0001056285--02-03false00010562852025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 05, 2025 |

Kirkland's, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Tennessee |

000-49885 |

62-1287151 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

5310 Maryland Way |

|

Brentwood, Tennessee |

|

37027 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 615 872-4800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

KIRK |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on October 21, 2024, Kirkland’s, Inc. (the “Company” or “Kirkland’s”) and its subsidiaries entered into a $17 million Term Loan Credit Agreement (the “Beyond Term Loan”), which was fully funded at closing of the Beyond Term Loan, with Beyond, Inc. (NYSE: BYON) (“Beyond”), as administrative agent and lender. Kirkland’s and one of its subsidiaries are serving as the guarantors under the Beyond Term Loan, and Kirkland’s other two subsidiaries are the borrowers. At the closing of the Beyond Term Loan, the Beyond Term Loan consisted of (i) an $8.5 million loan that was mandatorily convertible into Kirkland’s common stock, no par value (“Common Stock”) at a price of $1.85 per share upon the approval of Kirkland’s shareholders and (ii) a non-convertible $8.5 million loan.

In connection and concurrent with the Beyond Term Loan, on October 21, 2024, the Company and Beyond entered into a subscription agreement (the “Subscription Agreement”, the transactions contemplated by the Beyond Term Loan and the Subscription Agreement, the “Transactions”) pursuant to which Beyond agreed to purchase $8 million of Common Stock at a price of $1.85 per share for a total of 4,324,324 shares upon the approval of Kirkland’s shareholders.

As disclosed below, on February 5, 2025, the issuances of shares of Common Stock pursuant to the Subscription Agreement and upon conversion of the outstanding convertible debt under the Beyond Term Loan were approved by the shareholders of the Company at a Special Meeting of the Shareholders (the “Special Meeting”). On February 5, 2025, following the approval of the issuance of shares of Common Stock by the shareholders of the Company, Beyond completed (i) the $8 million equity purchase and (ii) the mandatory conversion of the $8.5 million convertible term loan, resulting in the issuance of 8,934,465 shares of Common Stock (collectively, the “Beyond Shares”) to Beyond.

Proceeds from the Subscription Agreement were used by the Company to reduce borrowings under the Company’s existing $90 million revolving credit facility with Bank of America, N.A and to fund related transaction expenses.

During the Standstill Period (as defined below), Beyond may not transfer any of the Beyond Shares to any person without the consent of Kirkland’s, provided that Beyond may, without the consent of Kirkland’s, transfer purchased shares: (i) to an affiliate of Beyond, (ii) to any person so long as the transfer represents less than 10% of the outstanding capital stock of the Company (provided that transfers to Company competitors are restricted), (iii) pursuant to a tender offer, exchange offer, merger, recapitalizations, or similar material transaction or (iv) pursuant to an underwritten offering or Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”).

Pursuant to an investor rights agreement also entered into at the initial closing on October 21, 2024 (the “Investor Rights Agreement”), Beyond is subject to standstill obligations that, among other things, generally restrict Beyond’s ability to acquire more than 40% of the Company’s stock, take affirmative actions, solicit proxies, engage in voting campaigns, engage in “group” activity for purposes of Section 13 of the Exchange Act of 1934, as amended, with any other person other than its affiliates, effect any tender offer, present shareholder proposals, make any public statement regarding material changes to the Company’s Board of Directors (the “Board”), management or securities. The “Standstill Period” will continue until the earlier of (a) the later of the two-year anniversary of the Investor Rights Agreement and the date Beyond no longer holds at least 5% of the outstanding Common Stock, or (b) a change of control of the Company.

