As

filed with the Securities and Exchange Commission on February 1, 2024

Registration

No. 333-

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

LIPELLA

PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

20-2388040 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

Lipella

Pharmaceuticals Inc.

7800 Susquehanna St.

Suite

505

Pittsburgh,

PA 15208

(412)

894-1853

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Jonathan

Kaufman

Chief

Executive Officer

7800

Susquehanna St.

Suite

505

Pittsburgh,

PA 15208

(412)

894-1853

(Name, address including zip code, and telephone number,

including area code, of agent for service)

With

copies to:

David

E. Danovitch, Esq.

Michael DeDonato, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

(212) 660-3060

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

please check the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans,

check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities

Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| |

|

|

|

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

|

|

| |

|

Emerging growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

FEBRUARY 1, 2024 |

Lipella

Pharmaceuticals Inc.

$50,000,000

Common

Stock

Preferred

Stock

Warrants

Debt

Securities

Convertible Debt Securities

Rights

Units

Lipella Pharmaceuticals Inc. (the “Company”,

“we”, “us” or “our”) may offer and sell, from time to time in one or more offerings, any combination

of our common stock, par value $0.0001 per share (the “Common Stock”), preferred stock, par value $0.0001 per share

(“preferred stock”), debt securities, including debt securities convertible into shares of Common Stock or other Company

securities in any combination thereof, rights to purchase shares of Common Stock or other Company securities in any combination

thereof, warrants to purchase shares of Common Stock or other Company securities in any combination thereof or units consisting

of shares of Common Stock or other Company securities in any combination thereof having an aggregate offering price not exceeding

$50,000,000. Our preferred stock, warrants, convertible debt securities, rights and units may be convertible, exercisable or exchangeable

for shares of Common Stock or other of our securities, and such securities have not been approved for listing on any market or

exchange, and we have not made any application for such listing.

This

prospectus provides you with a general description of the Common Stock that we may offer as well as other securities that we may

offer. A prospectus supplement containing specific information about the terms of the securities being offered and the offering,

including the compensation of any underwriter, agent or dealer, will accompany this prospectus to the extent required. Any prospectus

supplement may also add, update or change information contained in this prospectus. If information in any prospectus supplement

is inconsistent with the information in this prospectus, then the information in that prospectus supplement will apply and will

supersede the information in this prospectus. You should read this prospectus and any such prospectus supplement, as well as the

documents incorporated by reference or deemed to be incorporated by reference into this prospectus, carefully before you invest

in any securities.

These

securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters, dealers

or through a combination of these methods, including on a continuous or delayed basis. For additional information on the methods

of sale, see the section entitled “Plan of Distribution” in this prospectus. We will also describe the plan of distribution

for any particular offering of our securities in a prospectus supplement. If any agents, underwriters or dealers are involved

in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature

of our arrangements with them in a prospectus supplement, including any applicable fees, commissions, discounts or over-allotment

options. The price to the public of such securities and the net proceeds we expect to receive from any such sale will also be

included in such prospectus supplement.

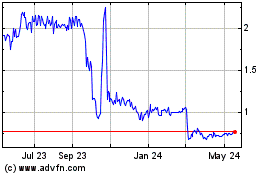

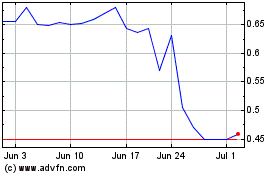

Our

Common Stock is currently listed on the Nasdaq Capital Market (“Nasdaq”)

under the symbol “LIPO”. On January 31, 2024, the last reported sale price of our Common

Stock on Nasdaq was $1.00. The applicable prospectus supplement will contain information, where applicable, as to any other

listing, if any, on Nasdaq or any other securities market or other securities exchange of the securities covered by such prospectus

supplement.

The aggregate market value of our outstanding

Common Stock held by non-affiliates is $5,141,833, based on 6,053,956 shares of outstanding

Common Stock on January 31, 2024, of which 4,632,282 shares are held by non-affiliates,

and a per share price of $1.11, which is the closing sale price of our Common Stock

on December 5, 2023. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our Common

Stock in a public primary offering with a value that exceeds more than one-third of our public float in any 12-month period

so long as our public float remains below $75,000,000. During the previous 12 calendar months prior to and including the date of

this prospectus, we have not offered any of our securities pursuant to General Instruction I.B.6 of Form S-3.

We

are an “emerging growth company” as the term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS

Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for this and future

filings.

Investing

in our securities involves risks. You should carefully review the risks described under the headings “Risk

Factors” beginning on page 6 of this prospectus and in the documents which are incorporated by reference herein and

contained in the applicable prospectus supplement before you invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus and any accompanying prospectus supplement or incorporated by

reference in these documents. No dealer, salesperson or other person is authorized to give any information or to represent anything

not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. If anyone provides you

with different, inconsistent or unauthorized information or representations, you must not rely on them. This prospectus and any

accompanying prospectus supplement are an offer to sell only the securities offered by these documents, but only under circumstances

and in jurisdictions where it is lawful to do so. The information contained in this prospectus or any prospectus supplement is

current only as of the date on the front of those documents.

ABOUT

THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration

process. By using a shelf registration statement, we may, from time to time, offer shares

of Common Stock; and we may offer shares of our preferred stock, debt securities,

convertible debt securities, warrants for such securities, rights to purchase our securities, and/or units that include any of

these securities, in one or more offerings from time to time, having an aggregate offering price of up to $50,000,000.

This

prospectus provides you with a general description of the securities that we may offer. Each

time we offer securities under this prospectus, we will provide you with a prospectus supplement that

will contain specific information about the terms of that offering. The prospectus supplement also may add, update or change

information contained in this prospectus. You should read carefully both this prospectus, including the section entitled “Risk

Factors,” and any prospectus supplement, together with the additional information described below under the headings “Where

You Can Find More Information” and “Incorporation of Documents by Reference”.

In

addition, this prospectus does not contain all of the information provided in the registration statement that we filed with the

SEC. For further information, we refer you to the registration statement of which this prospectus forms a part, including all

filings and documents incorporated by reference herein and therein, including the applicable exhibits to such registration statement.

Such registration statement, filings and documents can be read on the SEC’s website mentioned below under the heading “Where

You Can Find More Information”. Statements contained in this prospectus and any prospectus supplement about the provisions

or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations require

that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for

a complete description of such matters.

