MeiraGTx Holdings plc (Nasdaq: MGTX), a vertically integrated,

clinical stage genetic medicines company, today announced financial

and operational results for the third quarter ended September 30,

2024, and provided a corporate update. The Company also announced

that following meetings with the UK Medicines and Healthcare

products Regulatory Agency (MHRA), the Company intends to submit a

Marketing Authorization Application under exceptional circumstances

for AAV-AIPL1 in the United Kingdom without the need for further

clinical studies. The Company is also initiating discussions with

the FDA around the potential for a similar pathway to approval in

the U.S. In addition, MeiraGTx announced that the Offices of Orphan

Products Development and Pediatric Therapeutics of the U.S. Food

and Drug Administration (FDA) have granted the Company three Rare

Pediatric Disease Designations to its AAV8-RK-AIPL1 program,

AAV8-RK-BBS10 program, and AAV5-RDH12 program, each for the

treatment of inherited retinal diseases.

“The past few months at MeiraGTx have been highlighted by

exceptional clinical, regulatory, and research and development

advancements,” said Alexandria Forbes, Ph.D., president and chief

executive officer of MeiraGTx. “In October, we announced positive

data from our AAV-GAD bridging study using material

manufactured in house at MeiraGTx. This study was a randomized,

sham-controlled clinical study of AAV-GAD for the treatment of

Parkinson’s disease, demonstrating that the treatment is safe and

leads to significant and clinically meaningful improvements in key

efficacy endpoints including UPDRS Part 3 ’off’ score and PDQ-39

quality of life measure. Based on these extremely promising

results, we are engaging with global regulatory agencies to

initiate a Phase 3 registrational study.”

Dr. Forbes added, “We also just received RPDD for three

additional programs in our pipeline, a remarkable regulatory

achievement for the Company. This underscores the groundbreaking

therapeutic potential of our technology to uniquely address these

severe childhood blinding conditions and offer hope to the families

impacted. Upon FDA approval of a product with RPDD, we are eligible

to receive a priority review voucher which could provide meaningful

non-dilutive capital, as such vouchers have sold for $150 million

and $158 million in recent weeks.”

Dr. Forbes continued, “The AIPL1 program exemplifies how

MeiraGTx has leveraged our internal manufacturing infrastructure

and clinical expertise and worked with regulators to expedite by

many years the delivery of these potentially life changing

treatments to affected children. By releasing AAV-AIPL1 under our

MHRA manufacturing specials license, MeiraGTx was uniquely placed

to provide expert clinicians with a potential therapy for these

children prior to formal clinical studies. LCA4 caused by mutations

in the AIPL1 gene results in blindness from birth, with complete

degeneration of the retina by the age of four. Eleven children were

treated between 1 and 4 years old with MeiraGTx’s AAV-AIPL1

therapy. All 11 children, each of whom was blind from birth gained

vision within 6 weeks of treatment. These extraordinary results

supported a successful application to the MHRA Innovative Licensing

and Access Pathway (ILAP), and with the award of the Innovation

Passport, allowed an expedited Scientific Advice Meeting with the

MHRA. During the meeting, agreement was reached that we are in a

position to file a Marketing Authorization Application under

exceptional circumstance based on the data from these 11 children

with no further clinical studies required. In addition, because of

our end-to-end internal manufacturing infrastructure, we have also

agreed on the CMC requirement for approval. We have already engaged

with the FDA to discuss a path to potential approval in the U.S.,

and we will continue to explore this type of expedited approval

pathway for AIPL1 with other global agencies while investigating a

similar strategy with the other RPDD awarded indications, including

BBS10.”

“The potential approval of transformative products for rare and

devastating pediatric disorders in an expedited fashion is

extremely exciting, allowing us to more rapidly advance potential

treatments to severely impacted children many years faster than

possible via the standard approval pathway. This is an illustration

of the practical importance of optimizing our approach to viral

vector development, as well as internalizing full commercial ready

CMC capabilities, in developing effective treatments for rare,

severe, rapidly degenerative diseases.”

