As filed with the Securities and Exchange Commission

on August 31, 2023

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Luokung Technology Corp.

(Exact name of registrant as specified in its charter)

| British Virgin Islands |

|

Not Applicable |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

B9-8, Block B, SOHO Phase II, No 9, Guanghua

Road

Chaoyang District, Beijing

People’s Republic of China, 100020

(86)

10-65065217

(Address, including zip code, and telephone

number, including area code, of Registrant’s principal executive offices)

Luokung Technology Corp.

Amendment No. 1 to the Amended and Restated

2018 Omnibus Equity Plan

(Full title of the plans)

Elizabeth F. Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 326-0199

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement

on Form S-8 (this “Registration Statement”) is being filed by Luokung Technology Corp., a British Virgin Islands holding

company (the “Company” or “Registrant”), to register 1,881,586 ordinary shares, par value $0.30

each of the Company, and 33,333 preferred shares, par value $0.30 each, in addition to those previously registered on the Company’s

Registration Statement on Form S-8 (File No. 333-267577) filed with the Securities and Exchange Commission (the “Commission”)

on September 23, 2022, for issuance pursuant to the Company’s Amendment No. 1 to the Amended and Restated 2018 Omnibus Equity Plan.

Pursuant to General Instruction E to Form S-8, the contents of such previously filed registration statement are incorporated herein by

reference, except that the provisions contained in Part II of such earlier registration statement are modified as set forth in this Registration

Statement.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the

information specified in this Part I of Form S-8 (plan information and registration information and employee plan annual information)

will be sent or given to employees as specified by the Commission pursuant to Rule 428(b)(1) of the Securities Act of 1933, as amended

(the “Securities Act”). Such documents are not required to be and are not filed with the Commission either as

part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. These documents and the documents

incorporated by reference in this Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus

that meets the requirements of Section 10(a) of the Securities Act. The Registrant will provide a written statement to participants advising

them of the availability without charge, upon written or oral request, of the documents incorporated by reference in Item 3 of Part II

hereof and including the statement in the preceding sentence. The written statement to all participants will indicate the availability

without charge, upon written or oral request, of other documents required to be delivered pursuant to Rule 428(b), and will include the

address and telephone number to which the request is to be directed.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed with the Commission

are hereby incorporated by reference in this Registration Statement:

| |

(a) |

The Registrant’s Annual Report on Form 20-F for the year ended December 31, 2022, filed with the Commission on May 16, 2023, containing the Registrant’s audited consolidated financial statements for the years ended December 31, 2022, 2021 and December 31, 2020. |

| |

|

|

| |

(b) |

The Registrant’s Reports on Form 6-K filed on February 15, 2023, March 6, 2023, March 27, 2023, April 13, 2023 and June 6, 2023; and |

| |

|

|

| |

(c) |

The description of the Registrant’s securities filed as Exhibit 2.4 to the Registrant’s Annual Report on Form 20-F for the year ended December 31, 2020, filed with the Commission on May 14, 2021. |

All

documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date of this Registration

Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered

have been sold or that deregisters all securities then remaining unsold shall be deemed to be incorporated by reference in this Registration

Statement and to be part hereof from the date of filing of such documents; provided, however, that documents or information

deemed to have been furnished and not filed in accordance with the rules of the Commission shall not be deemed incorporated by reference

into this Registration Statement. Any statement contained in a document incorporated or deemed to be incorporated by reference herein

shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein

or in any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration

Statement.

Item 4. Description of Securities.

Not applicable

Item 5. Interests of Named Experts and Counsel.

Not applicable

Item 6. Indemnification of Directors and Officers.

Under British Virgin Islands

laws, each of our directors and officers, in performing his or her functions, is required to act honestly and in good faith with a view

to our best interests and exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

Such limitation of liability does not affect the availability of equitable remedies such as injunctive relief or rescission. These provisions

will not limit the liability of directors under United States federal securities laws.

We may indemnify any of our

directors or anyone serving at our request as a director of another entity against all expenses, including legal fees, and against all

judgments, fines and amounts paid in settlement and reasonably incurred in connection with legal, administrative or investigative proceedings.

