UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number 001-34738

Luokung Technology Corp.

(Translation of registrant’s name into English)

Room 805, West Tower, Century Fortune Center Guanghua

Road, Chaoyang District, Beijing

People’s Republic of China 100020

(Address

of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Luokung Technology Corp.

Luokung Technology Corp. Reports

Unaudited Financial Results for the First Six

Months of Fiscal Year 2024

Luokung Technology Corp. (Nasdaq: LKCO) (“Luokung,”

“we” or the “Company”), today announced the unaudited financial results for the six months ended June 30, 2024.

The financial statements and other financial information included in this Form 6-K are prepared in conformity with generally accepted

accounting principles in the United States of America (“U.S. GAAP”).

Financial Highlights for the Six Months Ended June

30, 2024:

Revenues for the six months ended June

30, 2024 decreased 78.2%, to $1,351,496 from $6,197,913 for the six months ended June 30, 2023;

Net loss of $11,590,311 for the six

months ended June 30, 2024 as compared to net loss of $22,458,378 for the six months ended June 30, 2023;

Basic and diluted loss per share was

$5.12 and $10.40 for the six months ended June 30, 2024 and 2023; and

Weighted average shares outstanding

for the six months ended June 30, 2024 were 2,223,447, compared to 2,125,368 for the six months ended June 30, 2023, both of which were

retroactively restated to reflect the impact of the 8-to-1 reverse stock split effective on September 17, 2024.

“In the first half of the 2024 fiscal year,

our revenue was $1.4 million, a decrease of 78.2% from $6.2 million for the same period of the 2023 fiscal year. The Company has made

certain adjustments to its business in response to market changes. It will continue to strengthen and advance its smart city and IoT-related

businesses. Additionally, the Company plans to undertake a series of asset restructuring and debt restructuring initiatives.” said

Mr. Song Xuesong, the Company’s Chief Executive Officer.

Results of Operations - Six Months Ended June

30, 2024 Compared to Six Months Ended June 30, 2023

Revenue

The Company’s revenues for the six months ended

June 30, 2024 and 2023 primarily consisted of smart transportation from the Company’s variable interest entity, eMapgo Technologies

(Beijing) Co., Ltd. (“EMG”).

Smart transportation

Map data licensing

EMG provides perpetual map data licenses to customers

and collects one-time license fees from customers. Revenue is recognized at the point in time when customers obtain the right to use the

map data.

Autonomous driving simulation and verification

test

EMG provides data collection and desensitization

for compliance with legal requirements to which system manufacturers and automobile manufacturers for autonomous driving simulation and

verification testing are subject. Revenues are derived from the provision of data collection and desensitization services for compliance

with legal requirements. Revenues are recognized over time as the services are performed because customers receive and consume the benefit

of the performance of services throughout the contract period.

Map service platform local deployment

Through local deployment, EMG provides a one-time

map service platform license or a map service platform license for a contracted period to certain public sectors and enterprises to support

location-based applications with updates to the map service platform during such contracted period. The map service platform includes

map data and software that support certain map applications including display, search, routing and others. Revenues from a map data license

for a given period are recognized ratably over time because customers receive and consume the benefit of the map services throughout the

contract period.

For the six months ended June 30, 2024, the Company

had revenue of $1,351,496, as compared to revenue of $6,197,913 for the six months ended June 30, 2023, a decrease of $4,846,417, or 78.2%.

Smart

transportation

For the six months ended June

30, 2024, revenue from smart transportation was $1,351,496, an increase of $4,516,821, or 77.0%, from $5,868,317 for

the six months ended June 30, 2023.

Operating costs and expenses

The Company’s operating costs and expenses

consisted of cost of revenues, selling, general and administrative expenses, and research and development expenses.

Cost of Revenues

Cost of revenues decreased by 75.1% to $797,815

for the six months ended June 30, 2024 from $3,202,677 for the six months ended June 30, 2023.

The cost of revenues primarily consisted of traffic

acquisition costs for advertising business and salary and benefit expenses. The Company’s traffic acquisition costs may vary due

to a number of factors, including scale, targeted audience and the geography of traffic.