Pursuant to the Investor Rights Agreement Beyond has the right, at its election, to designate two nominees for appointment to Kirkland’s Board. This right will remain in place so long as Beyond owns at least 20% of Kirkland’s outstanding Common Stock. If Beyond’s ownership of Common Stock drops below 20% of Kirkland’s outstanding Common Stock, Beyond will have the right to designate one person for appointment to Kirkland’s Board so long as Beyond continues to own at least 5% of Kirkland’s Common Stock. The Company’s Board is expected to remain at six directors following shareholder approval, and if the size of the Board is increased, Beyond will be entitled to maintain proportionate representation. In addition to the director nomination rights described above, Beyond will also have the right to designate a board observer during the term of the Beyond Term Loan and for so long as it continues to own at least 5% of Kirkland’s Common Stock. In addition, as part of its stock purchase, Beyond will have customary demand and piggyback registration rights with respect to the purchased shares. Beyond has indicated that it does not intend to exercise its director nomination rights and no changes to the composition of the Board are anticipated at this time.

In addition to the foregoing, and as previously described in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on November 8, 2024 in connection with the Special Meeting, on February 5, 2025, in connection with and upon completion of the transactions described above, the Company issued 310,135 shares of Common Stock to Consensus Securities LLC (“Consensus”), the Company’s financial advisor, as a partial payment of a success fee earned by Consensus in connection with the Beyond transactions. The shares of Common Stock were issued at a price of $1.85 per share for a total value of $537,750 pursuant to a subscription agreement (the “Consensus Subscription Agreement”).

The foregoing descriptions of the Beyond Term Loan, Subscription Agreement, Investor Rights Agreement and Consensus Subscription Agreement do not purport to be complete and are qualified in their entirety by reference to the agreements, which are incorporated by reference as Exhibits 10.1 through 10.4.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02. The shares sold to Beyond pursuant the Beyond Term Loan Agreement and Subscription Agreement are exempt from registration pursuant to Section 4(a)(2) of the Securities Act. The shares issued to Consensus pursuant to the Consensus Subscription Agreement are exempt from registration pursuant to Section 4(a)(2) of the Securities Act. Each of Beyond and Consensus have represented to the Company that it is an “accredited investor” as defined in Rule 501(a) of Regulation D under the Securities Act and that the Common Stock is being acquired for investment purposes and not with a view to, or for sale in connection with, any distribution thereof, and appropriate legends will be affixed to any certificates evidencing shares of Common Stock issued.

Item 3.03 Material Modification to Rights of Security Holders.

The information contained in Item 1.01 is incorporated by reference into this Item 3.03.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On February 5, 2025, the Company’s shareholders approved an amendment to the Company’s Amended and Restated Charter (“the Charter Amendment”) which decreases the number of authorized shares of Common Stock from 100,000,000 to 80,000,000, and decreases the number of authorized shares of capital stock from 110,000,000 to 90,000,000. The Charter Amendment does not provide for any decrease in the number of authorized shares of the Company’s preferred stock, which remains at 10,000,000 shares. The Charter Amendment became effective upon filing with the Secretary of State of the State of Tennessee on February 5, 2025.

The foregoing summary is qualified in its entirety by reference to the full text of the Charter Amendment, a copy of which is attached as Exhibit 3.1 hereto and incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On February 5, 2025, the Company reconvened and concluded a Special Meeting of Shareholders of the Company, originally convened and adjourned on December 23, 2024. A summary of the matters voted upon by the shareholders at the Special Meeting is set forth below.

Proposal 1. The shareholders approved, subject to certain conditions, the issuance of shares of common stock to Beyond, Inc. pursuant to Nasdaq Listing Rules 5635(b) and 5635 (d) based on the following votes:

|

|

|

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

Total Shares Voted |

|

5,202,083 |

|

162,308 |

|

248,547 |

|

2,564,249 |

Proposal 2. The shareholders approved an adjournment of the Special Meeting to a later date, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposal based on the following votes:

|

|

|

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

Total Shares Voted |

|

7,874,795 |

|

238,759 |

|

63,633 |

|

0 |

Proposal 3. The shareholders approved an amendment to the Amended and Restated Charter of the Company to reduce the number of authorized shares of common stock from 100,000,000 to 80,000,000 based on the following votes:

|

|

|

|

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

Total Shares Voted |

|

5,207,571 |

|

376,120 |

|

2,593,496 |

|

0 |

Item 8.01 Other Events.

