UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by party other than the registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

☐ |

Confidential,

for use of the Commission only |

| |

|

|

(as

permitted by Rule 14a-6(e)(2)). |

| ☐ |

Definitive

Proxy Statement |

|

|

| |

|

|

|

| ☐ |

Definitive

additional materials. |

|

|

| |

|

|

|

| ☐ |

Soliciting

material under Rule 14a-12. |

|

|

| KIDPIK

CORP. |

| (Name

of Registrant as Specified in Charter) |

N/A

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☒ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY

PROXY STATEMENT DATED NOVEMBER 5, 2024 — SUBJECT TO COMPLETION

Kidpik

Corp.

200

Park Avenue South, 3rd Floor

New

York, New York 10003

[●],

2024

Dear

Fellow Stockholder,

I

am pleased to invite you to attend the Annual Meeting of Stockholders of Kidpik Corp., a Delaware corporation (“Kidpik”,

“PIK”, “we”, “us” or the “Company”) to be held (subject to

any postponement(s) or adjournment(s) thereof (the “Annual Meeting”)):

| Date: |

[________],

[__________], 2024 |

| Time: |

[

]:00 a.m. Eastern Time |

| Virtual

Meeting Site: |

www.cleartrustonline.com/kidpik |

At

the Annual Meeting, you will be asked to approve (1) the election of one Class III Director to the Board of Directors (the

“Director Proposal”); (2) to ratify the appointment of CohnReznick

LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year 2024 (the “Auditor

Proposal”); (3) for the purposes of

Nasdaq Listing Rule 5635(a), the terms of, and issuance of shares of common stock in connection with, that certain March 29, 2024, Agreement

and Plan of Merger and Reorganization, as amended by the First Amendment thereto dated July 22, 2024 (as may be amended or restated from

time to time, the “Merger Agreement”) entered into between the Company, Nina Footwear Corp., a Delaware corporation

(“Nina Footwear”), and Kidpik Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Kidpik (“Merger

Sub”)(the “Merger Proposal”); (4) for the purposes of complying with the applicable listing

rules of Nasdaq, to consider and vote upon a proposal to approve the issuance of more than 20% of the Company’s issued and outstanding

common stock and voting stock in connection with certain Convertible Debentures which the Company sold and agreed to sell under the terms

of a Securities Purchase Agreement (the “Nasdaq Proposal”); (5) the approval of an amendment to our

Second Amended and Restated Certificate of Incorporation to change our corporate name to “Nina Holding Corp.” (the

“Name Change Proposal”); (6) to approve the adoption of the First Amendment to the Kidpik Corp. First

Amended and Restated 2021 Equity Incentive Plan (the “Equity Plan Proposal”); and (7) an adjournment

of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Merger Proposal

or Nasdaq Proposal (the “Adjournment Proposal”).

As

used herein, “Merger” means the merger transaction contemplated by the Merger Agreement. The Board of Directors of

Kidpik has approved the Merger Agreement and the transactions contemplated thereby, with Mr. Ezra Dabah abstaining because of a conflict

of interest in connection therewith.

We

are soliciting proxies for use at the Annual Meeting of Kidpik’s stockholders to consider and vote upon the seven (7) proposals

discussed above. Our Board of Directors recommends that you vote “FOR” each of the proposals discussed above.

A

complete list of stockholders entitled to vote at the Annual Meeting will be available at our principal executive offices, for any purpose

germane to the Annual Meeting, during ordinary business hours, for a period of ten days prior to the Annual Meeting.

We

have determined that the Annual Meeting will be held in a virtual meeting format only and will be conducted via live audio webcast. You

will be able to attend the meeting online, submit questions and vote your shares electronically by visiting www.cleartrustonline.com/kidpik

(please note this link is case sensitive), with your 12-Digit Control Number included on your notice or proxy card. We

recommend that you log in at least 15 minutes before the Annual Meeting to ensure you are logged in when the meeting starts.

We

are pleased to be using the Securities and Exchange Commission rules that allow companies to furnish proxy materials to their stockholders

primarily over the Internet. We believe that this process expedites stockholders’ receipt of the proxy materials, lowers the costs

of the annual meeting and helps to conserve natural resources.

Stockholders

attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

On or about [__________], 2024, we began mailing our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”)

containing instructions on how to access our 2024 Proxy Statement and our December 30, 2023 Annual Report on Form 10-K (the “2023

Annual Report”), and how to vote online. The Notice also includes instructions on how to request a paper copy of the proxy

materials, including the notice of annual meeting, 2024 Proxy Statement, 2023 Annual Report and proxy card.

To

be admitted to the virtual annual meeting, stockholders must enter the 12-Digit Control Number included on your notice or proxy card,

or, in the case of beneficial stockholders, requested in advance by pre-registration, at the website provided above, at the time of the

virtual annual meeting. If you are unable to attend the virtual annual meeting, it is very important that your shares be represented

and voted at the meeting.

Whether

or not you plan to attend the Annual Meeting, your vote is important to us. You may vote your shares by proxy on the Internet, by telephone

or by completing, signing and promptly returning a proxy card, or you may vote via the internet at the Annual Meeting. We encourage you

to vote by proxy on the Internet, by telephone or by proxy card even if you plan to attend the Annual Meeting. By doing so, you will

ensure that your shares are represented and voted at the Annual Meeting.

The

accompanying Proxy Statement provides you with detailed information about the proposed Merger, the Annual Meeting and the other business

to be considered by Kidpik’s stockholders. We encourage you to read the entire Proxy Statement, the Merger Agreement and the other

Annexes attached to the Proxy Statement, carefully. You may also obtain more information about Kidpik from documents we have filed with

the Securities and Exchange Commission (the “SEC” or the “Commission”), certain of which are incorporated

by reference in the Proxy Statement as disclosed therein.

On

behalf of the Board of Directors of Kidpik, we would like to thank you for being a stockholder and express our appreciation for your

ongoing support and continued interest in Kidpik. We are excited about the opportunities the Merger will bring to our stockholders.

Very

truly yours,

/s/

Ezra Dabah

Ezra

Dabah

Chief

Executive Officer and Chairman

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this Proxy Statement. Any representation to the contrary is a criminal offense.

Important

Notice Regarding the Availability of Proxy Materials for the Virtual Annual Meeting of Stockholders to Be Held on [___________], 2024.

The Proxy Statement and 2023 Annual Report are available on the Internet at www.cleartrustonline.com/kidpik (please note this

link is case sensitive).

Kidpik

Corp.

200

Park Avenue South, 3rd Floor

New

York, New York 10003

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON [●], 2024

NOTICE

IS HEREBY GIVEN that the Annual Meeting of Stockholders of Kidpik Corp. (“Kidpik”, “we”, “us”

or the “Company”), which will be held on [●], [●], 2024 at [●].M. [______] time (subject to postponement(s)

or adjournment(s) thereof), which we refer to as the Annual meeting. The Annual Meeting will be held virtually via live audio webcast

at www.cleartrustonline.com/kidpik. See also “Instructions For The Virtual Annual Meeting”, below.

A

Proxy Statement for the Annual Meeting is below.

You

are cordially invited to attend the Annual Meeting, which will be held for the following purposes:

1.

The Director Proposal - to consider and vote upon the appointment of Bart Sichel as a Class III member of the Board of Directors

for a term of three years and until his earlier death, resignation or removal (Proposal No. 1);

2.

The Auditor Proposal - to ratify the appointment of CohnReznick LLP as the Company’s independent registered public accounting

firm for the Company’s fiscal year 2024 (Proposal No. 2);

3.