You

should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We

have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer

to buy securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing

in this prospectus or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated

by reference, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations

and prospects may have changed since those dates. This prospectus may not be used to consummate a sale of our securities unless

it is accompanied by a prospectus supplement.

In

such registration statement and this prospectus forming a part thereof, we refer to Lipella Pharmaceuticals Inc. as “we,”

“us,” “our” “LIPO,” and the “Company”, unless we specifically state otherwise

or the context indicates otherwise.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, the applicable prospectus supplement, any amendment and the information incorporated by reference into this prospectus,

including the sections entitled “Risk Factors,” contain “forward-looking statements” within the meaning

of Section 21(E) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”). These forward-looking statements include, without limitation: statements

regarding our business, strategies, products, future results and events and financial performance, and other similar expressions

concerning matters that are not historical facts. Words such as “may,” “will,” “should,” “could,”

“would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes” and “estimates,” and variations

of such terms or similar expressions, are intended to identify such forward-looking statements.

Forward-looking

statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications

of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information

available at the time they are made and/or our management’s good faith belief as of that time with respect to future events.

Our actual results may differ materially from those expressed in, or implied by, the forward-looking statements due to a number

of factors including, but not limited to, those set forth under the heading “Risk Factors” in this prospectus, as

well as other risks discussed in documents that we file with the SEC.

Forward-looking

statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume

no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more

forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking

statements. You should review our subsequent reports filed with the SEC described in the sections of this prospectus and the applicable

prospectus supplement, and any amendments thereto, entitled “Where You Can Find More Information” and “Incorporation

of Certain Documents by Reference,” all of which are accessible on the SEC’s website at www.sec.gov.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus or incorporated by reference into this prospectus.

This summary does not contain all of the information that you should consider before investing in our Common Stock or in any of

our other securities. You should carefully read the entire registration statement of which this prospectus forms a part, all amendments

and prospectus supplements thereto, and our other filings with the SEC, including the following sections, which are either included

herein and/or incorporated by reference herein, “Risk Factors,” “Special Note Regarding Forward-Looking Statements,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements

and the related notes incorporated by reference herein and therein, before making a decision about whether to invest in any of

our securities.

Our

Business

Overview

We

are a clinical-stage biotechnology company focused on developing new drugs by reformulating the active agents in existing generic

drugs and optimizing these reformulations for new applications. We believe that this strategy combines many of the cost efficiencies

and risk abatements derived from using existing generic drugs with potential patent protections for our proprietary formulations;

this strategy allows us to expedite, protect, and monetize our product candidates. Additionally, we maintain a therapeutic focus

on diseases with significant, unaddressed morbidity and mortality where no approved drug therapy currently exists. We believe

that this focus can potentially help reduce the cost, time and risk associated with obtaining marketing approval.

Consistent

with our strategy, the initial indication that we are currently addressing (via development of our product candidate, which we

have designated as “LP-10”) is hemorrhagic cystitis (“HC”), which is chronic, uncontrolled urinary blood

loss that results from certain chemotherapies (such as alkylating agents) or pelvic radiation therapy (also called “radiation

cystitis”). Many radiation cystitis patients experience severe morbidity (and in some cases, mortality), and currently,

there is no therapy for their condition approved by the U.S. Food and Drug Administration (“FDA”), or, to our knowledge,

any other regulatory body. LP-10 is the development name of our reformulation of tacrolimus (an approved generic active agent)

specifically optimized for topical deposition to the internal surface of the urinary bladder lumen using a proprietary drug delivery

platform that we have developed and that we refer to as our metastable liposome drug delivery platform (our “Platform”).

We are developing LP-10 and our Platform to be, to our knowledge, the first drug candidate and drug delivery technology that could

be successful in treating cancer survivors who acquire HC. We have been granted orphan drug”

designation by the FDA for LP-10 in the treatment of moderate to severe HC. LP-10 has been evaluated in a multi-center

Phase 2a dose escalation trial of 13 subjects with moderate to severe refractory HC, obtaining positive top line results demonstrating

safety and efficacy, short duration of systemic uptake of LP-10, and a dose response including decreased hematuria, decreased

cystoscopic bleeding and ulceration sites, and improved urinary symptoms in patients. We intend to conduct a Phase-2b trial for

LP-10 involving 36 subjects in a double-blind, placebo-controlled study, focusing on the treatment’s impact on gross hematuria.

In

a second program, we are developing a product candidate, which we have designated “LP-310” and which employs a formulation

similar to LP-10, for the treatment of oral lichen planus (“OLP”). OLP is a chronic, T-cell-mediated, autoimmune oral

mucosal disease, and LP-310 contains tacrolimus which inhibits T-lymphocyte activation. Symptoms of OLP include painful burning

sensations, bleeding and irritation with tooth brushing, painful, thickened patches on the tongue, and discomfort when speaking,

chewing or swallowing. These symptoms frequently cause weight loss, nutritional deficiency, anxiety, depression, and scarring

from erosive lesions. OLP can also be a precursor to cancer, predominately squamous cell carcinoma, with a malignant transformation

rate of approximately one percent. LP-310 is the development name of our oral, liposomal formulation of tacrolimus (the same approved

generic active agent in LP-10) specifically optimized for local delivery to oral mucosa. We believe that our approach of using

metastable liposomal tacrolimus as a treatment for OLP is novel. To date, upon review of relevant FDA public data resources on

approved drugs and biologics, we are not aware of any other liposomal products developed to treat such disease. We recently received

FDA investigational new drug (“IND”) approval for a 12-subject, multicenter, phase-2a clinical trial with a dose escalation

design. We also recently were granted “orphan drug” designation by the

FDA for LP-310 in the treatment of moderate to severe HC.

Our

Platform includes proprietary drug delivery technologies optimized for use with epithelial tissues that coat lumenal surfaces,

such as the colon, the various tissues lining the mouth and esophagus and the tissues lining the bladder and urethra. The Company

has two issued patents in the United States that should exclude competitors from making, selling or using our LP-10 and LP-310

formulations in the United States until July 11, 2035. We also have issued patents in Australia, Canada, and Europe that do not

expire until October 22, 2034. Corresponding patent applications are pending in the United States Patent Offices. We also have

a pending United States patent application on an improvement to the technology.