Included in salary and benefit expenses are those

for employees directly involved in data collection and processing, direct production costs, which are primarily comprised of field survey-related

costs and hard disk materials costs, and depreciation of facilities and equipment used in data collection and processing.

Selling and marketing expense

The Company’s selling and marketing expense

mainly includes promotional and marketing expenses and compensation for our sales and marketing personnel.

Selling expense totaled $645,868 for the six months

ended June 30, 2024, as compared to $1,534,979 for the six months ended June 30, 2023, a decrease of $889,111 or 57.9%. The decrease was

mainly due to fewer selling and marketing activities was conducted.

General and administrative expense

The Company’s general and administrative

expenses consisted primarily of salaries and benefits for the Company’s general and administrative personnel, rent, fees and expenses

for legal, accounting and other professional services.

General and administrative expense totaled $1,748,765

for the six months ended June 30, 2024, as compared to $7,518,082 for the six months ended June 30, 2023, a decrease of $5,769,317 or

76.7%. The decrease was primarily attributable to the decrease in employee incentive plan of approximately $3,867,000.

Research and development expenses

Research and development expenses primarily consisted

of salaries and benefits for research and development personnel.

Research and development expenses totaled $8,566,187

for the six months ended June 30, 2024, as compared to $14,544,380 for the six months ended June 30, 2023, a decrease of $5,978,193 or

41.1%. The decrease was primarily attributable to a decrease in salaries and share based compensation due to a decrease in headcount of

staff in the research and development department.

Loss from operations

As a result of the factors described above, for

the six months ended June 30, 2024, loss from operations amounted to $10,407,139 as compared to loss from operations of $20,602,205 for

the six months ended June 30, 2023, a decrease of $10,195,066, or 49.5%.

Other income/expense

Other income/expense primarily included interest

expenses from other loans and foreign currency gains/losses.

For the six months ended June 30, 2024, other

expense, net, amounted to $1,739,360 as compared to other expense, net, of $2,412,361 for the six months ended June 30, 2023, a decrease

of $673,001, or 27.9%, which was primarily attributable to a decrease in other expenses of approximately $768,000, offset by an increase

in foreign currency transaction loss of approximately $163,000.

Net loss

As a result of the factors described above, the

Company’s net loss was $11,590,311 for the six months ended June 30, 2024, compared to net loss of $22,458,000 for the six months

ended June 30, 2023, a decrease of $10,868,067 or 48.4%.

Foreign currency translation adjustment

The Company’s reporting currency is the

U.S. dollar. The functional currency of the Company’s subsidiaries (LK Technology, MMB and Mobile Media) is the U.S. dollar and

the functional currency of the Company’s subsidiaries incorporated in China is the Chinese Renminbi (“RMB”). The financial

statements of the Company’s subsidiaries incorporated in China are translated to U.S. dollars using period end exchange rates for

assets and liabilities, and average exchange rates (for the period) for revenue, costs and expenses. Net gains and losses resulting from

foreign exchange transactions are included in the Company’s consolidated statements of operations and comprehensive loss. As a result

of foreign currency translations, which are a non-cash adjustment, the Company reported a foreign currency translation gain of $192,501

for the six months ended June 30, 2024, as compared to a foreign currency translation gain of $3,293,075 for the six months ended June

30, 2023. This non-cash gain had the effect of decreasing the Company’s reported comprehensive loss.

Comprehensive loss

As a result of the Company’s foreign currency

translation adjustment, the Company’s had comprehensive loss for the six months ended June 30, 2024 of $11,782,812, compared to

comprehensive loss of $19,165,303 for the six months ended June 30, 2023.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate

funds to support its current and future operations, satisfy its obligations and otherwise operate on an ongoing basis. The Company historically

relied on cash flow provided by operations and financing to provide its working capital. At June 30, 2024 and December 31, 2023, the Company

had cash balances of approximately $351,021 and $83,986, respectively. A significant portion of these funds are located in financial institutions

located in the PRC and will continue to be indefinitely reinvested in the Company’s operations in the PRC.

