Compensation and Related Information—Compensation Committee Report” for information regarding how the Compensation Committee sets executive compensation levels. The Compensation Committee has authority to delegate any of its responsibilities to a subcommittee as it may deem appropriate in its judgment.

25

25

| | | | | | | | | | | | | | |

Compensation Committee | | Primary Responsibilities |

| | | | |

| 5 | | • | Review and approve salaries, bonuses, equity awards, other compensation, and the performance measures and goals for our Chief Executive Officer and other executive officers. |

Meetings in Fiscal 2024 | |

| 3 | | • | Review and approve amendments to or terminations of any compensatory contracts with the Chief Executive Officer or other executive officers. |

| Members | |