On February 5, 2025, the Company issued a press release announcing the voting results of the Special Meeting. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

Exhibit Number |

|

Description |

|

|

|

3.1 |

|

Articles of Amendment to the Amended and Restated Charter of Kirkland’s, Inc. |

|

|

|

10.1* |

|

Term Loan Credit Agreement dated as of October 21, 2024, by and between Kirkland’s Stores, Inc., as Lead Borrower, the Borrowers named therein, the Guarantors named therein, Beyond, Inc., as Administrative Agent and Collateral Agent and the Lenders party thereto (Exhibit 10.1 to Form 8-K filed on October 21, 2024). |

|

|

|

10.2* |

|

Subscription Agreement, dated as of October 21, 2024, by and between Kirkland’s, Inc. and Beyond, Inc. (Exhibit 10.2 to Form 8-K filed on October 21, 2024). |

|

|

|

10.3* |

|

Investor Rights Agreement, dated as of October 21, 2024, by and between Kirkland’s, Inc. and Beyond, Inc. (Exhibit 10.3 to Form 8-K filed on October 21, 2024). |

|

|

|

10.4 |

|

Subscription Agreement, dated as of October 18, 2024, by and between Kirkland’s, Inc. and Consensus Securities, LLC. |

|

|

|

99.1 |

|

Press Release dated February 5, 2025 announcing the finalizing of the Beyond investment. |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

* Incorporated by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Kirkland’s Inc. |

|

|

|

|

Date: |

February 5, 2025 |

By: |

/s/ Carter R. Todd |

|

|

|

Name: Carter R. Todd

Title: Senior Vice President, General Counsel and Corporate Secretary |

ARTICLES OF AMENDMENT TO

THE AMENDED AND RESTATED CHARTER

OF

KIRKLAND’S, INC.

In accordance with Section 48-20-106 of the Tennessee Business Corporation Act, the undersigned corporation adopts the following Articles of Amendment (the “Articles of Amendment”) to its Amended and Restated Charter (the “Charter”):

1.The name of this corporation is Kirkland’s, Inc. (the “Corporation”).

2.Paragraph 4 of the Charter is hereby deleted in its entirety and replaced with the following, which states the authorized number and par value of common and preferred stock, and shall read in its entirety as follows:

“4. Authorized Shares. The total number of shares of all classes of stock which the Corporation shall have authority to issue is Ninety Million (90,000,000), of which Eighty Million (80,000,000) shares shall constitute a single class of shares known as Common Stock, which shall be without par value (the “Common Stock”), and the remaining Ten Million (10,000,000) shares shall be known as Preferred Stock (the “Preferred Stock”).”

3. Except as amended by these Articles of Amendment, the Charter of the Corporation shall remain in full force and effect.

4. On the recommendation of the Board of Directors of the Corporation, these Articles of Amendment were duly adopted by the shareholders of the Corporation at a meeting of the shareholders on February 5, 2025.

5. These Articles of Amendment will be effective upon filing with the Secretary of State of the State of Tennessee.

IN WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be signed by its duly authorized officer as set forth below this 5th day of February 2025.

|

|

|

|

|

KIRKLAND'S, INC. |

|

|

|

By: |

|

/s/ Carter R. Todd |

Name: |

|

Carter R. Todd |

Title: |

|

Senior Vice President, General Counsel and Corporate Secretary |

SUBSCRIPTION AGREEMENT

This SUBSCRIPTION AGREEMENT dated as of October 18, 2024 (this “Agreement”) is by and between Kirkland’s, Inc. (the “Company”), and Consensus Securities, LLC (the “Purchaser”).

WHEREAS, the Company and Purchaser have previously entered into that certain Engagement Agreement, as amended, dated May 15, 2024 (the “Engagement Agreement”), pursuant to which Purchaser has provided investment banking services to the Company, and in connection therewith the Purchaser has earned, among other things, a capital success fee in the amount of $573,750 (the “Fee”), which amount is to be paid to Purchaser by the Company within three (3) business days of the closing of the Company’s private placement of common stock to Beyond, Inc.; and

WHEREAS, the Company and the Purchaser have agreed that the Company may pay the Fee to Purchaser in exchange for 310,135 newly issued shares of Common Stock for an aggregate subscription price of $573,750.00 ( the “Purchased Shares”).

