Transaction Will Create One of the Largest

Multicultural Media Platforms in the Country.

MediaCo Holding Inc. (Nasdaq: MDIA) (“MediaCo”) today

announced that it has acquired all of Estrella Media’s network,

content, digital, and commercial operations. Among the Estrella

Media brands joining MediaCo are the EstrellaTV network and its

influential linear and digital video content business, and Estrella

Media’s expansive digital channels, including its four FAST

channels – EstrellaTV, Estrella News, Cine EstrellaTV, and Estrella

Games – and the EstrellaTV app. The transaction closed on April 17,

2024.

MediaCo, which operates marquee urban radio stations HOT 97 and

WBLS 107.5 in New York City, will be adding Estrella Media’s

Spanish-language video, audio, and digital content operations under

the same umbrella. This transaction will also allow MediaCo to

reach the established audiences of Estrella Media’s market-leading

Regional Mexican radio stations, including Que Buena Los Angeles,

home of the Don Cheto Al Aire nationally syndicated morning radio

show, La Raza in Houston and Dallas, and El Norte in Houston.

The combined footprint of MediaCo positions it as one of the

strongest radio content providers for Spanish and Urban music in

both terrestrial radio and audio streaming. These audiences

represent almost one third of the U.S. population and 100% of the

consumer growth in the marketplace.

Jacqueline Hernández, an established media executive, will lead

the company as the Interim CEO. Ms. Hernandez, who most recently

served as CEO and Founder of New Majority Ready, a multicultural

marketing and content strategy firm, has previously held the

position of Chief Operating Officer at Telemundo, as well as Chief

Marketing Officer at NBCUniversal Hispanic Enterprises, and

recently served as a board member of Estrella Media.

“This combination of tested media brands and talented teams will

fuel growth of content and distribution for the benefit of our

multicultural audiences,” said Ms. Hernández. “We believe this

combination is the first step in building a unique multicultural

media company that will reach diverse U.S. audiences wherever they

choose to consume content and create value for marketers working to

reach these important audiences.”

“This leverages the strengths of two great companies to build

something new,” said Deb McDermott, Chair of MediaCo. “We are

committed to representing and serving the Hispanic marketplace, as

well as continuing to represent and grow the diverse audience that

MediaCo already serves. We see a need for media brands to embrace

opportunities with all audiences, and Estrella Media is a key part

of our growth strategy.”

“Today marks the beginning of an exciting journey for MediaCo,”

said Kudjo Sogadzi, current President and COO of MediaCo. “As we

embark on this next chapter, we see a great opportunity to combine

our strengths and capabilities to redefine how we deliver media to

our diverse audiences.”

"This is a natural next step in the evolution of Estrella

Media’s content operations to better serve our important U.S.

Hispanic audience," said Peter Markham, CEO of Estrella Media.

"This transaction helps secure a bright and growing future for

MediaCo to become the preeminent media company serving the

multicultural audiences who drive ad spend ROI and brand

growth."

As part of the transaction, Estrella Media will continue to own

and operate its local radio and television stations, while MediaCo

provides the innovative programming and content to which their

audiences have grown accustomed. MediaCo will also work to increase

distribution with other broadcast partners, as well as to grow

digital streaming, CTV, and AVOD assets.

Transaction Terms

The transaction was effected pursuant to an Asset Purchase

Agreement with Estrella Broadcasting, Inc., the owner of Estrella

Media, under which a subsidiary of MediaCo purchased substantially

all of the assets of Estrella Broadcasting other than its local

radio and television stations. As part of the transaction, MediaCo

received an option to acquire those stations from Estrella

Broadcasting at a future date, subject to receipt of necessary

regulatory approval. As consideration in the transaction, Estrella

Broadcasting is receiving a warrant to purchase up to a total of

28,206,152 newly issued shares of MediaCo Class A Common Stock,

exercisable at an exercise price of $0.00001 per share; $60 million

of newly issued shares of MediaCo Series B Preferred Stock that

will accrue dividends at a rate of 6.0% per annum; a $30 million

second lien term note with a five-year term and an interest rate of

SOFR + 6.0% per annum; and approximately $30 million in cash. In

connection with the exercise of the local radio and television

stations option, Estrella Broadcasting would receive an additional

7,051,538 newly issued shares of MediaCo Class A Common Stock.