The Merger Proposal – to consider and vote upon a proposal to approve, for the purposes of Nasdaq Listing Rule 5635(a), the

terms of, and the issuance of shares of common stock in connection with, that certain March 29, 2024, Agreement and Plan of Merger and

Reorganization, as amended by the First Amendment thereto dated July 22, 2024 (as may be amended or restated from time to time, the “Merger

Agreement”) entered into between the Company, Nina Footwear Corp., a Delaware corporation (“Nina Footwear”),

and Kidpik Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Kidpik (“Merger Sub”), pursuant

to which Nina Footwear will be merged with and into Merger Sub, with Nina Footwear continuing as the surviving entity and as a wholly-owned

subsidiary of the Company (Proposal No. 3);

4.

The Nasdaq Proposal – to consider and vote upon a proposal to approve, for the purposes of complying with the applicable listing

rules of Nasdaq, the issuance of more than 20% of the Company’s issued and outstanding common stock and voting stock in connection

with the issuance of shares of common stock issuable by the Company upon the conversion of $2,000,000 of convertible debentures (the

“Convertible Debentures”)(Proposal No. 4);

5.

The Name Change Proposal – to consider and vote upon the approval of an amendment to our Second Amended and Restated Certificate

of Incorporation to change our corporate name to “Nina Holding Corp.” (Proposal No. 5);

6.

The Equity Plan Proposal - to consider and vote upon the approval of the adoption of the First Amendment to the Kidpik Corp. First

Amended and Restated 2021 Equity Incentive Plan (Proposal No. 6); and

7.

The Adjournment Proposal – to consider and vote upon a proposal to adjourn the Annual Meeting to a later date or dates, if

necessary, to permit further solicitation and vote of proxies if there are insufficient votes for, or otherwise in connection with, the

approval of the Merger Proposal or Nasdaq Proposal. This proposal will only be presented at the Annual Meeting if there are not sufficient

votes to approve the Merger Proposal or Nasdaq Proposal (Proposal No. 7).

After

careful consideration, the Board of Directors of Kidpik determined that the Merger Agreement and the transactions contemplated thereby,

are in the best interests of Kidpik and its stockholders, approved the Merger Agreement and the transactions contemplated thereby, including,

but not limited to the issuance of shares of common stock in connection therewith, and recommends that you vote “FOR”

the approval, for the purposes of Nasdaq Listing Rule 5635(a), of the issuance of shares of common stock in connection of the Merger

Agreement and the transactions contemplated therein, subject to the conditions set forth in the Merger Agreement; and that you vote “FOR”

the ratification of the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for the Company’s

fiscal year 2024, “FOR” the appointment of Bart Sichel as a Class III member of the Board of Directors, “FOR”

the approval of the Nasdaq Proposal, “FOR” the approval of an amendment to our Second Amended and Restated Certificate

of Incorporation to change our corporate name to “Nina Holding Corp.”, “FOR” the approval of the

adoption of the First Amendment to the Kidpik Corp. First Amended and Restated 2021 Equity Incentive Plan, and “FOR”

an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Merger

Proposal or Nasdaq Proposal.

The

Board of Directors’ approval of the Merger Agreement is not conditioned on the approval of any of the other proposals above other

than the Merger Proposal.

More

information about Kidpik, Nina Footwear and the proposed transactions contemplated in the Merger Agreement and related agreements, as

well as the other proposals set forth above, are contained in the accompanying Proxy Statement. Kidpik urges you to read the accompanying

Proxy Statement carefully and in its entirety. IN PARTICULAR, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DISCUSSED UNDER “RISK FACTORS” BEGINNING ON PAGE 14.

We

do not expect to transact any other business at the Annual Meeting, except as described herein. Only holders of record of shares of Kidpik’s

common stock at the close of business on [●], 2024, are entitled to notice of, and to vote at, the Annual Meeting and any postponements

or adjournments thereof. At the close of business on the record date, [ ] shares of our common stock were outstanding, which each vote

one voting share, and as such, a total of [ ] voting shares are eligible to be voted at the Annual Meeting. Other than our common stock

we have no other voting securities currently outstanding.

Your

vote is very important. Pursuant to Nasdaq Listing Rule 5635(a), stockholder approval is required prior to the issuance of securities

in connection with the acquisition of the stock or assets of another company if: (1) where, due to the present or potential issuance

of common stock, including shares issued pursuant to an earn-out provision or similar type of provision, or securities convertible into

or exercisable for common stock, other than a public offering for cash: (A) the common stock has or will have upon issuance voting power

equal to or in excess of 20% of the voting power outstanding before the issuance of stock or securities convertible into or exercisable

for common stock; or (B) the number of shares of common stock to be issued is or will be equal to or in excess of 20% of the number of

shares of common stock outstanding before the issuance of the stock or securities; or (2) where any director, officer or significant

stockholder of the Company has a 5% or greater interest (or such persons collectively have a 10% or greater interest), directly or indirectly,

in the Company or assets to be acquired or in the consideration to be paid in the transaction or series of related transactions and the

present or potential issuance of common stock, or securities convertible into or exercisable for common stock, could result in an increase

in outstanding common shares or voting power of 5% or more. As part of the Merger, Kidpik will be issuing to the stockholders of Nina

Footwear a number of shares of common stock equal to 400% of Kidpik’s pre-Merger outstanding shares of common stock, equaling 80%

of Kidpik’s post-Closing shares of common stock, in each case without taking into account any potential dilution caused by the

conversion of Convertible Debentures, as discussed in greater detail under, “Proposal No. 4: Approval of the Issuance of More Than 20% of the Company’s Issued and Outstanding Common Stock in Connection Convertible Debentures”. As the number of shares of

common stock issuable to the stockholders of Nina Footwear “Nina Footwear Stockholders”) pursuant to the terms of

the Merger Agreement will exceed 20% of the Company’s outstanding voting shares and because Mr. Ezra Dabah, our Chief Executive

Officer, Chairman and controlling stockholder, has a 5% or greater interest in Nina Footwear and the issuance of Merger Shares will result

in an increase in outstanding common shares of more than 5%, we are required to obtain stockholder approval for the Merger Agreement

and the transactions contemplated therein, pursuant to applicable Nasdaq rules and requirements (“Stockholder Approval”).

We are therefore seeking the approval of the Merger Agreement, and the issuance of shares of common stock pursuant to the terms of the

Merger Agreement and the transactions contemplated therein to be issued by Kidpik to the Nina Footwear Stockholders, by adopting a resolution

as described in the accompanying Proxy Statement under “Proposal No. 3: The Merger Proposal—Stockholder Approval of the Merger Agreement”.

Proposal

Nos. 2, 3, 4, 6 and 7 each require the affirmative vote of a majority of the votes cast on such proposals, by the holders of shares of

Kidpik’s voting stock present in person (i.e., virtually at the Annual Meeting) or by proxy and entitled to vote on the matter

at the Annual Meeting, provided that a quorum exists at such Annual Meeting. Proposal 5 requires the affirmative vote of a majority of

the outstanding shares of common stock eligible to vote at the Annual Meeting. Proposal 1 requires a plurality of the votes cast at the

Annual Meeting. A plurality of the votes cast means (1) the director nominee with the most votes for a particular seat is elected for

that seat; and (2) votes cast shall include votes to “withhold authority” and exclude abstentions with respect to

that director’s election. Therefore, abstentions and broker non-votes (which occur if a broker or other nominee does not have discretionary

authority and has not received instructions with respect to a particular director nominee within ten days of the Annual Meeting) will

not be counted in determining the number of votes cast with respect to that director’s election. No individual proposal is contingent

on any other proposal set forth above.

All

stockholders of Kidpik are cordially invited to attend the Annual Meeting in person, virtually. However, even if you plan to attend the

Annual Meeting in person, virtually, we request that you complete, date, sign and return the enclosed proxy card in the postage-paid

envelope (if you received a proxy card) or vote your shares by telephone, or through the Internet as set forth on the Proxy Card, as

promptly as possible prior to the Annual Meeting to ensure that your shares of Kidpik’s common stock will be represented at the

Annual Meeting if you are unable to attend. If you sign, date and mail your proxy card without indicating how you wish to vote, all of

your shares will be voted “FOR” Proposals Nos. 1 through 7. If you fail to return your proxy card as instructed on

the enclosed proxy card or fail to submit your proxy by telephone, or through the Internet and do not vote at the Annual Meeting, your

shares will not be counted for purposes of determining whether a quorum is present at the Annual Meeting and will have no effect with

respect to the vote on Proposals Nos. 1 through 7, except to the extent that such non-vote prohibits the Company from obtaining a quorum

for the Annual Meeting. If you do attend the Annual Meeting and wish to vote, you may withdraw your proxy and vote via the Annual Meeting

web interface.