NOW THEREFORE, in consideration of the premises and the mutual representations, warranties, covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

Article I

PURCHASE AND SALE OF PURCHASED SHARES

Section 1.1Purchase and Sale. On the terms and subject to the satisfaction or waiver of the conditions set forth in this Agreement, at the Closing, the Purchaser shall purchase, and the Company shall issue and sell to the Purchaser, the Purchased Shares, free and clear of any liens for an aggregate purchase price of $573,750.00 to be paid by cancellation of the Fee.

Section 1.2Closing. On the terms set forth in this Agreement, the closing of the issuance, sale and purchase of the Purchased Shares (the “Closing”) shall take place remotely via the exchange of final documents and signature pages, as soon as practicable, but in no event later than three (3) business days after all applicable conditions to closing specified in Article IV hereof having been satisfied or waived by the Company, including the closing of the Beyond, Inc. private placement with the Company, or at such other time and place as the Company and the Purchaser may mutually agree in writing. The date on which the Closing is to occur is herein referred to as the “Closing Date.” At the Closing, upon receipt by the Company of payment of the full purchase price to be paid at the Closing therefor by or on behalf of such Purchaser to the Company, the Company will deliver to the Purchaser evidence reasonably satisfactory to the Purchaser of the issuance of the Purchased Shares in the name of the Purchaser by book-entry on the books and records of the Company. At the Closing, the Purchaser shall deliver to the Company a duly executed, valid, accurate and properly completed Internal Revenue Service Form W-9 certifying that such Purchaser is a U.S. person and that such Purchaser is not subject to backup withholding.

Article II

REPRESENTATIONS AND WARRANTIES OF THE PURCHASER

The Purchaser represents and warrants to the Company that:

Section 2.1Organization and Power. The Purchaser is a limited liability company duly formed, validly existing and in good standing under the laws of the jurisdiction of its formation and has all requisite corporate or other entity power and authority to own its properties and to carry on its business as presently conducted.

Section 2.2Authorization, Etc. The Purchaser has all necessary corporate power and authority and has taken all necessary corporate action required for the due authorization, execution, delivery and performance by the Purchaser of this Agreement and the consummation by the Purchaser of the transactions contemplated hereby. The authorization, execution, delivery and performance by the Purchaser of this Agreement, and the consummation by the Purchaser of the transactions contemplated hereby do not and will not: (a) violate or result in the breach of any provision of the certificate of incorporation and bylaws (or similar organizational document) of the Purchaser; or (b) with the exceptions that are not reasonably likely to have, individually or in the aggregate, a material adverse effect on its ability to perform its obligations under this Agreement: (i) violate any provision of, constitute a breach of, or default under, any judgment, order, writ, or decree applicable to the Purchaser or any material contract to which the Purchaser is a party; or (ii) violate any provision of, constitute a breach of, or default under, any applicable state, federal or local law, rule or regulation. This Agreement has been duly executed and delivered by the Purchaser. Assuming due execution and delivery thereof by the other parties hereto or thereto, this Agreement will be a valid and binding obligation of the Purchaser enforceable against the Purchaser in accordance with its terms, except as the enforceability may be limited by applicable laws relating to bankruptcy, insolvency, reorganization, moratorium or other similar legal requirement relating to or affecting creditors’ rights generally and except as the enforceability is subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law).

Section 2.3Government Approvals. No consent, approval, license or authorization of, or filing with, any court or governmental authority is or will be required on the part of the Purchaser in connection with the execution, delivery and performance by the Purchaser of this Agreement.

Section 2.4Investment Representations.

(a)The Purchaser is an “accredited investor” as that term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act.