The following table sets forth a summary of changes

in the Company’s working capital from December 31, 2023 to June 30, 2024:

| | |

June 30,

2024 | | |

December 31,

2023 | | |

Change | | |

Percentage

Change | |

| Working capital deficit: | |

| | |

| | |

| | |

| |

| Total current assets | |

$ | 7,630,058 | | |

$ | 7,148,724 | | |

$ | 481,334 | | |

| (6.7 | )% |

| Total current liabilities | |

| 96,359,654 | | |

| 100,740,467 | | |

| (4,380,813 | ) | |

| (4.3 | )% |

| Working capital deficit: | |

$ | (88,729,596 | ) | |

$ | (93,591,743 | ) | |

$ | 4,862,147 | | |

| (5.2 | )% |

The Company’s working capital deficit decreased

by $4,862,147 to a working capital deficit of $88,729,596 at June 30, 2024 from $93,591,743 at December 31, 2023. This decrease in working

capital deficit is primarily attributable to an increase in cash of approximately $267,000, an increase in other receivables and prepayment

of approximately $1,005,000, a decrease in accounts payable of approximately $198,000, a decrease in accrued liabilities and other payables

of approximately $3,510,000 and a decrease in lease liabilities – current portion of approximately $657,000, offset by a decrease

in accounts receivable, net of allowance for expected credit losses of approximately $757,000.

The Company had incurred negative cash flows from

operating activities and net losses for the six months ended June 30, 2024, which raise substantial doubt about the Company’s ability

to continue as a going concern. In order to continue as a going concern and mitigate our liquidity risk, the Company will need additional

capital resources, among other things. Management’s plans to obtain such resources for the Company include (1) endeavoring to enter

into more sales contracts, (2) increasing proceeds from loans from both unrelated and related parties to provide the resources necessary

to fund the development of our business plan and operations, and (3) increasing proceeds from loans from financial institutions and/or

existing investors to increase working capital in order to meet capital demands.

About Luokung Technology Corp.

Luokung Technology Corp. is a leading spatial-temporal

intelligent big data services company, as well as a leading provider of LBS for various industries in China. Backed by its proprietary

technologies and expertise in multi-sourced intelligent spatial-temporal big data, Luokung has established city-level and industry-level

holographic spatial-temporal digital twin systems and actively serves industries including smart transportation (autonomous driving, smart

highway and vehicle-road collaboration), natural resource asset management (carbon neutral and environmental protection remote sensing

data service), and LBS smart industry applications (mobile Internet LBS, smart travel, smart logistics, new infrastructure, smart cities,

emergency rescue, among others). The Company routinely provides important updates on its website: https://www.luokung.com.

Safe Harbor Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including certain plans, expectations, goals,

and projections, which are subject to numerous assumptions, risks, and uncertainties. These forward-looking statements may include, but

are not limited to, statements containing words such as “may,” “could,” “would,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,” “expects,”

“intends”, “future” and “guidance” or similar expressions. These forward-looking statements speak

only as of the date of this press release and are subject to change at any time. These forward-looking statements are based upon management’s

current expectations and are subject to a number of risks, uncertainties and contingencies, many of which are beyond the Company’s

control that may cause actual results, levels of activity, performance or achievements to differ materially from any future results, levels

of activity, performance or achievements expressed or implied by such forward-looking statements. The Company’s actual results could

differ materially from those contained in the forward-looking statements due to a number of factors, including those described under the

heading “Risk Factors” in the Company’s Annual Report of Foreign Private Issuer of Form 20-F for the fiscal year ended

December 31, 2023, filed with the Securities and Exchange Commission on October 22, 2024, and the Company’s subsequent filings with

the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except as required under applicable law.

