0000891103false00008911032024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2024

MATCH GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34148 | 59-2712887 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

8750 North Central Expressway, Suite 1400

Dallas, TX 75231

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 576-9352

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.001 | | MTCH | | The Nasdaq Stock Market LLC |

| | | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Item 7.01. Regulation FD Disclosure.

On July 30, 2024, Match Group, Inc. (“Match Group”) published a shareholder letter, which included results for the quarter ended June 30, 2024. The full text of the shareholder letter, which is posted on the “Investor Relations” section of Match Group’s website at https://ir.mtch.com and appears in Exhibit 99.1 hereto, is incorporated herein by reference.

Exhibit 99.1 is being furnished under both Item 2.02 “Results of Operations and Financial Condition” and Item 7.01 “Regulation FD Disclosure.”

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | |

Exhibit Number | Description |

| |

| 104 | Inline XBRL for the cover page of this Current Report on Form 8-K |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MATCH GROUP, INC. |

| | |

| By: | /s/ Gary Swidler |

| | Gary Swidler |

| | President and Chief Financial Officer |

Date: July 30, 2024

Letter to

Q2 2024 | July 30, 2024

Second Quarter 2024 Financial Highlights

| | | | | | | | | | | | | | | | | |

| • | | Total Revenue grew 4% over the prior year quarter to $864 million. On a foreign exchange (“FX”) neutral (“FXN”) basis, Total Revenue was up 8% over the prior year quarter to $892 million. | • | | Operating income was $205 million, a decrease of 5% from the prior year quarter, representing an operating margin of 24%. |

| |

| | | |

| | | |

| | | | |

| | • | | Adjusted Operating Income was $306 million, an increase of 2% over the prior year quarter, representing an Adjusted Operating Income Margin of 35%. |

| | | |

| • | | Tinder Direct Revenue was up 1% (4% FXN), while collectively our other brands’ Direct Revenue was up 8% over the prior year quarter. Within our other brands, Hinge Direct Revenue was up 48% versus the prior year quarter. | | |

| | |

| | | |

| | | | |

| | • | | Repurchased1 $197 million of our stock in the quarter, or 6.4 million shares, at an average price of $31 per share. |

| | |

| | | |

| | | |

| | | | | |

| • | | Payers declined 5% to 14.8 million over the prior year quarter. | • | | Operating Cash Flow and Free Cash Flow were $413 million and $383 million, respectively, year-to-date as of June 30, 2024. We have deployed approximately 100% of our free cash flow year-to-date for repurchases. |

| |

| | | |

| | | | |

| • | | RPP increased 9% over the prior year quarter to $19.05. | | |

| | |

| | | |

1

11 On a trade date basis.

Dear Shareholders,

Match Group delivered Q2 results that were slightly ahead of our expectations for both Total Revenue and Adjusted Operating Income, despite incremental FX headwinds and Canada’s abrupt enactment of a retroactive Digital Services Tax. We’re pleased that Tinder’s initiatives have led to stabilization in year-over-year (“Y/Y”) monthly active user (“MAU”) trends and improving Y/Y Payer trends. We expect further improvement in Tinder’s Y/Y MAU and Payer trends in Q3, as well as strong sequential Payer net additions. More importantly, we believe Tinder has begun to lay the foundation for a broader transformation to better meet the evolving needs of today’s daters. We’re excited to see the Tinder experience and brand perception continue to improve over the coming quarters to enable a more sustainably growing business.

We’re thrilled by the exceptional performance at Hinge, which delivered another quarter of nearly 50% Y/Y Direct Revenue growth, reached the #2 dating app rank by downloads2 collectively in its core English-speaking and European expansion markets, launched exciting new marketing campaigns, and continued to make solid progress on key feature initiatives. Our E&E brands progressed on their tech re-platforming while also showing growth in several key Emerging brands. MG Asia’s Azar app delivered strong user and revenue momentum as it continued to expand across Europe.

We’ve made the decision to exit live streaming services in our dating apps and to sunset Hyperconnect’s Hakuna app, which provides live streaming services primarily in Korea and Japan. We continually evaluate our portfolio with an emphasis on making strategic decisions that strengthen our overall growth and margin profile and allow us to focus on businesses where we have deep expertise, and we’re confident this is the case with our decision to exit live streaming.

We believe we have a clear plan to drive shareholder value over the coming years: (1) re-establish sustainable growth at Tinder; (2) establish Hinge as the second largest dating app globally; (3) continue to build new growth brands including Azar, our Emerging brands, and new experiences, leveraging the latest technology; (4) maintain our historically strong financial discipline, including through efficiencies at our established platforms; and (5) return a significant amount of capital to shareholders. We look forward to sharing more about our long-term strategy and plans at our first-ever Investor Day to be held in December.

| | | | | |

| |

| Bernard Kim (“BK”) | Gary Swidler |

| Chief Executive Officer | President &

Chief Financial Officer |

2 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Among all dating apps, as defined by Match Group.

Q2 2024 Business Financial Performance

In Q2, Total Revenue grew 4% Y/Y to $864 million. RPP rose 9% Y/Y, partially offset by a 5% decrease in Payers. On an FXN basis, Total Revenue was $892 million, up 8% Y/Y.

Tinder® Direct Revenue for the quarter was up 1% Y/Y to $480 million, up 4% Y/Y FXN. RPP showed continued growth, up 10% Y/Y to $16.61. Tinder Payers declined 8% Y/Y to 9.6 million, an improvement over the 9% Y/Y decline in Q1, and down ~78,000 sequentially. Subscription revenue was solid, up 7% Y/Y, while à la carte (“ALC”) revenue remained challenged, down 17% Y/Y, although we anticipate that ALC initiatives to address these trends will begin to roll out in Q3. Tinder’s Q2 MAU were down 9% Y/Y, same as in Q1 and stable sequentially, a key first indicator of improved performance.

Hinge® Direct Revenue increased 48% Y/Y to $134 million, driven by a 19% Y/Y increase in RPP to $30 and a 24% Y/Y increase in Payers to nearly 1.5 million. Hinge’s user growth strengthened in Q2, with a 14% Y/Y increase in downloads3 globally in the quarter. Hinge moved up to the second most downloaded3 dating app collectively in both its core English-speaking and European expansion markets for the first time.

Our Match Group Asia (“MG Asia”) businesses’ Direct Revenue declined 4% Y/Y to $74 million largely due to the impacts of FX. On an FXN basis, MG Asia Direct Revenue was up 9% Y/Y, with Direct Revenue up Y/Y at both Azar® and Pairs™.

Evergreen & Emerging (“E&E”) Direct Revenue was down 8% Y/Y to $161 million. The Evergreen brands’ Direct Revenue declined 13% Y/Y, while the Emerging brands’ Direct Revenue grew 17% Y/Y, with continued solid user momentum at newer Emerging brands.

Operating Income (“OI”) in Q2 was $205 million, down 5% Y/Y, representing a margin of 24%, impacted by increased stock-based compensation expense due to higher headcount and lower forfeitures of equity awards in 2024 than in 2023, and higher depreciation expense due to increases in internally developed software placed in service. Adjusted Operating Income (“AOI”) was $306 million, up 2% Y/Y, representing a 35% margin. Both OI and AOI were unexpectedly impacted by Canada’s implementation of a Digital Services Tax retroactive to 2022, which resulted in $7.5 million of expense in the quarter.

3 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Among all dating apps, as defined by Match Group.

Intense Focus on Innovation to Drive Growth

Throughout our history, we’ve leveraged advances in technology to evolve the user experience and drive step-function changes in dating category adoption and usage rates. Tinder’s novel swiping interface led to massive viral adoption by younger daters, while Hinge‘s product experience and brand narrative attracted intentioned daters and led to explosive user growth.

We’re constantly optimizing our strategy and investment decisions to ensure they align with evolving user needs and preferences. As part of that approach, we’ve made the decision to exit live streaming services in our dating apps including Plenty of Fish®, and to sunset Hyperconnect’s Hakuna® app, which provides live streaming services primarily in Korea and Japan. These businesses lack scale in a competitive market, require substantial further investment, and we expect they will deliver margins below the total Company’s desired level. While this decision will result in the loss of approximately $60 million of annual Total Revenue, we’re confident it will be margin and growth enhancing to the Company over the medium term and will allow us to focus on our businesses where we have proven advantages. We expect that exiting these live streaming services, along with other ongoing initiatives across the portfolio, will result in total workforce reductions of approximately 6% globally, which we expect to result in annual cost savings of approximately $13 million in addition to our previously disclosed expected cost savings from platform consolidation.