(b)The Purchaser has been advised by the Company that the Purchased Shares have not been registered under the Securities Act, that the Purchased Shares will be issued on the basis of the statutory exemption provided by Section 4(a)(2) under the Securities Act or Regulation D promulgated thereunder, or both, relating to transactions by an issuer not involving any public offering and under similar exemptions under certain state securities laws, that this transaction has not been reviewed by, passed on or submitted to any federal or state agency or self-regulatory organization where an exemption is being relied upon, and that the Company’s reliance thereon is

based in part upon the representations made by the Purchaser in this Agreement. The Purchaser acknowledges that it has been informed by the Company of, or is otherwise familiar with, the nature of the limitations imposed by the Securities Act and the rules and regulations thereunder on the transfer of securities.

(c)The Purchaser is purchasing the Purchased Shares for its own account and not with a view to, or for sale in connection with, any distribution thereof in violation of federal or state securities laws.

(d)By reason of its business or financial experience, the Purchaser has the capacity to protect its own interest in connection with the transactions contemplated hereunder.

(e)The Company has provided to the Purchaser all documents and information that the Purchaser has requested relating to an investment in the Company. The Purchaser recognizes that investing in the Company involves substantial risks, and has taken full cognizance of and understands all of the risk factors related to the acquisition of the Purchased Shares. The Purchaser has carefully considered and has, to the extent it believes such discussion necessary, discussed with the Purchaser’s professional legal, tax and financial advisers the suitability of an investment in the Company, and the Purchaser has determined that the acquisition of the Purchased Shares is a suitable investment for the Purchaser. The Purchaser has not relied on the Company for any tax or legal advice in connection with the purchase of the Purchased Shares. In evaluating the suitability of an investment in the Company, the Purchaser has not relied upon any representations or other information.

Section 2.5No Prior Ownership. Prior to the Closing, the Purchaser does not have record or beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of any shares of the Company’s Common Stock.

Section 2.6No Brokers or Finders. No Person has or will have, as a result of the transactions contemplated by this Agreement, any right, interest or claim against or upon the Company for any commission, fee or other compensation as a finder or broker because of any act by the Purchaser.

Section 2.7ERISA. The Purchaser does not hold, and no part of the funds used by the Purchaser to acquire any Purchased Shares constitutes, “plan assets” (within the meaning of the ERISA Regulations). The Purchaser is not (a) an “employee benefit plan” that is subject to Part 4 of Title I of ERISA, (b) a “plan” to which Section 4975 of the Code applies or (c) an entity whose underlying assets could be deemed to include “plan assets” by reason of an employee benefit plan’s or a plan’s investment in such entity.

Section 2.8No Additional Representations. The Purchaser acknowledges and agrees, on behalf of itself and its affiliates, that neither the Company nor any other person, makes any express or implied representation or warranty with respect to the Company, its Subsidiaries or their respective businesses, operations, assets, liabilities, employees, employee benefit plans, conditions or prospects, and the Purchaser, on behalf of itself and its affiliates, hereby disclaims reliance upon any such other representations or warranties. In particular, without limiting the foregoing disclaimer, the Purchaser acknowledges and agrees, on behalf of itself and its affiliates, that neither

the Company nor any other Person, makes or has made any representation or warranty with respect to, and the Purchaser, on behalf of itself and its affiliates, hereby disclaims reliance upon (a) any financial projection, forecast, estimate, budget or prospect information relating to the Company, its Subsidiaries or their respective business, or (b) any information presented to the Purchaser or any of its affiliates or representatives in the course of their due diligence investigation of the Company, the negotiation of this Agreement or in the course of the transactions contemplated hereby. To the fullest extent permitted by applicable law, neither the Company nor any of its subsidiaries shall have any liability to any Purchaser or its affiliates or representatives on any basis (including in contract or tort, under federal or state securities laws or otherwise) based upon any other representation or warranty, either express or implied, included in any information or statements (or any omissions therefrom) provided or made available by the Company or its Subsidiaries to Purchaser or its affiliates or representatives in the course of their due diligence investigation of the Company, the negotiation of this Agreement or in the course of the transactions contemplated by this Agreement.

Article III

COVENANTS OF THE PARTIES

Section 3.1Restrictions on Transfer.

