Active Riders and Rides reached new all-time

highs Gross Bookings grew 16% year-over-year

Lyft, Inc. (Nasdaq:LYFT) today announced financial results for

the third quarter ended September 30, 2024.

“Our team delivered one of the strongest quarters in Lyft

history, following the many new innovations we’ve brought to

drivers and riders so far this year,” said CEO David Risher.

“Going forward, our work with best-of-breed partners and the

autonomous future we’re building will give people even more reasons

to choose Lyft every time.”

“Operational excellence underpins the health of our marketplace

and remains a long-term driver of our business,” said CFO Erin

Brewer. “In Q3, we delivered across the board with both driver

hours and Active Riders reaching all-time highs, surpassing the

prior quarter records.”

Third Quarter 2024 Financial Highlights

- Gross Bookings of $4.1 billion was up 16% year-over-year.

- Revenue of $1.5 billion was up 32% year-over-year.

- Net loss of $(12.4) million, which includes a restructuring

charge of $36.4 million taken during the quarter, compared to

$(12.1) million in Q3’23.

- Net loss as a percentage of Gross Bookings was (0.3)%, which

was flat year-over-year.

- Adjusted EBITDA of $107.3 million compared to $92.0 million in

Q3’23.

- Adjusted EBITDA margin as a percentage of Gross Bookings was

2.6%, which was flat year-over-year.

- Net cash provided by operating activities of $264.0 million

compared to $2.3 million in Q3’23.

- For the trailing twelve months, net cash provided by operating

activities was $739.9 million.

- Free cash flow of $242.8 million compared to $(30.0) million in

Q3’23.

- For the trailing twelve months, free cash flow was $641.2

million.

Third Quarter 2024 Operational Highlights

- Record Active Riders of 24.4 million: up 9%

year-over-year.

- Record Rides of 217 million: up 16% year-over-year.

- Autonomous partnerships: Lyft to join forces with

Mobileye, May Mobility, and Nexar to connect riders to autonomous

vehicles. Starting in 2025, riders in Atlanta will have the

opportunity to be matched with an AV when hailing a ride on

Lyft.

- DoorDash x Lyft: signed a strategic partnership with the

local delivery leader in the U.S., offering exclusive benefits to

riders that link their DashPass accounts. Millions of DashPass

members in the U.S. now have another reason to choose Lyft every

time.

- Further driver earnings improvements: drivers can count

on their earnings being increased any time a ride takes 5 minutes

longer than estimated, or for dropping off a rider that takes them

out of their way without a ride back. Drivers also now see the

estimated dollar per hour rate upfront for each ride.

Fourth Quarter 2024 Outlook

- Gross Bookings of approximately $4.28 billion to $4.35 billion,

up 15% to 17% year-over-year

- Adjusted EBITDA of $100 million to $105 million and an Adjusted

EBITDA margin (calculated as a percentage of Gross Bookings) of

approximately 2.3% to 2.4%.

Updated FY’24 Outlook

- Rides growth in the mid-teens year-over-year.

- Gross Bookings to grow approximately 17% year-over-year.

- Adjusted EBITDA margin (calculated as a percentage of Gross

Bookings) of approximately 2.3%, up from the prior outlook of

2.1%.

- Free cash flow to exceed $650 million.

We have not provided the forward-looking GAAP equivalent to our

non-GAAP outlook or a GAAP reconciliation as a result of the

uncertainty regarding, and the potential variability of reconciling

items such as stock-based compensation and income tax. Accordingly,

a reconciliation of these non-GAAP guidance metrics to their

corresponding GAAP equivalent is not available without unreasonable

effort. However, it is important to note that the reconciling items

could have a significant effect on future GAAP results. We have

provided historical reconciliations of GAAP to non-GAAP metrics in

tables at the end of this release. For more information regarding

the non-GAAP financial measures discussed in this earnings release,

please see “GAAP to non-GAAP Reconciliations” below.