Recent Development Highlights and Anticipated

Milestones

AAV-GAD for the Treatment of Parkinson’s

Disease:

The primary study objective of safety and tolerability was met

and significant and clinically meaningful improvements from

baseline were demonstrated for key efficacy endpoints at 26

weeks.

Top-line data summary:

- AAV-GAD was safe and well tolerated, with no serious adverse

events (SAEs) related to AAV-GAD treatment.

- At Week 26, a statistically significant 18-point average

improvement from baseline in Unified Parkinson’s Disease Rating

Scale (UPDRS) Part 3 “off” medication score was demonstrated in the

high dose group (p=0.03), with no significant change in the sham or

low dose groups. For the UPDRS Part 3 in the “off” state, a change

of 5 to 10 points is considered clinically meaningful.

- Significant improvements from baseline in the disease-specific,

patient-reported quality of life Parkinson’s Disease Questionnaire

(PDQ-39) score were demonstrated in both the high and low dose

groups with no significant change in the sham group at Week 26:

- In the high dose AAV-GAD group, the PDQ-39 score improved by 8

points from baseline (p=0.02), the low dose group improved by 6

points from baseline (p=0.04), while the 0.2 point worsening in the

sham surgery group was not statistically significant. For the

PDQ-39, a 2 to 4-point change is considered clinically

meaningful.

- A dose response in PDQ-39 score was observed, with 100% of

participants in the high dose group, 60% of participants in the low

dose group, and 25% of participants in the sham surgery group

reporting an improvement.

- For the PDQ-39 score, there was a trend to significance between

the high dose and sham surgery groups at 6 months (n=4 evaluable

per group).

AAV-AIPL1 for the Treatment of Leber Congenital

Amaurosis (LCA4) Retinal Dystrophy:

- Following recent meetings with the MHRA, the Company intends to

submit a Marketing Authorization Application (MAA) under

exceptional circumstances for AAV-AIPL1 in the United Kingdom.

- The Company is currently engaging with the FDA to discuss a

path forward for regulatory approval in the United States.

- MeiraGTx was awarded an Innovation Passport designation by the

U.K. Innovative Licensing and Access Pathway Steering Group for

AAV8-RK-AIPL1.

- Meaningful responses have been observed in 11 out of 11 LCA4

children treated to date with AAV-AIPL1. All children were treated

between 1 and 4 years old, all were blind on treatment, and all

gained visual acuity 4 or more weeks following treatment.

- The Company’s AAV-AIPL1 for the treatment of inherited retinal

dystrophy due to defects in the AIPL1 gene has been

granted orphan drug and now RPDD by the FDA and orphan designation

by the European Commission.

Rare Pediatric Disease Designation Awards from the

FDA:

- The Offices of Orphan Products Development and Pediatric

Therapeutics of the FDA has granted RPDD to three of MeiraGTx’s

inherited retinal disease programs:

- AAV8-RK-AIPL1 for the treatment of LCA4 retinal dystrophy

- AAV8-RK-BBS10 for the treatment of Bardet-Biedl syndrome (BBS)

due to BBS10 mutations

- AAV5-RDH12 for the treatment of RDH12 associated retinal

dystrophy

An RPDD may be granted by the FDA to drugs and biologics

intended to treat certain orphan diseases affecting fewer than

200,000 patients in the U.S., the serious or life-threatening

manifestations of which primarily affect individuals aged 18 years

or younger. Under the FDA’s Rare Pediatric Disease Priority Review

Voucher (PRV) program, a sponsor that receives approval for a

biologics license application for a rare pediatric disease may be

eligible to receive a voucher for a priority review of a subsequent

marketing application for a different product. PRVs may be used by

the sponsor or sold to another sponsor for their use and have

recently been sold for between $100 million to $158 million.