The

enclosed Proxy Statement which is first being made available to stockholders on or about [●], 2024, is also available at

www.cleartrustonline.com/kidpik. The accompanying Proxy Statement provides you with detailed information about the Merger Agreement and

the transactions contemplated therein and the other proposals and business to be considered by you at the Annual Meeting. We encourage

you to read the accompanying Proxy Statement and its annexes (which are incorporated by reference therein) carefully and in their entirety.

If you have any questions concerning the Merger, any of the other proposals described herein, the Annual Meeting or the accompanying

Proxy Statement, would like additional copies of the accompanying Proxy Statement or additional proxy cards, please contact:

Ezra

Dabah, Chief Executive Officer

200

Park Avenue South, 3rd Floor

New

York, New York 10003

Telephone:

(212) 399-2323

Email:

ir@kidpik.com

Important

Notice Regarding the Availability of Proxy Materials for the Virtual Annual Meeting of Stockholders to Be Held on [_____________], 2024.

The Proxy Statement and 2023 Annual Report are available on the Internet at www.cleartrustonline.com/kidpik (please note this

link is case sensitive).

By

Order of the Board of Directors,

/s/

Ezra Dabah

Ezra

Dabah

Chairman

[●],

2024

IMPORTANT:

If you hold shares of common stock of Kidpik through an account with a broker, dealer, bank or other nominee please follow the instructions

you receive from them to vote your shares.

Kidpik

Corp.

200

Park Avenue South, 3rd Floor

New

York, New York 10003

PROXY

STATEMENT FOR THE

ANNUAL

MEETING OF STOCKHOLDERS

TO

BE HELD ON [●], 2024

Kidpik

Corp. (“Kidpik”, “we”, “us” or the “Company”) has delivered

printed versions of these materials to you by mail, on or about [●], 2024, in connection with the solicitation of proxies by the

Board of Directors of Kidpik (the “Board of Directors” or the “Board”) for the annual meeting of

Kidpik’s stockholders and any adjournment or postponement thereof (the “Annual Meeting”) for the purposes set

forth in the accompanying Notice of Annual Meeting. The Annual Meeting will be held on [●], [●], 2024 at [●].M. [______]

time (subject to any postponement(s) or adjournment(s) thereof), virtually via live audio webcast at www.cleartrustonline.com/kidpik

(please note this link is case sensitive). See also “Instructions For The Virtual Annual Meeting”, below.

The

Board of Directors encourages you to read this Proxy Statement and its annexes (which are incorporated by reference herein) carefully

and, in their entirety, and to take the opportunity to submit a proxy to vote your shares on the matters to be decided at the Annual

Meeting.

Only

holders of record of shares of Kidpik’s common stock at the close of business on [●], 2024, are entitled to notice of, and

to vote at, the Annual Meeting and any postponements or adjournments thereof. At the close of business on the record date, [ ] shares

of our common stock were outstanding, which each vote one voting share, and as such, a total of [ ] voting shares are eligible to be

voted at the Annual Meeting. Other than our common stock, we have no other voting securities currently outstanding.

If

you have any questions concerning the Annual Meeting or this Proxy Statement, or would like additional copies of the Proxy Statement

or additional proxy cards, please contact:

Attn:

Corporate Secretary

200

Park Avenue South, 3rd Floor

New

York, New York 10003

Telephone:

(212) 399-2323

Email:

ir@kidpik.com

The

date of this Proxy Statement is [●], 2024.

TABLE

OF CONTENTS

| Annex

A |

— |

Agreement

and Plan of Merger and Reorganization, dated March 29, 2024, by and among Kidpik Corp., Kidpik Merger Sub, Inc. and Nina Footwear

Corp. and the First Amendment to Agreement and Plan of Merger and Reorganization, dated July 22, 2024, by and among Kidpik Corp.,

Kidpik Merger Sub, Inc. and Nina Footwear Corp. |

| Annex

B |

— |

Certificate

of Amendment of Second Amended and Restated Certificate of Incorporation of Kidpik Corp. |

| Annex

C |

— |

First

Amendment to Kidpik Corp. First Amended and Restated 2021 Equity Incentive Plan |

| Annex

D |

— |

Opinion

of Hempstead & Co., LLC |

About

This Document

Kidpik

Corp., which we refer to herein as the “Company,” “Kidpik,”, “PIK”, “we,”

“our,” or “us,” is providing these proxy materials in connection with the solicitation by our Board

of Directors of proxies to be voted at our Annual Meeting of stockholders to be held on [●], [●], 2024, at [●].M. [___________]

time at www.cleartrustonline.com/kidpik, subject to any postponement(s) or adjournment(s) thereof. This Proxy Statement and the enclosed

proxy card is first being made available to Kidpik stockholders on or about [●], 2024.

You

should rely only on the information contained in or incorporated by reference into this Proxy Statement. No one has been authorized to

provide you with information that is different from that contained in or incorporated by reference into this Proxy Statement. This Proxy

Statement is dated [●], 2024. You should not assume that the information contained in this Proxy Statement is accurate as of any

other date, nor should you assume that the information incorporated by reference into this Proxy Statement is accurate as of any date

other than the date of such incorporated document. The mailing of this Proxy Statement to our stockholders will not create any implication

to the contrary.

This

Proxy Statement does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a

proxy, in any jurisdiction in which or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

REVERSE

STOCK SPLIT

On

June 19, 2023, at the Company’s 2023 Annual Meeting of the stockholders, the stockholders of the Company approved an amendment

to the Company’s Second Amended and Restated Certificate of Incorporation, to effect a reverse stock split of our issued and outstanding

shares of our common stock, par value $0.001 per share, by a ratio of between one-for-four to one-for-twenty, inclusive, with the exact

ratio to be set at a whole number to be determined by our Board of Directors or a duly authorized committee thereof in its discretion,

at any time after approval of the amendment and prior to April 24, 2024 (the “Stockholder Authority”). On February

20, 2024, the Company’s Board, with the Stockholder Authority, approved an amendment to our Second Amended and Restated Certificate

of Incorporation to effect a reverse stock split of our common stock at a ratio of 1-for-5 (the “Reverse Stock Split”).

On

March 4, 2024, we filed a Certificate of Amendment to our Second Amended and Restated Certificate of Incorporation (the “Certificate

of Amendment”) with the Secretary of State of the State of Delaware to affect the Reverse Stock Split.

Pursuant

to the Certificate of Amendment, the Reverse Stock Split was effective on March 7, 2024 at 12:01 a.m. Eastern Time. The Certificate of

Amendment did not reduce the number of authorized shares of our common stock, nor alter the par value of our common stock or modify any

voting rights or other terms of our common stock.

No

fractional shares were issued in connection with the Reverse Stock Split and stockholders of record who otherwise would be entitled to

receive fractional shares, were instead entitled to have their fractional shares rounded up to the nearest whole share.

The

effects of the 1-for-5 Reverse Stock Split have been retroactively reflected throughout this Proxy Statement, including in the audited

and unaudited financial statements of Kidpik as included herein.

Website

Links

Website

links included in this Proxy Statement are for convenience only. The content in any website links included in this Proxy Statement is

not incorporated herein and does not constitute a part of this Proxy Statement.

References

to Additional Information

You

may request a copy of this Proxy Statement from ClearTrust, LLC, the Company’s proxy agent, at the following address and telephone

number:

ClearTrust,

LLC

16540

Pointe Village Dr Suite 210, Lutz, FL 33558

(813)

235-4490

For

additional details about where you can find information about Kidpik, please see the section titled “Where You Can Find More Information; Incorporation of Information by Reference” in this Proxy Statement.