Financial and Operational Results through the Third Quarter

of 2024

Three Months Ended

Sept. 30, 2024

Jun. 30, 2024

Sept. 30, 2023

(in millions, except for

percentages)

Active Riders

24.4

23.7

22.4

Rides

216.7

205.3

187.4

Gross Bookings

$

4,108.4

$

4,018.9

$

3,554.1

Revenue

$

1,522.7

$

1,435.8

$

1,157.6

Net income (loss)

$

(12.4

)

$

5.0

$

(12.1

)

Net income (loss) as a percentage of Gross

Bookings

(0.3

)%

0.1

%

(0.3

)%

Net cash provided by (used in) operating

activities

$

264.0

$

276.2

$

2.3

Adjusted EBITDA

$

107.3

$

102.9

$

92.0

Adjusted EBITDA margin (calculated as a

percentage of Gross Bookings)

2.6

%

2.6

%

2.6

%

Adjusted Net Income (Loss)

$

118.1

$

98.9

$

92.3

Free cash flow

$

242.8

$

256.4

$

(30.0

)

Note: Information on our key metrics and

non-GAAP financial measures is also available on our Investor

Relations page.

Definitions of Key Metrics

Active Riders

The number of Active Riders is a key indicator of the scale of

our user community. Lyft defines Active Riders as all riders who

take at least one ride during a quarter where the Lyft Platform

processes the transaction. An Active Rider is identified by a

unique phone number. If a rider has two mobile phone numbers or

changed their phone number and that rider took rides using both

phone numbers during the quarter, that person would count as two

Active Riders. If a rider has a personal and business profile tied

to the same mobile phone number, that person would be considered a

single Active Rider. If a ride has been requested by an

organization using our Concierge offering for the benefit of a

rider, we exclude this rider in the calculation of Active Riders,

unless the ride is accessible in that rider’s Lyft App.

Rides

Rides represent the level of usage of our multimodal platform.

Lyft defines Rides as the total number of rides including rideshare

and bike and scooter rides completed using our multimodal platform

that contribute to our revenue. These include any Rides taken

through our Lyft App. If multiple riders take a private rideshare

ride, including situations where one party picks up another party

on the way to a destination, or splits the bill, we count this as a

single rideshare ride. Each unique segment of a Shared Ride is

considered a single Ride. For example, if two riders successfully

match in Shared Ride mode and both complete their Rides, we count

this as two Rides. We have largely shifted away from Shared Rides,

and now only offer Shared Rides in limited markets. Lyft includes

all Rides taken by riders via our Concierge offering, even though

such riders may be excluded from the definition of Active Riders

unless the ride is accessible in that rider’s Lyft App.

Gross Bookings

Gross Bookings is a key indicator of the scale and impact of our

overall platform. Lyft defines Gross Bookings as the total dollar

value of transactions invoiced to rideshare riders including any

applicable taxes, tolls and fees excluding tips to drivers. It also

includes amounts invoiced for other offerings, including but not

limited to: Express Drive vehicle rentals, bike and scooter

rentals, and amounts recognized for subscriptions, bike and bike

station hardware and software sales, media, sponsorships,

partnerships, and licensing and data access agreements.

Adjusted EBITDA margin (calculated as a percentage of Gross

Bookings)

Adjusted EBITDA margin (calculated as a percentage of Gross

Bookings) is calculated by dividing Adjusted EBITDA for a period by

Gross Bookings for the same period. For the definition of Adjusted

EBITDA, refer to “Non-GAAP Financial Measures”.

Webcast

Lyft will host a webcast today at 2:00 p.m. Pacific Time (5:00

p.m. Eastern Time) to discuss these financial results and business

highlights. To listen to a live audio webcast, please visit our

Investor Relations page at https://investor.lyft.com/. The archived

webcast will be available on our Investor Relations page shortly

after the call.

About Lyft

Whether it’s an everyday commute or a journey that changes

everything, Lyft is driven by our purpose: to serve and connect. In

2012, Lyft was founded as one of the first ridesharing communities

in the United States. Now, millions of drivers have chosen to earn

on billions of rides. Lyft offers rideshare, bikes, and scooters

all in one app — for a more connected world, with transportation

for everyone.