We plan to re-deploy some of our retained Hyperconnect® talent, which has distinct expertise in artificial intelligence (“AI”), to our key growth apps including Azar, Tinder, and Hinge, as well as on innovation efforts to build entirely new experiences. Given the major opportunity that AI presents to improve the entire dating journey and build new experiences, we think it’s compelling to deploy our best talent in these areas.

Business Trends

Tinder: Stabilizing Trends with Product Transformation Underway

Tinder made solid progress in Q2 as a series of initiatives led to stabilizing MAU and we began to anniversary the effects of the significant trust & safety initiatives implemented mid-last year, which improved ecosystem health but meaningfully reduced Tinder’s user base. Several key product changes are now in test, including the addition of more inclusive gender identities, which are particularly important for Gen Z, as well as features focused on trust & safety and improving recommendations, especially for women. Tinder also plans to test a refreshed Explore experience, with new Swipe® gestures expected to follow. Tinder intends to build on these over the coming year, with an emphasis on deeply integrating AI across the experience to create a safer, more effective, and fun experience that addresses key user concerns and positions the app for sustained long-term growth.

Solidifying the foundation of Tinder through a cleaner ecosystem: Tinder is the category leader in trust & safety features, which are critical to the quality of the experience and the perception of the app as an effective way to meet people. Last Summer’s changes to its policies and procedures regarding users who were not there for dating purposes, were an important step forward in improving ecosystem health. Tinder recently began testing requiring face photos in select markets and plans to expand the number of test markets in August. Tinder expects to begin testing technology to further help verify the authenticity of a profile later this quarter. We believe these important initiatives will meaningfully deepen user trust and the perception of realness on the platform.

Raising the efficacy of Tinder by improving user outcomes: With a cleaner ecosystem, Tinder is working to deliver high-quality user outcomes, especially for women. Later this Summer, Tinder intends to begin testing a new feature designed to provide highly curated recommendations. Tinder plans to subsequently integrate AI capabilities into this feature to contextualize matches and drive increased relevancy.

Tinder also recently launched Photo Selector, its first major AI-driven feature designed to simplify the user journey. A Tinder survey revealed that singles aged 18-24 spend an average of 33 minutes selecting the right profile photo and roughly half find it hard to select a profile picture altogether. We believe this new feature, which automatically suggests the best photos from a user’s camera roll, will dramatically simplify profile creation and strengthen profile quality.

Bringing the fun back to Tinder: Tinder’s viral growth since its inception was driven by its engaging and fun user experience. Over time, however, sentiment has shifted as users seek a lower-pressure experience with greater authenticity that more easily delivers desired connections. We expect Tinder to begin testing new lower pressure forms of discovery in the coming quarters, including more ways for users to use Tinder with friends.

Tinder also continues to make strides in rebuilding its brand narrative through the It Starts with a Swipe™ campaign. Since the launch of the campaign, among U.S. women aged 18-30, brand perception for "Tinder is a place where I can find meaningful connections" is up by nearly 50% and Tinder’s “hook-up stigma” has fallen by 20%4. In early July, Tinder launched the newest iteration of the brand campaign, highlighting the real-life rom-com-like ‘meet cutes’ that happen on Tinder, which we expect will further propel these trends. Reaction towards the new campaign has been very strong, with positive press coverage to date. Tinder is also leveraging powerful cultural moments, including the 2024 Summer Olympics–always a natural backdrop for dating apps–to market key new features. Marketing initiatives continue to support the product work with a message of efficacy–the latest brand campaign shared that a relationship is formed on Tinder every 3 seconds.

As the largest dating app on the planet and the one that young users generally turn to first, Tinder is primarily focused on innovating the experience to satisfy the next generations of users. Leveraging its scale, resources, and user insights, over the coming 12 months Tinder plans to leverage AI to support daters throughout the entire dating journey, from building a standout profile at onboarding to providing AI-powered profile insights when matching, to meaningful insights and user support in the post-match experience. The type of broad product transformation that Tinder is undertaking generally does not achieve linearly improving results across the board, but we do expect to see tangible markers of progress, including improvement in Y/Y MAU trends, starting in Q3.

4 Source: Internal Tinder survey conducted May 2024.

Hinge: Robust User Trends and Accelerating Product Momentum

In Q2, Hinge continued to achieve strong new user growth, with several fresh features and marketing campaigns having led to especially strong user trends in May and June. Hinge achieved the second highest download5 ranking in its European expansion markets throughout Q2 and in its core English-speaking markets in May and June and raised its rank in 7 of its 10 most critical markets since last June.

Hinge’s product strategy is helping to improve the user journey for daters. Most recently, Hinge launched Top Photo, which helps users display their most engaging photo as their first profile photo, as determined by Hinge’s real-time AI. This has led to a measurable improvement in Hinge’s north star goal of getting users out on great dates. Hinge also began testing Photo Finder, which suggests the best of a user’s photo library to help easily create more effective profiles.

The AI-enabled photo selection features now being deployed at Hinge and Tinder were created by these teams in partnership with our Hyperconnect team, demonstrating the power of leveraging the strong AI-expertise we have embedded within the broader Match Group organization to drive our individual brands’ innovation efforts.

5 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Among all dating apps, as defined by Match Group.

Hinge also began testing Your Turn Limits, a first-of-its-kind feature designed to increase daters’ focus on quality over quantity by requiring a user to close out conversations before starting more chats once a set limit is reached. This feature has received significant press attention and positive user feedback and is showing significant improvement in the rate of users chatting and ultimately going out on dates.

Later this year, Hinge plans to begin testing other AI-enabled features including suggested prompts and AI-generated feedback to coach users on coming up with great prompt answers. Longer term, Hinge sees other opportunities to embed AI into the dating journey to create a more personalized experience, including dramatically improving its matching capabilities, integrating more features that help articulate user compatibility, and enabling post-match conversation guidance based on shared interests to help get users out on great dates faster. The ultimate vision is for a Hinge user to feel like they have a personal matchmaker (driven by AI) inside the app.

MG Asia: Azar Continues to Expand Across Europe; Pairs Growth

At Hyperconnect, the Azar app has continued to attract users—especially Gen Z—across Asian and European expansion markets, including in France, the UK, and Italy. Azar maintained its position as the third most downloaded6 social discovery app in Europe through June. The app’s robust revenue growth is being driven by ongoing core experience enhancements and its highly successful AI-driven matching algorithm, alongside monetization initiatives. Given the app’s momentum, its successful expansion in Europe, and the opportunity we see for the 1:1 video chat experience overall, we’re reallocating resources at Hyperconnect to accelerate Azar’s product innovation and speed market expansion, including to the U.S.

At Pairs, product innovation and marketing and government relations efforts to ensure Japanese daters are comfortable using dating apps have continued. After several quarters of Y/Y decline, downloads7 in the Japanese dating market overall, and at Pairs specifically, showed 6% Y/Y growth in Q2 and were especially solid during the critical Golden Week holiday period in May, as marketing spend on TV drove user strength. Through the first half of 2024, Pairs has delivered several product features that are helping improve user engagement, including specific prompts and photo assistance to help users build strong profiles, as well as embedded questions as a new form of discovery.

6 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Among all social discovery apps, as defined by Match Group.

7 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Among all dating apps, as defined by Match Group.

E&E: Consolidation Plans on Track; Growth at Emerging Apps Continues

E&E continues to make progress consolidating the Evergreen brands onto a single technology platform, with OkCupid® slated to join the combined platform in October. We continue to anticipate completing the re-platforming of the remaining E&E businesses by the end of 2025 and to realize the full cost savings in 2026. Within our Evergreen brands, our Match® brand has partnered with global best-selling author, award-winning podcast host of On Purpose, and purpose-driven entrepreneur, Jay Shetty, as Match's Relationship Advisor to build new product features and content designed to tackle dating challenges and offer relationship guidance.

Within our Emerging brands, we continue to execute on our strategy of expanding into new underserved demographics. Archer™ has continued to build momentum as the #2 most downloaded8 gay male dating app in the U.S. as product enhancements, including new methods for discovery based on intent, have driven increases in engagement metrics. Most recently we launched Yuzu, which caters to the Asian community, and includes both broader social and dating-centric aspects. Despite limited initial marketing spend, Yuzu’s MAU growth has been strong and engagement with the social features has been high.

8 Source: Sensor Tower. Combined downloads across Apple App Store and Google Play Store. Among all gay male dating apps, as defined by Match Group.

Capital Allocation

Last quarter, we stated our intent to deploy more than 75% of our free cash flow (“FCF”) for share buybacks for the remainder of the year. Given the Company’s significant FCF generation and minimal capital needs, we believe that continuing to return a significant part of our FCF to shareholders will help drive long-term shareholder value.