Summary

of Terms of the Merger

This

summary highlights selected information from this Proxy Statement. It may not contain all of the information that is important to you

with respect to the Merger Agreement, a copy of which is attached as Annex A, and the transactions contemplated therein, or any

other proposal or matter described in this Proxy Statement. We urge you to carefully read this Proxy Statement, the Merger Agreement,

as well as the documents attached to this Proxy Statement, to fully understand the Merger Proposal and the other proposals set forth

therein.

(i)

In this Proxy Statement, references to: “Adjournment Proposal” means the proposal to adjourn the Annual Meeting, if

necessary, to solicit additional proxies if there are not sufficient votes in favor of the Merger Proposal and/or Nasdaq Proposal, to

approve such proposals;

(ii)

“Board” or the “Board of Directors” refer to the Board of Directors of Kidpik;

(iii)

“Cleared Comments” means the date that (i) all comments, if any, on this Proxy Statement are cleared by the SEC, or

(ii) if the SEC or its staff does not have any comments on this Proxy Statement, after 10 days after passed from the date of filing the

preliminary Proxy Statement relating hereto;

(iv)

“Closing” means the closing of the Merger;

(v)

“Closing Date” means the date that the Closing occurs;

(vi)

“Combined Company” means Kidpik following the Closing and the acquisition of Nina Footwear;

(vii)

“Contemplated Transactions” means the Merger and other transactions contemplated by the Merger Agreement;

(viii)

“Convertible Debentures” means $2,000,000 of principal amount of Convertible Debentures agreed to be sold by the Company

pursuant to the terms of that certain Securities Purchase Agreement dated May 31, 2024, entered into with EF Hutton YA Fund, LP, of which

$500,000 in Convertible Debentures have been sold as of the date of this Proxy Statement;

(ix)

“DGCL” means Delaware General Corporation Law;

(x)

“Effective Time” means the effective time of the Merger Agreement, which will be the time of acceptance for filing

of the Certificate of Merger with the Secretary of State of the State of Delaware or at such later time as may be specified in such Certificate

of Merger with the consent of the parties;

(xi)

“End Date” means the date the Merger is required to be consummated by, subject to certain extension rights, which

date is currently December 31, 2024;

(xii)

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

(xiii)

“GAAP” or “US GAAP” means United States generally accepted accounting principles;

(xiv)

“Hempstead” means Hempstead & Co., LLC;

(xv)

“Kidpik,” the “Company,” “we,” “our,” or “us”

refers to Kidpik Corp.;

(xvi)

“Kidpik Stockholder Matters” means the Merger Proposal and the Name Change Proposal;

(xvii)

“Nina Footwear” means Nina Footwear Corp. and its subsidiaries (unless the context requires otherwise);

(xviii)

“Nasdaq” means the Nasdaq Capital Market;

(xix)

“Nasdaq Proposal” means the proposal to consider and approve of, for the purposes of complying with the applicable

listing rules of Nasdaq, the issuance of more than 20% of the Company’s issued and outstanding common stock and voting stock in

connection with the issuance of shares of common stock issuable by the Company upon the conversion of $2,000,000 of Convertible Debentures;

(xx)

“Merger” or “Merger Transactions” mean the acquisition of Nina Footwear contemplated by the Merger

Agreement and the other terms of the Merger Agreement;

(xxi)

“Merger Agreement” means that certain March 29, 2024, Agreement and Plan of Merger and Reorganization by and between

Kidpik, Nina Footwear and Merger Sub, as amended by the First Amendment thereto dated July 22, 2024, and as further amended from time

to time;

(xxii)

“Merger Shares” means the shares of common stock of Kidpik which will be issued to the Nina Footwear Stockholders

at the Closing;

(xxiii)

“Merger Sub” means Kidpik Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Kidpik;

(xxiv)

“Merger Proposal” means the proposal to approve the Merger Agreement and the terms thereof, including the shares of

Company common stock issuable in connection therewith, pursuant to which the Company will acquire Nina Footwear;

(xxv)

“Nina Footwear Stockholders” means the stockholders of Nina Footwear who will receive Merger Shares;

(xxvi)

“SEC” or the “Commission” refers to the Securities and Exchange Commission;

(xxvii)

“Securities Act” refers to the Securities Act of 1933, as amended; and

(xxviii)

“Strategy Committee” means the Strategy and Alternatives Committee of the Board of Directors of Kidpik, made up entirely

of independent members of the Board of Director of Kidpik, which was formed to review and evaluate potential strategic alternatives,

including acquisitions and divestures.

Overview

of the Merger

On

March 29, 2024, the Company entered into an Agreement and Plan of Merger and Reorganization with Nina Footwear Corp., a Delaware corporation,

a brand specializing in women’s footwear, particularly in dress shoes and accessories for special occasions, and Kidpik Merger

Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Kidpik. Upon the terms and subject to the satisfaction of the conditions

described in the Merger Agreement, Merger Sub will be merged with and into Nina Footwear, with Nina Footwear surviving as a wholly-owned

subsidiary of Kidpik. The Merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

At

the effective time of the Merger: each share of Nina Footwear capital stock outstanding immediately prior to the Effective Time, excluding

any shares of Nina Footwear capital stock held by Nina Footwear (if any), and any dissenting shares, will be automatically converted

solely into the right to receive a number of shares of Kidpik common stock equal to their pro rata share of 80% of Kidpik’s outstanding

shares of common stock following the Merger, with any fractional shares rounded up to the nearest whole share.

As

a result, at the Effective Time, the stockholders of Kidpik immediately prior to the Merger are expected to own approximately 20% of

the outstanding shares of Kidpik common stock immediately after the Effective Time and the stockholders of Nina Footwear immediately

prior to the Merger will own approximately 80% of the outstanding shares of Kidpik common stock immediately after the Effective Time.

Kidpik

is controlled by Mr. Ezra Dabah, the Chief Executive Officer, majority stockholder (59% beneficial owner), and Chairman of Kidpik, who

is also the Chief Executive Officer of Nina Footwear. Mr. Dabah and his family own approximately 79.3% of Nina Footwear, and Moshe Dabah

(Mr. Dabah’s son), is the Vice President, Chief Operating Officer and Chief Technology Officer of Kidpik, and the Chief Operating

Officer, Chief Information Officer and Secretary of Nina Footwear. There are a number of related party transactions between Nina Footwear

and Kidpik which are disclosed below under “Certain Relationships and Related Party Transactions”.

The

Kidpik Board of Directors (with Mr. Ezra Dabah abstaining from the vote), acting on the unanimous recommendation of a special committee

(the “Strategy Committee”) consisting of independent and disinterested directors of Kidpik that was formed to negotiate

and evaluate a potential strategic transaction involving Kidpik, has: (a) determined that the Merger Agreement and the Merger are fair

to and in the best interests of Kidpik’s stockholders; (b) approved, adopted and declared advisable the Merger Agreement and approved

the execution, delivery and performance by Kidpik of the Merger Agreement and the consummation by Kidpik of the Merger; and (c) resolved

to recommend that the stockholders of Kidpik approve the Merger Agreement and the Merger. Mr. Ezra Dabah recused himself from the Kidpik

Board of Directors approval due to his status as a related party in connection with the Merger, as discussed above.

The

Merger Agreement does not include a price-based termination right, so there will be no adjustment to the total number of shares of Kidpik

common stock that the stockholders of Nina Footwear (the “Nina Footwear Stockholders”) will be entitled to receive

for changes in the market price of Kidpik common stock. Accordingly, the market value of the shares of Kidpik common stock issued pursuant

to the Merger Agreement will depend on the market value of the shares of Kidpik common stock at the time the Merger Agreement closes,

and could vary significantly from the market value on the date the Merger Agreement was entered into and/or the date of this Proxy Statement.