Available Information

Lyft announces material information to the public about Lyft,

its products and services and other matters through a variety of

means, including filings with the Securities and Exchange

Commission, press releases, public conference calls, webcasts, the

investor relations section of its website (investor.lyft.com), its

X accounts (@lyft and @davidrisher), its Chief Executive Officer’s

LinkedIn account (linkedin.com/in/jdavidrisher) and its blogs

(including: lyft.com/blog, lyft.com/hub, and eng.lyft.com) in order

to achieve broad, non-exclusionary distribution of information to

the public and for complying with its disclosure obligations under

Regulation FD.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or Lyft’s future financial or operating performance. In some

cases, you can identify forward looking statements because they

contain words such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “going to,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“potential” or “continue” or the negative of these words or other

similar terms or expressions that concern Lyft's expectations,

strategy, priorities, plans or intentions. Forward-looking

statements in this release include, but are not limited to, Lyft’s

guidance and outlook, including for the fourth quarter and full

fiscal year 2024, and the trends and assumptions underlying such

guidance and outlook, and Lyft’s plans and expectations, including

statements about autonomous partnerships and our strategic

partnership with DoorDash and the benefits such partnerships will

provide. Lyft’s expectations and beliefs regarding these matters

may not materialize, and actual results in future periods are

subject to risks and uncertainties that could cause actual results

to differ materially from those projected, including risks related

to the macroeconomic environment and risks regarding our ability to

forecast our performance due to our limited operating history and

the macroeconomic environment and the risk that our partnerships

may not materialize as expected. The forward-looking statements

contained in this release are also subject to other risks and

uncertainties, including those more fully described in Lyft’s

filings with the Securities and Exchange Commission (“SEC”),

including in our Quarterly Report on Form 10-Q for the quarter

ended June 30, 2024 that was filed with the SEC on August 7, 2024

and our Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024 that will be filed with the SEC by November 12,

2024. The forward-looking statements in this release are based on

information available to Lyft as of the date hereof, and Lyft

disclaims any obligation to update any forward-looking statements,

except as required by law. This press release discusses

“customers.” For rideshare, there are two customers in every car -

the driver is Lyft’s customer, and the rider is the driver’s

customer. We care about both.

Non-GAAP Financial Measures

To supplement Lyft’s financial information presented in

accordance with generally accepted accounting principles in the

United States of America, or GAAP, Lyft considers certain financial

measures that are not prepared in accordance with GAAP, including

Adjusted Net Income (Loss), Adjusted EBITDA, Adjusted EBITDA margin

(calculated as a percentage of Gross Bookings) and free cash flow.

Lyft defines Adjusted EBITDA as net income (loss) adjusted for

interest expense, other income (expense), net, provision for

(benefit from) income taxes, depreciation and amortization,

stock-based compensation expense, payroll tax expense related to

stock-based compensation and sublease income, as well as, if

applicable, restructuring charges, costs related to acquisitions

and divestitures and costs from transactions related to certain

legacy auto insurance liabilities. Adjusted EBITDA margin

(calculated as a percentage of Gross Bookings) is calculated by

dividing Adjusted EBITDA for a period by Gross Bookings for the

same period and is considered a key metric. Lyft defines Adjusted

Net Income (Loss) as net income (loss) adjusted for amortization of

intangible assets, stock-based compensation expense (net of any

benefit), and payroll tax expense related to stock-based

compensation, as well as, if applicable, restructuring charges and

transaction costs related to certain legacy auto insurance

liabilities and cost related to acquisitions and divestitures. Lyft

defines free cash flow as GAAP net cash provided by (used in)

operating activities less purchases of property and equipment and

scooter fleet.

Lyft subleases certain office space and earns sublease income.

Sublease income is included within other income, net on the

condensed consolidated statement of operations, while the related

lease expense is included within operating expenses and loss from

operations. Lyft believes the adjustment to include sublease income

in Adjusted EBITDA is useful to investors by enabling them to

better assess Lyft’s operating performance, including the benefits

of recent transactions, by presenting sublease income as a

contra-expense to the related lease charges that are part of

operating expenses.

In November 2022, April 2023 and September 2024, Lyft committed

to plans of termination as part of efforts to reduce operating

expenses. Lyft believes the costs associated with these

restructuring efforts do not reflect performance of Lyft’s ongoing

operations. Lyft believes the adjustment to exclude the costs

related to restructuring from Adjusted EBITDA and Adjusted Net

Income (Loss) is useful to investors by enabling them to better

assess Lyft’s ongoing operating performance and provide for better

comparability with Lyft’s historically disclosed Adjusted EBITDA

and Adjusted Net Income (Loss) amounts.