AAV2-hAQP1 for the Treatment of Xerostomia:

- Data from the Company’s Phase 1 AQUAx clinical trial were

presented in an oral session at the American Academy of Oral

Medicine (AAOM) 2024 annual meeting in April 2024, demonstrating

that treatment with AAV2-hAQP1 resulted in significant improvements

across three different patient-reported outcomes and in saliva

production, with no treatment-related serious adverse events or

dose-limiting toxicities reported.

- The Company continues to enroll and dose participants at

multiple sites in the U.S., Canada and the U.K. in the Phase 2

AQUAx2 (NCT05926765) randomized, double-blind, placebo-controlled

study.

- The Company recently gained alignment with the FDA on

requirements for the ongoing Phase 2 AQUAx2 clinical trial for

grade 2/3 radiation-induced xerostomia to be considered a pivotal

trial in support of a potential BLA filing.

Botaretigene Sparoparvovec for the Treatment of

XLRP:

- Data from the Phase 3 LUMEOS trial of botaretigene

sparoparvovec (bota-vec) for the treatment of X-linked retinitis

pigmentosa in collaboration with Johnson & Johnson Innovative

Medicine is expected towards the end of this year. The Company is

eligible to receive up to $285 million upon the first commercial

sales of bota-vec in the U.S. and EU and manufacturing tech

transfer.

- MeiraGTx also entered into a commercial supply agreement with

Johnson & Johnson Innovative Medicine for bota-vec

manufacturing, which the Company anticipates will generate

additional revenue during the product launch.

Riboswitch Gene Regulation Technology Platform

for in vivo

Delivery:

- MeiraGTx continues to progress its riboswitch technology

platform in multiple potential indications, with an initial focus

on obesity and metabolic disease and CAR-T for oncology and

autoimmune disease.

- The Company continues to generate compelling preclinical data

with metabolic peptides and hormones including incretins, myokines

and leptin which suggests greater efficacy on weight loss as well

as positive impact on fat to muscle ratio with certain novel

combinations of peptides.

- The Company is in dialogue with regulatory agencies and intends

to initiate first in human studies using the riboswitch platform

for an undisclosed metabolic disease indication in 2025.

As of September 30, 2024, MeiraGTx had cash and cash equivalents

of approximately $122.9 million as well as approximately $3.3

million in receivables due from Johnson & Johnson Innovative

Medicine. The Company believes that with such funds, as well as

anticipated near-term milestones from Johnson & Johnson

Innovative Medicine under the asset purchase agreement, together

with the tax incentive receivable, it will have sufficient capital

to fund operating expenses and capital expenditure requirements

into the second quarter of 2026. This estimate does not include the

$285.0 million in milestones the Company is eligible to receive

under the asset purchase agreement upon first commercial sale of

bota-vec in the United States and in at least one of the United

Kingdom, France, Germany, Spain and Italy, and for completion of

the transfer of certain manufacturing technology.

Financial Results

Cash, cash equivalents and restricted cash were $125.0 million

as of September 30, 2024, compared to $130.6 million as of December

31, 2023.

Service revenue was $10.9 million for the three months ended

September 30, 2024 due to progress of process performance

qualification (PPQ) services under the asset purchase agreement and

related agreements with Johnson & Johnson Innovative

Medicine.

There was no license revenue for the three months ended

September 30, 2024, compared to $5.1 million for the three months

ended September 30, 2023. The decrease is due to the termination of

the collaboration agreement concurrent with the execution of the

asset purchase agreement with Johnson & Johnson Innovative

Medicine.

Cost of service revenue was $12.0 million for the three months

ended September 30, 2024 due to progress of PPQ services under the

asset purchase agreement and related agreements with Johnson &

Johnson Innovative Medicine.