WhiteHawk Capital Partners provided a $45 million first lien

term loan facility to MediaCo in connection with the transaction,

$35 million of which has been drawn at closing. In connection with

the transaction, three designees of Estrella Broadcasting were

added to the Board of Directors of MediaCo. The transaction was

approved by the boards of directors of MediaCo and Estrella

Broadcasting.

Prior to the consummation of the transaction, Standard General

converted all of the outstanding shares of MediaCo Series A

Preferred Stock into a total of 20,733,869 shares of newly issued

shares of MediaCo Class A Common Stock in accordance with the terms

of the Series A Preferred Stock.

MediaCo is filing with the Securities and Exchange Commission a

Current Report on Form 8-K that will provide additional detail

regarding the transaction.

Fried, Frank, Harris, Shriver & Jacobson LLP and Pillsbury

Winthrop Shaw Pittman LLP served as legal counsel to MediaCo in

connection with the transaction. RBC Capital Markets, LLC served as

exclusive financial advisor to Estrella Broadcasting and Paul,

Weiss, Rifkind, Wharton & Garrison LLP and Wiley Rein LLP

served as Estrella Broadcasting’s legal counsel. Sidley Austin LLP

served as legal counsel to WhiteHawk Capital Partners.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act, as amended,

and it is intended that all forward-looking statements concerning

MediaCo and Estrella Broadcasting, the transaction and other

matters, will be subject to the safe harbor protections created

thereby. All statements contained in this communication other than

statements of historical facts, including without limitation

statements concerning MediaCo’s future performance, business

strategy, future operations, and plans and objectives of management

and related matters, contained in this communication or any

documents referred to herein are forward-looking statements. Words

such as “believe,” “may,” “will,” “expect,” “should,” “could,”

“would,” “anticipate,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “project,” “target,” “is/are

likely to,” “forecast,” “future,” “guidance,” “possible,”

“predict,” “seek,” “see,” or the negative of these terms or other

similar expressions are intended to identify forward-looking

statements, though not all forward-looking statements use these

words or expressions. These statements are neither promises nor

guarantees, but involve known and unknown risks, uncertainties and

other important factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements, including, but not limited to, the

following the potential impact of consummation of the transaction

on relationships with third parties, including clients, employees

and competitors; risks that the new businesses will not be

integrated successfully or that the combined company will not

realize estimated cost savings; risks associated with the exercise

of the option to acquire the broadcast assets of Estrella

Broadcasting at a future date, failure to realize anticipated

benefits of the combined operations; unexpected costs, charges or

expenses resulting from the transaction; and potential litigation

relating to the transaction. These and other important factors

discussed under the caption “Risk Factors” in MediaCo’s Annual

Report on Form 10-K for the year ended December 31, 2023 filed with

the SEC on April 1, 2024, as may be updated from time to time in

other filings MediaCo makes with the SEC could cause actual results

to differ materially from those indicated by the forward-looking

statements made in this communication.

These statements reflect management’s current expectations

regarding future events and operating performance and speak only as

of the date of this communication. You should not put undue

reliance on any forward-looking statements. Although we believe

that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee that future results, levels of

activity, performance and events and circumstances reflected in the

forward-looking statements will be achieved or will occur. Except

as required by law, we undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which

the statements are made or to reflect the occurrence of

unanticipated events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418153467/en/

For press inquiries: press@mediacoholding.com.

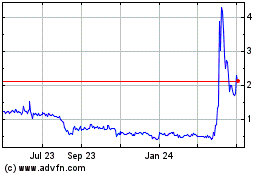

Mediaco (NASDAQ:MDIA)

Historical Stock Chart

From Dec 2024 to Jan 2025

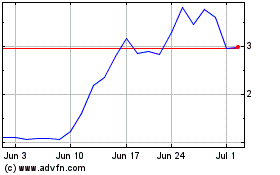

Mediaco (NASDAQ:MDIA)

Historical Stock Chart

From Jan 2024 to Jan 2025