Since

our inception in 2005, we have focused primarily on business planning and progressing our lead product candidates, including progressing

LP-10 through clinical development, raising capital, organizing and staffing the Company.

Corporate

Information and Where You Can Find Us

We

were incorporated under the laws of the state of Delaware in February 2005. Our principal executive offices are located at 7800

Susquehanna Street, Suite 505, Pittsburgh, PA 15208, and our telephone number is (412) 894-1853. We have approximately 6,000 square

feet of combined laboratory, office and warehouse space at our principal executive offices that we use in our research and development

efforts, including a sterile pharmaceutical pilot plant for manufacturing liposomal and other formulations, as well as relevant

analytical facilities. Our corporate website address is www.lipella.com. The information contained in, or accessible through,

our website is not incorporated by reference into this prospectus or the registration of which it forms a part, or any prospectus

supplements thereto, and is intended for informational purposes only. You should not consider such website information to be a

part of the registration statement of which this prospectus forms a part.

Implications

of Being an Emerging Growth and Smaller Reporting Company

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS

Act”). An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that

are otherwise applicable generally to public companies. These provisions include:

● reduced

obligations with respect to financial data;

● an

exception from compliance with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”);

● reduced

disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements;

and

● exemptions

from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements.

We

may take advantage of these provisions for up to five years following our December 2022 initial public offering (our “IPO”)

or such earlier time that we no longer qualify as an emerging growth company. We would cease to be an emerging growth company

upon the earliest of:

● the

last day of the fiscal year on which we have $1.235 billion or more in annual revenue,

● the

date on which we become a “large accelerated filer” (i.e., as of our fiscal year end, the total market value of our

common equity securities held by non-affiliates is $700 million or more as of June 30),

● the

date on which we issue more than $1.0 billion of non-convertible debt over a three-year period, or

● the

last day of our fiscal year following the fifth anniversary of the date of the completion of our IPO.

We

may choose to take advantage of some but not all of these reduced reporting burdens.

In

addition, under the JOBS Act, emerging growth companies can take advantage of an extended transition period and delay adopting

new or revised accounting standards until such time as those standards apply to private companies. We have elected to use this

extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which

adoption of such standards is required for private companies. If we were to subsequently elect instead to comply with public company

effective dates, such election would be irrevocable pursuant to the JOBS Act.

Also,

we are a “smaller reporting company” (and may continue to qualify as such even after we no longer qualify as an emerging

growth company). For as long as we qualify as a “smaller reporting company,” we may provide reduced disclosure in

the public filings that we make with the SEC than larger public companies, such as the inclusion of only two years of audited

financial statements and only two years of management’s discussion and analysis of financial condition and results of operations

disclosure.

As

a result of qualifying as an emerging growth company and a smaller reporting company, to the extent we take advantage of the allowable

reduced reporting burdens, the information that we provide to our stockholders may be different than what you might receive from

other public reporting companies in which you hold equity interests.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described herein and

in “Risk Factors” in our most recently filed Annual Report on Form 10-K filed with the SEC, in each case as these

risk factors are amended or supplemented by subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K that have

been or will be incorporated by reference in this prospectus and each prospectus supplement thereto. The prospectus supplement

relating to a particular offering of our securities may also discuss certain risks of investing in that offering. The risks incorporated

herein by reference and set forth or incorporated by reference in any prospectus supplement are those which we believe are the

material risks that we face. The occurrence of any of such risks may materially and adversely affect our business, financial condition,

results of operations and future prospects. In such an event, the market price of our Common Stock could decline, the value of

any other securities we may issue could decline, and you could lose part or all of your investment.

USE

OF PROCEEDS

We

cannot assure you that we will receive any proceeds in connection with securities offered by us pursuant to this prospectus. Unless

otherwise provided in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities

offered by this prospectus for general corporate purposes, which may include, among other things, working capital, capital expenditures,

product development, marketing activities, acquisitions of new technologies and investments, repayment of debt and repurchases

and redemptions of securities.

We

will set forth in the applicable prospectus supplement our intended use for the net proceeds received from the sale of any securities

by us. The precise amount and timing of the application of these proceeds will depend on our funding requirements and the availability

and costs of other funds. Accordingly, we will retain broad discretion over the use of such proceeds. Pending the application

of any net proceeds, we intend to invest the net proceeds generally in short-term, investment grade, interest-bearing securities.

THE

SECURITIES THAT WE MAY OFFER

The

descriptions of the securities contained in this prospectus, together with the applicable prospectus supplements, summarize all

of the material terms and provisions of the various types of securities that we may offer. We will describe in the applicable

prospectus supplement relating to any securities the particular terms of the securities offered by that prospectus supplement.

If we indicate in the applicable prospectus supplement, the terms of such securities may differ from the terms that we have summarized

below. We will also include in the prospectus supplement information, where applicable, about material United States federal income

tax considerations relating to the securities, and the securities exchange, if any, on which such securities will be listed.

We

may sell from time to time, in one or more offerings:

| |

● |

shares of our Common Stock; |

| |

● |

shares of our preferred stock; |

| |

● |

warrants to purchase shares of our Common Stock,

preferred stock or debt securities; |

| |

● |

rights to purchase shares of our Common Stock,

preferred stock or other securities; and/or |

| |

● |

units consisting of any of the securities listed

above. |

The

terms of any securities that we offer will be determined at the time of sale. We may issue securities that are exchangeable or

exercisable for Common Stock or any of the other securities that may be sold under this prospectus. When particular securities

are offered, a supplement to this prospectus will be filed with the SEC, which will describe the terms of the offering and sale

of such securities.

DESCRIPTION

OF CAPITAL STOCK

General

The following summary description sets

forth some of the general terms and provisions of our capital stock. Because this is a summary description, it does not contain

all of the information that may be important to you. For a more detailed description of our capital stock, you should refer to

the applicable provisions of the General Corporation Law of the State of Delaware (“DGCL”), as well as our second amended

and restated articles of incorporation, as amended (“Charter”), and our second amended and restated bylaws (“Bylaws”),

each as in effect at the time of any offering conducted pursuant to the registration statement of which this prospectus forms a

part. Copies of our Charter and our Bylaws are filed as exhibits to the documents incorporated by reference into the registration

statement of which this prospectus forms a part.