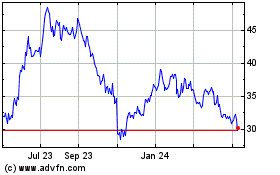

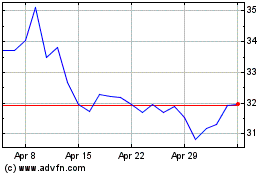

In Q2, we repurchased9 $197 million of stock, for a total of $395 million repurchased year-to-date, reflecting the long-term value that we see at current stock prices. We remain confident in our product roadmap and outlook and believe that investing in our stock at the current levels is highly accretive. We have returned approximately 100% of our FCF via share buybacks year-to-date, exceeding our current 75% of FCF target. We ended Q2 with trailing twelve-month net leverage of 2.4x10 and $844 million in cash and cash equivalents and short-term investments on hand.

Since resuming our share repurchase program in May 2022, the Company has used $1.5 billion of cash to repurchase an aggregate of 35 million shares, equating to approximately 12% of the then outstanding share count, through July 26, 2024.

Our Board continuously evaluates the optimal levels and mechanisms for capital return, with significant consideration given to our liquidity position, balance sheet strength and future outlook for the business, as well as the valuation of our stock.

9 On a trade date basis.

10 Leverage is calculated utilizing the non-GAAP measure Adjusted Operating Income as the denominator. For a reconciliation of the non-GAAP measure for each period presented, see page 22.

Financial Outlook

Q3 2024

For Q3, we expect Total Revenue of $895 to $905 million, up 2% to 3% Y/Y compared to Q3 ‘23 (up 4% to 5% Y/Y FXN). This includes the revenue impact of exiting our live streaming services over the course of Q3 (estimated at roughly $8 million). FX headwinds have worsened by roughly one point since our last earnings call.

For Tinder, we expect Direct Revenue of $505 to $510 million, roughly flat compared to Q3 ’23 (up ~2.5% Y/Y FXN). We expect Tinder Payers to be down approximately 5% on a Y/Y basis in Q3, which would lead to positive sequential Payer net additions of approximately 250,000, driven by improvement in Y/Y MAU trends due to ongoing product and marketing initiatives. We expect Tinder Payers to improve further on a Y/Y basis in Q4, though we do expect some typical seasonal impacts on Payers in Q4 versus Q3.

Across our other brands, we expect Direct Revenue to be $375 to $380 million, representing 5% to 6% Y/Y growth (7% to 8% Y/Y FXN). Within our other brands, we expect Hinge Direct Revenue of approximately $145 million, representing 35% Y/Y growth. We expect Indirect Revenue to be approximately $15 million in the quarter.

For Q3, we expect Match Group AOI of $335 to $340 million, up slightly Y/Y, with a margin of 37.5% at the mid-points of the ranges. While we plan to continue to increase marketing spend at Tinder and Hinge, we expect reductions at other brands to result in a more modest Y/Y increase in overall marketing spend as compared to the first half of ‘24. Our AOI range for the quarter reflects approximately $6 million in employee severance and other charges related to the exit of live streaming as well as approximately $1 million of Canada Digital Services Tax. We expect Q3 OI to be impacted by roughly $50 million of impairments of intangibles and other charges related to our exit of live streaming services.

| | | | | | | | | | | | | | |

| | Total Revenue | | Adjusted Operating Income |

| Q3 2024 | | $895 to $905 million | | $335 to $340 million |

| | | | |

| | | | |

| | | | |

| | | | |

Full Year 2024

After accounting for the exit of our live streaming services and based on our latest FX expectations (which have worsened by about one point since our last earnings call), we expect Match Group to deliver Y/Y Total Revenue growth of approximately 5% (up ~7.5% Y/Y FXN) and Tinder to deliver roughly 3% Y/Y Direct Revenue growth (up ~5.5% Y/Y FXN) for the full year ’24.

We expect to achieve our full year AOI margin target of 36% despite incurring approximately $6 million of severance and other charges related to our exit of live streaming and $9 million of full year cost related to the impact of the retroactive Canada Digital Services Tax, none of which was included in our initial outlook for 2024.

Conference Call

Match Group will audiocast a conference call to answer questions regarding its second quarter financial results on Wednesday, July 31, 2024 at 8:30 a.m. Eastern Time. This call will include the disclosure of certain information, including forward-looking information, which may be material to an investor’s understanding of Match Group’s business. The live audiocast will be open to the public on Match Group’s investor relations website at https://ir.mtch.com.

Financial Results

Revenue and Key Drivers | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | |

| 2024 | | 2023 | | Change |

| | | | | |

| (In thousands, except RPP) | | |

| Revenue | | | | | |

| Direct Revenue: | | | | | |

| Americas | $ | 450,546 | | | $ | 429,946 | | | 5% |

| Europe | 240,193 | | | 227,718 | | | 5% |

| APAC and Other | 157,394 | | | 158,472 | | | (1)% |

| Total Direct Revenue | 848,133 | | | 816,136 | | | 4% |

| Indirect Revenue | 15,933 | | | 13,416 | | | 19% |

| Total Revenue | $ | 864,066 | | | $ | 829,552 | | | 4% |

| | | | | |

| Direct Revenue | | | | | |

| Tinder | $ | 479,945 | | | $ | 474,746 | | | 1% |

| Hinge | 133,569 | | | 90,331 | | | 48% |

| MG Asia | 73,684 | | | 76,605 | | | (4)% |

| Evergreen and Emerging | 160,935 | | | 174,454 | | | (8)% |

| Total Direct Revenue | $ | 848,133 | | | $ | 816,136 | | | 4% |

| | | | | |

| Payers | | | | | |

| Americas | 6,735 | | | 7,717 | | | (13)% |

| Europe | 4,499 | | | 4,417 | | | 2% |

| APAC and Other | 3,607 | | | 3,496 | | | 3% |

| Total Payers | 14,841 | | | 15,630 | | | (5)% |

| | | | | |

| | | | | |

| | | | | |

| Revenue Per Payer (“RPP”) | | | | | |

| Americas | $ | 22.30 | | | $ | 18.57 | | | 20% |

| Europe | $ | 17.79 | | | $ | 17.18 | | | 4% |

| APAC and Other | $ | 14.55 | | | $ | 15.11 | | | (4)% |

| Total RPP | $ | 19.05 | | | $ | 17.41 | | | 9% |

| | | | | |

| | | | | |

Operating Income and Adjusted Operating Income

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | |

| 2024 | | 2023 | | Change |

| | | | | |

| (In thousands) | | |

| Operating income | $ | 204,526 | | | $ | 214,796 | | | (5)% |

| Operating income Margin | 24 | % | | 26 | % | | (2.2) points |

| Adjusted Operating Income | $ | 306,437 | | | $ | 301,313 | | | 2% |

| Adjusted Operating Income Margin | 35 | % | | 36 | % | | (0.9) points |

Operating Costs and Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 | | % of Revenue | | Q2 2023 | | % of Revenue | | Change |

| | | | | | | | | |

| (In thousands) | | |

| Cost of revenue | $ | 244,988 | | | 28% | | $ | 250,294 | | | 30% | | (2)% |

| Selling and marketing expense | 154,628 | | | 18% | | 136,597 | | | 16% | | 13% |

| General and administrative expense | 114,304 | | | 13% | | 107,698 | | | 13% | | 6% |

| Product development expense | 113,576 | | | 13% | | 94,287 | | | 11% | | 20% |

| Depreciation | 21,092 | | | 2% | | 14,565 | | | 2% | | 45% |

| Amortization of intangibles | 10,952 | | | 1% | | 11,315 | | | 1% | | (3)% |

| Total operating costs and expenses | $ | 659,540 | | | 76% | | $ | 614,756 | | | 74% | | 7% |

Liquidity and Capital Resources

During the six months ended June 30, 2024, we generated operating cash flow of $413 million and Free Cash Flow of $383 million, both of which were favorably impacted by the timing of a cash receipt from an app store.

During the quarter ended June 30, 2024, we repurchased 6.4 million shares of our common stock for $197 million on a trade date basis at an average price of $30.74. Between July 1, 2024 and July 26, 2024, we repurchased an additional 2.5 million shares of our common stock for $77 million on a trade date basis. As of July 26, 2024, $528 million in aggregate value of shares of Match Group stock remains available under our previously announced share repurchase program.

As of June 30, 2024, we had $844 million in cash and cash equivalents and short-term investments and $3.9 billion of long-term debt, $3.5 billion of which is fixed rate debt, including $1.2 billion of Exchangeable Senior Notes. Our $500 million revolving credit facility was undrawn as of June 30, 2024. Match Group’s trailing twelve-month leverage11 as of June 30, 2024 is 3.0x on a gross basis and 2.4x on a net basis.