Upon

termination of the Merger Agreement in certain circumstances, a termination fee of $100,000 may be payable by either Kidpik or Nina Footwear

to the other party, including (i) where the Merger Agreement is terminated because (x) the Merger fails to close prior to December 31,

2024, (y) one party’s stockholders fail to approve the Merger, or (z) a breach of a representation, warranty, covenant or agreement,

and an Acquisition Proposal (as defined and discussed below under “Agreements Related to the Merger—The Merger Agreement—Non-Solicitation”)

has been announced regarding the non-terminating party, and/or is entered into or closed within three months of the date of termination;

and (ii) where such party’s board of directors changes or withdraws its recommendation in favor of the Merger or recommends to

enter into an alternative transaction. Nina Footwear and Kidpik have also agreed to reimburse the other party for up to $62,500 in expenses,

as applicable, if the Merger Agreement is terminated in certain circumstances, as further described in the Merger Agreement. Such amounts

payable by either party upon termination of the Merger Agreement are discussed in greater detail below under “Agreements Related to the Merger—The Merger Agreement—Termination of the Merger Agreement”.

The

Closing contemplated by the Merger Agreement is expected to occur in the fourth calendar quarter of 2024, subject to satisfaction of

customary closing conditions, including approval of the transactions contemplated by the Merger Agreement, and the issuance of the shares

of common stock issuable pursuant to the terms of the Merger Agreement, by the stockholders of the Company at the Annual Meeting.

The

conditions to the closing of the Merger Agreement may not be met, and such Closing may not ultimately occur on the terms set forth in

the Merger Agreement, if at all.

Upon

closing of the transactions contemplated by the Merger Agreement, Mr. Dabah and his immediate family are expected to control approximately

75.3% of the Combined Company’s voting shares, without taking into account any potential dilution caused by the issuance of common

stock upon the conversion of the Convertible Debentures, as discussed in greater detail under, “Proposal No. 4: Approval of the Issuance of More Than 20% of the Company’s Issued and Outstanding Common Stock in Connection Convertible Debentures”. However,

because Mr. Dabah currently controls 59.4% of the total stockholder vote, there will not be a change of control of the Company in connection

with the Merger.

Following

the closing of the Merger, Kidpik’s executive officers and directors will remain the same as immediately prior to the Effective

Time.

See

“Management Following the Merger—Executive Officers and Directors of the Combined Company Following the Merger”.

A

copy of the Merger Agreement is attached as Annex A to this Proxy Statement. Kidpik encourages you to read such Merger

Agreement in its entirety because it is the principal document governing the Merger. For more information on the Merger Agreement see

the section of this Proxy Statement titled “Agreements Related to the Merger—Merger Agreement”.

For

more information about the Merger itself and Nina Footwear to be acquired pursuant to the Merger, see “The Merger” and “Information

about Nina Footwear”.

On

July 22, 2024, the Company, Nina Footwear and Merger Sub entered into a First Amendment to Agreement and Plan of Merger and Reorganization,

pursuant to which each of the parties agreed to extend the required closing date of the Merger from September 30, 2024, to December 31,

2024.

Parties

to the Merger

Kidpik

Corp.

Kidpik,

a Delaware corporation, began operations in 2016 as a subscription-based e-commerce company on the proposition of making shopping easy,

convenient, and accessible for parents by delivering fashionable and customized kids’ outfits in a box. Kidpik provides kids clothing

subscription boxes for boys and girls (sizes 12M-16) that include mix-&-match, coordinated outfits that are personalized based on

each member’s style preferences. Kidpik focuses on providing entire outfits from head-to-toe (including shoes) by designing each

seasonal collection in-house from concept to box.

After

launching girls’ subscription boxes for sizes 4-14 in 2016, Kidpik expanded into boys’ clothing, added larger sizes for boys

and girls (up to 16 for apparel and 6 youth for shoes), in the Spring of 2022, added toddler sizes down to 2T & 3T for apparel and

7 & 8 toddler shoes. During the second quarter of 2022, Kidpik introduced sizes 12 months and 18 months apparel to its offerings.

Kidpik has expanded its distribution by selling its branded products on third-party websites.

Kidpik’s

principal executive offices are located at 200 Park Avenue South, 3rd Floor, New York, New York 10003. More information about Kidpik

Corp. can be found at https://kidpikcorp.com. Information contained on, or that can be accessed through, our website is not incorporated

by reference into this Proxy Statement, and you should not consider information on our website to be part of this Proxy Statement. Kidpik’s

common stock is listed on the Nasdaq Capital Market under the trading symbol “PIK.”

Nina

Footwear

Nina

Footwear and its subsidiaries design, source, and market branded fashion footwear and accessories for women and children. Nina Footwear

distributes its products in the wholesale channel through department stores, shoe chains, off-price retailers, online retailers, national

chains, specialty retailers, and independent stores throughout the United States, Canada, Australia, and other international markets.

In addition, its products are distributed through its direct-to-consumer channel within the United States, and Canada.

Nina

Footwear’s product lines are designed towards special occasions and wedding events, mainly dress and bridal shoes, fashionably

designed for a broad range to capitalize on market size. Over the past 70 years, Nina Footwear has established a reputation as a brand

known for quality and fashionable footwear and over the past 25 years, has been a trusted authority in the women’s bridal and special

occasion shoe category. Nina Footwear is known for design creativity and its ability to offer quality, seasonable products at accessible

price points.

Nina

Footwear designs, merchandises, sources, and markets its brands and sells its products, including its women’s and girl’s

dress shoes which are designed and marketed for special occasions and include sandals, pumps, boots, girl’s shoes, and accessories.

Nina

Footwear’s direct to consumer business serves as a marketing tool that allows it to strengthen its brand recognition and to showcase

its products. Nina Footwear believes that its website enhances its overall sales and brand image.

Nina

Footwear’s principal business location is 200 Park Avenue South, 3rd Floor, New York, New York 10003. More information about Nina

Footwear can be found at www.ninashoes.com. Information contained on, or that can be accessed through, Nina Footwear’s website

is not incorporated by reference into this Proxy Statement, and you should not consider information on Nina Footwear’s website

to be part of this Proxy Statement. Nina Footwear is a private company.

*

* * * *

For

more information see “The Merger—Parties to the Merger”.

Reasons

for the Merger

The

Board of Directors considered a number of factors before deciding to enter into the Merger Agreement, including, among other factors,

the benefits to current Company stockholders, and the terms and conditions of the Merger Agreement. For additional information, see the

section titled “The Merger—Recommendation of the Board of Directors and its Reasons for the Merger”.

Activities

of Kidpik Following the Merger

Following

the completion of the Merger, we plan to focus on growing the Combined Company business. Since Kidpik’s inception, the Company

and Nina Footwear have always operated under the same roof in a shared office environment and warehouse space. In view of the shared

working environment, assuming the closing of the Merger, the Company believes the combination will be seamless. The Combined Company

management team plans to refocus a significant majority of its time and efforts on growing Nina Footwear’s business.

The

Company plans on mainly growing the Nina Footwear brand organically, by capitalizing on its brand recognition and relationships with

large retailers to upsell and cross sell existing partners. In addition, the Company plans to develop and sell expanded categories to

widen Nina Footwear’s total addressable market. The Company is contemplating bringing back the Delman brand which was known as

the footwear to the stars and at one time was the only shoe brand at Bergdorf Goodman, with the slogan “the best shoes you can

buy are the best buy”. The Company is also focused on increasing mobile and online sales. The Company will also seek accretive

acquisitions that it believes will bring additional revenues and profitability, with good management teams that have high growth potential.

Following

the completion of the Merger, Kidpik will continue to be a public company. The Merger will have no effect on the attributes of shares

of Kidpik’s common stock held by Kidpik’s stockholders, except for the increase in such outstanding shares of common stock

in connection with the issuance of the shares of common stock issuable to the Nina Footwear Stockholders in connection therewith, as

discussed in greater detail herein.