Our

Authorized Capital Stock

Under

our Charter, we are authorized to issue 220,000,000 shares of capital stock consisting of (a) 200,000,000 shares of Common Stock,

par value $0.0001 per share, and (b) 20,000,000 shares of “blank check” preferred stock, par value $0.0001 per share.

As of January 31, 2024, there were 6,053,956 shares of Common Stock issued and outstanding and no shares of such preferred stock

issued and outstanding.

Common

Stock

Voting

Rights. Each share of our Common Stock entitles the owner to one vote. There is no cumulative voting. A simple majority can

elect all of the directors at a given meeting, and the minority would not be able to elect any director at that meeting.

Dividend

Rights. Each share of our Common Stock is entitled to receive an equal dividend, if one is declared. We cannot provide any

assurance that we will declare or pay cash dividends on our Common Stock in the future. Any future determination to declare cash

dividends will be made at the discretion of our Board, subject to applicable laws, and will depend on our financial condition,

results of operations, capital requirements, general business conditions and other factors that our Board may deem relevant. Our

Board may determine it to be necessary to retain future earnings (if any) to finance our growth. See “Risk Factors.”

Liquidation.

If the Company is liquidated, then assets that remain (if any) after the creditors are paid and the owners of any securities with

liquidation preferences senior to the Common Stock are paid will be distributed to the owners of our Common Stock pro rata.

Preemptive

Rights. Owners of our Common Stock have no preemptive rights. We may sell shares of our Common Stock to third parties without

first offering such shares to current stockholders.

Redemption

Rights. We do not have the right to buy back shares of our Common Stock except in extraordinary transactions, such as mergers

and court approved bankruptcy reorganizations. Owners of our Common Stock do not ordinarily have the right to require us to buy

their Common Stock. We do not have a sinking fund to provide assets for any buy back.

Conversion

Rights. Shares of our Common Stock cannot be converted into any other kind of stock except in extraordinary transactions,

such as mergers and court approved bankruptcy reorganizations.

Nonassessability.

All outstanding shares of our Common Stock are fully paid and nonassessable.

Listing.

Our Common Stock trades on Nasdaq under the symbol “LIPO.”

Preferred

Stock

Our

Board is authorized to provide by resolution or resolutions from time to time for the issuance, out of the unissued shares of

preferred stock, of one or more series of preferred stock, without stockholder approval, by filing a certificate pursuant to the

DGCL and any other applicable law of the State of Delaware (the “Preferred Stock Designation”), setting forth such

resolution and, with respect to each such series, establishing the number of shares to be included in such series, and fixing

the voting powers, full or limited, or no voting power of the shares of such series, and the designation, preferences and relative,

participating, optional or other special rights, if any, of the shares of each such series and any qualifications, limitations

or restrictions thereof. The powers, designation, preferences and relative, participating, optional and other special rights of

each series of preferred stock, and the qualifications, limitations and restrictions thereof, if any, may differ from those of

any and all other series at any time outstanding.

It

is not possible to state the actual effects of any future series of preferred stock upon the rights of holders of the Common Stock

because our Board has the power to determine the specific rights of the holders of any future series of preferred stock. Our Board’s

authority to issue preferred stock provides a convenient vehicle in connection with possible acquisitions and other corporate

purposes, but could have the effect of making it more difficult for a third party to acquire a majority of our outstanding voting

stock. Accordingly, the issuance of the preferred stock may be used as an “anti-takeover” device without further action

on the part of our stockholders and may adversely affect the holders of the common stock.

Options

and Warrants

As

of January 31, 2024, there were outstanding Common Stock options entitling the holders to purchase 2,453,000 shares of Common

Stock at a weighted average exercise price of $2.73 per share with a weighted average remaining contractual life of 5.13 years,

warrants entitling the holders to purchase up to 1,558,467 shares of Common Stock at a weighted average exercise price of $1.76

per share with a weighted average remaining contractual life of 2.68 years and pre-funded warrants to purchase up to 1,065,790

shares of common stock, which do not have an expiration date.

Anti-Takeover

Provisions

The

provisions of Delaware law and our Charter and our Bylaws could have the effect of delaying, deferring or discouraging another

person from acquiring control of the Company. These provisions, which are summarized below, may have the effect of discouraging

takeover bids. They are also designed, in part, to encourage persons seeking to acquire control of us to negotiate first with

our board of directors. We believe that the benefits of increased protection of our potential ability to negotiate with an unfriendly

or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us because negotiation of these proposals

could result in an improvement of their terms.

Delaware

Law

We

are subject to the provisions of Section 203 of the DGCL regulating corporate takeovers. In general, Section 203 of the DGCL prohibits

a publicly held Delaware corporation from engaging in a business combination with an interested stockholder for a period of three

years following the date on which the person became an interested stockholder unless:

| |

● |

prior to the date

of the transaction, the board of directors of the corporation approved either the business combination or the transaction

which resulted in the stockholder becoming an interested stockholder; |

| |

● |

the interested stockholder

owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for

purposes of determining the voting stock outstanding, but not the outstanding voting stock owned by the interested stockholder:

(i) shares owned by persons who are directors and also officers; and (ii) shares owned by employee stock plans in which employee

participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in

a tender or exchange offer; or |

| |

● |

at or subsequent

to the date of the transaction, the business combination is approved by the board of directors of the corporation and authorized

at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66.67% of

the outstanding voting stock that is not owned by the interested stockholder. |

Generally,

a business combination includes a merger, asset or stock sale, or other transaction or series of transactions together resulting

in a financial benefit to the interested stockholder. An interested stockholder is a person who, together with affiliates and

associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of a

corporation’s outstanding voting stock. We expect the existence of this provision to have an anti-takeover effect with respect

to transactions our board of directors does not approve in advance. We also anticipate that DGCL Section 203 may also discourage

attempts that might result in a premium over the market price for the shares of Common Stock held by stockholders.