Lyft uses its non-GAAP financial measures in conjunction with

GAAP measures as part of our overall assessment of our performance,

including the preparation of our annual operating budget and

quarterly forecasts, to evaluate the effectiveness of our business

strategies, and to communicate with our board of directors

concerning our financial performance. Free cash flow is a measure

used by our management to understand and evaluate our operating

performance and trends. We believe free cash flow is a useful

indicator of liquidity that provides our management with

information about our ability to generate or use cash to enhance

the strength of our balance sheet, further invest in our business

and pursue potential strategic initiatives. Free cash flow has

certain limitations, including that it does not reflect our future

contractual commitments and it does not represent the total

increase or decrease in our cash balance for a given period. Free

cash flow does not necessarily represent funds available for

discretionary use and is not necessarily a measure of our ability

to fund our cash needs.

Lyft’s definitions may differ from the definitions used by other

companies and therefore comparability may be limited. In addition,

other companies may not publish these or similar metrics.

Furthermore, these measures have certain limitations in that they

do not include the impact of certain expenses that are reflected in

our consolidated statement of operations that are necessary to run

our business. Thus, our non-GAAP financial measures should be

considered in addition to, not as substitutes for, or in isolation

from, measures prepared in accordance with GAAP.

Lyft, Inc.

Condensed Consolidated Balance

Sheets

(in thousands, except for share

and per share data)

(unaudited)

September 30,

2024

December 31,

2023

Assets

Current assets

Cash and cash equivalents

$

770,298

$

558,636

Short-term investments

1,156,735

1,126,548

Prepaid expenses and other current

assets

940,335

892,235

Total current assets

2,867,368

2,577,419

Restricted cash and cash equivalents

270,248

211,786

Restricted investments

1,196,837

837,291

Other investments

42,982

39,870

Property and equipment, net

483,861

465,844

Operating lease right of use assets

83,866

98,202

Intangible assets, net

48,242

59,515

Goodwill

256,393

257,791

Other assets

13,358

16,749

Total assets

$

5,263,155

$

4,564,467

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

109,336

$

72,282

Insurance reserves

1,592,564

1,337,868

Accrued and other current liabilities

1,715,181

1,508,855

Operating lease liabilities — current

41,752

42,556

Convertible senior notes, current

389,773

—

Total current liabilities

3,848,606

2,961,561

Operating lease liabilities

103,779

134,102

Long-term debt, net of current portion

574,475

839,362

Other liabilities

80,516

87,924

Total liabilities

4,607,376

4,022,949

Stockholders’ equity

Preferred stock, $0.00001 par value;

1,000,000,000 shares authorized as of September 30, 2024 and

December 31, 2023; no shares issued and outstanding as of September

30, 2024 and December 31, 2023

—

—

Common stock, $0.00001 par value;

18,000,000,000 Class A shares authorized as of September 30, 2024

and December 31, 2023; 406,280,530 and 391,239,046 Class A shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively; 100,000,000 Class B shares authorized as of

September 30, 2024 and December 31, 2023; 8,530,629 and 8,566,629

Class B shares issued and outstanding as of September 30, 2024 and

December 31, 2023.

4

4

Additional paid-in capital

10,978,966

10,827,378

Accumulated other comprehensive loss

(3,329

)

(4,949

)

Accumulated deficit

(10,319,862

)

(10,280,915

)

Total stockholders’ equity

655,779

541,518

Total liabilities and stockholders’

equity

$

5,263,155

$

4,564,467

Lyft, Inc.

Condensed Consolidated

Statements of Operations

(in thousands, except for per

share data)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

1,522,692

$

1,157,550

$

4,235,739

$

3,179,004

Costs and expenses

Cost of revenue

888,255

644,500

2,463,135

1,800,091

Operations and support

117,462

118,763

336,238

325,338

Research and development

104,447

109,229

303,277

460,745

Sales and marketing

215,779

129,947

537,621

355,055

General and administrative

253,436

195,290

742,332

653,228

Total costs and expenses

1,579,379

1,197,729

4,382,603

3,594,457

Loss from operations

(56,687

)

(40,179

)

(146,864

)

(415,453

)

Interest expense

(7,362

)

(6,209

)

(22,262

)

(17,793

)