Due

to Mr. Dabah’s controlling interest in both Kidpik and Nina Footwear, we anticipate the Merger being completed. In the event the

Merger is not consummated, Kidpik plans to seek out alternative accretive business acquisitions that we believe will add revenues and

profitability and utilize the Nasdaq listing.

See

also “The Merger — Activities of Kidpik Following the Merger”.

Recommendation

of the Board of Directors and its Reasons for the Merger

The

Board of Directors determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best

interests of Kidpik and its stockholders, approved the Merger Agreement and the transactions contemplated thereby, including the Merger,

and recommends that you vote:

1.

“FOR” the election of one Class III Director to the Board of Directors;

2.

“FOR” ratification of the appointment of CohnReznick LLP as the Company’s independent registered public

accounting firm for the Company’s fiscal year 2024;

3.

“FOR” approval of the Merger Agreement, for the purposes of Nasdaq Listing Rule 5635(a) including the terms

of, and issuance of shares of common stock in connection with the Merger Agreement;

4.

“FOR” a proposal to approve the issuance of more than 20% of the Company’s issued and outstanding common

stock and voting stock in connection with the issuance of shares of common stock issuable by the Company upon the conversion of $2,000,000

of Convertible Debentures, for the purposes of complying with the applicable listing rules of Nasdaq;

5.

“FOR” approval of an amendment to our Second Amended and Restated Certificate of Incorporation to change our

corporate name to “Nina Holding Corp.”;

6.

“FOR” to approve the adoption of the First Amendment to the Kidpik Corp. First Amended and Restated 2021 Equity

Incentive Plan; and

7.

“FOR” the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient

votes in favor of the Merger Proposal or Nasdaq Proposal.

The

proposals described above are collectively referred to herein as the “Proposals”.

For

a discussion of factors that the Board of Directors considered in deciding to recommend the approval of the Merger Proposal, see the

section titled “The Merger—Recommendation of the Board of Directors and its Reasons for the Merger”.

Opinion

of Hempstead & Co., LLC to the Strategy Committee

On

February 14, 2024, the Strategy and Alternatives Committee of the Board of Directors of Kidpik, made up entirely of independent members

of the Board of Director of Kidpik, which was formed to review and evaluate potential strategic alternatives, including acquisitions

and divestures (the “Strategy Committee”) retained Hempstead & Co., LLC (“Hempstead”) to act

as the Board’s financial advisor in connection with the proposed Merger, including providing the Board with an opinion, from a

financial point of view, as to the fairness of the Merger. At a meeting of the Board held on March 28, 2024, Hempstead rendered its opinion,

to the effect that, as of that date and based upon and subject to the various assumptions made, procedures followed, matters considered

and limitations on the scope of the analysis undertaken as set forth in its opinion, the consideration to be paid by the Company pursuant

to the Merger Agreement was fair, from a financial point of view, to the Company, as more fully described in the section of this Proxy

Statement entitled “Opinion of Hempstead & Co., LLC to the Strategy Committee”.

The

full text of the written opinion of Hempstead, dated as of March 28, 2024, is attached hereto as Annex D. Hempstead’s

opinion sets forth, among other things, the assumptions made, procedures followed, matters considered and limitations on the scope of

the analysis undertaken by Hempstead in rendering its opinion. The Company encourages you to read Hempstead’s opinion carefully

and in its entirety. Hempstead’s opinion was directed to the Board (in its capacity as such) and addresses only the fairness, from

a financial point of view, of the consideration to be paid by the Company pursuant to the Merger Agreement. It does not address the relative

merits of the transaction contemplated by the Merger Agreement as compared to any alternative transaction or opportunity that might be

available to the Company, nor does it address the underlying business decision by the Company to engage in the Merger or the terms of

the Merger Agreement or the documents referred to therein. Hempstead’s opinion does not constitute a recommendation as to how any

Company stockholder should vote on the Merger or any matter related thereto.

For

additional information, see the section titled “Opinion of Hempstead & Co., LLC to the Strategy Committee”.

Conditions

to the Completion of the Merger

We

expect to complete the Merger as soon as possible following the approval of the Merger Proposal at the Annual Meeting, and most likely

in the fourth quarter of 2024. The parties’ obligations to effect the Merger are subject to the satisfaction or, to the extent

permitted, waiver, of various conditions, including, among others, the following:

(i)

no order preventing the Merger and the other transactions and actions contemplated by the Merger Agreement having been issued and remaining

in effect and there being no law which has the effect of making the consummation of the Merger and the other transactions and actions

contemplated by the Merger Agreement illegal;

(ii)

the required approvals by each of the parties’ stockholders having been obtained;

(iii)

the existing shares of Kidpik common stock having been continually listed on the Nasdaq Capital Market and the Merger Shares being approved

for listing on Nasdaq (subject to official notice of issuance);

(iv)

there being an exemption from registration pursuant to Section 4(a)(2) and/or Rule 506 of the Securities Act of 1933, as amended (the

“Securities Act”) for the issuance of the Merger Shares;

(v)

no event having occurred which would constitute a material adverse effect on Kidpik or Nina Footwear;

(vi)

Kidpik having filed all required Securities and Exchange Commission filings; and

(vii)

certain other matters as described in greater detail in the Merger Agreement and summarized below under “Agreements Related to the Merger—The Merger Agreement—Conditions to the Completion of the Merger”.

The

Closing is also subject to certain closing conditions of each party, including:

(i)

the accuracy of each party’s representations and warranties, subject to certain materiality qualifications;

(ii)

compliance by each party with its covenants in all material respects, respectively; and

(iii)

no continuing Nina Footwear Material Adverse Effect or Kidpik Material Adverse Effect described and defined below under “Agreements Related to the Merger—The Merger Agreement—Conditions to the Completion of the Merger”.

Kidpik’s

obligation to consummate the Merger is also subject to (i) Nina Footwear acknowledging that all of the debt owed by the Company to Nina

Footwear (approximately $2.9 million as of November 1, 2024 and which amount may increase until the Closing) is extinguished

as consideration of entering into the Merger; (ii) the waiver or termination of certain change of control and related triggering events

held by certain stockholders of Nina Footwear which if not waived may have required approximately $2.55 million to be paid to such stockholders

of Nina Footwear at Closing; and (iii) holders of no more than 10% of the shares of Nina Footwear capital stock exercising their statutory

appraisal rights in connection with the Merger.

For

additional information, see the section titled “Agreements Related to the Merger—The Merger Agreement—Conditions to the Completion of the Merger”.

Planned

Closing Date

The

transactions contemplated by the Merger Agreement are expected to close in the fourth calendar quarter of 2024, subject to satisfaction

of customary closing conditions, including the approval of the Merger Proposal at the Annual Meeting, the accuracy of the representations

and warranties of the parties at Closing, subject, in certain instances, to certain materiality and other thresholds, the performance

by the parties of their obligations and covenants under the Merger Agreement, the delivery of certain documentation by the parties and

the absence of any injunction or other legal prohibitions preventing consummation of the Merger.

Governmental

and Regulatory Approvals

Kidpik

must comply with applicable federal and state securities laws and the rules and regulations of The Nasdaq Stock Market in connection

with the issuance of shares of Kidpik common stock upon the Closing of the Merger Agreement.

Kidpik

and Nina Footwear have determined that no antitrust or competition law approvals, or other governmental or regulatory approvals are required

to be applied for or obtained in any jurisdiction in connection with the Merger, provided that as discussed in greater detail below under,

“The Merger—Nasdaq Stock Market Listing”, the Company is required to provide Nasdaq notice of the issuance of the shares

of common stock to the stockholders of Nina Footwear in the Merger (the “Merger Shares”).