Income Taxes

We recorded an income tax provision of $42 million in the second quarter of 2024, which equated to an effective tax rate of 24%. In the second quarter of 2023, the income tax provision was $41 million, which equated to an effective tax rate of 23%.

11 Leverage is calculated utilizing the non-GAAP measure Adjusted Operating Income as the denominator. For a reconciliation of the non-GAAP measure for each period presented, see page 22.

GAAP Financial Statements

Consolidated Statement of Operations | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | (In thousands, except per share data) |

| Revenue | $ | 864,066 | | | $ | 829,552 | | | $ | 1,723,713 | | | $ | 1,616,676 | |

| Operating costs and expenses: | | | | | | | |

| Cost of revenue (exclusive of depreciation shown separately below) | 244,988 | | | 250,294 | | | 501,730 | | | 490,304 | |

| Selling and marketing expense | 154,628 | | | 136,597 | | | 319,929 | | | 273,956 | |

| General and administrative expense | 114,304 | | | 107,698 | | | 220,545 | | | 198,309 | |

| Product development expense | 113,576 | | | 94,287 | | | 229,313 | | | 192,473 | |

| Depreciation | 21,092 | | | 14,565 | | | 41,613 | | | 25,117 | |

Amortization of intangibles | 10,952 | | | 11,315 | | | 21,319 | | | 23,432 | |

| Total operating costs and expenses | 659,540 | | | 614,756 | | | 1,334,449 | | | 1,203,591 | |

| Operating income | 204,526 | | | 214,796 | | | 389,264 | | | 413,085 | |

| Interest expense | (40,038) | | | (39,742) | | | (80,391) | | | (79,093) | |

| | | | | | | |

| Other income, net | 10,525 | | | 3,432 | | | 19,999 | | | 6,824 | |

Earnings before income taxes | 175,013 | | | 178,486 | | | 328,872 | | | 340,816 | |

Income tax provision | (41,693) | | | (41,141) | | | (72,318) | | | (82,780) | |

Net earnings | 133,320 | | | 137,345 | | | 256,554 | | | 258,036 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net (earnings) loss attributable to noncontrolling interests | (6) | | | — | | | (42) | | | 118 | |

Net earnings attributable to Match Group, Inc. shareholders | $ | 133,314 | | | $ | 137,345 | | | $ | 256,512 | | | $ | 258,154 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net earnings per share attributable to Match Group, Inc. shareholders: | | | | | | | |

| Basic | $ | 0.50 | | | $ | 0.49 | | | $ | 0.96 | | | $ | 0.93 | |

| Diluted | $ | 0.48 | | | $ | 0.48 | | | $ | 0.93 | | | $ | 0.89 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic shares outstanding | 264,397 | | | 278,133 | | | 266,270 | | | 278,693 | |

| Diluted shares outstanding | 281,882 | | | 295,002 | | | 284,047 | | | 295,823 | |

| | | | | | | |

| Stock-based compensation expense by function: | | | | | | | |

| Cost of revenue | $ | 1,809 | | | $ | 1,673 | | | $ | 3,520 | | | $ | 2,990 | |

| Selling and marketing expense | 3,298 | | | 2,558 | | | 6,136 | | | 4,471 | |

| General and administrative expense | 25,018 | | | 28,088 | | | 49,229 | | | 41,205 | |

| Product development expense | 39,742 | | | 28,318 | | | 74,802 | | | 53,534 | |

| Total stock-based compensation expense | $ | 69,867 | | | $ | 60,637 | | | $ | 133,687 | | | $ | 102,200 | |

Consolidated Balance Sheet | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| | | |

| (In thousands) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 837,792 | | | $ | 862,440 | |

| Short-term investments | 5,812 | | | 6,200 | |

| Accounts receivable, net | 324,269 | | | 298,648 | |

| | | |

| | | |

| Other current assets | 118,049 | | | 104,023 | |

| | | |

| Total current assets | 1,285,922 | | | 1,271,311 | |

| | | |

| | | |

| Property and equipment, net | 181,138 | | | 194,525 | |

| Goodwill | 2,255,302 | | | 2,342,612 | |

| Intangible assets, net | 275,721 | | | 305,746 | |

| Deferred income taxes | 235,246 | | | 259,803 | |

| | | |

| Other non-current assets | 135,600 | | | 133,889 | |

| | | |

| TOTAL ASSETS | $ | 4,368,929 | | | $ | 4,507,886 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| LIABILITIES | | | |

| | | |

| | | |

| Accounts payable | $ | 17,223 | | | $ | 13,187 | |

| Deferred revenue | 187,076 | | | 211,282 | |

| | | |

| | | |

| Accrued expenses and other current liabilities | 308,036 | | | 307,299 | |

| | | |

| Total current liabilities | 512,335 | | | 531,768 | |

| | | |

| Long-term debt, net | 3,845,571 | | | 3,842,242 | |

| Income taxes payable | 26,696 | | | 24,860 | |

| Deferred income taxes | 17,477 | | | 26,302 | |

| | | |

| | | |

| Other long-term liabilities | 96,962 | | | 101,787 | |

| | | |

| | | |

| | | |

| | | |

| Commitments and contingencies | | | |

| | | |

| SHAREHOLDERS’ EQUITY | | | |

| Common stock | 293 | | | 290 | |

| | | |

| | | |

| | | |

| | | |

| Additional paid-in capital | 8,663,157 | | | 8,529,200 | |

| Retained deficit | (6,874,517) | | | (7,131,029) | |

| Accumulated other comprehensive loss | (488,993) | | | (385,471) | |

| Treasury stock | (1,430,180) | | | (1,032,538) | |

| Total Match Group, Inc. shareholders’ equity | (130,240) | | | (19,548) | |

| Noncontrolling interests | 128 | | | 475 | |

| Total shareholders’ equity | (130,112) | | | (19,073) | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 4,368,929 | | | $ | 4,507,886 | |

Consolidated Statement of Cash Flows | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| | | |

| | (In thousands) |

| Cash flows from operating activities: | | | |

| | | |

| | | |

| Net earnings | $ | 256,554 | | | $ | 258,036 | |

Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Stock-based compensation expense | 133,687 | | | 102,200 | |

| Depreciation | 41,613 | | | 25,117 | |

| Amortization of intangibles | 21,319 | | | 23,432 | |

| Deferred income taxes | 16,964 | | | 26,627 | |

| | | |

| | | |

| Other adjustments, net | (109) | | | 6,912 | |

| Changes in assets and liabilities | | | |

| Accounts receivable | (28,670) | | | (83,074) | |

| Other assets | 2,410 | | | 2,128 | |

| Accounts payable and other liabilities | 3,118 | | | (27,988) | |

| Income taxes payable and receivable | (11,690) | | | 4,001 | |

| Deferred revenue | (22,128) | | | (7,526) | |

Net cash provided by operating activities | 413,068 | | | 329,865 | |

| Cash flows from investing activities: | | | |

| | | |

| Capital expenditures | (29,905) | | | (37,457) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | (8,807) | | | 89 | |

| Net cash used in investing activities | (38,712) | | | (37,368) | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from issuance of common stock pursuant to stock-based awards | 5,739 | | | 15,816 | |

Withholding taxes paid on behalf of employees on net settled stock-based awards | (10,095) | | | (2,580) | |

| | | |

| | | |

| | | |

Purchase of treasury stock | (387,366) | | | (145,108) | |

| | | |

| Purchase of noncontrolling interests | (737) | | | (1,872) | |

| | | |

| | | |

| Other, net | (2,184) | | | — | |

Net cash used in financing activities | (394,643) | | | (133,744) | |

Total cash (used) provided | (20,287) | | | 158,753 | |

| | | |

| | | |

| | | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (4,361) | | | 1,421 | |

| Net (decrease) increase in cash, cash equivalents, and restricted cash | (24,648) | | | 160,174 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 862,440 | | | 572,516 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 837,792 | | | $ | 732,690 | |

Earnings Per Share

The following table sets forth the computation of the basic and diluted earnings per share attributable to Match Group shareholders:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2024 | | 2023 |

| Basic | | Diluted | | Basic | | Diluted |

| | | | | | | |

| (In thousands, except per share data) |

| Numerator | | | | | | | |

Net earnings | $ | 133,320 | | | $ | 133,320 | | | $ | 137,345 | | | $ | 137,345 | |

Net earnings attributable to noncontrolling interests | (6) | | | (6) | | | — | | | — | |