General and administrative expenses were $12.7 million for the

three months ended September 30, 2024, compared to $10.0 million

for the three months ended September 30, 2023. The increase of $2.7

million was primarily due to an increase in legal and accounting

fees, other office related costs, payroll and payroll-related costs

and consulting fees. These increases were partially offset by a

decrease in share-based compensation, rent and facilities costs and

insurance costs.

Research and development expenses for the three months ended

September 30, 2024 were $26.2 million, compared to $27.9 million

for the three months ended September 30, 2023. The decrease of $1.6

million was primarily due to a decrease in manufacturing costs

primarily due to an increase in the number of batches of clinical

trial material produced, which costs were charged to the clinical

programs, a reduction in manufacturing material purchases during

the three months ended September 30, 2024 compared to the three

months ended September 30, 2023 as well as a reclassification of

cost of service revenue due to progress of PPQ services provided

under the asset purchase agreement and related agreements. This

decrease was partially offset by a reduction in reimbursements from

Johnson & Johnson Innovative Medicine as the reimbursement for

the three months ended September 30, 2023 was in connection with

research funding provided under the collaboration agreement, which

was terminated on December 20, 2023. Expenses related to our

preclinical programs increased primarily related to development of

our preclinical ocular disease programs and clinical trial expenses

increased primarily due to an increase in the number of batches of

clinical trial material produced during the three months ended

September 30, 2024 compared to the three months ended September 30,

2023, which costs were charged from manufacturing costs to the

clinical programs. The increase in clinical trial expenses was

partially offset by a decrease in costs related to bota-vec as

Johnson & Johnson Innovative Medicine is now primarily funding

the expenses related to this program as a result of the asset

purchase agreement. Additionally, other research and development

expenses increased.

Foreign currency gain was $3.5 million for the three months

ended September 30, 2024, compared to a loss of $8.7 million for

the three months ended September 30, 2023. The change of $12.1

million was primarily due to the restructuring and payment of

certain intercompany receivables and payables. Foreign currency

gains and losses subsequent to the restructuring are recorded as a

part of accumulated other comprehensive income.

Interest income was $1.2 million for the three months ended

September 30, 2024, compared to $0.5 million for the three months

ended September 30, 2023. The increase of $0.7 million was due to

higher interest rates and cash balances during 2024.

Interest expense was $3.4 million for each of the three months

ended September 30, 2024 and September 30, 2023.

Loss on sale of nonfinancial assets was $0.6 million for the

three months ended September 30, 2024, which was a result of an

adjustment to the allocation of the transaction price and $50.0

million milestone payment to the performance obligations identified

under the asset purchase agreement. The nonfinancial assets were

sold and assigned to Johnson & Johnson Innovative Medicine

including a License Agreement between the Company and UCL Business

Plc (now UCL Business Ltd.) relating to the research, development,

manufacture and exploitation of bota-vec, and other related assets

pursuant in the asset purchase agreement.

Net loss attributable to ordinary shareholders for the quarter

ended September 30, 2024, was $39.3 million, or $0.55 basic and

diluted net loss per ordinary share, compared to a net loss

attributable to ordinary shareholders of $44.3 million, or $0.74

basic and diluted net loss per ordinary share for the quarter ended

September 30, 2023.

About AAV8-RK-AIPL1

AAV8-RK-AIPL1 is an investigational genetic medicine for the

treatment of one of the most severe forms of Leber congenital

amaurosis (LCA) owing to genetic deficiency of

Aryl-hydrocarbon-interacting protein-like 1 (AIPL1). It is

delivered via subretinal injection to children, and through a

one-time administration, AAV8-RK-AIPL1 is designed to deliver

functional copies of the AIPL1 gene to cone and rod photoreceptors

in the central retina to slow further degeneration and restore

vision.

About AAV8-RK-BBS10

The investigational genetic medicine AAV8-RK-BBS10 is an

adeno-associated virus with a serotype 8 capsid with a

complementary DNA (cDNA) encoding the human BBS10 gene for

treatment of Bardet-Biedl syndrome (BBS) due to BBS10 mutations.