Provisions

of Our Charter and Bylaws

Our

Charter and our Bylaws in effect upon the completion of this offering will include a number of provisions that could deter hostile

takeovers or delay or prevent changes in control of our company, including the following:

| |

● |

Board of Directors

Vacancies. Our Charter and our Bylaws will authorize only our board of directors to fill vacant directorships, including

newly created seats, subject to the rights of the holders of any series of preferred stock to elect directors under certain

circumstances. In addition, the number of directors constituting our board of directors will be permitted to be set only by

a resolution adopted by a majority vote of our entire board of directors. These provisions would prevent a stockholder from

increasing the size of our board of directors and then gaining control of our board of directors by filling the resulting

vacancies with its own nominees. This makes it more difficult to change the composition of our board of directors but promotes

continuity of management. |

| |

● |

Stockholder Action;

Special Meetings of Stockholders. Our Charter and our Bylaws provide that our stockholders may not take action by

written consent, but may only take action at annual or special meetings of our stockholders. As a result, a holder controlling

a majority of our capital stock would not be able to amend our Bylaws or remove directors without holding a meeting of our

stockholders called in accordance with our Bylaws. Further, our Bylaws and Certificate of Incorporation provide that special

meetings of our stockholders may be called only by a majority of our board of directors, the chairman of our board of directors,

or our Chief Executive Officer, thus prohibiting a stockholder from calling a special meeting. These provisions might delay

the ability of our stockholders to force consideration of a proposal or for stockholders controlling a majority of our capital

stock to take any action, including the removal of directors. |

| |

● |

Advance Notice

Requirements for Stockholder Proposals and Director Nominations. Our Bylaws provide advance notice procedures for

stockholders seeking to bring business before our annual meeting of stockholders or to nominate candidates for election as

directors at our annual meeting of stockholders. Our Bylaws also specify certain requirements regarding the form and content

of a stockholder’s notice. These provisions might preclude our stockholders from bringing matters before our annual

meeting of stockholders or from making nominations for directors at our annual meeting of stockholders if the proper procedures

are not followed. We expect that these provisions might also discourage or deter a potential acquirer from conducting a solicitation

of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company. |

| |

● |

No Cumulative

Voting. The DGCL provides that stockholders are not entitled to the right to cumulate votes in the election of directors

unless a corporation’s certificate of incorporation provides otherwise. Our Certificate of Incorporation does not provide

for cumulative voting. |

| |

● |

Directors Removed

Only for Cause. Our Charter provides that stockholders may remove directors only for cause and only by the affirmative

vote of the holders of a majority of our outstanding Common Stock. |

| |

● |

Amendment of

Charter Provisions. Any amendment of the above expected provisions in our Charter requires approval by holders of

at least two-thirds of our outstanding Common Stock. |

| |

● |

Issuance of Undesignated

Preferred Stock. Pursuant to our Charter, our board of directors has the authority, without further action by the

stockholders, to issue up to 20,000,000 shares of undesignated preferred stock with rights and preferences, including voting

rights, designated from time to time by our board of directors. The existence of authorized but unissued shares of preferred

stock would enable our board of directors to render more difficult or to discourage an attempt to obtain control of us by

means of a merger, tender offer, proxy contest or other means. |

| |

● |

Choice of Forum. Our

Charter and our Bylaws provide that the Court of Chancery of the State of Delaware will be the exclusive forum for: any derivative

action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty; any action asserting a claim

against us arising pursuant to the DGCL, our Charter and our Bylaws; any action to interpret, apply, enforce or determine

the validity of our Charter and our Bylaws; or any action asserting a claim against us that is governed by the internal affairs

doctrine. Notwithstanding the foregoing, the exclusive forum provision does not apply to suits brought to enforce any liability

or duty created by the Securities Act, the Exchange Act or any other claim for which the federal courts have

exclusive jurisdiction. Unless we consent in writing to the selection of an alternative forum, the United States federal district

courts shall, to the fullest extent permitted by applicable law, be the sole and exclusive forum for the resolution of any

complaint asserting a cause of action arising under the Securities Act, Exchange Act or any such other claim

for which the federal courts have exclusive jurisdiction. The enforceability of similar choice of forum provisions in other

companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that a court could

find these types of provisions to be inapplicable or unenforceable. |

Transfer

Agent

Nevada

Agency and Transfer Company is the transfer agent and registrar for our Common Stock. The transfer agent’s address is 50

W Liberty St # 880, Reno, NV 89501, and its telephone number is (775) 322-0626. We intend to issue shares of Common Stock in uncertificated

form only, subject to limited circumstances.

DESCRIPTION

OF WARRANTS

The

following description, together with the additional information that we may include in any applicable prospectus supplements,

summarizes the material terms and provisions of the warrants that we may offer under this prospectus and the related warrant agreements

and warrant certificates. While the terms summarized below will apply generally to any warrants that we may offer, we will describe

the particular terms of any series of warrants in more detail in the applicable prospectus supplement. If we indicate in the prospectus

supplement, the terms of any warrants offered under that prospectus supplement may differ from the terms described below. If there

are differences between that prospectus supplement and this prospectus, the prospectus supplement will control. Thus, the statements

we make in this section may not apply to a particular series of warrants. Specific warrant agreements will contain additional

important terms and provisions and will be incorporated by reference as an exhibit to the registration statement which includes

this prospectus.

General

We

may issue warrants for the purchase of Common Stock and/or other securities described in this prospectus. We may issue warrants

independently or together with Common Stock and/or such other securities, and the warrants may be attached to or separate from

any such offered securities.

We will evidence each series of warrants

by warrant certificates that we may issue under a separate agreement. We may enter into the warrant agreement with a warrant agent.

Each warrant agent may be a bank that we select which has its principal office in the United States and a combined capital and

surplus sufficient under the laws of any jurisdiction under which it is organized or in which it is doing business, and that is

otherwise authorized under such laws to conduct such business and is subject to supervision or examination by federal or state

authorities. We may also choose to act as our own warrant agent. We will indicate the name and address of any such warrant agent

in the applicable prospectus supplement relating to a particular series of warrants.