(a)The Purchased Shares shall not be Transferred except upon the conditions specified in the Engagement Letter and in Section 3.2, which conditions are intended to ensure compliance with the provisions of the Securities Act. Any attempted Transfer in violation of this Section 3.1 shall be void ab initio.

Section 3.2Restrictive Legends.

(a)Each certificate representing the Purchased Shares (unless otherwise permitted by the provisions of Section 4.2(d)) shall be stamped or otherwise imprinted with a legend in substantially the following form (in addition to any legend required under applicable state securities laws):

“THE OFFER AND SALE OF THIS SECURITY AND THE SHARES OF COMMON STOCK ISSUABLE UPON CONVERSION OF THIS SECURITY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND THIS SECURITY AND SUCH SHARES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED EXCEPT (A) PURSUANT TO A REGISTRATION STATEMENT THAT IS EFFECTIVE UNDER THE SECURITIES ACT; OR (B) PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.”

(b)In addition, for so long as the Purchased Shares are subject to the restrictions set forth in Section 3.1, each certificate representing the Purchased Shares shall be stamped or otherwise imprinted with a legend in substantially the following form:

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO RESTRICTIONS ON TRANSFER SET FORTH IN A SUBSCRIPTION AGREEMENT. THE COMPANY WILL MAIL TO THE HOLDER OF THIS CERTIFICATE A COPY OF SUCH SUBSCRIPTION AGREEMENT, AS IN EFFECT ON THE DATE OF MAILING, WITHOUT CHARGE, PROMPTLY AFTER RECEIPT OF A WRITTEN REQUEST THEREFOR.”

(c)The Purchaser consents to the Company making a notation on its records and giving instructions to any transfer agent of the Purchased Shares in order to implement the restrictions on transfer set forth in this Section 3.2.

(d)Prior to any proposed Transfer of any of the Purchased Shares, unless there is in effect a registration statement under the Securities Act covering the proposed Transfer, a Purchaser shall give written notice to the Company of such Purchaser’s intention to effect such Transfer. Each such notice shall describe the manner and circumstances of the proposed Transfer in sufficient detail, and shall be accompanied by either (i) an opinion of legal counsel reasonably satisfactory to the Company to the effect that the proposed Transfer of the Restricted Securities may be effected without registration under the Securities Act, or (ii) any other evidence reasonably satisfactory to counsel to the Company, whereupon such Purchaser shall be entitled to Transfer such Restricted Securities in accordance with the terms of the notice delivered by such Purchaser to the Company. Notwithstanding the foregoing, in the event a Purchaser shall give the Company a representation letter containing such representations as the Company shall reasonably request, the Company will not require such legal opinion or such other evidence (A) in a routine sales transaction in compliance with Rule 144 under the Securities Act, (B) in any transaction in which a Purchaser that is a corporation distributes Restricted Securities solely to its majority owned subsidiaries or affiliates for no consideration or (C) in any transaction in which a Purchaser that is a partnership or limited liability company distributes Restricted Securities solely to its affiliates (including affiliated fund partnerships), or partners or members of such Purchaser or its affiliates for no consideration. Each certificate evidencing the Restricted Securities transferred shall bear the appropriate restrictive legend set forth in Section 4.2 above, except that such certificate shall not bear the first such restrictive legend if such legend is not required in order to establish compliance with any provisions of the Securities Act. Upon the request of a Purchaser of a certificate bearing the first such restrictive legend and, if necessary, the appropriate evidence as required by clause (i) or (ii) above, the Company shall remove the first such restrictive legend from such certificate and from the certificate to be issued to the applicable transferee if such legend is not required in order to establish compliance with any provisions of the Securities Act and the Purchaser promptly Transfers the Purchased Shares. If the Purchaser holds a certificate bearing the second restrictive legend, upon the request of the Purchaser, the Company shall remove such restrictive legend from such certificate when the provisions of Section 4.2 are no longer applicable to the applicable Purchased Shares.