We may only indemnify a director if he or she acted honestly and in good faith with the view to our best interests and, in the case of

criminal proceedings, the director had no reasonable cause to believe that his or her conduct was unlawful. The decision of our board

of directors as to whether the director acted honestly and in good faith with a view to our best interests and as to whether the director

had no reasonable cause to believe that his or her conduct was unlawful, is in the absence of fraud sufficient for the purposes of indemnification,

unless a question of law is involved. The termination of any proceedings by any judgment, order, settlement, conviction or the entry of

no plea does not, by itself, create a presumption that a director did not act honestly and in good faith and with a view to our best interests

or that the director had reasonable cause to believe that his or her conduct was unlawful. If a director to be indemnified has been successful

in defense of any proceedings referred to above, the director is entitled to be indemnified against all expenses, including legal fees,

and against all judgments, fines and amounts paid in settlement and reasonably incurred by the director or officer in connection with

the proceedings.

We may purchase and maintain

insurance in relation to any of our directors or officers against any liability asserted against the directors or officers and incurred

by the directors or officers in that capacity, whether or not we have or would have had the power to indemnify the directors or officers

against the liability as provided in our memorandum of association and articles of association.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted for our directors or officers under the foregoing provisions, we have

been informed that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed

in the Securities Act and is therefore unenforceable as a matter of United States law.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

The following exhibits are filed as part of this

Registration Statement:

Item 9. Undertakings.

(a) The undersigned Registrant

hereby undertakes:

(1) To file, during

any period in which offers or sales are being made of securities registered hereby, a post-effective amendment to this Registration Statement

which shall include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement

or any material change to such information in the Registration Statement;

(2) That, for

the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof; and

(3) To remove

from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(b) The undersigned Registrant

hereby further undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s

annual report pursuant to Section 13(a) or 15(d) of the Exchange Act that is incorporated by reference in the Registration Statement shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant

to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling

person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in Beijing, the People’s Republic of China, on August 30, 2023.

| |

LUOKUNG TECHNOLOGY CORP. |

| |

|

|

| |

By: |

/s/ Xuesong Song |

| |

|

Xuesong Song |

| |

|

Chief Executive Officer |

KNOW ALL PERSONS BY THESE

PRESENTS, that each person whose signature appears below hereby constitutes and appoints Xuesong Song, as his true and lawful attorneys-in-fact

and agents, with full power of substitution and resubstitution, for him and in his name, place and stead in any and all capacities, in

connection with this registration statement, including to sign in the name and on behalf of the undersigned, this registration statement

and any and all amendments thereto, including post-effective amendments and registrations filed pursuant to Rule 462 under the U.S. Securities

Act of 1933, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and

Exchange Commission, granting unto such attorneys-in-fact and agents full power and authority to do and perform each and every act and

thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person,

hereby ratifying and confirming all that said attorneys-in-fact and agents, or his substitute, may lawfully do or cause to be done by

virtue hereof.

Pursuant to the requirements

of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Xuesong Song |

|

Chief Executive Officer, Chairman and Director |

|

August 30, 2023 |

| Xuesong Song |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Jian Zhang |

|

Chief Financial Officer |

|

August 30, 2023 |

| Jian Zhang |

|

(Principal Financial Officer) |

|

|

| |

|

|

|

|

| /s/ Dongpu Zhang |

|

President and Director |

|

August 30, 2023 |

| Dongpu Zhang |

|

|

|

|

| |

|

|

|

|

| /s/ David Wei Tang |

|

Director |

|

August 30, 2023 |

| David Wei Tang |

|

|

|

|

| |

|

|

|

|

| /s/ Jin Meng Bryan Yap |

|

Director |

|

August 30, 2023 |

| Jin Meng Bryan Yap |

|

|

|

|

| |

|

|

|

|

| /s/ Yang Zhou |

|

Director |

|

August 30, 2023 |

| Yang Zhou |

|

|

|

|

Signature of Authorized U.S. Representative

of Registrant

Pursuant

to the requirements of the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States

of Luokung Technology Corp., has signed this Registration Statement on August 30, 2023.