Impact from subsidiaries’ dilutive securities | — | | | (5) | | | — | | | (34) | |

| Interest on dilutive Exchangeable Senior Notes, net of tax | — | | | 3,171 | | | — | | | 3,179 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net earnings attributable to Match Group, Inc. shareholders | $ | 133,314 | | | $ | 136,480 | | | $ | 137,345 | | | $ | 140,490 | |

| | | | | | | |

| Denominator | | | | | | | |

| Weighted average basic shares outstanding | 264,397 | | | 264,397 | | | 278,133 | | | 278,133 | |

Dilutive securities | — | | | 4,088 | | | — | | | 3,472 | |

| Dilutive shares from Exchangeable Senior Notes, if-converted | — | | | 13,397 | | | — | | | 13,397 | |

Denominator for earnings per share—weighted average shares | 264,397 | | | 281,882 | | | 278,133 | | | 295,002 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share attributable to Match Group, Inc. shareholders | $ | 0.50 | | | $ | 0.48 | | | $ | 0.49 | | | $ | 0.48 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Basic | | Diluted | | Basic | | Diluted |

| | | | | | | |

| (In thousands, except per share data) |

| Numerator | | | | | | | |

Net earnings | $ | 256,554 | | | $ | 256,554 | | | $ | 258,036 | | | $ | 258,036 | |

Net (earnings) loss attributable to noncontrolling interests | (42) | | | (42) | | | 118 | | | 118 | |

Impact from subsidiaries’ dilutive securities | — | | | (13) | | | — | | | (64) | |

| Interest on dilutive Exchangeable Senior Notes, net of tax | — | | | 6,342 | | | — | | | 6,357 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net earnings attributable to Match Group, Inc. shareholders | $ | 256,512 | | | $ | 262,841 | | | $ | 258,154 | | | $ | 264,447 | |

| | | | | | | |

| Denominator | | | | | | | |

| Weighted average basic shares outstanding | 266,270 | | | 266,270 | | | 278,693 | | | 278,693 | |

Dilutive securities | — | | | 4,380 | | | — | | | 3,733 | |

| Dilutive shares from Exchangeable Senior Notes, if-converted | — | | | 13,397 | | | — | | | 13,397 | |

| Denominator for earnings per share—weighted average shares | 266,270 | | | 284,047 | | | 278,693 | | | 295,823 | |

| | | | | | | |

Earnings per share: | | | | | | | |

| | | | | | | |

| | | | | | | |

Earnings per share attributable to Match Group, Inc. shareholders | $ | 0.96 | | | $ | 0.93 | | | $ | 0.93 | | | $ | 0.89 | |

Trended Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 2022 | | 2023 | | 2024 | | | | | | | | | | | | | | Year Ended December 31, |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | | | | | | | | | | | | | | | | | 2022 | | 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue (in millions, rounding differences may occur) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 400.0 | | | $ | 408.7 | | | $ | 413.8 | | | $ | 406.6 | | | $ | 405.9 | | | $ | 429.9 | | | $ | 455.2 | | | $ | 453.5 | | | $ | 450.2 | | | $ | 450.5 | | | | | | | | | | | | | | | | | | | $ | 1,629.1 | | | $ | 1,744.6 | |

| Europe | | | | | | | | | | | | | | | | | | | | | | | | | | | 215.3 | | | 208.5 | | | 214.8 | | | 210.3 | | | 212.5 | | | 227.7 | | | 252.0 | | | 241.2 | | | 239.4 | | | 240.2 | | | | | | | | | | | | | | | | | | | 848.9 | | | 933.4 | |

| APAC and Other | | | | | | | | | | | | | | | | | | | | | | | | | | | 168.5 | | | 163.0 | | | 166.6 | | | 154.2 | | | 156.0 | | | 158.5 | | | 159.6 | | | 156.1 | | | 155.7 | | | 157.4 | | | | | | | | | | | | | | | | | | | 652.3 | | | 630.1 | |

| Total Direct Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | 783.8 | | | 780.2 | | | 795.1 | | | 771.1 | | | 774.4 | | | 816.1 | | | 866.8 | | | 850.8 | | | 845.3 | | | 848.1 | | | | | | | | | | | | | | | | | | | 3,130.2 | | | 3,308.1 | |

| Indirect Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | 14.8 | | | 14.4 | | | 14.4 | | | 15.1 | | | 12.7 | | | 13.4 | | | 14.8 | | | 15.5 | | | 14.3 | | | 15.9 | | | | | | | | | | | | | | | | | | | 58.6 | | | 56.4 | |

| Total Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 798.6 | | | $ | 794.5 | | | $ | 809.5 | | | $ | 786.2 | | | $ | 787.1 | | | $ | 829.6 | | | $ | 881.6 | | | $ | 866.2 | | | $ | 859.6 | | | $ | 864.1 | | | | | | | | | | | | | | | | | | | $ | 3,188.8 | | | $ | 3,364.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Direct Revenue (in millions, rounding differences may occur) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tinder | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 441.0 | | | $ | 449.1 | | | $ | 460.2 | | | $ | 444.2 | | | $ | 441.1 | | | $ | 474.7 | | | $ | 508.5 | | | $ | 493.2 | | | $ | 481.5 | | | $ | 479.9 | | | | | | | | | | | | | | | | | | | $ | 1,794.5 | | | $ | 1,917.6 | |

| Hinge | | | | | | | | | | | | | | | | | | | | | | | | | | | 65.0 | | | 67.1 | | | 74.4 | | | 77.2 | | | 82.8 | | | 90.3 | | | 107.3 | | | 116.1 | | | 123.8 | | | 133.6 | | | | | | | | | | | | | | | | | | | 283.7 | | | 396.5 | |

| MG Asia | | | | | | | | | | | | | | | | | | | | | | | | | | | 87.2 | | | 79.6 | | | 80.6 | | | 74.3 | | | 75.7 | | | 76.6 | | | 76.8 | | | 73.6 | | | 71.5 | | | 73.7 | | | | | | | | | | | | | | | | | | | 321.7 | | | 302.6 | |

| Evergreen & Emerging | | | | | | | | | | | | | | | | | | | | | | | | | | | 190.7 | | | 184.3 | | | 180.0 | | | 175.4 | | | 174.9 | | | 174.5 | | | 174.2 | | | 167.8 | | | 168.6 | | | 160.9 | | | | | | | | | | | | | | | | | | | 730.4 | | | 691.4 | |

| Total Direct Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 783.8 | | | $ | 780.2 | | | $ | 795.1 | | | $ | 771.1 | | | $ | 774.4 | | | $ | 816.1 | | | $ | 866.8 | | | $ | 850.8 | | | $ | 845.3 | | | $ | 848.1 | | | | | | | | | | | | | | | | | | | $ | 3,130.2 | | | $ | 3,308.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Payers (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,159 | | | 8,225 | | | 8,233 | | | 8,059 | | | 7,989 | | | 7,717 | | | 7,494 | | | 7,117 | | | 6,869 | | | 6,735 | | | | | | | | | | | | | | | | | | | 8,169 | | | 7,579 | |

| Europe | | | | | | | | | | | | | | | | | | | | | | | | | | | 4,732 | | | 4,564 | | | 4,648 | | | 4,451 | | | 4,397 | | | 4,417 | | | 4,573 | | | 4,459 | | | 4,499 | | | 4,499 | | | | | | | | | | | | | | | | | | | 4,599 | | | 4,462 | |

| APAC and Other | | | | | | | | | | | | | | | | | | | | | | | | | | | 3,443 | | | 3,606 | | | 3,667 | | | 3,555 | | | 3,488 | | | 3,496 | | | 3,645 | | | 3,610 | | | 3,562 | | | 3,607 | | | | | | | | | | | | | | | | | | | 3,568 | | | 3,561 | |

| Total Payers | | | | | | | | | | | | | | | | | | | | | | | | | | | 16,334 | | | 16,395 | | | 16,548 | | | 16,065 | | | 15,874 | | | 15,630 | | | 15,712 | | | 15,186 | | | 14,930 | | | 14,841 | | | | | | | | | | | | | | | | | | | 16,336 | | | 15,602 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RPP | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Americas | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 16.34 | | | $ | 16.56 | | | $ | 16.75 | | | $ | 16.81 | | | $ | 16.94 | | | $ | 18.57 | | | $ | 20.25 | | | $ | 21.24 | | | $ | 21.85 | | | $ | 22.30 | | | | | | | | | | | | | | | | | | | $ | 16.62 | | | $ | 19.18 | |

| Europe | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 15.17 | | | $ | 15.23 | | | $ | 15.40 | | | $ | 15.75 | | | $ | 16.11 | | | $ | 17.18 | | | $ | 18.37 | | | $ | 18.03 | | | $ | 17.73 | | | $ | 17.79 | | | | | | | | | | | | | | | | | | | $ | 15.38 | | | $ | 17.43 | |

| APAC and Other | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 16.32 | | | $ | 15.06 | | | $ | 15.14 | | | $ | 14.46 | | | $ | 14.91 | | | $ | 15.11 | | | $ | 14.60 | | | $ | 14.41 | | | $ | 14.57 | | | $ | 14.55 | | | | | | | | | | | | | | | | | | | $ | 15.24 | | | $ | 14.75 | |

| Total RPP | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 16.00 | | | $ | 15.86 | | | $ | 16.02 | | | $ | 16.00 | | | $ | 16.26 | | | $ | 17.41 | | | $ | 18.39 | | | $ | 18.67 | | | $ | 18.87 | | | $ | 19.05 | | | | | | | | | | | | | | | | | | | $ | 15.97 | | | $ | 17.67 | |