We

will describe in the applicable prospectus supplement the terms of the series of warrants, including:

| ● | the

offering price and aggregate number of warrants offered; |

| ● | the

currency for which the warrants may be purchased; |

| ● | if

applicable, the designation and terms of the securities with which the warrants are issued

and the number of warrants issued with each such security or each principal amount of

such security; |

| ● | if

applicable, the date on and after which the warrants and the related securities will

be separately transferable; |

| ● | the

number of shares of Common Stock or other securities purchasable upon the exercise of

one warrant and the price at which such shares or other securities may be purchased upon

such exercise; |

| ● | the

warrant agreement under which the warrants will be issued; |

| ● | the

effect of any merger, consolidation, sale or other disposition of our business on the

warrant agreement and the warrants; |

| ● | anti-dilution

provisions of the warrants, if any; |

| ● | the

terms of any rights to redeem or call the warrants; |

| ● | any

provisions for changes to or adjustments in the exercise price or number of securities

issuable upon exercising the warrants; |

| ● | the

manner in which the warrant agreement and warrants may be modified; |

| ● | the

identities of the warrant agent and any calculation or other agent for the warrants; |

| ● | federal

income tax consequences of holding or exercising the warrants; |

| ● | the

terms of the securities issuable upon exercise of the warrants; |

| ● | any

securities exchange or quotation system on which the warrants or any securities deliverable

upon exercise of the warrants may be listed; and |

| ● | any

other specific terms, preferences, rights or limitations of or restrictions on the warrants. |

Before

exercising their warrants, holders of warrants will not have any of the rights of holders of Common Stock purchasable upon such

exercise, including the right to receive dividends, if any, or, payments upon our liquidation, dissolution or winding up or to

exercise voting rights, if any.

Exercise

of Warrants

Each

warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise

price that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement,

holders of the warrants may exercise the warrants at any time up to 5:00 p.m. Eastern Time on the expiration date that we set

forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become

void.

Holders

of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together

with specified information, and paying the required amount to the warrant agent in immediately available funds, as provided in

the applicable prospectus supplement. We will set forth on the reverse side of the warrant certificate, and in the applicable

prospectus supplement, the information that the holder of the warrant will be required to deliver to the warrant agent.

Until

the warrant is properly exercised, no holder of any warrant will be entitled to any rights of a holder of the securities purchasable

upon exercise of the warrant.

Upon

receipt of the required payment and the warrant certificate properly completed and duly executed at the corporate trust office

of the warrant agent or any other office indicated in the applicable prospectus supplement, we will issue and deliver the securities

purchasable upon such exercise. If fewer than all of the warrants represented by the warrant certificate are exercised, then we

will issue a new warrant certificate for the remaining amount of warrants. If we so indicate in the applicable prospectus supplement,

holders of the warrants may surrender securities as all or part of the exercise price for warrants.

Enforceability

of Rights By Holders of Warrants

Any

warrant agent will act solely as our agent under the applicable warrant agreement and will not assume any obligation or relationship

of agency or trust with any holder of any warrant. A single bank or trust company may act as warrant agent for more than one issue

of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable warrant agreement

or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us.

Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by appropriate

legal action its right to exercise, and receive the securities purchasable upon exercise of, its warrants in accordance with their

terms.

Calculation

Agent

Calculations

relating to warrants may be made by a calculation agent, an institution that we appoint as our agent for this purpose. The prospectus

supplement for a particular warrant will name the institution that we have appointed to act as the calculation agent for that

warrant as of the original issue date for that warrant. We may appoint a different institution to serve as calculation agent from

time to time after the original issue date without the consent or notification of the holders.

The

calculation agent’s determination of any amount of money payable or securities deliverable with respect to a warrant will

be final and binding in the absence of manifest error.

Governing

Law

Unless

we provide otherwise in the applicable prospectus supplement, the warrants and warrant agreements, and any claim, controversy

or dispute arising under or related to the warrants or warrant agreements, will be governed by and construed in accordance with

the laws of the State of New York.

DESCRIPTION

OF DEBT SECURITIES AND CONVERTIBLE DEBT SECURITIES

The

following description, together with the additional information that we include in any applicable prospectus supplement, summarizes

the material terms and provisions of the debt securities that may be offered from time to time under this prospectus. We may issue

debt securities, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. While

the terms we have summarized below will generally apply to any future debt securities that may be offered under this prospectus,

we will describe the particular terms of any debt securities that may be offered in more detail in the applicable prospectus supplement.

The terms of any debt securities offered under a prospectus supplement may differ from the terms we describe below.

We

may issue secured or unsecured debt securities offered under this prospectus, which may be senior, subordinated or junior subordinated,

and/or convertible and which may be issued in one or more series. We will issue any new senior debt securities under a senior

indenture that we will enter into with a trustee named in such senior indenture. We will issue any subordinated debt securities

under a subordinated indenture that we will enter into with a trustee named in such subordinated indenture. We will have filed

forms of these documents as exhibits to the registration statement, of which this prospectus is a part. The terms of the debt

securities will include those set forth in the applicable indenture, any related supplemental indenture and any related securities

documents that are made a part of the indenture by the Trust Indenture Act of 1939, as amended (the “Trust Indenture

Act”). You should read the summary below, the applicable prospectus supplement and the provisions of the applicable indenture,

any supplemental indenture and any related security documents, if any, in their entirety before investing in our debt securities.

We use the term “indentures” to refer to both the senior indentures and the subordinated indentures.

The

indentures will be qualified under the Trust Indenture Act. We use the term “trustee” to refer to either a trustee

under the senior indenture or a trustee under the subordinated indenture, as applicable.

The

following summaries of material provisions of any senior debt securities, any subordinated debt securities and the related indentures

are subject to, and qualified in their entirety by reference to, all the provisions of the indentures and any supplemental indenture

or related document applicable to a particular series of debt securities. We urge you to read the applicable prospectus supplements

related to the debt securities that are offered under this prospectus, as well as the complete indentures, that contains the terms

of the debt securities. See the information under the heading “Where You Can Find More Information” for information

on how to obtain a copy of the appropriate indenture. Except as we may otherwise indicate, the terms of any senior indenture and

any subordinated indenture will be identical.

In

addition, the material specific financial, legal and other terms as well as any material U.S. federal income tax consequences

particular to securities of each series will be described in the prospectus supplement relating to the securities of that series.

The prospectus supplement may or may not modify the general terms found in this prospectus and will be filed with the SEC. For

a complete description of the terms of a particular series of debt securities, you should read both this prospectus and the prospectus

supplement relating to that particular series.