The

Closing is also subject to Kidpik’s common stock continuing to trade on Nasdaq following the Closing, and Nasdaq has provided Kidpik

preliminary non-binding guidance that because Ezra Dabah will control the vote of Kidpik both prior to and after Closing, that the Combined

Company will not need to re-apply for initial listing on Nasdaq as a result of the Merger. As such, in the event the Merger closes, it

will have no effect on the trading of our common stock on the Nasdaq Capital Market.

Termination

of the Merger Agreement

Rights

of Termination

The

Merger Agreement contains certain termination rights, including:

(i)

the right to terminate the Merger Agreement at any time with mutual approval of the parties;

(ii)

the right of either party to terminate the Merger Agreement if (1) the Merger is not consummated by December 31, 2024, subject to certain

extension rights (the “End Date”), (2) if Kidpik’s stockholders fail to adopt and approve the issuance of the

Shares pursuant to Nasdaq Listing Rule 5635(a), (3) if a court of competent jurisdiction or other governmental body has issued a final

and non-appealable order, decree or ruling, or has taken any other action, having the effect of permanently restraining, enjoining or

otherwise prohibiting the Merger; or (4) the other party breaches any representation, warranty, covenant or agreement set forth in the

Merger Agreement, and such breach is not cured by the earlier of (i) the End Date; and (ii) within 30 days of notice thereof from the

non-breaching party;

(iii)

the right of Kidpik to terminate the Merger Agreement if the required Nina Footwear stockholder vote has not been received within 10

days of this Proxy Statement clearing comments with the SEC;

(iv)

the right of Nina Footwear (at any time prior to the approval of the Merger Proposal by the stockholders of Kidpik) to terminate the

Merger Agreement if a Kidpik Triggering Event (as defined below under “Agreements Related to the Merger—The Merger Agreement—Conditions to the Completion of the Merger”) has occurred;

(v)

the right of Kidpik (at any time prior to the approval by the Nina Footwear Stockholders of the Merger Agreement) to terminate the Merger

Agreement if a Nina Footwear Triggering Event (as defined below under “Agreements Related to the Merger—The Merger Agreement—Conditions to the Completion of the Merger”) has occurred; and

(vi)

The right of Kidpik, if Nina Footwear has not provided to Kidpik audited financial statements for the fiscal years ended 2023 and 2022,

prior to April 30, 2024, and/or unaudited financial statements of the Company for the period ended March 31, 2024 to the extent required

by applicable Securities and Exchange Commission rules.

For

additional information, see the section titled “Agreements Related to the Merger—The Merger Agreement—Termination of the Merger Agreement”.

Effect

of Termination

Upon

termination of the Merger Agreement in certain circumstances, a termination fee of $100,000 may be payable by either Kidpik or Nina Footwear

to the other party, including (i) where the Merger Agreement is terminated because (x) the Merger fails to close prior to December 31,

2024, (y) one party’s stockholders fail to approve the Merger, or (z) a breach of a representation, warranty, covenant or agreement,

and an Acquisition Proposal (as defined in the Merger Agreement) has been announced regarding the non-terminating party, and/or is entered

into or closed within three months of the date of termination; and (ii) where such party’s board of directors changes or withdraws

its recommendation in favor of the Merger or recommends to enter into an alternative transaction. Nina Footwear and Kidpik have also

agreed to reimburse the other party for up to $62,500 in expenses, as applicable, if the Merger Agreement is terminated in certain circumstances,

as further described in the Merger Agreement. See “Agreements Related to the Merger—The Merger Agreement—Termination of the Merger Agreement” for additional information.

Agreements

Related to the Merger

As

a required condition to the Closing, each stockholder of Nina Footwear will be required to enter into a Stockholder Representation Agreement

with Kidpik. The Stockholder Representation Agreement includes general representations of the Nina Footwear stockholder relating to ownership

of the applicable Nina Footwear common stock shares to be tendered at Closing; an agreement to comply with certain conditions of the

Merger Agreement, as if a party thereto; various representations in order for Kidpik to confirm that an exemption from the registration

requirements of the Securities Act exists for the Merger Agreement; certain requirements for Kidpik to promptly remove the legend on

any Kidpik securities issued to the Nina Footwear stockholders as a result of the Merger in the event such securities (a) are subsequently

registered under the Securities Act; or (b) subsequently become available for sale pursuant to Rule 144 of the Securities Act, including

setting forth certain damages payable by Kidpik upon its failure to comply with the deadlines set forth in such Stockholder Representation

Agreement, and buy-in rights for the Nina Footwear stockholders as a result thereof; and a lock-up agreement, prohibiting the Nina Footwear

stockholder from transferring any shares of Nina Footwear until the earlier of the consummation or termination of the Merger Agreement,

subject to certain customary exceptions, discussed in greater detail below under “Agreements Related to the Merger—Stockholder

Representation Agreements”.

Management

Following the Closing

There

will be no changes in the officers or directors of the Company in connection with the Merger, and as a result, the officers and directors

of the Combined Company will be the same after the Merger as they are currently.

As

a result, at Closing our officers and directors are expected to include:

| Name |

|

Position |

|

Independent |

| Executive

Officers |

|

|

|

|

| Ezra

Dabah |

|

President

and Chief Executive Officer |

|

|

| Moshe

Dabah |

|

Vice

President, Chief Operating Officer and Chief Technology Officer, and Secretary |

|

|

| Jill

Pasechnick |

|

Chief

Accounting Officer |

|

|

| |

|

|

|

|

| Directors |

|

|

|

|

| Ezra

Dabah |

|

Director |

|

|

| Bart

Sichel |

|

Director |

|

X |

| Jill

Kronenberg |

|

Director |

|

X |

| Louis

G. Schott |

|

Director |

|

X |

In

the above table, ‘independent’ means meeting the independence requirements of the Securities and Exchange Commission, or

SEC, and The Nasdaq Stock Market, or Nasdaq.

See

also, “Management Following the Merger—Executive Officers and Directors of the Combined Company Following the Merger”.

Interests

of Certain Directors, Officers and Affiliates of Kidpik

When

considering the recommendation of the Kidpik Board of Directors, you should be aware that certain members of the Kidpik Board of Directors

and named executive officers of Kidpik have interests in the Merger Agreement that may be different from, or in addition to, interests

they may have as Kidpik stockholders, summarized below and discussed in greater detail below under “The Merger—Interests of Certain Persons in the Merger”. The Kidpik Board of Directors was aware of the following interests and considered them, among

other matters, in its decision to approve the Merger Agreement.

Continued

Service with Combined Company

At

the effective time of the Merger Agreement, which will be the time of acceptance for filing of the Certificate of Merger with the Secretary

of State of the State of Delaware or at such later time as may be specified in such Certificate of Merger with the consent of the parties

(the “Effective Time”), the officers of the Combined Company will continue to include Mr. Ezra Dabah, the Company’s

Chief Executive Officer, President and Chairman (who currently serves as Chief Executive Officer of Nina Footwear); Moshe Dabah, the

Company’s Vice President, Chief Operating Officer and Chief Technology Officer, and Secretary (who currently serves as Chief Operating

Officer, Chief Information Officer and Secretary of Nina Footwear); and Jill Pasechnick, the Company’s Chief Accounting Officer,

and as such, we do not anticipate any changes in our officers in connection with the Merger.

Similarly,

all of our current Board members, Mr. Ezra Dabah, Mr. Bart Sichel, Mrs. Jill Kronenberg and Mr. Louis G. Schott, will continue as directors

of the Combined Company after the Closing.

Related

Party Transaction

Mr.