Reconciliations of GAAP to Non-GAAP Measures

Reconciliation of Net Earnings to Adjusted Operating Income | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars in thousands) |

Net earnings attributable to Match Group, Inc. shareholders | $ | 133,314 | | | $ | 137,345 | | | $ | 256,512 | | | $ | 258,154 | |

Add back: | | | | | | | |

Net earnings (loss) attributable to noncontrolling interests | 6 | | | — | | | 42 | | | (118) | |

| | | | | | | |

Income tax provision | 41,693 | | | 41,141 | | | 72,318 | | | 82,780 | |

Other income, net | (10,525) | | | (3,432) | | | (19,999) | | | (6,824) | |

Interest expense | 40,038 | | | 39,742 | | | 80,391 | | | 79,093 | |

Operating income | 204,526 | | | 214,796 | | | 389,264 | | | 413,085 | |

| Stock-based compensation expense | 69,867 | | | 60,637 | | | 133,687 | | | 102,200 | |

| Depreciation | 21,092 | | | 14,565 | | | 41,613 | | | 25,117 | |

Amortization of intangibles | 10,952 | | | 11,315 | | | 21,319 | | | 23,432 | |

| | | | | | | |

| Adjusted Operating Income | $ | 306,437 | | | $ | 301,313 | | | $ | 585,883 | | | $ | 563,834 | |

| | | | | | | |

| Revenue | $ | 864,066 | | | $ | 829,552 | | | $ | 1,723,713 | | | $ | 1,616,676 | |

| Operating income margin | 24 | % | | 26 | % | | 23 | % | | 26 | % |

| Adjusted Operating Income margin | 35 | % | | 36 | % | | 34 | % | | 35 | % |

Reconciliation of Net Earnings to Adjusted Operating Income used in Leverage Ratios | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Twelve months ended |

| | | | | | | | | | | | | 6/30/2024 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | (In thousands) |

| Net earnings attributable to Match Group, Inc. shareholders | | | | | | | | | | | | | $ | 649,897 | |

Add back: | | | | | | | | | | | | | |

| Net earnings attributable to noncontrolling interests | | | | | | | | | | | | | 93 | |

| | | | | | | | | | | | | |

| Income tax provision | | | | | | | | | | | | | 114,847 | |

| Other income, net | | | | | | | | | | | | | (32,947) | |

Interest expense | | | | | | | | | | | | | 161,185 | |

Operating income | | | | | | | | | | | | | 893,075 | |

| Stock-based compensation expense | | | | | | | | | | | | | 263,586 | |

| Depreciation | | | | | | | | | | | | | 78,303 | |

Amortization of intangibles | | | | | | | | | | | | | 45,618 | |

| | | | | | | | | | | | | |

| Adjusted Operating Income | | | | | | | | | | | | | $ | 1,280,582 | |

Reconciliation of Operating Cash Flow to Free Cash Flow | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| | | |

| (In thousands) |

| Net cash provided by operating activities | $ | 413,068 | | | $ | 329,865 | |

| Capital expenditures | (29,905) | | | (37,457) | |

| Free Cash Flow | $ | 383,163 | | | $ | 292,408 | |

Reconciliation of Forecasted Operating Income to Adjusted Operating Income | | | | | | | |

| Three Months Ended September 30, 2024 |

| | | |

| | | |

| (In millions) |

Operating income | $185 to $190 | | |

| Stock-based compensation expense | 70 | | |

| Depreciation and impairment and amortization of intangibles | 80 | | |

| Adjusted Operating Income | $335 to $340 | | |

Reconciliation of GAAP Revenue to Non-GAAP Revenue, Excluding Foreign Exchange Effects

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | $ Change | | % Change | | 2023 | | 2024 | | $ Change | | % Change | | 2023 |

| | | | | | | | | | | | | | | |

| | (Dollars in millions, rounding differences may occur) |

| Revenue, as reported | $ | 864.1 | | | $ | 34.5 | | | 4% | | $ | 829.6 | | | $ | 1,723.7 | | | $ | 107.0 | | | 7% | | $ | 1,616.7 | |

| Foreign exchange effects | 27.9 | | | | | | | | | 47.9 | | | | | | | |

| Revenue, excluding foreign exchange effects | $ | 892.0 | | | $ | 62.4 | | | 8% | | $ | 829.6 | | | $ | 1,771.6 | | | $ | 154.9 | | | 10% | | $ | 1,616.7 | |

| | | | | | | | | | | | | | | |

| Total Direct Revenue, as reported | $ | 848.1 | | | $ | 32.0 | | | 4% | | $ | 816.1 | | | $ | 1,693.4 | | | $ | 102.9 | | | 6% | | $ | 1,590.6 | |

| Foreign exchange effects | 27.6 | | | | | | | | | 47.4 | | | | | | | |

| Total Direct Revenue, excluding foreign exchange effects | $ | 875.7 | | | $ | 59.6 | | | 7% | | $ | 816.1 | | | $ | 1,740.9 | | | $ | 150.3 | | | 9% | | $ | 1,590.6 | |

| | | | | | | | | | | | | | | |

| Americas Direct Revenue, as reported | $ | 450.5 | | | $ | 20.6 | | | 5% | | $ | 429.9 | | | $ | 900.8 | | | $ | 64.9 | | | 8% | | $ | 835.9 | |

| Foreign exchange effects | 8.6 | | | | | | | | | 15.8 | | | | | | | |

Americas Direct Revenue, excluding foreign exchange effects | $ | 459.1 | | | $ | 29.2 | | | 7% | | $ | 429.9 | | | $ | 916.6 | | | $ | 80.7 | | | 10% | | $ | 835.9 | |

| | | | | | | | | | | | | | | |

| Europe Direct Revenue, as reported | $ | 240.2 | | | $ | 12.5 | | | 5% | | $ | 227.7 | | | $ | 479.6 | | | $ | 39.3 | | | 9% | | $ | 440.2 | |

| Foreign exchange effects | 1.5 | | | | | | | | | (3.3) | | | | | | | |

| Europe Direct Revenue, excluding foreign exchange effects | $ | 241.7 | | | $ | 14.0 | | | 6% | | $ | 227.7 | | | $ | 476.2 | | | $ | 36.0 | | | 8% | | $ | 440.2 | |

| | | | | | | | | | | | | | | |

| APAC and Other Direct Revenue, as reported | $ | 157.4 | | | $ | (1.1) | | | (1)% | | $ | 158.5 | | | $ | 313.1 | | | $ | (1.4) | | | —% | | $ | 314.5 | |

| Foreign exchange effects | 17.5 | | | | | | | | | 35.0 | | | | | | | |

| APAC and Other Direct Revenue, excluding foreign exchange effects | $ | 174.9 | | | $ | 16.4 | | | 10% | | $ | 158.5 | | | $ | 348.0 | | | $ | 33.6 | | | 11% | | $ | 314.5 | |

| | | | | | | | | | | | | | | |

| Tinder Direct Revenue, as reported | $ | 479.9 | | | $ | 5.2 | | | 1% | | $ | 474.7 | | | $ | 961.4 | | | $ | 45.5 | | | 5% | | $ | 915.9 | |

| Foreign exchange effects | 15.9 | | | | | | | | | 26.7 | | | | | | | |

| Tinder Direct Revenue, excluding foreign exchange effects | $ | 495.9 | | | $ | 21.1 | | | 4% | | $ | 474.7 | | | $ | 988.1 | | | $ | 72.2 | | | 8% | | $ | 915.9 | |

| | | | | | | | | | | | | | | |

| Hinge Direct Revenue, as reported | $ | 133.6 | | | $ | 43.2 | | | 48% | | $ | 90.3 | | | $ | 257.3 | | | $ | 84.2 | | | 49% | | $ | 173.1 | |