Other income (expense), net

50,941

34,399

133,941

124,689

Loss before income taxes

(13,108

)

(11,989

)

(35,185

)

(308,557

)

Provision for (benefit from) income

taxes

(682

)

111

3,762

5,454

Net loss

$

(12,426

)

$

(12,100

)

$

(38,947

)

$

(314,011

)

Net loss per share

Basic

$

(0.03

)

$

(0.03

)

$

(0.10

)

$

(0.82

)

Diluted

$

(0.03

)

$

(0.03

)

$

(0.10

)

$

(0.82

)

Weighted-average number of shares

outstanding used to compute net loss per share

Basic

412,229

389,307

406,785

381,697

Diluted

412,229

389,307

406,785

381,697

Stock-based compensation included in

costs and expenses:

Cost of revenue

$

6,789

$

5,553

$

18,564

$

23,825

Operations and support

2,310

2,818

6,299

12,727

Research and development

32,036

40,699

89,208

183,555

Sales and marketing

4,822

5,723

13,257

25,360

General and administrative

42,999

43,750

127,464

147,385

Lyft, Inc.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities

Net loss

$

(38,947

)

$

(314,011

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities

Depreciation and amortization

115,189

85,350

Stock-based compensation

254,793

392,852

Amortization of premium on marketable

securities

236

93

Accretion of discount on marketable

securities

(66,220

)

(46,581

)

Amortization of debt discount and issuance

costs

2,744

2,124

(Gain) loss on sale and disposal of

assets, net

8,180

(9,471

)

Other

(2,556

)

2,173

Changes in operating assets and

liabilities, net effects of acquisition

Prepaid expenses and other assets

(39,631

)

(35,354

)

Operating lease right-of-use assets

19,971

21,769

Accounts payable

34,711

(52,988

)

Insurance reserves

254,696

(94,580

)

Accrued and other liabilities

189,903

(77,919

)

Lease liabilities

(36,698

)

(15,209

)

Net cash (used in) provided by operating

activities

696,371

(141,752

)

Cash flows from investing

activities

Purchases of marketable securities

(2,976,674

)

(2,354,598

)

Purchases of term deposits

(2,194

)

—

Proceeds from sales of marketable

securities

155,181

345,422

Proceeds from maturities of marketable

securities

2,497,355

2,751,529

Proceeds from maturities of term

deposits

3,539

5,000

Purchases of property and equipment and

scooter fleet

(70,055

)

(121,250

)

Cash paid for acquisitions, net of cash

acquired

—

1,630

Sales of property and equipment

67,856

79,033

Other

1,113

—

Net cash (used in) provided by investing

activities

(323,879

)

706,766

Cash flows from financing

activities

Repayment of loans

(61,807

)

(60,519

)

Proceeds from issuance of convertible

senior notes

460,000

—

Payment of debt issuance costs

(11,888

)

—

Purchase of capped call

(47,886

)

—

Repurchase of Class A common stock

(50,000

)

—

Payment for settlement of convertible

senior notes due 2025

(350,000

)

—

Proceeds from exercise of stock options

and other common stock issuances

7,173

6,697

Taxes paid related to net share settlement

of equity awards

(12,490

)

(2,208

)

Principal payments on finance lease

obligations

(35,403

)

(35,935

)

Contingent consideration paid

—

(14,100

)

Net cash used in financing activities

(102,301

)

(106,065

)

Effect of foreign exchange on cash, cash

equivalents and restricted cash and cash equivalents

(67

)

(68

)

Net increase in cash, cash equivalents and

restricted cash and cash equivalents

270,124

458,881

Cash, cash equivalents and restricted

cash and cash equivalents

Beginning of period

771,786

391,822

End of period

$

1,041,910

$

850,703

Lyft, Inc.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Nine Months Ended September

30,

2024

2023

Reconciliation of cash, cash

equivalents and restricted cash and cash equivalents to the

consolidated balance sheets

Cash and cash equivalents

$

770,298

$

590,541

Restricted cash and cash equivalents

270,248

258,798

Restricted cash, included in prepaid

expenses and other current assets

1,364

1,364

Total cash, cash equivalents and

restricted cash and cash equivalents

$

1,041,910

$

850,703

Non-cash investing and financing

activities

Financed vehicles acquired

$

90,918

$

130,891

Purchases of property and equipment and

scooter fleet not yet settled

7,144

10,998

Right-of-use assets acquired under finance

leases

39,845

63,706

Right-of-use assets acquired under

operating leases

4,336

3,760

Remeasurement of finance and operating

lease right of use assets

(9,505

)

(12,729

)

Lyft, Inc.