We

will describe in the applicable prospectus supplement the terms relating to a series of debt securities, including:

| ● | principal

amount being offered, and, if a series, the total amount authorized and the total amount

outstanding; |

| ● | any

limit on the amount that may be issued; |

| ● | whether

or not we will issue the series of debt securities in global form and, if so, the terms

and who the depositary will be; |

| ● | the

principal amount due at maturity, and whether the debt securities will be issued with

any original issue discount; |

| ● | whether

and under what circumstances, if any, we will pay additional amounts on any debt securities

held by a person who is not a United States person for tax purposes, and whether we can

redeem the debt securities if we have to pay such additional amounts; |

| ● | the

annual interest rate, which may be fixed or variable, or the method for determining the

rate, the date interest will begin to accrue, the dates interest will be payable and

the regular record dates for interest payment dates or the method for determining such

dates; |

| ● | whether

or not the debt securities will be secured or unsecured, and the terms of any secured

debt; |

| ● | the

terms of the subordination of any series of subordinated debt; |

| ● | the

place where payments will be payable; |

| ● | restrictions

on transfer, sale or other assignment, if any; |

| ● | our

right, if any, to defer payment of interest and the maximum length of any such deferral

period; |

| ● | the

date, if any, after which, the conditions upon which, and the price at which we may,

at our option, redeem the series of debt securities pursuant to any optional or provisional

redemption provisions, and any other applicable terms of those redemption provisions; |

| ● | provisions

for a sinking fund, purchase or other analogous fund, if any; |

| ● | the

date, if any, on which, and the price at which we are obligated, pursuant to any mandatory

sinking fund or analogous fund provisions or otherwise, to redeem, or at the holder’s

option to purchase, the series of debt securities; |

| ● | whether

the indenture will restrict our ability and/or the ability of our subsidiaries to: |

| ○ | incur

additional indebtedness; |

| ○ | issue

additional securities; |

| ○ | pay

dividends and make distributions in respect of our capital stock and the capital stock

of our subsidiaries; |

| ○ | place

restrictions on our subsidiaries’ ability to pay dividends, make distributions

or transfer assets; |

| ○ | make

investments or other restricted payments; |

| ○ | sell

or otherwise dispose of assets; |

| ○ | enter

into sale-leaseback transactions; |

| ○ | engage

in transactions with stockholders and affiliates; |

| ○ | issue

or sell stock of or sell assets of our subsidiaries; or |

| ○ | effect

a consolidation or merger; |

| ● | whether

the indenture will require us to maintain any interest coverage, fixed charge, cash flow-based,

asset-based or other financial ratios; |

| ● | a

discussion of any material or special United States federal income tax considerations

applicable to the debt securities; |

| ● | information

describing any book-entry features; |

| ● | the

procedures for any auction and remarketing, if any; |

| ● | the

denominations in which we will issue the series of debt securities, if other than denominations

of $1,000 and any integral multiple thereof; |

| ● | if

other than U.S. dollars, the currency in which the series of debt securities will be

denominated and the currency in which principal, premium, if any, and interest will be

paid; and |

| ● | any

other specific terms, preferences, rights or limitations of, or restrictions on, the

debt securities, including any events of default that are in addition to or different

than those described in this prospectus or any covenants provided with respect to the

debt securities that are in addition to those described above, and any terms which may

be required by us or advisable under applicable laws or regulations or advisable in connection

with the marketing of the debt securities. |

In

addition to the debt securities that may be offered pursuant to this prospectus, we may issue other debt securities in public

or private offerings from time to time. These other debt securities may be issued under other indentures or documentation that

are not described in this prospectus, and those debt securities may contain provisions materially different from the provisions

applicable to one or more issues of debt securities offered pursuant to this prospectus.

Original

Issue Discount

One

or more series of debt securities offered under this prospectus may be sold at a substantial discount below their stated principal

amount, bearing no interest or interest at a rate that at the time of issuance is below market rates. The federal income tax consequences

and special considerations applicable to any series of debt securities generally will be described in the applicable prospectus

supplement.

Senior

Debt Securities

Payment

of the principal or premium, if any, and interest on senior debt securities will rank on a parity with all of our other indebtedness

that is not subordinated.

Subordination

of Subordinated Debt Securities

The

subordinated debt securities will be subordinate and junior in priority of payment to certain of our other indebtedness to the

extent described in a prospectus supplement. The indentures in the forms initially filed as exhibits to the registration statement

of which this prospectus is a part do not limit the amount of indebtedness which we may incur, including senior indebtedness or

subordinated indebtedness, and do not limit us from issuing any other debt, including secured debt or unsecured debt.

Conversion

or Exchange Rights

We

will set forth in the applicable prospectus supplement the terms on which a series of debt securities may be convertible into

or exchangeable for our Common Stock or other securities, including the conversion or exchange rate, as applicable, or how it

will be calculated, and the applicable conversion or exchange period. We will include provisions as to whether conversion or exchange

is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which the number of securities

that the holders of the series of debt securities receive upon conversion or exchange would, under the circumstance described

in those provisions, be subject to adjustment, or pursuant to which those holders would, under those circumstances, receive other

property upon conversion or exchange, for example in the event of our merger or consolidation with another entity.

Consolidation,

Merger or Sale

The

indentures in the forms initially filed as exhibits to the registration statement of which this prospectus is a part do not contain

any covenant that restricts our ability to merge or consolidate, or sell, convey, transfer or otherwise dispose of all or substantially

all of our assets. However, any successor of ours or acquirer of such assets must assume all of our obligations under the indentures

and the debt securities.

If

the debt securities are convertible for our other securities, the person with whom we consolidate or merge or to whom we sell

all of our property must make provisions for the conversion of the debt securities into securities which the holders of the debt

securities would have received if they had converted the debt securities before the consolidation, merger or sale.