Ezra Dabah our Chairman, President and Chief Executive Officer, and Moshe Dabah, our Vice President, Chief Operating Officer and Chief

Technology Officer, and Secretary, who is the son of Ezra Dabah, are each also owners of Nina Footwear. Additionally, Ezra Dabah and

his children (including Moshe Dabah) own approximately 79.3% of Nina Footwear, and Ezra Dabah and his extended family own 100% of Nina

Footwear. There are a number of related party transactions between Nina Footwear and the Company. Ezra Dabah and his immediate family

will continue to control approximately 75.3% of the Combined Company’s voting shares following the closing of the Merger;

Ezra

Dabah, who was recused from board deliberations regarding the Merger and the other Contemplated Transactions, serves on both the Kidpik

Board and the Nina Footwear Board and as the Chief Executive Officer of both Kidpik and Nina Footwear, and Moshe Dabah, Mr. Ezra Dabah’s

son, currently the Chief Operating Officer, Chief Technology Officer, Secretary and Vice President of the Company, and serves as Chief

Operating Officer, Chief Information Officer and Secretary of Nina Footwear.

There

are a number of related party transactions between Nina Footwear and Kidpik, as discussed in greater detail below under “Certain

Relationships and Related Transactions”, including, but not limited to a total of $1.9 million owed by Kidpik to Nina Footwear

as of Kidpik’s entry into the Merger Agreement, and approximately $2.9 million as of November 1, 2024, the fact that

Kidpik subleases both its office and warehouse space from Nina Footwear, and the fact that Nina Footwear provides Kidpik management services

at the rate of 0.0075% of cash receipts, pursuant to the terms of a Management Agreement.

While

the Closing will be deemed a ‘change of control’ under the Company’s First Amended and Restated 2021 Equity Incentive

Plan, which includes the “consummated merger, consolidation or similar transaction involving (directly or indirectly) the Company

[if] immediately after the consummation of such merger, consolidation or similar transaction, the stockholders of the Company immediately

prior thereto do not [o]wn, directly or indirectly, either (A) outstanding voting securities representing more than 50% of the combined

outstanding voting power of the surviving [entity] in such merger, consolidation or similar transaction or (B) more than 50% of the combined

outstanding voting power of the parent of the surviving [entity] in such merger, consolidation or similar transaction, in each case in

substantially the same proportions as their [o]wnership of the outstanding voting securities of the Company immediately prior to such

transaction”, the Company has no outstanding and unvested equity awards, and as such, the occurrence of a ‘change of control’

under the equity plan will have no effect.

The

Strategy Committee and the Kidpik Board were aware of these potential conflicts of interest and considered them, among other matters,

in reaching their respective decisions to approve the Merger Agreement and the Merger, and to recommend, as applicable, that Kidpik’s

stockholders approve the proposals to be presented to Kidpik’s stockholders for consideration at the Kidpik Annual Meeting as contemplated

by this Proxy Statement.

Material

U.S. Federal Income Tax Consequences of the Merger Agreement

The

proposed Merger is entirely a corporate action undertaken by Kidpik. Kidpik’s U.S. stockholders should not realize any gain or

loss for U.S. federal income tax purposes as a result of the Merger.

For

additional information, see the section titled “The Merger—Material U.S. Federal Income Tax Consequences of the Merger”.

Indemnification

by Kidpik and Nina Footwear

The

Merger Agreement does not include any indemnification obligations of the parties and instead the representations and warranties of Kidpik,

Nina Footwear and Merger Sub contained in the Merger Agreement terminate at the Effective Time.

For

additional information, see the section titled “Agreements Related to the Merger—The Merger Agreement—Indemnification”.

No

Appraisal or Dissenters’ Rights

Under

Delaware General Corporation Law (“DGCL”), appraisal and dissenters’ rights are not available to any stockholder

in connection with the Merger, regardless of whether such stockholder votes for or against the approval of the Merger Proposal, or any

of the proposals which will be voted on at the Annual Meeting.

See

also the section titled “The Merger—No Appraisal or Dissenters’ Rights”.

Risk

Factors

Before

voting at the Annual Meeting, you should carefully consider all of the information contained in or incorporated by reference into this

Proxy Statement, as well as the specific factors under the section titled “Risk Factors.” These risk factors include, but

are not limited to, the following:

Risks

Related to the Merger

| ● | The

Merger may not be completed on the terms or timeline currently contemplated, or at all. Failure

to complete the Merger may result in Kidpik or Nina Footwear paying a termination fee to

the other party. |

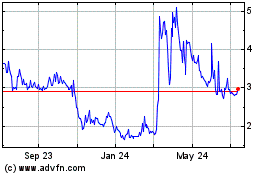

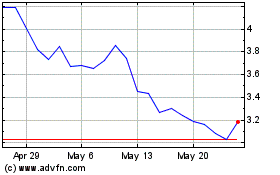

| ● | The

number of shares of common stock that will be issuable in the Merger Agreement are not adjustable

based on the market price of the Company’s common stock, so the shares issued at the

closing may have a greater or lesser value than the market price at the time the Merger Agreement

was signed. The number of shares of common stock issuable pursuant to the Merger Agreement

will cause significant dilution to existing stockholders. |

| ● | Some

executive officers and directors of Kidpik and Nina Footwear have interests in the Merger

that are different from the respective stockholders of Kidpik and Nina Footwear and that

may influence them to support or approve the Merger without regard to the interests of the

respective stockholders of Kidpik and Nina Footwear. |

| ● | The

consummation of the Merger will increase the voting rights of Ezra Dabah, our Chief Executive

Officer and Director. |

| ● | Certain

provisions of the Merger Agreement may discourage third parties from submitting competing

proposals, including proposals that may be superior to the arrangements contemplated by the

Merger Agreement. |

| ● | Because

the lack of a public market for Nina Footwear’s capital stock makes it difficult to

evaluate the fairness of the Merger, the stockholders of Nina Footwear may receive consideration

in the Merger that is less than the fair market value of Nina Footwear’s capital stock

and/or Kidpik may pay more than the fair market value of Nina Footwear’s capital stock. |

| ● | Kidpik

or Nina Footwear may waive one or more of the conditions to the Merger without recirculation

of this Proxy Statement or resoliciting stockholder approval. |

| ● | Failure

to complete the acquisition of Nina Footwear could negatively impact our stock price and

future business and financial results. We will be subject to business uncertainties and contractual

restrictions while the acquisition of Nina Footwear is pending. |

| ● | The

Company may fail to realize the anticipated benefits of the Merger. |

Risk

Factors Related to the Convertible Debentures

| ● | The

issuance of common stock upon conversion of the Convertible Debentures will cause immediate

and substantial dilution to existing shareholders. |

| ● | We

are required to make amortization payments of the amounts owed under the Convertible Debentures

upon the occurrence of certain events and we may not have sufficient cash to make such payments,

if required. |

| ● | Future

sales of Kidpik’s common stock in the public market, or the perception that such sales

may occur, including as a result of the potential sale of the Conversion Shares, could reduce

the price of Kidpik’s common stock, and any additional capital raised by Kidpik through

the sale of equity or convertible securities may dilute your ownership in Kidpik. |

Risk

Factors Related to Nina Footwear and the Combined Company

| ● | Nina

Footwear and the Combined Company will require additional capital to fund their operations

and grow, and their inability to obtain such capital, or to adequately manage their existing

capital resources, could materially adversely affect their business, financial condition

and operating results. |

| ● | The

business of Nina Footwear and the Combined Company, including their costs and supply chain,

is subject to risks associated with sourcing, manufacturing and warehousing. |

| ● | Adverse

macro-economic conditions, including inflation, could adversely impact Nina Footwear’s

and the Combined Company’s operating results. |

| ● | System

interruptions that impair client access to Nina Footwear’s and the Combined Company’s

websites or other performance failures in Nina Footwear’s and the Combined Company’s

technology infrastructure could damage Nina Footwear’s and the Combined Company’s

business. |

| ● | The

process of Kidpik and Nina Footwear upgrading to an Enterprise Resource Planning (ERP) system. |

| ● | Increased

competition presents an ongoing threat to the success of Nina Footwear’s and the Combined

Company’s business. Nina Footwear’s and the Combined Company’s business

depends on Nina Footwear’s and the Combined Company’s brand, and any failure

to maintain, protect or enhance Nina Footwear’s and the Combined Company’s brand,

including as a result of events outside Nina Footwear’s and the Combined Company’s