GAAP to Non-GAAP

Reconciliations

(in millions)

(unaudited)

Three Months Ended

Sept. 30, 2024

Jun. 30, 2024

Sept. 30, 2023

Adjusted EBITDA

Net income (loss)

$

(12.4

)

$

5.0

$

(12.1

)

Adjusted to exclude the following:

Interest expense(1)

8.9

9.4

7.3

Other (income) expense, net

(50.9

)

(41.9

)

(34.4

)

Provision for (benefit from) income

taxes

(0.7

)

1.9

0.1

Depreciation and amortization

45.1

37.7

29.5

Stock-based compensation

89.0

85.7

98.5

Payroll tax expense related to stock-based

compensation

1.7

4.2

1.9

Sublease income

0.9

1.0

1.2

Restructuring charges(2)

25.8

—

—

Adjusted EBITDA

$

107.3

$

102.9

$

92.0

Gross Bookings

$

4,108.4

$

4,018.9

$

3,554.1

Net income (loss) as a percentage of Gross

Bookings

(0.3

)%

0.1

%

(0.3

)%

Adjusted EBITDA margin (calculated as a

percentage of Gross Bookings)

2.6

%

2.6

%

2.6

%

_______________

(1) Includes $1.5 million, $1.5 million

and $1.1 million related to the interest component of vehicle

related finance leases in the three months ended September 30,

2024, June 30, 2024 and September 30, 2023, respectively.

(2) In the third quarter of 2024, we

incurred restructuring charges of $13.4 million of fixed asset

disposals, $10.8 million of other current assets disposals and

other costs and $1.5 million of severance and other employee costs.

Restructuring related charges for accelerated depreciation of fixed

assets of $10.6 million are included on its respective line item.

These charges were related to the restructuring plan announced in

September 2024.

Note: Due to rounding, numbers presented

may not add up precisely to the totals provided.

Three Months Ended

Sept. 30, 2024

Jun. 30, 2024

Sept. 30, 2023

Adjusted Net Income (Loss)

Net income (loss)

$

(12.4

)

$

5.0

$

(12.1

)

Adjusted to exclude the following:

Amortization of intangible assets

3.5

4.0

4.0

Stock-based compensation expense

89.0

85.7

98.5

Payroll tax expense related to stock-based

compensation

1.7

4.2

1.9

Restructuring charges(1)

36.4

—

—

Adjusted Net Income (Loss)

$

118.1

$

98.9

$

92.3

_______________

(1) In the third quarter of 2024, we incurred restructuring charges

of $13.4 million of fixed asset disposals, $10.8 million of other

current assets disposals and other costs, $10.6 million of

accelerated depreciation of fixed assets and $1.5 million of

severance and other employee costs. These charges were related to

the restructuring plan announced in September 2024. Note: Due to

rounding, numbers presented may not add up precisely to the totals

provided.

Trailing Twelve Months

Ended

Three Months Ended

Sep. 30, 2024

Sep. 30, 2024

Jun. 30, 2024

Mar. 31, 2024

Dec. 31, 2023

Sep. 30, 2023

Free cash flow

Net cash provided by (used in) operating

activities

$

739.9

$

264.0

$

276.2

$

156.2

$

43.5

$

2.3

Less: purchases of property and equipment

and scooter fleet

(98.7

)

(21.2

)

(19.8

)

(29.1

)

(28.6

)

(32.3

)

Free cash flow

$

641.2

$

242.8

$

256.4

$

127.1

$

14.9

$

(30.0

)

_______________

Note: Due to rounding, numbers presented may not add up precisely

to the totals provided.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106680853/en/

Aurélien Nolf, Investor Relations investor@lyft.com

Stephanie Rice, Media press@lyft.com

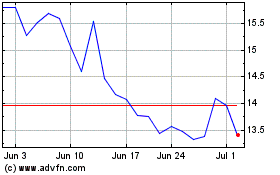

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Nov 2023 to Nov 2024