Events

of Default under the Indentures

Except

as otherwise set forth in an applicable prospectus supplement, the following are events of default under the indentures with respect

to any series of debt securities that we may issue:

| ● | if

we fail to pay interest when due and payable and our failure continues for 30 days and

the time for payment has not been extended or deferred; |

| ● | if

we fail to pay the principal, or premium, if any, when due and payable and the time for

payment has not been extended or delayed; |

| ● | if

we fail to observe or perform any other covenant contained in the debt securities or

the indentures, other than a covenant solely for the benefit of another series of debt

securities, and our failure continues for 90 days after we receive notice from the trustee

or holders of a to-be-determined percentage in aggregate principal amount of the outstanding

debt securities of the applicable series; and |

| ● | if

specified events of bankruptcy, insolvency or reorganization occur. |

If

an event of default with respect to debt securities of any series occurs and is continuing, other than an event of default specified

in the last bullet point above under “— Events of Default Under the Indentures,” the trustee or the holders

of a to-be-determined percentage in aggregate principal amount of the outstanding debt securities of that series, by notice to

us in writing, and to the trustee if notice is given by such holders, may declare the unpaid principal of, premium, if any, and

accrued interest, if any, due and payable immediately. If an event of default specified in the last bullet point above “—

Events of Default Under the Indentures” occurs with respect to us, the principal amount of and accrued interest, if any,

of each series of debt securities then outstanding shall be due and payable without any notice or other action on the part of

the trustee or any holder.

The

holders of a majority in aggregate principal amount of the outstanding debt securities of an affected series may waive any default

or event of default with respect to the series and its consequences (other than bankruptcy defaults), except there may be no waiver

of defaults or events of default regarding payment of principal, premium, if any, or interest, unless we have cured the default

or event of default in accordance with the applicable indenture.

Subject

to the terms of the indentures, if an event of default under an indenture shall occur and be continuing, the trustee will be under

no obligation to exercise any of its rights or powers under such indenture at the request or direction of any of the holders of

the applicable series of debt securities, unless such holders have offered the trustee indemnity satisfactory to it. The holders

of a majority in principal amount of the outstanding debt securities of any series will have the right to direct the time, method

and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or power conferred on

the trustee, with respect to the debt securities of that series, provided that:

| ● | the

direction so given by the holder is not in conflict with any law or the applicable indenture;

and |

| ● | subject

to its duties under the Trust Indenture Act, the trustee need not take any action that

might involve it in personal liability or might be unduly prejudicial to the holders

not involved in the proceeding. |

A

holder of the debt securities of any series will only have the right to institute a proceeding under the indentures or to appoint

a receiver or trustee, or to seek other remedies if:

| ● | the

holder has given written notice to the trustee of a continuing event of default with

respect to that series; |

| ● | the

holders of a to-be-determined percentage in aggregate principal amount of the outstanding

debt securities of that series have made written request to the trustee, and such holders

have offered indemnity satisfactory to the trustee, to institute the proceeding as trustee;

and |

| ● | the

trustee does not institute the proceeding, and does not receive from the holders of a

majority in aggregate principal amount of the outstanding debt securities of that series

other conflicting directions, within 90 days after the notice, request and offer. |

These

limitations do not apply to a suit instituted by a holder of debt securities if we default in the payment of the principal, premium,

if any, or interest on, the debt securities.

We

will periodically file statements with the trustee regarding our compliance with the covenants in the indentures.

Modification

of Indenture; Waiver

We

and the trustee may modify an indenture or enter into or modify any supplemental indenture without the consent of any holders

of the debt securities with respect to specific matters, including:

| ● | to

fix any ambiguity, defect or inconsistency in the indenture; |

| ● | to

comply with the provisions described above under “—Consolidation, Merger

or Sale;” |

| ● | to

comply with any requirements of the SEC in connection with the qualification of any indenture

under the Trust Indenture Act; |

| ● | to

evidence and provide for the acceptance of appointment hereunder by a successor trustee; |

| ● | to

provide for uncertificated debt securities and to make any appropriate changes for such

purpose; |

| ● | to

add to, delete from, or revise the conditions, limitations and restrictions on the authorized

amount, terms or purposes of issuance, authorization and delivery of debt securities

of any unissued series; |

| ● | to

add to our covenants such new covenants, restrictions, conditions or provisions for the

protection of the holders, to make the occurrence, or the occurrence and the continuance,

of a default in any such additional covenants, restrictions, conditions or provisions

an event of default, or to surrender any of our rights or powers under the indenture;

or |

| ● | to

change anything that does not materially adversely affect the legal rights of any holder

of debt securities of any series. |

In

addition, under the indentures, the rights of holders of a series of debt securities may be changed by us and the trustee with

the written consent of the holders of at least a majority in aggregate principal amount of the outstanding debt securities of

each series that is affected. However, we and the trustee may only make the following changes with the consent of each holder

of any outstanding debt securities affected:

| ● | extending

the fixed maturity of the series of debt securities; |

| ● | reducing

the principal amount, reducing the rate of or extending the time of payment of interest,

or reducing any premium payable upon the redemption of any debt securities; or |

| ● | reducing

the percentage of debt securities, the holders of which are required to consent to any

supplemental indenture. |

Discharge

Each

indenture provides that, subject to the terms of the indenture and any limitation otherwise provided in the prospectus supplement

applicable to a particular series of debt securities, we can elect to be discharged from our obligations with respect to one or

more series of debt securities, except for specified obligations, including obligations to:

| ● | register

the transfer or exchange of debt securities of the series; |

| ● | replace

stolen, lost or mutilated debt securities of the series; |

| ● | maintain

paying agents and agencies for payment, registration of transfer and exchange and service

of notices and demands; |

| ● | recover

excess money held by the trustee; |

| ● | compensate

and indemnify the trustee; and |

| ● | appoint

any successor trustee. |

In

order to exercise our rights to be discharged, we must deposit with the trustee money or government obligations sufficient to

pay all the principal of, any premium and interest on, the debt securities of the series on the date payments are due.

“Street

Name” and Other Indirect Holders

Investors

who hold securities in accounts at banks or brokers generally will not be recognized by us as legal holders of debt securities.

This manner of holding securities is called holding in “street name.” Instead, we would recognize only the bank or

broker, or the financial institution that the bank or broker uses to hold its securities. These intermediary banks, brokers and

other financial institutions pass along principal, interest and other payments on the debt securities, either because they agree

to do so in their customer agreements or because they are legally required to do so. If you hold debt securities in “street

name,” you should check with your own institution to find out, among other things:

| ● | how

it handles payments and notices; |

| ● | whether

it imposes fees or charges; |

| ● | how

it would handle voting if applicable; |

| ● | whether

and how you can instruct it to send you debt securities registered in your own name so

you can be a direct holder as described below; and |

| ● | if

applicable, how it would pursue rights under your debt securities if there were a default