BBS is a rare genetic disease affecting approximately 1 in 250,000

people around the world. One of the primary symptoms of BBS is

visual impairment secondary to retinal degeneration. More than 20

different genes are associated with the development of BBS, with

BBS10 accounting for approximately 25% of cases.

About AAV5-RDH12

The investigational genetic medicine AAV5-RDH12 is an

adeno-associated virus serotype 5 containing the human RDH12 gene

for treatment of RDH12 associated retinal dystrophy. Defects in

retinol dehydrogenase 12 (RDH12) account for 3–10% of Leber

congenital amaurosis (LCA) and early-onset severe retinal dystrophy

(EOSRD) and is particularly devastating due to early macular

atrophy. RDH12 encodes retinol dehydrogenase 12, an enzyme

expressed in photoreceptors that reduces all-trans-retinal to

all-trans-retinol.

About MeiraGTx

MeiraGTx (Nasdaq: MGTX) is a vertically integrated,

clinical-stage genetic medicines company with a broad pipeline of

late-stage clinical programs supported by end-to-end manufacturing

capabilities. MeiraGTx has internal plasmid production for GMP, two

GMP viral vector production facilities as well as an in-house

Quality Control hub for stability and release, all fit for IND

through commercial supply. In addition, MeiraGTx has developed a

proprietary manufacturing platform with leading yield and quality

aspects and commercial readiness, core capabilities in viral vector

design and optimization and a transformative riboswitch gene

regulation platform technology that allows for the precise,

dose-responsive control of gene expression by oral small molecules.

MeiraGTx is focusing the riboswitch platform on the delivery

of metabolic peptides, including GLP-1, GIP, Glucagon, and PYY,

using oral small molecules, as well as cell therapy for oncology

and autoimmune diseases. MeiraGTx has developed the technology to

apply genetic medicine to more common diseases, increasing

efficacy, addressing novel targets, and expanding access in some of

the largest disease areas where the unmet need remains high.

For more information, please visit www.meiragtx.com.

Forward Looking Statement

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, without limitation,

statements regarding our product candidate development, and

anticipated milestones regarding our pre-clinical and clinical

data, reporting of such data and the timing of results of data and

regulatory matters, as well as statements that include the words

“expect,” “will,” “intend,” “plan,” “believe,” “project,”

“forecast,” “estimate,” “may,” “could,” “should,” “would,”

“continue,” “anticipate” and similar statements of a future or

forward-looking nature. These forward-looking statements are based

on management’s current expectations. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements, including, but not

limited to, our incurrence of significant losses; any inability to

achieve or maintain profitability, raise additional capital, repay

our debt obligations, identify additional and develop existing

product candidates, successfully execute strategic transactions or

priorities, bring product candidates to market, expansion of our

manufacturing facilities and processes, successfully enroll

patients in and complete clinical trials, accurately predict growth

assumptions, recognize benefits of any orphan drug or rare

pediatric disease designations, retain key personnel or attract

qualified employees, or incur expected levels of operating

expenses; the impact of pandemics, epidemics or outbreaks of

infectious diseases on the status, enrollment, timing and results

of our clinical trials and on our business, results of operations

and financial condition; failure of early data to predict eventual

outcomes; failure to obtain FDA or other regulatory approval for

product candidates within expected time frames or at all; the novel

nature and impact of negative public opinion of gene therapy;

failure to comply with ongoing regulatory obligations;

contamination or shortage of raw materials or other manufacturing

issues; changes in healthcare laws; risks associated with our

international operations; significant competition in the

pharmaceutical and biotechnology industries; dependence on third

parties; risks related to intellectual property; changes in tax

policy or treatment; our ability to utilize our loss and tax credit

carryforwards; litigation risks; and the other important factors

discussed under the caption “Risk Factors” in our Quarterly Report

on Form 10-Q for the quarter ended September 30, 2024, as such

factors may be updated from time to time in our other filings with

the SEC, which are accessible on the SEC’s website at www.sec.gov.