For investor and media inquiries, please contact:

Mr. Jian Zhang

Tel: (+86) 10-6506 5217

Email: zhangjian@luokung.com

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS

(IN U.S. DOLLARS)

| | |

As of

June 30, | | |

As of

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash | |

$ | 351,021 | | |

$ | 83,986 | |

| Restricted cash | |

| 459,440 | | |

| 462,300 | |

| Accounts receivable, net of allowance for expected credit losses | |

| 2,592,618 | | |

| 3,349,504 | |

| Other receivables and prepayment | |

| 3,810,948 | | |

| 2,805,669 | |

| Amounts due from associate | |

| 411,822 | | |

| 447,265 | |

| Notes receivable | |

| 4,209 | | |

| - | |

| Total current assets | |

| 7,630,058 | | |

| 7,148,724 | |

| Non-current assets: | |

| | | |

| | |

| Property and equipment, net | |

| 589,280 | | |

| 1,082,000 | |

| Intangible assets, net | |

| 38,550,715 | | |

| 43,329,144 | |

| Goodwill | |

| 377,665 | | |

| 377,665 | |

| Investment | |

| 704,909 | | |

| 707,430 | |

| Right-of-use assets | |

| 124,431 | | |

| 744,210 | |

| Deferred tax assets | |

| | | |

| - | |

| Other assets | |

| | | |

| - | |

| Equity method investment | |

| 124,856 | | |

| - | |

| Other receivables, net (long term) | |

| 270,877 | | |

| 248,569 | |

| Total non-current assets | |

| 40,742,733 | | |

| 46,489,018 | |

| TOTAL ASSETS | |

| 48,372,791 | | |

| 53,637,742 | |

| Liabilities | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 8,036,662 | | |

| 8,234,891 | |

| Accrued liabilities and other payables | |

| 85,734,582 | | |

| 89,244,659 | |

| Amounts due to associate | |

| 35,115 | | |

| 35,334 | |

| Contract liabilities | |

| 678,311 | | |

| 682,534 | |

| Lease liabilities – current portion | |

| 73,456 | | |

| 730,304 | |

| Amounts due to related parties | |

| 1,801,528 | | |

| 1,812,745 | |

| Total current liabilities | |

| 96,359,654 | | |

| 100,740,467 | |

| Non-current liabilities: | |

| | | |

| | |

| Lease liabilities – non-current portion | |

| 82,129 | | |

| 62,528 | |

| Deferred tax liabilities | |

| 2,010,792 | | |

| 2,566,980 | |

| Accrued liabilities and other payables | |

| 3,271,352 | | |

| 3,291,721 | |

| Total non- current liabilities | |

| 5,364,273 | | |

| 5,921,229 | |

| TOTAL LIABILITIES | |

| 101,723,927 | | |

| 106,661,696 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | |

| Redeemable preferred shares, $2.4 par value, 90,812 shares authorized, issued and outstanding at June 30, 2024 and December 31, 2023 | |

| 10,204,326 | | |

| 10,204,326 | |

| | |

| | | |

| | |

| Shareholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Share capital | |

| | | |

| | |

| Preferred shares, $2.4; 10,417 shares authorized, issued and outstanding at June 30, 2024 and December 31, 2023 | |

| 25,000 | | |

| 25,000 | |

| Ordinary shares, $2.4 par value; 125,000,000 shares authorized; 2,439,727 and 2,052,078 shares issued and outstanding at June 30, 2024 and December 31, 2023 | |

| 5,855,345 | | |

| 5,855,345 | |

| Additional paid-in capital | |

| 348,787,846 | | |

| 348,787,846 | |

| Accumulated deficit | |

| (427,972,747 | ) | |

| (416,581,282 | ) |

| Accumulated other comprehensive (loss) / income | |

| 11,773,696 | | |

| 536,155 | |

| Total (deficit) attributable to owners of the company | |

| (61,530,860 | ) | |

| (61,376,936 | ) |

| Non-controlling interest | |

| (2,024,602 | ) | |

| (1,851,344 | ) |

| | |

| | | |

| | |

| Total Shareholders’ (Deficit) | |

| (63,555,462 | ) | |

| (63,228,280 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY | |

$ | 48,372,791 | | |

$ | 53,637,742 | |

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(IN U.S. DOLLARS)

| | |

For the Six Months Ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 1,351,496 | | |

