Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 23 2024 - 6:14AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October 2024

Commission File Number 001-34837

MAKEMYTRIP LIMITED

(Exact name of registrant as specified in its charter)

19th Floor, Building No. 5

DLF Cyber City

Gurugram, India, 122002

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Other Events

Unaudited Business and Financial Highlights for the Quarter ended September 30, 2024

On October 23, 2024, MakeMyTrip Limited (“MakeMyTrip”) issued a press release announcing its unaudited business and financial highlights for the second quarter of fiscal 2025 (i.e. quarter ended September 30, 2024). A copy of the press release dated October 23, 2024 is attached hereto as Exhibit 99.1.

Exhibit

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 23, 2024

|

|

|

MAKEMYTRIP LIMITED |

|

|

By: |

|

/s/ Rajesh Magow |

Name: |

|

Rajesh Magow |

Title: |

|

Group Chief Executive Officer |

Exhibit 99.1

EARNINGS PRESS RELEASE

MakeMyTrip delivers consistent strong growth in a seasonally slow quarter Q2 FY25 Revenue up 26.5%2 YoY

National, October 23, 2024 (NASDAQ: MMYT) — MakeMyTrip Limited, India’s leading travel service provider, today announced its unaudited financial and operating results for its fiscal second quarter ended September 30, 2024 as attached herewith and available at www.sec.gov/ and on our website at http://investors.makemytrip.com.

Business & Financial Highlights | Q2 FY25

|

|

|

|

|

Q2 FY25 ($ Million) |

Q2 FY24 ($ Million) |

YoY Change (Constant Currency)2 |

Gross Bookings |

2,257.2 |

1,839.7 |

24.3% |

Revenue as per IFRS |

211.0 |

168.7 |

26.5% |

Adjusted Margin1 |

|

|

|

Air Ticketing |

96.0 |

80.3 |

21.1% |

Hotels and Packages |

90.7 |

75.7 |

21.4% |

Bus Ticketing |

27.1 |

21.8 |

25.6% |

Others |

16.4 |

11.0 |

51.0% |

Results from Operating Activities |

26.1 |

6.7 |

|

Adjusted Operating Profit1 (also referred to as Adjusted EBIT)3 |

37.5 |

28.2 |

|

Profit for the period |

17.9 |

2.0 |

|

•Revenue as per IFRS grew by 26.5% YoY in constant currency2 to $211.0 million in Q2 FY25 from $168.7 million in Q2 FY24.

•Adjusted Operating Profit1 registered growth of 32.9% YoY and reached $37.5 million in Q2 FY25 compared to $28.2 million in Q2 FY24.

•Profit for Q2 FY25 was $17.9 million, compared to $2.0 million in Q2 FY24.

Commenting on the results, Rajesh Magow, Group Chief Executive Officer, MakeMyTrip, said,

“We are pleased to have achieved sustained growth in a seasonally slow quarter. Our unwavering focus on innovation, powered by advanced technology to deliver a differentiated customer experience, has been a key driver of this progress. We continue to be positive about the long-term outlook of India’s travel and tourism market and stay committed to further accelerating efforts to expand our supply partnerships and deepen engagement with our customers.”

Notes:

(1)This is a non-IFRS measure. Reconciliations of IFRS measures to non-IFRS financial measures, and operating results are included at the end of our earnings release. For more information, see “About Key Performance Indicators and Non-IFRS Measures” in our earnings release.

(2)Constant currency refers to our financial results assuming constant foreign exchange rates for the current fiscal period based on the rates in effect during the comparable period in the prior fiscal year. This is a non-IFRS measure. Reconciliations of IFRS measures to non-IFRS financial measures and operating results are included at the end of our earnings release. For more information, see “About Key Performance Indicators and Non-IFRS Measures” in our earnings release.

(3)Adjusted Operating Profit is commonly referred to among investors and analysts in India as Adjusted EBIT.

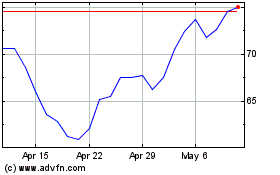

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Feb 2025 to Mar 2025

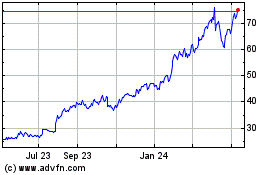

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Mar 2024 to Mar 2025