| |

Pryor Cashman LLP |

| |

|

| |

By: |

/s/ Elizabeth Chen |

| |

|

Name: |

Elizabeth Chen |

| |

|

Title: |

Partner |

II-5

Exhibit

5.1

|

|

CONYERS DILL & PEARMAN |

| |

|

| |

29th Floor |

| |

One Exchange Square |

| |

8 Connaught Place |

| |

Central |

| |

Hong Kong |

| |

|

| |

T +852 2524 7106 | F +852 2845 9268 |

| |

conyers.com |

30 August 2023

Matter No.: 865712

Doc Ref: 109323921

852 2842 9530

Richard.Hall@conyers.com

Luokung Technology Corp.

B9-8, Block B, SOHO Phase II

No 9, Guanghua Road

Chaoyang District

Beijing

People’s Republic of China

Dear Sir/ Madam,

Re: Luokung Technology Corp. (the “Company”)

We have acted as special British Virgin Islands

legal counsel to the Company in connection with a registration statement on Form S-8 filed by the Company with the United States Securities

and Exchange Commission (the “Commission”) on or about the date hereof (the “Registration Statement”,

which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit

or schedule thereto), relating to the registration of an aggregate of (i) 1,881,586 ordinary shares of par value of US$0.30 each and (ii)

33,333 preferred shares of a par value of US$0.30 each (collectively, the “Shares”) to be issued pursuant to the Amendment

No.1 to the Amended and Restated 2018 Omnibus Equity Plan of the Company approved and adopted on 15 August 2023 (the “Plan”,

which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit

or schedule thereto).

For the purposes of giving this opinion, we have

examined and relied upon copies of the following documents:

| 1.1. | the Registration Statement; and |

The documents listed in items 1.1 through 1.2

above are herein sometimes collectively referred to as the “Documents” (which term does not include any other instrument

or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto).

We have also reviewed:

| 1.3. | a copy of the certificate of incorporation, the amended and

restated memorandum of association and the amended and restated articles of association of the Company, as obtained from the Registrar

of Corporate Affairs at 3.00 p.m. on 29 August 2023; |

| 1.4. | copies of the resolutions in written consent of the board of

directors of the Company dated 4 November 2018, 15 September 2022 and 15 August 2023 and the resolutions in writing of a majority of

the shareholders of the Company dated 15 December 2019 and 15 August 2023 (collectively, the “Resolutions”); |

| 1.5. | a copy of certificate of good standing of the Company issued

by the Registrar of Corporate Affairs and dated 29 August 2023 (the “Certificate Date”); and |

| 1.6. | such other documents and made such enquiries as to questions

of law as we have deemed necessary in order to render the opinion set forth below. |

We have assumed:

| 2.1. | the genuineness and authenticity of all signatures and the conformity to the originals of all copies of

documents (whether or not certified) examined by us and the authenticity and completeness of the originals from which such copies were

taken; |

| 2.2. | the accuracy and completeness of all factual representations made in the Registration Statement, the Plan

and other documents reviewed by us; |

| 2.3. | that the Resolutions were passed at one or more duly convened, constituted and quorate meetings, or by

unanimous written resolutions, remain in full force and effect and have not been rescinded or amended; |

| 2.4. | that there is no provision of the law of any jurisdiction, other than the British Virgin Islands, which

would have any implication in relation to the opinions expressed herein; |

| 2.5. | that upon issue of any Shares by the Company the Company will receive consideration for the full issue

price thereof which shall be equal to at least the par value thereof; |

| 2.6. | the validity and binding effect under the laws of the United States of America of the Registration Statement

and that the Registration Statement will be duly filed with the Commission; |

| 2.7. | that on the date of issuance of any of the Shares, the Company will have sufficient authorised but unissued