| Foreign exchange effects | 0.4 | | | | | | | | | 0.3 | | | | | | | |

| Hinge Direct Revenue, excluding foreign exchange effects | $ | 133.9 | | | $ | 43.6 | | | 48% | | $ | 90.3 | | | $ | 257.6 | | | $ | 84.5 | | | 49% | | $ | 173.1 | |

| | | | | | | | | | | | | | | |

| MG Asia Direct Revenue, as reported | $ | 73.7 | | | $ | (2.9) | | | (4)% | | $ | 76.6 | | | $ | 145.1 | | | $ | (7.1) | | | (5)% | | $ | 152.3 | |

| Foreign exchange effects | 10.1 | | | | | | | | | 19.2 | | | | | | | |

| MG Asia Direct Revenue, excluding foreign exchange effects | $ | 83.7 | | | $ | 7.1 | | | 9% | | $ | 76.6 | | | $ | 164.3 | | | $ | 12.1 | | | 8% | | $ | 152.3 | |

| | | | | | | | | | | | | | | |

| E&E Direct Revenue, as reported | $ | 160.9 | | | $ | (13.5) | | | (8)% | | $ | 174.5 | | | $ | 329.5 | | | $ | (19.8) | | | (6)% | | $ | 349.3 | |

| Foreign exchange effects | 1.2 | | | | | | | | | 1.3 | | | | | | | |

| E&E Direct Revenue, excluding foreign exchange effects | $ | 162.2 | | | $ | (12.3) | | | (7)% | | $ | 174.5 | | | $ | 330.9 | | | $ | (18.5) | | | (5)% | | $ | 349.3 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Azar Direct Revenue, as reported | $ | 38.9 | | | $ | (0.3) | | | (1)% | | $ | 39.2 | | | $ | 75.9 | | | $ | 1.3 | | | 2% | | $ | 74.7 | |

| Foreign exchange effects | 5.9 | | | | | | | | | 11.2 | | | | | | | |

| Azar Direct Revenue, excluding foreign exchange effects | $ | 44.8 | | | $ | 5.6 | | | 14% | | $ | 39.2 | | | $ | 87.2 | | | $ | 12.5 | | | 17% | | $ | 74.7 | |

| | | | | | | | | | | | | | | |

| Pairs Direct Revenue, as reported | $ | 27.9 | | | $ | (3.2) | | | (10)% | | $ | 31.1 | | | $ | 55.8 | | | $ | (7.1) | | | (11)% | | $ | 62.9 | |

| Foreign exchange effects | 3.7 | | | | | | | | | 7.1 | | | | | | | |

| Pairs Direct Revenue, excluding foreign exchange effects | $ | 31.7 | | | $ | 0.6 | | | 2% | | $ | 31.1 | | | $ | 62.9 | | | $ | — | | | —% | | $ | 62.9 | |

Reconciliation of GAAP Revenue to Non-GAAP Revenue, Excluding Foreign Exchange Effects (Revenue Per Payer)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | $ Change | | % Change | | 2023 | | 2024 | | $ Change | | % Change | | 2023 |

| | | | | | | | | | | | | | | |

| (Percentage change calculated using non-rounded numbers) |

| RPP, as reported | $ | 19.05 | | | $ | 1.64 | | | 9% | | $ | 17.41 | | | $ | 18.96 | | | $ | 2.13 | | | 13% | | $ | 16.83 | |

| Foreign exchange effects | 0.62 | | | | | | | | | 0.53 | | | | | | | |

| RPP, excluding foreign exchange effects | $ | 19.67 | | | $ | 2.26 | | | 13% | | $ | 17.41 | | | $ | 19.49 | | | $ | 2.66 | | | 16% | | $ | 16.83 | |

| | | | | | | | | | | | | | | |

| Americas RPP, as reported | $ | 22.30 | | | $ | 3.73 | | | 20% | | $ | 18.57 | | | $ | 22.07 | | | $ | 4.33 | | | 24% | | $ | 17.74 | |

| Foreign exchange effects | 0.42 | | | | | | | | | 0.39 | | | | | | | |

| Americas RPP, excluding foreign exchange effects | $ | 22.72 | | | $ | 4.15 | | | 22% | | $ | 18.57 | | | $ | 22.46 | | | $ | 4.72 | | | 27% | | $ | 17.74 | |

| | | | | | | | | | | | | | | |

| Europe RPP, as reported | $ | 17.79 | | | $ | 0.61 | | | 4% | | $ | 17.18 | | | $ | 17.76 | | | $ | 1.11 | | | 7% | | $ | 16.65 | |

| Foreign exchange effects | 0.12 | | | | | | | | | (0.12) | | | | | | | |

| Europe RPP, excluding foreign exchange effects | $ | 17.91 | | | $ | 0.73 | | | 4% | | $ | 17.18 | | | $ | 17.64 | | | $ | 0.99 | | | 6% | | $ | 16.65 | |

| | | | | | | | | | | | | | | |

| APAC and Other RPP, as reported | $ | 14.55 | | | $ | (0.56) | | | (4)% | | $ | 15.11 | | | $ | 14.56 | | | $ | (0.45) | | | (3)% | | $ | 15.01 | |

| Foreign exchange effects | 1.61 | | | | | | | | | 1.62 | | | | | | | |

| APAC and Other RPP, excluding foreign exchange effects | $ | 16.16 | | | $ | 1.05 | | | 7% | | $ | 15.11 | | | $ | 16.18 | | | $ | 1.17 | | | 8% | | $ | 15.01 | |

Dilutive Securities

Match Group has various tranches of dilutive securities. The table below details these securities and their potentially dilutive impact (shares in millions; rounding differences may occur).

| | | | | | | | | | | | | | | | | | | |

| Average Exercise Price | | 7/26/2024 | | |

| Share Price | | | $33.25 | | | | | | | | |

| Absolute Shares | | | 257.9 | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Equity Awards | | | | | | | | | | | |

| Options | $18.01 | | 1.2 | | | | | | | | |

| RSUs and subsidiary denominated equity awards | | | 14.1 | | | | | | | | |

| Total Dilution - Equity Awards | | | 15.3 | | | | | | | | |

| Outstanding Warrants | | | | | | | | | | | |

| Warrants expiring on September 15, 2026 (6.6 million outstanding) | $134.76 | | — | | | | | | | | |

| Warrants expiring on April 15, 2030 (6.8 million outstanding) | $134.82 | | — | | | | | | | | |

| Total Dilution - Outstanding Warrants | | | — | | | | | | | | |

| | | | | | | | | | | |

| Total Dilution | | | 15.3 | | | | | | | | |

| % Dilution | | | 5.6% | | | | | | | | |

| Total Diluted Shares Outstanding | | | 273.1 | | | | | | | | |

______________________

The dilutive securities presentation above is calculated using the methods and assumptions described below; these are different from GAAP dilution, which is calculated based on the treasury stock method.

Options — The table above assumes the option exercise price is used to repurchase Match Group shares.

RSUs and subsidiary denominated equity awards — The table above assumes RSUs are fully dilutive. All performance-based and market-based awards reflect the expected shares that will vest based on current performance or market estimates. The table assumes no change in the fair value estimate of the subsidiary denominated equity awards from the values used for GAAP purposes at June 30, 2024.

Exchangeable Senior Notes — The Company has two series of Exchangeable Senior Notes outstanding. In the event of an exchange, each series of Exchangeable Senior Notes can be settled in cash, shares, or a combination of cash and shares. At the time of each Exchangeable Senior Notes issuance, the Company purchased call options with a strike price equal to the exchange price of each series of Exchangeable Senior Notes (“Note Hedge”), which can be used to offset the dilution of each series of the Exchangeable Senior Notes. No dilution is reflected in the table above for any of the Exchangeable Senior Notes because it is the Company’s intention to settle the Exchangeable Senior Notes with cash equal to the face amount of the notes; any shares issued would be offset by shares received upon exercise of the Note Hedge.

Warrants — At the time of the issuance of each series of Exchangeable Senior Notes, the Company also sold warrants for the number of shares with the strike prices reflected in the table above. The cash generated from the exercise of the warrants is assumed to be used to repurchase Match Group shares and the resulting net dilution, if any, is reflected in the table above.

Non-GAAP Financial Measures

Match Group reports Adjusted Operating Income, Adjusted Operating Income Margin, Free Cash Flow, and Revenue Excluding Foreign Exchange Effects, all of which are supplemental measures to U.S. generally accepted accounting principles (“GAAP”). The Adjusted Operating Income, Adjusted Operating Income Margin, and Free Cash Flow measures are among the primary metrics by which we evaluate the performance of our business, on which our internal budget is based and by which management is compensated. Revenue Excluding Foreign Exchange Effects provides a comparable framework for assessing the performance of our business without the effect of exchange rate differences when compared to prior periods. We believe that investors should have access to the same set of tools that we use in analyzing our results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP results. Match Group endeavors to compensate for the limitations of the non-GAAP measures presented by providing the comparable GAAP measures and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. We encourage investors to examine the reconciling adjustments between the GAAP and non-GAAP measures, which we describe below. Interim results are not necessarily indicative of the results that may be expected for a full year.