Article IV

CONDITIONS TO THE COMPANY’S OBLIGATIONS

Section 4.1Conditions of the Company. The obligations of the Company to consummate the transaction contemplated hereby is subject to the satisfaction, on or prior to the Closing Date, of each of the following conditions precedent:

(a)Representations and Warranties; Performance. Each of the representations and warranties of the Purchaser contained in Article II of this Agreement shall be true and correct on and as of the Closing Date with the same effect as though such representations and warranties had been made on and as of the Closing Date.

(b)Closing of Beyond Private Placement. The Beyond private placement shall have closed and been fully funded by Beyond, Inc.

Section 5.1Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and will become effective when one or more counterparts have been signed by a party and delivered to the other parties.

Section 5.2Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the state of Delaware, without giving effect to any choice of law or conflict of law rules or provisions (whether of the state of Delaware or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the state of Delaware.

Section 5.3Entire Agreement; No Third Party Beneficiary. This Agreement contains the entire agreement by and among the parties with respect to the subject matter hereof and all prior negotiations, writings and understandings relating to the subject matter of this Agreement. Headings. The Section, Article and other headings contained in this Agreement are inserted for convenience of reference only and will not affect the meaning or interpretation of this Agreement.

Section 5.4Amendments. This Agreement may not be modified or amended except by an instrument or instruments in writing signed by each party hereto. Any party hereto may, only by an instrument in writing, waive compliance by any other party or parties hereto with any term or provision hereof on the part of such other party or parties hereto to be performed or complied with.

The parties have caused this Subscription Agreement to be executed as of the date first written above.

KIRKLAND’S, INC.

By: /s/ W. Michael Madden

Name: W. Michael Madden

Title: Executive Vice President and Chief Financial Officer

CONSENSUS SECURITIES, INC.

By: /s/ Michael A. O'Hara

Name: Michael A. O'Hara

Title: Managing Member

KIRKLAND’S FINALIZES $25 MILLION INVESTMENT FROM BEYOND, INC. PROVIDING LIQUIDITY AND STRENGTHENING STRATEGIC PARTNERSHIP

Receives Strong Shareholder Support in Favor of Proposal Related to Beyond Transaction at Special Meeting

NASHVILLE, Tenn. (February 5, 2025) — Kirkland’s, Inc. (Nasdaq: KIRK) (“Kirkland’s” or the “Company”), a specialty retailer of home décor and furnishings, announced that the Company’s shareholders, in accordance with applicable Nasdaq Listing Rules at a Special Meeting of the Shareholders concluded on February 5, 2025 (the “Special Meeting”), have approved the issuances of shares of common stock pursuant to the Term Loan Credit Agreement and Subscription Agreement previously entered into with Beyond, Inc. (NYSE: BYON) (“Beyond”) on October 21, 2024. Following the Special Meeting in which the Company obtained the requisite shareholder approvals, with 97% of votes cast in favor of the proposal, Beyond completed both an $8 million equity purchase under the Subscription Agreement and the mandatory conversion of an $8.5 million convertible term loan under the Term Loan Credit Agreement. With the completion of this transaction, Beyond has now provided Kirkland’s with a total of $25 million of capital and now owns approximately 40% of Kirkland’s outstanding shares of common stock.

Amy Sullivan, CEO of Kirkland’s, commented, “Today marks a pivotal moment for Kirkland’s, as the completion of this transaction and ongoing value of our strategic partnership with Beyond begin to unlock new drivers of transformation following our efforts over the past year focused on revitalizing the Kirkland’s brand. I am immensely proud of the team and the significant improvements we continue to make through our strategic initiatives of reengaging our core customer, refocusing our product assortment and strengthening our omni-channel capabilities. As we look ahead, together with the Beyond team we will continue to leverage Kirkland’s core strengths including our Merchandising, Store Operations and Supply Chain expertise and infrastructure to build a cohesive omni-channel strategy for Beyond’s portfolio of iconic brands. Plans are underway for our first Bed Bath & Beyond store opening later this year, and we look forward to continuing to explore opportunities to maximize the value of our partnership. We enter fiscal 2025 with additional capital, new opportunities for growth and an intense focus on aggressively addressing underperforming assets and delivering improved profitability.”