Shares; and |

| 2.8. | that on the date of issuance of any Shares or exercise of any award under the Plan, the Company will be

able to pay its liabilities as they become due. |

| 3.1. | We express no opinion with respect to the issuance of Shares pursuant to any provision of the Plan that

purports to obligate the Company to issue Shares following the commencement of a winding up or liquidation. |

| 3.2. | We have made no investigation of and express no opinion in relation to the laws of any jurisdiction other

than the British Virgin Islands. This opinion is to be governed by and construed in accordance with the laws of the British Virgin Islands

and is limited to and is given on the basis of the current law and practice in the British Virgin Islands. This opinion is issued solely

for the purposes of the filing of the Registration Statement and the issuance of the Shares by the Company and is not to be relied upon

in respect of any other matter. |

On the basis of and subject to the foregoing,

we are of the opinion that:

| 4.1. | The Company is duly incorporated and existing under the laws of the British Virgin Islands in good standing

(meaning solely that it has not failed to make any filing with any British Virgin Islands governmental authority or to pay any British

Virgin Islands government fee or tax which would make it liable to be struck off the Register of Companies and thereby cease to exist

under the laws of the British Virgin Islands). |

| 4.2. | The Shares, when issued and paid for in accordance with the Plan, will be validly issued, fully paid and

non-assessable (which term means when used herein that no further sums are required to be paid by the holders thereof in connection with

the issue or holding of such shares). |

We hereby consent to the filing of this opinion

with the Commission as an exhibit to the Registration Statement. In giving this consent, we do not hereby admit that we are experts within

the meaning of Section 11 of the Securities Act or that we come within the category of persons whose consent is required under Section

7 of the Securities Act or the Rules and Regulations of the Commission promulgated thereunder.

| Yours faithfully, |

|

| |

|

| /s/ Conyers Dill & Pearman |

|

| Conyers Dill & Pearman |

|

Exhibit 10.2

Amendment

No. 1 to

AMENDED AND RESTATED

LUOKUNG TECHNOLOGY CORP.

2018 OMNIBUS EQUITY PLAN

Luokung Technology Corp. (the

“Company”) previously approved and adopted the Amended and Restated Luokung Technology Corp. 2018 Omnibus Equity Plan (the

“Plan”) to encourage the Plan’s participants to acquire and hold stock in the Company as an added incentive to remain

with the Company and increase their efforts in promoting the interests of the Company, and to enable the Company to attract and retain

capable individuals. By this Amendment, the Company desires to amend the Plan to increase the number of ordinary shares (“Ordinary

Shares”) and preferred shares (“Preferred Shares”) available under the Plan.

| 1. | Capitalized terms used but not otherwise defined herein shall

have the respective meanings assigned to such terms in the Plan. |

| 2. | The effective date of this Amendment to the Plan shall be

August 15, 2023, upon the shareholder’s approval. |

| 3. | Section 1.5(a)(i) of the Plan is amended and restated in

its entirety as follows: |

| 1.5 | Stock Subject to

this Plan. |

| (a) | Shares Available for Issuance. |

| (i) | Plan Securities’ Reserve. |

The Ordinary Shares issuable under

the Plan shall be authorized but unissued Ordinary Shares, including Ordinary Shares repurchased by the Corporation and held by the Corporation

as treasury shares. The maximum number of Ordinary Shares available for issuance under the Plan shall be 4,300,000 Ordinary Shares, all

of which may be issued as Awards, including, but not limited to, Incentive Stock Options.

The Preferred Shares issuable under

the Plan shall be authorized but unissued Preferred Shares, including Preferred Shares repurchased by the Corporation and held by the

Corporation as treasury shares. The maximum number of Preferred Shares available for issuance under the Plan shall be 166,667 shares,

all of which may only be issued as Awards under Restricted Stock Program under “Article 4 – Terms” hereto and

Unrestricted Stock Program under “Article 5 - Unrestricted Stock means an Award of Shares or Preferred Shares made pursuant to

5 of the Plan” hereto.

| 4. | This Amendment No.1 shall amend only the provisions of the

Plan as set forth herein. Those provisions of the Plan not expressly amended hereby shall be considered in full force and effect. |

IN WITNESS WHEREOF, the Company

has caused this Amendment No.1 to be executed by its duly authorized representative on this August 15, 2023.