These and other important factors could cause actual results to

differ materially from those indicated by the forward-looking

statements made in this press release. Any such forward-looking

statements represent management’s estimates as of the date of this

press release. While we may elect to update such forward-looking

statements at some point in the future, unless required by law, we

disclaim any obligation to do so, even if subsequent events cause

our views to change. Thus, one should not assume that our silence

over time means that actual events are bearing out as expressed or

implied in such forward-looking statements. These forward-looking

statements should not be relied upon as representing our views as

of any date subsequent to the date of this press release.

Contacts

Investors:MeiraGTxInvestors@meiragtx.com

or

Media:Jason Braco, Ph.D.LifeSci

Communicationsjbraco@lifescicomms.com

| |

|

MEIRAGTX HOLDINGS PLC AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

(unaudited) |

|

(in thousands, except share and per share

amounts) |

| |

| |

|

FortheThree-Month Periods Ended September 30, |

|

FortheNine-Month Periods Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Service revenue – related party |

|

$ |

10,910 |

|

|

$ |

— |

|

|

$ |

11,889 |

|

|

$ |

— |

|

| License revenue – related

party |

|

|

— |

|

|

|

5,103 |

|

|

|

— |

|

|

|

11,977 |

|

| Total revenue |

|

|

10,910 |

|

|

|

5,103 |

|

|

|

11,889 |

|

|

|

11,977 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of service revenue – related party |

|

|

11,985 |

|

|

|

— |

|

|

|

11,985 |

|

|

|

— |

|

|

General and administrative |

|

|

12,723 |

|

|

|

10,009 |

|

|

|

37,127 |

|

|

|

35,169 |

|

|

Research and development |

|

|

26,243 |

|

|

|

27,856 |

|

|

|

95,499 |

|

|

|

70,115 |

|

| Total operating expenses |

|

|

50,951 |

|

|

|

37,865 |

|

|

|

144,611 |

|

|

|

105,284 |

|

| Loss from operations |

|

|

(40,041 |

) |

|

|

(32,762 |

) |

|

|

(132,722 |

) |

|

|

(93,307 |

) |

| Other non-operating income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency gain (loss) |

|

|

3,463 |

|

|

|

(8,677 |

) |

|

|

2,644 |

|

|

|

(2,915 |

) |

|

Interest income |

|

|

1,189 |

|

|

|

523 |

|

|

|

3,113 |

|

|

|

1,723 |

|

|

Interest expense |

|

|

(3,357 |

) |

|

|

(3,381 |

) |

|

|

(9,861 |

) |

|

|

(9,796 |

) |

|

(Loss) gain on sale of nonfinancial assets |

|

|

(584 |

) |

|

|

— |

|

|

|

28,434 |

|

|

|

— |

|

|

Fair value adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

53 |

|

| Net loss |

|

|

(39,330 |

) |

|

|

(44,297 |

) |

|

|

(108,392 |

) |

|

|

(104,242 |

) |

| Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

(loss) gain |

|

|

(1,234 |

) |

|

|

6,007 |

|

|

|

(3,413 |

) |

|

|

1,113 |

|

| Comprehensive loss |

|

$ |

(40,564 |

) |

|

$ |

(38,290 |

) |

|

$ |

(111,805 |

) |

|

$ |

(103,129 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(39,330 |

) |

|

$ |

(44,297 |

) |

|

$ |

(108,392 |

) |

|

$ |

(104,242 |

) |

| Basic and diluted net loss per

ordinary share |

|

$ |

(0.55 |

) |

|

$ |

(0.74 |

) |

|

$ |

(1.62 |

) |

|

$ |

(1.91 |

) |

| Weighted-average number of

ordinary shares outstanding |

|

|

71,633,150 |

|

|

|

59,526,642 |

|

|

|

66,709,847 |

|

|

|

54,544,660 |

|

|

MEIRAGTX HOLDINGS PLC AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(unaudited) |