“Our investment and the overwhelming shareholder support reinforces the value we see in Kirkland’s and its management team. Through this strategic partnership we are committed to leveraging the strengths of each company to drive long-term sustainable growth as we work together to build the omni-channel strategy across our family of brands,” said Marcus Lemonis, Executive Chairman of Beyond.

About Kirkland’s, Inc.

Kirkland’s, Inc. is a specialty retailer of home décor and furnishings in the United States, currently operating 317 stores in 35 states as well as an e-commerce website, www.kirklands.com, under the Kirkland’s Home brand. The Company provides its customers an engaging shopping experience characterized by a curated, affordable selection of home décor and furnishings along with inspirational design ideas. This combination of quality and stylish merchandise, value pricing and a stimulating in-store and online environment provides the Company’s customers with a unique brand experience. More information can be found at www.kirklands.com.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “aim,” “believe,” “can,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “forecast,” “plan,” “possible,” “intend,” “target,” or the negative of these words or other similar expressions that concern the Company’s expectations, strategy, priorities, plans, or intentions. Such forward-looking statements involve known and unknown risks and uncertainties, many of which are outside of the Company’s control, which may cause the Company’s actual results to differ materially from forecasted results. Forward-looking statements in this communication include, but are not limited to, the effect of the transactions entered into with Beyond (the “Transactions”) on the Company’s business relationships, operating results and business generally; unexpected costs, charges or expenses resulting from the Transactions; potential litigation relating to the Transactions that could be instituted against Beyond, the Company or their affiliates’ respective directors, managers or officers, including the effects of any outcomes related thereto; continued availability of capital and financing; the ability to obtain the various synergies envisioned between the Company and Beyond; the ability of the Company to successfully open Bed Bath & Beyond stores; the ability of each company to successfully market their products to the other company’s customers and to implement its plans, forecasts and other expectations with respect to its business after the completion of the Transactions and realize additional opportunities for growth and innovation; risks associated with the Company’s liquidity including cash flows from operations and the amount of borrowings under the secured revolving credit facility; the Company’s ability to successfully implement cost savings and other strategic initiatives intended to improve operating results and liquidity positions; the Company’s actual and anticipated progress towards its short-term and long-term objectives including its brand strategy; the risk that natural disasters, pandemic outbreaks, global political events, war and terrorism could impact the Company’s revenues, inventory and supply chain; the continuing consumer impact of inflation and countermeasures, including high interest rates, the effectiveness of the Company’s marketing campaigns; risks related to changes in U.S. policy related to imported merchandise, particularly with regard to the impact of tariffs on goods imported from China and strategies undertaken to mitigate such impact; the Company’s ability to retain its senior management team; volatility in the price of the Company’s common stock; the competitive environment in the home décor industry in general and in the Company’s specific market areas; inflation, fluctuations in cost and availability of inventory, increased transportation costs and potential interruptions in supply chain, distribution systems and delivery network, including the Company’s e-commerce systems and channels; the ability to control employment and other operating costs, availability of suitable retail locations and other growth opportunities; disruptions in information technology systems including the potential for security breaches of the Company’s information, or our customers’ information, seasonal fluctuations in consumer spending, and economic conditions in general and other risks detailed in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Company’s Annual Report on Form 10-K filed with the SEC on March 29, 2024 and subsequent filings. All information provided in this communication is as of the date hereof, and the Company undertakes no duty to update this information unless required by law. Any changes in assumptions or factors on which such statements are based could produce materially different results. These forward-looking statements should not be relied upon as representing the Company’s assessment as of any date subsequent to the date of this communication.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

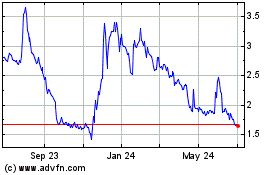

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Feb 2025 to Mar 2025

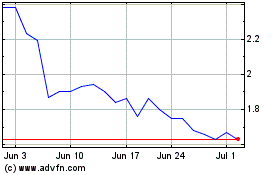

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Mar 2024 to Mar 2025