| |

Luokung Technology Corp. |

| |

|

|

| |

By: |

/s/ Xuesong Song

|

| |

Name: |

Xuesong Song |

| |

Title: |

Chief Executive Officer |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in

this Registration Statement on Form S-8 of Luokung Technology Corp. of our report dated May 15, 2023 relating to the consolidated financial

statements of Luokung Technology Corp. and Subsidiaries (the “Company”) as of December 31, 2022 and 2021 and for the years then

ended, and our report dated May 15, 2023 related to the Company internal control over financial reporting as of December 31, 2022, which

appear in the Company’s Form 20-F for the year ended December 31, 2022.

| |

|

| |

MSPC |

| |

Certified Public Accountants and Advisors, |

| |

A Professional Corporation |

New York, New York

August 30, 2023

Exhibit 23.2

Your Ref:

Our Ref: 126341/2023/GEN/ATGCO02F

August 30, 2023

The Board of Directors

Luokung Technology Corp.

B9-8, Block B, SOHO phase II

No. 9 Guanghua Road

Chaoyang District

Beijing

People’s Republic of China

Consent of Independent Registered

Public Accounting Firm

We consent to the incorporation by

reference in this Registration Statement on Form S-8 of Luokung Technology Corp. of our report dated May 14, 2021 relating to the consolidated

financial statements of Luokung Technology Corp. and subsidiaries (the “Company”) as of December 31, 2020 and for the year ended

December 31, 2020 appearing in the Annual Report on Form 20-F of the Company for the year ended December 31, 2022.

Certified Public Accountants

Hong Kong

An independent member firm of Moore Global Network

Limited - members in principal cities throughout the world.

Exhibit 107

Calculation of Filing Fee Tables

S-8

(Form Type)

Luokung

Technology Corp.

(Exact Name of Registrant as Specified in its Charter)

Not

Applicable

(Translation of Registrant’s Name into English)

Table 1: Newly Registered and Carry Forward

Securities

| | |

Security

Type | |

Security

Class

Title | |

Fee

Calculation

or Carry

Forward

Rule | |

Amount

Registered(1) | | |

Proposed

Maximum

Offering

Price Per

Unit(2) | | |

Maximum

Aggregate

Offering

Price(2) | | |

Fee

Rate | | |

Amount

of

Registration

Fee | | |

Carry

Forward

Form

Type | | |

Carry

Forward

File

Number | | |

Carry

Forward

Initial

effective

date | | |

Filing

Fee

Previously

Paid In

Connection

with Unsold

Securities to be

Carried

Forward | |

| Newly

Registered Securities |

| Fees

to Be Paid | |

Equity | |

Ordinary Shares,

$0.30 par value per share | |

457 (c) | |

| 1,881,586 | | |

$ | 1.08 | | |

$ | 2,032,112.88 | | |

| .0001102 | | |

$ | 223.94 | | |

| | | |

| | | |

| | | |

| | |

| Fees

to Be Paid | |

Equity | |

Preferred Shares, $0.30 par

value per share | |

457 (c) | |

| 33,333 | | |

$ | 1.08 | | |

$ | 35,999.64 | | |

| .0001102 | | |

$ | 3.97 | | |

| | | |

| | | |

| | | |

| | |

| Fees

Previously Paid | |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

$ | 2,732.96 | | |

| | | |

| | | |

| | | |

| | |

| Carry

Forward Securities |

| Carry

Forward Securities | |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Total

Offering Amounts | | | |

$ | 2,068,112.52 | | |

| | | |

$ | 227.91 | | |

| | | |

| | | |

| | | |

| | |

| | |

Total

Fees Previously Paid | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Total

Fee Offsets | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Net

Fee Due | | | |

| | | |

| | | |

$ | 227.91 | | |

| | | |

| | | |

| | | |

| | |

| (1) |

In accordance with Rule 416 under the Securities Act of 1933, as amended,

this registration statement shall also be deemed to cover any additional securities that may from time to time be offered or issued to

prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| (2) |

Estimated solely for the purpose of calculating the amount of the registration

fee pursuant to Rules 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices of the Registrant’s

ordinary shares on August 28, 2022. |

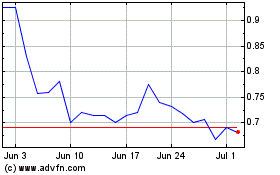

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Nov 2023 to Nov 2024