$ | 6,197,913 | |

| Less: Operating costs and expenses: | |

| | | |

| | |

| Cost of revenues | |

| 797,815 | | |

| 3,202,677 | |

| Selling and marketing | |

| 645,868 | | |

| 1,534,979 | |

| General and administrative | |

| 1,748,765 | | |

| 7,518,082 | |

| Research and development | |

| 8,566,187 | | |

| 14,544,380 | |

| Total Operating costs and expenses | |

| 10,960,820 | | |

| 23,597,441 | |

| Loss from operations | |

| (10,407,139 | ) | |

| (20,602,205 | ) |

| Other income (expense): | |

| | | |

| | |

| Interest expense | |

| (1,716,108 | ) | |

| (1,783,900 | ) |

| Foreign exchange losses, net | |

| (11,838 | ) | |

| 151,234 | |

| Other income, net | |

| (11,414 | ) | |

| (779,695 | ) |

| Total other expense, net | |

| (1,739,360 | ) | |

| (2,412,361 | ) |

| Loss before income taxes | |

| (12,146,499 | ) | |

| (23,014,566 | ) |

| Income tax credit | |

| 556,188 | | |

| 556,188 | |

| Net loss | |

$ | (11,590,311 | ) | |

$ | (22,458,378 | ) |

| Less: Net loss attributable to the non-controlling interest | |

| 198,846 | | |

| 326,948 | |

| Net loss attributable to owners of the Company | |

$ | (11,391,465 | ) | |

$ | (22,131,430 | ) |

| Comprehensive loss: | |

| | | |

| | |

| Net loss | |

| (11,590,311 | ) | |

| (22,458,378 | ) |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 192,501 | | |

| 3,293,075 | |

| Comprehensive loss | |

$ | (11,782,812 | ) | |

$ | (19,165,303 | ) |

| Less: Comprehensive profit (loss) attributable to the non-controlling interest | |

| 185,687 | | |

| (1,960,326 | ) |

| Comprehensive loss attributable to owner of the company | |

$ | (11,597,125 | ) | |

$ | (21,125,629 | ) |

| Net loss per ordinary share: | |

| | | |

| | |

| Basic and Diluted | |

$ | (5.12 | ) | |

$ | (10.40 | ) |

| | |

| | | |

| | |

| Weighted average number of ordinary shares outstanding Basic and Diluted | |

| 2,223,447 | | |

| 2,125,368 | |

LUOKUNG

TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN

U.S. DOLLARS)

| | |

For the Six month

June 30, | |

| | |

2023 | | |

2024 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| | |

| | |

| |

| Net loss | |

$ | (11,590,311 | ) | |

| (22,458,378 | ) |

| Depreciation and amortization | |

| 5,233,784 | | |

| 8,155,535 | |

| Amortization of right-of-use assets | |

| 99,779 | | |

| 851,698 | |

| Increase in allowance for doubtful accounts | |

| (176,406 | ) | |

| (559,797 | ) |

| Loss on disposal of Subsidiary | |

| (105,379 | ) | |

| - | |

| Common stock issuance for professional fee | |

| - | | |

| 2,858,833 | |

| Loss on disposal of property and equipment | |

| - | | |

| 872,638 | |

| | |

| | | |

| | |

| Changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| 884,808 | | |

| 6,331,799 | |

| Change in note receivable | |

| (4,209 | ) | |

| 2,194 | |

| Other receivables and prepayment | |

| (960,327 | ) | |

| 25,570,668 | |

| Deferred revenue | |

| (4,223 | ) | |

| (566,206 | ) |

| Accounts payable | |

| (198,229 | ) | |

| (1,913,437 | ) |

| Accrued liabilities and other payables | |

| 6,477,279 | | |

| (19,231,288 | ) |

| Change in deferred tax liability | |

| (556,188 | ) | |

| (556,188 | ) |

| Change in inventories | |

| 28 | | |

| 273 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (899,594 | ) | |

| (641,656 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| - | | |

| 226,899 | |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| - | | |

| 226,899 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Repayment to related parties | |

| 24,007 | | |

| 583,726 | |

| Net cash provided by financing activities | |

| 24,007 | | |

| 583,726 | |

| | |

| | | |

| | |

| Effect of foreign exchange rate changes | |

| 1,139,762 | | |

| (437,027 | ) |

| | |

| | | |

| | |

| Net decrease in cash | |

| 264,175 | | |

| (268,058 | ) |

| Cash at beginning of year | |

| 546,286 | | |

| 1,264,881 | |

| | |

| | | |

| | |

| Cash at end of period | |

$ | 810,461 | | |

| 996,823 | |

| Supplemental cash flow disclosures: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash and cash equivalents | |

| 351,021 | | |

| 683,848 | |

| Restricted cash | |

| 459,440 | | |

| 312,975 | |

| Total cash, cash equivalents and restricted cash shown in the statement of cash flows | |

| 810,461 | | |

| 996,823 | |

| Non-cash transaction: | |

| | | |

| | |

| Share based compensation | |

| - | | |

| 2,858,833 | |

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’