Definitions of Non-GAAP Measures

Adjusted Operating Income is defined as operating income excluding: (1) stock-based compensation expense; (2) depreciation; and (3) acquisition-related items consisting of (i) amortization of intangible assets and impairments of goodwill and intangible assets, if applicable, and (ii) gains and losses recognized on changes in the fair value of contingent consideration arrangements, as applicable. We believe Adjusted Operating Income is useful to analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. The above items are excluded from our Adjusted Operating Income measure because they are non-cash in nature. Adjusted Operating Income has certain limitations because it excludes certain expenses.

Adjusted Operating Income Margin is defined as Adjusted Operating Income divided by revenues. We believe Adjusted Operating Income Margin is useful for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. Adjusted Operating Income margin has certain limitations in that it does not take into account the impact to our consolidated statement of operations of certain expenses.

Free Cash Flow is defined as net cash provided by operating activities, less capital expenditures. We believe Free Cash Flow is useful to investors because it represents the cash that our operating businesses generate, before taking into account non-operational cash movements. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, we think it is important to evaluate Free Cash Flow along with our consolidated statement of cash flows.

We look at Free Cash Flow as a measure of the strength and performance of our businesses, not for valuation purposes. In our view, applying “multiples” to Free Cash Flow is inappropriate because it is subject to timing, seasonality and one-time events. We manage our business for cash, and we think it is of utmost importance to maximize cash – but our primary valuation metric is Adjusted Operating Income.

Revenue Excluding Foreign Exchange Effects is calculated by translating current period revenues using prior period exchange rates. The percentage change in Revenue Excluding Foreign Exchange Effects is calculated by determining the change in current period revenues over prior period revenues where current period revenues are translated using prior period exchange rates. We believe the impact of foreign exchange rates on Match Group, due to its global reach, may be an important factor in understanding period over period comparisons if movement in rates is significant. Since our results are reported in U.S. dollars, international revenues are favorably impacted as the U.S. dollar weakens relative to other currencies, and unfavorably impacted as the U.S. dollar strengthens relative to other currencies. We believe the presentation of revenue excluding foreign exchange effects in addition to reported revenue helps improve the ability to understand Match Group’s performance because it excludes the impact of foreign currency volatility that is not indicative of Match Group’s core operating results.

Non-Cash Expenses That Are Excluded From Our Non-GAAP Measures

Stock-based compensation expense consists principally of expense associated with the grants of stock options, RSUs, performance-based RSUs and market-based awards. These expenses are not paid in cash, and we include the related shares in our fully diluted shares outstanding using the treasury stock method; however, performance-based RSUs and market-based awards are included only to the extent the applicable performance or market condition(s) have been met (assuming the end of the reporting period is the end of the contingency period). To the extent stock-based awards are settled on a net basis, we remit the required tax-withholding amounts from our current funds.

Depreciation is a non-cash expense relating to our property and equipment and is computed using the straight-line method to allocate the cost of depreciable assets to operations over their estimated useful lives, or, in the case of leasehold improvements, the lease term, if shorter.

Amortization of intangible assets and impairments of goodwill and intangible assets are non-cash expenses related primarily to acquisitions. At the time of an acquisition, the identifiable definite-lived intangible assets of the acquired company, such as customer lists, trade names and technology, are valued and amortized over their estimated lives. Value is also assigned to (i) acquired indefinite-lived intangible assets, which consist of trade names and trademarks, and (ii) goodwill, which are not subject to amortization. An impairment is recorded when the carrying value of an intangible asset or goodwill exceeds its fair value. We believe that intangible assets represent costs incurred by the acquired company to build value prior to acquisition and the related amortization and impairment charges of intangible assets or goodwill, if applicable, are not ongoing costs of doing business.

Additional Definitions

Americas includes North America, Central America, South America, and the Caribbean islands.

Europe includes continental Europe, the British Isles, Iceland, Greenland, and Russia (ceased operations in June 2023), but excludes Turkey (which is included in APAC and Other).

APAC and Other includes Asia, Australia, the Pacific islands, the Middle East, and Africa.

Match Group Asia (“MG Asia”) consists of the brands primarily focused on Asia and the Middle East, including Pairs and Azar.

Evergreen & Emerging (“E&E”) consists primarily of the brands Match, Meetic, OkCupid, Plenty of Fish, and a number of demographically focused brands.

Direct Revenue is revenue that is received directly from end users of our services and includes both subscription and à la carte revenue.

Indirect Revenue is revenue that is not received directly from end users of our services, substantially all of which is advertising revenue.

Payers are unique users at a brand level in a given month from whom we earned Direct Revenue. When presented as a quarter-to-date or year-to-date value, Payers represents the average of the monthly values for the respective period presented. At a consolidated level, duplicate Payers may exist when we earn revenue from the same individual at multiple brands in a given month, as we are unable to identify unique individuals across brands in the Match Group portfolio.

Revenue Per Payer (“RPP”) is the average monthly revenue earned from a Payer and is Direct Revenue for a period divided by the Payers in the period, further divided by the number of months in the period.

Monthly Active User (“MAU”) is a unique registered user at a brand level who has visited the brand’s app or, if applicable, their website in the last 28 days as of the measurement date. At a consolidated level, duplicate users will exist within MAU when the same individual visits multiple brands in a given month.

Leverage on a gross basis is calculated as principal debt balance divided by Adjusted Operating Income for the period referenced.

Leverage on a net basis is calculated as principal debt balance less cash and cash equivalents and short-term investments divided by Adjusted Operating Income for the period referenced.

Other Information

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This letter and our conference call, which will be held at 8:30 a.m. Eastern Time on July 31, 2024, may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are “forward looking statements.” The use of words such as “anticipates,” “estimates,” “expects,” “plans” and “believes,” among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: Match Group’s future financial performance, Match Group’s business prospects and strategy, anticipated trends, and other similar matters. These forward-looking statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others: our ability to maintain or grow the size of our user base, competition, the limited operating history of some of our brands, our ability to attract users to our services through cost-effective marketing and related efforts, our ability to distribute our services through third parties and offset related fees, risks relating to our use of artificial intelligence, foreign currency exchange rate fluctuations, the integrity and scalability of our systems and infrastructure (and those of third parties) and our ability to adapt ours to changes in a timely and cost-effective manner, our ability to protect our systems from cyberattacks and to protect personal and confidential user information, risks relating to certain of our international operations and acquisitions, damage to our brands' reputations as a result of inappropriate actions by users of our services, uncertainties related to the tax treatment of our separation from IAC, uncertainties related to the acquisition of Hyperconnect, including, among other things, the expected benefits of the transaction and the impact of the transaction on the businesses of Match Group, and macroeconomic conditions. Certain of these and other risks and uncertainties are discussed in Match Group’s filings with the Securities and Exchange Commission. Other unknown or unpredictable factors that could also adversely affect Match Group’s business, financial condition and results of operations may arise from time to time. In light of these risks and uncertainties, these forward-looking statements may not prove to be accurate. Accordingly, you should not place undue reliance on these forward-looking statements, which only reflect the views of Match Group management as of the date of this letter. Match Group does not undertake to update these forward-looking statements.

About Match Group

Match Group (NASDAQ: MTCH), through its portfolio companies, is a leading provider of digital technologies designed to help people make meaningful connections. Our global portfolio of brands includes Tinder®, Hinge®, Match®, Meetic®, OkCupid®, Pairs™, PlentyOfFish®, Azar®, BLK®, and more, each built to increase our users’ likelihood of connecting with others. Through our trusted brands, we provide tailored services to meet the varying preferences of our users. Our services are available in over 40 languages to our users all over the world.

Contact Us | | | | | |

Tanny Shelburne Match Group Investor Relations ir@match.com | Justine Sacco Match Group Corporate Communications matchgroupPR@match.com |

| |

Match Group 8750 North Central Expressway, Suite 1400, Dallas, TX 75231, (214) 576-9352 https://mtch.com |

v3.24.2

Cover Page

|

Jul. 30, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0000891103

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 30, 2024

|

| Entity Registrant Name |

MATCH GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34148

|

| Entity Tax Identification Number |

59-2712887

|

| Entity Address, Address Line One |

8750 North Central Expressway, Suite 1400

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75231

|

| City Area Code |

214

|

| Local Phone Number |

576-9352

|

| Written Communications |

false

|

| Soliciting Material |

false

|