|

(in thousands, except share and per share

amounts) |

| |

| |

|

September30, |

|

December31, |

| |

|

2024 |

|

2023 |

|

ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

122,873 |

|

|

$ |

129,566 |

|

| Accounts receivable –

related party |

|

|

3,279 |

|

|

|

10,138 |

|

| Prepaid expenses |

|

|

7,029 |

|

|

|

5,625 |

|

| Tax incentive receivable |

|

|

5,152 |

|

|

|

13,277 |

|

| Other current assets |

|

|

713 |

|

|

|

1,016 |

|

|

Total Current Assets |

|

|

139,046 |

|

|

|

159,622 |

|

| |

|

|

|

|

|

|

| Property, plant and equipment,

net |

|

|

112,541 |

|

|

|

115,896 |

|

| Intangible assets, net |

|

|

951 |

|

|

|

1,118 |

|

| Restricted cash |

|

|

2,156 |

|

|

|

1,083 |

|

| Other assets |

|

|

1,139 |

|

|

|

1,917 |

|

| Equity method and other

investments |

|

|

6,766 |

|

|

|

6,766 |

|

| Right-of-use assets –

operating leases, net |

|

|

12,782 |

|

|

|

15,910 |

|

| Right-of-use assets –

finance leases, net |

|

|

24,107 |

|

|

|

24,432 |

|

|

TOTAL ASSETS |

|

$ |

299,488 |

|

|

$ |

326,744 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

| Accounts payable |

|

$ |

29,504 |

|

|

$ |

16,042 |

|

| Accrued expenses |

|

|

19,341 |

|

|

|

42,639 |

|

| Lease obligations,

current |

|

|

4,183 |

|

|

|

4,193 |

|

| Deferred revenue –

related party, current |

|

|

5,107 |

|

|

|

2,926 |

|

| Other current liabilities |

|

|

1,283 |

|

|

|

1,278 |

|

|

Total Current Liabilities |

|

|

59,418 |

|

|

|

67,078 |

|

| Deferred revenue –

related party |

|

|

58,902 |

|

|

|

34,017 |

|

| Lease obligations |

|

|

9,610 |

|

|

|

12,952 |

|

| Asset retirement

obligations |

|

|

2,880 |

|

|

|

2,401 |

|

| Note payable, net |

|

|

72,942 |

|

|

|

72,119 |

|

|

TOTAL LIABILITIES |

|

|

203,752 |

|

|

|

188,567 |

|

| |

|

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES

(Note 11) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

| Ordinary Shares, $0.00003881

par value, 1,288,327,750 authorized, 77,695,418 and 63,601,015

shares issued and outstanding at September 30, 2024 and December

31, 2023, respectively |

|

|

3 |

|

|

|

2 |

|

| Capital in excess of par

value |

|

|

763,204 |

|

|

|

693,841 |

|

| Accumulated other

comprehensive loss |

|

|

(4,848 |

) |

|

|

(1,435 |

) |

| Accumulated deficit |

|

|

(662,623 |

) |

|

|

(554,231 |

) |

|

Total Shareholders' Equity |

|

|

95,736 |

|

|

|

138,177 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

$ |

299,488 |

|

|

$ |

326,744 |

|

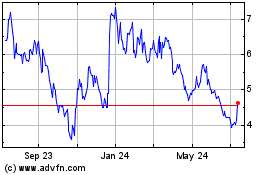

MeiraGTx (NASDAQ:MGTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

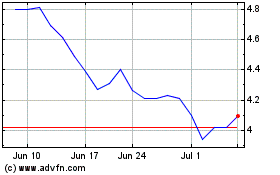

MeiraGTx (NASDAQ:MGTX)

Historical Stock Chart

From Nov 2023 to Nov 2024