EQUITY

(IN U.S. DOLLARS)

| | |

Ordinary shares | | |

Preferred shares | | |

Additional paid-in | | |

Accumulated | | |

Accumulated other comprehensive Income | | |

Non- controlling | | |

Total Shareholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

capital | | |

deficit | | |

(loss) | | |

Interest | | |

Equity | |

| Balance as of December 31, 2021 | |

| 385,542,224 | | |

$ | 3,855,422 | | |

| 1,000,000 | | |

$ | 10,000 | | |

$ | 316,322,976 | | |

$ | (182,710,276 | ) | |

$ | (1,592,762 | ) | |

$ | 7,758,316 | | |

$ | 143,643,676 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of ordinary shares | |

| 106,956,464 | | |

| 1,069,565 | | |

| - | | |

| - | | |

| 27,286,328 | | |

| - | | |

| - | | |

| - | | |

| 28,355,893 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of preferred shares | |

| | | |

| | | |

| 1,500,000 | | |

| 15,000 | | |

| 292,500 | | |

| | | |

| | | |

| | | |

| 307,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (52,539,682 | ) | |

| - | | |

| 2,327,941 | | |

| (50,211,741 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition of subsidiaries | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (194,363 | ) | |

| (194,363 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,135,731 | | |

| 68,475 | | |

| 2,204,206 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of December 31, 2022 | |

| 492,498,688 | | |

$ | 4,924,987 | | |

| 2,500,000 | | |

$ | 25,000 | | |

$ | 343,901,804 | | |

$ | (235,249,958 | ) | |

$ | 542,969 | | |

$ | 9,960,369 | | |

$ | 124,105,171 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of ordinary shares | |

| 11,195,339 | | |

| 930,358 | | |

| - | | |

| - | | |

| 7,561,742 | | |

| - | | |

| - | | |

| - | | |

| 8,492,100 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reverse split | |

| (501,254,300 | ) | |

| | | |

| (2,489,583 | ) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (181,331,324 | ) | |

| - | | |

| (390,905 | ) | |

| (181,722,229 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss of control over subsidiaries | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,675,700 | ) | |

| - | | |

| - | | |

| (11,235,121 | ) | |

| (13,910,821 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,814 | ) | |

| (185,687 | ) | |

| (192,501 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of December 31, 2023 | |

| 2,439,727 | | |

$ | 5,855,345 | | |

| 10,417 | | |

$ | 25,000 | | |

$ | 348,787,846 | | |

$ | (407,381,356 | ) | |

$ | 531,136 | | |

$ | (1,851,344 | ) | |

$ | (63,228,280 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reverse split | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of ordinary shares | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (11,391,465 | ) | |

| - | | |

| (198,846 | ) | |

| (11,590,311 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss of control over subsidiaries | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 11,237,541 | | |

| 25,588 | | |

| 11,263,129 | |

| Balance June 30, 2024 | |

| 2,439,727 | | |

$ | 5,855,345 | | |

| 10,417 | | |

$ | 25,000 | | |

$ | 348,787,846 | | |

$ | (427,972,747 | ) | |

$ | (11,773,696 | ) | |

$ | (2,024,602 | ) | |

$ | (63,555,462 | ) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Luokung Technology Corp. |

| |

|

| Date: January 10, 2025 |

By |

/s/ Xuesong Song |

| |

|

Xuesong Song |

| |

|

Chief Executive Officer |

10

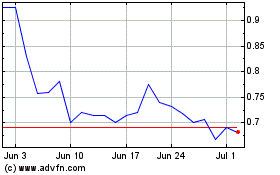

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Jan 2024 to Jan 2025