The first full day of LPL Financial LLC’s annual flagship

conference, Focus 2024, is under way at the San Diego Convention

Center today. Renowned throughout the wealth management industry,

LPL’s Focus conference convenes one of the largest gatherings of

financial advisors and industry professionals and curates content

and experiences from LPL’s broad portfolio of offerings as well as

from leading partners in financial technology, services and

products.

The LPL community of financial advisors and institutions

collectively serves 5 million American families, helping them

navigate uncertainty, keep their goals in focus and pursue their

financial dreams. According to Cerulli, the value of advice is

increasingly taking hold in investors’ minds, with 63% of

respondents indicating a willingness to pay for advice, up from 38%

in 2009. Since 2009, investor interest in formal financial plans

has increased from 38% to 54% of respondents.1

“As the need for personalized financial advice grows, advisors

are seeking ways to manage this demand while maintaining high

levels of client service,” said Greg Gates, managing director,

chief technology and information officer. “Our role to help enable

their success is to bring innovative ways AI can transform how we

all work, ensuring our advisors’ time is prioritized for client

engagement.”

Financial advisors are bullish on artificial intelligence tools

that could help them gain more insight and become better informed

and more efficient in their role. And 9 out of 10 financial

advisors believe AI can help grow their book of business

organically by more than 20%, according to the 2024 Accenture AI in

Wealth Management Report. 2

While noting advancements in the automation of repetitive

activities, Gates added, “As AI capabilities develop, we expect its

functionality to extend beyond the back-office to nearly all

applications across wealth management, generating more personalized

experiences, improving overall efficiency and elevating the value

of financial advisors to their end-clients.”

LPL is actively piloting a tool that applies AI through secured

systems to analyze client data and generate customized insights to

shape personalized financial planning.

Increased focus on cybersecurity empowers advisors to

protect their businesses

During Focus 2024, advisors will learn more about LPL

Financial’s advancements in addressing the challenges of

cybersecurity, including secure cloud storage and comprehensive

risk assessments.

With 46% of all cyber breaches impacting businesses with fewer

than 1,000 employees, the importance for financial advisors to

prioritize cybersecurity cannot be overstated.3 LPL’s Digital

Office provides three cybersecurity solutions for advisors: Secure

Office, Secure Cloud and Secure Password. These solutions can be

used together or individually to help advisors efficiently and

compliantly protect their businesses from cyber threats.

- Secure

Office ensures technology compliance, offers data

backup and features 24/7 cybersecurity monitoring, including

anti-virus protection, examiner review preparation and

cybersecurity insurance.

- Secure

Cloud is an enterprise-grade cloud storage solution

that allows secure file access and sharing, secure client document

uploads and automatic virus scanning, all while maintaining

compliance.

- Secure

Password simplifies password management with features

like dark web monitoring and encrypted password management,

reducing the complexity and enhancing the security of logins.

Wealth Management Platform Expands ETFs, SMAs, Fixed

Income and Alts Products

LPL announced several expansions of the Model Wealth Portfolios

(MWP) platform, highlighting the introduction of new products

designed to meet the increasingly diverse and sophisticated needs

of advisors and their clients.

- Addressing advisors’

needs for lower-cost access to low-volatility managers and

strategies, LPL now offers eight of the top ten ETF providers at no

transaction charge. LPL Research has also launched coverage of

active ETFs to help advisors assess managers to choose from in any

market environment.

- LPL announced 200

new SMAs for the MWP platform, including more than 25 additional

fixed income options. Advisors can now provide these options at

lower fees while still providing an increased level of

sophistication and customization that comes with owning securities

directly.

- Citing the

increasing demand for alternative investment strategies, especially

among high-net-worth investors,4 LPL highlighted advancements it

continues to make in enabling advisors to incorporate more

alternative strategies for their clients. This includes the

addition of 12 new alts strategies, including hedge fund, drawdown,

evergreen and tax deferral strategies. LPL plans to continue this

expansion with an additional 50 alternative investment products by

the end of 2025.

Focus 2024 continues at the San Diego Convention Center through

August 14.

About LPL FinancialLPL Financial Holdings Inc.

(Nasdaq: LPLA) was founded on the principle that the firm should

work for advisors and institutions, and not the other way

around. Today, LPL is a leader in the markets we serve,

serving more than 23,000 financial advisors, including advisors at

approximately 1,000 institutions and at approximately 580

registered investment advisor firms nationwide. We are steadfast in

our commitment to the advisor-mediated model and the belief that

Americans deserve access to personalized guidance from a financial

professional. At LPL, independence means that advisors and

institution leaders have the freedom they deserve to choose the

business model, services and technology resources that allow them

to run a thriving business. They have the flexibility to do

business their way. And they have the freedom to manage

their client relationships, because they know their clients best.

Simply put, we take care of our advisors and institutions, so they

can take care of their clients.

Securities and Advisory services offered through LPL

Financial LLC (“LPL Financial”), a registered investment

advisor. Member FINRA/SIPC. LPL Financial and its

affiliated companies provide financial services only from the

United States.

Investing involves risk including loss of principal. There is no

guarantee that a diversified portfolio will enhance overall returns

or outperform a non-diversified portfolio. Diversification does not

protect against market risk. Asset allocation does not ensure a

profit or protect against a loss. In choosing to participate in an

SMA, investors should carefully consider the amount they plan to

invest; their investment objectives; and the SMA’s investment

objectives, risks, charges, and expenses before investing.

Investing in an SMA involves direct ownership of the assets

purchased by the investment manager on the investor’s behalf.

Therefore, investors should understand and be able to bear all of

the risks associated with the underlying assets. The amount and

type of investment restrictions are subject to change and manager’s

acceptance. There can be no assurance that any stated investment

objectives will be achieved. Alternative investments include

non-traditional asset classes. This may include hedge funds,

private equity/debt/credit, etc. This may also include Business

Development Companies (BDCs) and Opportunity Zone investments.

These are not registered securities and there may be significant

restrictions on purchase and suitability requirements. Alternative

investments may not be suitable for all investors and should be

considered as an investment for the risk capital portion of the

investor’s portfolio. The strategies employed in the management of

alternative investments may accelerate the velocity of potential

losses.

Throughout this communication, the terms “financial advisors”

and “advisors” are used to refer to registered representatives

and/or investment advisor representatives affiliated with LPL

Financial.

We routinely disclose information that may be important to

shareholders in the “Investor Relations” or “Press Releases”

section of our website.

1 The Evolving Future of Wealth Management, Cerulli and

Securities Industry and Financial Markets Association (SIFMA),

November 30, 2023.2 AI in Wealth Management Report Financial

Advisor Study, Accenture3 Verizon’s 2021 Data Breach

Investigations Report, Verizon4 High-Net-Worth Investors Embrace

Alternative Investments, Cerulli, January 17, 2023.

Connect with Us!

https://twitter.com/lpl

https://www.linkedin.com/company/lpl-financial

https://www.facebook.com/LPLFinancialLLC

https://www.youtube.com/user/lplfinancialllc

Media

Contact:Media.relations@LPLFinancial.com(402) 740-2047

Tracking # 614732

This press release was published by a CLEAR® Verified

individual.

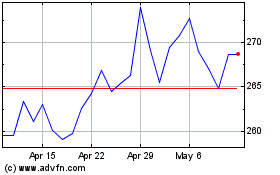

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Oct 2024 to Nov 2024

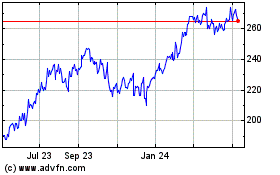

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Nov 2023 to Nov 2024